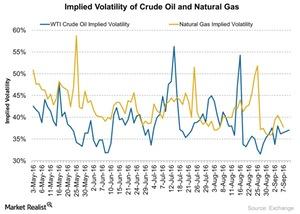

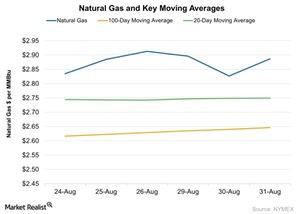

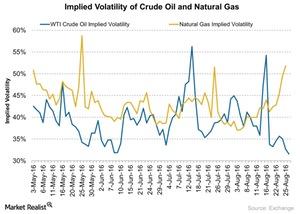

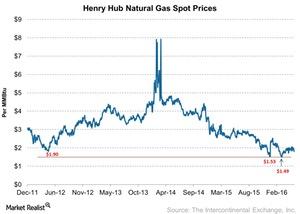

A Look into the Implied Volatilities of Crude Oil and Natural Gas

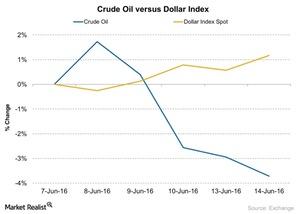

Crude oil’s implied volatility was 37.1% on September 9, 2016. Its 15-day average implied volatility is 35.1%.

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.