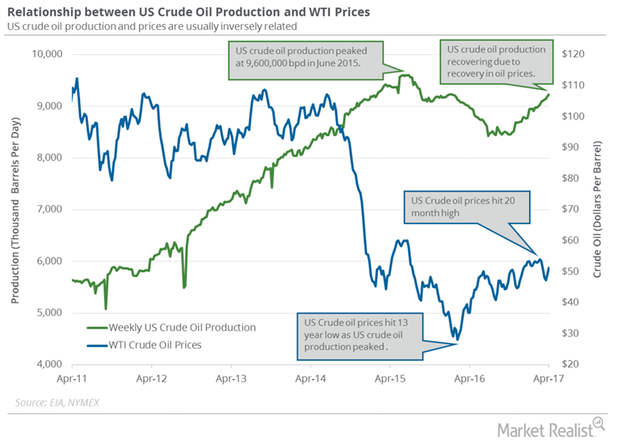

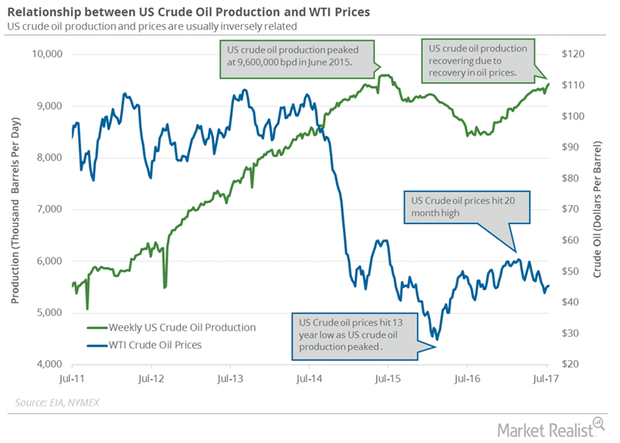

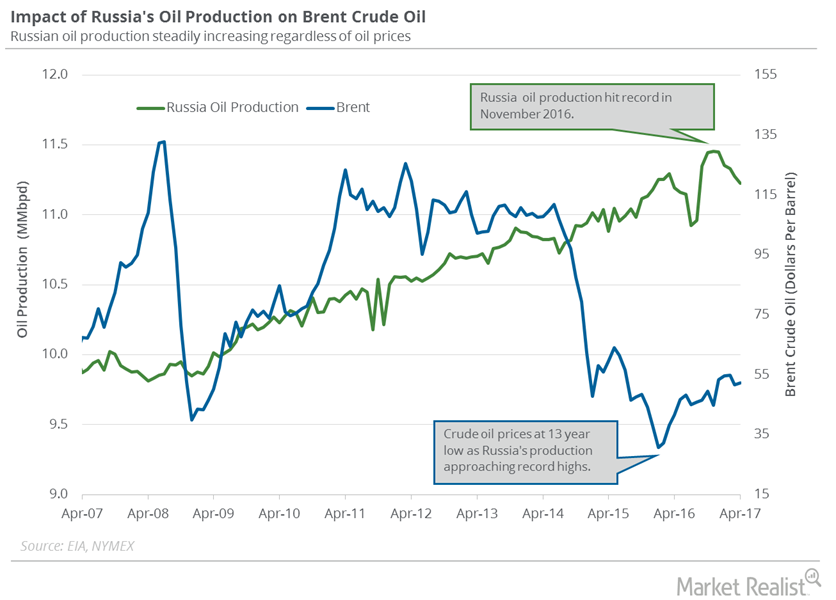

Is Oil at the End of Its Rise?

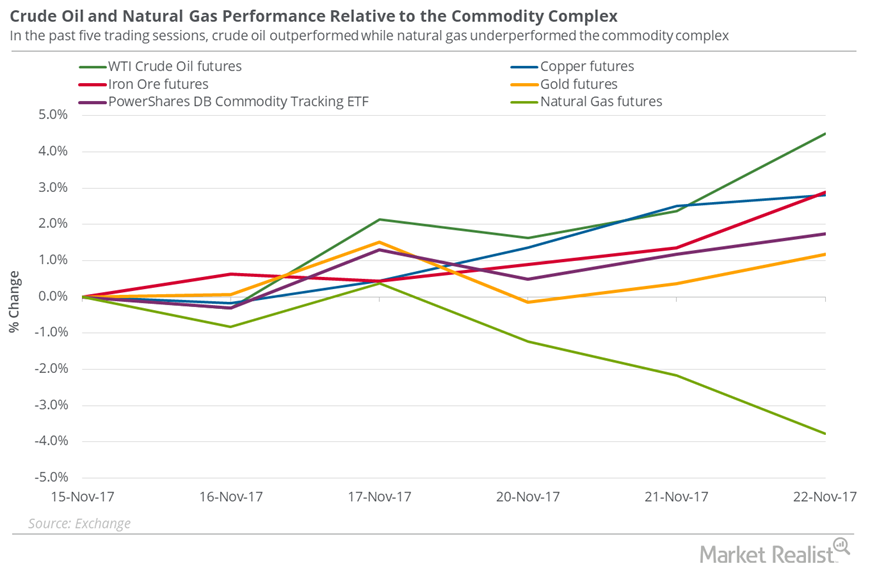

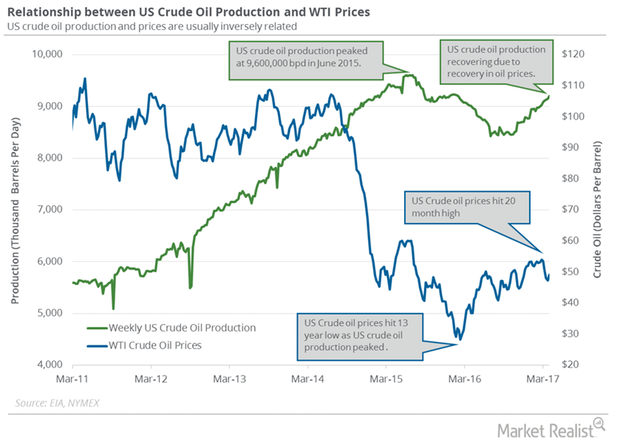

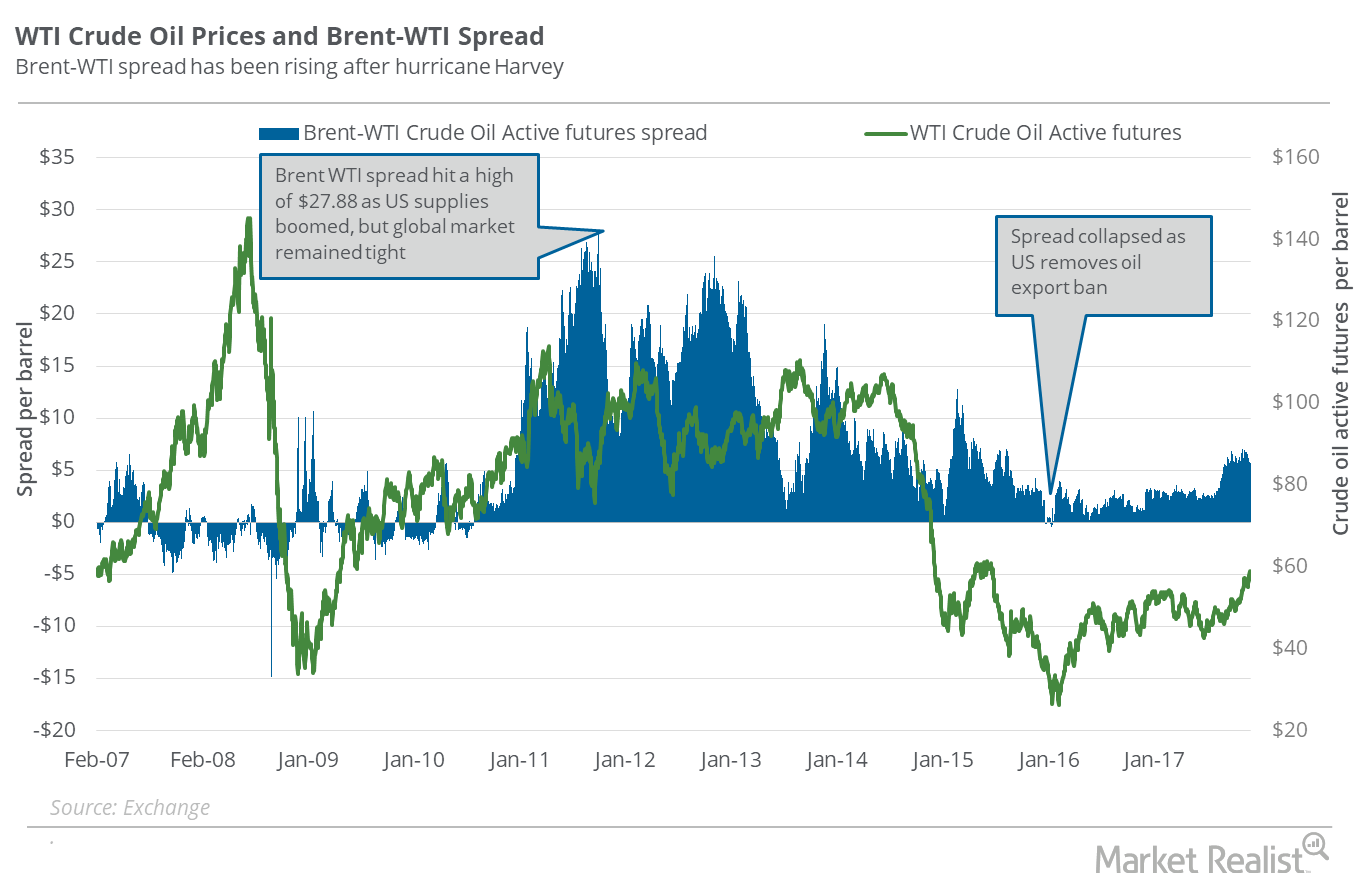

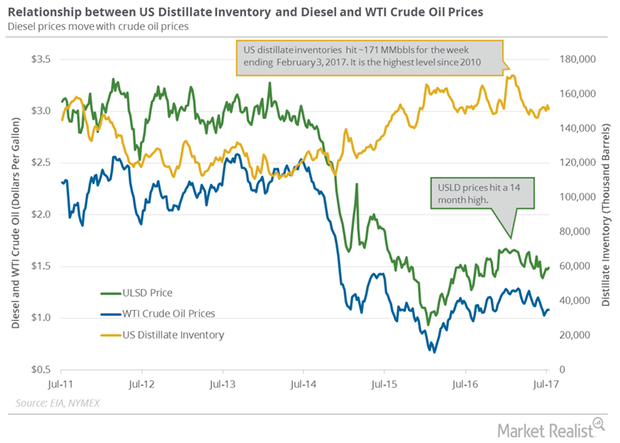

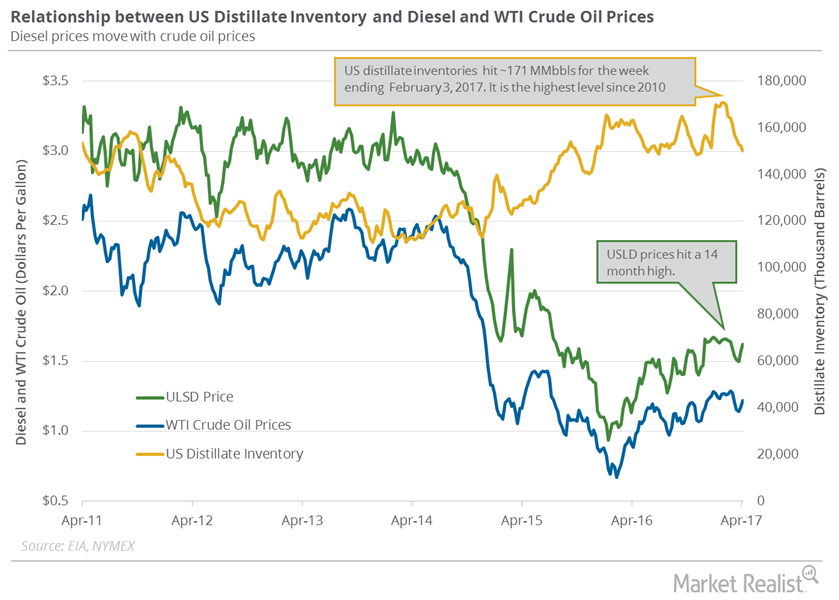

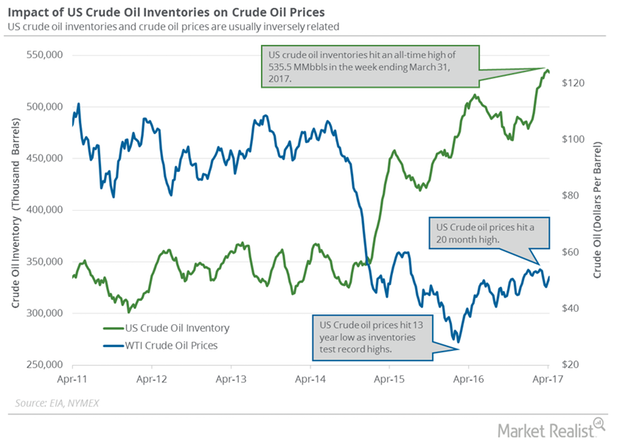

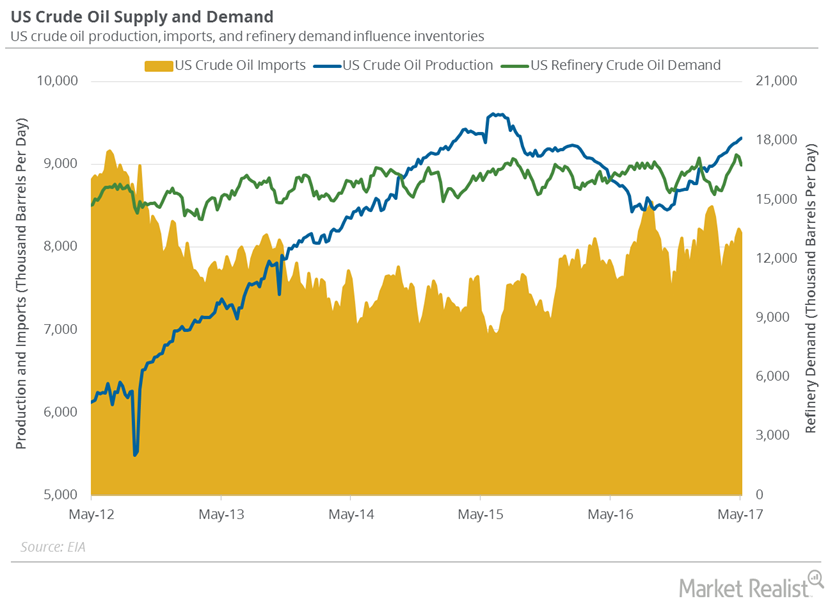

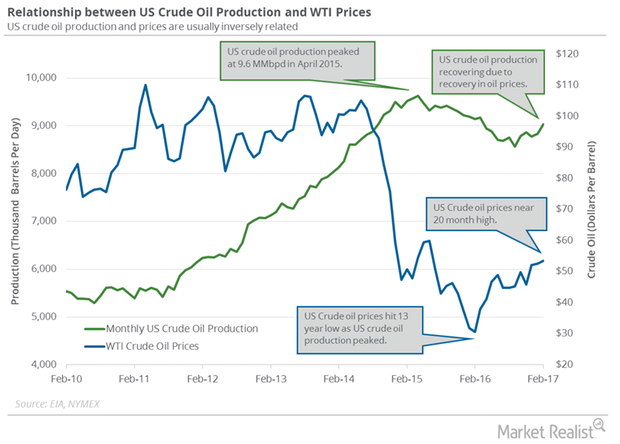

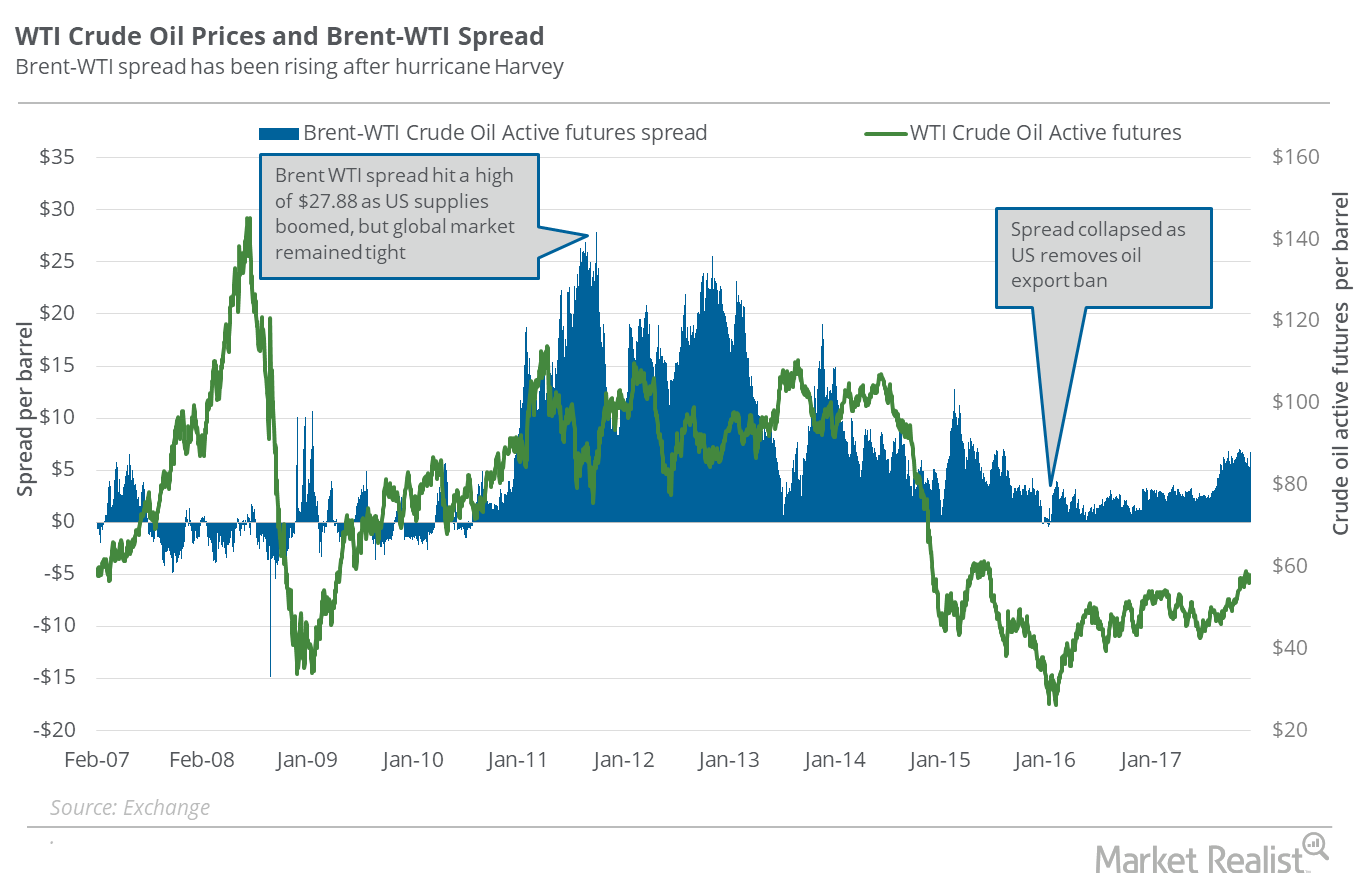

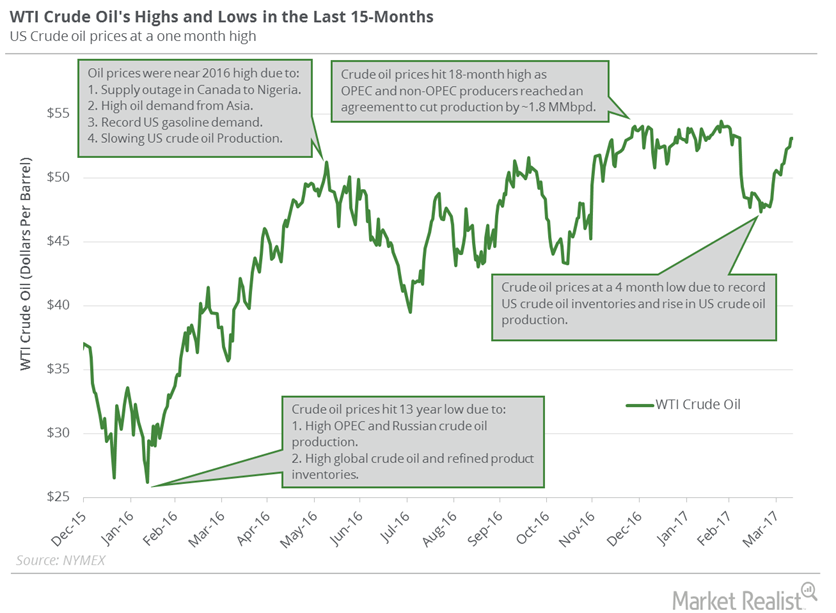

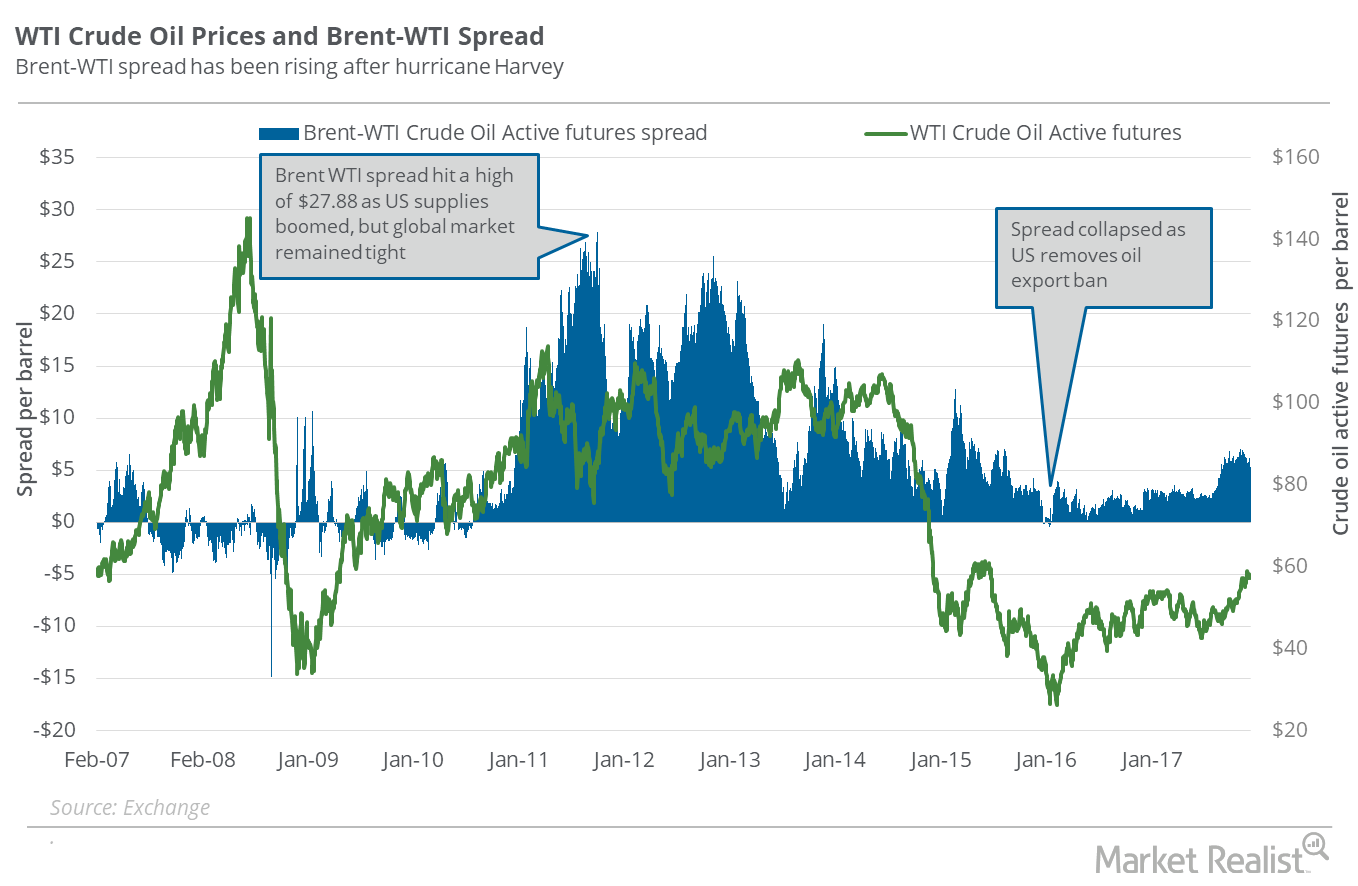

On November 22, 2017, US crude oil (USO) (USL) January futures rose 2.1% and closed at $58.02 per barrel—the highest closing price in 2017.

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.