Keisha Bandz

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Keisha Bandz

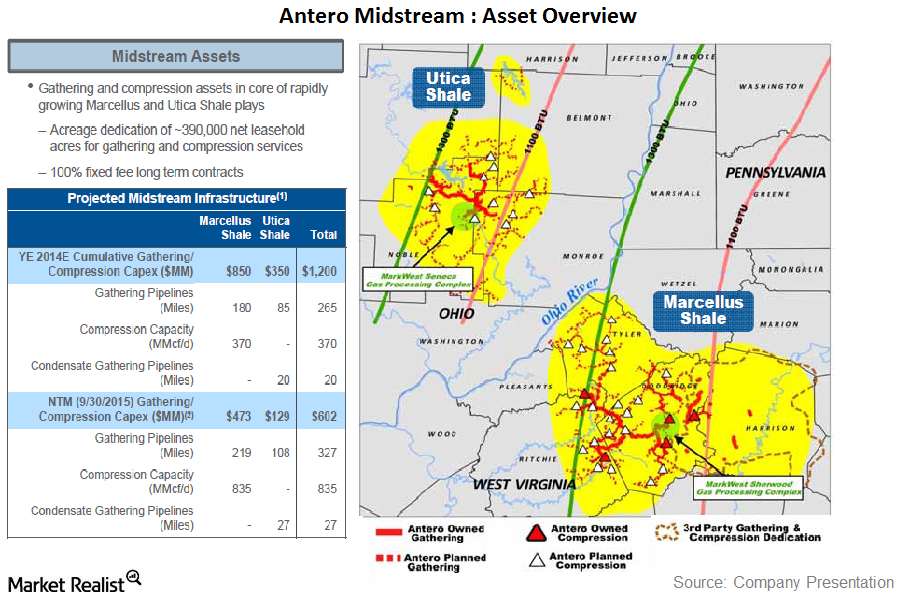

Must-know: A quick look into the Antero Midstream IPO

On October 27, Antero Resources Corporation announced the initial public offering of Antero Midstream Partners LP.

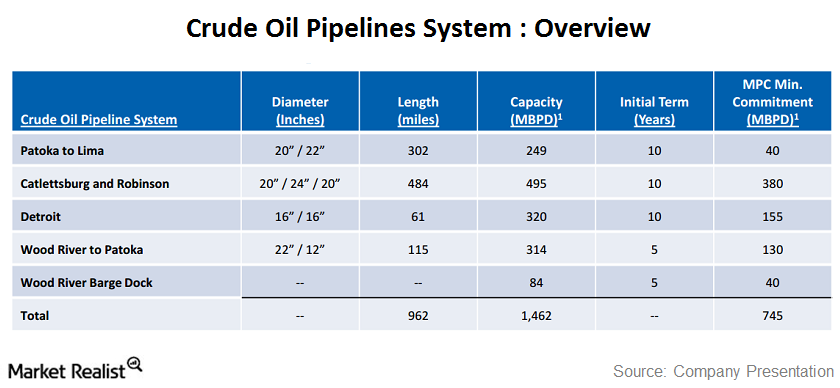

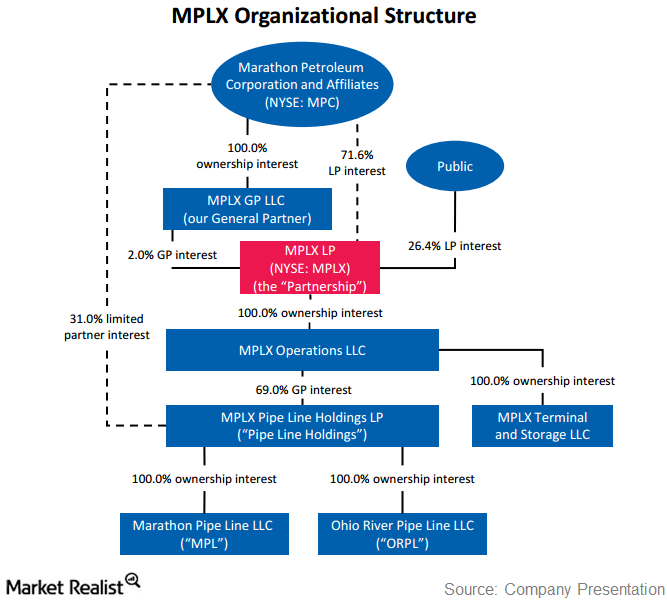

The MPLX crude oil pipeline system

MPLX crude pipelines are connected to supply hubs, and transport crude oil to Marathon Petroleum Corporation’s, or MPC’s, refineries and third parties.

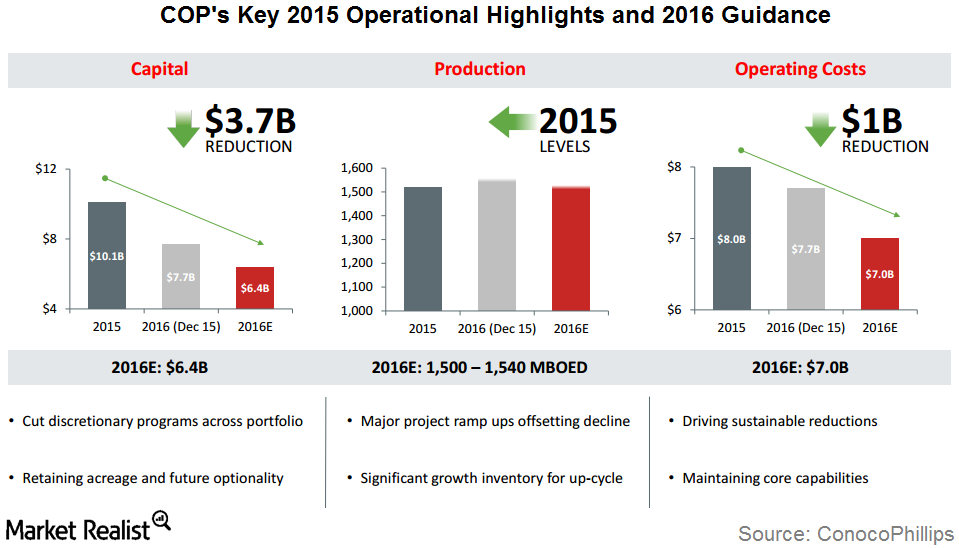

ConocoPhillips: 2015 Operational Highlights, 2016 Guidance

ConocoPhillips’s (COP) total production volume in 2015 was 1,589 Mboe/d excluding Libya. This represents a 5% year-over-year growth after adjusting for asset dispositions and downtime.

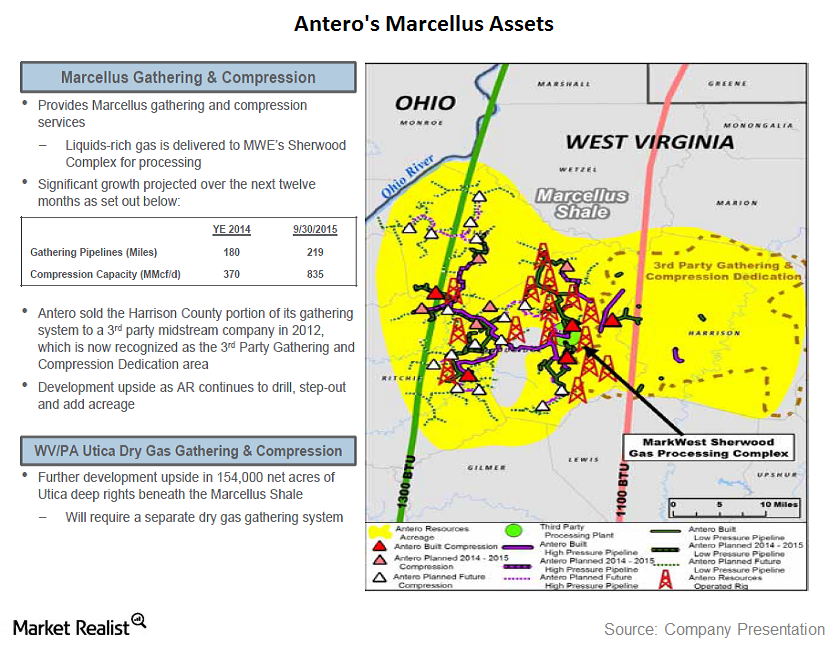

Key update on Antero Midstream’s assets

Antero Resources’ current acreage is focused in the Marcellus Shale in West Virginia and the Utica Shale in Ohio.

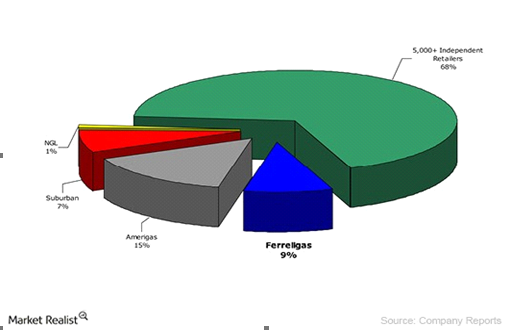

Overview: How Suburban measures up among its competitors

Over the past 12 months the group has had mixed results.

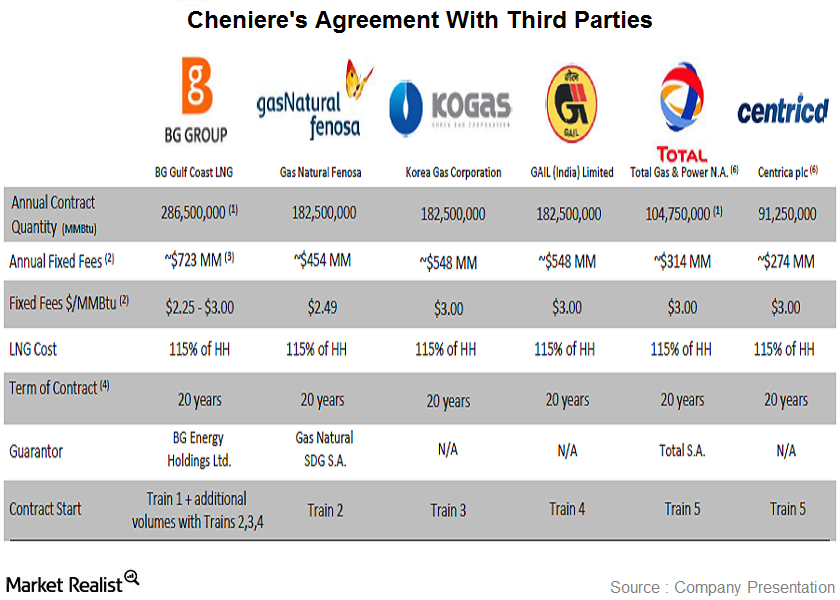

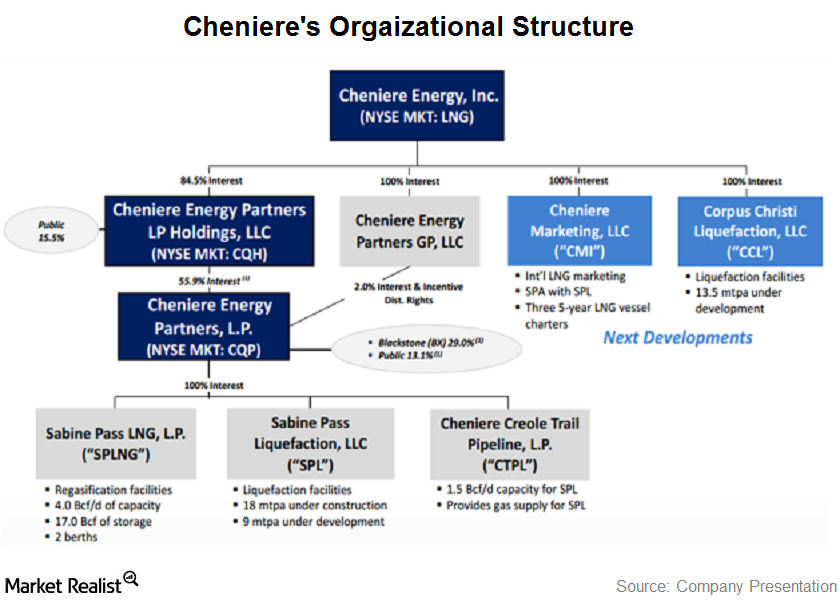

Overview of Cheniere’s sale and purchase contracts

Cheniere Energy, Inc.’s MLP company’s Sabine Pass liquefaction project has already secured four fixed-price, 20-year sales and purchase agreements with third parties.

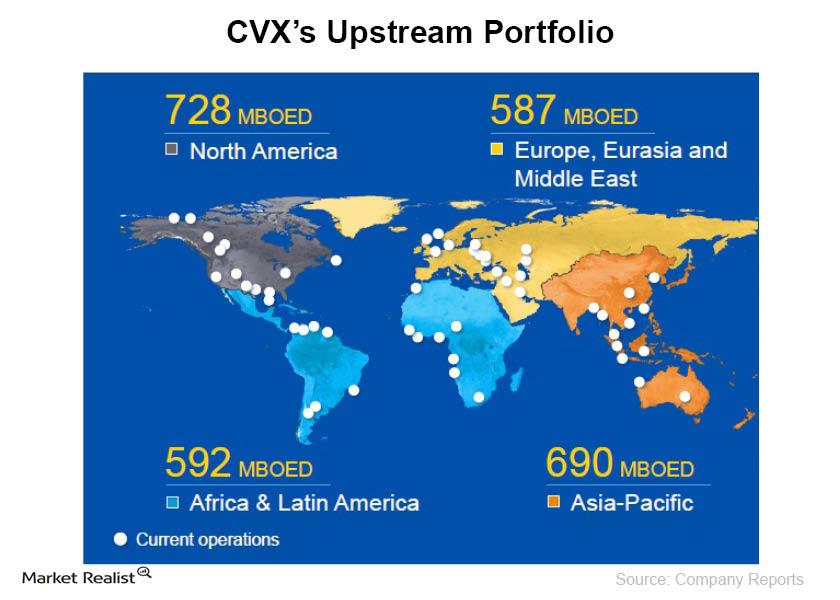

Chevron Corporation: A must-know brief overview

Chevron Corporation is currently trading at EV-to-2014E EBITDA of 5x, has an approximately $239 billion market cap, and ~$245 billion enterprise value.

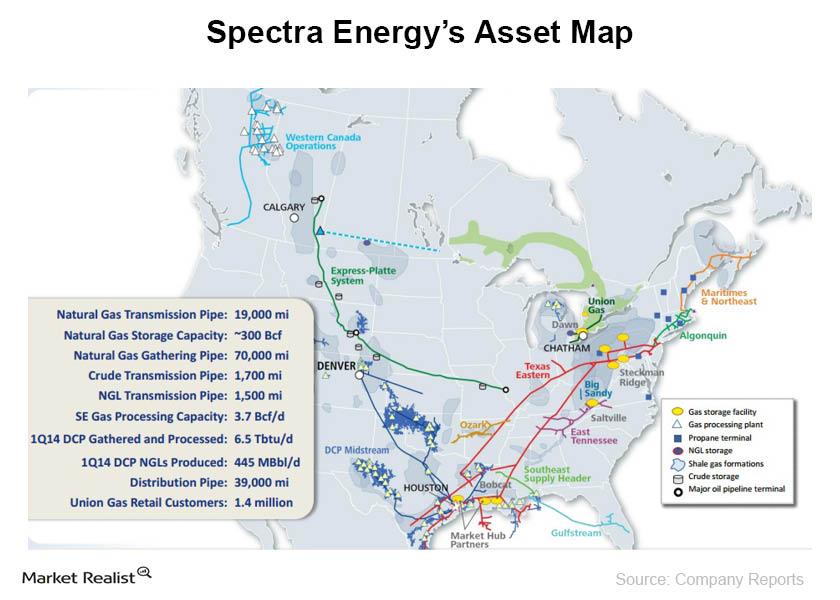

An investor’s guide to Spectra Energy Corp. and its earnings

Spectra Energy Corp. (SE), headquartered in Houston, Texas, owns and operates a large and diversified portfolio of natural gas–related assets in North America.

Overview: ONEOK Partners and its 3 operating segments

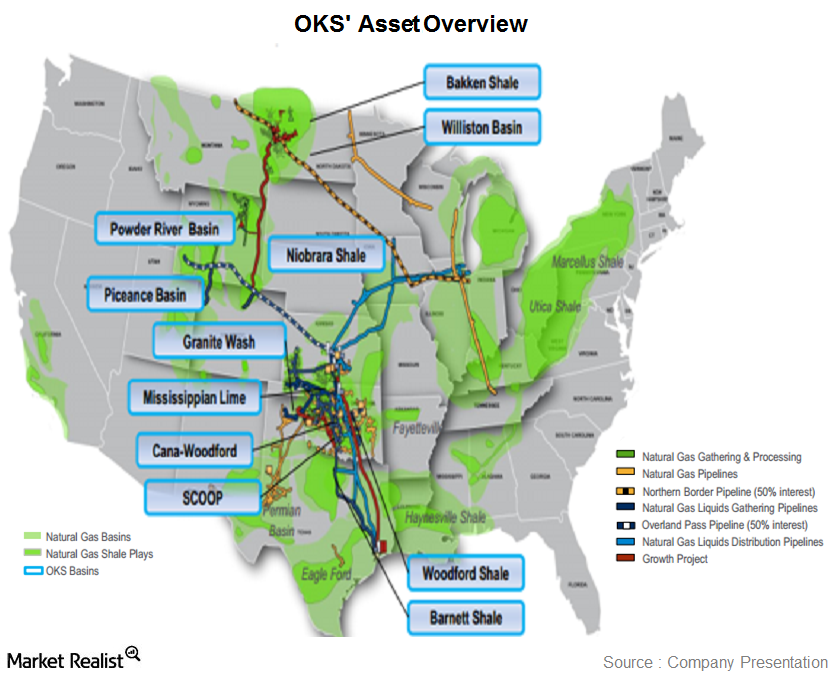

ONEOK Partners (OKS) is a master limited partnership (or MLP) engaged in gathering, processing, storing, and transporting natural gas and natural gas liquids (or NGLs) in the U.S.

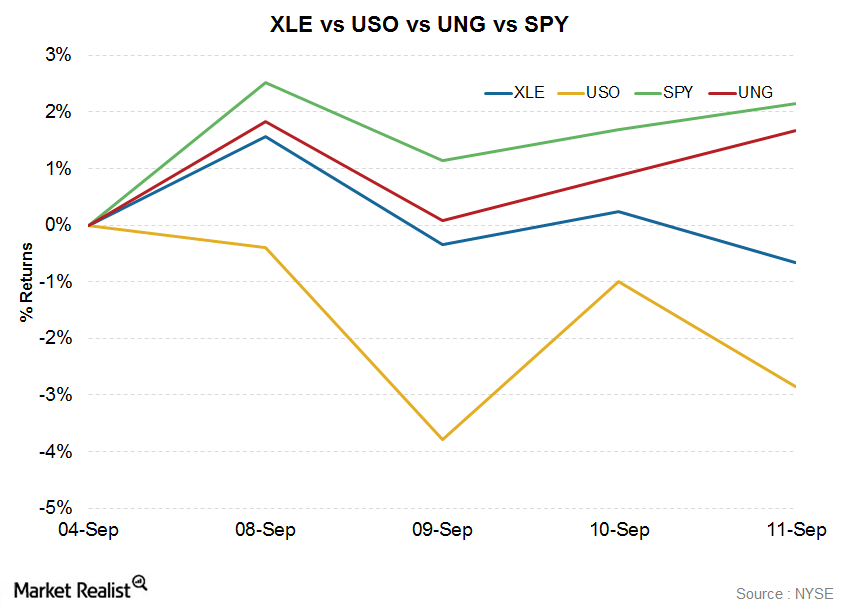

XLE Outperforms USO Last Week

The Energy Select Sector SPDR ETF (XLE) fell 0.66% in the week ended September 11. XLE tracks a diverse group of 45 of the largest American energy stocks in the S&P 500 Index (SPX).

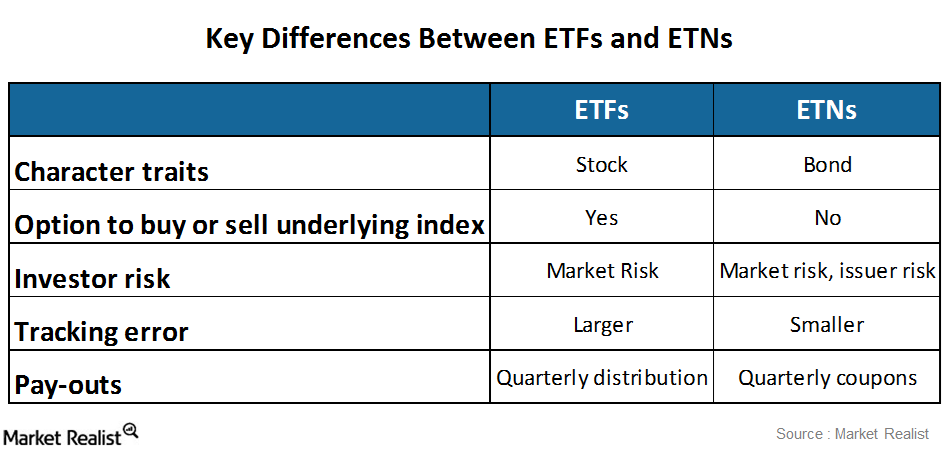

Comparison of exchange-traded funds and exchange-traded notes

ETFs (exchange-traded funds) have stock-like characteristics, while ETNs (exchange-traded notes) possess bond-like traits.

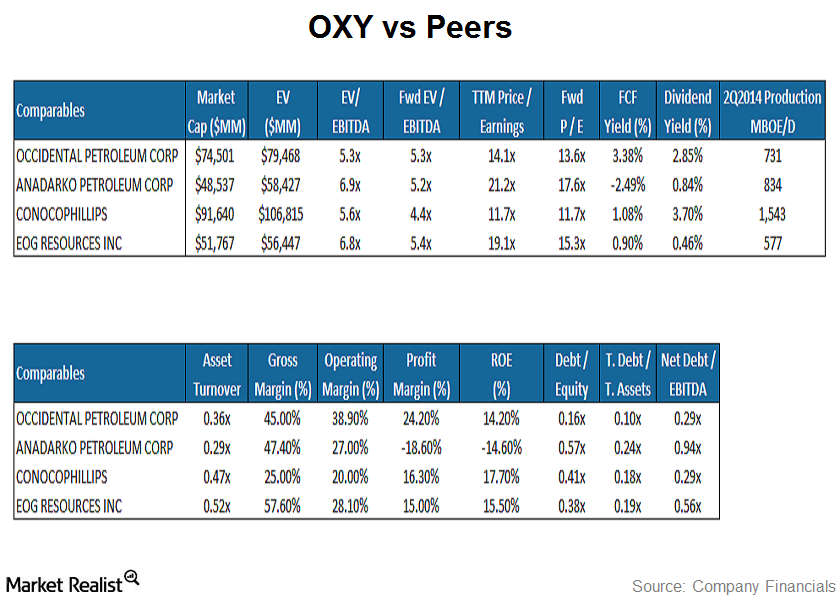

How does Occidental Petroleum compare to industry peers?

In terms of profitability, OXY has the highest profit margins amongst its peers at 24.2%. OXY also has one of the highest dividend yields at 2.85%.

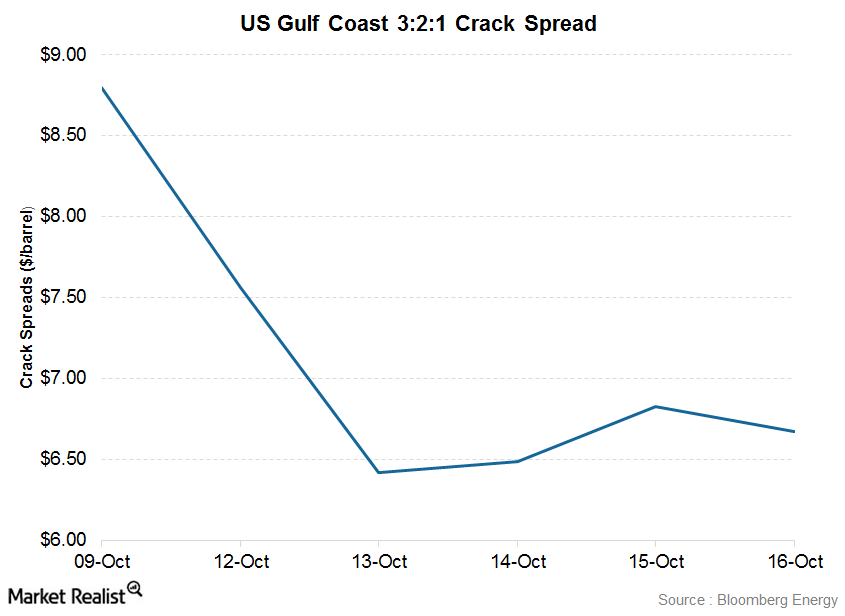

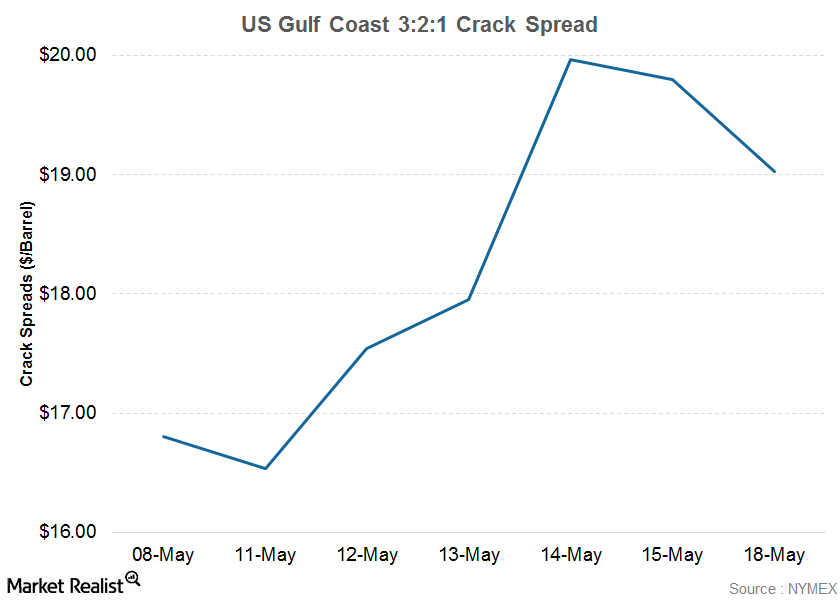

Overview of US Gulf Coast 3:2:1 Crack Spread

Crack spreads usually fall when crude oil prices (USO) increase by more than product prices, or when product prices fall more than crude oil prices.

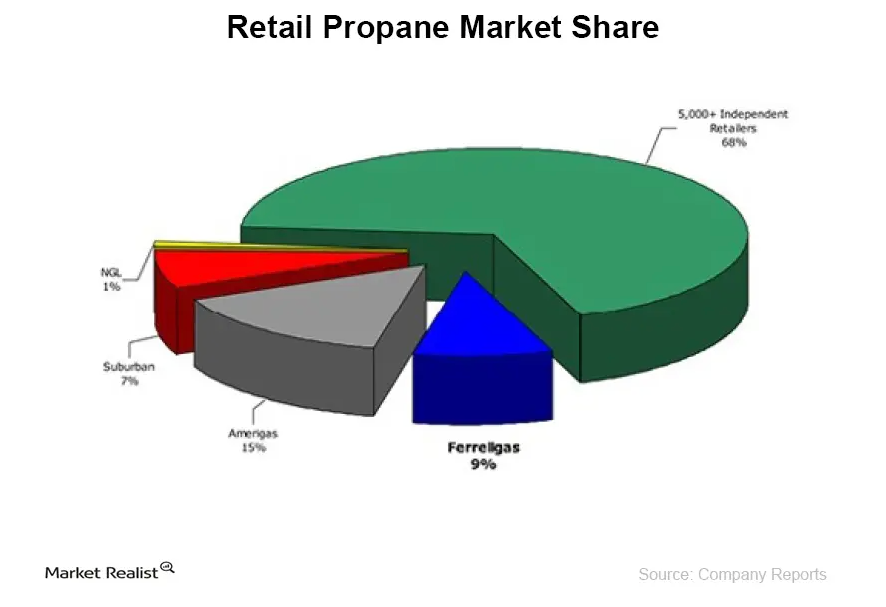

Must-know: How does AmeriGas stack up against its competition?

APU competes with Suburban Propane (SPH) and Ferrellgas Partners (FGP). APU is the country’s largest retail propane marketer, serving 2 million customers in all 50 states.

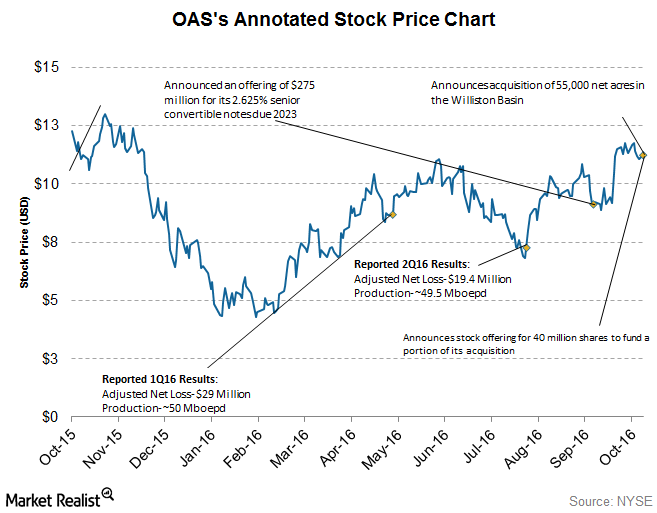

How Has Oasis Petroleum’s Stock Performed This Year?

Oasis Petroleum’s (OAS) stock has shown an uptrend for the most part of 2016. Its stock dipped between June 2016 and August 2016….

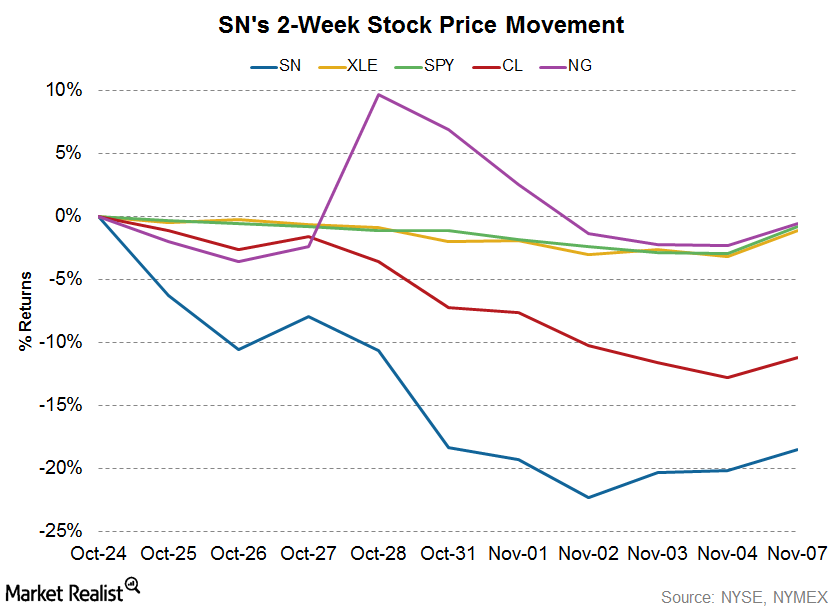

Why Did Sanchez’s Stock Rise after 3Q16 Earnings Release?

After Sanchez Energy’s (SN) 3Q16 earnings release on November 7, its stock rose ~2%.

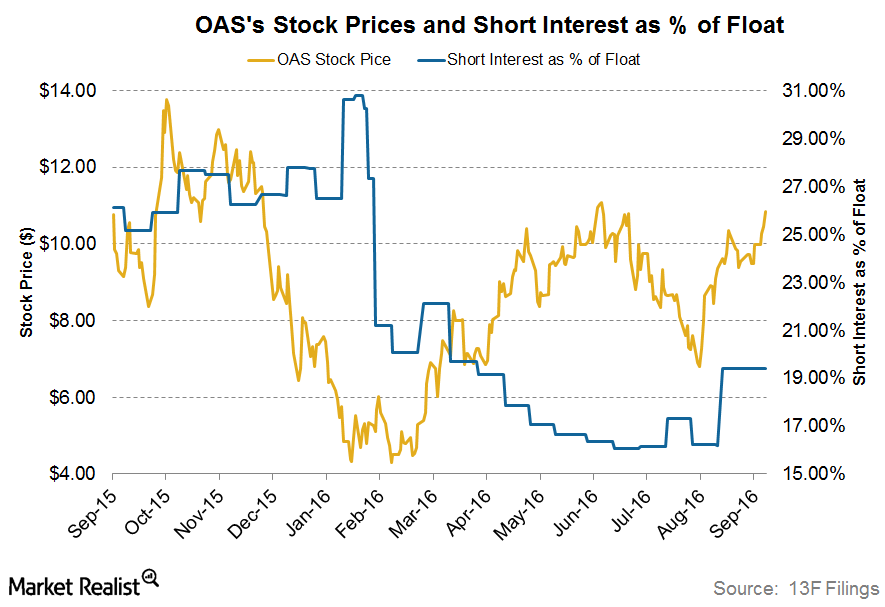

Analyzing Short Interest Trends in Oasis Petroleum

Oasis Petroleum’s short interest ratio on September 13, 2016, was ~19.4%. Its short interest ratio on June 30, 2016, was 16.1%.

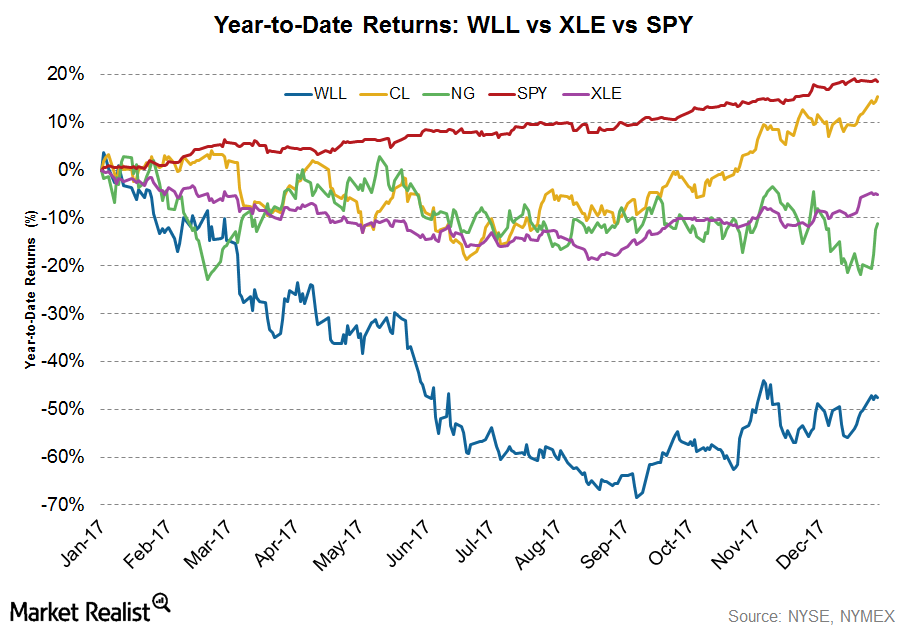

What Drove Whiting Petroleum Stock in 2017?

Whiting Petroleum (WLL) stock rose 5.3% in the week ending December 29 from the previous week. However, the stock fell ~47.6% by the end of 2017.

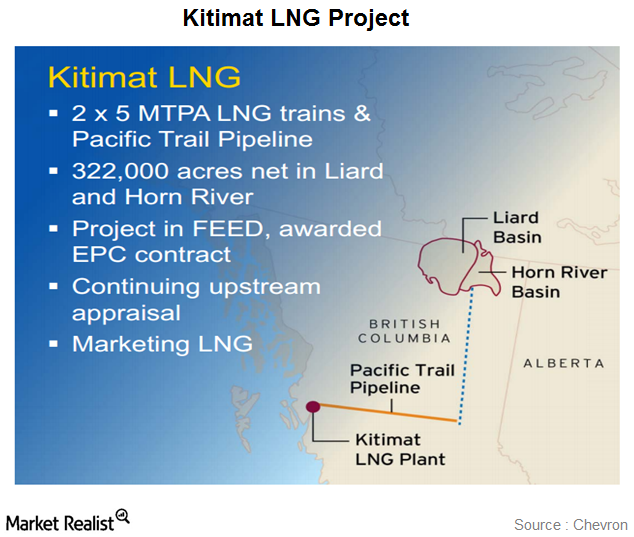

Why Chevron is cutting spending on some projects

Chevron has cut spending on the Kitimat liquefied natural gas project (or LNG) in Canada due to falling crude prices.

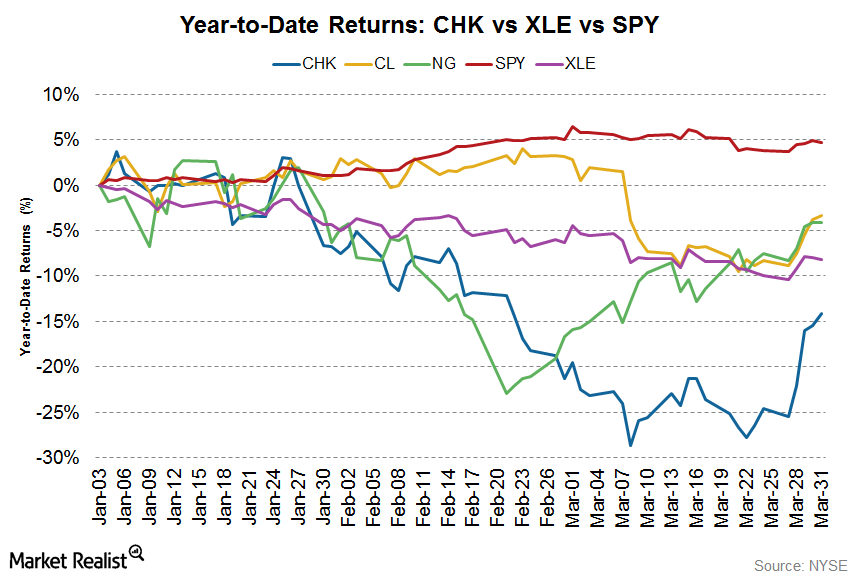

Natural Gas Prices Driving Chesapeake Energy Stock in 2017

Chesapeake Energy’s (CHK) 2016 debt management efforts included a combination of debt exchanges, open market repurchases, and equity-for-debt exchanges.

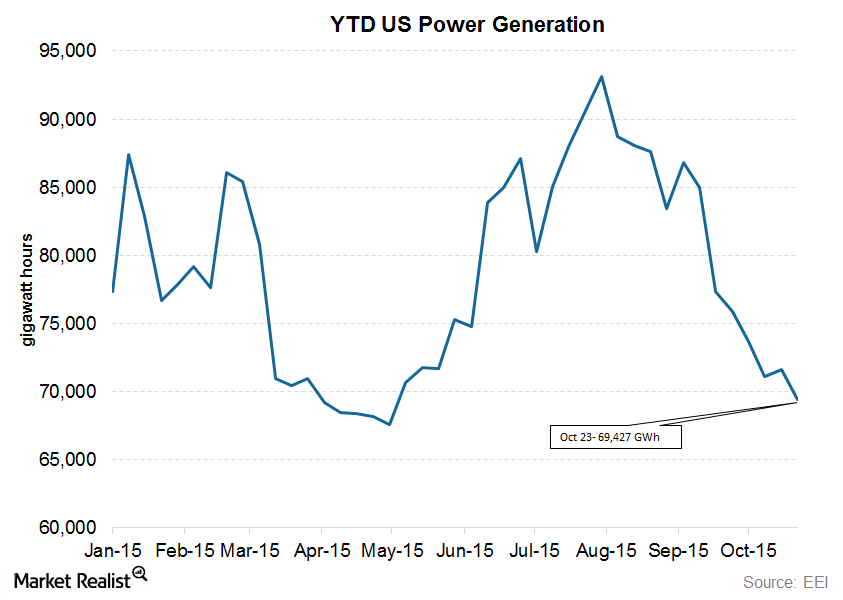

US Power Generation Down Again: An Analysis of Trends

An increase in US power generation numbers is expected for the week ended October 30, 2015.

Why oil prices spiked on tensions in Gaza and Ukraine

Early last week, WTI crude oil had eased to close to $99 following Libya’s restarting exports from major ports and abating fears over supply disruptions in Iraq.

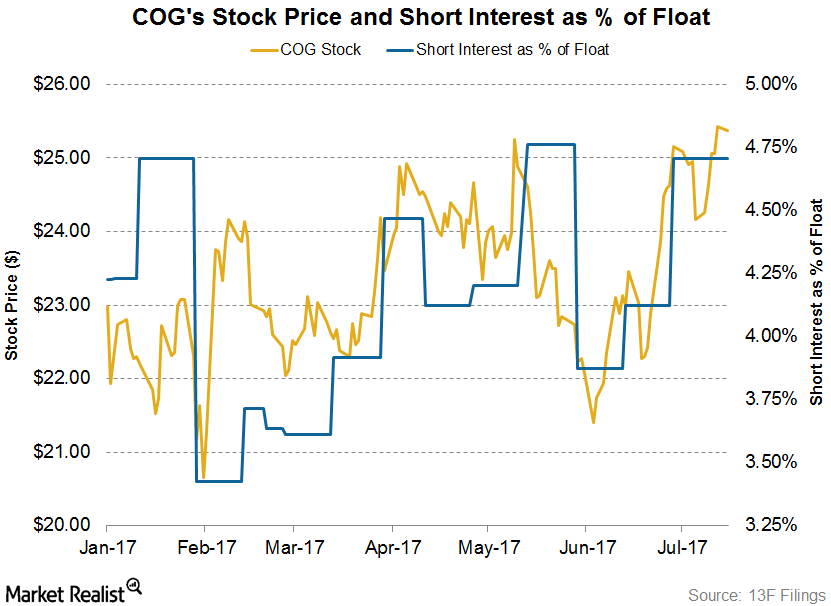

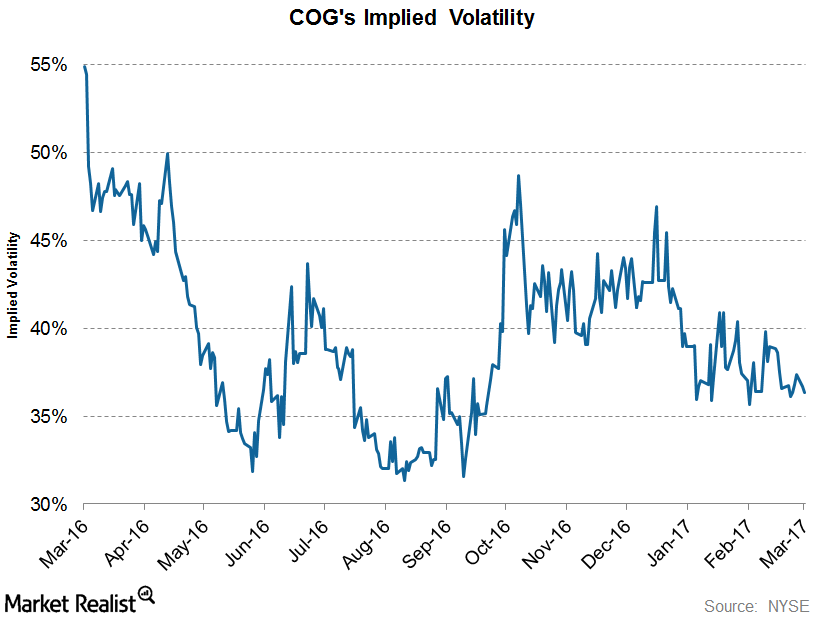

Cabot Oil & Gas: Short Interest Trends in Its Stock

On July 18, 2017, Cabot Oil & Gas’s (COG) short interest ratio was ~4.7%. At the beginning of the year, its short interest ratio was 4.2%.

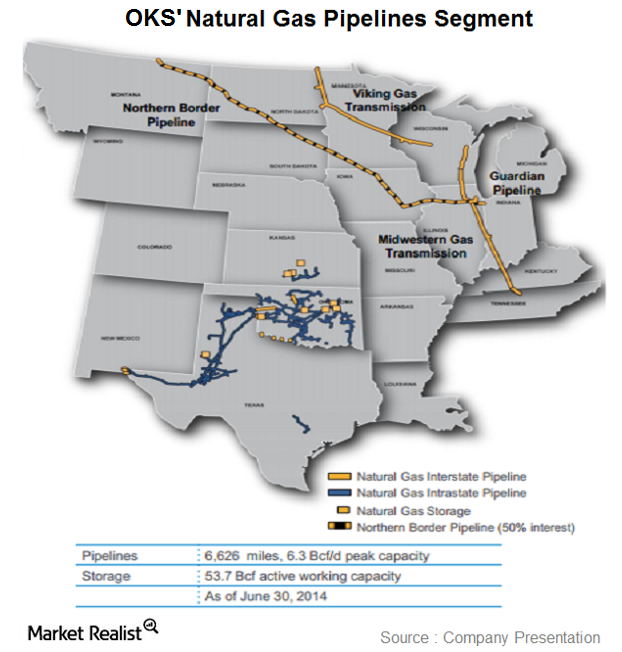

Overview: ONEOK Partners’ natural gas pipelines segment

ONEOK Partners’ (OKS) natural gas pipelines segment owns and operates regulated interstate and intrastate natural gas pipelines and natural gas storage facilities.

A must-know overview of Cheniere Energy

Cheniere Energy, Inc., is a Houston-based energy company engaged in the liquefied natural gas business.The Sabine Pass liquefaction project is one of the first projects to receive the necessary government permits to export liquefied natural gas.

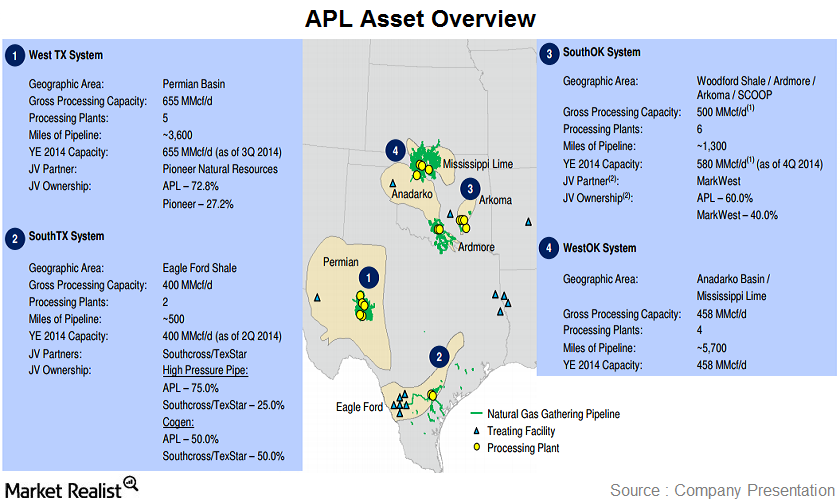

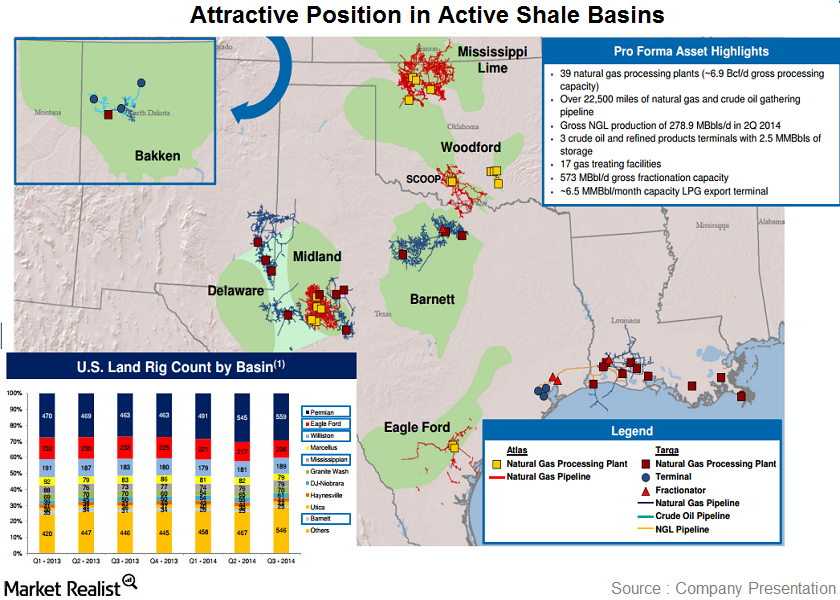

A brief overview on Atlas Pipeline Partners

The company provides natural gas gathering and processing services in the Eagle Ford Shale play in Texas, as well as in the Anadarko, Arkoma, and Permian basins.

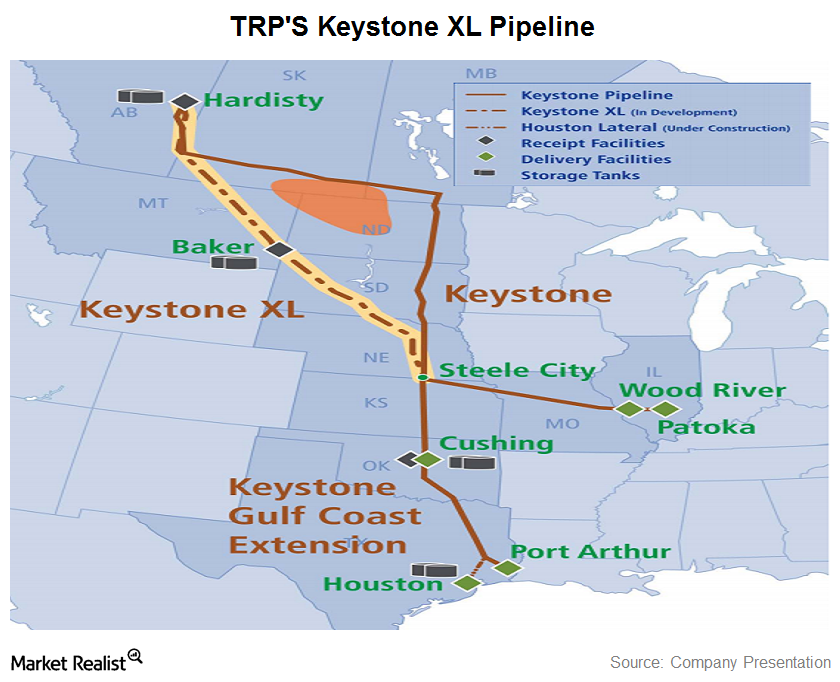

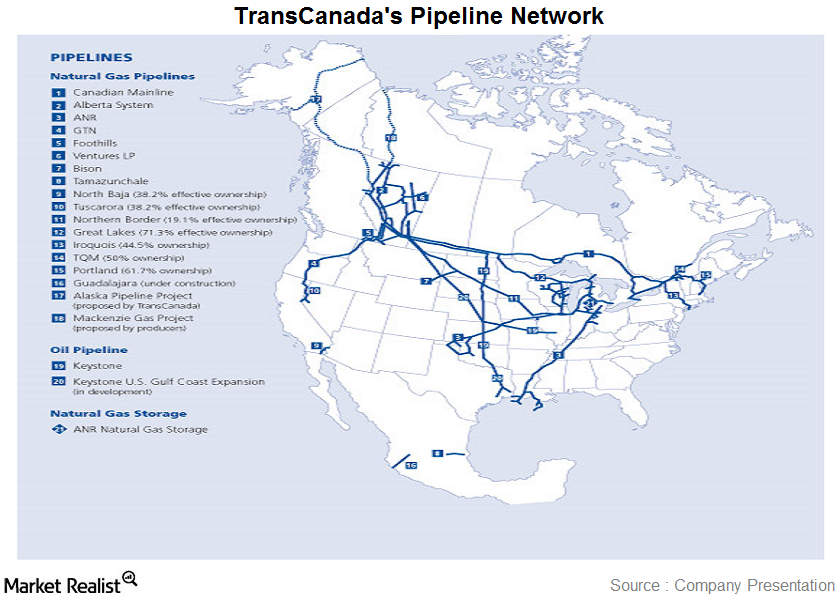

TransCanada’s controversial Keystone XL Pipeline project

The Keystone XL Pipeline project is a proposed 1,179-mile pipeline. It begins in Alberta, Canada and extends south to join the existing Keystone Pipeline in Steele City, Nebraska.

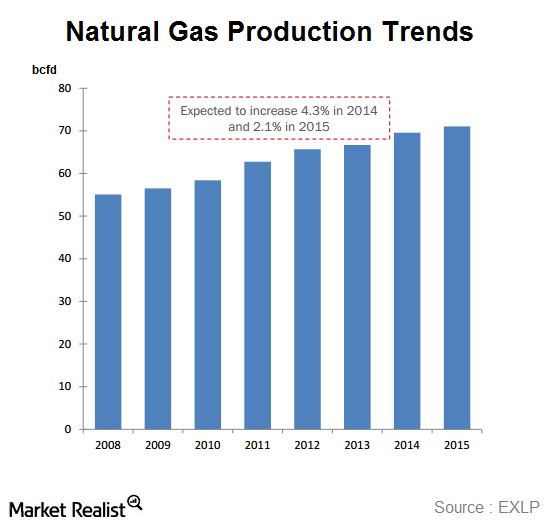

An overview of the natural gas compression industry

Natural gas compression is essential for transporting natural gas. Compression is used several times during the natural gas production and transportation cycle.

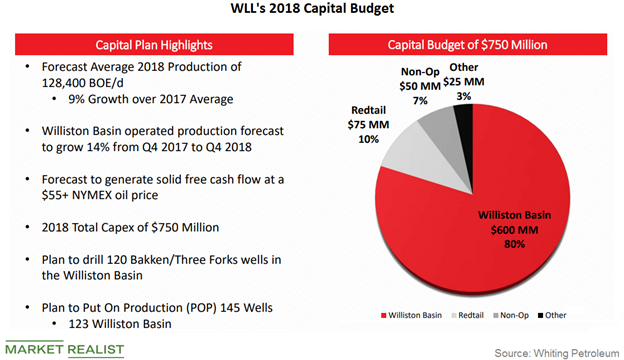

Whiting Petroleum’s Capex Plans for 2018

Whiting Petroleum’s (WLL) 2018 capital expenditure forecast is $750 million, compared to its capex of $912 million in 2017.

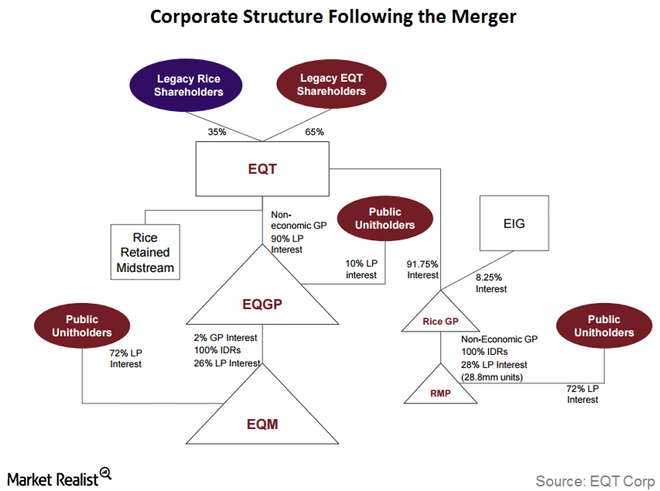

Key Updates on the EQT-RICE Merger

Under EQT Corporation’s (EQT) existing ownership, the company owns a 90% limited partner interest and non-economic general partner interest in EQT GP Holdings (EQGP).

How Natural Gas Prices Have Supported Chesapeake Energy

2016 has been good for natural gas prices (UGAZ). Prices have risen ~34% year-over-year.

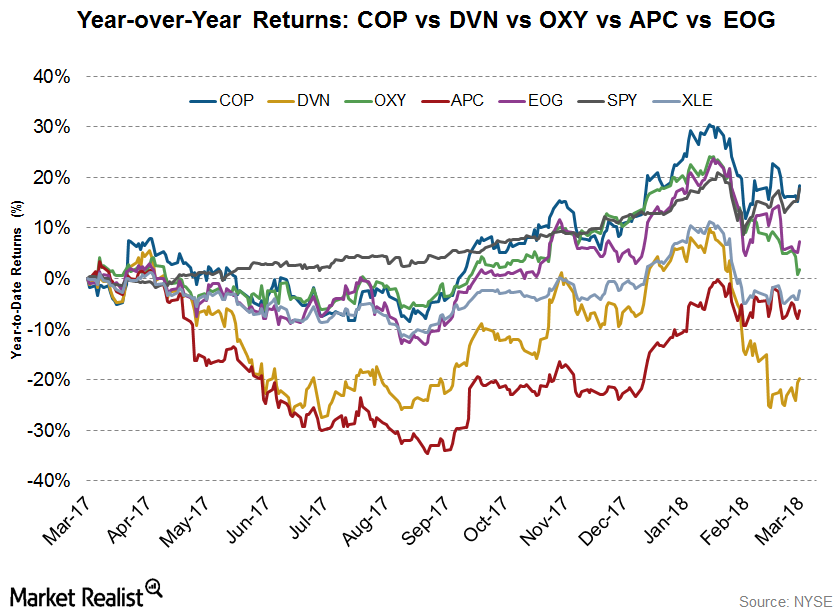

Stock Comparison: How Have COP, DVN, OXY, APC, and EOG Fared?

Stock performance In this article, we’ll discuss the year-to-date (YTD) stock performance of ConocoPhillips (COP), Devon Energy (DVN), Occidental Petroleum (OXY), Anadarko Petroleum (APC), and EOG Resources (EOG), which reported the highest revenue among upstream companies in fiscal 2017. Outliers and underperformers The above image shows that ConocoPhillips (COP) is the outlier among peers. YoY […]

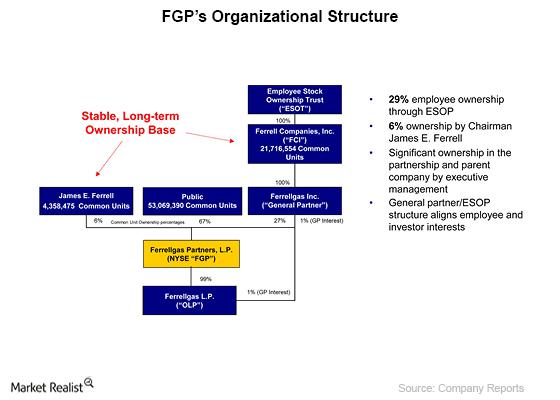

Ferrellgas Partners (FGP): An investor’s must-know overview

Ferrellgas Partners, L.P. (FGP), a master limited partnership (MLP), is the second largest retail propane distributor in the U.S. serving all 50 states, the District of Columbia and Puerto Rico, as measured by the volume of retail sales in fiscal 2013, and the largest national provider of propane by portable tank exchange.

The story behind the Canadian giant—TransCanada Corp.

TransCanada Corporation (TRP) is based in Canada. It’s one of North America’s leading natural gas pipeline network owners. TransCanada also provides natural gas storage services.

COG’s Implied Volatility Has Fallen Significantly since Early 2016

Cabot Oil and Gas’s (COG) current implied volatility is ~36.4%, ~3% lower than its 15-day average of 37.4%.

MPLX LP: The infrastructure link in Marathon Petroleum’s chain

Marathon Petroleum Corporation, or MPC, owns 100% of the MPLX general partnership, or GP, interests, as well as the incentive distribution rights.

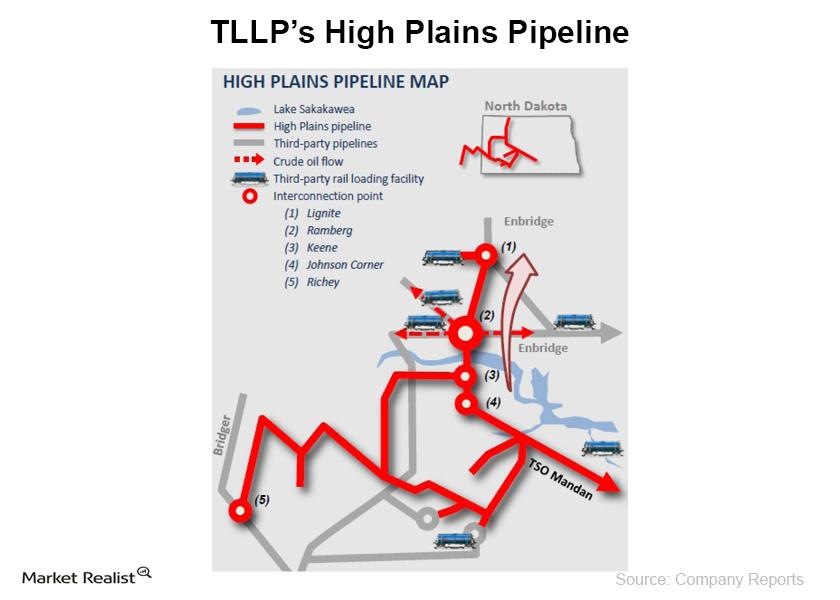

Why Tesoro’s crude oil gathering and pipeline segment is positive

Tesoro Logistics’ (TLLP) operations are organized into the Crude Oil Gathering segment and the Terminalling and Transportation segment.

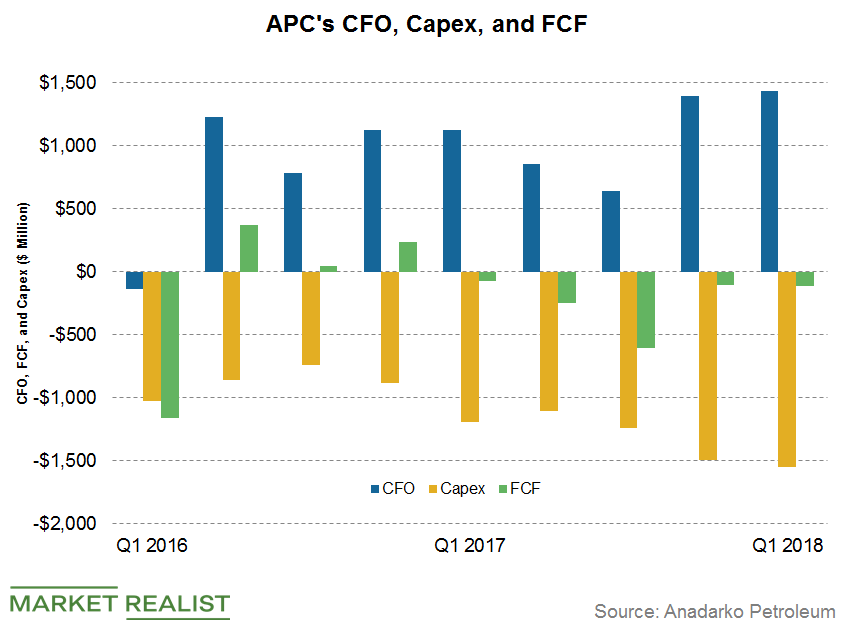

Anadarko Petroleum’s Free Cash Flow Forecast

Anadarko Petroleum’s capex has mainly been showing an increasing trend since the first quarter of 2016. The free cash flow has been negative.

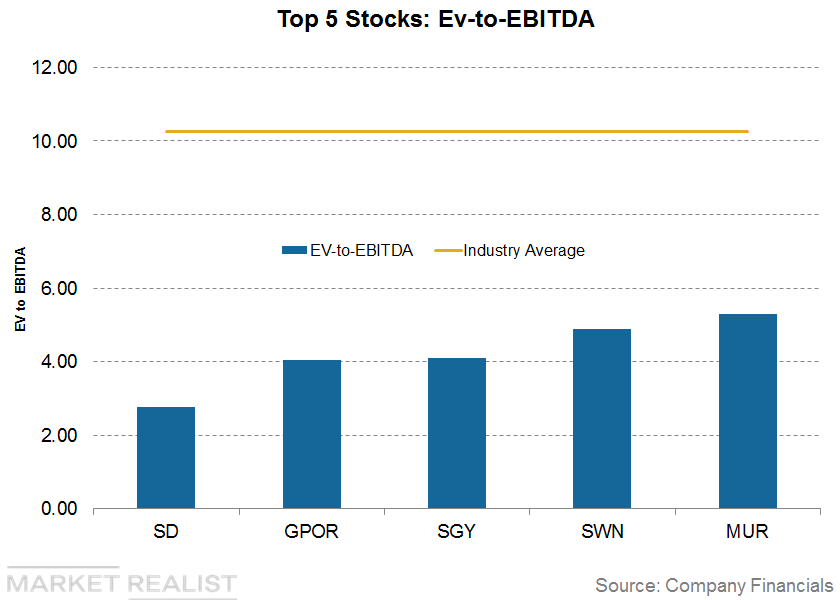

Upstream Companies with the Lowest EBITDA Multiples

As of the first quarter, Sandridge Energy’s (SD) EV-to-adjusted EBITDA ratio was ~2.77x. The company has a market capitalization of $529.83 million.

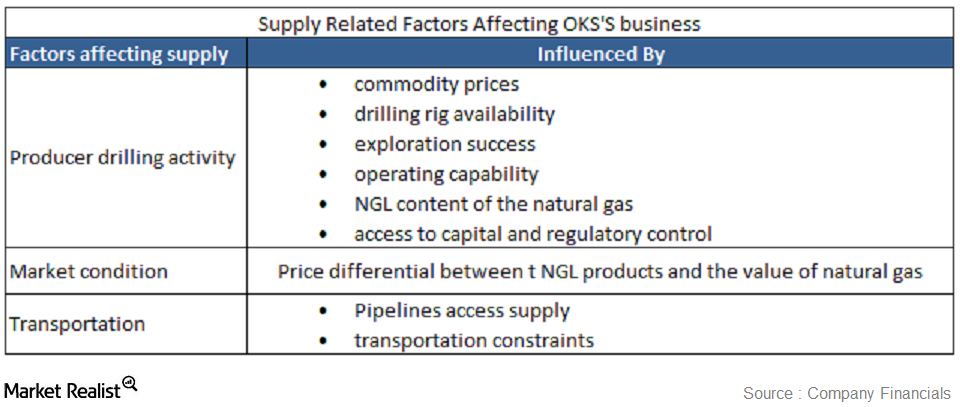

Must-know: Supply-related factors that affect ONEOK Partners

Natural gas, crude oil, and NGL (or natural gas liquid) supply is affected by several factors that could be supply related or demand related.

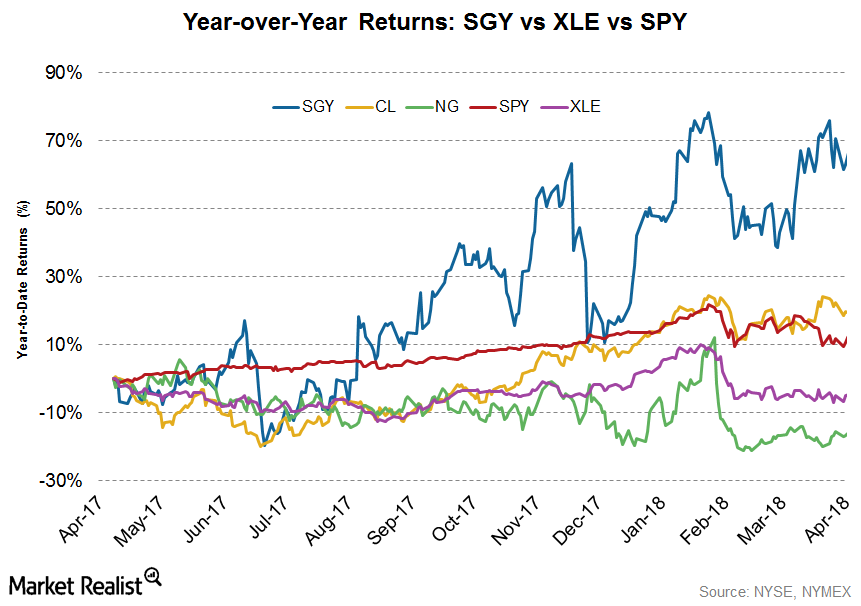

Stone Energy’s Stock Performance in 2018

Stone Energy stock has increased the most among our top five companies. Stone Energy stock has risen 60% YoY (year-over-year).

An overview of the Targa Resources and Atlas Pipeline deal

The combined company will create a midstream enterprise with more than 22,500 miles of crude oil and natural gas pipelines across the U.S. The $7.7 billion deal is expected to close in the first quarter of 2015.

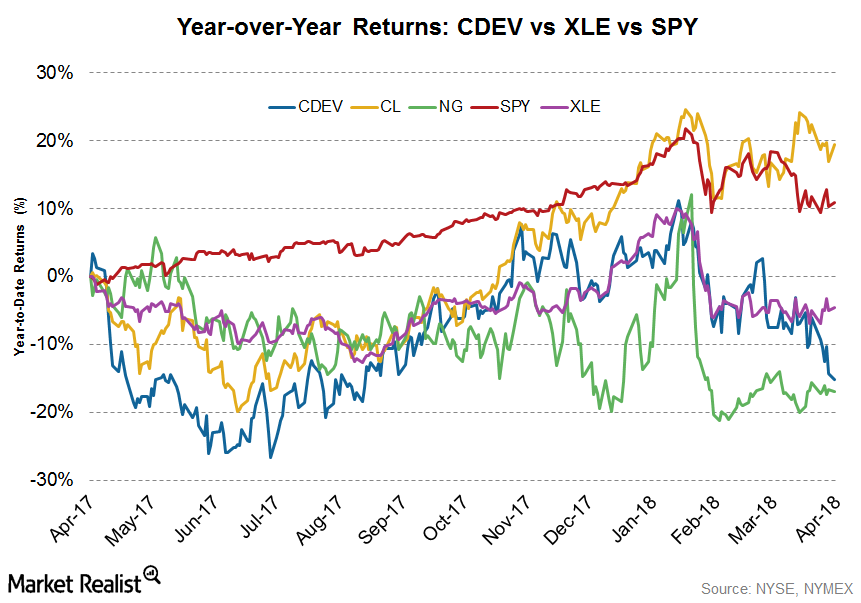

Centennial Resource Development: Stock Performance in 2018

Centennial Resource Development stock has declined ~15% YoY. The Energy Select Sector SPDR ETF (XLE) has declined ~4.5% YoY.

Introducing the UBS ETRACS Alerian MLP Infrastructure ETN AMZIX

The UBS ETRACS 1x Monthly Short Alerian MLP Infrastructure Total Return Index ETN (MLPS) tracks the Alerian MLP Infrastructure Total Return Index (AMZIX).

What a Wider Crack Spread in Mid-May Means for American Refiners

A crack spread represents the price difference between refiners’ revenues—achieved through the sale of finished refined products—and refiner costs—that is, the price of crude oil.

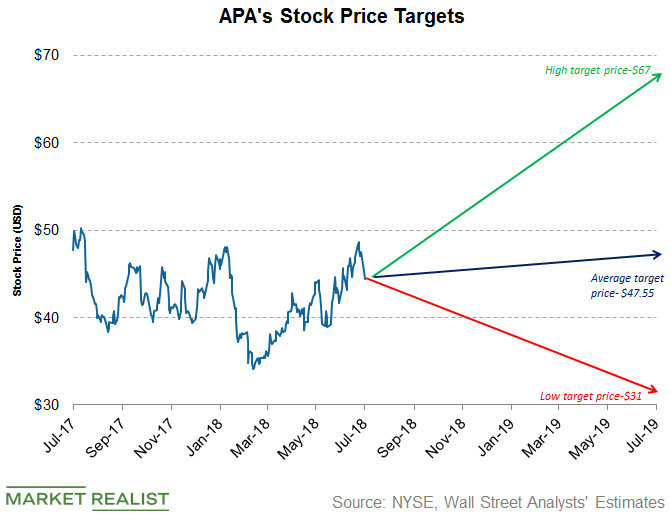

Apache Stock: What Are Analysts’ Recommendations?

On June 11, Argus upgraded Apache stock from “hold” to “buy.” On March 7, UBS initiated coverage on Apache stock with a “sell” rating.

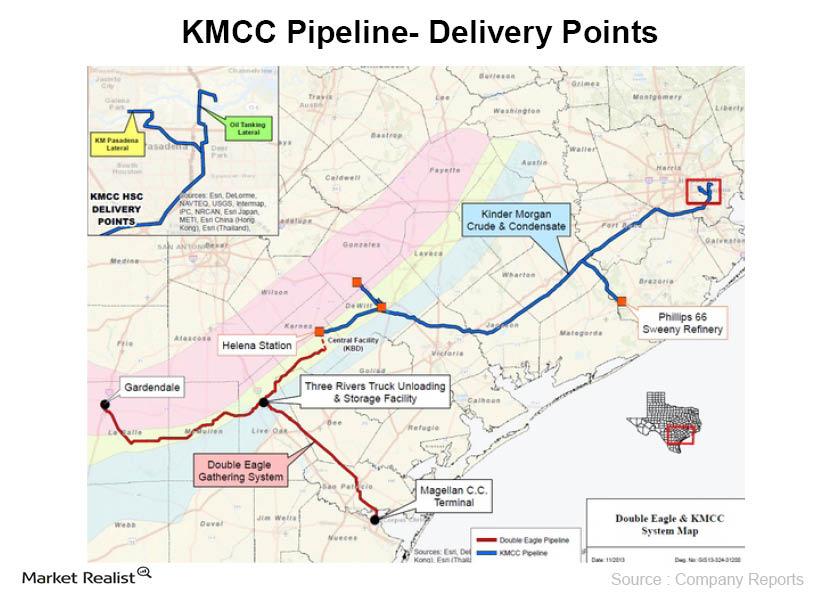

Must-know: Why the Kinder Morgan Eagle Ford expansion is positive

Kinder Morgan Energy Partners plans several major Eagle Ford joint ventures and projects that could reach almost $900 million in expenditures if company reports are to be believed.

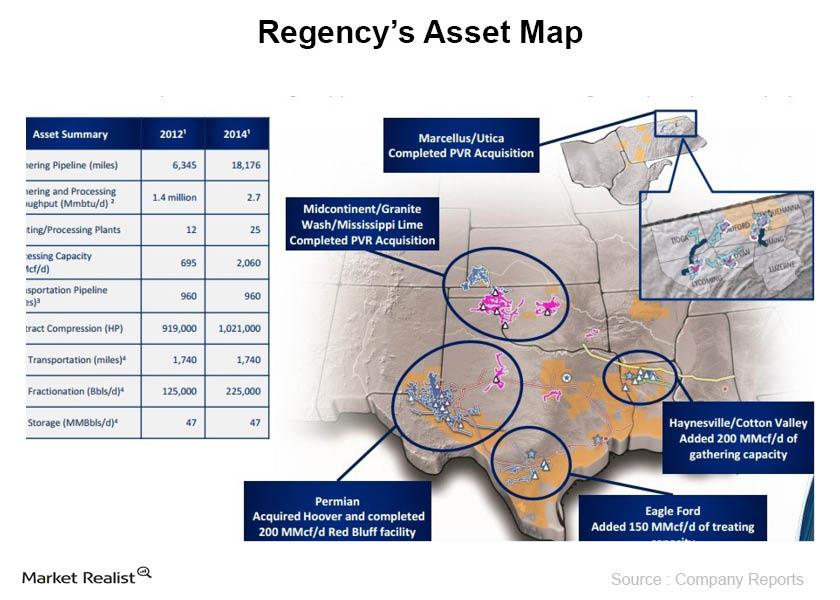

Overview: Regency Energy Partners

Regency Energy Partners L.P. (RGP) is a midstream operator of natural gas pipelines, gathering systems, and processing facilities.

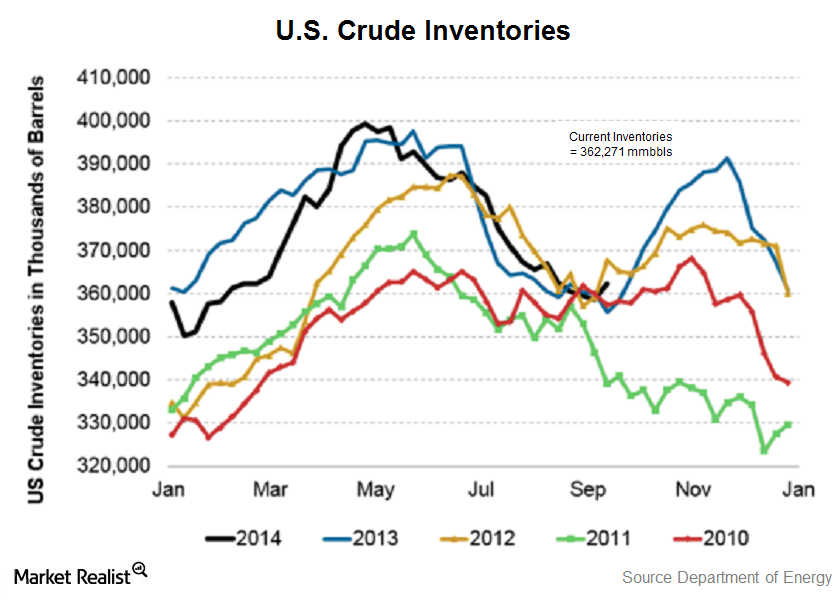

Must-know: Why energy investors monitor crude oil inventories

Analysts had expected a drop of 1.5 million barrels (mmbbls) in crude inventories last week. The following parts will cover actual changes in inventories.

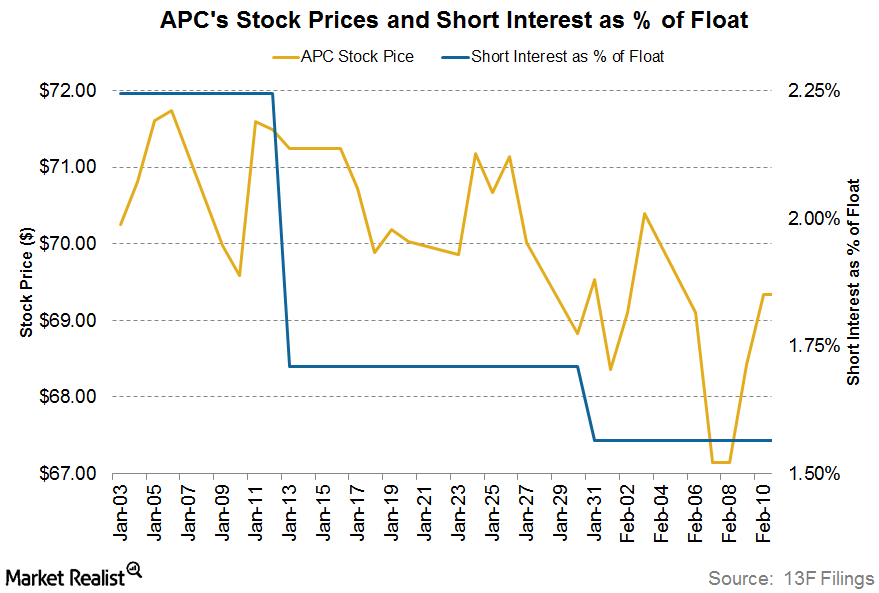

Anadarko Petroleum: Key Short Interest Trends

Anadarko Petroleum’s (APC) short interest ratio on February 10, 2017, was ~1.6%. At the beginning of the year, its short interest ratio was ~2.2%.