Freescale Semiconductor Ltd

Latest Freescale Semiconductor Ltd News and Updates

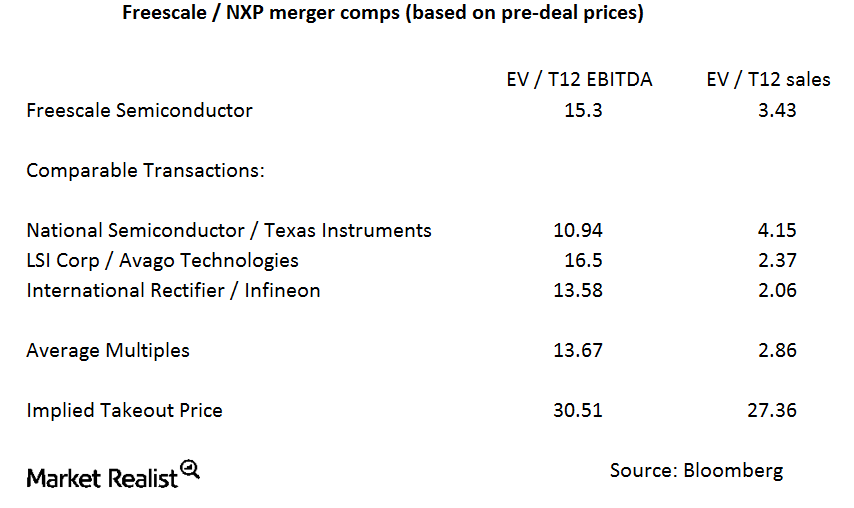

Why is the Freescale–NXP merger premium so low?

The companies were asked about the takeover premium and the background to the transaction on the conference call, but they refused to comment.

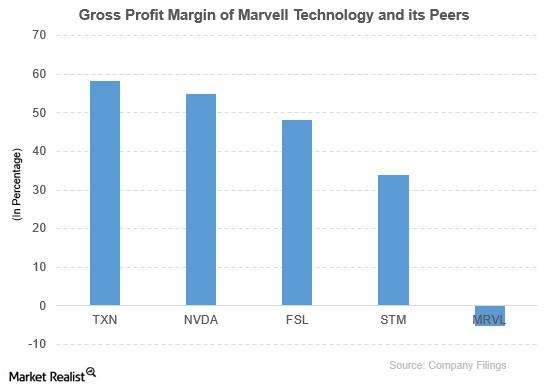

How Did Marvell Technology Compare to Its Peers?

Marvell Technology was outperformed by its peers based on the gross profit margin and PBV ratio. ETFs outperformed it based on the price movement and PBV ratio.

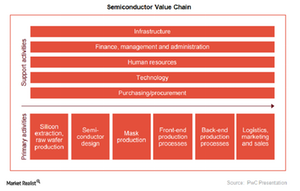

Where Intel Fits in the New Semiconductor Value Chain

Huge investment is required at every stage of semiconductor development to make smaller-sized chips in a cost-effective manner without compromising on functionality.