Becton, Dickinson And Co.

Latest Becton, Dickinson And Co. News and Updates

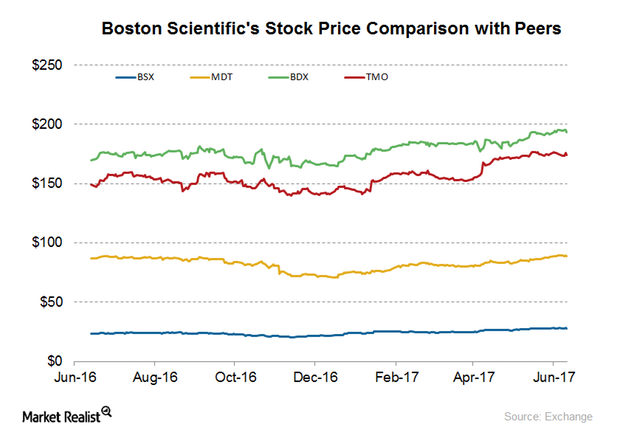

How Has Boston Scientific Stock Performed Recently?

Boston Scientific (BSX) was trading at $27.9 on June 29, 2017.

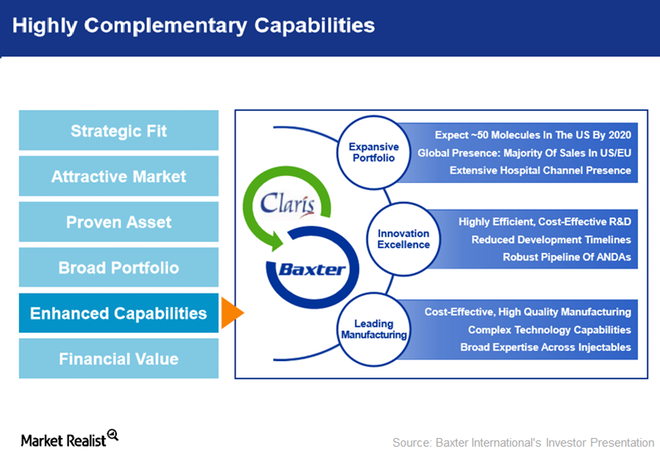

Effect of Claris Injectables Acquisition on Baxter’s 2017 Growth

On July 27, 2017, Baxter International (BAX) completed the acquisition of Claris Injectables, which is expected to help expand and strengthen Baxter’s core capabilities.

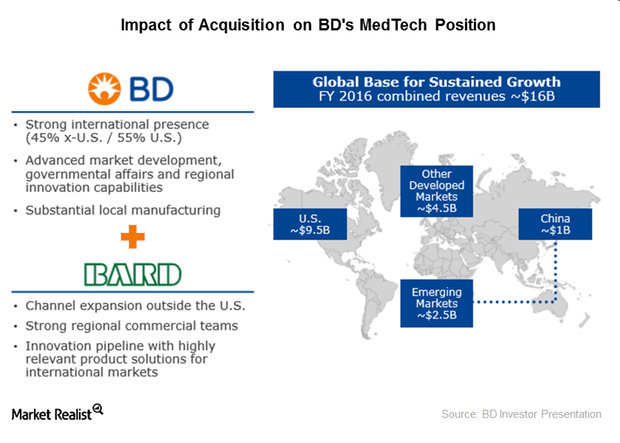

How BD-Bard Acquisition Will Strengthen International Presence

C.R. Bard (BCR) has grown significantly outside the United States in recent years, driven by its international channel expansion strategy.

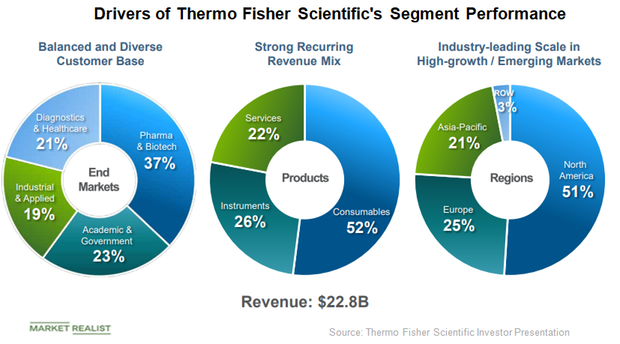

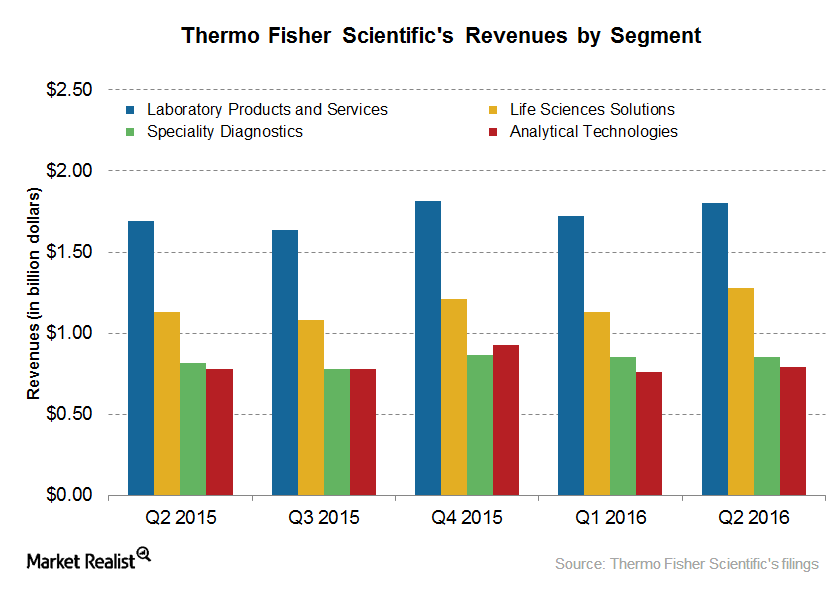

What’s Driving the Growth in Thermo Fisher Scientific’s Segments?

Thermo Fisher Scientific (TMO) operates in four business segments.

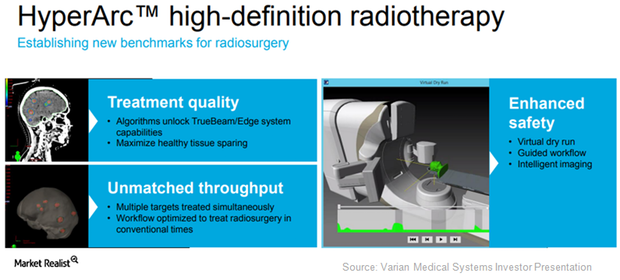

Varian’s HyperArc: Driven by Rising Metastatic Brain Cancer?

Varian Medical Systems’ (VAR) HyperArc is an end-to-end, high-definition, intracranial radiotherapy solution.

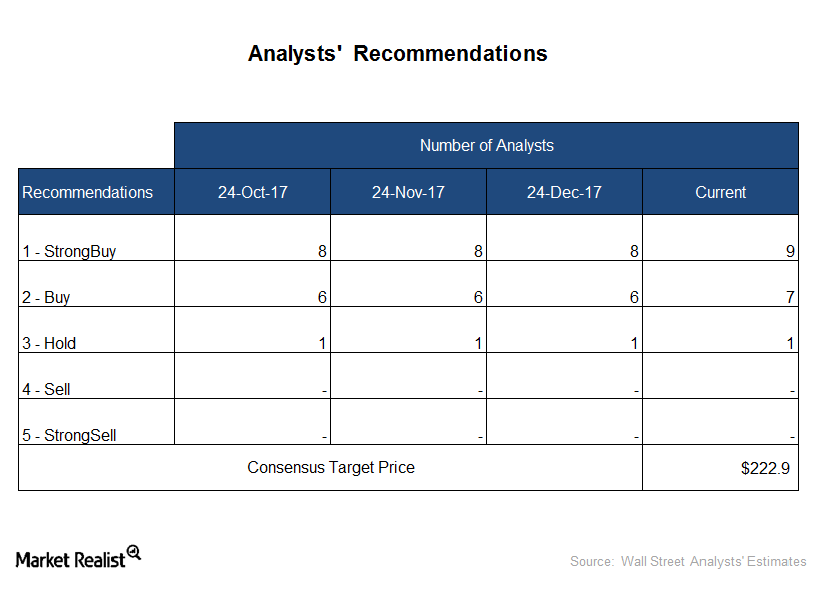

Analyst Ratings for Thermo Fisher Scientific before 4Q17 Results

Thermo Fisher Scientific (TMO) will announce its 4Q17 and fiscal 2017 results on January 31, 2018. It has launched some innovative products and entered into strategic collaborations and partnerships.

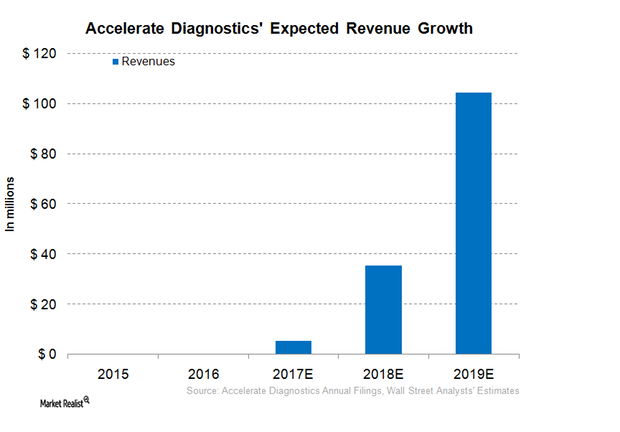

Does Accelerate Diagnostics’ Financial Performance Bode Well?

The net sales of Accelerate Diagnostics (AXDX) increased from $24,000 in 3Q16 to $828,000 in 3Q17.

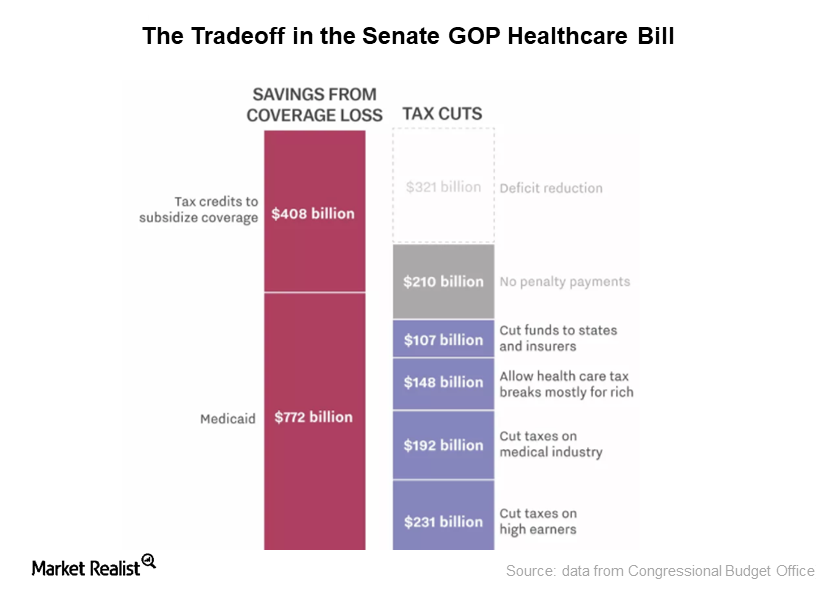

How the Corporate Tax Rate Cut Could Affect R&D in the Medtech Industry

The repeal of the tax deduction for high medical expenses may reduce the number of taxpayers opting for costly medical technologies and services.

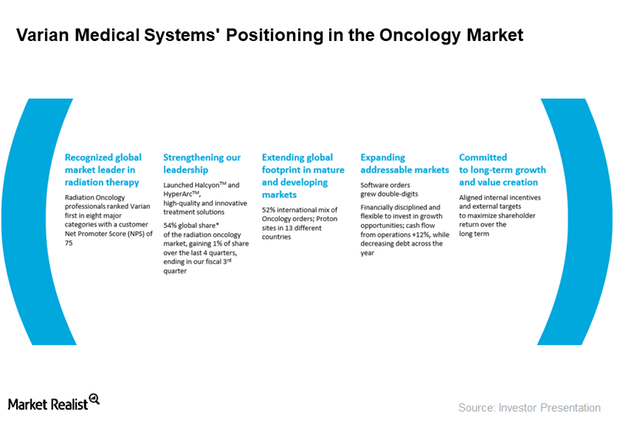

A Look at Varian Medical Systems’ Long-Term Objectives

Varian Medical Systems (VAR) spun off its imaging components business into Varex Imaging in January 2017, thus strengthening its positioning in the oncology market.

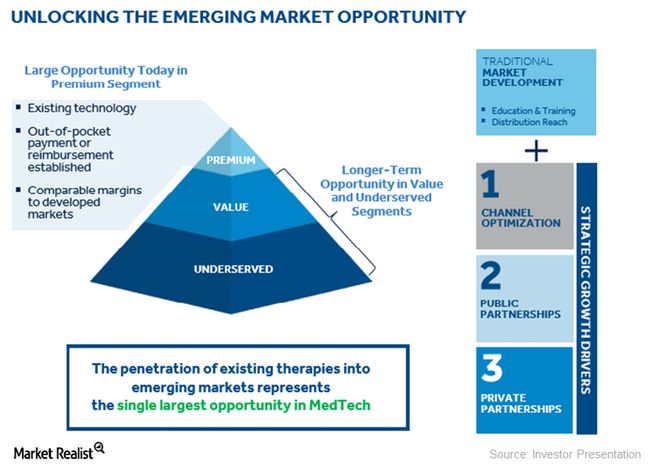

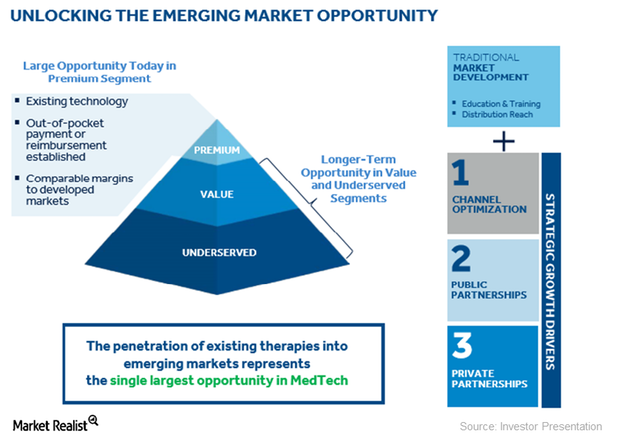

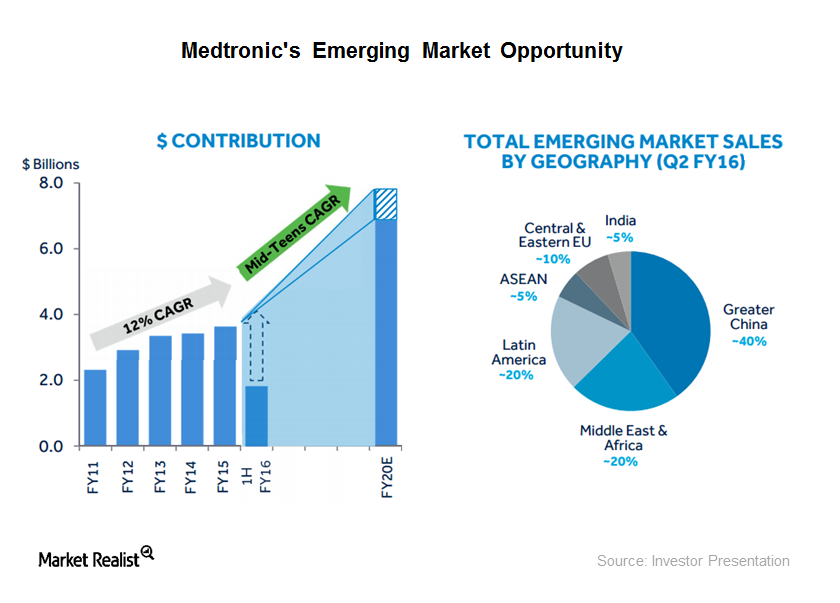

Emerging Markets Growth Is Driving Medtronic’s Geographic Strategy

In fiscal 2Q18, Medtronic registered sales of ~$1.1 billion from emerging markets.

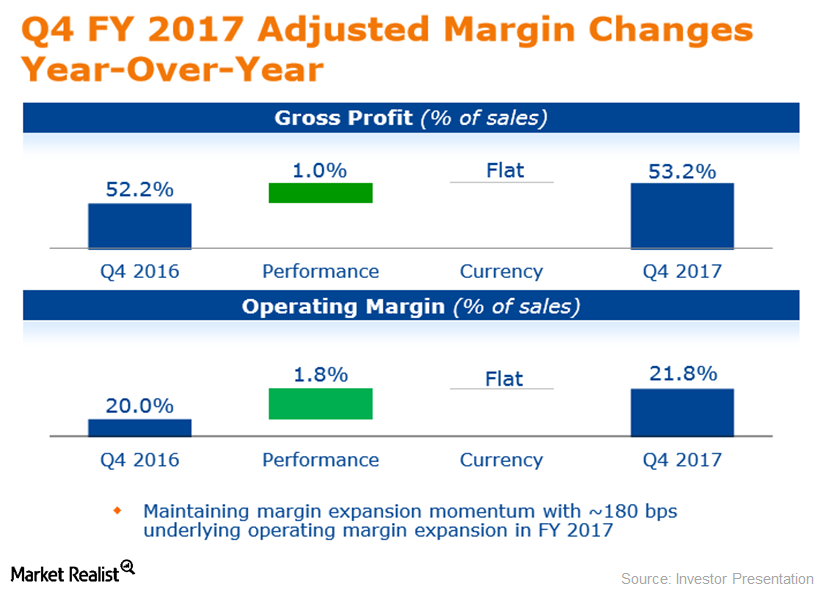

What’s Driving BD’s Operating Margin Expansion

Overview BD (BDX) has registered strong operating margin expansion in recent years. Its margin improved by 100 basis points in fiscal 2015 and 200 basis points in fiscal 2016. In fiscal 2017, BD’s margin expanded by ~180 basis points. In 4Q17, BD’s operating margin grew ~14.6% YoY (year-over-year), limited by 700 basis points due to the divestiture of BD’s […]

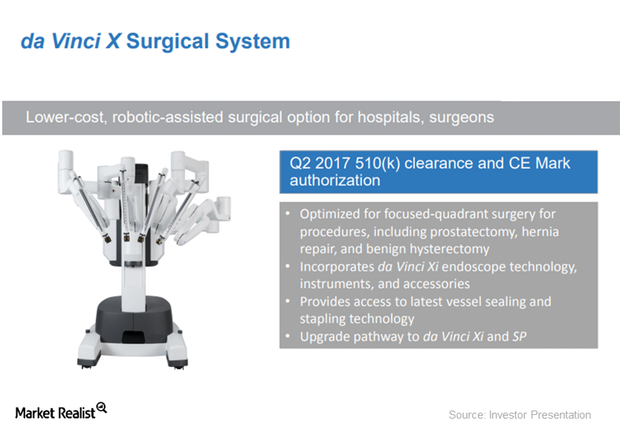

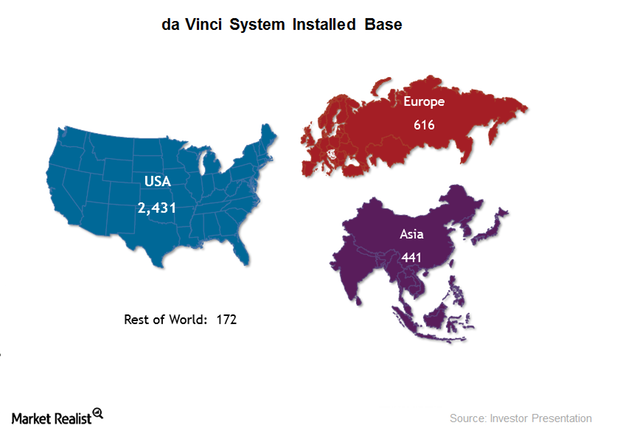

How Intuitive Surgical Is Expanding Its Da Vinci X Systems Worldwide

Intuitive Surgical’s (ISRG) Da Vinci X received early FDA approval in May 2017 and was given a CE Mark in Europe in April 2017.

What’s BD’s Latest News in the Diabetes Management Market?

On September 19, 2017, Becton, Dickinson, and Company (BDX), or BD, introduced a new pen needle for its pen injection devices.

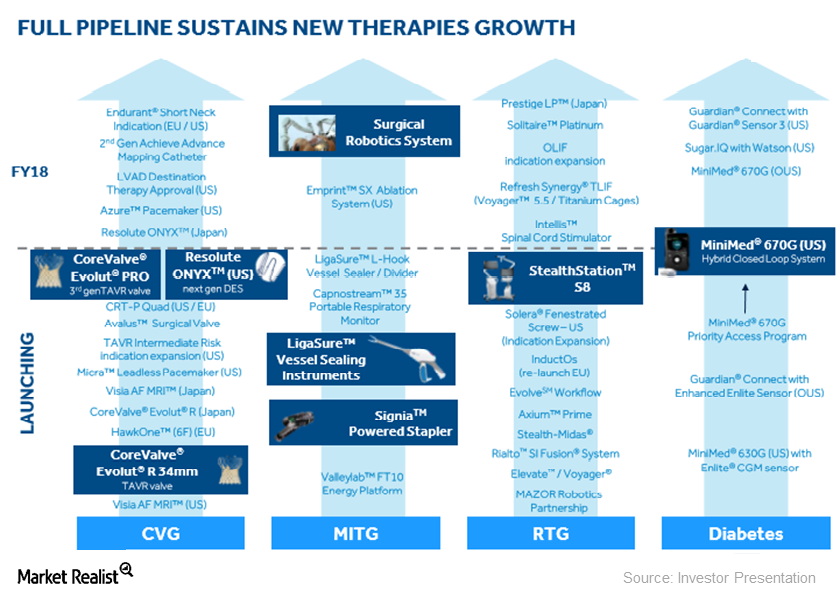

Medtronic’s Robust Product Pipeline

On May 1, 2017, Medtronic announced the FDA approval of its Resolute Onyx DES (drug eluting stent) for adult patients suffering from coronary artery disease.

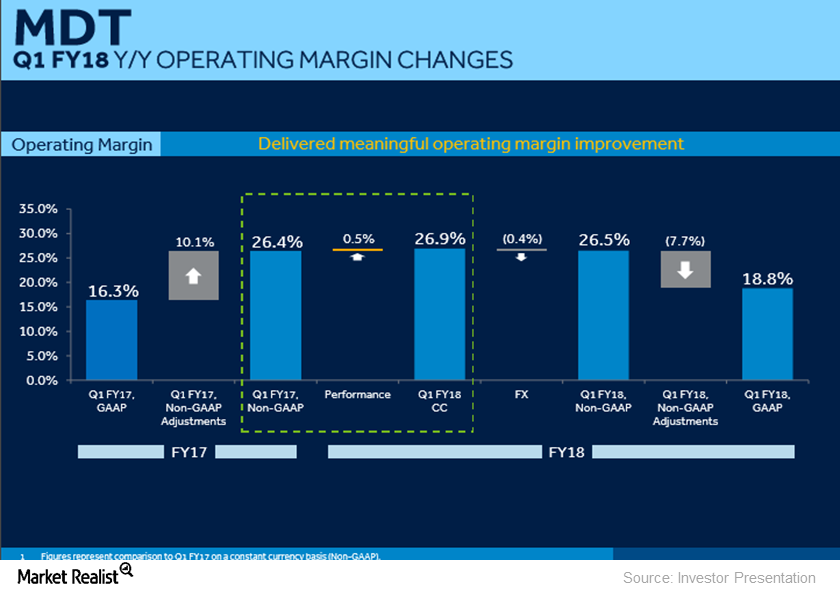

What’s behind Medtronic’s Accelerating Margin Expansion?

In fiscal 1Q18, Medtronic (MDT) reported ~26.9% of operating margin on a constant currency basis. This represented year-over-year growth of ~50 basis points.

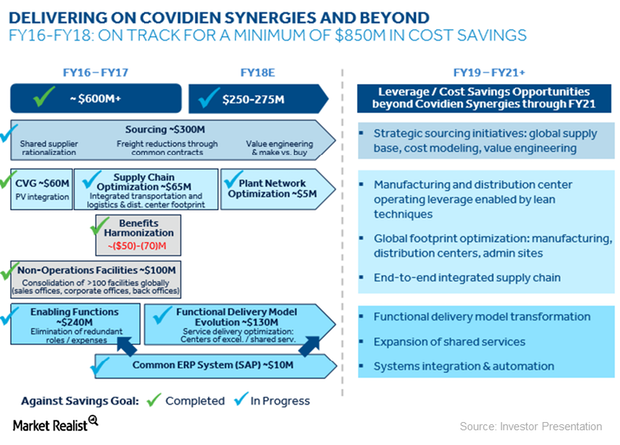

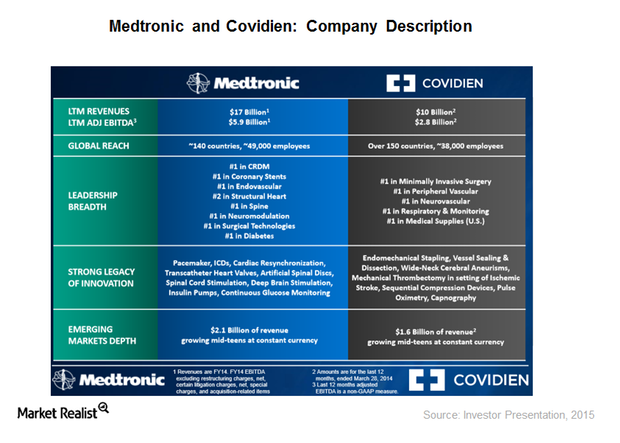

How Medtronic Is Delivering on Its Covidien Synergies

In January 2015, Medtronic (MDT) acquired Covidien for ~$43 billion in cash and MDT stock in a tax inversion deal.

Medtronic’s Emerging Market Position and Opportunities for Fiscal 2018

Medtronic (MDT) registered revenues of ~$1.0 billion revenues from emerging markets in fiscal 1Q18, which represents YoY (year-over-year) sales growth of ~11% in that market.

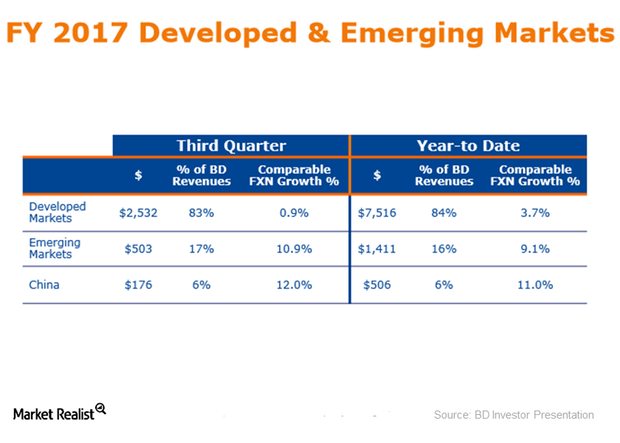

How Is Becton Dickinson Progressing with Emerging Market Growth?

Becton Dickinson’s (BDX) emerging markets registered a strong double-digit growth of 10.9% in 3Q17.

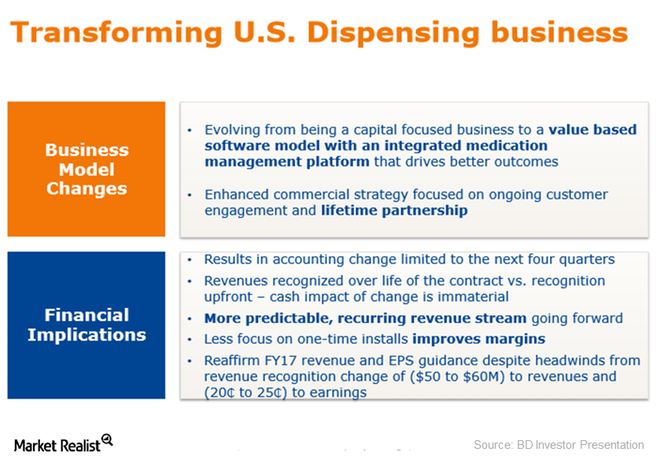

Headwind for Becton Dickinson: US Dispensing Business

Becton Dickinson (BDX) is the leading player in the US dispensing business. Its Pyxis system sales contribute significantly to the company’s total revenues.

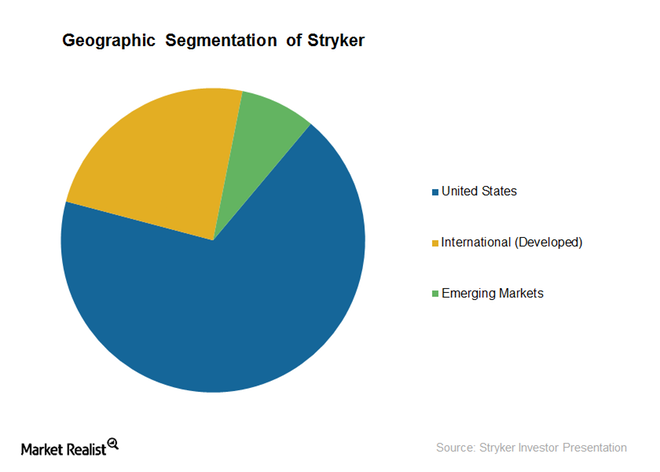

How Stryker Plans to Capture the International Markets

Most of Stryker’s emerging market sales are from China. However, Europe and emerging markets sales have witnessed high growth in recent quarters.

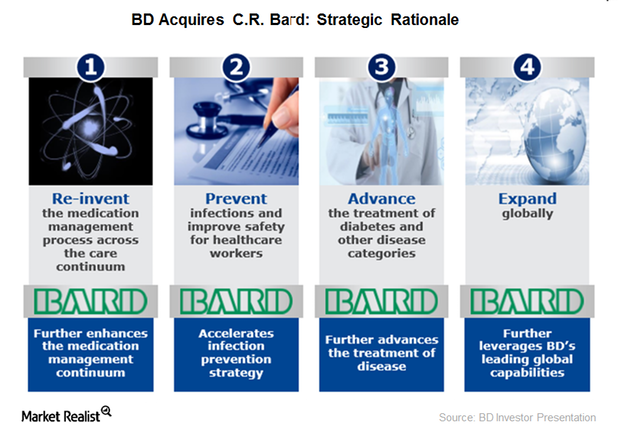

A Look at BD’s Deal Rationale in Its C.R. Bard Acquisition

BD’s acquisition of C.R. Bard is aimed at providing a comprehensive product portfolio to customers at more reasonable costs and enhanced efficiency.

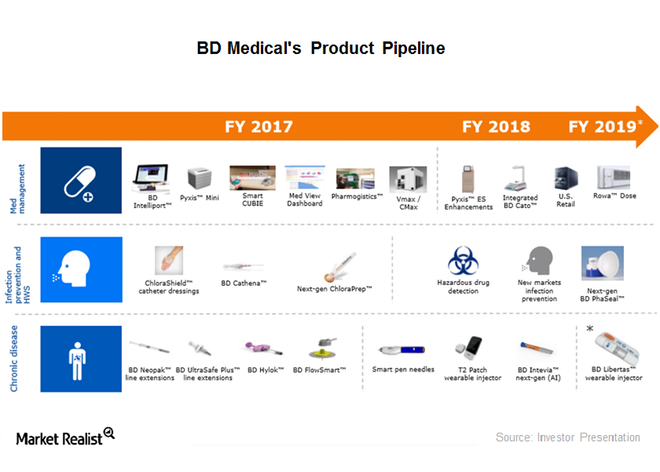

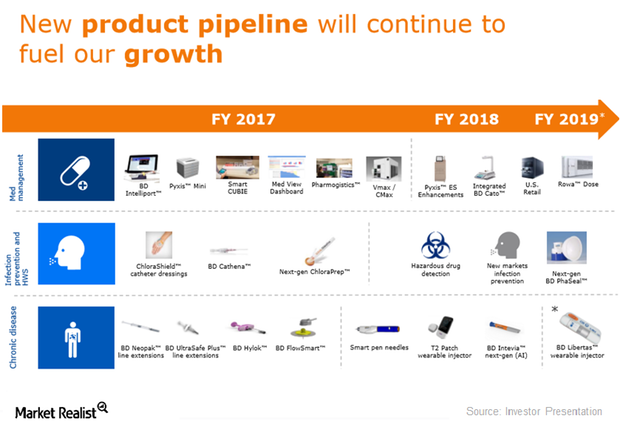

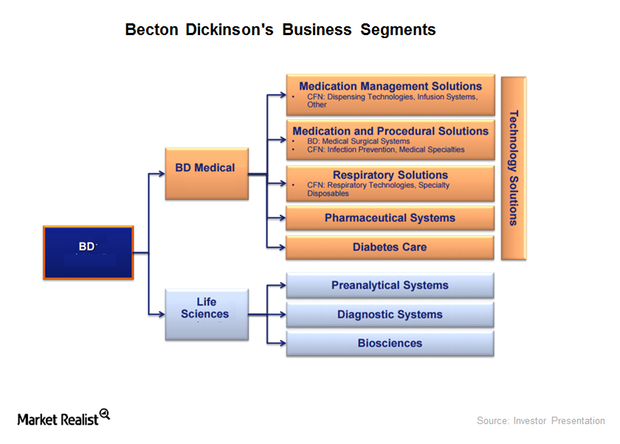

Analyzing the BD Medical Segment’s Product Pipeline

Becton, Dickinson and Company (BDX) generates ~$1 billion from its Infection Prevention business.

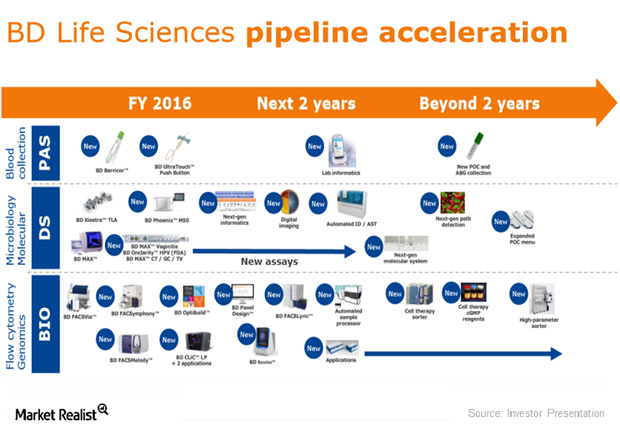

BD Lifesciences’s Product Pipeline Could Boost Its Fiscal 2017 Growth

Becton, Dickinson and Company (BDX) recently launched BD Barricor and BD Ultra Touch Push Button under its Pre-Analytical Systems division.

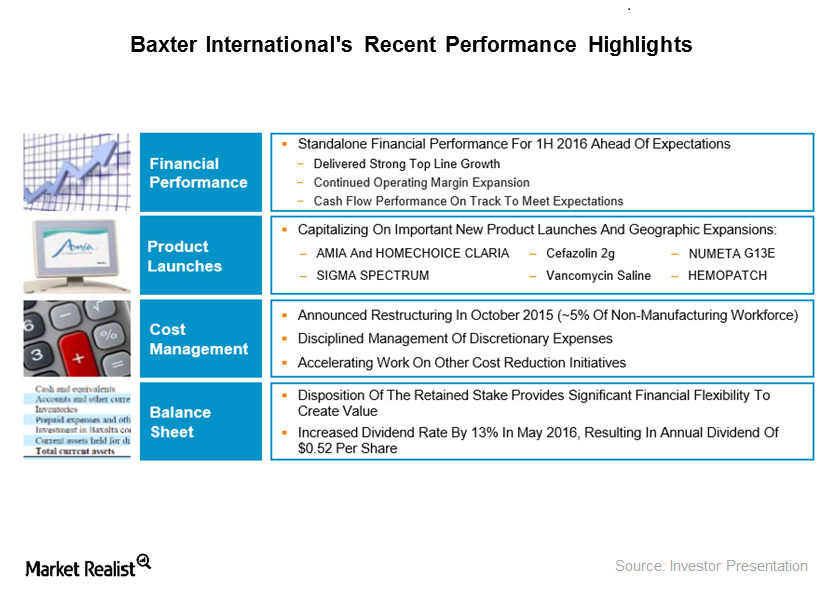

Baxter International’s Recent Product Launches and Partnerships

Baxter International’s R&D investments were around $150 million in 2Q16, which represents a YoY (year-over-year) increase of around 1%.

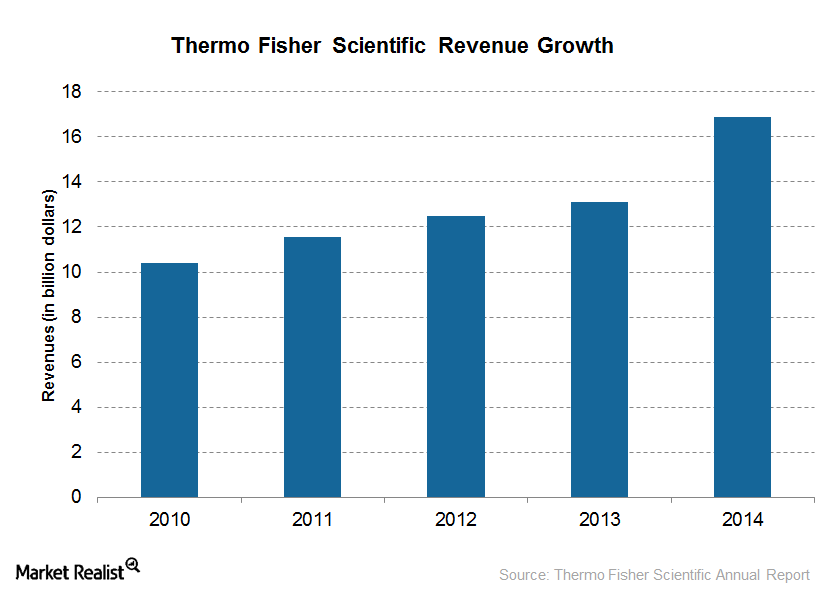

Thermo Fisher Scientific’s Key Growth Strategy

Thermo Fisher Scientific reported ~$4.5 billion in revenues in 2Q16, representing YoY (year-over-year) growth of ~6%.

Can Thermo Fisher’s PPI Business System Continue to Drive Growth in 2016?

The PPI system has helped nourish strong top-line growth across Thermo Fisher’s businesses while boosting margins.

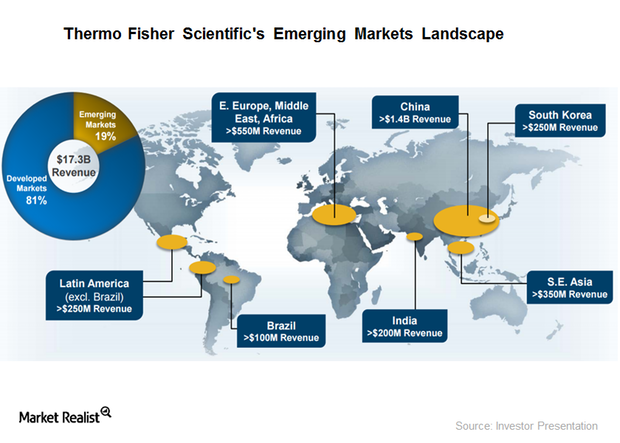

Inside Thermo Fisher Scientific’s Emerging Markets Strategy

Thermo Fisher has a presence in more than 50 countries. It generates ~19% of its revenues from emerging markets and the rest from developed markets.

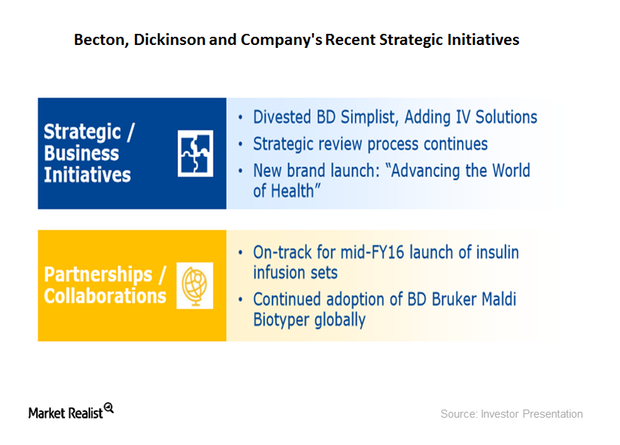

What’s the Verdict on Becton Dickinson’s Strategic Portfolio Review?

Becton Dickinson (BDX) completed its annual strategic review of its portfolio, which was initiated after the acquisition of CareFusion.

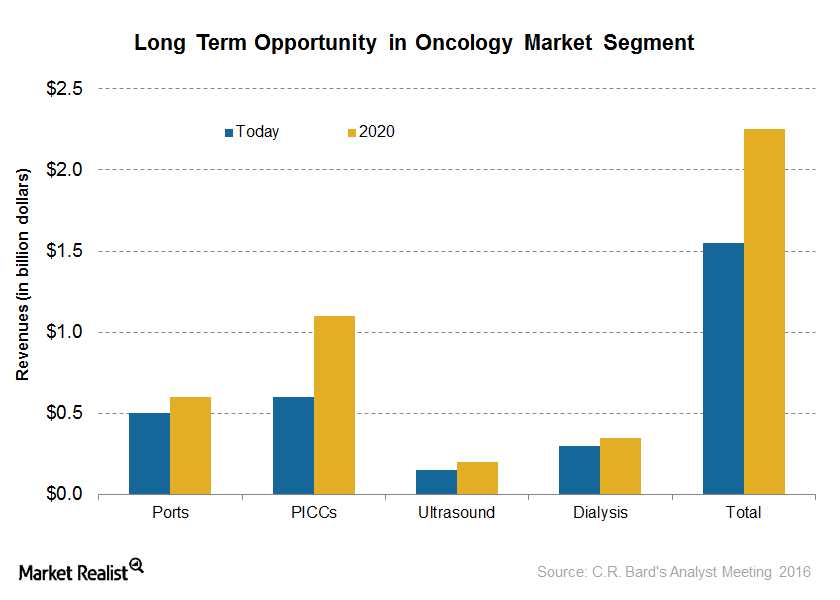

A Look at C. R. Bard’s Oncology Business Segment

C. R. Bard’s (BCR) Oncology segment contributes around 27% of the total revenues of the company.

Exploring Intuitive Surgical’s Sales Model

Intuitive Surgical follows a diversified sales strategy and doesn’t generate more than 10% of its revenue through any one customer.

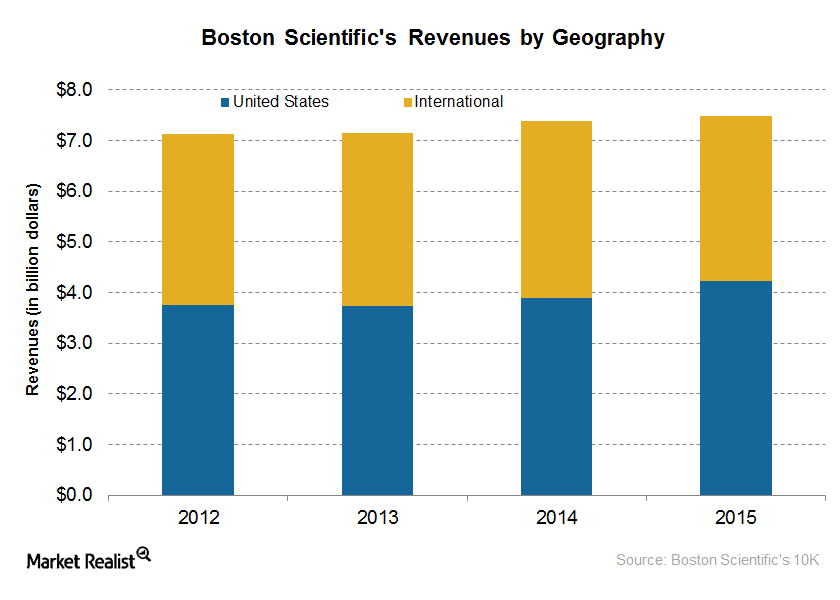

How Is Boston Scientific’s Geographic Strategy Driving Growth?

Boston Scientific has strategically expanded in these geographies through organic as well as inorganic strategies.

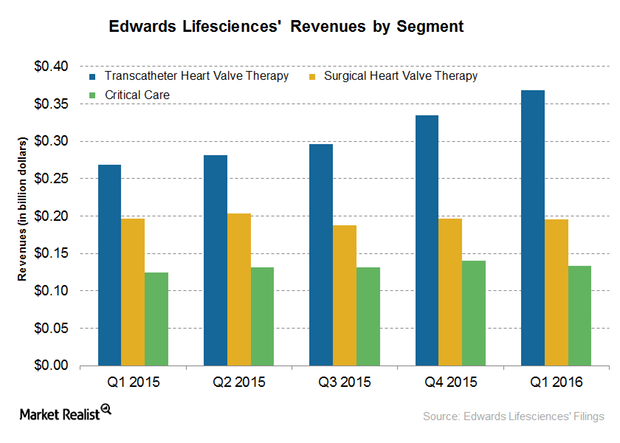

How Did Edwards Lifesciences’ Critical Care Segment Fare in 1Q16?

Edwards Lifesciences (EW) reported ~$697 million in total revenue in 1Q16. Of that, ~$134 million was contributed by the company’s Critical Care segment.

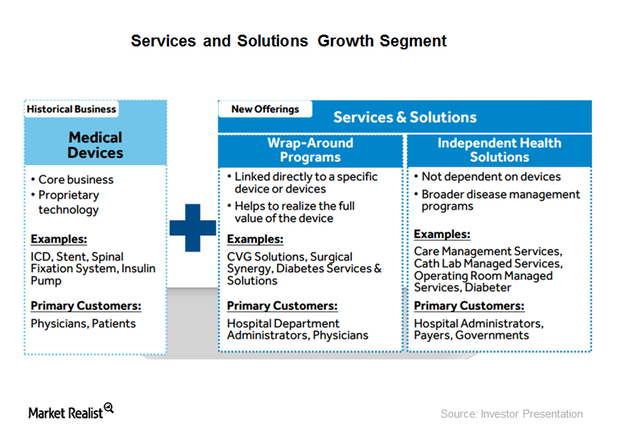

Why Medtronic Is Diversifying beyond Medical Devices

Medtronic established a services and solutions growth vector as one of its core strategies. It contributed ~20 basis points to Medtronic’s growth in 3Q16.

How Is Medtronic’s Globalization Strategy Driving Its Growth?

Medtronic’s (MDT) growth is driven by three of the company’s core strategies—therapy innovation, globalization, and economic value.

Sizing up Medtronic-Covidien, the Biggest Deal in the Medical Device Industry

On January 26, Medtronic completed the acquisition of Covidien for $42.9 billion in cash and Medtronic stocks and assumed Covidien’s debt of ~$5 billion.

Behind Becton Dickinson’s Strategic Restructuring and Business Consolidation

To better position itself amid the changing medical device environment, Becton Dickinson has come to focus on restructuring and business model evolution.

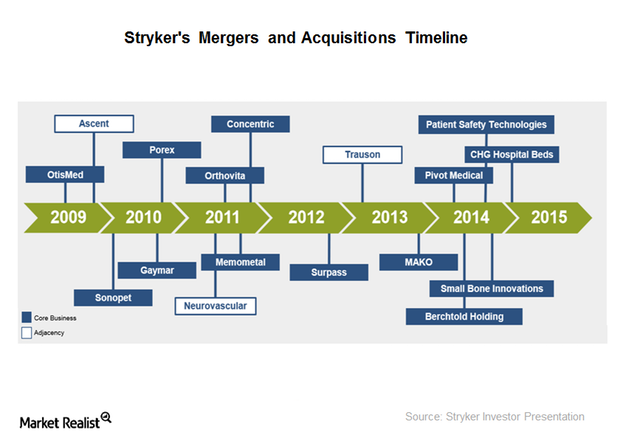

Growth and Profitability: How Does Stryker Do It?

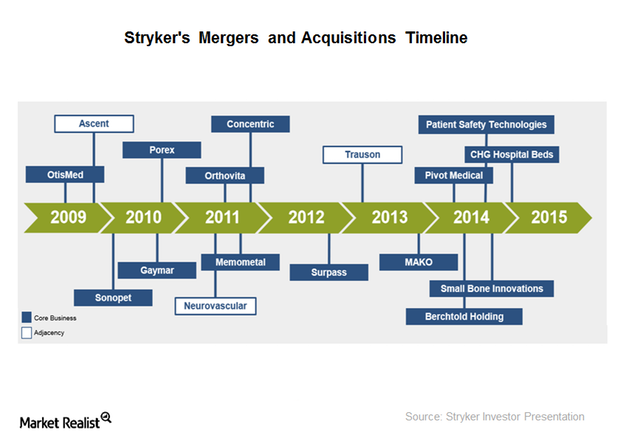

Between 2012 and 2014, Stryker (SYK) entered into a number of mergers and acquisition deals, investing ~$3.4 billion.

How Inorganic Growth Strategy of Stryker Is Driving Growth

Stryker has expanded its portfolio and geographic reach through mergers and acquisitions and product development. It saw a 7.3% sales growth in 2014.

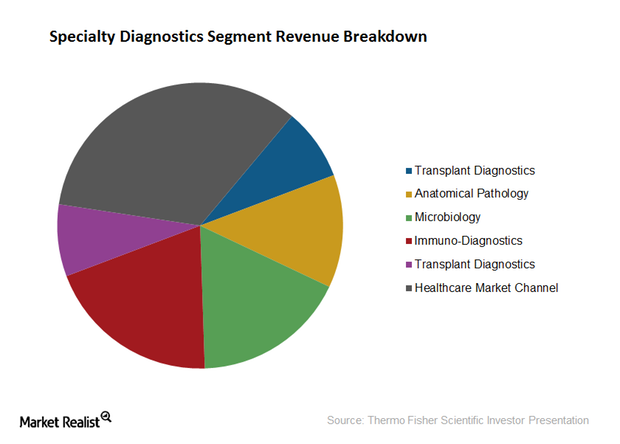

Specialty Diagnostics Segment of Thermo Fisher Scientific

A leading provider of diagnostic products and services, Thermo Fisher Scientific (TMO) has witnessed strong recurring revenues and high margins in the Specialty Diagnostics Segment over the years.

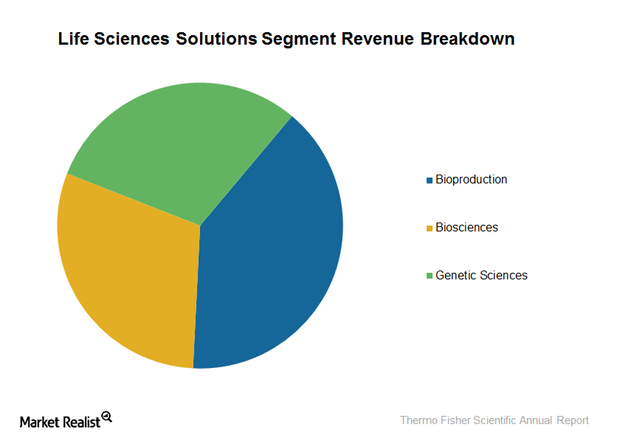

The Life Sciences Solutions Segment of Thermo Fisher Scientific

Thermo Fisher Scientific’s Life Sciences Solutions segment earned revenues of ~$4.2 billion in 2014, representing organic growth of around 4%.

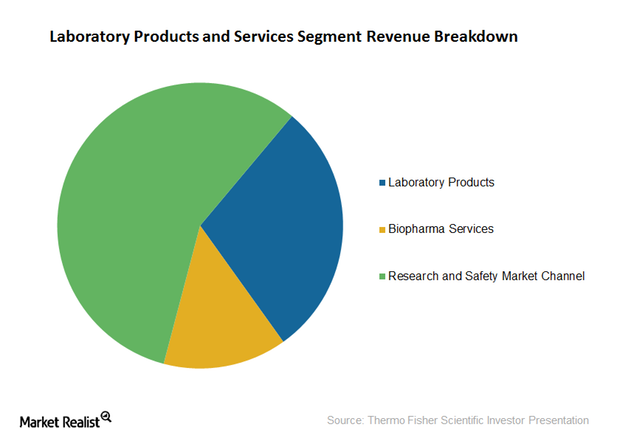

Thermo Fisher Scientific’s Laboratory Products and Services Segment

Thermo Fisher Scientific’s Laboratory Products and Services segment earned revenues of approximately $6.6 billion in 2014, representing organic growth of around 5%.

Thermo Fisher Scientific: A Leading Medical Technology Company

Thermo Fisher Scientific (TMO) is one of the leading medical technology companies in the world, providing a broad portfolio of laboratory equipment and services.

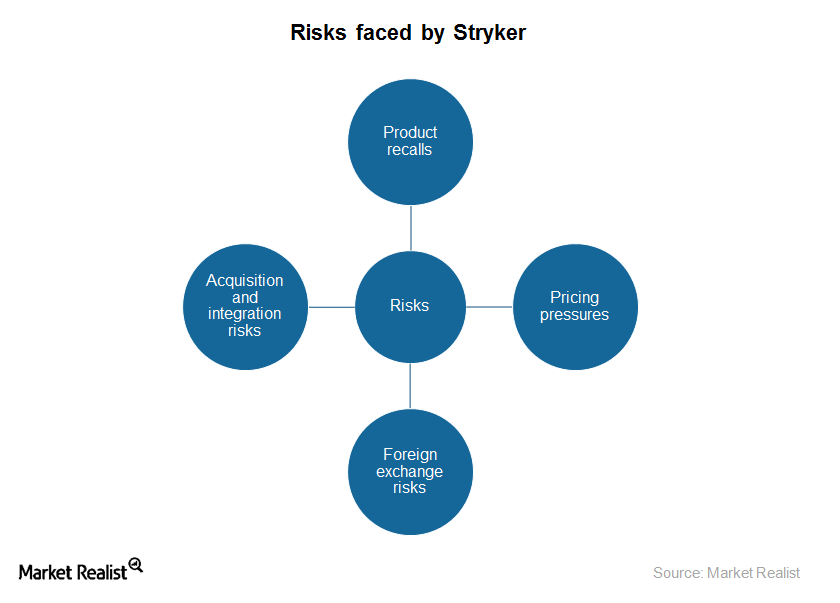

Assessing Stryker’s Major Risks at the Dawn of 2016

Stryker is a leading medical technology company and subject to big challenges impacting the medical technology industry, both systematic and unsystematic.

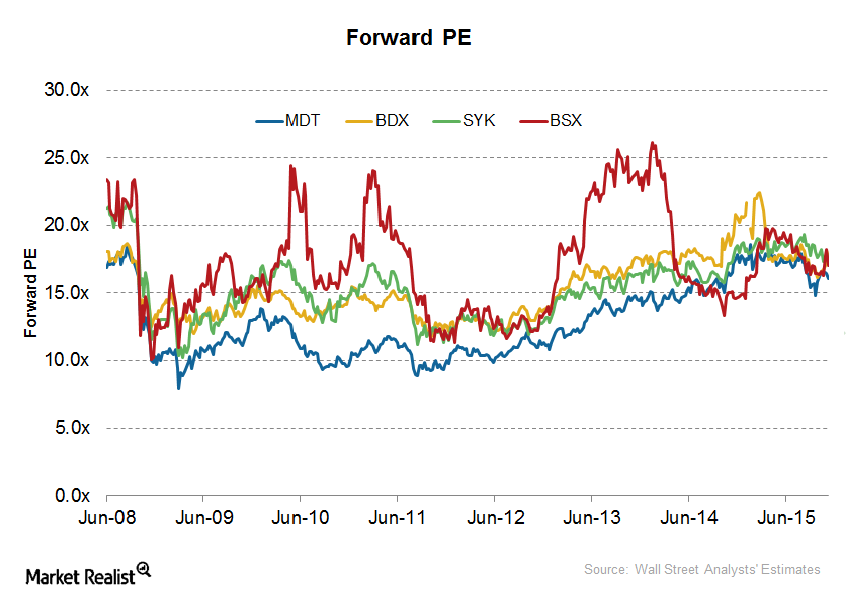

A Look at Becton, Dickinson and Company’s Valuation

Becton, Dickinson and Company is one of the five biggest medical device companies in the United States.

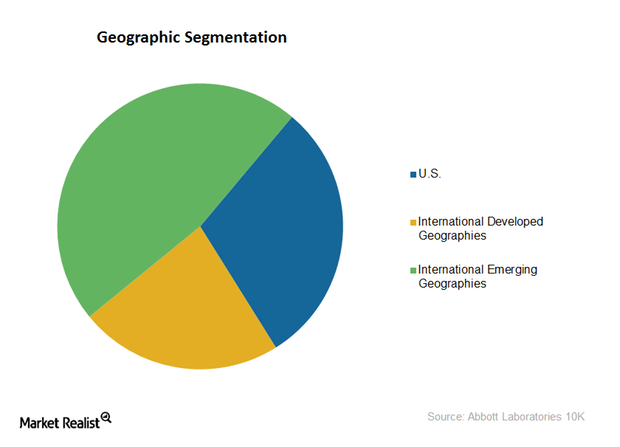

Mapping Abbott Laboratories’ Geographic Strategy

Abbott Laboratories is a global healthcare company that sees 70% of its total revenues generated in markets outside the United States.

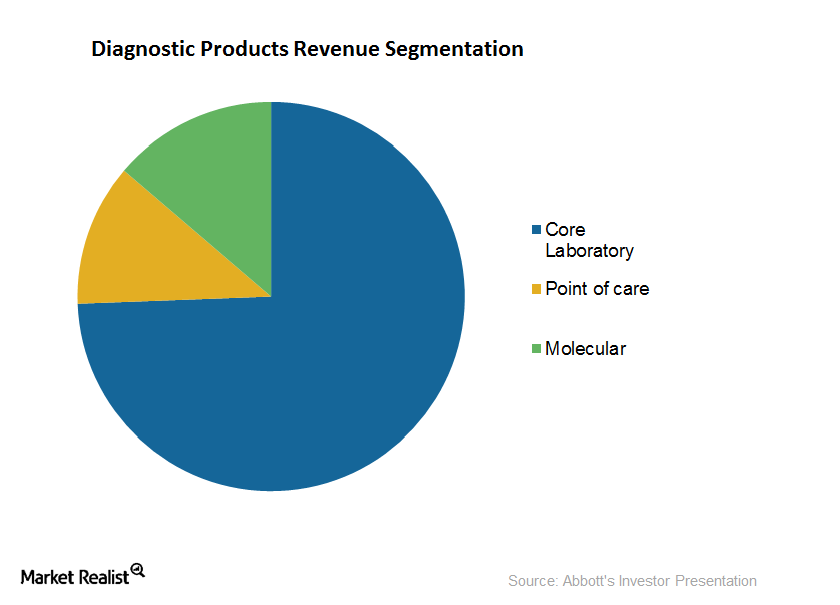

A Rundown of Abbott Laboratories’ Diagnostic Products Segment

Abbott Laboratories is one of the leading companies in the diagnostic products space in the United States, with sales of around $4.7 billion in 2014.

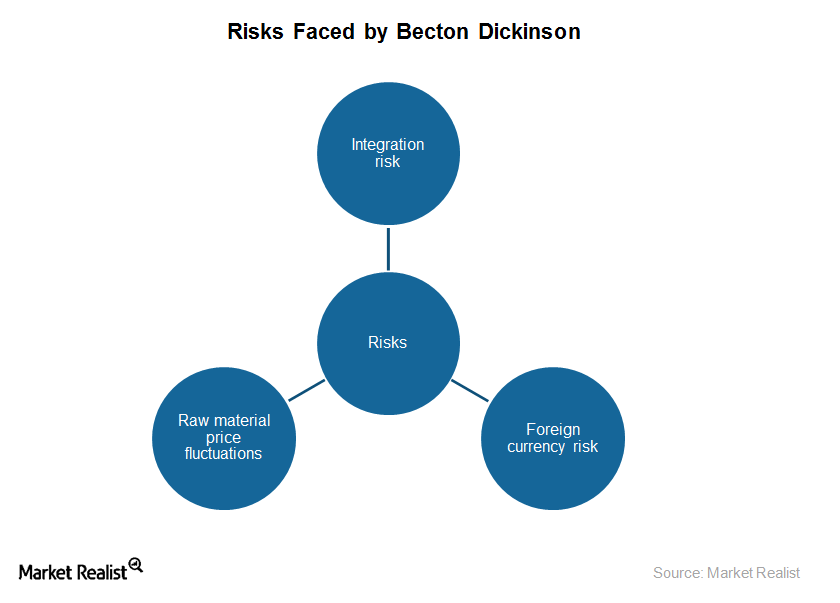

Risks Faced by Becton, Dickinson and Company

As it is susceptible to industry risks, Becton, Dickinson and Company (BDX), or BD, is transforming its business model.

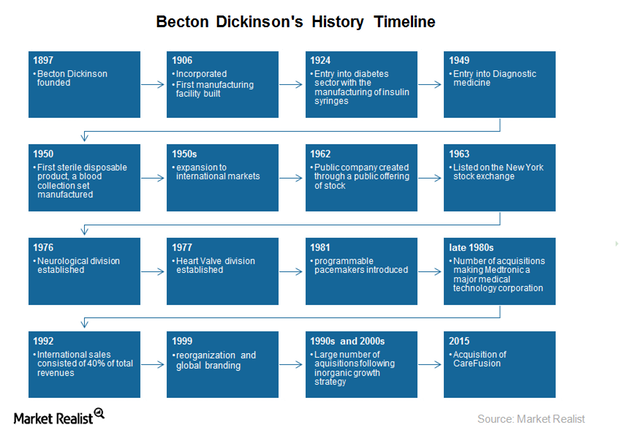

Becton, Dickinson and Company’s Acquisitions and Collaborations

Becton, Dickinson and Company’s (BDX), or BD’s, growth strategy includes acquisitions and collaborations.

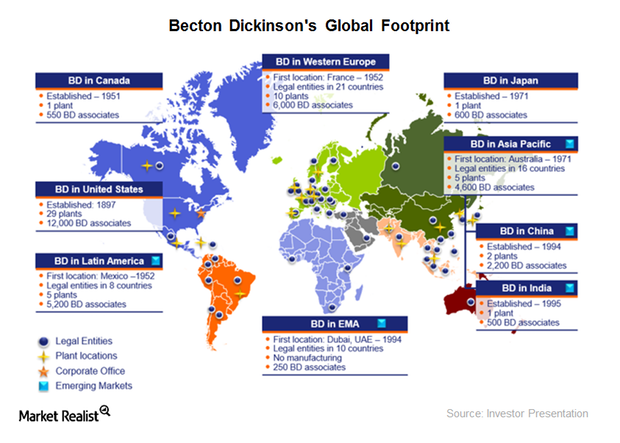

Analyzing Becton, Dickinson and Company’s Geographic Strategy

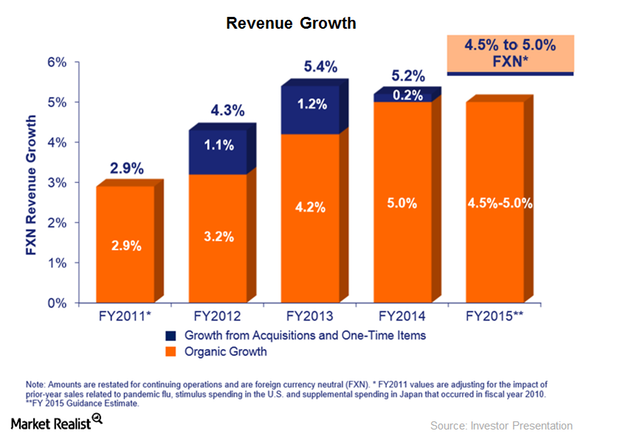

Becton, Dickinson and Company (BDX), or BD, has operations across the globe, with more than 50% of its 2015 revenues coming from international markets.

Becton, Dickinson and Company: A Leading Global Medical Device Company

Becton, Dickinson and Company, or BD, headquartered in Franklin Lakes, New Jersey, is one of the leading medical technology companies in the United States.