Regulatory Path for the Lam Research-KLA-Tencor Merger

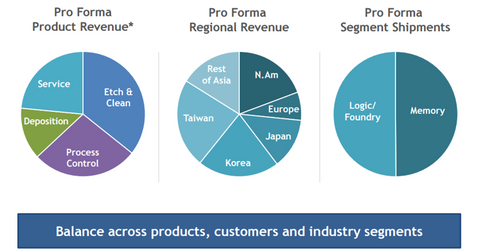

In the press release announcing the Lam Research-KLA-Tencor merger, the companies mention they will serve approximately 42% of the wafer fabrication equipment market immediately upon closing.

Nov. 20 2020, Updated 12:38 p.m. ET

Regulatory approvals determine when the deal will close

With almost all mergers, the rate of return is driven by the time it takes to finalize the transaction. In the case of the KLA-Tencor–Lam Research merger, several regulatory approvals are required to close the deal.

SEC approval

Lam Research (LRCX) and KLA-Tencor (KLAC) will have to get the joint proxy statement approved by the SEC (Securities and Exchange Commission). If the SEC makes any comments, the companies will need to fix the language and refile. Once the SEC approves the proxy statement, a vote must be scheduled at least 30 days from the mailing date.

Antitrust requirement

To get over the first regulatory hurdle in the Lam Research-KLA-Tencor merger, Lam Research will need to file under the Hart-Scott-Rodino Antitrust Improvements Act (HSR). While the companies describe their offering as “complementary,” the mid-2016 timing guidance indicates they believe there is at least a decent chance of an extended antitrust review. The merger agreement mentions the HSR requirement and “other governmental approvals.” The deal will almost certainly have to pass the muster of the European Union antitrust regulators, the German Foreign Cartel Office, and probably China, as well.

Arbitrageurs typically first check the respective companies’ Form 10-K filings to see if they are named competitors. Neither company mentions the other when discussing competition in its 10-K filings. In the press release, the companies mention they will serve approximately 42% of the wafer fabrication equipment market immediately upon closing. While it is unclear if that means their market share will increase to 42%, that sort of number would definitely trigger a second request from the U.S. Department of Justice and an in-depth review in the European Union.

Rick Wallace, president and chief executive officer of KLA-Tencor, addressed the antitrust review in the press release: “Given their complementary product lines and the significant industry benefits the transaction will enable, the companies believe that they will be able to obtain the requisite regulatory approvals on a timely basis.”

Best efforts language

The companies will use reasonable best efforts to get regulatory approval and contest any findings by the antitrust authorities. They will use reasonable best efforts to remedy the antitrust concerns. However, they are not required to do anything that “is not commercially reasonable or materially impacts in an adverse manner the benefits to be derived by Parent from the Transactions.” Note there is a reverse termination fee if the deal cannot get antitrust approval. LRCX will weigh the cost of the remedies demanded by the regulators versus the cost of paying the reverse termination fee.

Merger arbitrage resources

Other important merger spreads include the deal between Baker Hughes (BHI) and Halliburton (HAL) and the merger between Freescale Semiconductor (FSL) and NXP Semiconductors (NXPI). For a primer on risk arbitrage investing, read “Merger Arbitrage Must-Knows: A Key Guide for Investors.”

Investors who are interested in trading in the tech sector can look at the iShares Global Technology ETF (IXN).