Sonya Bells

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Sonya Bells

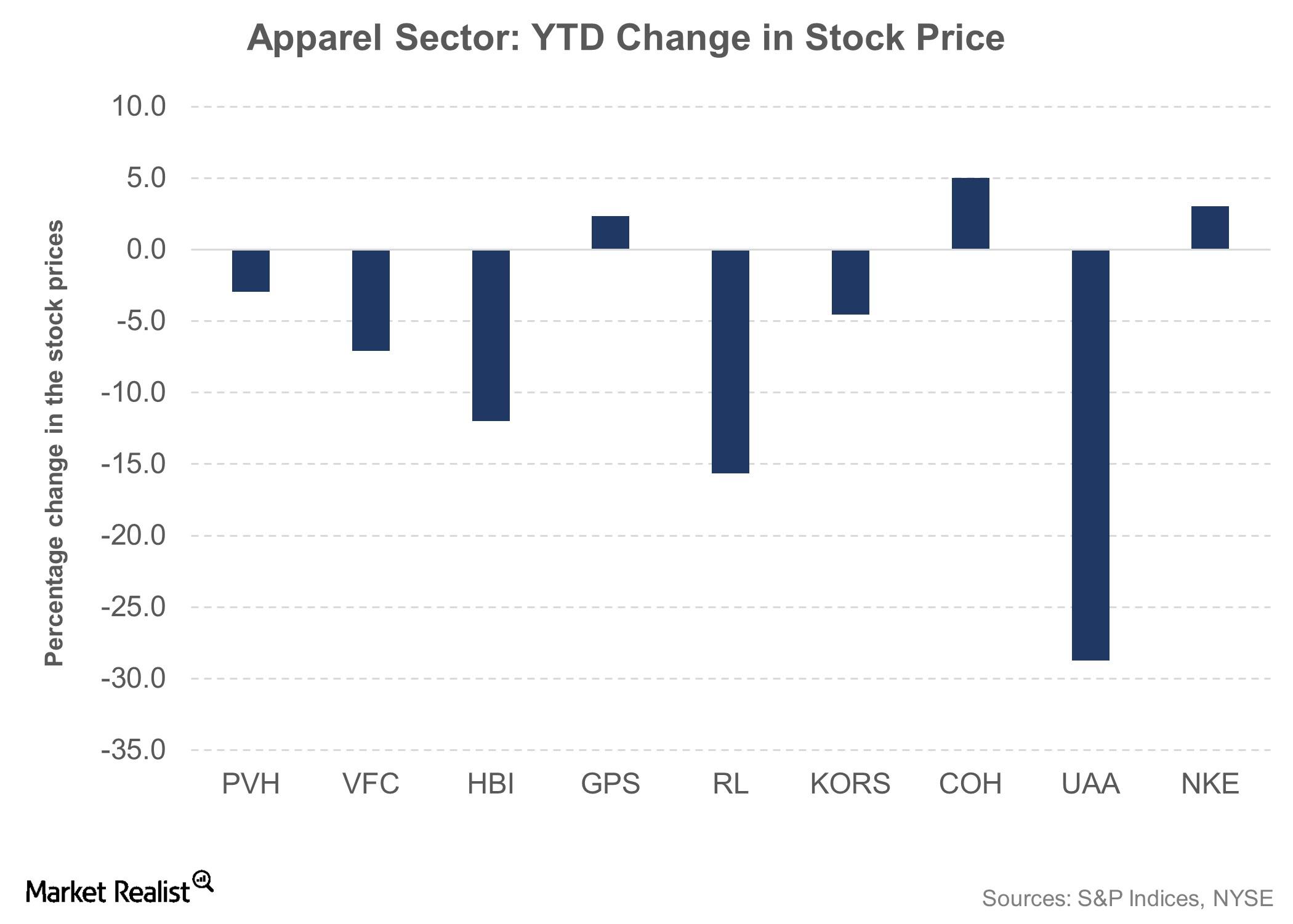

Under Armour Stock Lost 29% during the Week after Its 4Q16 Results

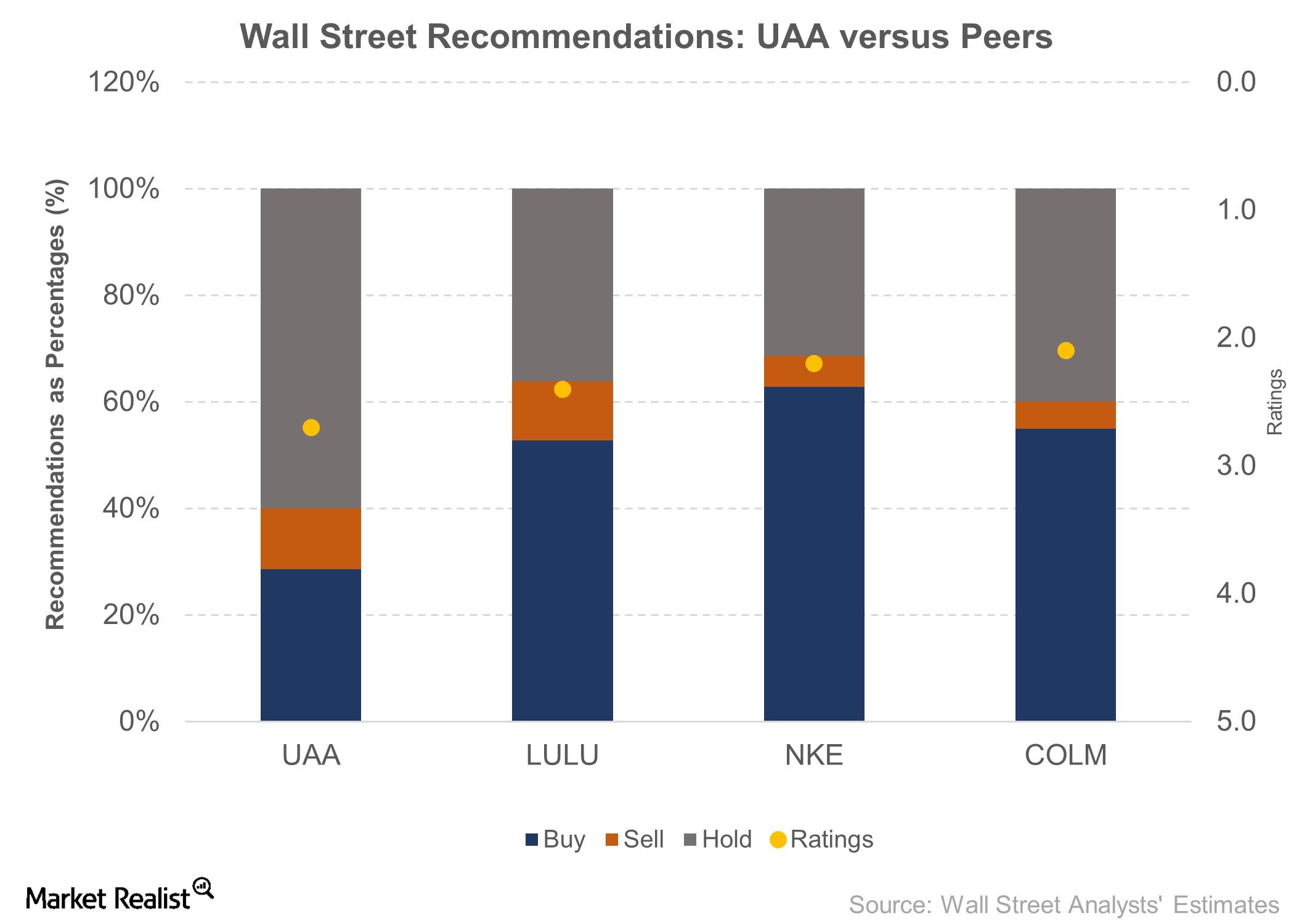

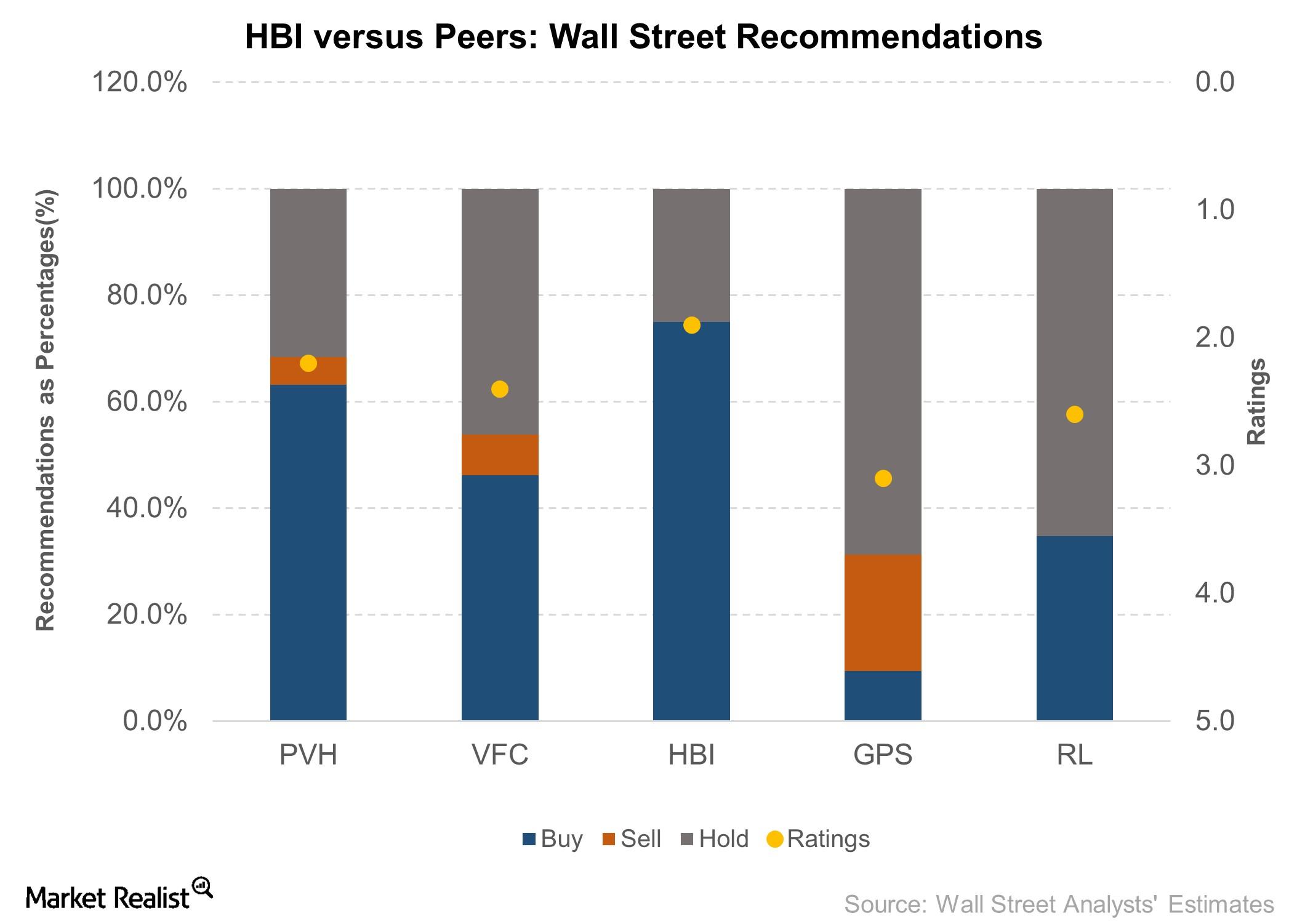

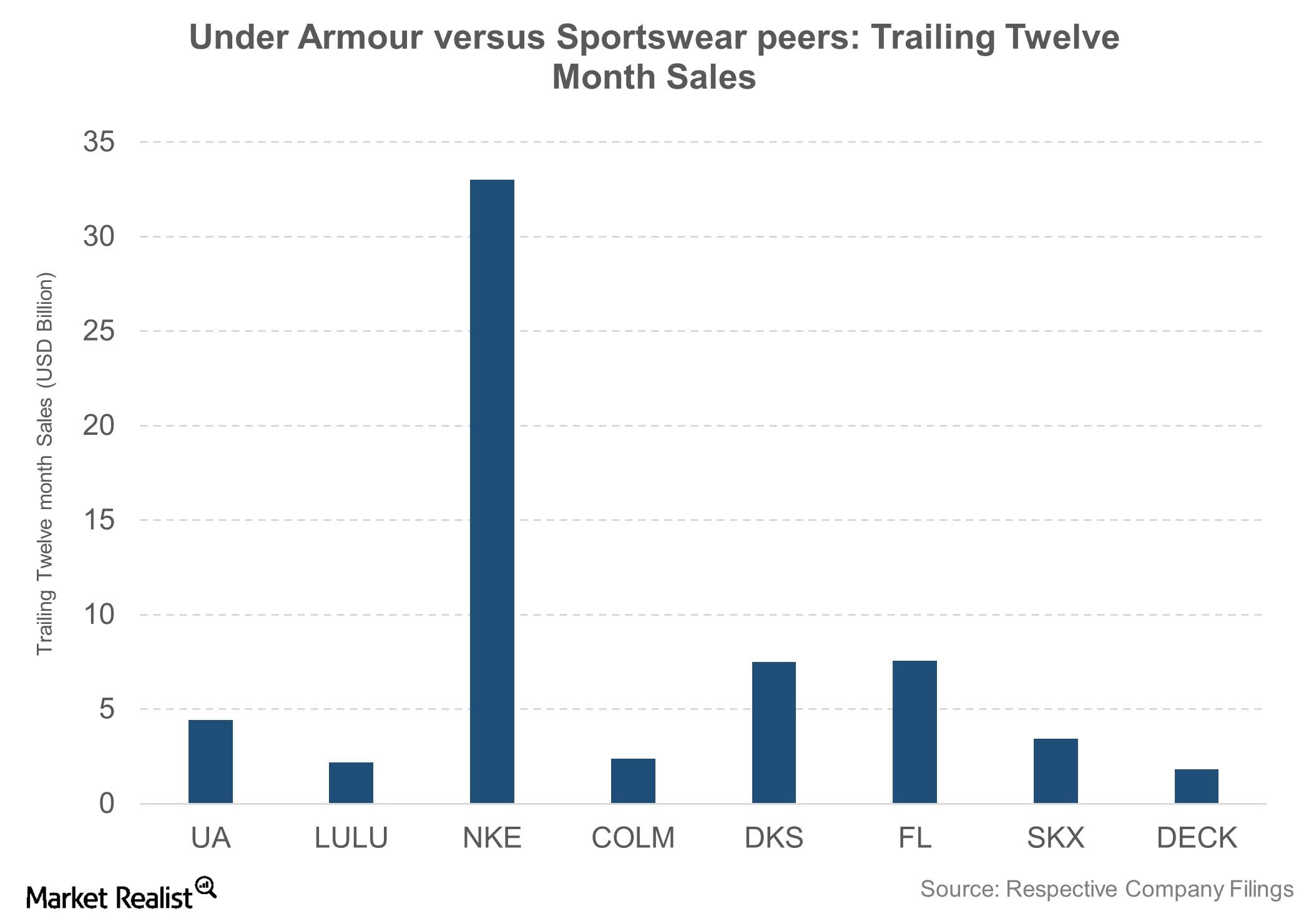

Under Armour (UAA), which is covered by 35 Wall Street analysts, has ten “buy” recommendations, four “sell” recommendations, and 21 “hold” recommendations.

Why Hanesbrands’ Weak Innerwear Sales Drove Its Top Line Miss

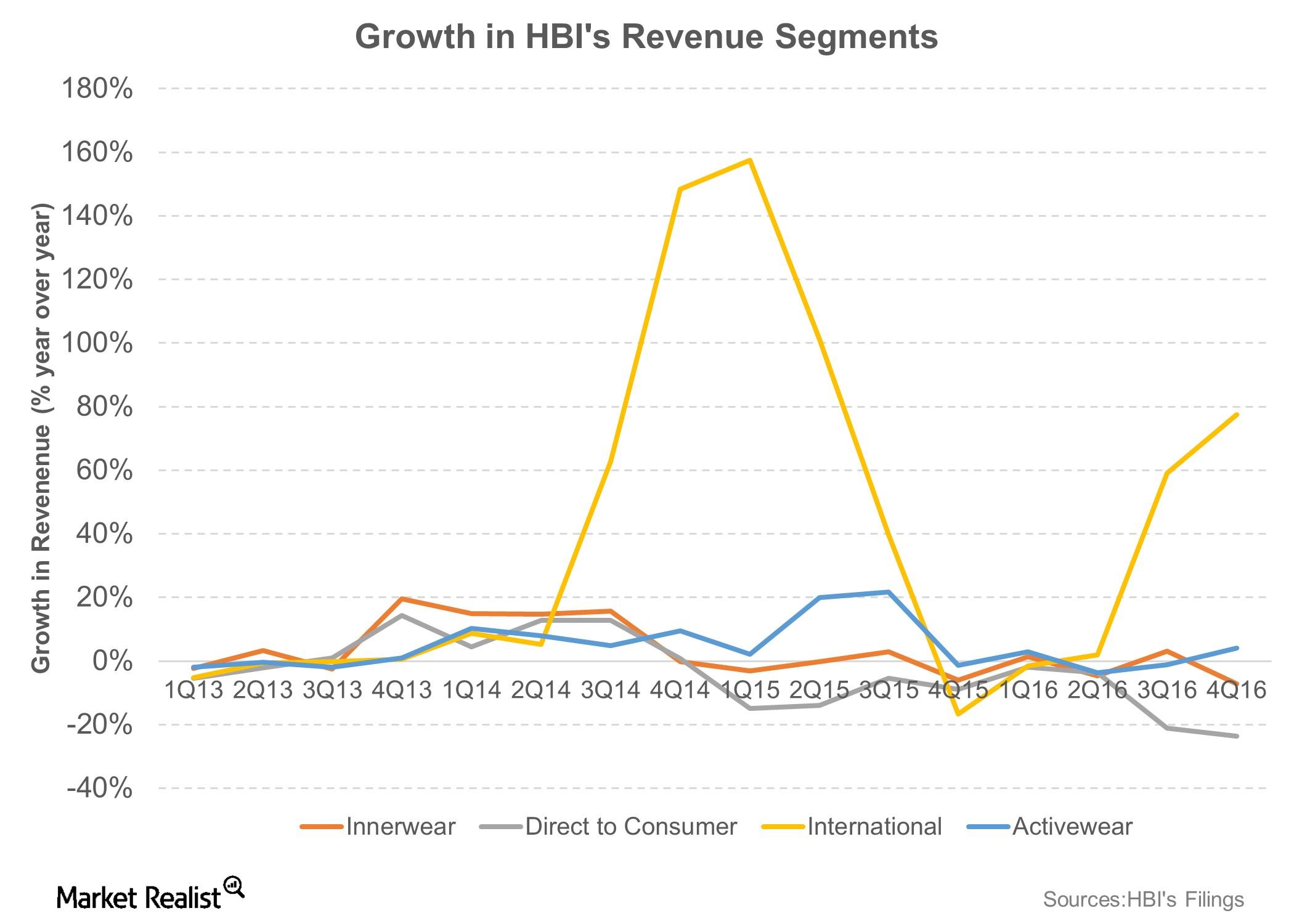

With trailing-12-month sales of over $6 billion, Hanesbrands (HBI) is one the largest marketers of basic apparel in the United States.

Hanesbrands Stock Reacts to Weak Results and Gloomy Guidance

Shares of Hanesbrands (HBI) tumbled 16% on Friday, February 3, as the company posted weaker-than-expected fourth quarter results and lackluster guidance.

Inside Ralph Lauren’s Fiscal 3Q17 Results

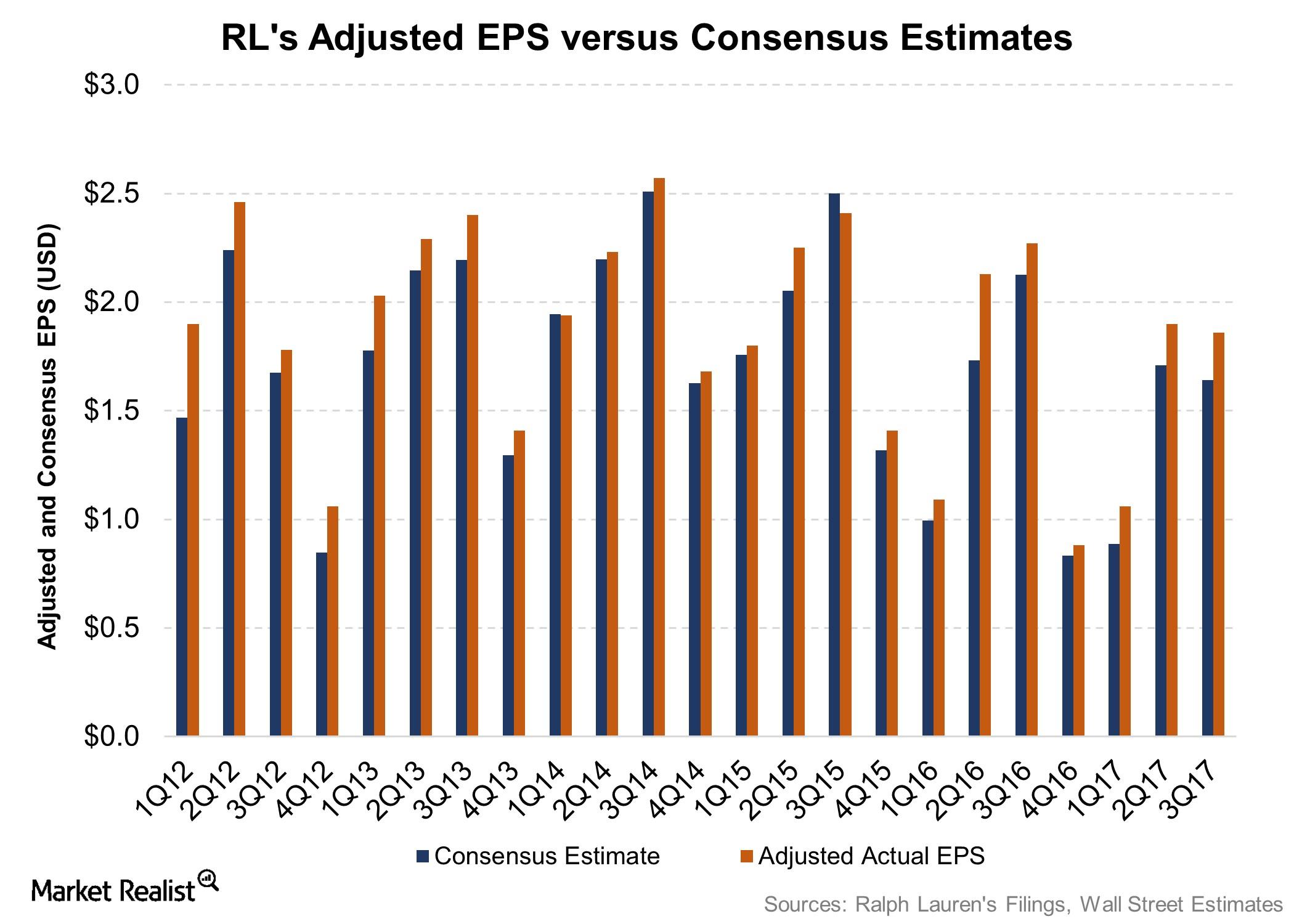

RL delivered better-than-expected earnings and in-line revenues, but its EPS fell 18% YoY to $1.86.

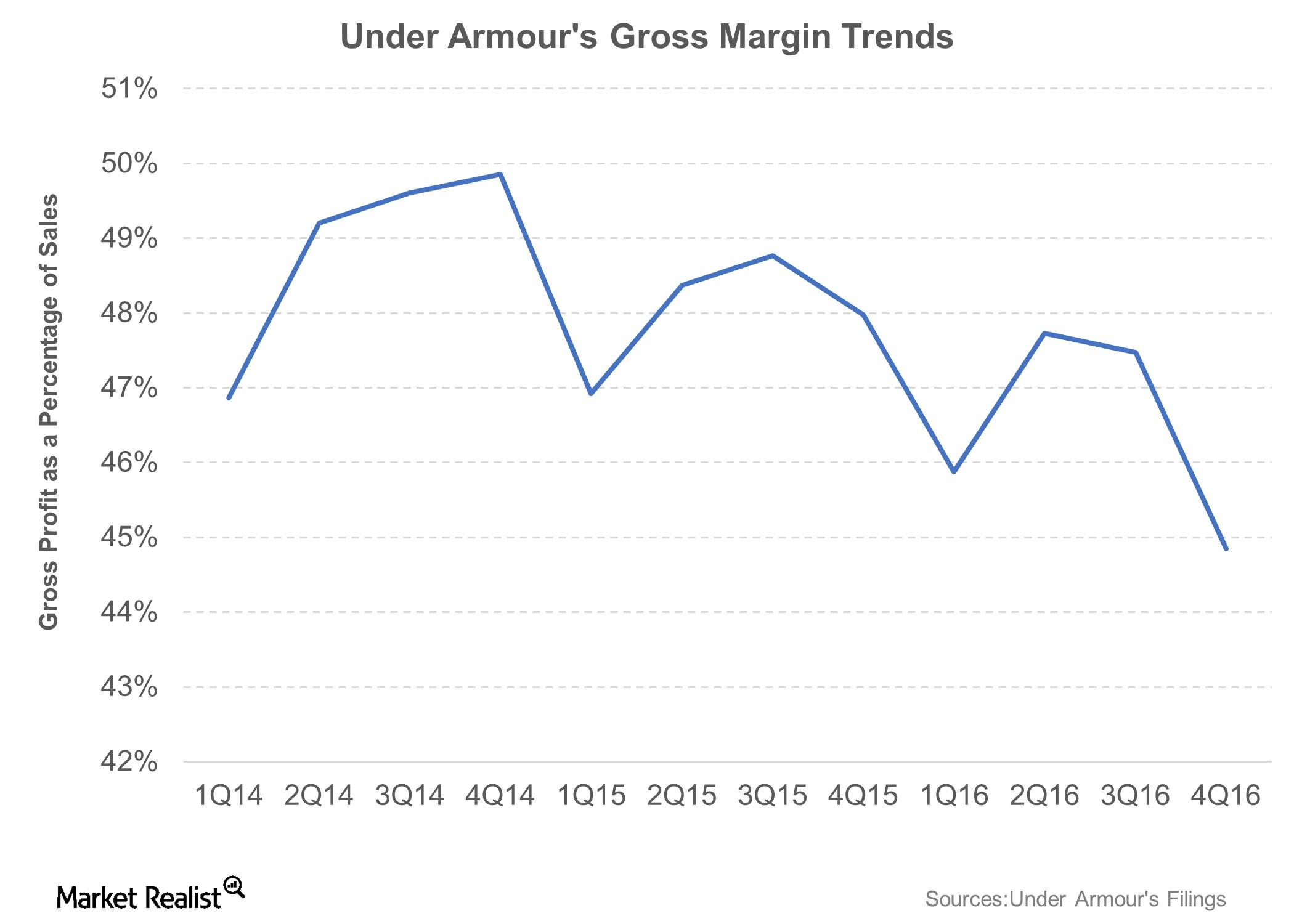

What Hampered Under Armour’s 4Q16 Profitability?

In 4Q16, Under Armour’s adjusted earnings per diluted share stood at $0.23, which was $0.02 lower than what analysts were expecting.

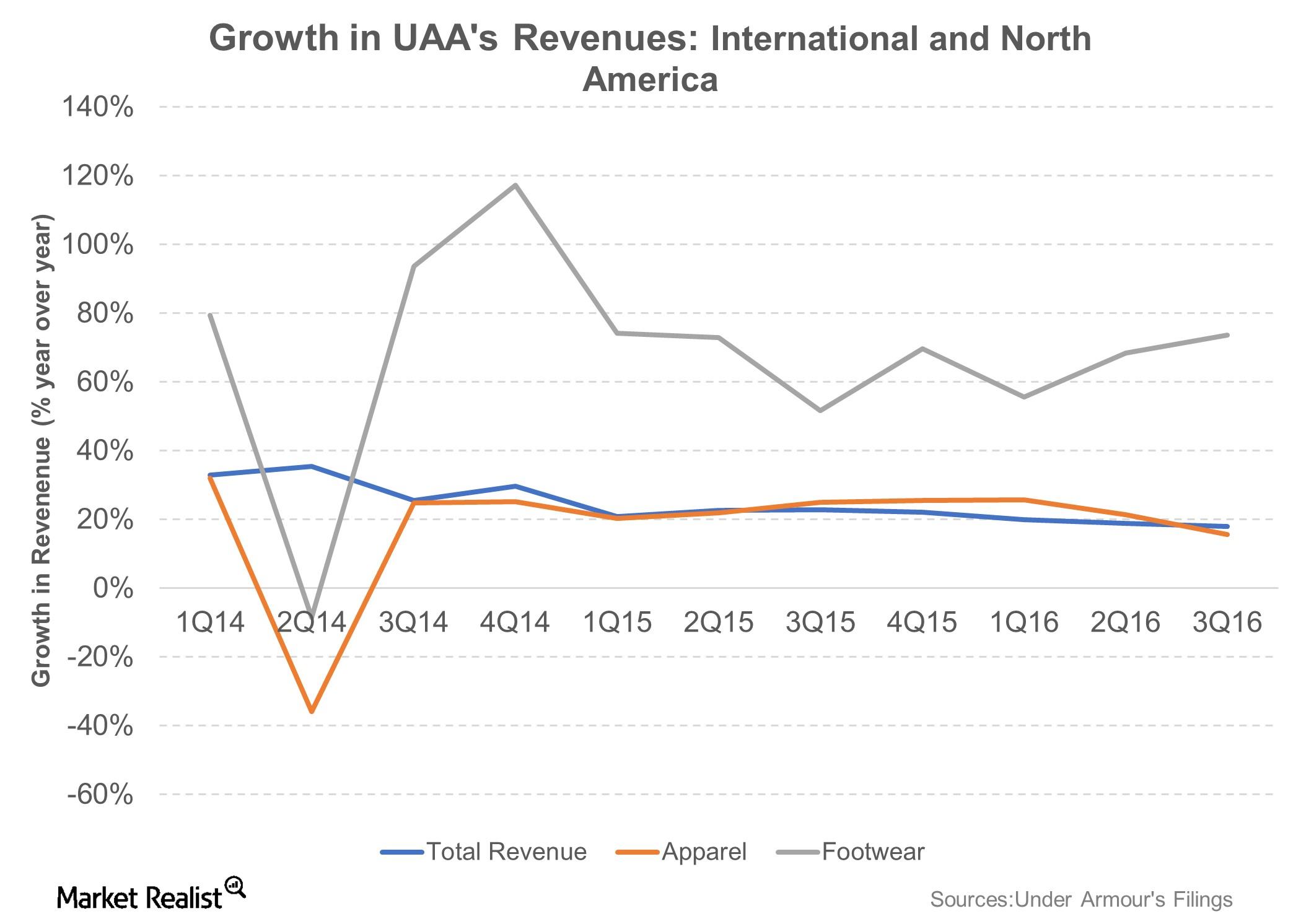

Under Armour Plans to Expand Its International Presence

International sales account for about 15.0% of UAA’s total sales compared to less than 6.0% in fiscal 2013. It has plans to further expand that business.

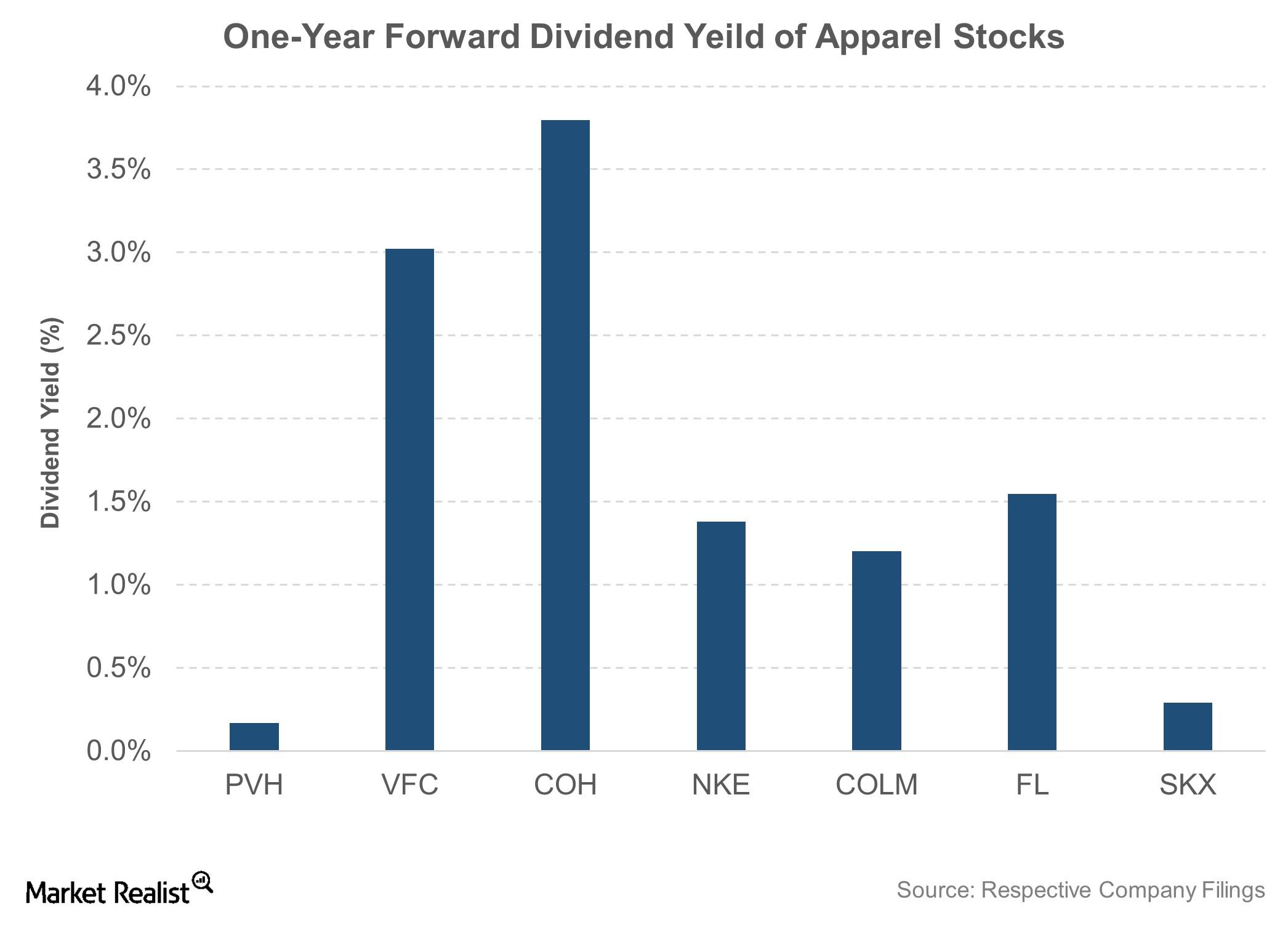

What’s Nike’s Dividend Policy?

Nike (NKE) is a consistent dividend payer and has increased dividends over the last 14 years.

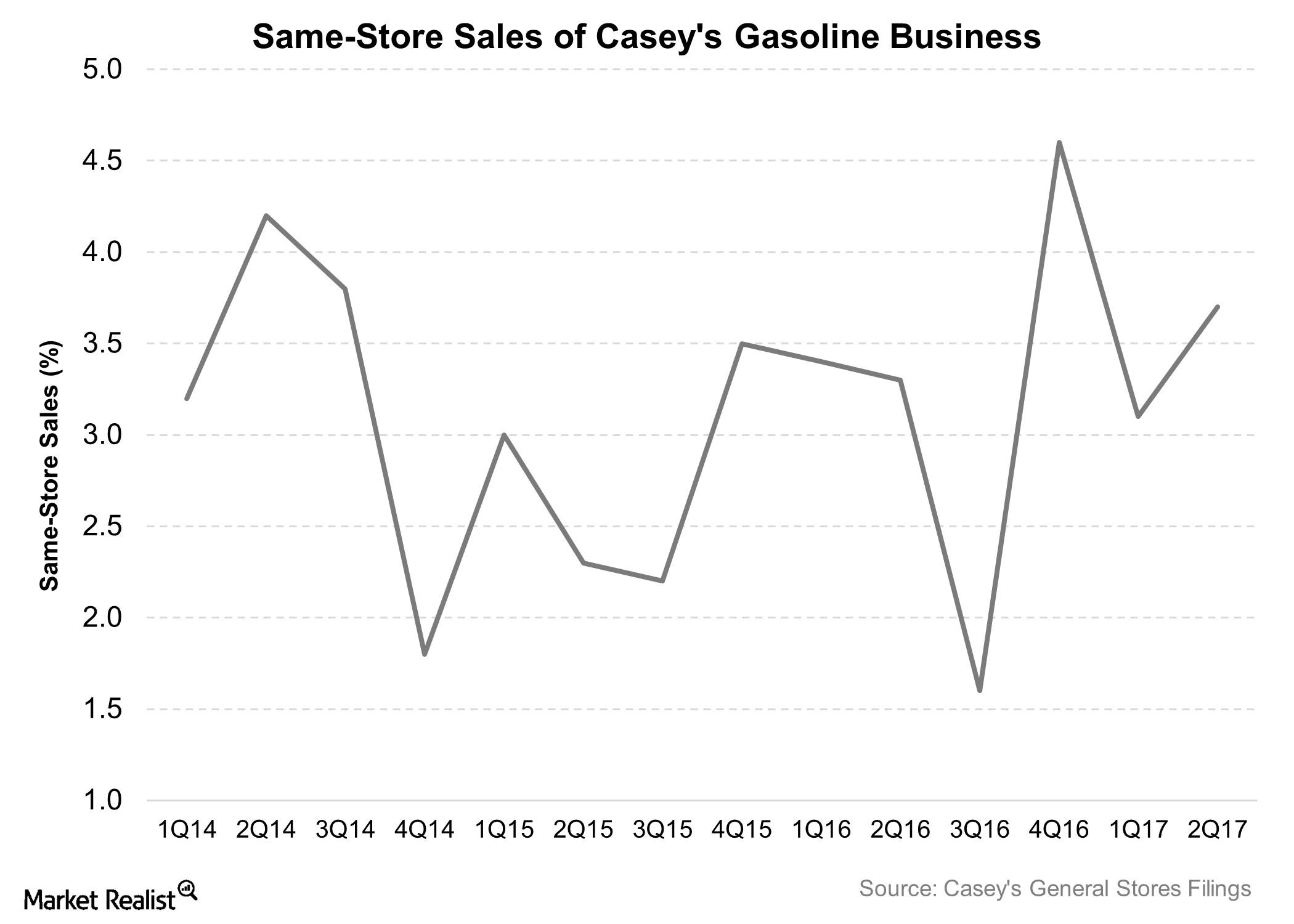

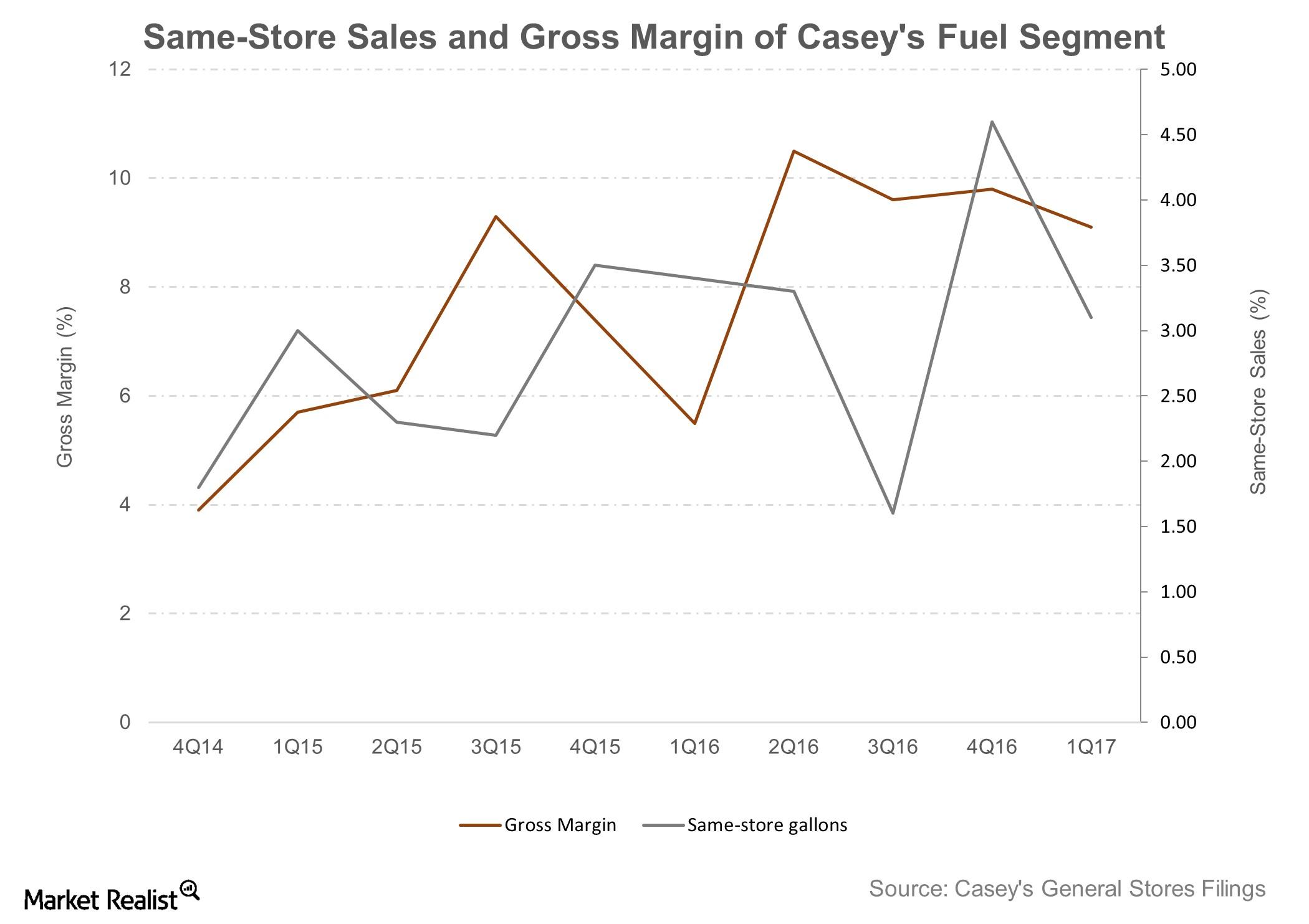

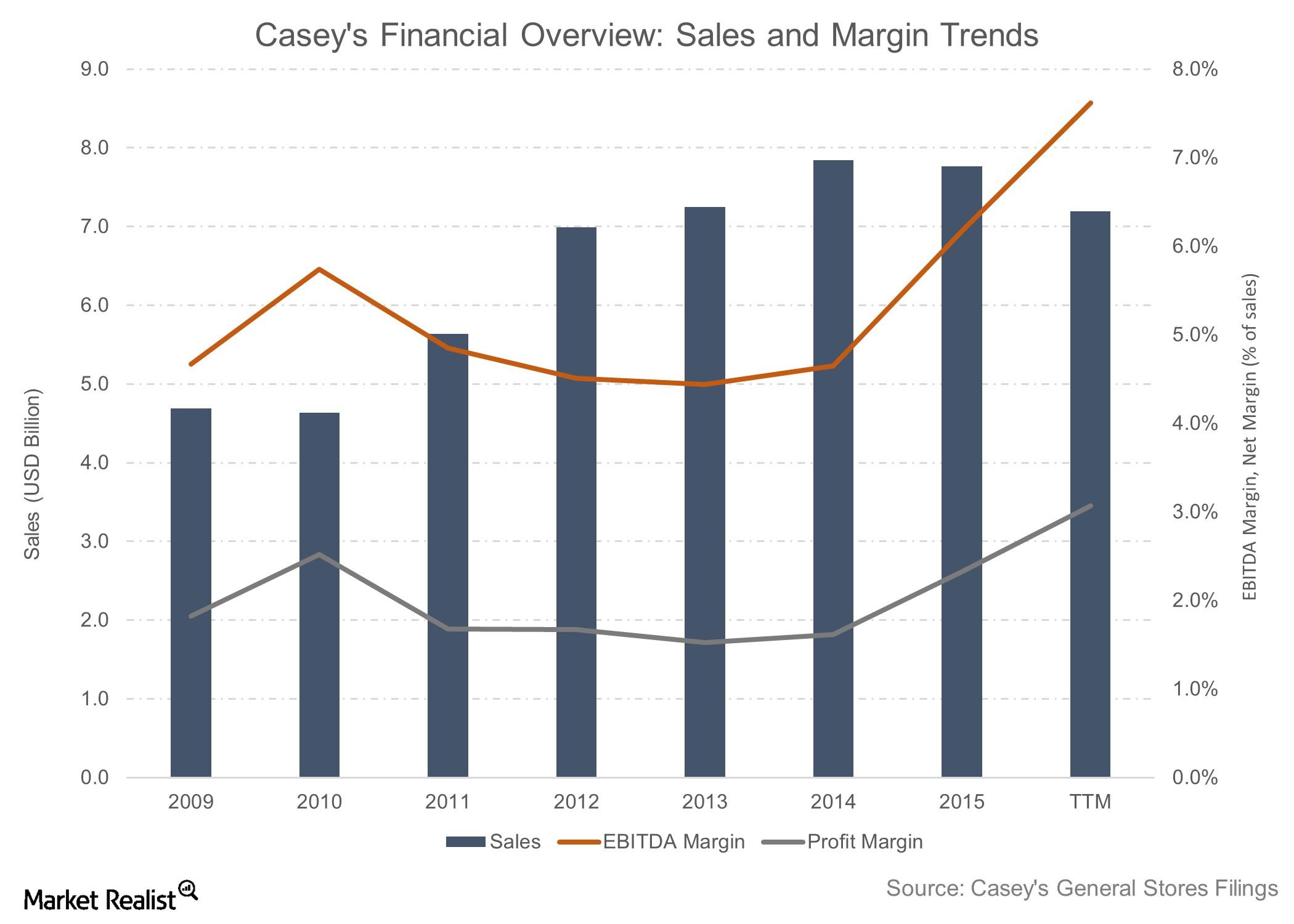

Lower Fuel Margins Drove Casey’s 2Q17 Earnings Miss

Gasoline sales accounted for 58.0% of Casey’s (CASY) total revenue in fiscal 2Q17. Total gasoline sales fell 4.6% YoY (year-over-year) in fiscal 2Q17.

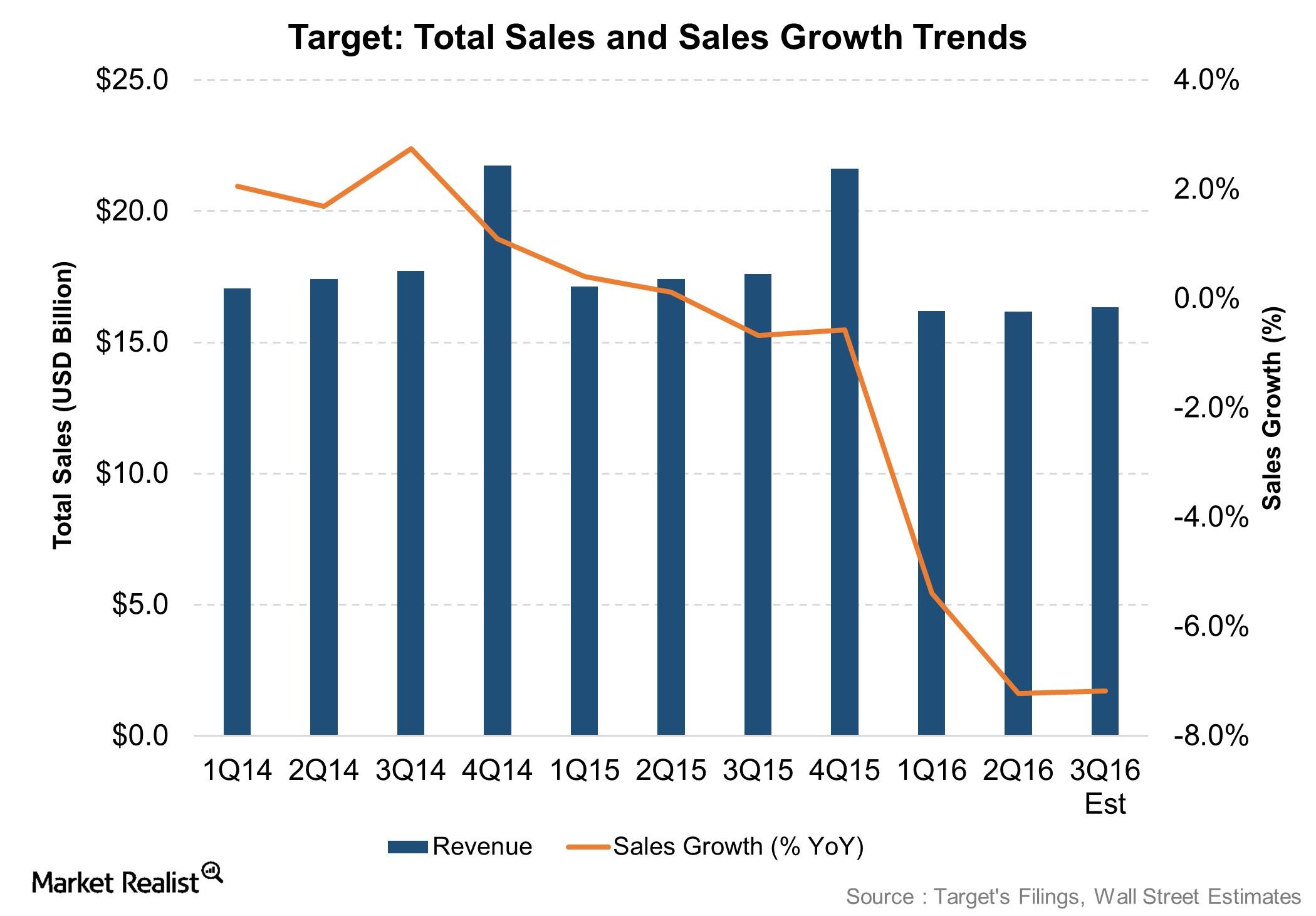

Looking Back: What Drove Target’s Top Line in 2Q16?

In 2Q16, mass merchandiser Target (TGT) reported a 7.2% decline in its top line to $16.2 billion. Target’s 2Q16 revenues were affected by lower traffic and higher variability in sales patterns.

Analyzing Sprouts Farmers Market’s Margins and Profitability

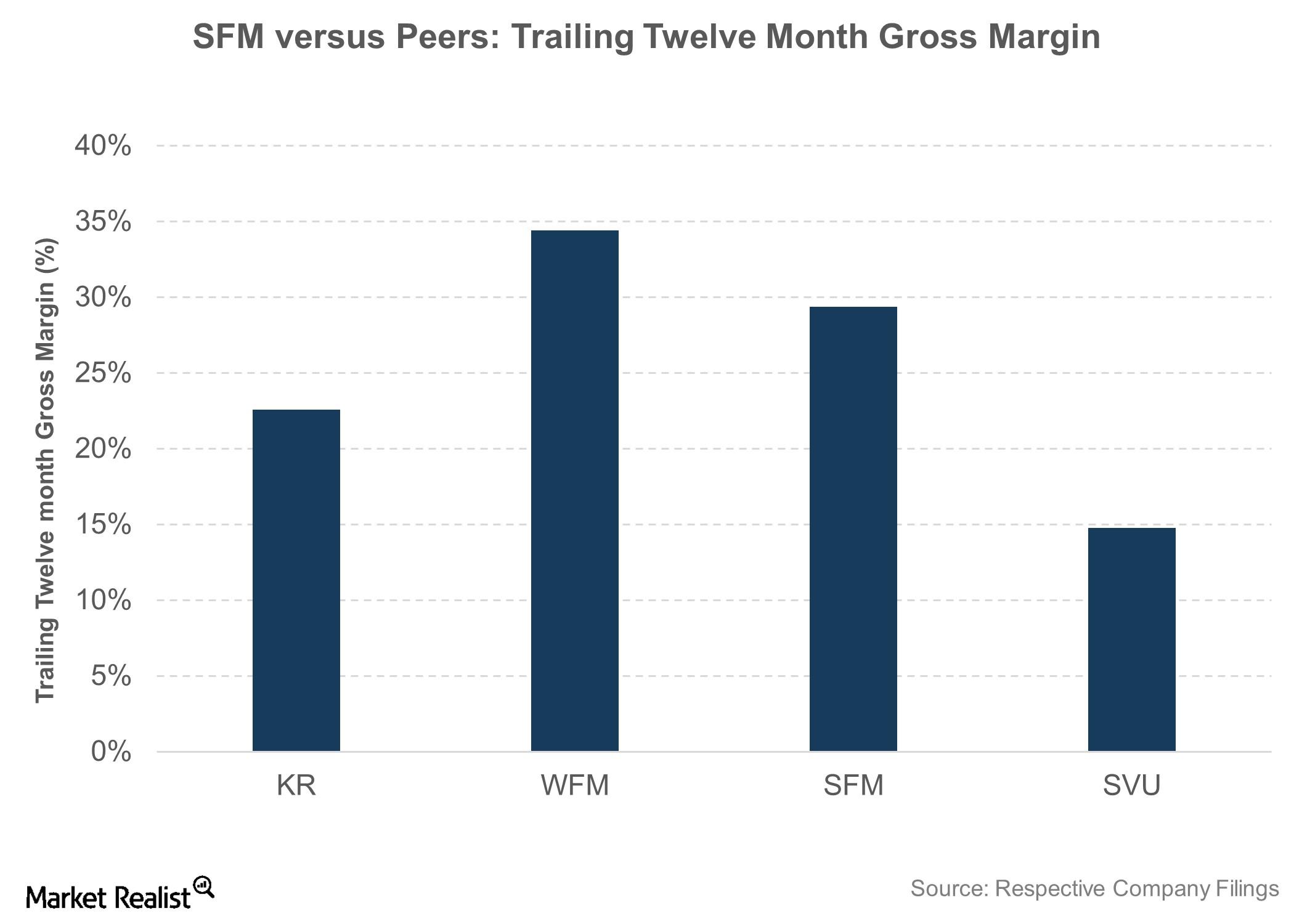

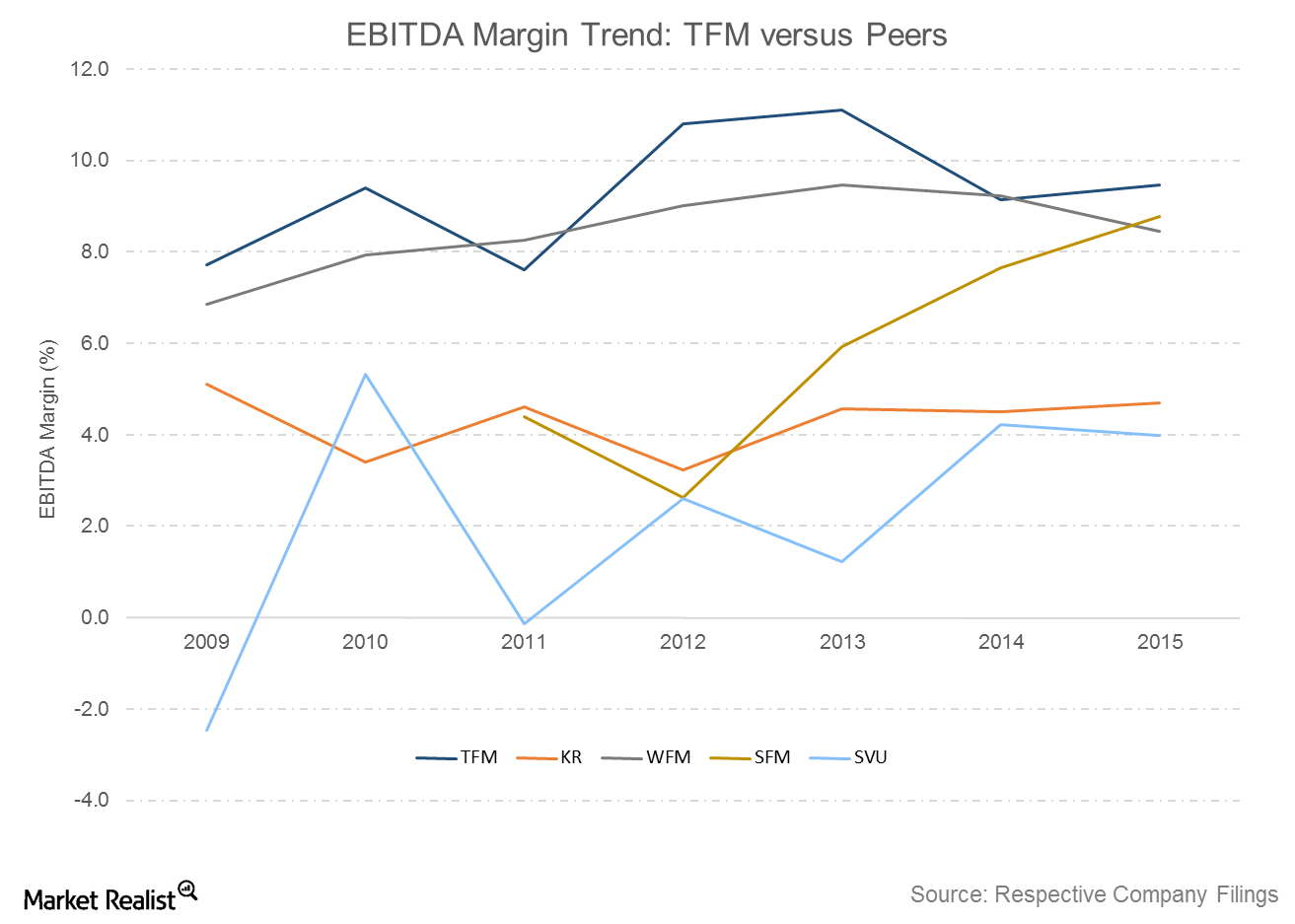

Despite the slowdown, Sprouts Farmers Market continues to display better margins compared to Kroger (KR) and Supervalu (SVU).

Sprouts Farmers Market Beat Revenue Estimates in 3Q16

Sprouts Farmers Market (SFM) reported its 3Q16 results on November 3, 2016. The results relate to the three-month period ending October 2, 2016.

What Does Wall Street Expect from HBI for the Rest of 2016?

Hanesbrands updated its 2016 full-year outlook while reporting its third quarter results.

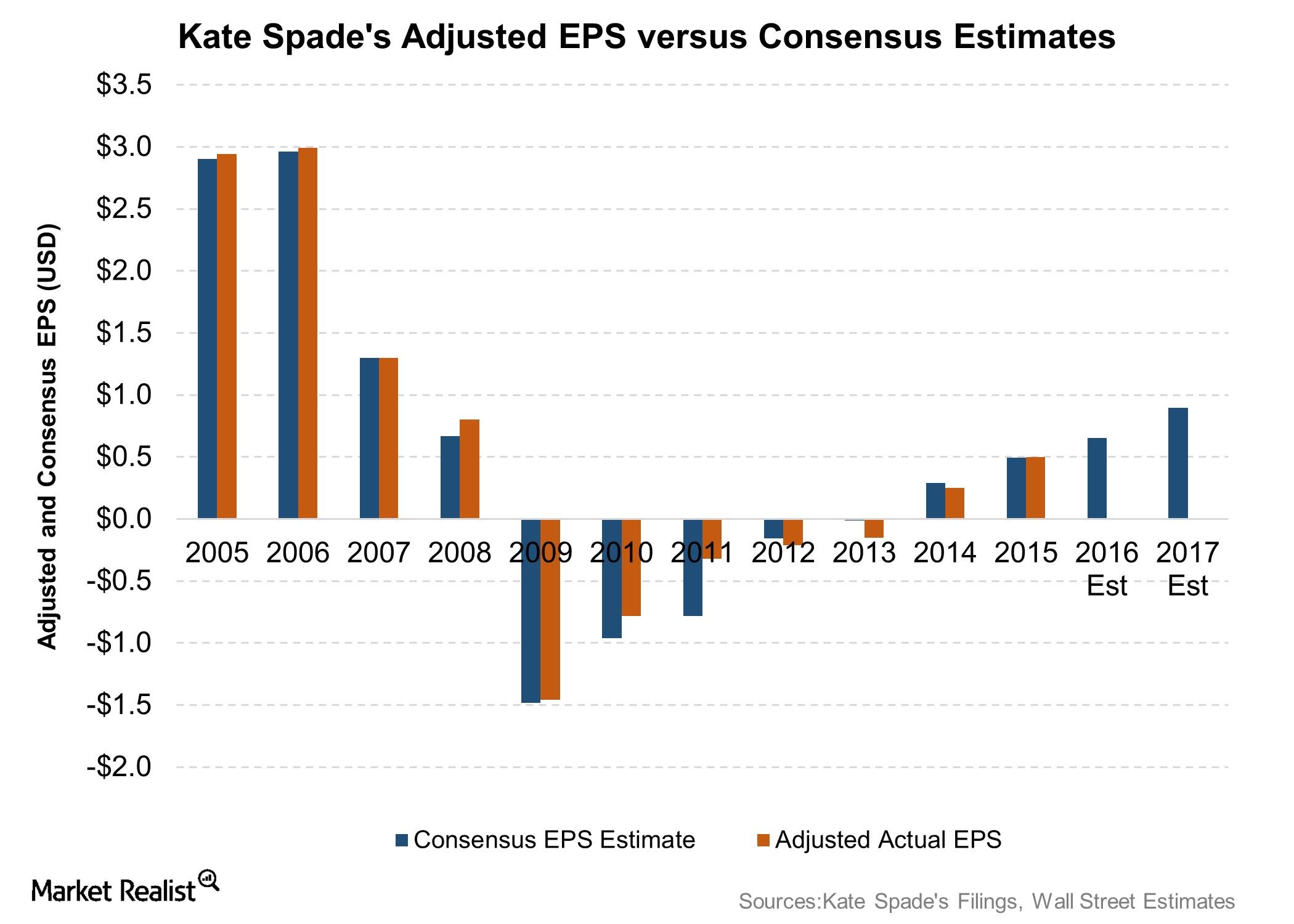

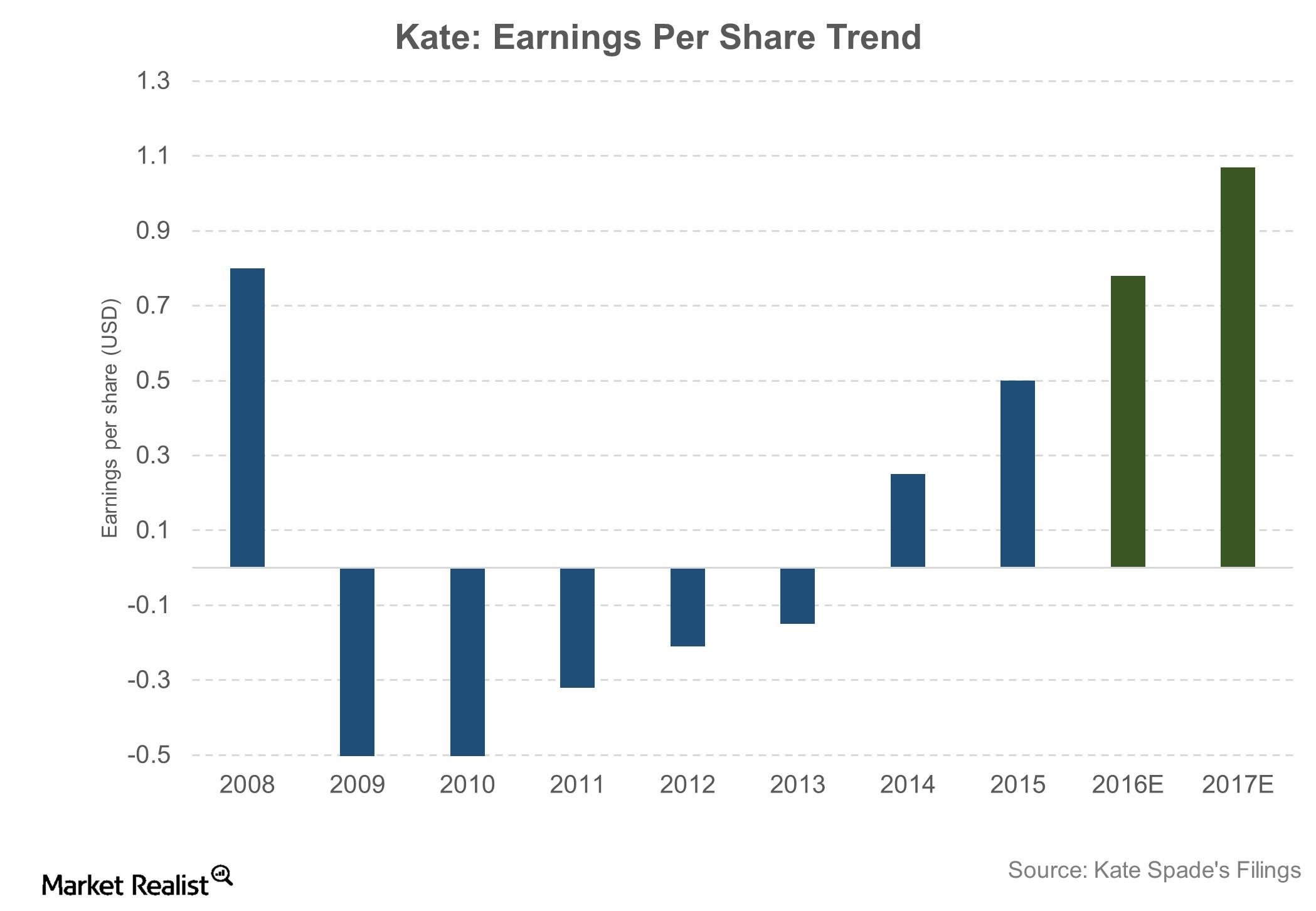

How Will Kate Spade’s Fiscal 2016 Performance Shape Up?

As a result of its second quarter headwinds, Kate Spade (KATE) lowered its full fiscal 2016 outlook.

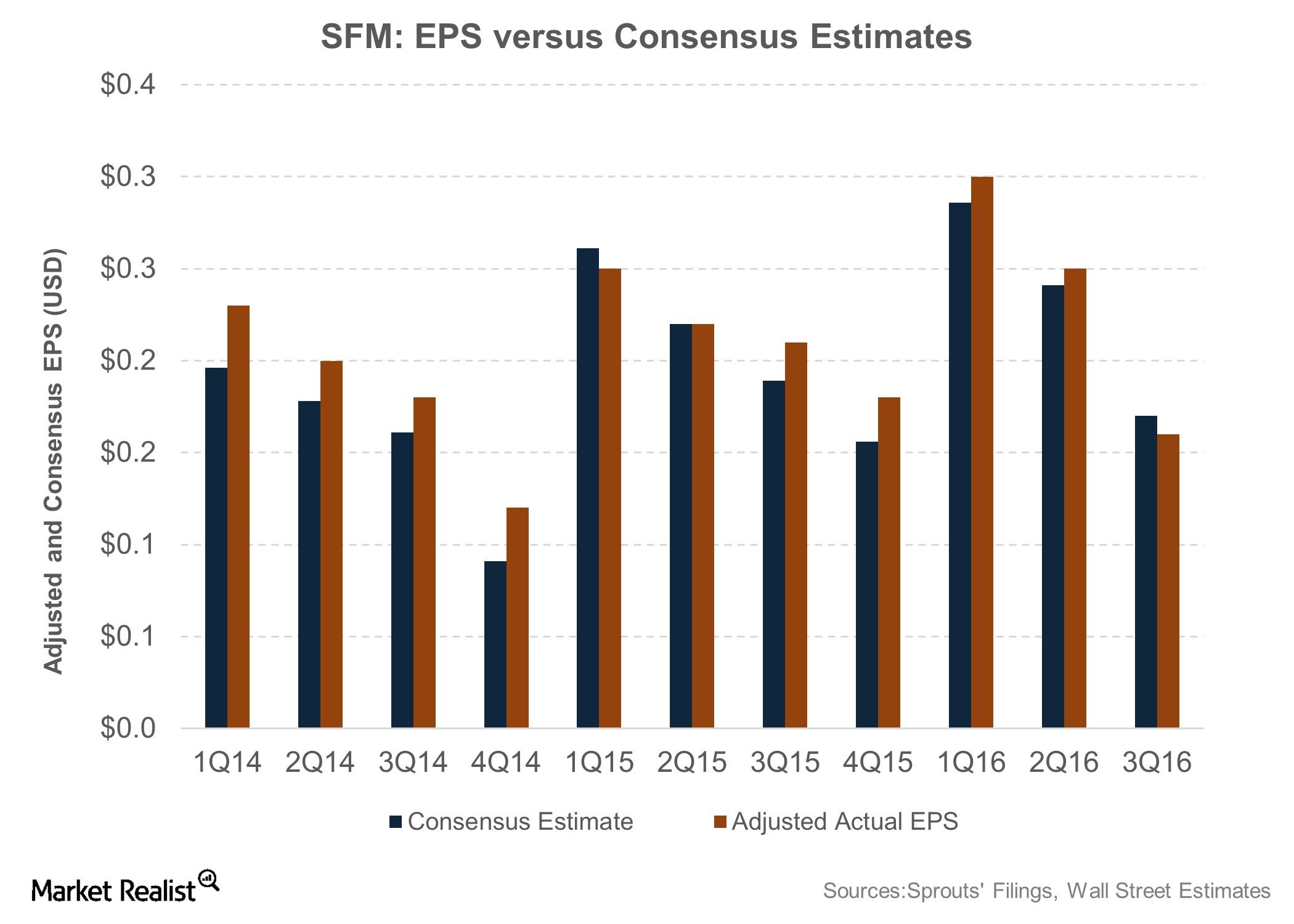

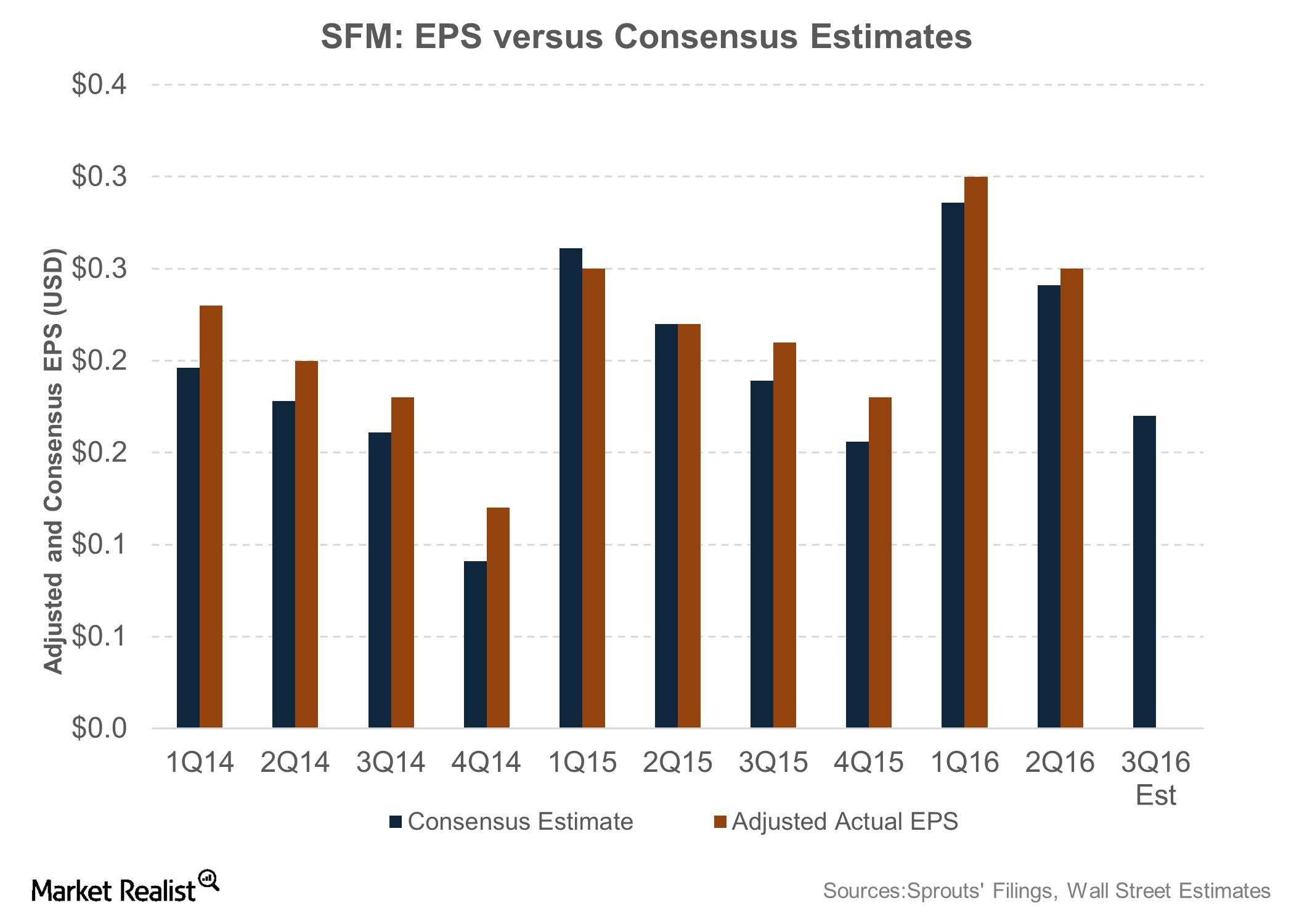

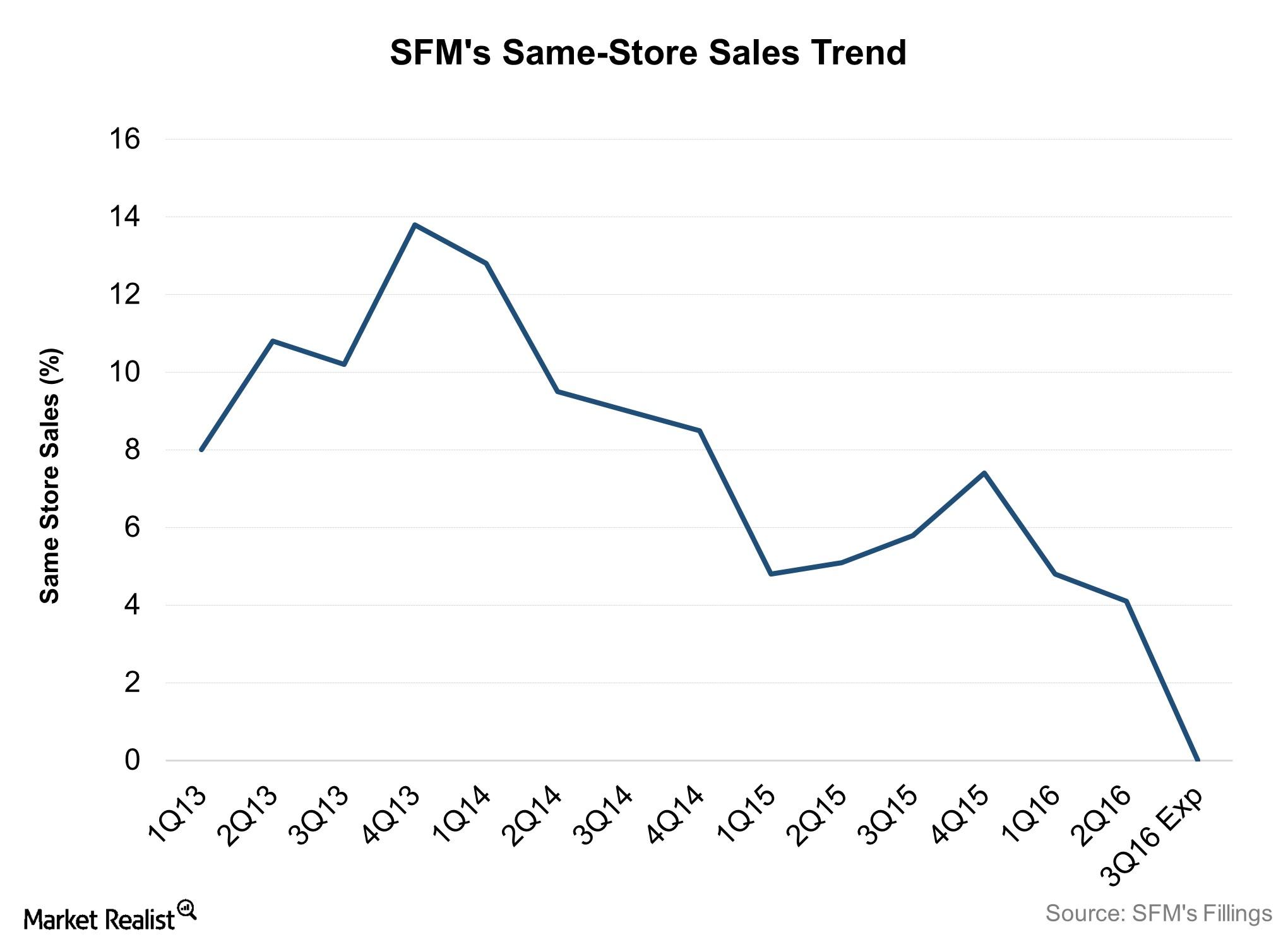

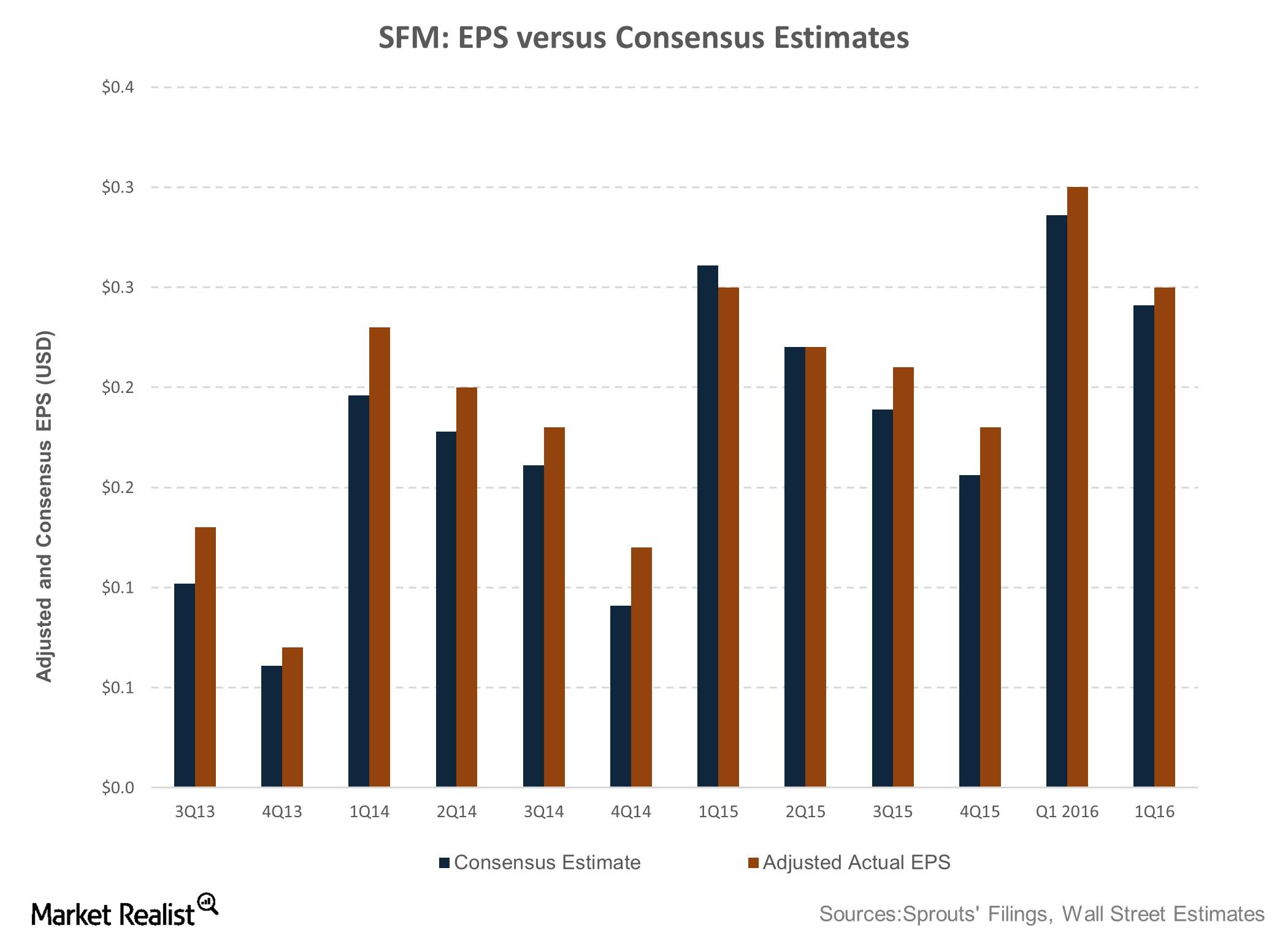

Sprouts Farmers Market May Not Have the Best Quarter

Sprouts Farmers Market (SFM) is slated to release its 3Q16 results on Thursday, November 3, 2016, before the market opens. Wall Street is expecting a fall of 19.0% in EPS.

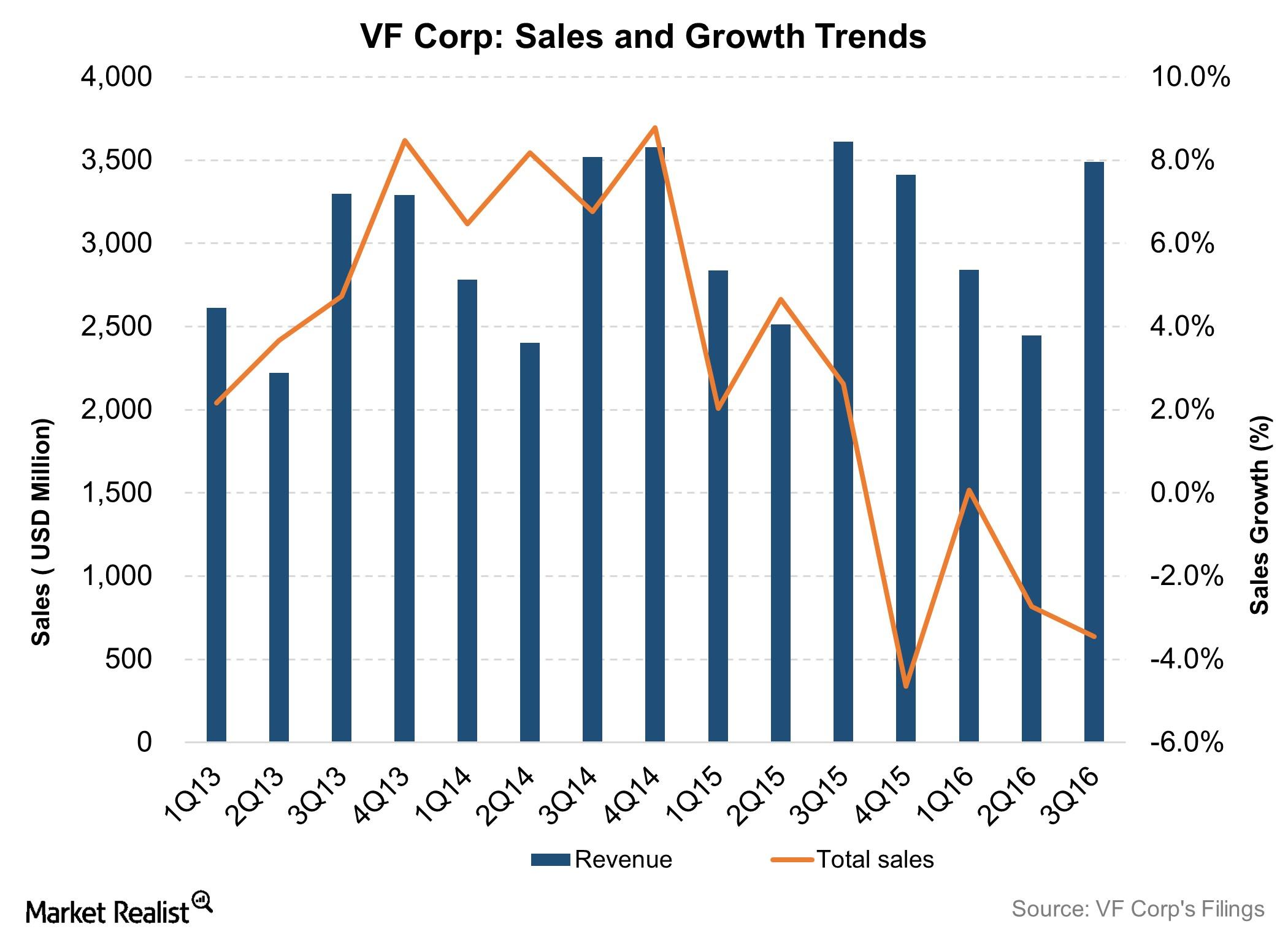

Weakness in North America Offset VFC’s International Gains

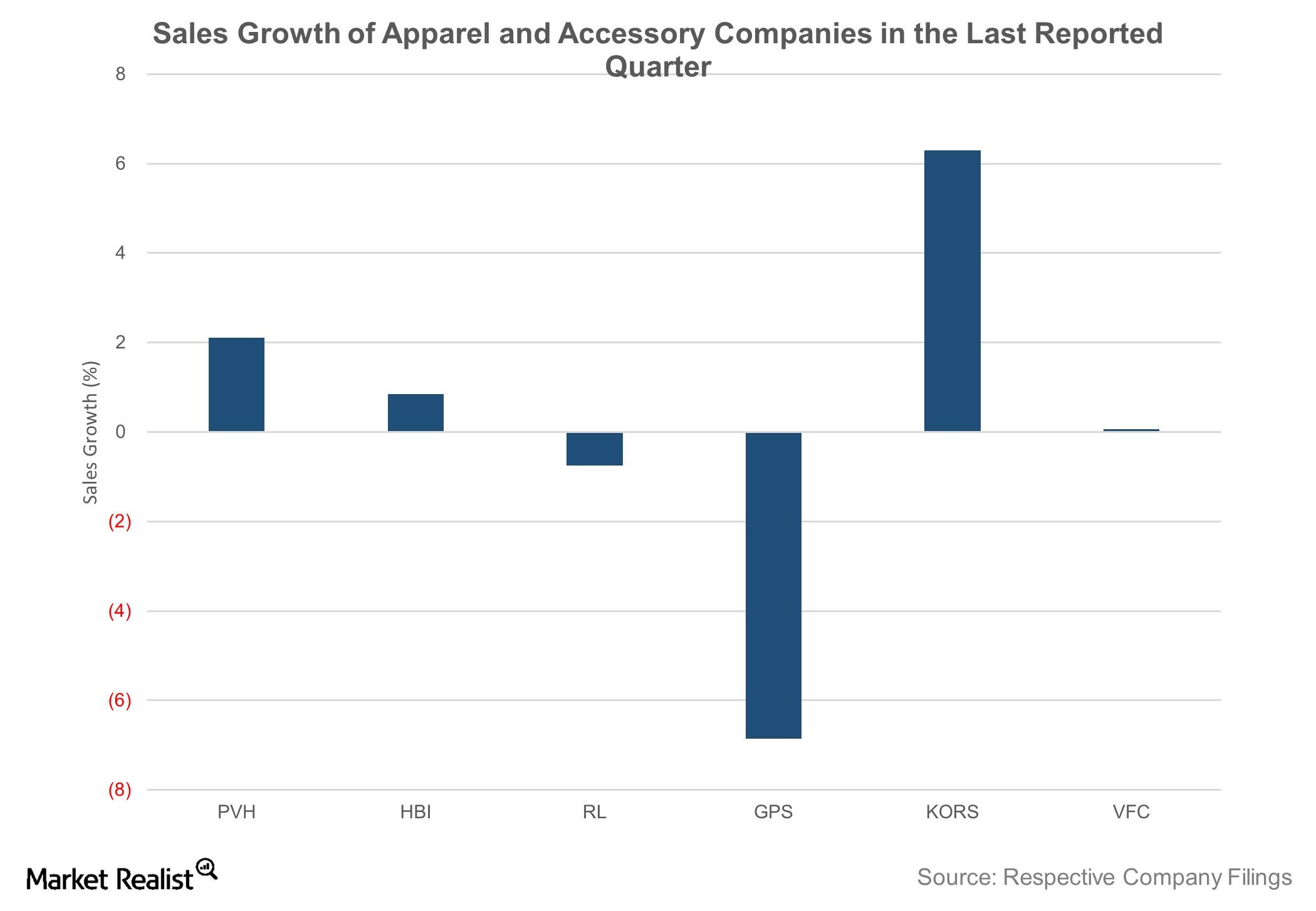

As in the last several quarters, VF’s (VFC) international business remained firm during the third quarter.

Nike May Have Jordan, but Under Armour Boasts Phenom Curry

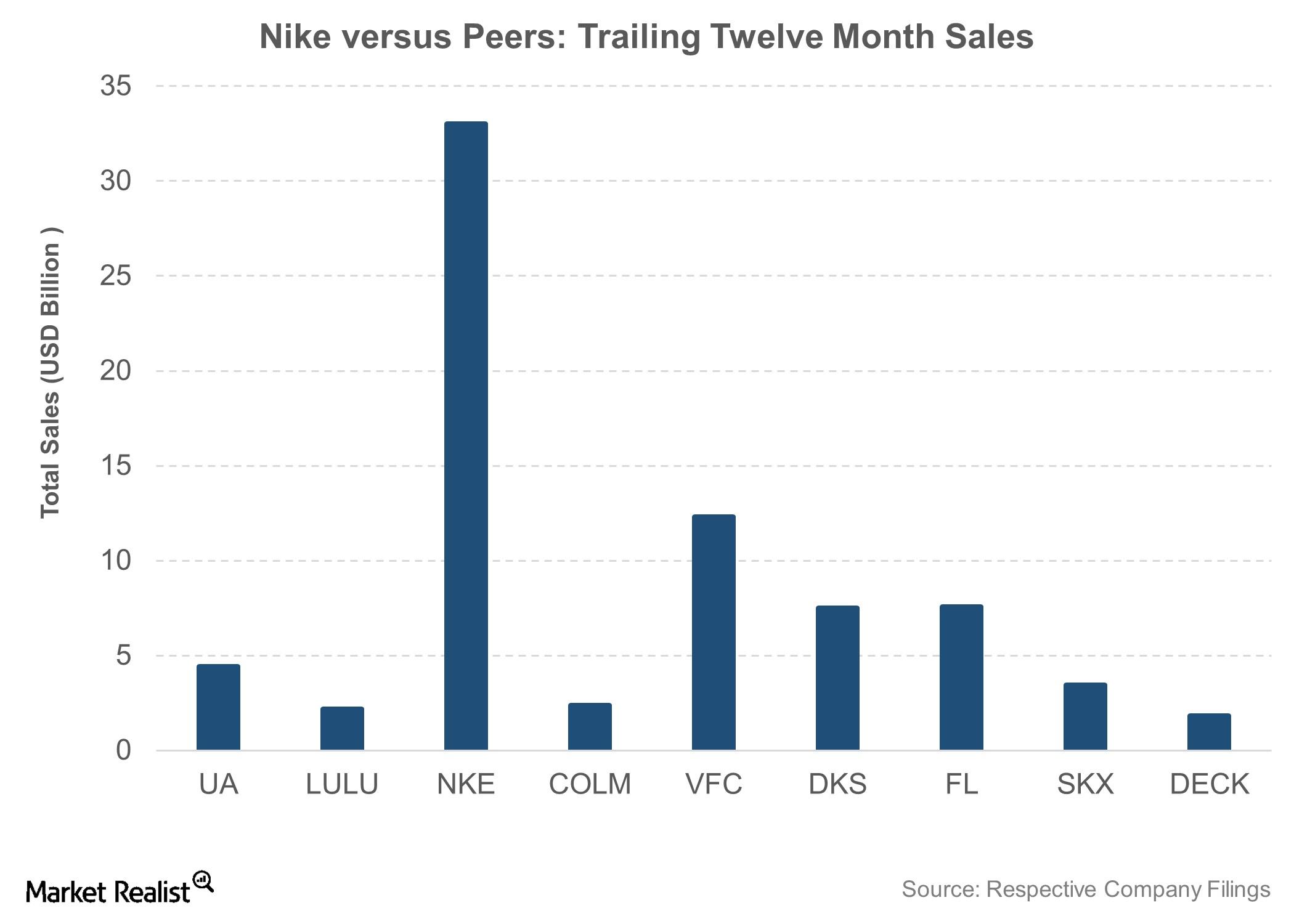

Although it’s a relatively new player in the sportswear industry, Under Armour has given tough competition to industry pioneers such as Nike (NKE) and Adidas (ADDYY).

Why Star Power and Sponsorships Are Key for Nike

Endorsement deals and sponsorships have been key for Nike since the beginning.

A Quick Look at SFM’s Guidance Update for Fiscal 2016

Sprouts Farmers Market has displayed industry-leading earnings growth in the past few years.

Casey’s Gasoline Sales Witnessed a Resurgence in 1Q17

Gasoline sales accounted for 58.2% of Casey’s (CASY) total revenue in 1Q17.

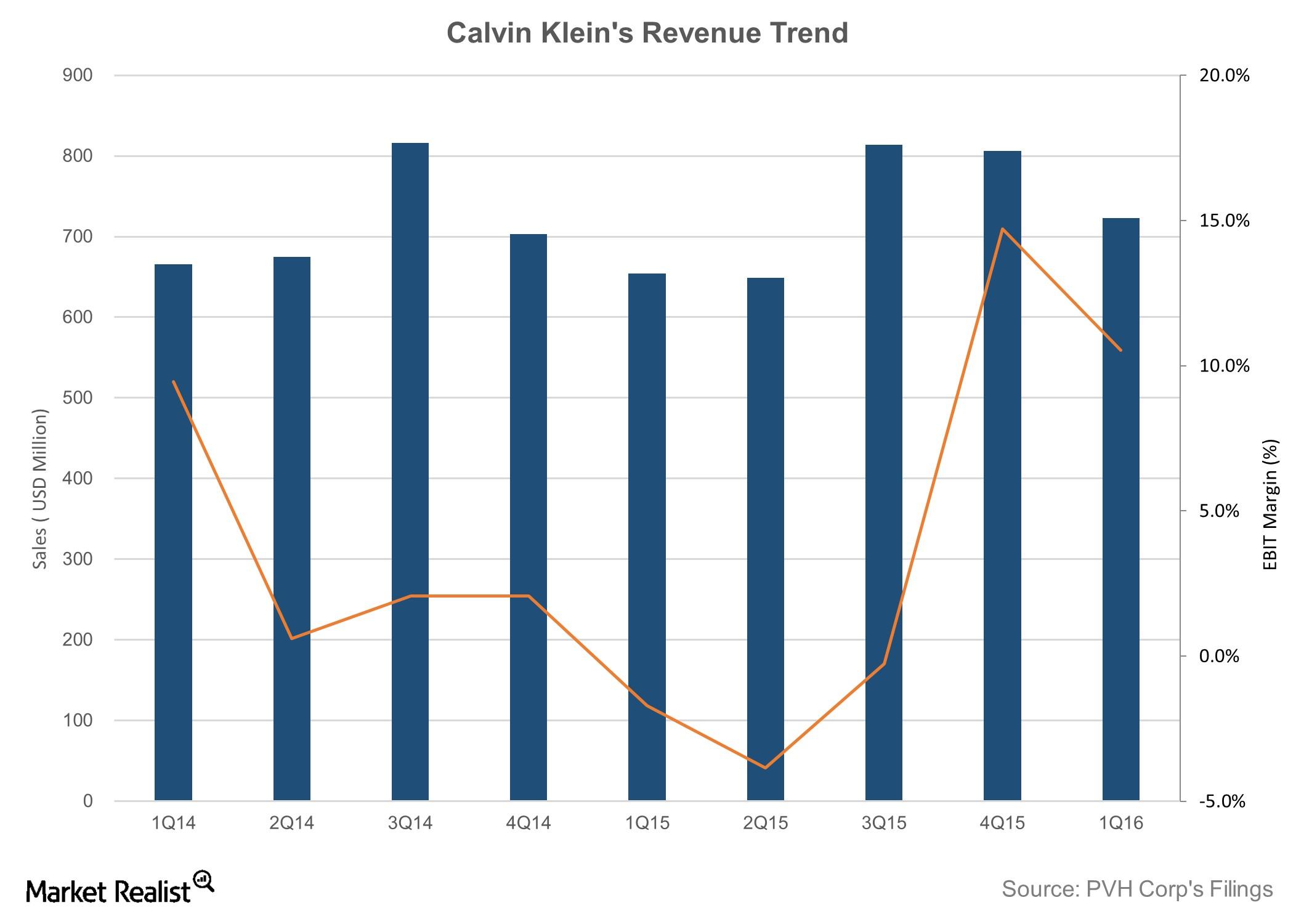

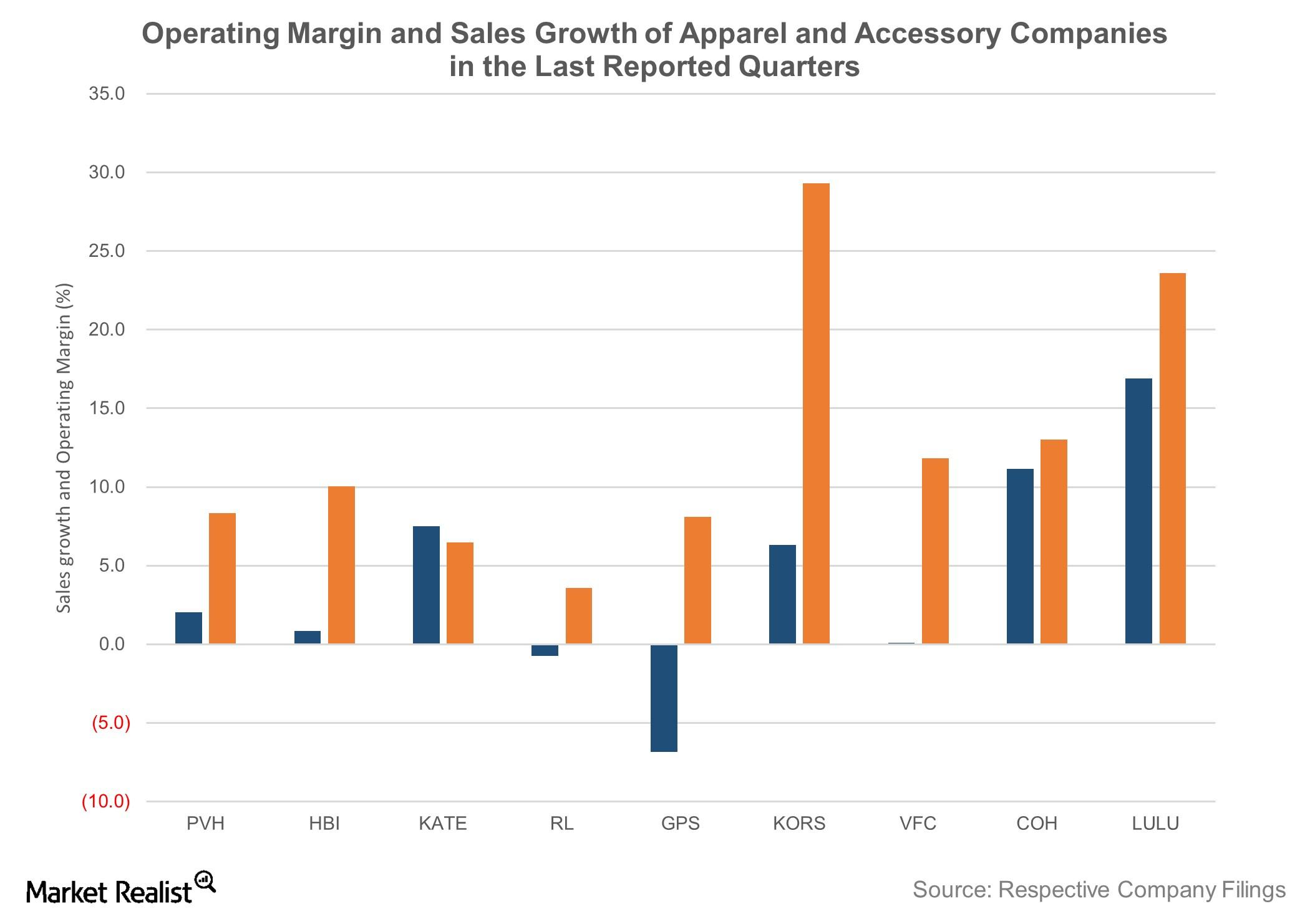

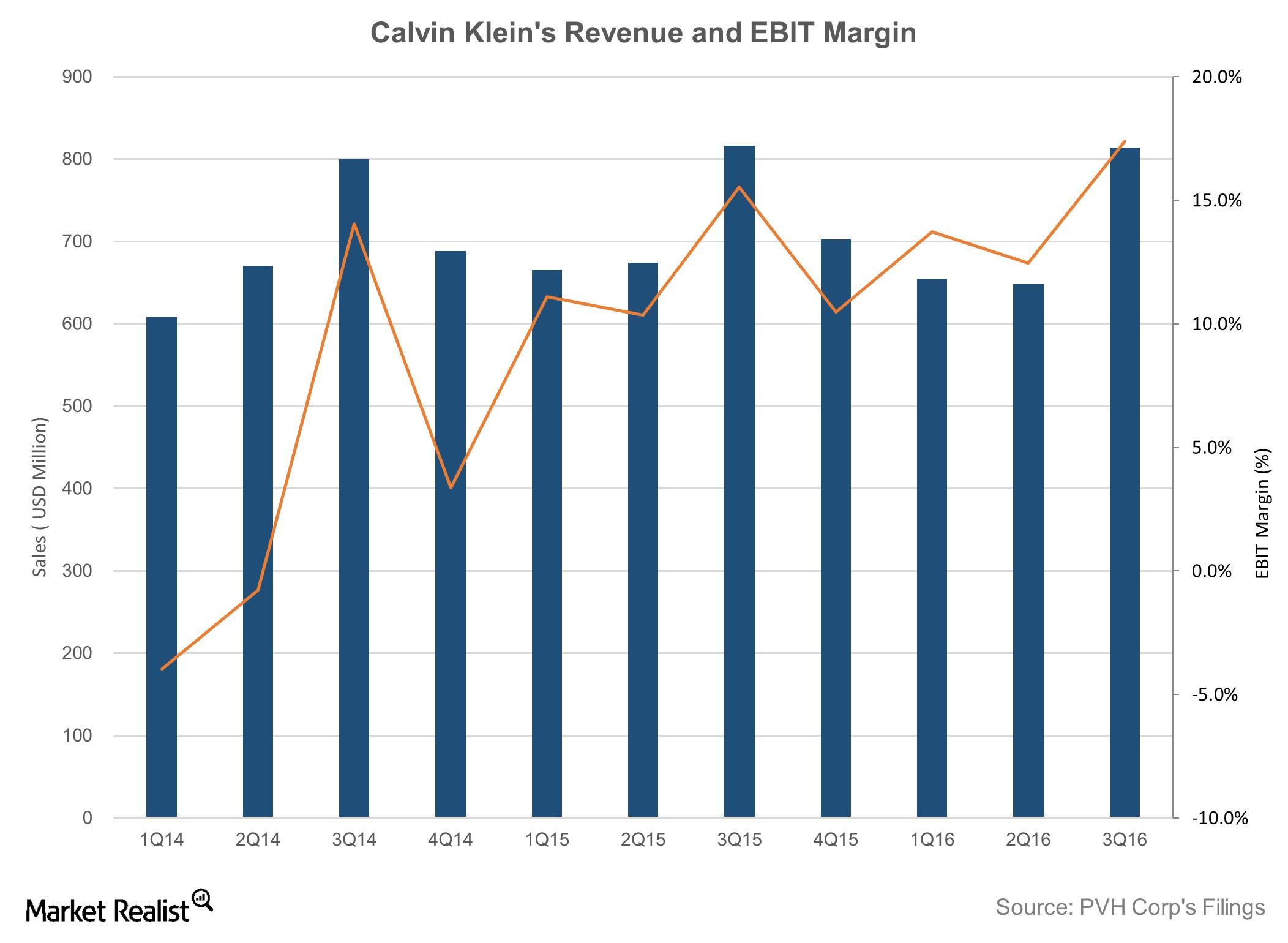

Can Calvin Klein Drive PVH’s Sales Growth in 2Q16?

Among PVH’s (PVH) three segments, Calvin Klein has been the best performer. The brand accounts for more than 37% of the company’s total revenue.

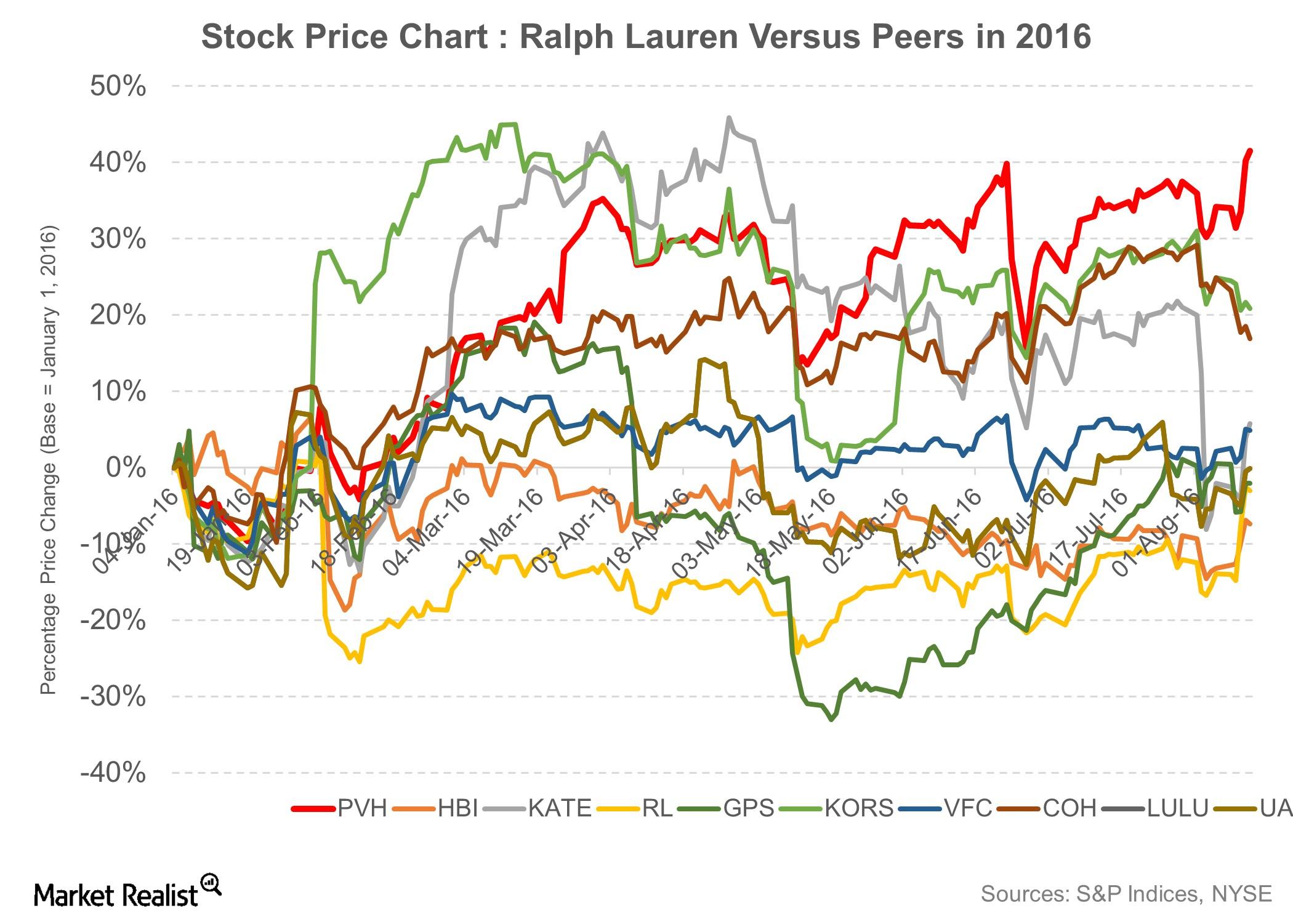

Better-than-Expected Earnings Support Falling Ralph Lauren Stock

Despite a decline in earnings, Ralph Lauren continues to hold $1.2 billion in cash and short-term investments on its balance sheet.

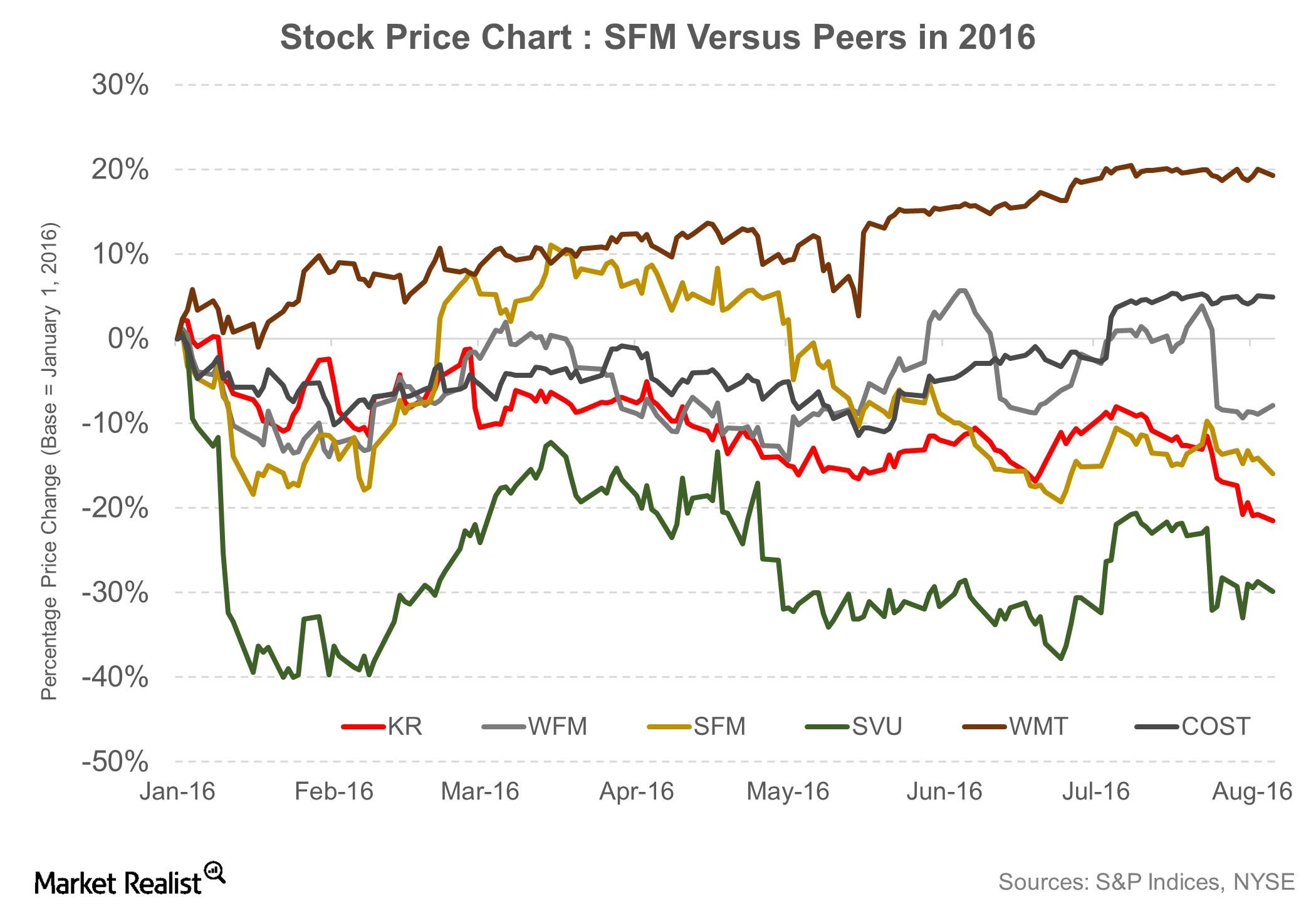

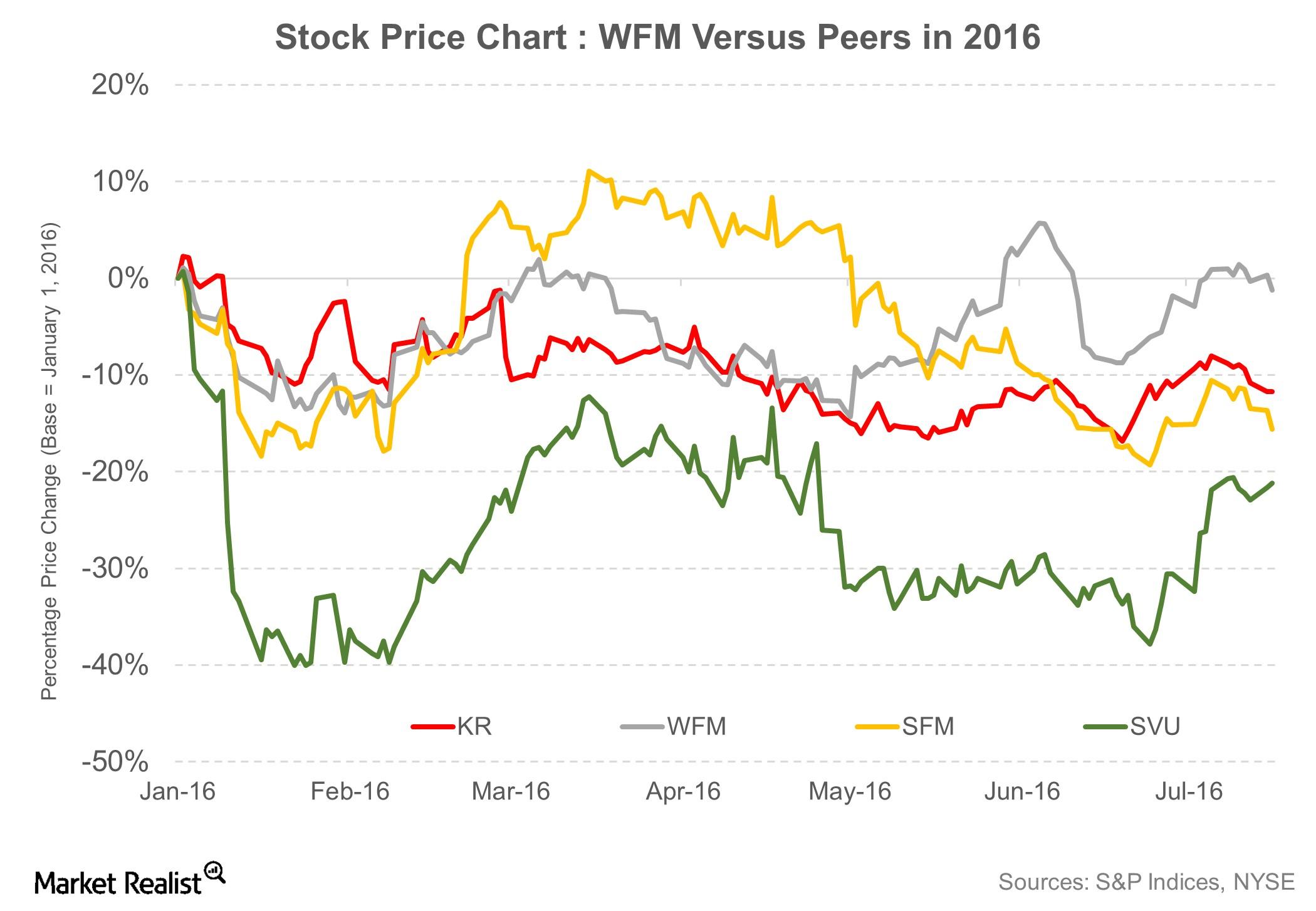

Stock Market Performance and Valuations Summary: SFM versus Peers

Of the 18 analysts who have rated SFM, 12 have recommended a “buy,” and 6 have recommended a “hold.” None of the analysts have a “sell” rating on the stock.

2Q16 Earnings Overview: SFM Beats on Earnings, Misses on Revenue

Sprouts Farmers Market (SFM) reported results for fiscal 2Q16 on August 4, 2016. The value-oriented organic and natural food retailer reported a 14% year-over-year increase in adjusted diluted EPS, beating the consensus by 1 cent.

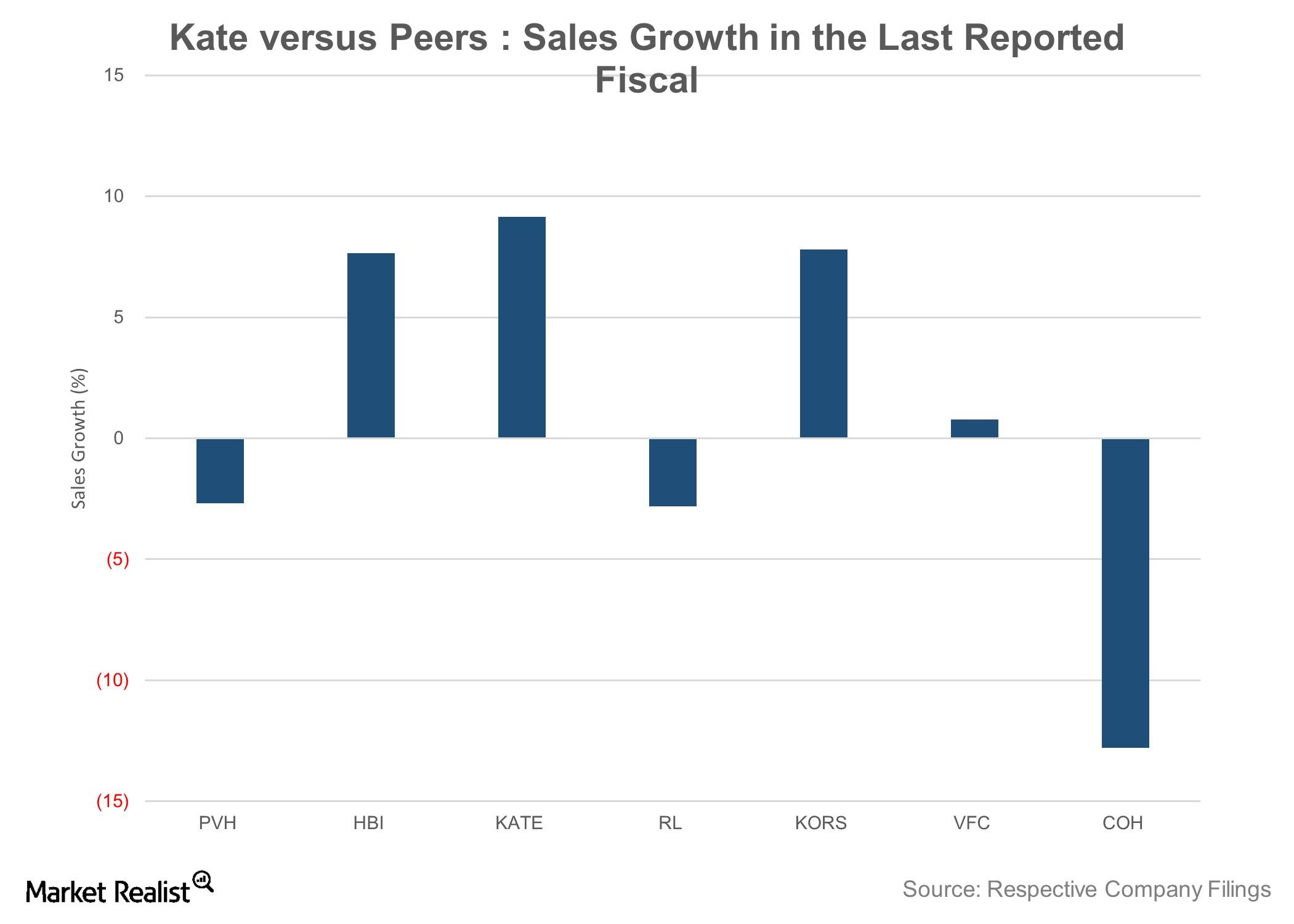

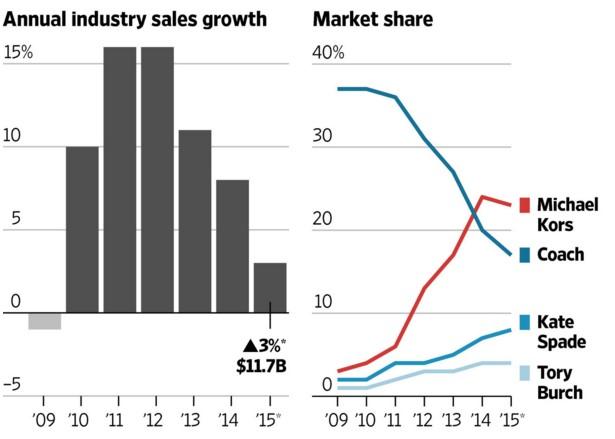

Inside Kate Spade’s Key Focus Areas

KATE’s top line grew by 9.1% YoY (year-over-year) in fiscal 2015, as compared to a 7.7% YoY increase for Michael Kors and a 12.7% YoY decline for Coach.

SuperValu’s Stock Market Performance: A Peer Comparison

SuperValu’s stock is currently trading at $5.36, which is 42% below its 52-week high.

What Lies ahead for Kate Spade?

Kate Spade has predicted that its top-line growth will be in the 11.0%–13.5% range in fiscal 2016, which is in line with the consensus average of 13.5%.

How Is Kate Spade Positioned in the American Affordable Luxury Segment?

Kate Spade recorded total sales of $1.3 billion in the past twelve months. Michael Kors and Coach saw sales of $4.7 billion and $4.3 billion, respectively.

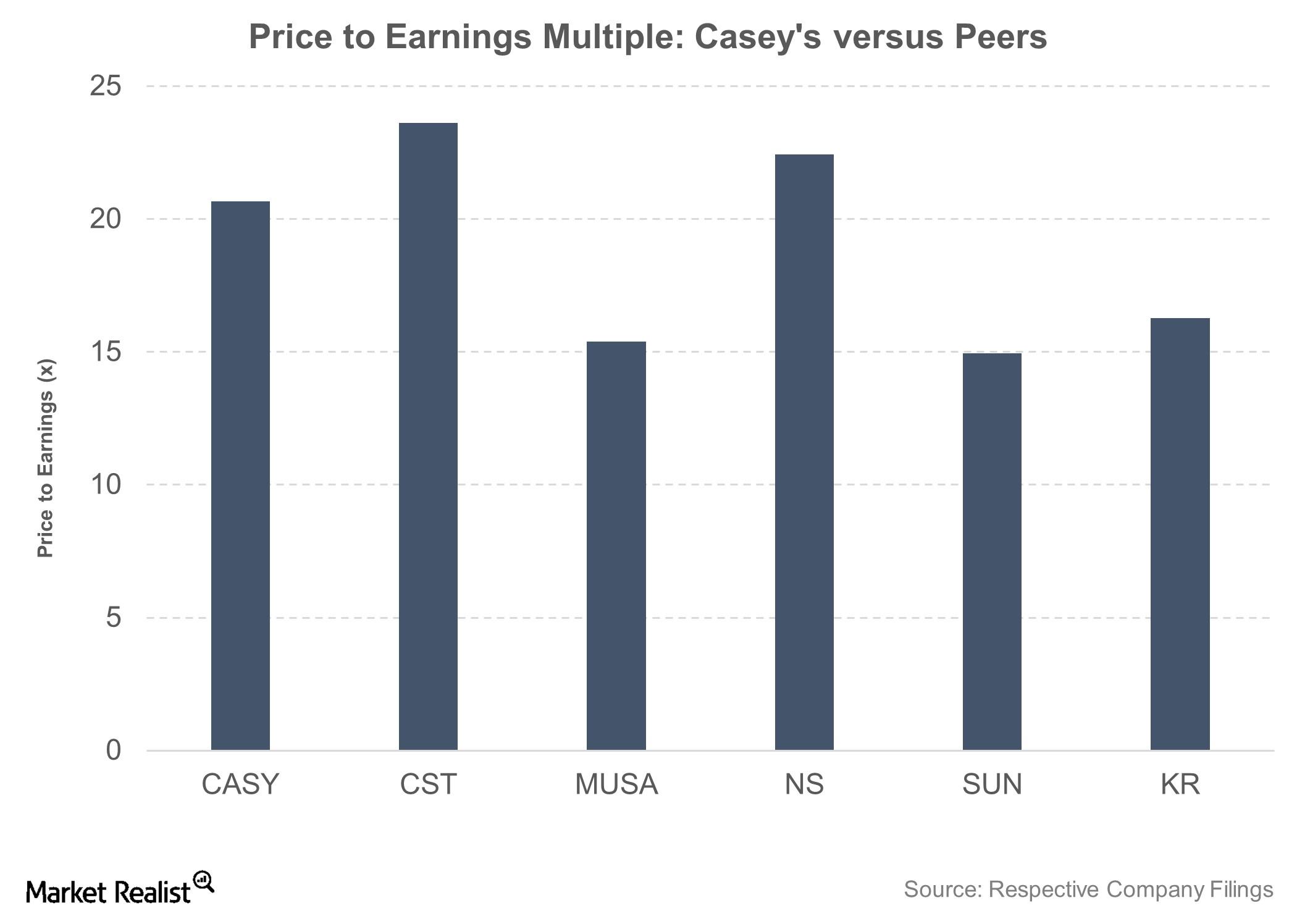

How Do Casey’s Valuations Stack Up against Its Peers’?

After Casey’s General Stores’ double-digit earnings growth over the last three fiscal years, Wall Street expects a slowdown in its earnings per share growth.

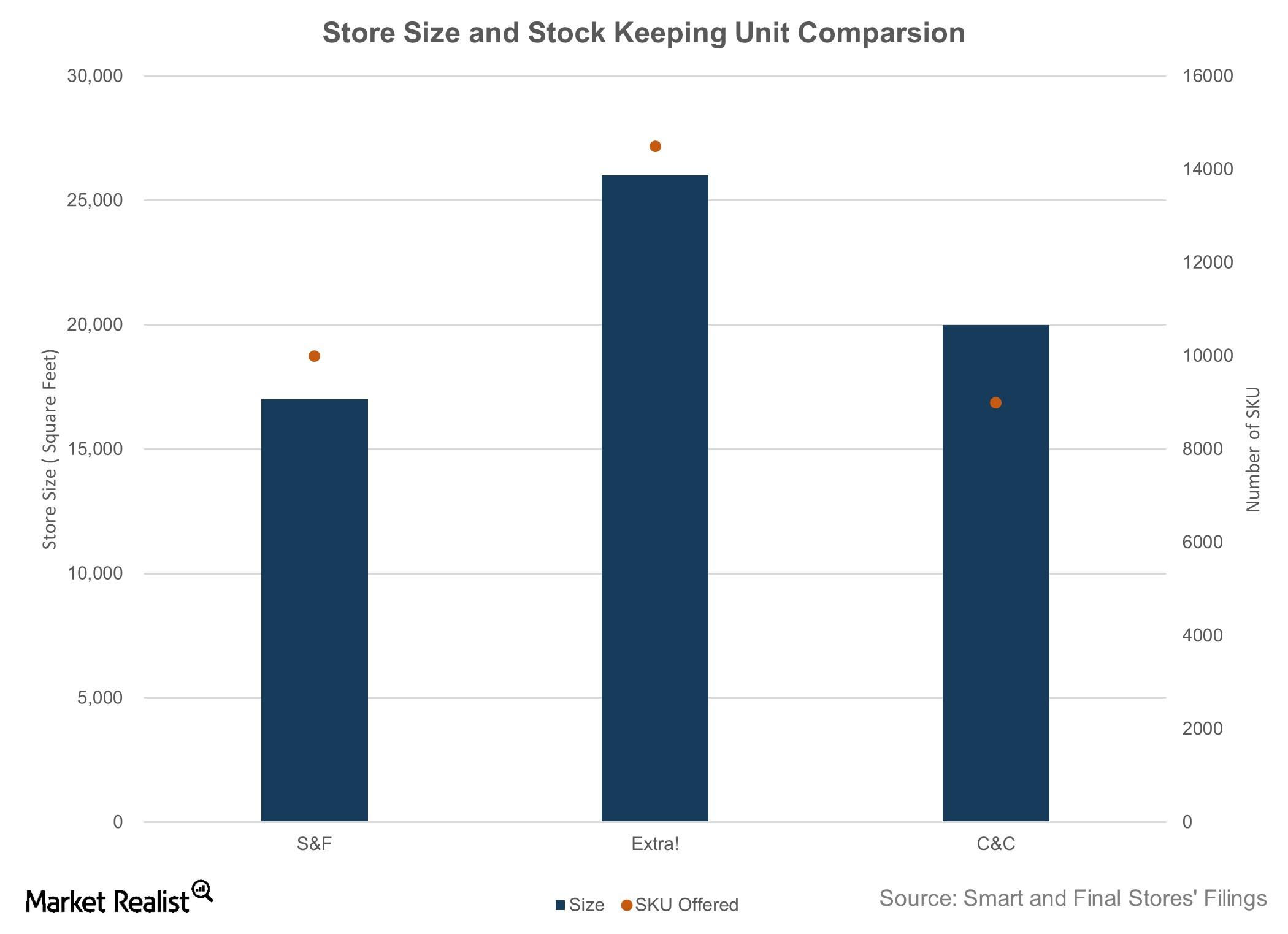

What Does a Typical Smart & Final Store Look Like?

Smart & Final stores have a smaller physical footprint than other warehouse clubs and grocery chains, but they offer a larger SKU selection.

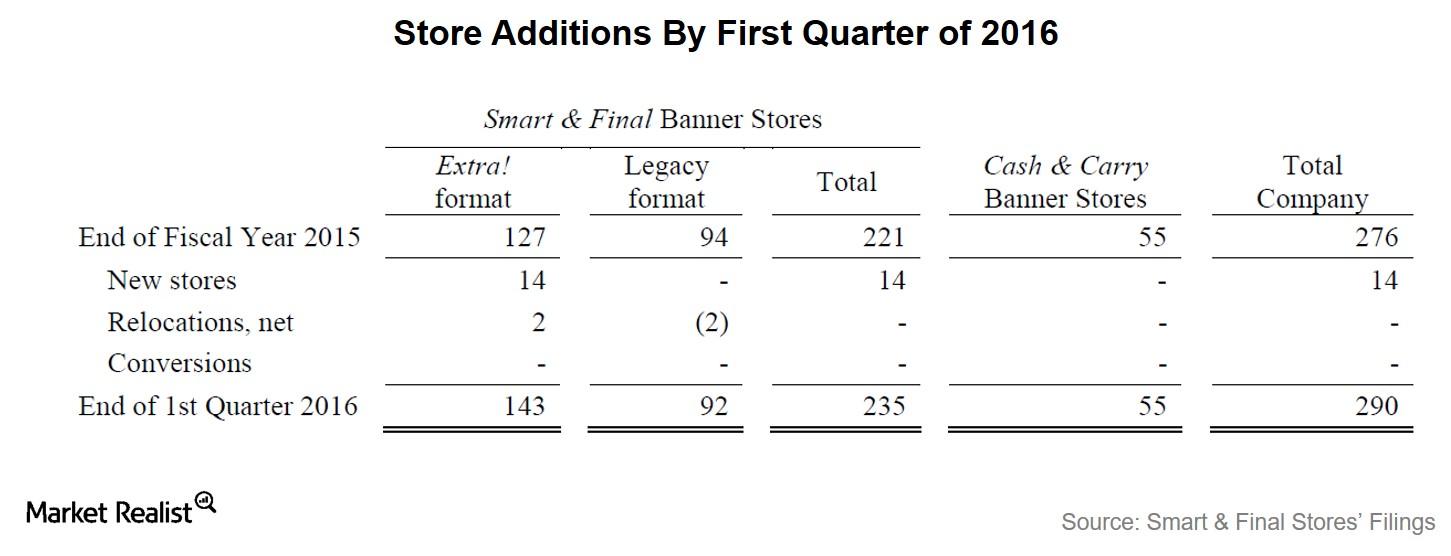

What Key Strategies Does Smart & Final Follow?

Let’s discuss Smart & Final Stores’ (SFS) main strategies regarding pricing, private labels, expansion, distribution, and merchandising.

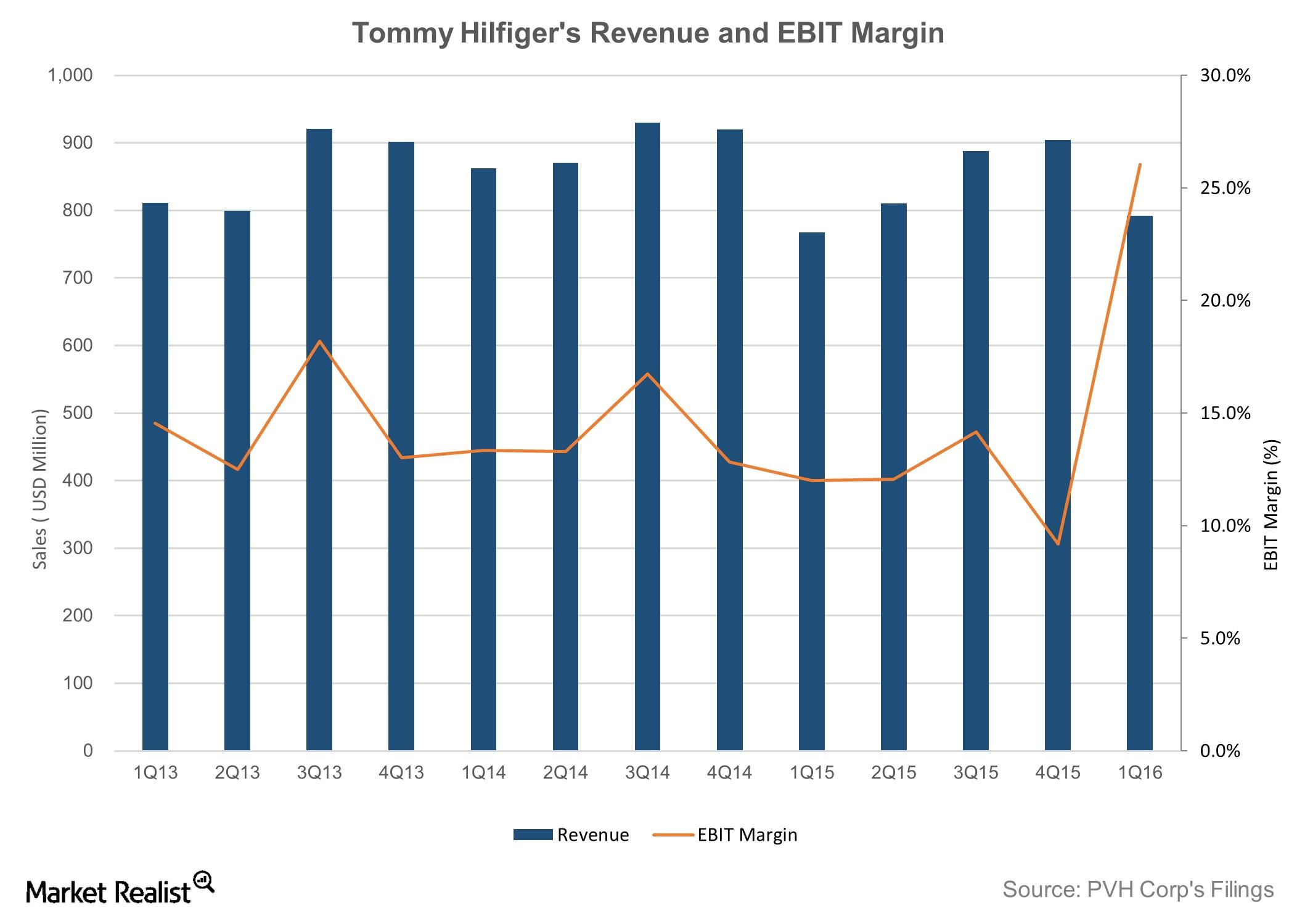

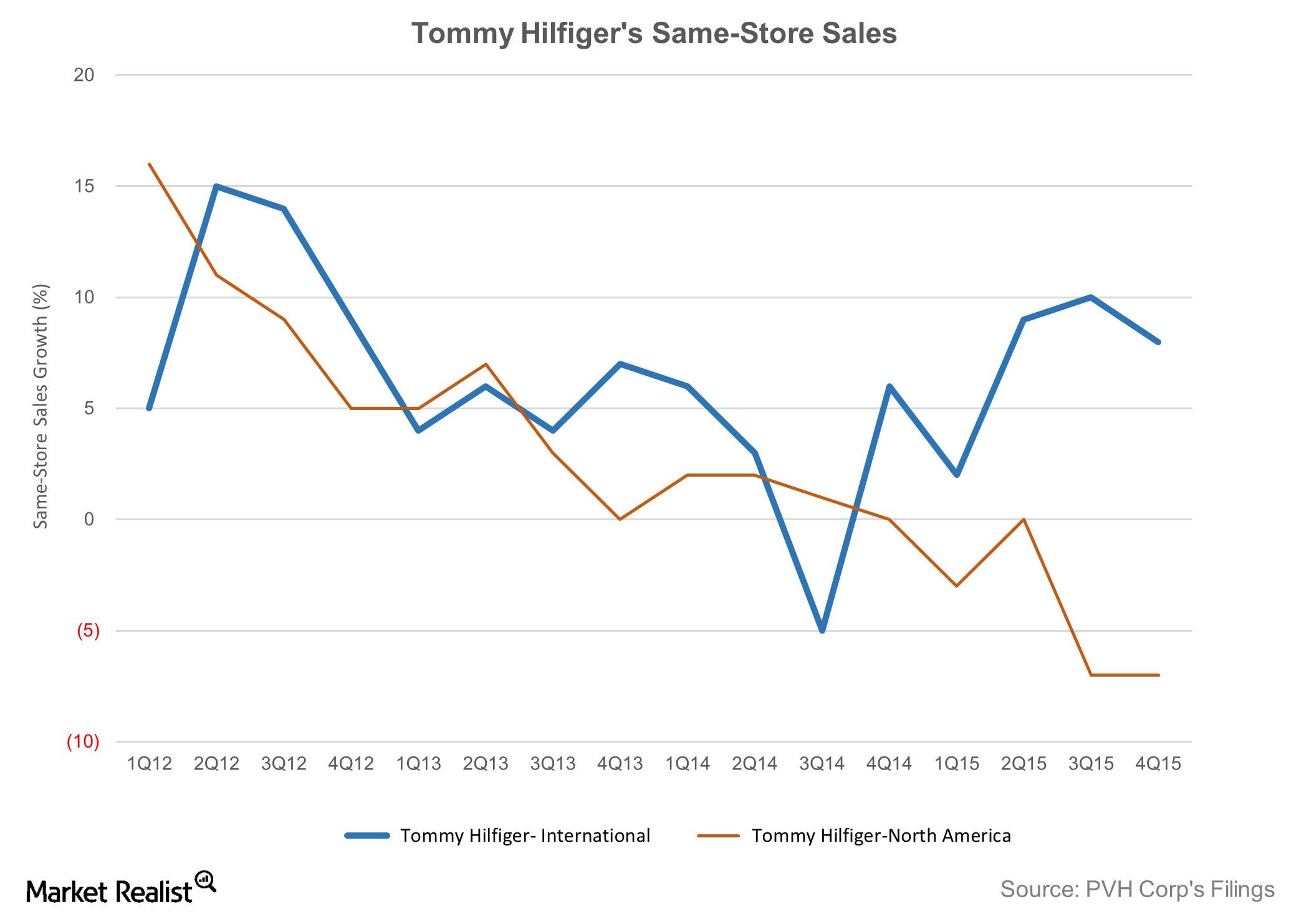

PVH’s Tommy Hilfiger Gets Boost from Strong International Sales

Tommy Hilfiger was acquired by PVH (PVH) in 2010. In fiscal 2015, the Tommy Hilfiger brand accounted for 43.5% of the company’s total revenue and 44% of its operating profit.

How Calvin Klein and Tommy Hilfiger Gave PVH a Strong 1Q16

Phillips-Van Heusen (PVH) posted $1.9 billion in revenue for fiscal 1Q16. That’s a 2.1% YoY increase on a GAAP basis.

PVH Delivered a Solid 4Q15 on Strong Calvin Klein Performance

PVH Corp. (PVH) registered a 2.1% year-over-year increase in its top line in fiscal 4Q15, which ended January 31, 2016, to $2.1 billion.

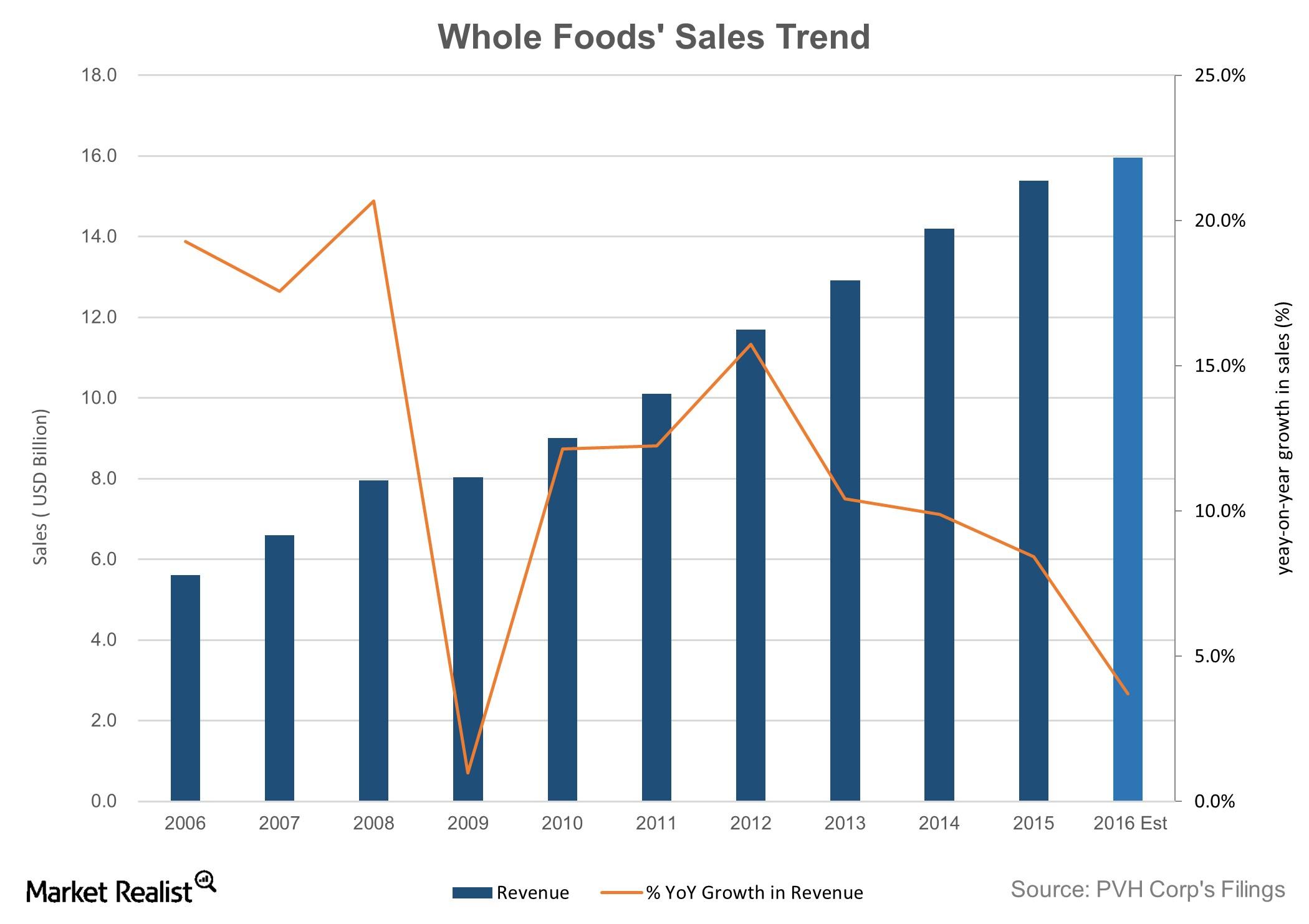

What to Expect from Whole Foods Market in Fiscal 2016

Whole Foods Market (WFM) is likely to see a slowdown in its top line during fiscal 2016. The organic and natural foods retailer could register sales growth of 3%–5%, according to the company’s guidance.

Inside Ralph Lauren’s Liquidity Position and Financial Health

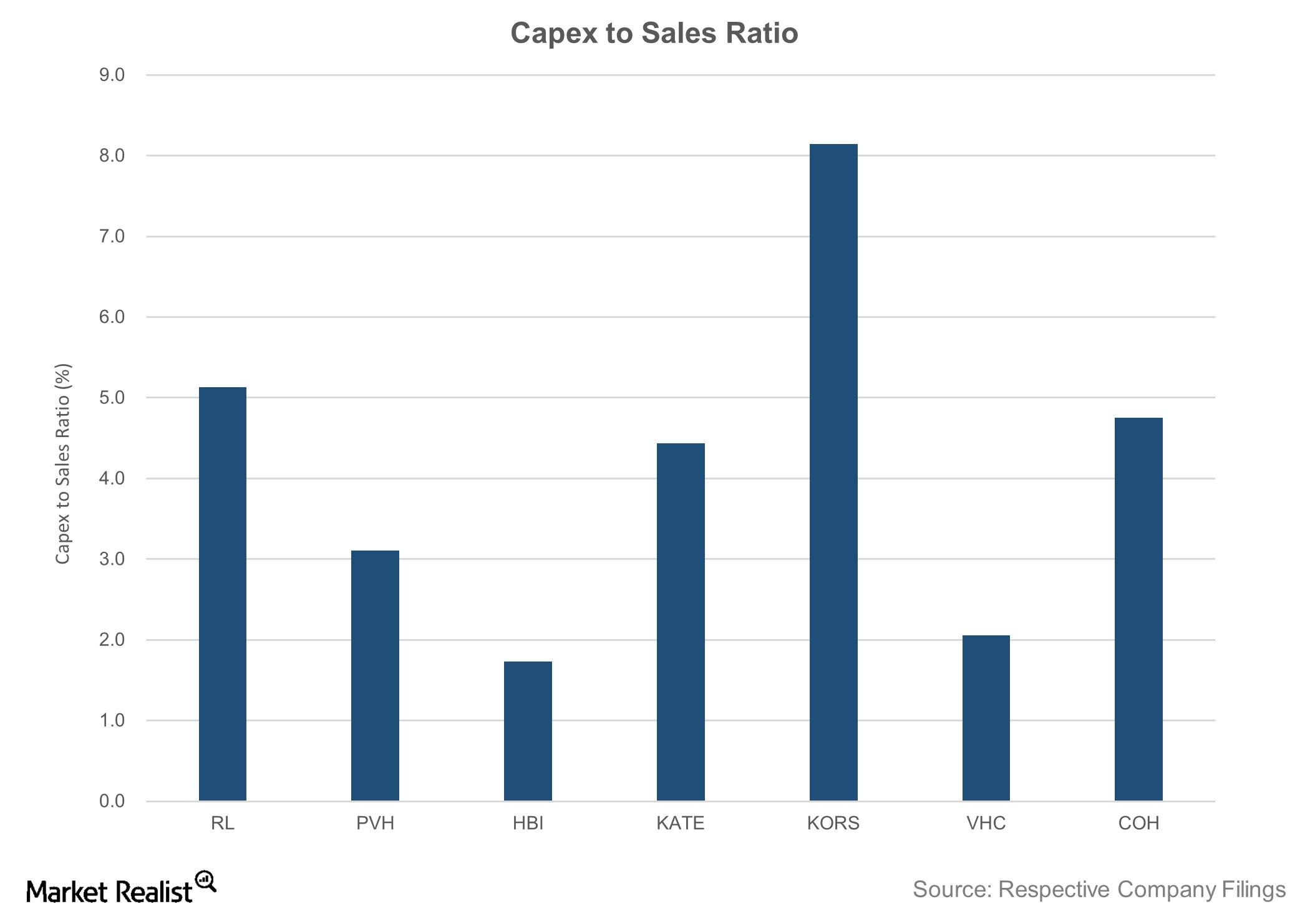

Ralph Lauren has a $1.7 billion capex. Its capex-to-sales ratio of 5.1% (as of March 28, 2015) is among the highest in its fashion and apparel peer group.

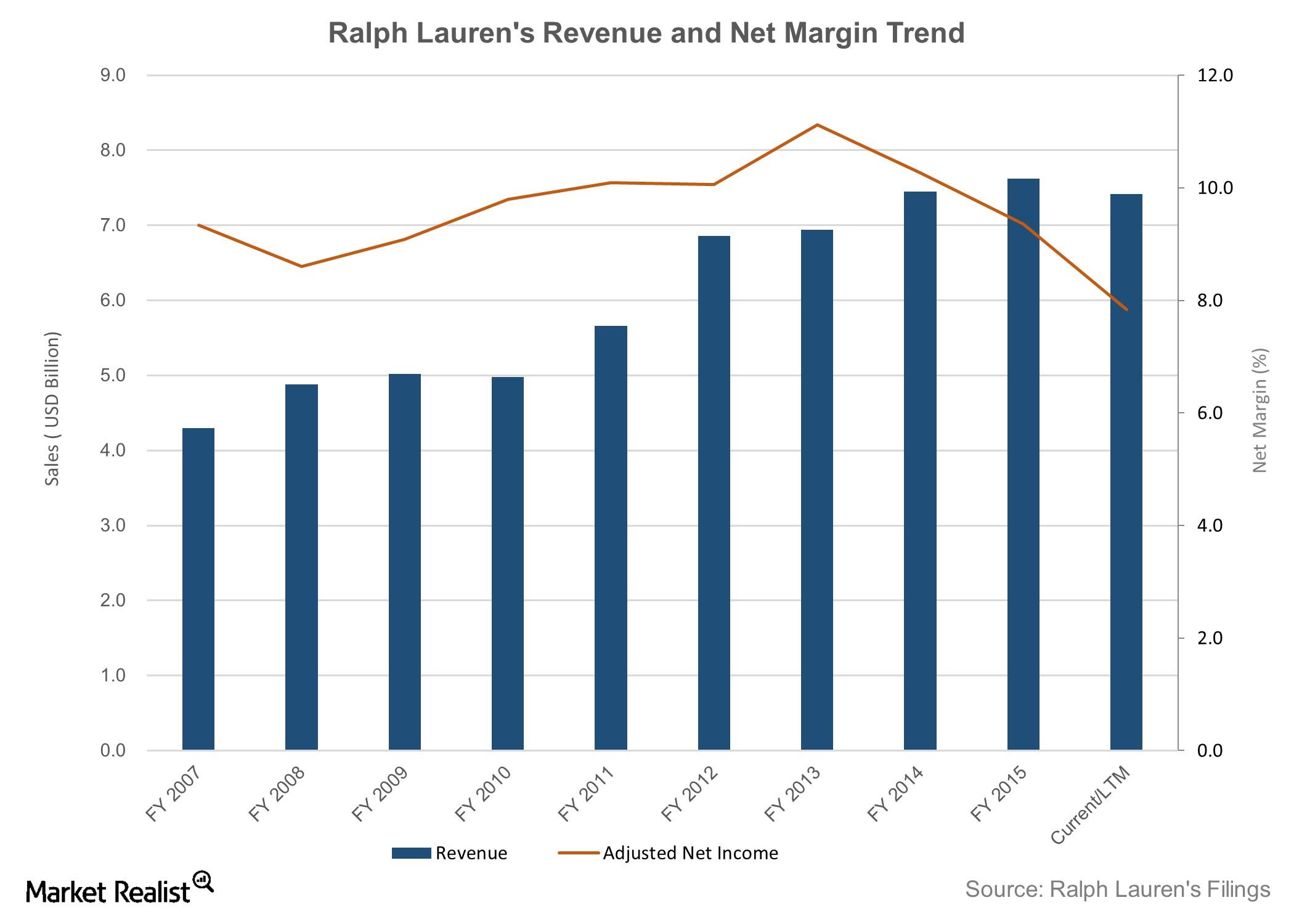

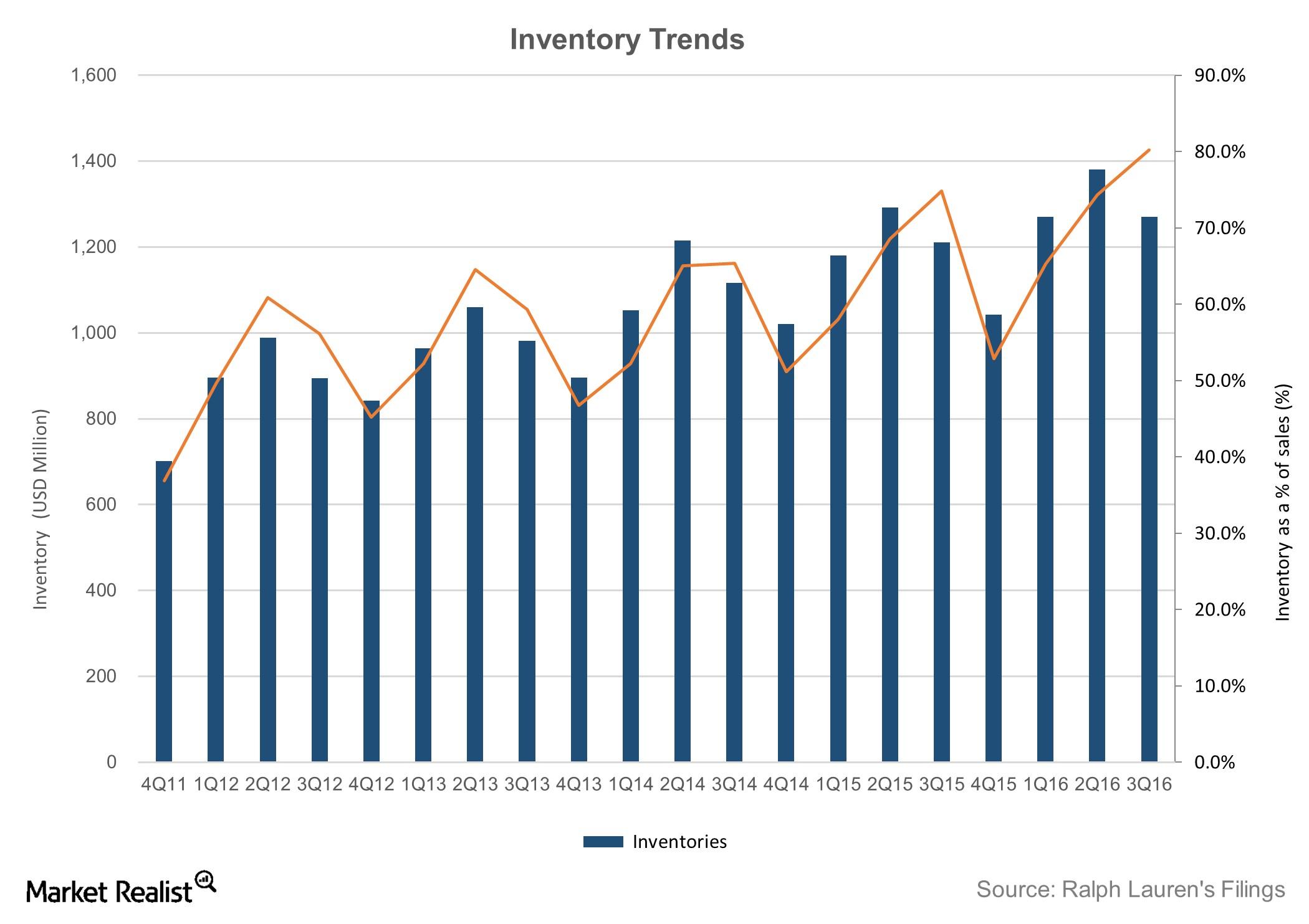

Behind Ralph Lauren’s Historical Financial Performance

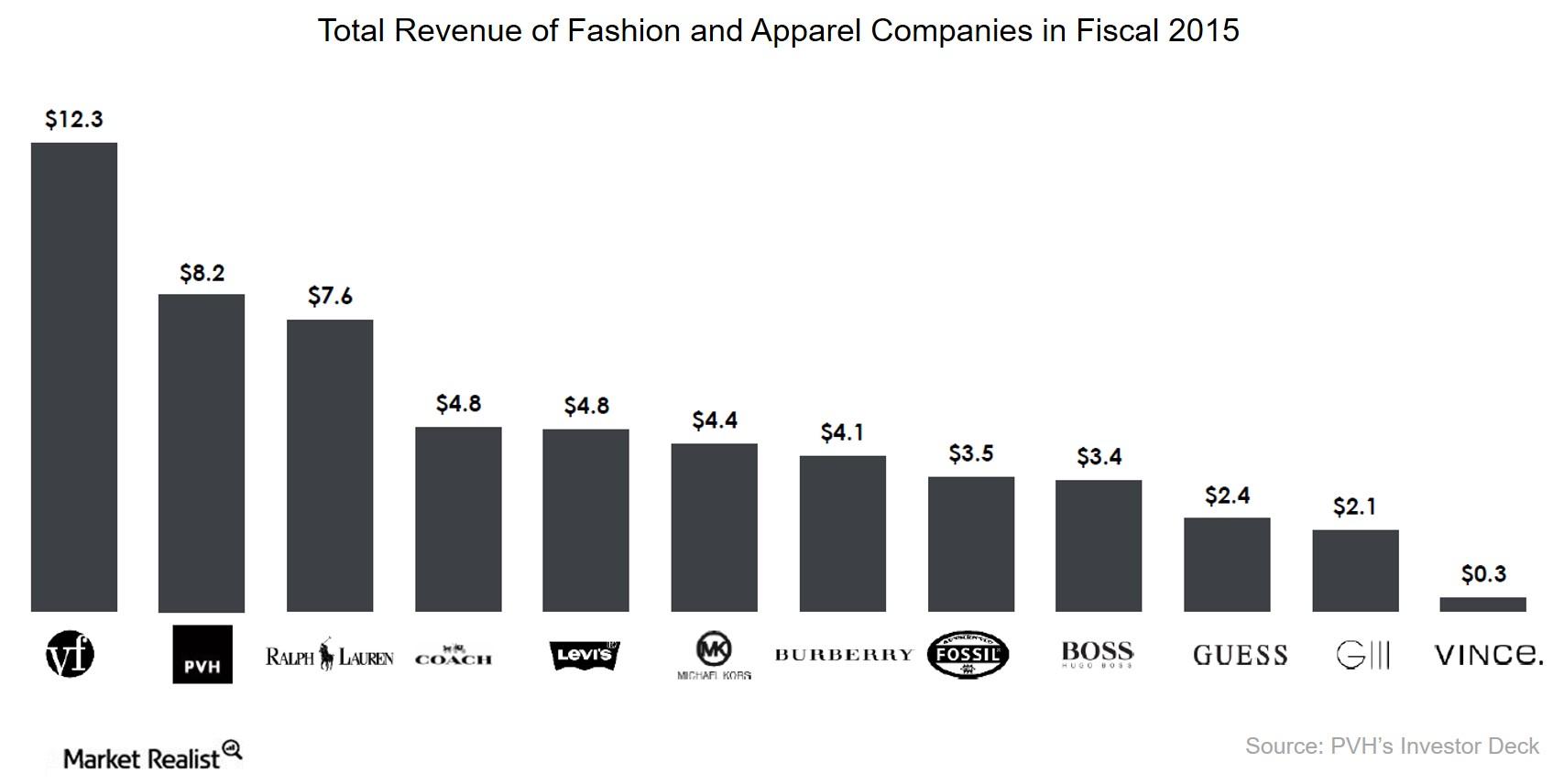

Ralph Lauren’s top line has grown by a CAGR of around 9% over the past five fiscal years to reach $7.6 billion in fiscal 2015.

Ralph Lauren’s Strategies and Initiatives: The Story behind the Story

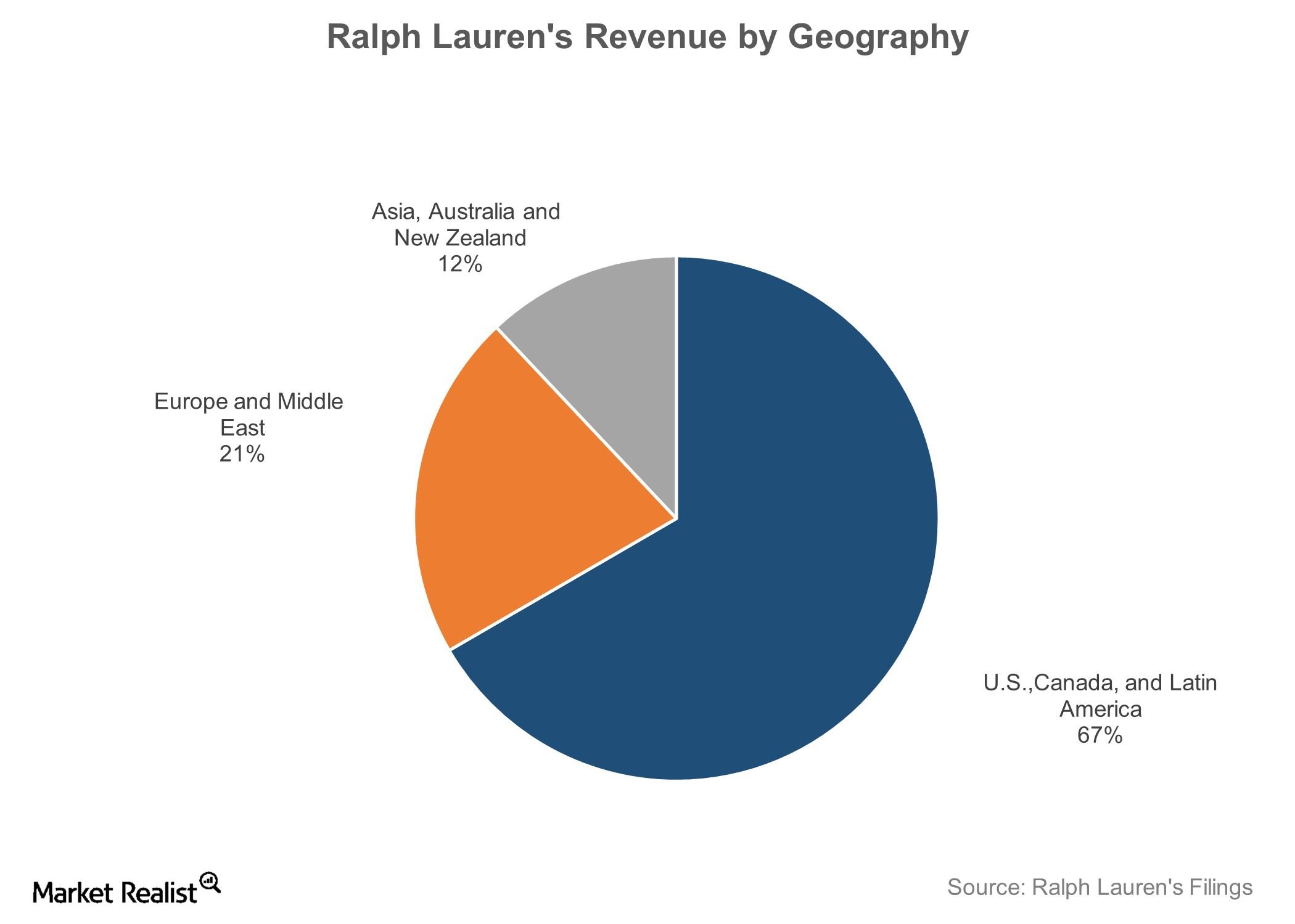

Ralph Lauren’s long-term strategies include expanding global presence, extending direct-to-consumer reach, and expanding apparel and accessory portfolio.

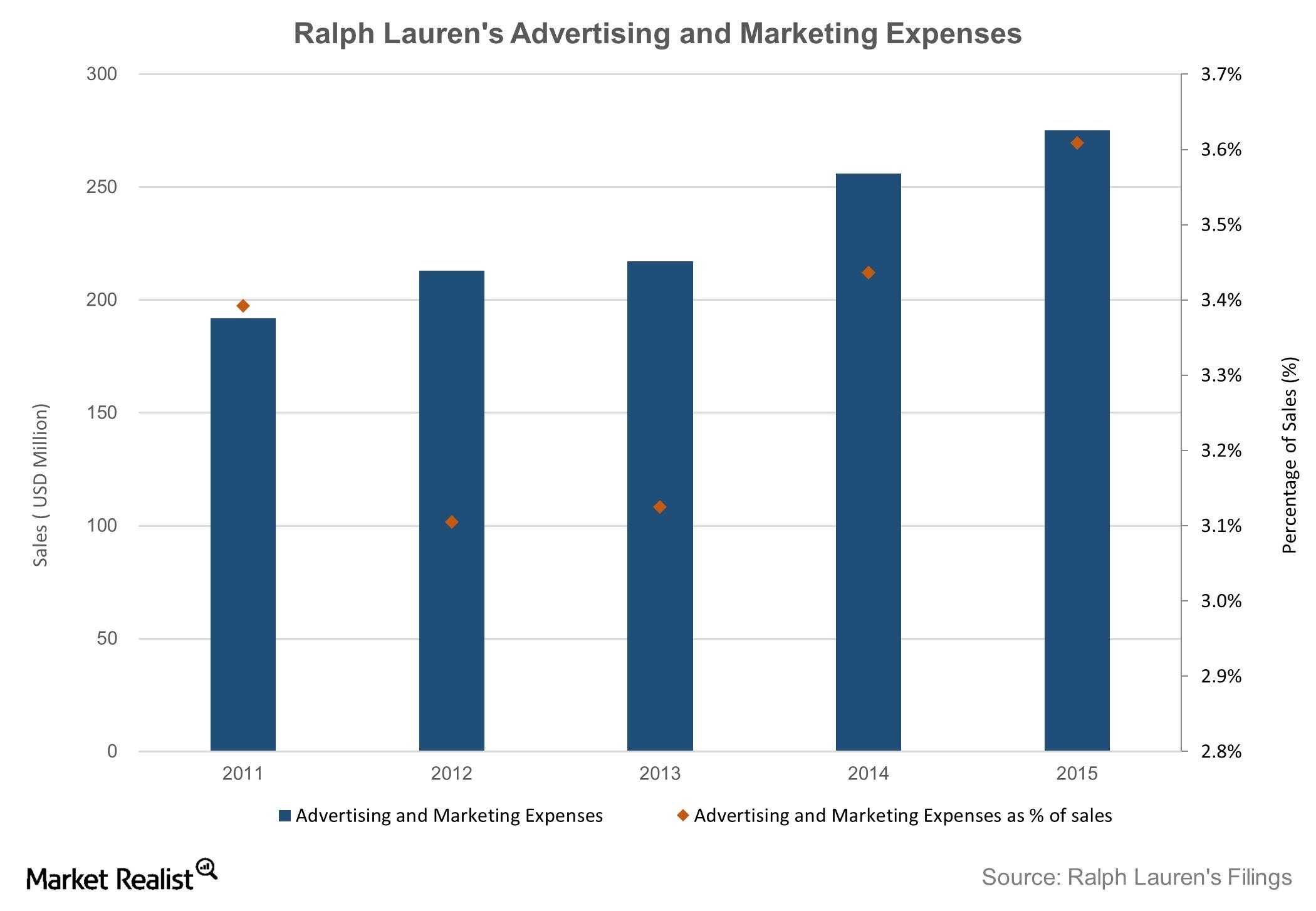

Understanding Ralph Lauren’s Marketing and Advertising Strategy

Ralph Lauren’s (RL) advertising programs are created and executed through the company’s in-house creative and advertising organization.

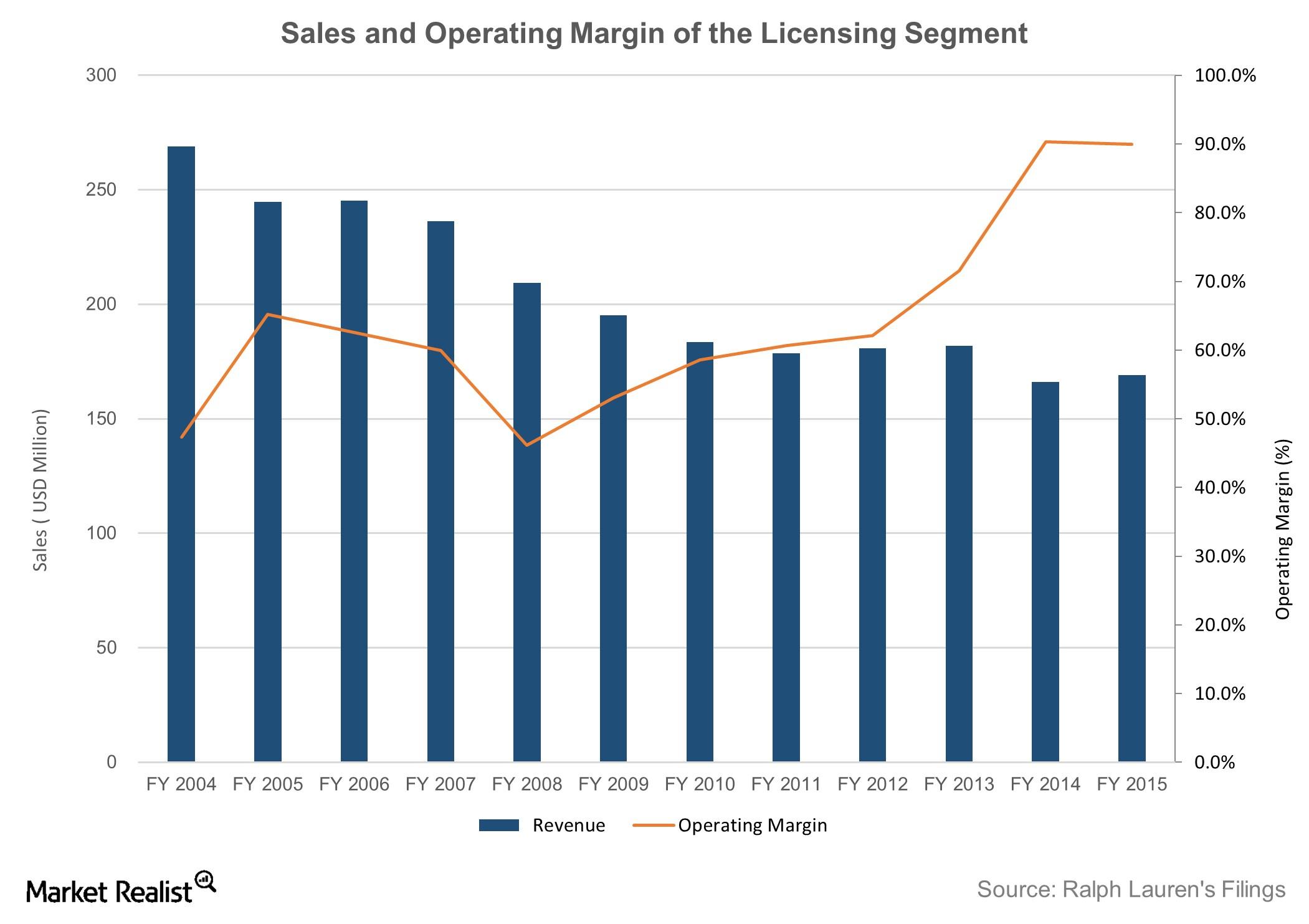

Inside Ralph Lauren’s Licensing Business

Ralph Lauren earns royalties from licensing the use of its trademarks or the right to operate stores to third parties for apparel, eyewear, and fragrances.

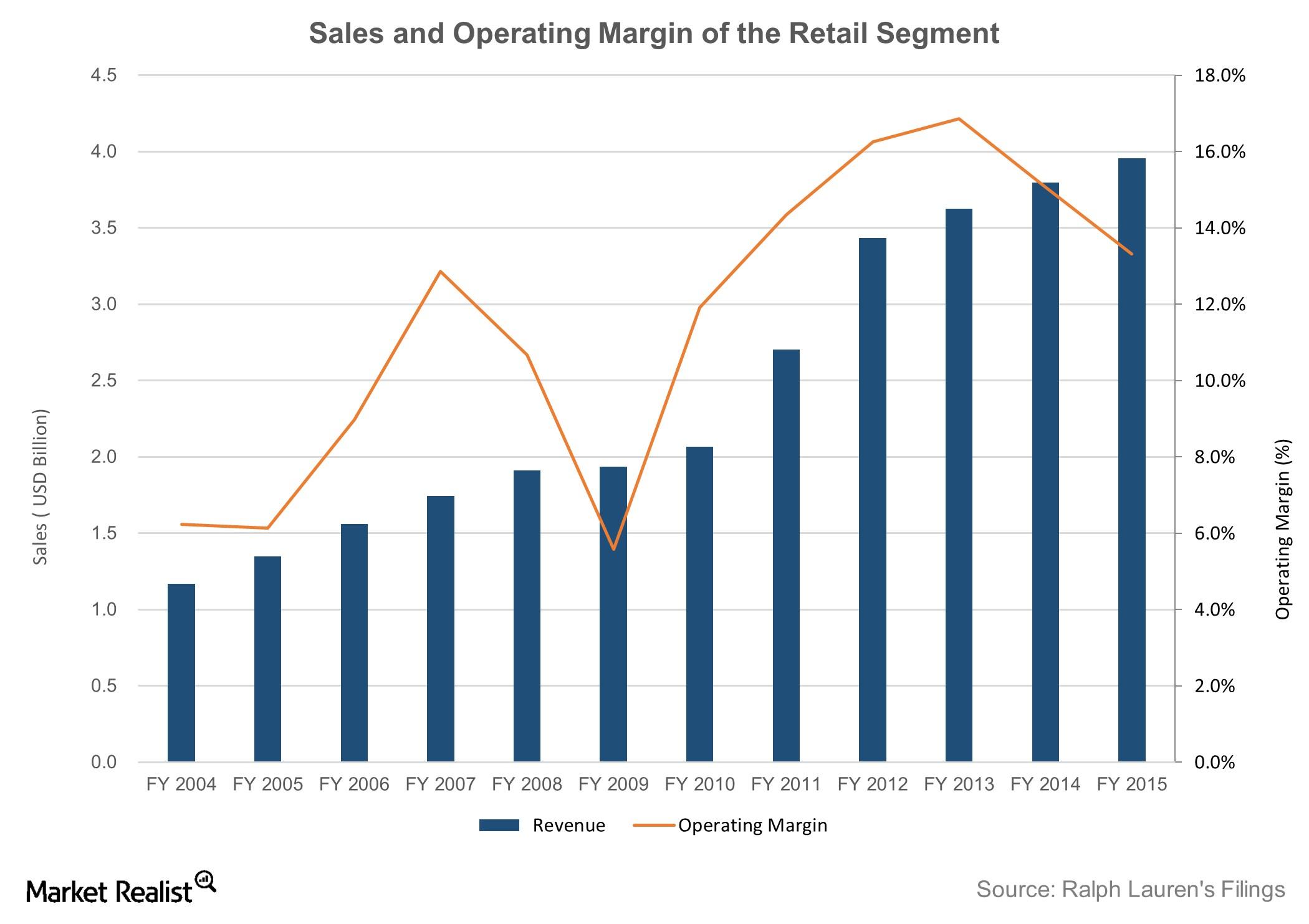

How Ralph Lauren’s Retail Channel Became the Biggest Revenue Generator

In retail, Ralph Lauren operated 143 Ralph Lauren stores, 64 Club Monaco stores, and 259 factory outlets at the end of fiscal 2015.

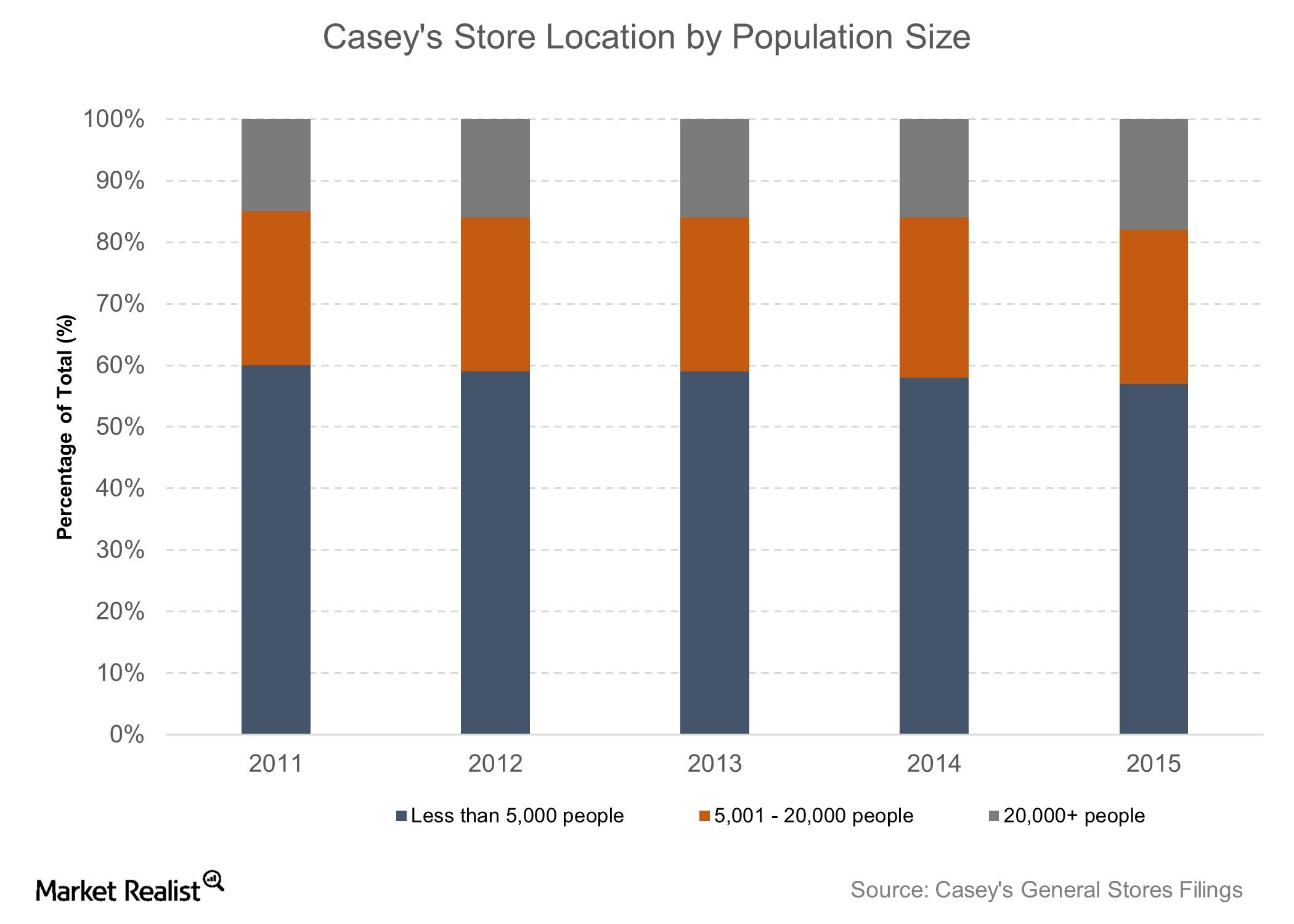

Casey’s Strengths, Weaknesses, Opportunities, and Threats

Casey’s has a strong, differentiated, low-risk business model. In fiscal 2015, 82% of its stores were in areas with populations of fewer than 20,000 people.

Ralph Lauren: Where It Began, What It Offers, and Who It’s up Against

Ralph Lauren was founded by Ralph Lauren in 1967 and offers apparel, accessories, home products, and fragrances under several well-known brand names.

Introducing Ralph Lauren: Everything You Need to Know at a Glance

Ralph Lauren is the third-largest branded apparel company (by revenue) in the US and has grown at a CAGR of around 9% over the past ten years.

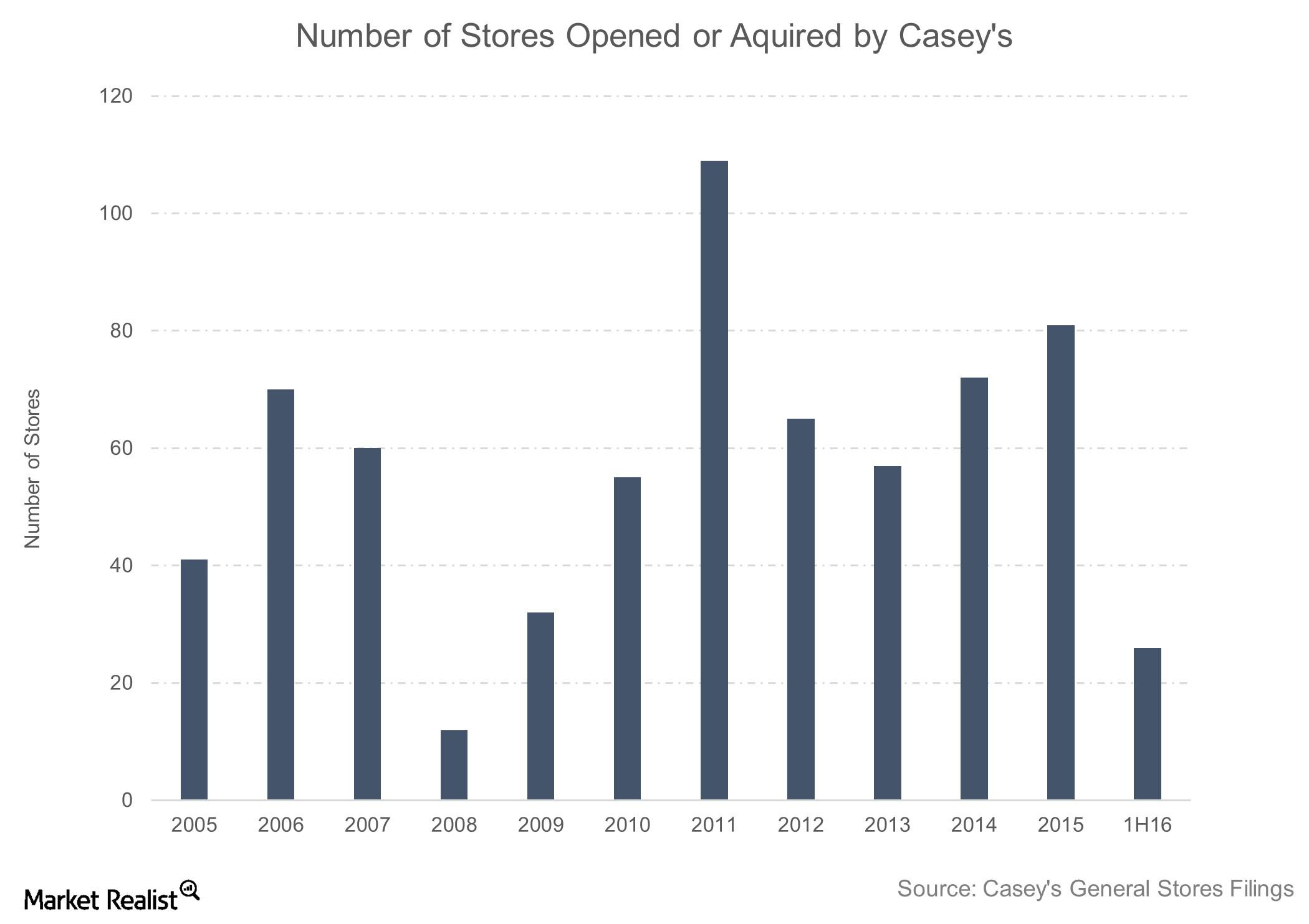

An Overview of Casey’s Business Strategies

Casey follows both organic and inorganic expansion strategies for its growth. In fiscal 2015, the company opened 45 new stores and acquired 36 stores.

A Quick Look at Casey’s Business Model

Casey’s business model focuses on opening stores in smaller towns, where the population is lower and competition is minimal.

Company Overview: An Introduction to Casey’s General Stores

Casey’s General Stores’ strong and differentiated business model has resulted in the company’s delivering total returns of 27% in the last year.

Challenging Apparel Market Dampened Tommy Hilfiger’s Performance

Tommy Hilfiger is one of the world’s leading designer lifestyle brands. PVH reports its business under the North America and International segments.

PVH Corp: Why Calvin Klein’s Still Strong Despite Harsh Conditions

Calvin Klein in fiscal 3Q15 PVH Corp’s (PVH) Calvin Klein business recorded strong performance despite several macroeconomic headwinds. On a constant-currency basis, revenue was up 7% compared to the third quarter of the previous year. Including the $58 million negative impact of foreign currency translation, the segment’s revenue was down 0.3%. Revenue in the Calvin […]

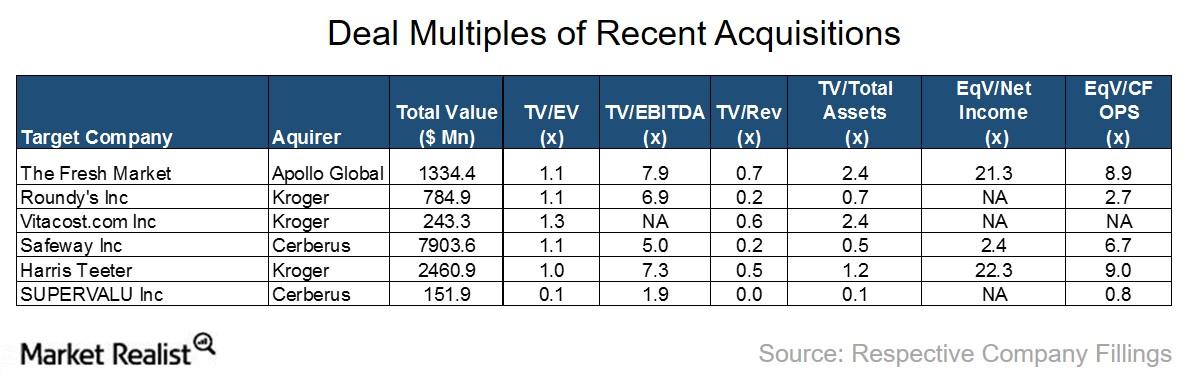

What’s the Valuation of The Fresh Market Deal?

The transaction value of the deal between Apollo and The Fresh Market stands at $1,334 million. Apollo is paying 7.9x the EBITDA.

What’s the Key to The Fresh Market’s Profitability?

Compared with other food retail chains, The Fresh Market’s performance in terms of profitability has been best-in-class.