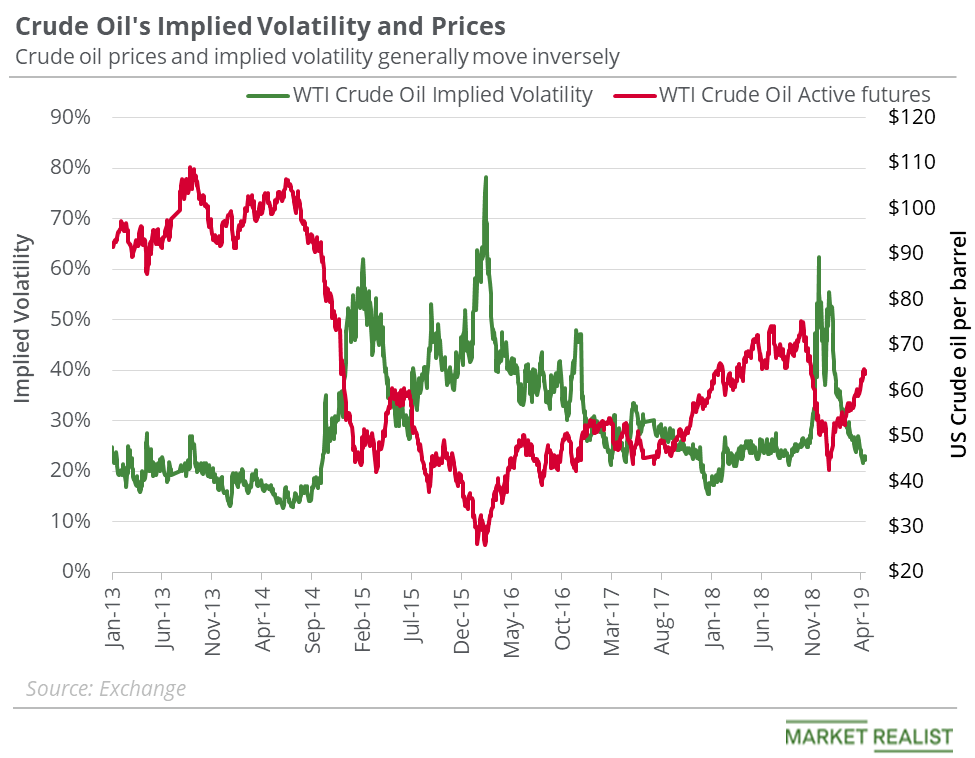

Crude Oil’s Implied Volatility and Price Forecast

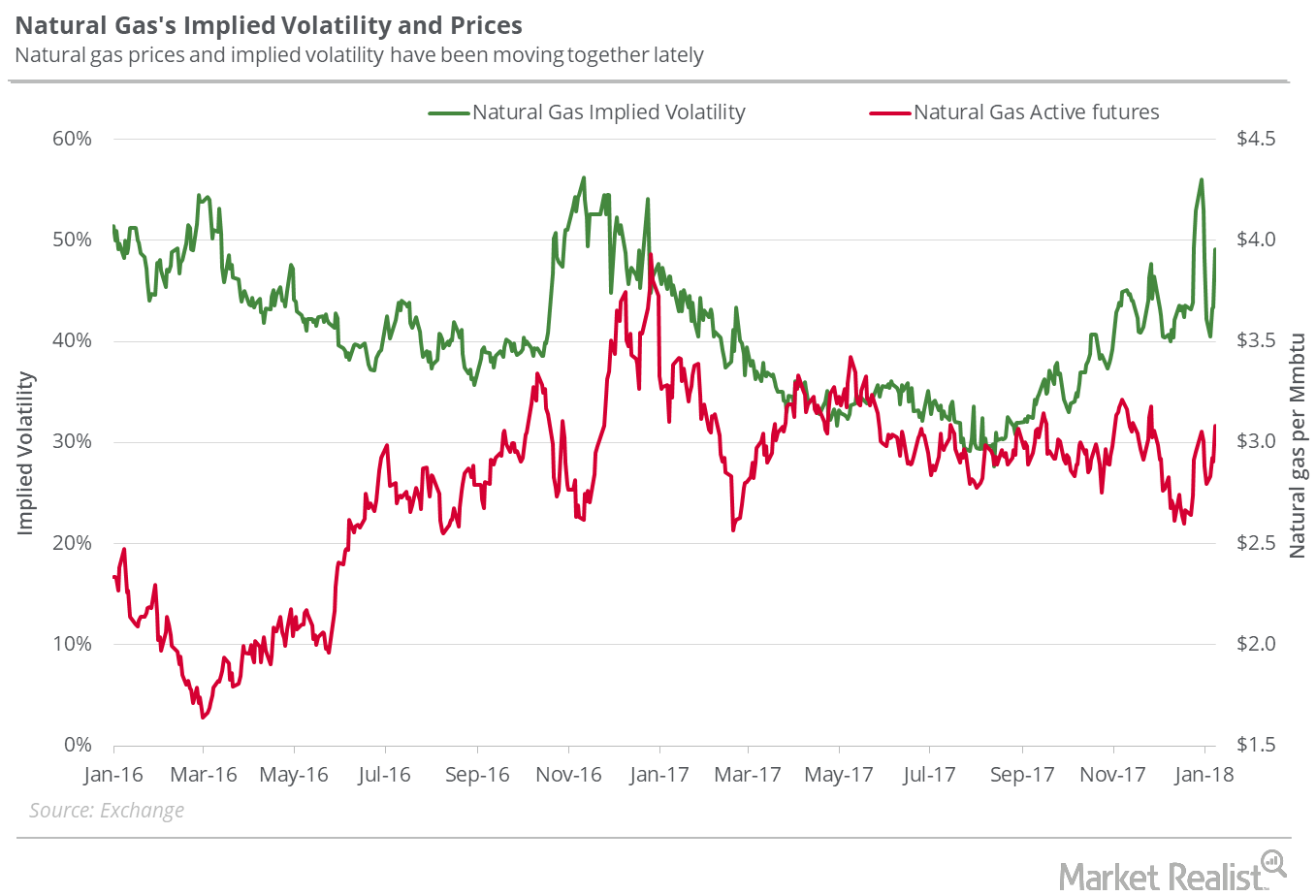

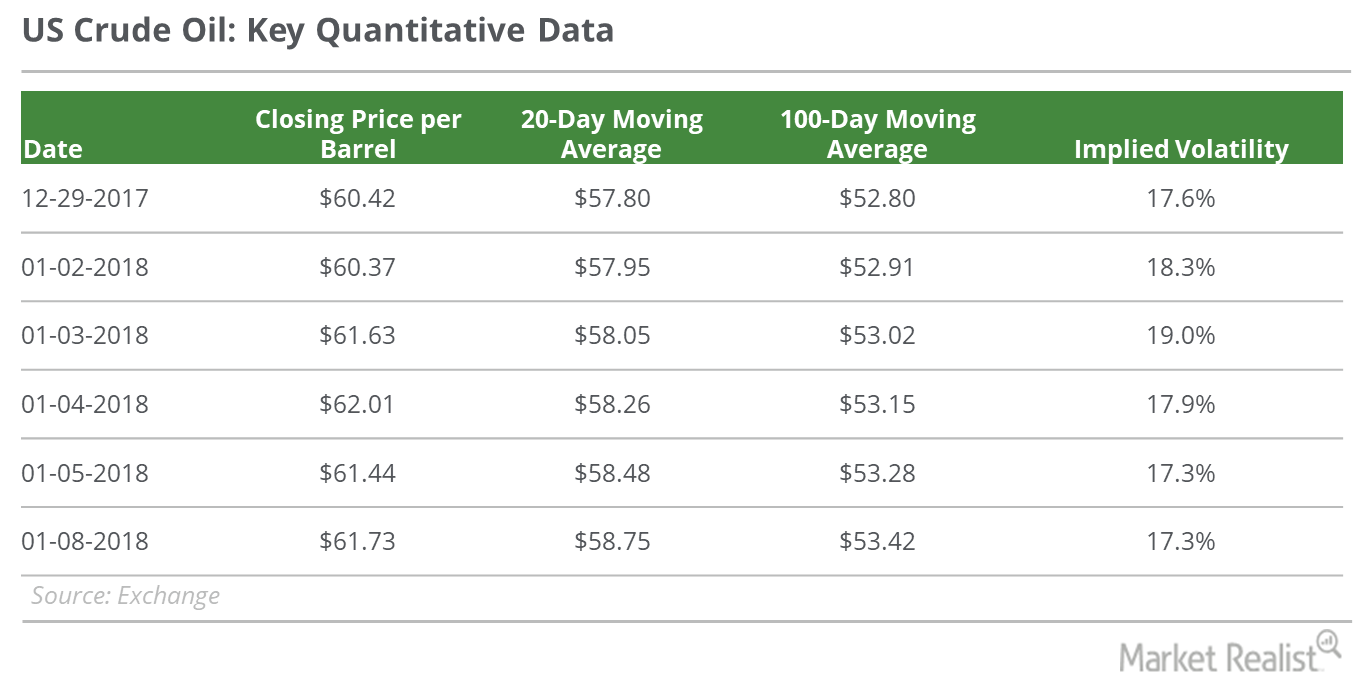

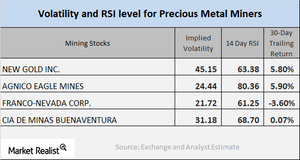

On April 17, US crude oil’s implied volatility was 22.1%, which is 5.5% below its 15-day average.

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.