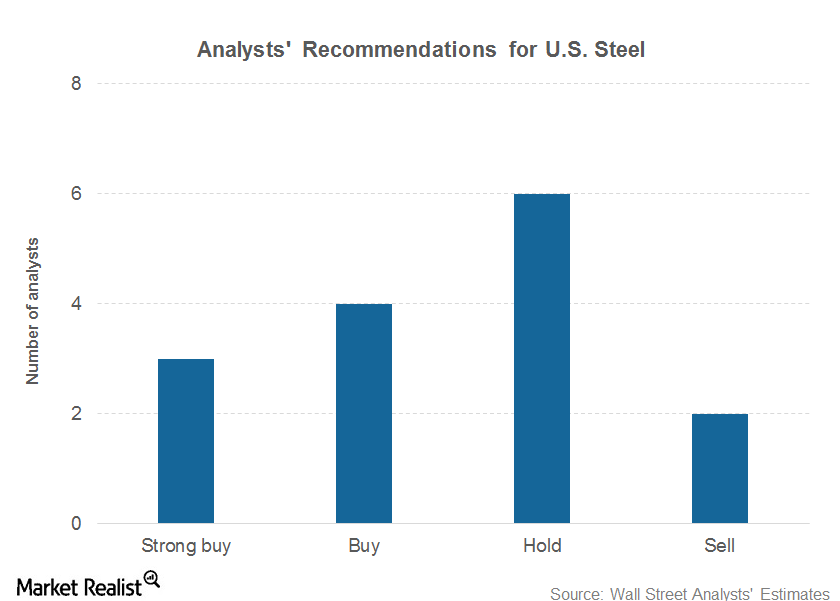

Analysts Might Take a Fresh Look at U.S. Steel Corporation

U.S. Steel Corporation will release its 1Q17 earnings on April 24 after the market closes. The company’s earnings conference call will be on April 25.

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.