iShares Global Tech

Latest iShares Global Tech News and Updates

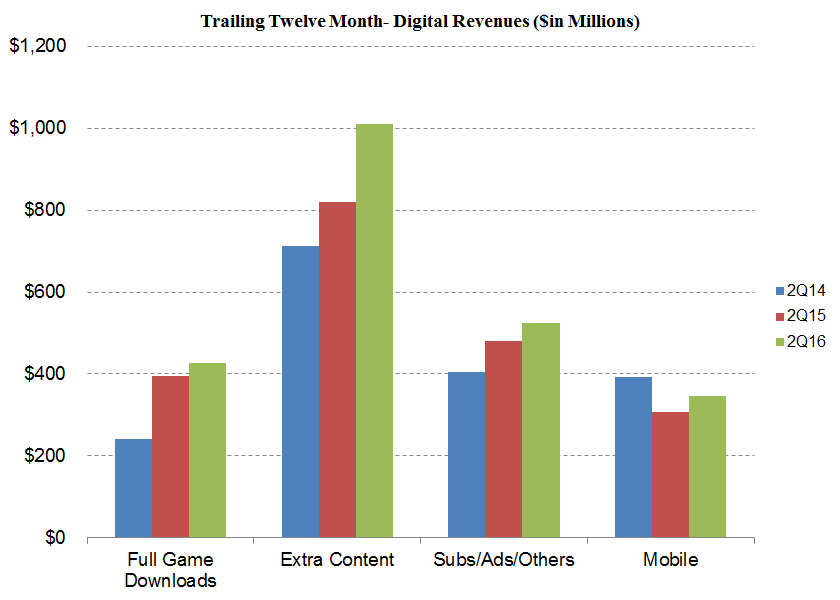

Micro-Transactions Are an Important Strategy for Electronic Arts

Accounting for over $200 million in revenues, micro-transactions present users with the opportunity to buy items that enhance their gameplay.

The Oracle-NetSuite Merger: What’s the Rationale?

The relationship between Oracle and NetSuite goes back a long way. Oracle co-founder Larry Ellison and his family own almost half of NetSuite stock.

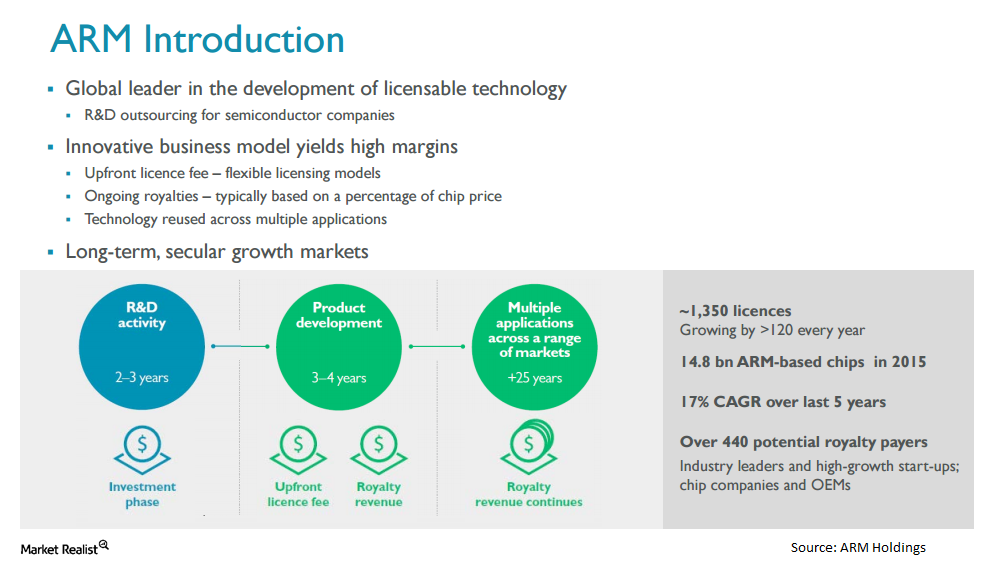

What Are the Conditions for the ARM Holdings-Softbank Merger?

ARM Holdings and Softbank are merging in a cash transaction. In an unusual step, there aren’t regulatory or antitrust conditions to the transaction.

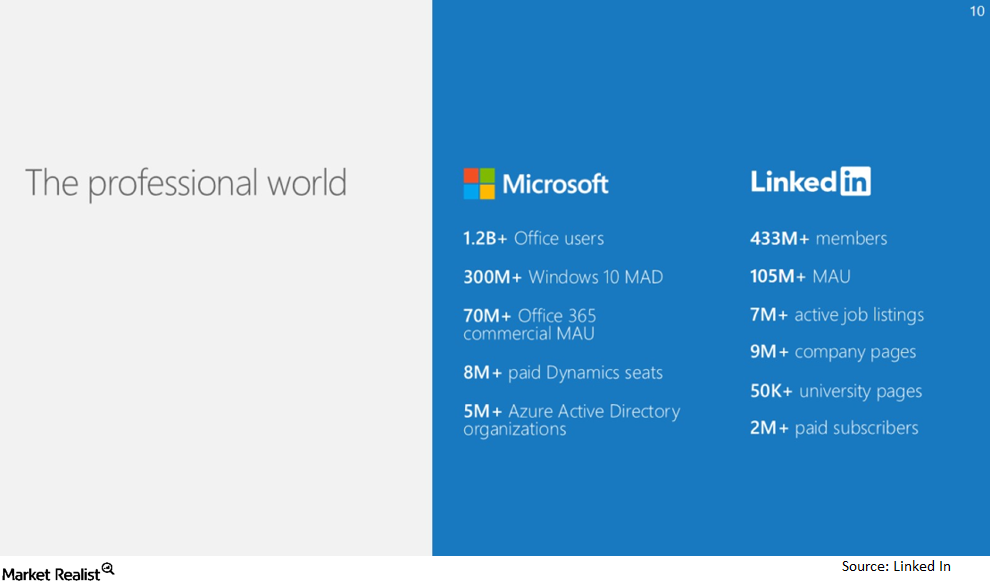

What’s the Rationale for the Microsoft-LinkedIn Merger?

LinkedIn will be a standalone entity within Microsoft. This transaction is part of Microsoft’s plan to focus on cloud-based offerings. It wants to rely less on PCs.

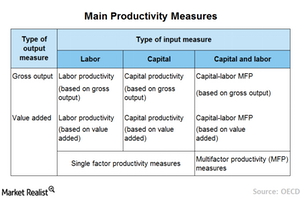

What Are the Traditional Measures of Labor Productivity?

Labor productivity is an important tool to measure the strength of a country’s economy. Policymakers often use this indicator to compare output efficiency during a particular period.