What’s the Valuation of The Fresh Market Deal?

The transaction value of the deal between Apollo and The Fresh Market stands at $1,334 million. Apollo is paying 7.9x the EBITDA.

March 16 2016, Updated 12:10 p.m. ET

About the deal

On March 14, 2016, Apollo Global Management (APO) and The Fresh Market (TFM) announced that they entered into a definitive agreement. Apollo would acquire The Fresh Market for $1.36 billion in an all-cash deal. Apollo agreed to pay $28.50 per share to The Fresh Market shareholders. This includes a premium of 24% to the closing share price on the day before the announcement of the deal. The Fresh Market’s stock rose 23.5% on the announcement of the deal. It closed at $23.39 on March 14. The company’s stock gained more than 53% since February 10—the day before the press speculation regarding a potential transaction.

What’s the valuation of the deal?

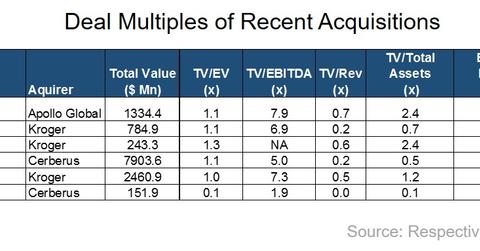

The transaction value of the deal stands at $1,334 million. This includes a negative net debt value of $4.8 million. Apollo is paying 7.9x the EBITDA (earnings before interest, tax, depreciation, and amortization). It’s on the higher side of the recent deal valuations. While Kroger (KR) paid 6.9x the EBITDA for Roundy’s, it paid 7.3x for Harris Teeter. Safeway fetched 5x the EBITDA from Cerberus in 2014. Supervalu sold off its retail business for just 1.9x in 2013.

The Fresh Market’s sales have been under pressure due to rising competition in the organic space. It’s predicted to have flat earnings growth over the next two years. However, the Fresh Market boasts the best EBITDA margin and highest ROA (returns on assets) in its peer group. The trailing 12-month EBITDA margin stands at 9.3% for The Fresh Market—compared to Kroger’s 5.1%, Whole Foods’ (WFM) 8.4%, and Sprouts Farmers Market’s (SFM) 8.3%. The Fresh Market’s ROA in its last reported quarter stood at 11.7%—compared to Whole Foods’ 8.6%, Kroger’s 6.4%, and Sprouts Farmers Market’s 8.7%.

Investors looking for exposure in The Fresh Market can invest in the SPDR S&P Retail ETF (XRT), the Vanguard Small-Cap Growth ETF (VDC), or Barron’s 400 ETF (BFOR). While XRT invests 1.06% of its holdings in The Fresh Market, BFOR invests 0.27% and VDC invests 0.13%.