Can Lululemon Keep Up Its Strong Revenue Growth?

Lululemon’s (LULU) revenue increased 24.9%, 24.5%, and 20.8% in the first, second, and third quarters of fiscal 2018, respectively.

Feb. 20 2019, Updated 2:50 p.m. ET

Top-line growth so far

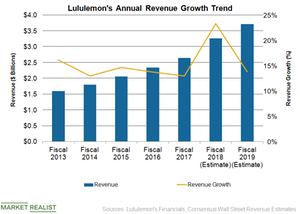

Lululemon’s (LULU) revenue increased 24.9%, 24.5%, and 20.8% in the first, second, and third quarters of fiscal 2018, respectively. Overall, the company’s revenue increased 23.3% to $2.1 billion in the first nine months of fiscal 2018. Lululemon’s revenue growth in this period was driven by a strong rise in direct-to-consumer revenue, same-store sales growth of 8%, and revenue contribution from new stores.

Based on the company’s latest guidance on January 14, Lululemon expects its revenue in the range of $1.14 billion–$1.15 billion in Q4 of fiscal 2018, which ended on February 3, 2019. Analysts expect the company’s fourth-quarter revenue to rise 23.8% year-over-year to $1.2 billion.

Analysts expect Lululemon’s revenue to increase 23.4% to $3.3 billion in fiscal 2018. Currently, analysts expect a 13.8% rise in Lululemon’s fiscal 2019 revenue.

Growth initiatives

Lululemon is recording rapid growth in its direct-to-consumer business, which comprises sales from e-commerce websites and mobile apps. Lululemon’s revenue from the direct-to-consumer segment grew 50.7% to $514.6 million in the first nine months of fiscal 2018. The company’s direct-to-consumer revenue accounted for 24.3% of the overall revenue in the first nine months of fiscal 2019, compared to 19.9% in the comparable period of the previous fiscal year.

The company’s efforts to strengthen its digital capabilities, personalization efforts, and attractive merchandise have helped increase online traffic and improve conversion rates.

Lululemon is seeking growth in the outerwear category. The company’s outerwear merchandise recorded comparable sales growth of 150% and 40% in the men’s and women’s divisions, respectively, in Q3 of fiscal 2018. Lululemon sees tremendous growth in this category and is working on offering tougher, water-resistant styles. Lululemon is also looking for opportunities in the bra category with innovations such as the “Like Nothing” bra.

International expansion remains a key focus for the company. Lululemon’s revenue outside North America grew 45.4% to $244.4 million in the first nine months of fiscal 2018. Revenue outside North America accounted for 11.5% of the company’s overall revenue in the first nine months of fiscal 2018, compared to 9.8% in the first nine months of fiscal 2017.

Let’s discuss Lululemon’s valuation in the next part of this series.