Amgen Inc

Latest Amgen Inc News and Updates

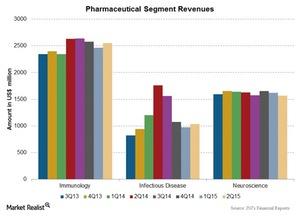

Johnson & Johnson’s Pharmaceuticals Segment Grows in 2Q15

Johnson & Johnson’s (JNJ) Pharmaceuticals segment grew by 1.0% at constant exchange rates, reporting a revenue of $7,946 million for 2Q15 over 2Q14.

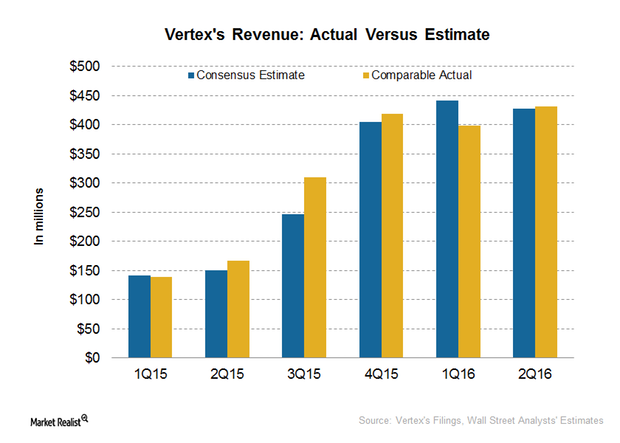

How Vertex’s Revenue and Earnings Surprised in 2Q16

Vertex Pharmaceuticals (VRTX) reported its 2Q16 earnings on July 27, 2016. VRTX surpassed Wall Street analysts’ projections and reported revenue of $431.6 million.

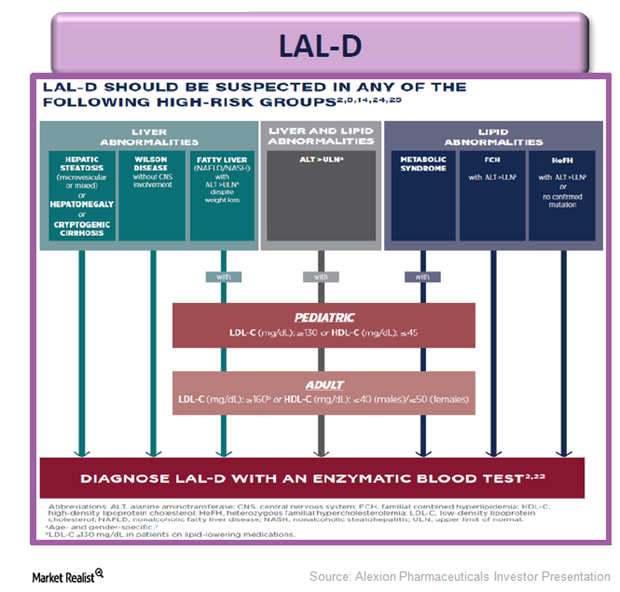

Alexion Pharmaceuticals Adds Metabolic Drug Kanuma to Portfolio

Kanuma was acquired by Alexion Pharmaceuticals on completion of the acquisition of Synageva Pharmaceuticals in June 2015.

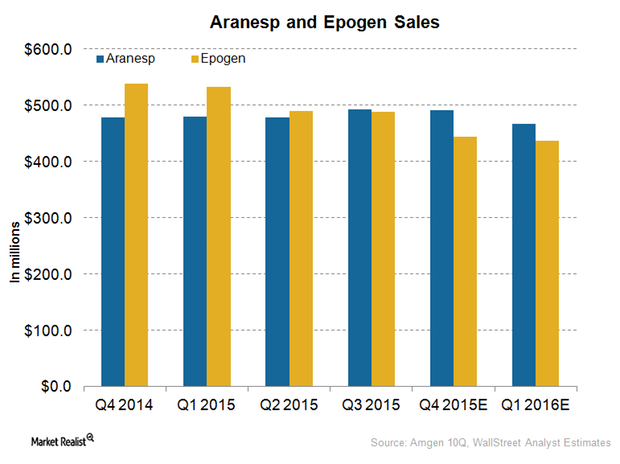

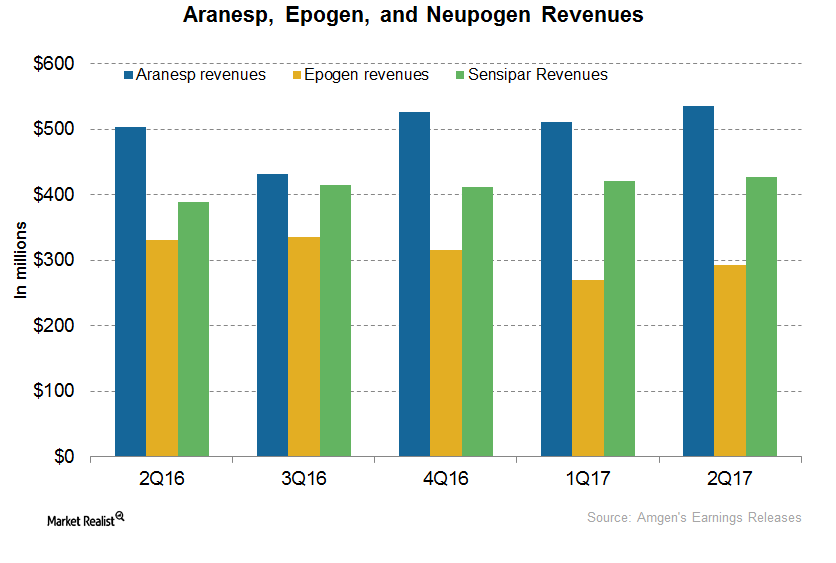

Amgen’s Nephrology Drugs Expect Falling Revenue in 4Q15

Analysts projected a fall in the revenue for Amgen’s nephrology drugs, Aranesp and Epogen, in 4Q15. The drugs are expected to suffer in the coming quarters.

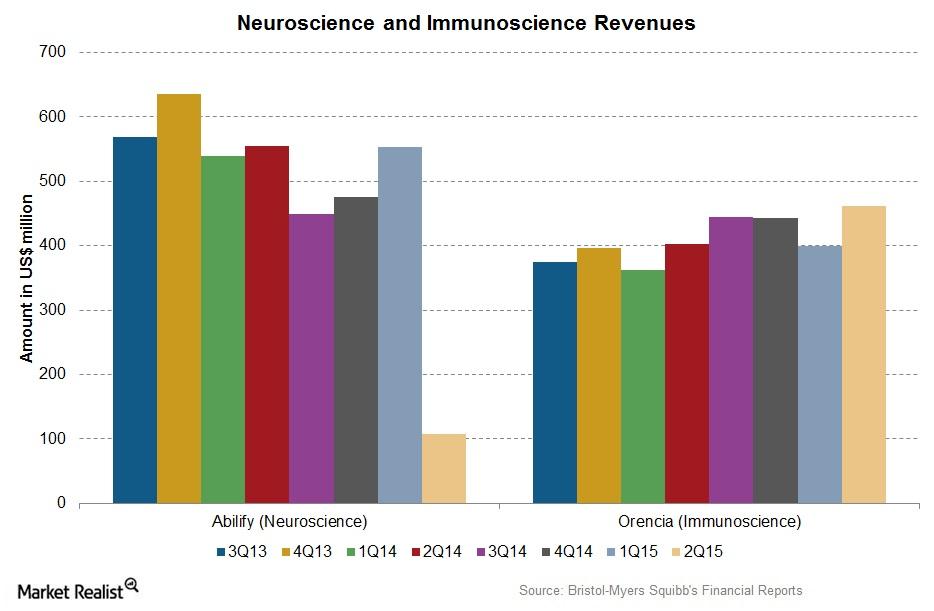

Bristol-Myers Squibb’s Neuroscience and Immunoscience Segments

Sales for Bristol-Myers Squibb’s (BMY) neuroscience segment declined over 80% in 2Q15, while the immunoscience segment’s sales improved ~15% in 2Q15 as compared to 2Q14.

Teva’s Granix Gets FDA Approval for Expanded Indication

Today, Teva Pharmaceutical Industries (TEVA) announced that its Granix (tbo-filgrastim) injection has received FDA approval for a new presentation and indication.

Novartis Receives 2 Breakthrough Therapy Designations in January

In January 2018, the FDA granted a BTD to Novartis’s (NVS) Promacta for use along with standard immunosuppressive therapy.

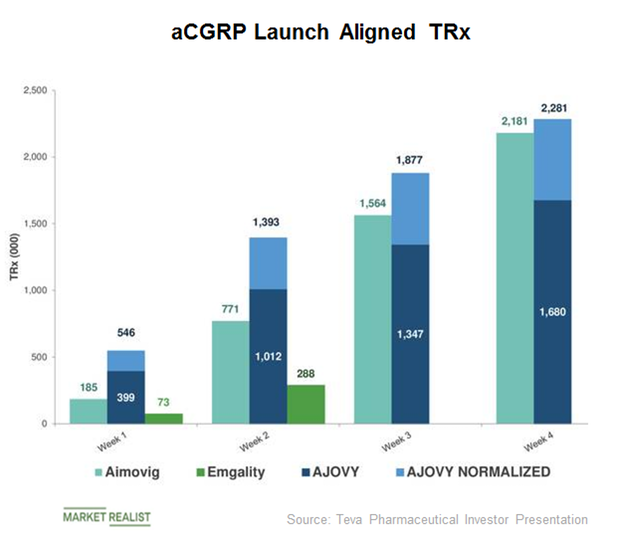

Competition Dynamics for Ajovy—Teva’s Migraine Drug

Approved by the FDA on September 14, Teva’s Ajovy has multiple competitors set to enter the market.

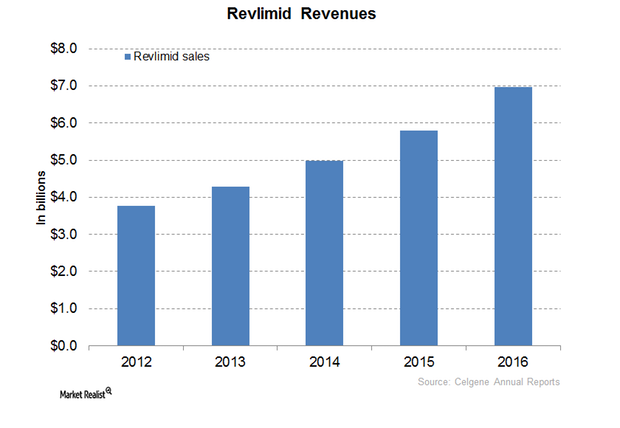

Revlimid Could Continue to Drive Celgene’s Revenue Growth in 2017

In 2016, Celgene’s (CELG) Revlimid generated revenues of around $6.9 billion, which reflected a ~20% year-over-year (or YOY) growth.

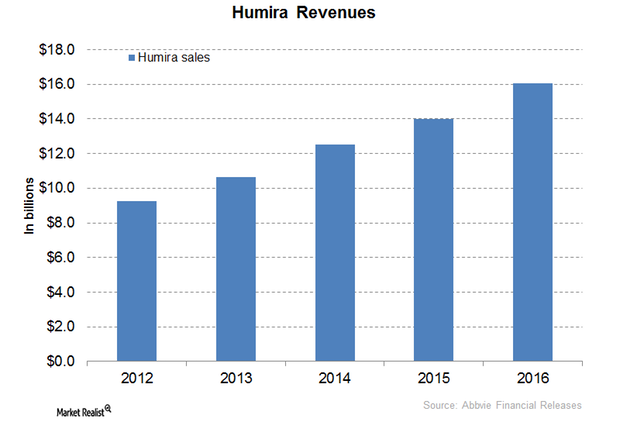

Humira May Continue to Drive AbbVie’s Revenue Growth

In 2016, AbbVie’s (ABBV) drug Humira reported revenue of ~$16.0 billion, which reflected a ~15% year-over-year (or YoY) rise.

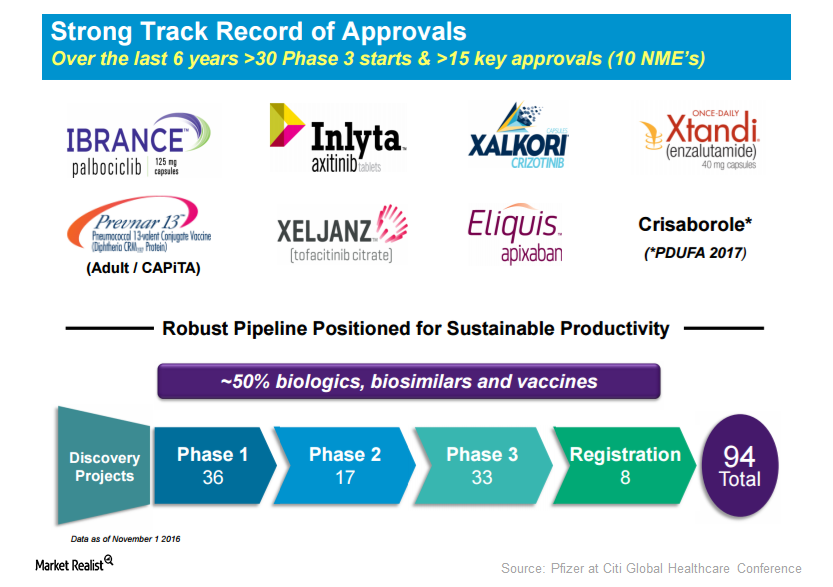

Pfizer Has Strong Track Record since 2010

As of November 1, Pfizer had ~94 projects in various development stages. More than 40% of these projects are in phase three or the registration phase.

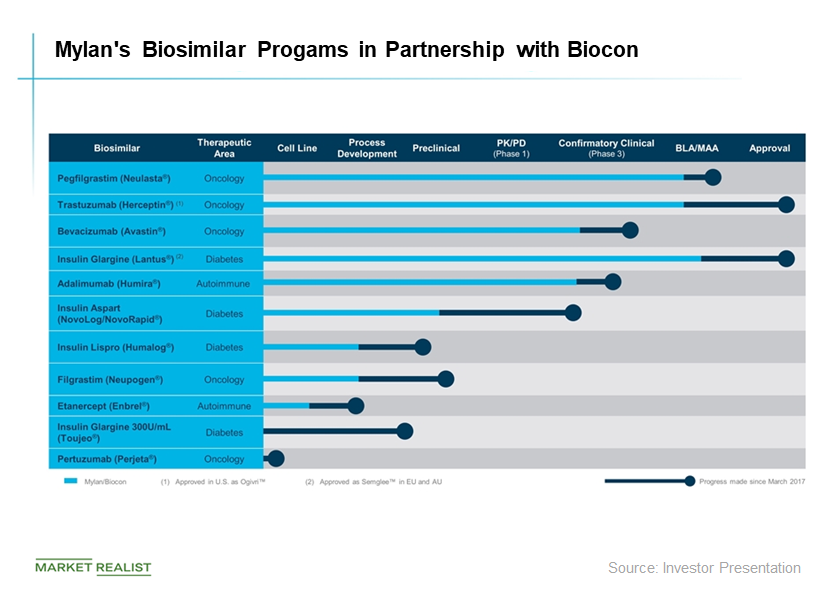

Wall Street Looks at Sales Forecasts for Mylan’s Fulphila

According to Leerink analyst Amy Fadia, Fulphila is expected to generate sales of $73.0 million in 2018. Fadia expects Fulphila’s sales to reach $260.0 million in 2019.

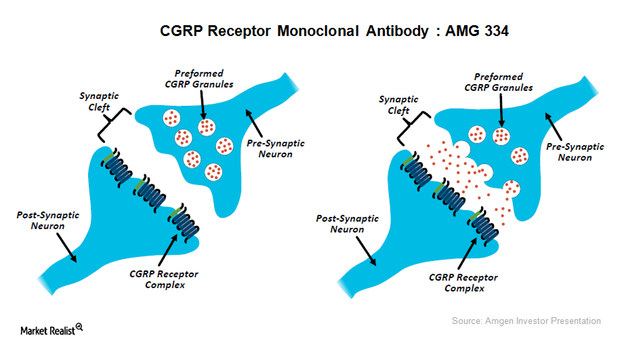

Entering Migraine Market Won’t Be Easy for Novartis, Amgen

Novartis (NVS) and Amgen (AMGN) recently announced that the CGRP inhibitor therapy, AMG 334, reported positive results in a Phase 2 clinical trial as a therapy for preventing chronic migraine.

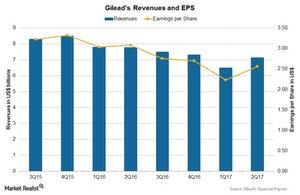

What’s Gilead Sciences’ Valuation?

Gilead’s stock price has risen ~8.9% in the last 12 months. Wall Street analysts estimate that the stock price will fall ~4.5% over the next 12 months.

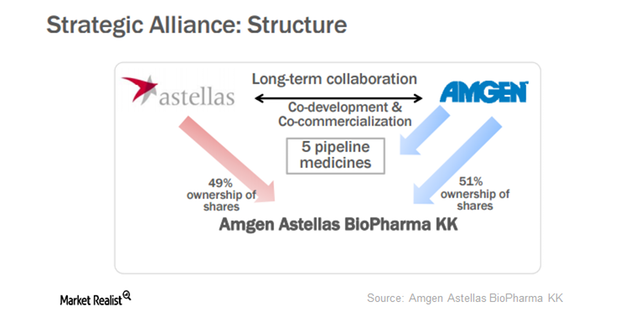

Multinational and Japanese Pharmaceuticals Should Build Alliances

The Japanese pharmaceuticals market is not very welcoming to foreign companies. Similarly, the Japanese population is quite loyal to domestic manufacturers.

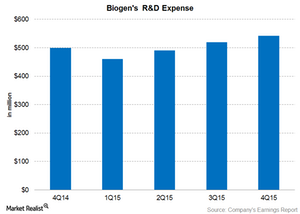

How Much Does Biogen Spend on Research and Development?

Biogen’s (BIIB) R&D expenses for 4Q15 were $542 million, or 19% of its total revenue, including a $60 million payment to Mitsubishi Tanabe.

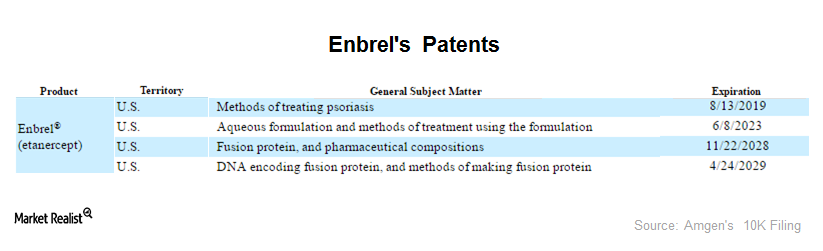

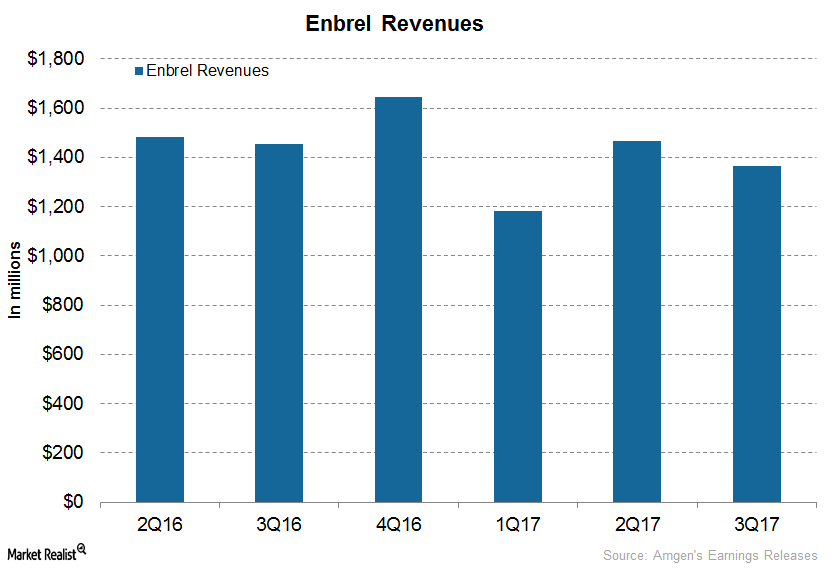

Why Is Enbrel So Important for Amgen?

YTD, Amgen’s (AMGN) stock has already fallen 9%. Perhaps the pressure that Enbrel (etanercept) is seeing is to blame for the negative investor sentiment.

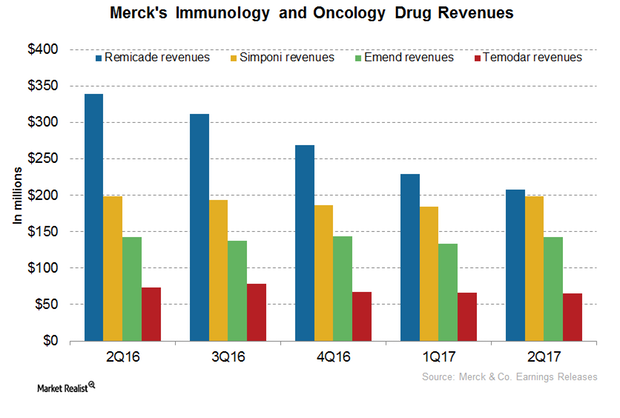

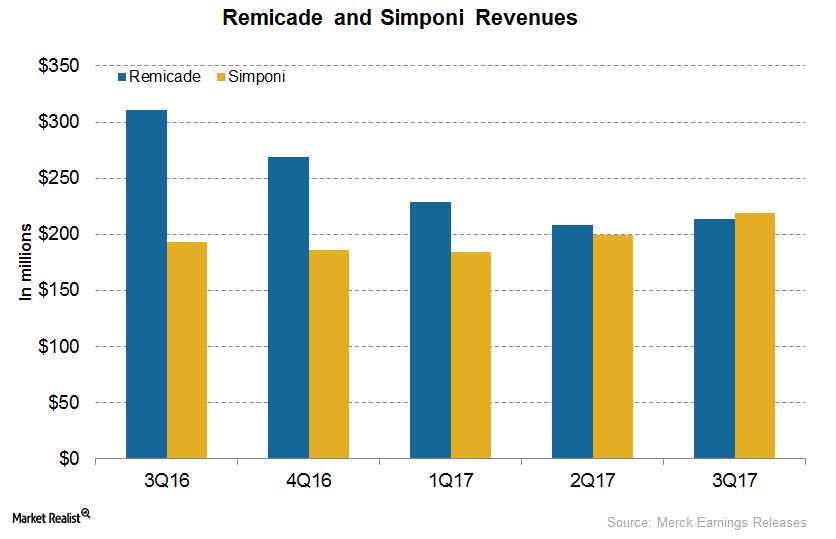

A Look into Merck’s Immunology and Oncology Portfolio

In 1H17, Remicade generated revenues of around $437 million, which is a 37% decline year-over-year.

How Amgen’s Nephrology Drugs Are Positioned after 2Q17?

In 2Q17, Amgen’s (AMGN) Aranesp generated revenues of ~$535 million, which represented a 6% year-over-year rise.

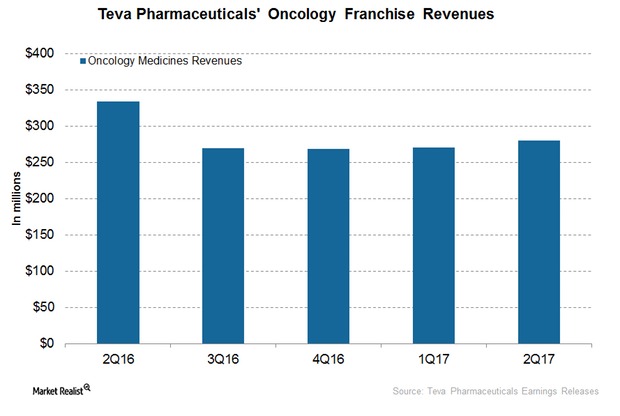

The Latest on TEVA’s Oncology Business

In 1H17, Teva Pharmaceutical’s (TEVA) oncology business generated revenues of ~$550 million, or ~9% lower YoY (year-over-year).

Teva Announces First-to-File Launch of Generic Cialis

Yesterday, Teva Pharmaceutical Industries (TEVA) announced the exclusive FTF (first-to-file) launch of the generic Cialis1 tablets in the US.

An Easier Way to Understand the Pharma Industry

In 2018, the global pharmaceutical industry stood at $1.2 trillion, and experts expect $1.5 trillion by 2023. Here’s everything investors need to know.

Why Pfizer Stock Continues to Tank after Mylan Deal

Pfizer stock (PFE) has fallen 10% in the past two days on its deal with Mylan (MYL) and its lower earnings guidance.

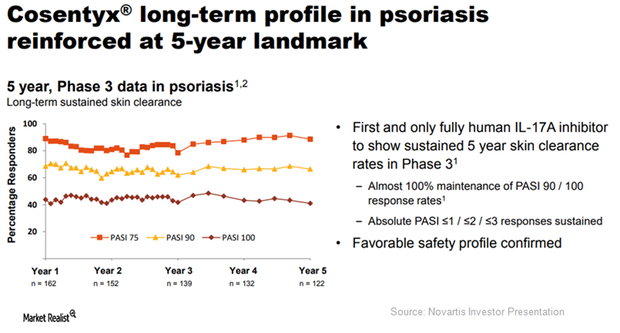

A Look at Cosentyx, Novartis’s Fast-Growing Immunology Drug

In the first quarter, Novartis’s (NVS) Cosentyx reported net sales of $791 million, a YoY (year-over-year) rise of 41% on a constant currency basis.

Ajovy Is a New Growth Driver for Teva Pharmaceutical

On September 14, Teva Pharmaceutical (TEVA) issued a press release announcing FDA approval of humanized monoclonal antibody and anti-calcitonin gene-related peptide (or CGRP) therapy.

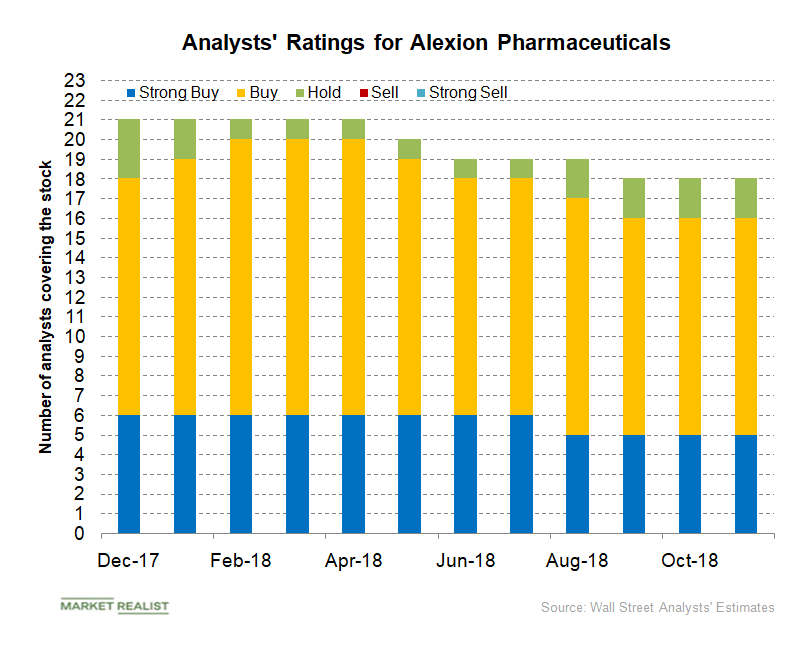

How Analysts View Alexion Stock

In November 2018, of the total 18 analysts covering Alexion Pharmaceuticals (ALXN), 16 analysts have given the stock a “buy” or higher rating, and two analysts have given it a “hold” rating.

How Wall Street Analysts View Merck

On October 25, Merck (MRK) announced a dividend of $0.55 per share for its outstanding common stock in the fourth quarter of 2018.

Analysts Have Mixed Opinions about Ionis

Wall Street analysts estimate that Ionis’s (IONS) Q2 2018 revenues will rise ~30.0% to $135.5 million as compared to $104.2 million in Q2 2017.

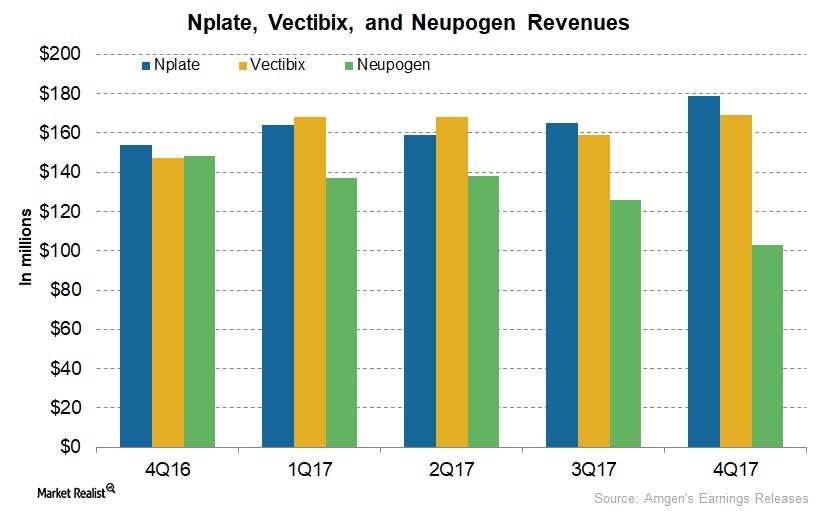

How Amgen’s Nplate, Vectibix, and Neupogen Performed in 1Q18

In 1Q18, Amgen’s (AMGN) Nplate revenue grew 16% YoY (year-over-year) to $179 million from $154 million, primarily driven by unit demand.

How Celgene Performed in 1Q18

In 1Q18, Celgene’s (CELG) revenue grew 20% year-over-year to $3.5 billion from $3.0 billion, boosted by Revlimid, Pomalyst, and Otezla sales.

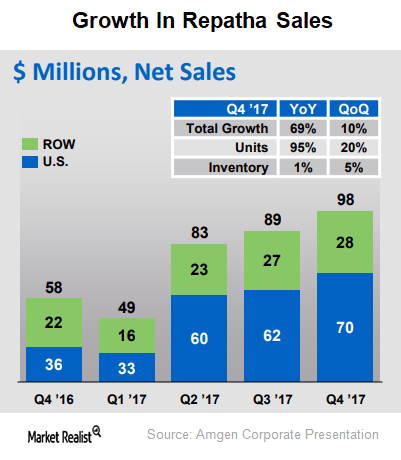

Exploring the Growth Trajectory of Amgen’s Repatha

Amgen (AMGN) is one of the world’s leading biotechnology companies, with a presence in ~100 countries.

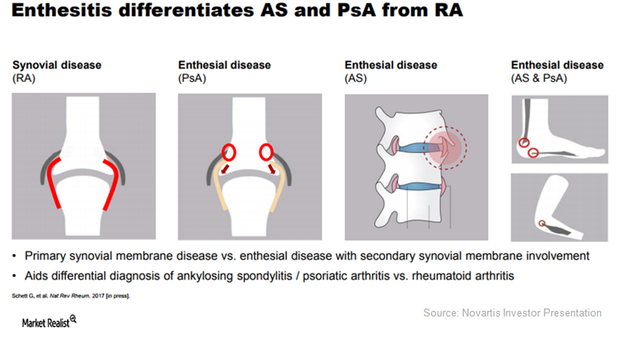

How Cosentyx Resolves Enthesitis in Psoriatic Arthritis Patients

Only 525,000 patients (or 55% of the diagnosed psoriatic arthritis patients) were eligible for treatment with biologics.

Novartis’s Cosentyx May Emerge as a Leading Psoriasis Drug

According to Novartis’s estimates for the US biologics market in 2016, there were ~8.4 million patients with moderate to severe psoriasis in the US.

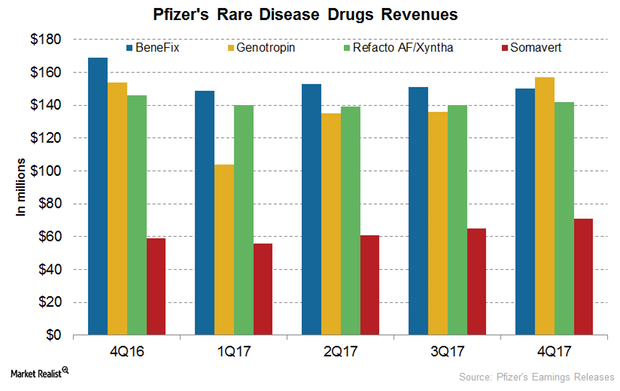

Inside Pfizer’s Rare Disease Segment Performance in 2017

In 4Q17, Pfizer’s BeneFix reported revenues of $150 million, which represents a ~11% decline YoY and a ~1% decline quarter-over-quarter.

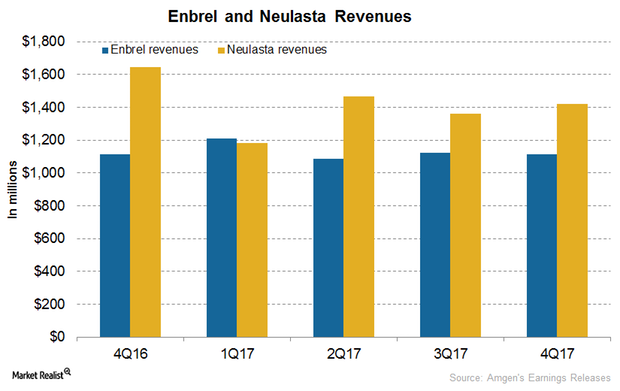

Amgen’s Neulasta and Enbrel in 4Q17 and 2017

In 4Q17, Amgen’s (AMGN) Neulasta generated revenues of $1.1 billion, which reflected a 1% decline on a quarter-over-quarter basis.

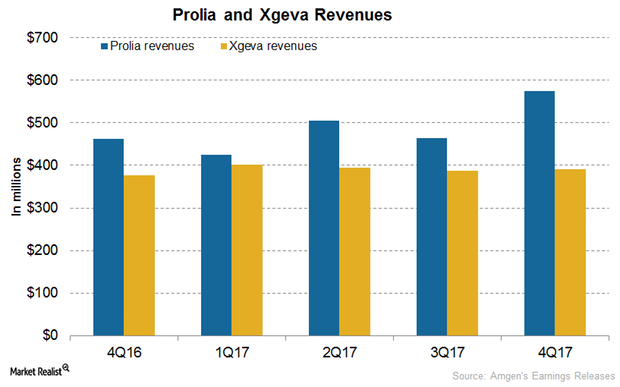

How Amgen’s Xgeva and Prolia Performed in 4Q17

In 4Q17, Xgeva generated revenues of $391 million, which reflected a 4% growth on a YoY (year-over-year) basis and a 1% growth quarter-over-quarter.

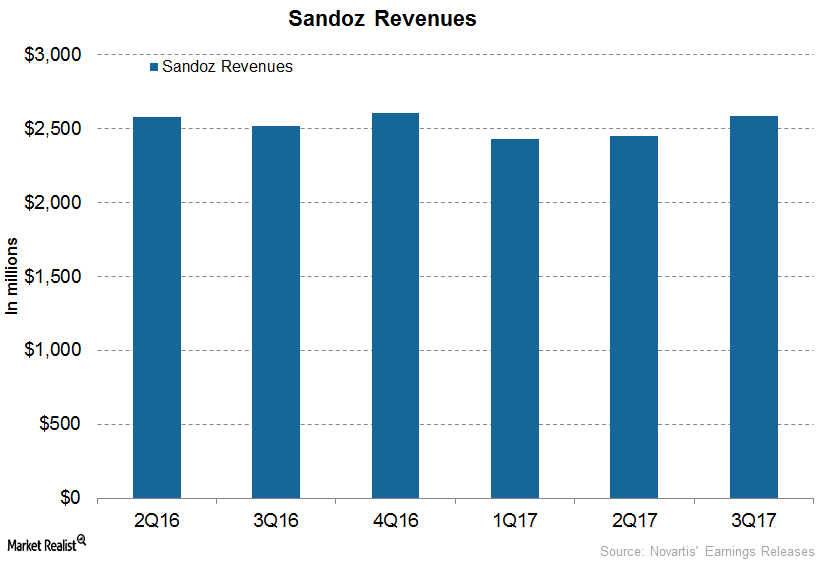

How Is Novartis’s Subsidiary Sandoz Positioned for 2018?

In 1Q17, 2Q17, and 3Q17, Novartis’s (NVS) subsidiary Sandoz generated revenues of $2.4 billion, $2.5 billion, and $2.6 billion, respectively.

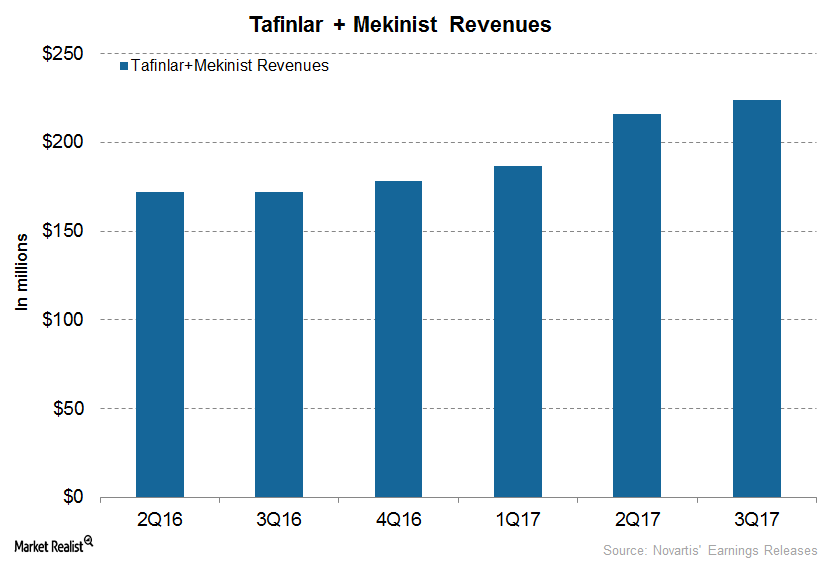

How Is Novartis’s Tafinlar+Mekinist Positioned for 2018?

In 1Q17, 2Q17, and 3Q17, Tafinlar+Mekinist reported revenues of $187 million, $216 million, and $224 million, respectively.

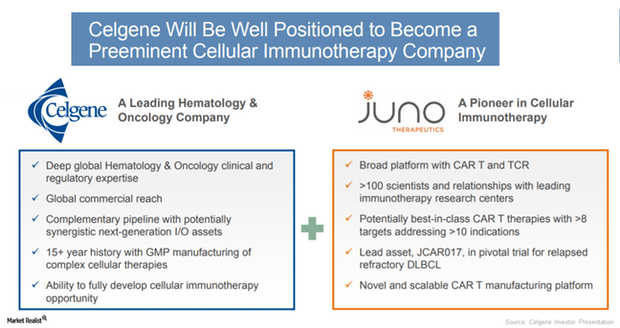

Celgene to Acquire Juno Therapeutics

On January 22, 2018, Celgene and Juno Therapeutics announced a merger agreement in which the former will acquire the latter’s business.

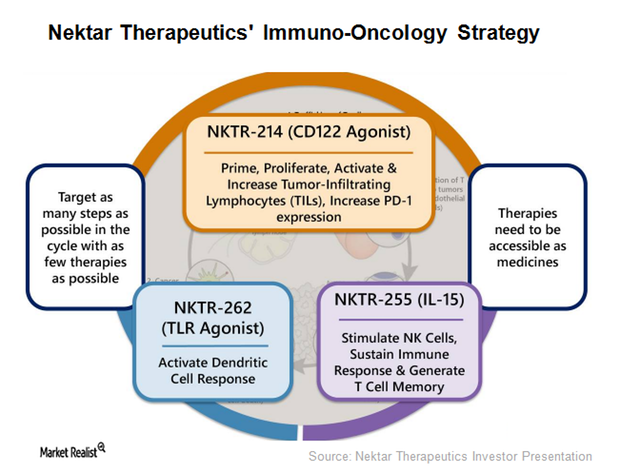

A Deeper Look at Nektar Therapeutics’ Licensing Agreements

License and collaboration agreements Nektar Therapeutics (NKTR) has entered into a number of licensing and collaboration agreements for research, development, and commercialization with various healthcare companies, including Eli Lilly (LLY), AstraZeneca (AZN), and Amgen (AMGN). Under these agreements, Nektar is entitled to receive license fees, milestone payments, royalties, and payments for manufacturing and supplying Nektar’s […]

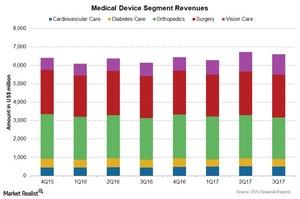

Johnson & Johnson’s Medical Devices Segment: 4Q17 Estimates

Johnson & Johnson’s (JNJ) Medical Devices segment includes products for specialty surgery, orthopedics, cardiovascular care, surgical care, diabetes care, and vision care.

How Amgen’s Enbrel and Nplate Are Positioned for 2018

In 1Q17, 2Q17, and 3Q17, Amgen’s (AMGN) Enbrel generated revenues of ~$1.2 billion, ~$1.5 billion, and ~$1.4 billion, respectively.

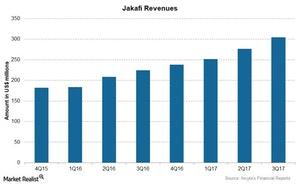

How Incyte’s Jakafi Performed in 3Q17

Incyte’s (INCY) oncology drug Jakafi (ruxolitinib) is approved for the treatment of myelofibrosis and polycythemia vera, two rare types of blood cancer.

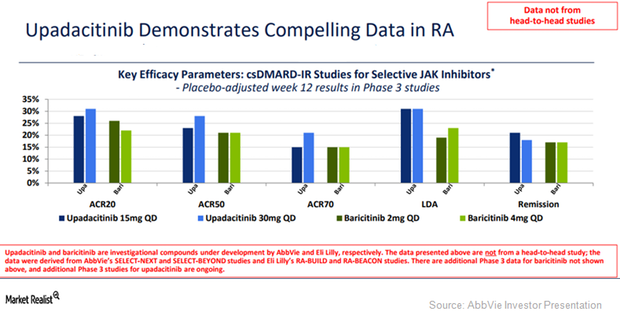

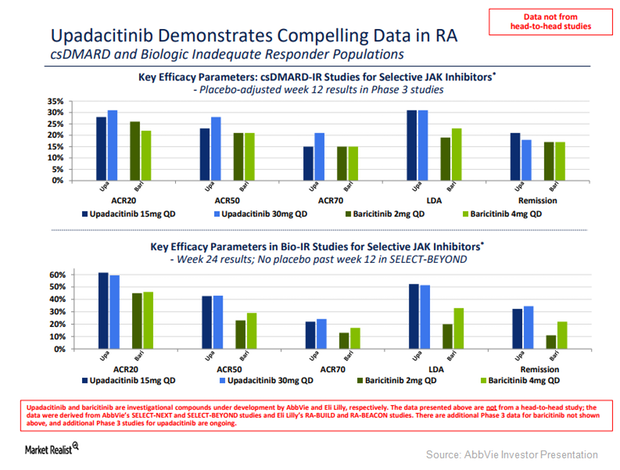

Why AbbVie’s Upadacitinib Keeps Posting Strong Data for Rheumatoid Arthritis

On December 20, 2017, AbbVie (ABBV) reported positive top-line results from its phase-3 trial Select-Monotherapy.

What Upadacitinib Did for AbbVie in 2017

In September 2017, AbbVie’s (ABBV) investigational immunology drug, Upadacitinib (ABT-494), managed to demonstrate its clinical potential.

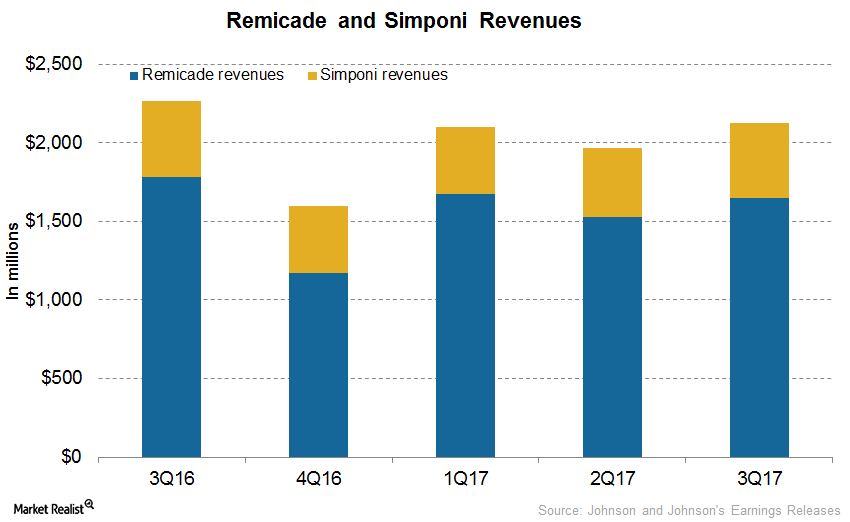

How Johnson & Johnson’s Remicade and Simponi Performed in 3Q17

In 3Q17, Johnson & Johnson’s (JNJ) Remicade generated revenues of $1.6 billion, which reflected a ~8% decline on a year-over-year (or YoY) basis and 8% growth on a quarter-over-quarter basis.

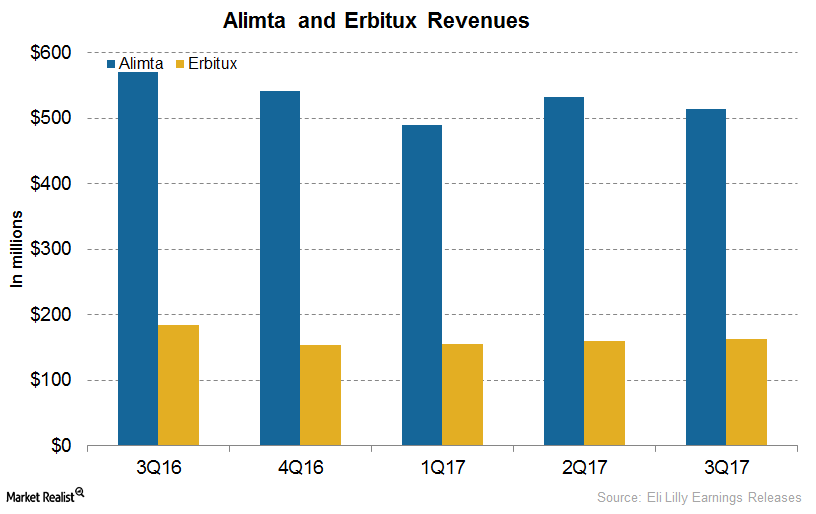

An Update on Eli Lilly’s Oncology Drugs: Alimta, Erbitux, and Gemzar

In 3Q17, Eli Lilly’s (LLY) Alimta generated revenues of $514.5 million, a ~10% increase on a year-over-year (or YoY) basis and a 3% decline on a quarter-over-quarter basis.

Merck’s Immunology and Oncology Drugs, Post-3Q17

Immunology drug revenue In 3Q17, Remicade generated revenue of $214 million, a ~31% fall YoY (year-over-year) and 3% growth QoQ (quarter-over-quarter). During the first nine months of 2017, Remicade reported revenue of $651 million, which reflected a ~35% fall YoY. Foreign exchange had a 3% favorable effect towards 3Q17 Remicade revenue. In 3Q17, Simponi reported revenue of […]

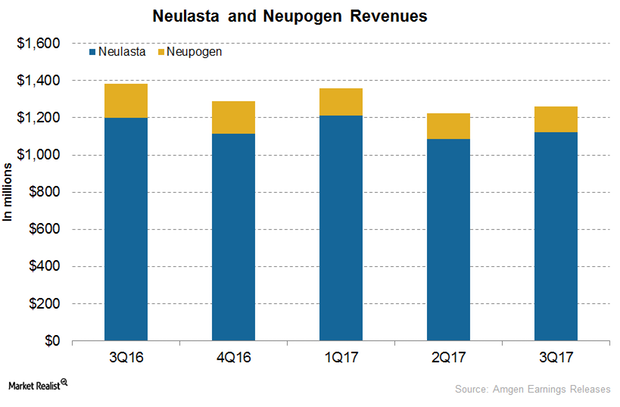

How Did Amgen’s Neulasta and Neupogen Perform in 3Q17?

In 3Q17, Amgen’s (AMGN) Neulasta generated revenues of around $1.1 billion, a ~6% decline on a year-over-year (or YoY) basis and ~3% growth on a quarter-over-quarter basis.

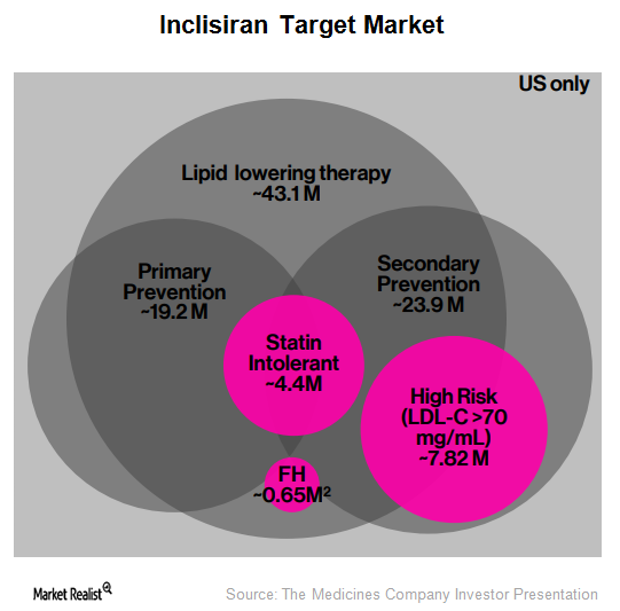

Inclisiran: Long-Term Growth Driver for The Medicines Company?

According to a Monte Carlo simulation performed at Harvard, it’s estimated that 5.0 million patients in the United States stand to benefit from PCSK9 inhibitor therapy.