What Key Strategies Does Smart & Final Follow?

Let’s discuss Smart & Final Stores’ (SFS) main strategies regarding pricing, private labels, expansion, distribution, and merchandising.

June 3 2016, Updated 11:06 a.m. ET

Strategic overview

In this section, we’ll discuss Smart & Final Stores’ (SFS) main strategies regarding pricing, private labels, expansion, distribution, and merchandising.

Pricing strategy

The company’s pricing strategy centers around determining the right set of prices to boost its operating margins. The company seeks to optimize its product pricing and promotional activities across a mix of higher-margin perishable items and everyday value-oriented traditional grocery items.

Expansion strategy

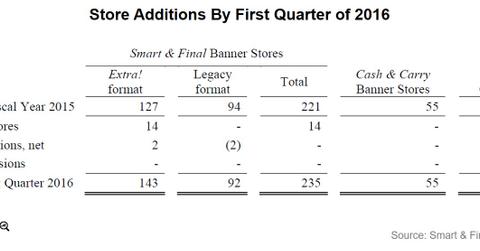

Continued development of SFS’s Extra! store format is the cornerstone of the company’s expansion strategy. SFS plans to increase its footprint in existing as well as new markets. It follows both an organic route and an inorganic route for store expansion.

Merchandising strategy

The company’s merchandising strategy aims to improve its merchandising mix with the introduction of higher-margin bulk foods, an enhanced selection of natural and organic products, and an increased selection of ready-to-eat offerings in its Smart & Final stores.

Private label

The company believes that its private label products are key to its pricing and merchandising strategy. These products, which typically have higher gross margins, help the company to build customer loyalty by enhancing its value proposition.

Private label products represented approximately 30% of net sales at Smart & Final stores and 14% of net sales at Cash & Carry stores in 2015.

Sourcing strategy

SFS sources its products from over 1,350 vendors and suppliers, and it has long-term supply relationships with many national brand and private label suppliers. While no single product supplier represents more than 5% of Smart & Final store sales, about 82% of Cash & Carry product requirements were met through Unified Grocers.

Investors looking to gain exposure to SFS can invest through ETFs such as the SPDR S&P Retail ETF (XRT). XRT invests 0.26% of its portfolio in SFS. The ETF also invests in food retail companies such as Whole Foods Market (WFM), Kroger (KR), Sprouts Farmers Market (SFM), and SuperValu (SVU). The above-mentioned five companies, including SFS, constitute 4.3% of XRT.