Keisha Bandz

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Keisha Bandz

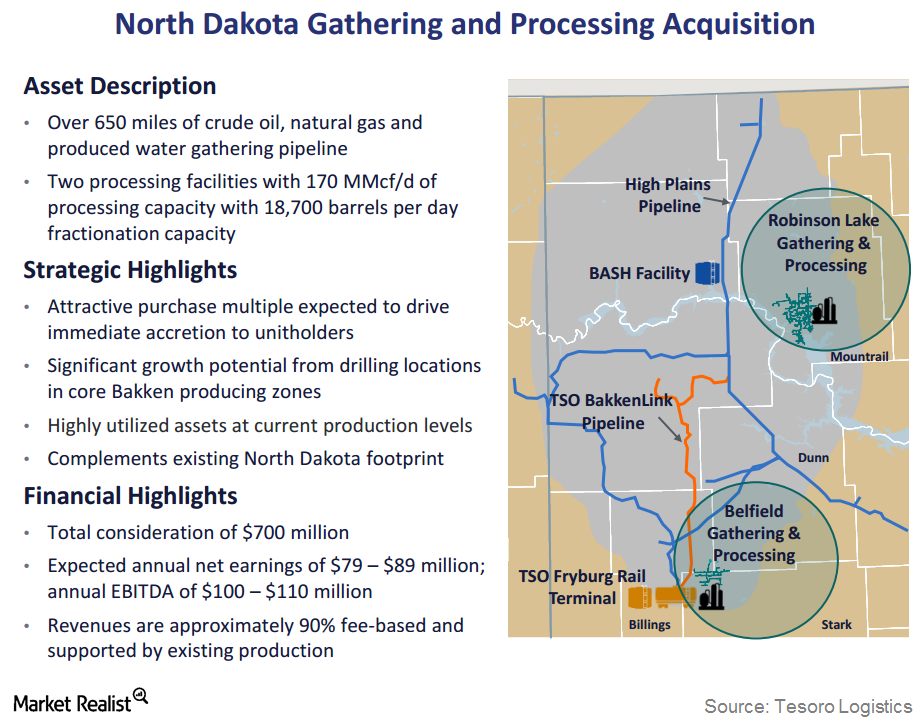

Whiting Petroleum Announces Bakken Midstream Divestiture

On November 21, 2016, Whiting Petroleum announced its intention to sell its Bakken midstream assets to an affiliate of Tesoro Logistics Rockies for $375 million.

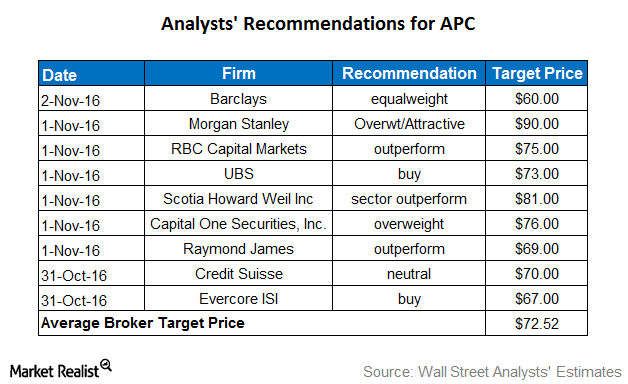

What Do Analysts Recommend for Anadarko Petroleum?

Approximately 73% of the analysts rate Anadarko a “buy,” 22% rate it a “hold,” and 5% rate it a “sell.” The average broker target price is $72.52.

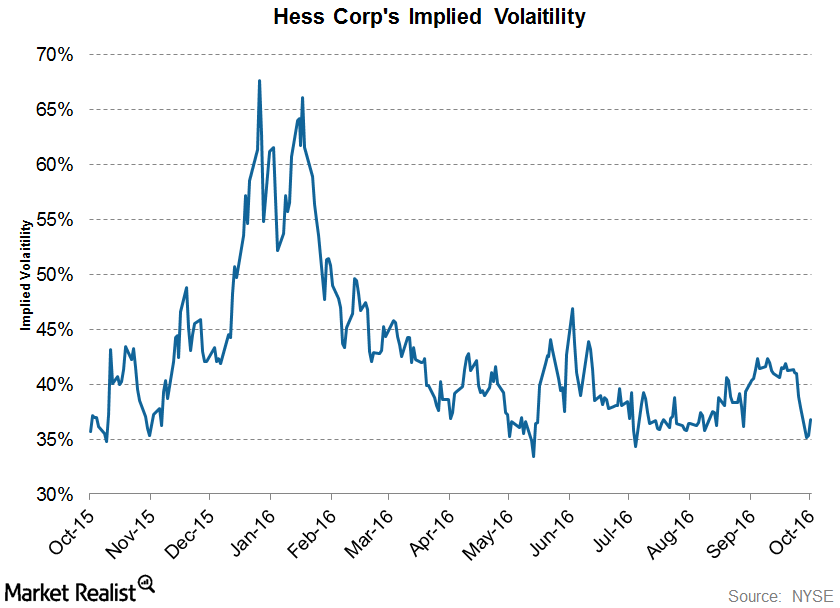

What Analysts Recommend for Hess after 3Q16 Earnings

About 42% of analysts rate Hess a “buy,” and ~58% rate it a “hold.” The average target price of $64.89 implies a return of ~29% in the next 12 months.

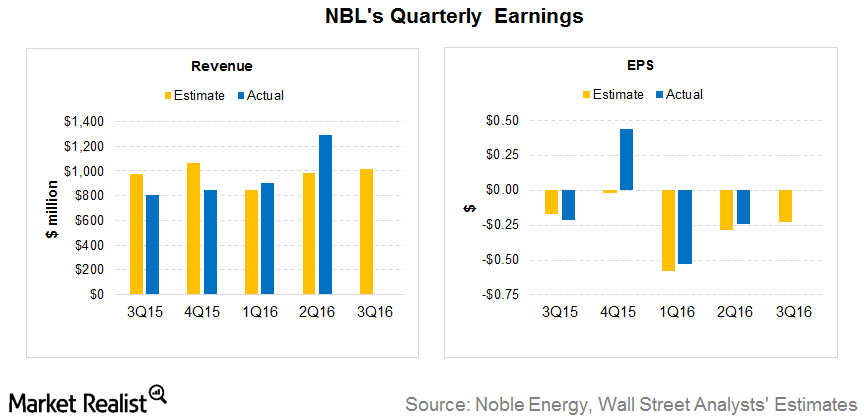

Noble Energy Sets the Stage for Another Earnings Beat in 3Q16

Noble Energy (NBL) is expected to release its 3Q16 earnings results on November 2, 2016. What can investors expect?

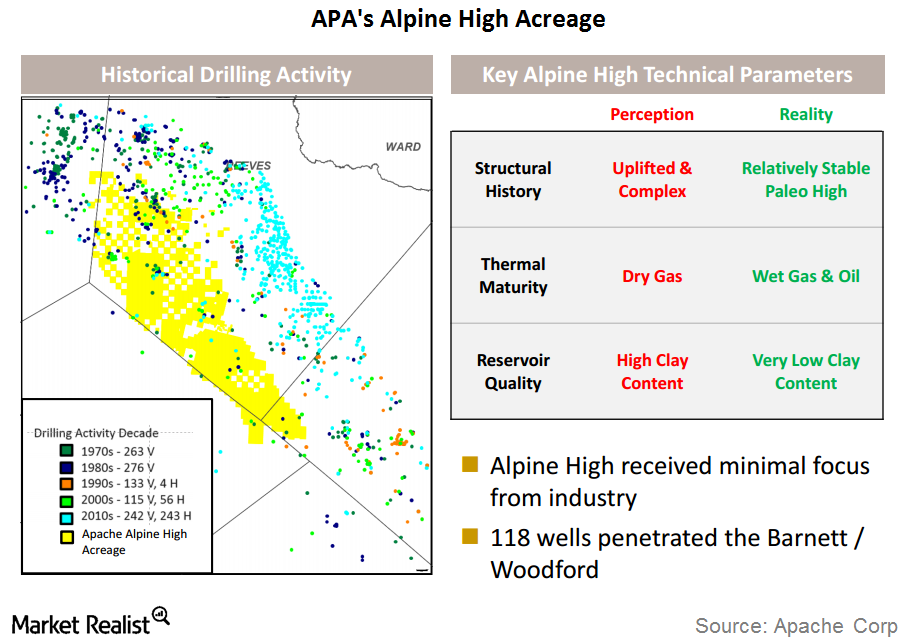

Key Highlights of Apache’s Alpine High Resource Play

Apache owns 307,000 contiguous net acres in its Alpine High play that have been secured over the past 18 months at an average cost of $1,300 a net acre.

Apache Announces a New Oil and Gas Discovery

On September 7, 2016, Apache (APA) announced a new resource play, Alpine High, in the Delaware Basin of Texas.

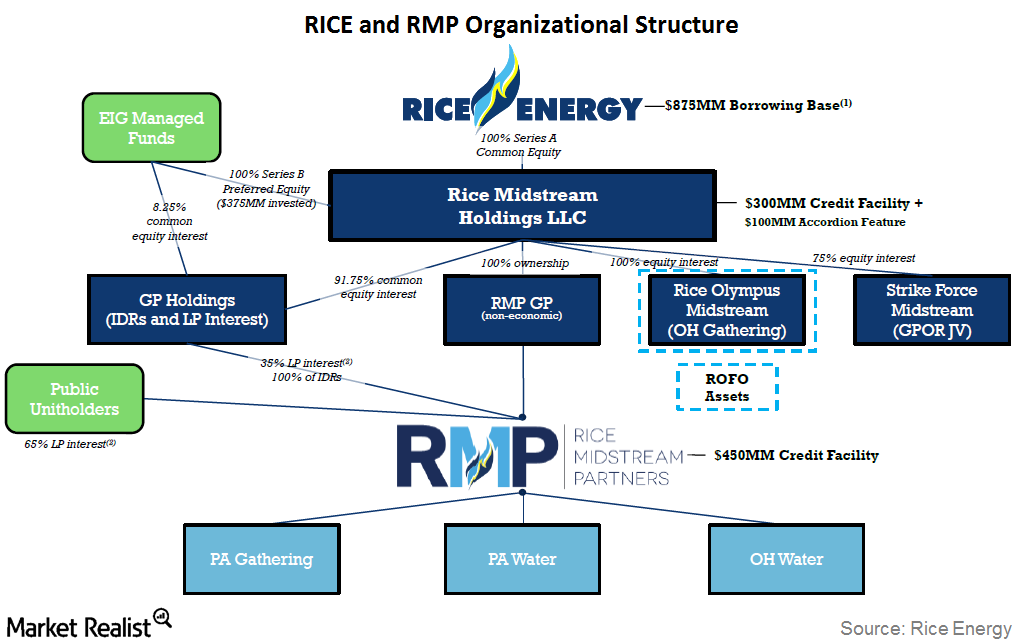

Rice Energy’s Organizational Structure: A Brief Overview

In its organizational structure, Rice Energy, through its GP Holdings subsidiary, and the public hold 35% and 65% limited partner interest, respectively, in Rice Midstream Partners.

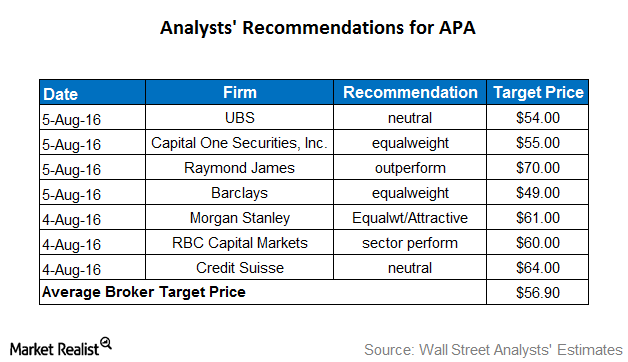

What Analysts Recommend for Apache after 2Q16 Earnings

Approximately 33% of analysts rate Apache (APA) a “buy,” and 55% rate it a “hold.” The remaining 12% rate it a “sell.”

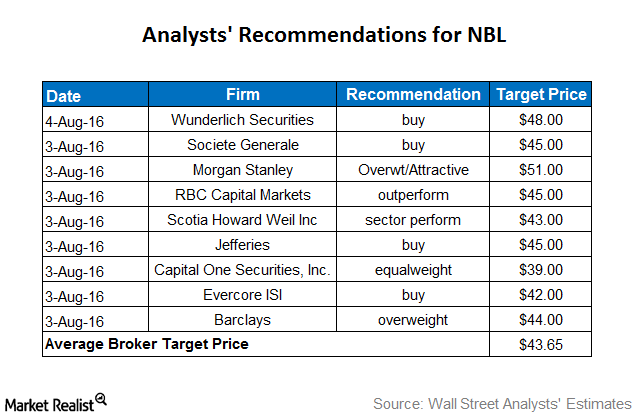

What Analysts Recommend for Noble Energy after Its 2Q16 Earnings

Approximately 63% of analysts rate Noble Energy (NBL) a “buy,” and 34% rate it a “hold.” The remaining ~3% rate it a “sell.”

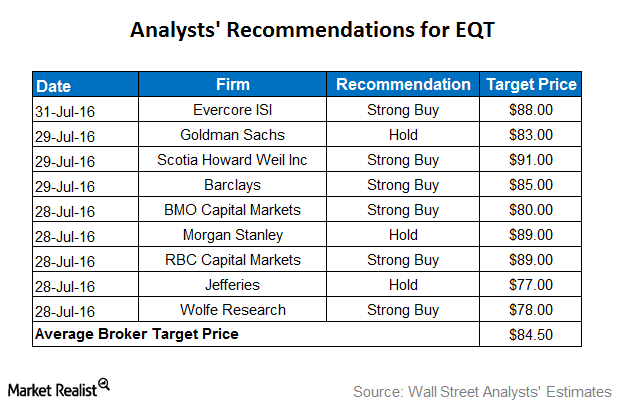

What Analysts Recommend for EQT after 2Q16 Earnings

Approximately 65% of analysts rate EQT (EQT) a “buy,” and 30% rate it a “hold.” The remaining 5% rate it a “sell.”

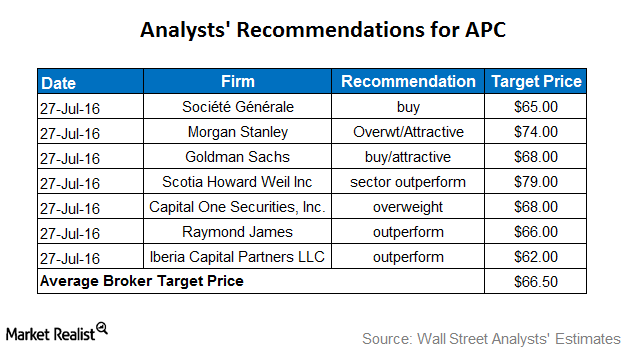

What Do Analysts Recommend for Anadarko after Its 2Q16 Earnings?

Approximately 73% of analysts rate Anadarko a “buy,” whereas 22% rate it a “hold,” and 5% rate it a “sell.” The average broker target price is $66.50.

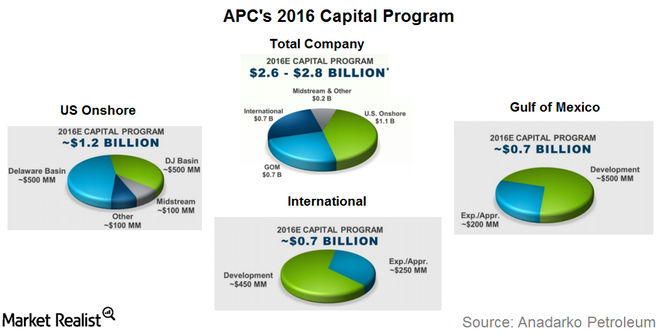

What Are Anadarko’s Capex Plans in 2016?

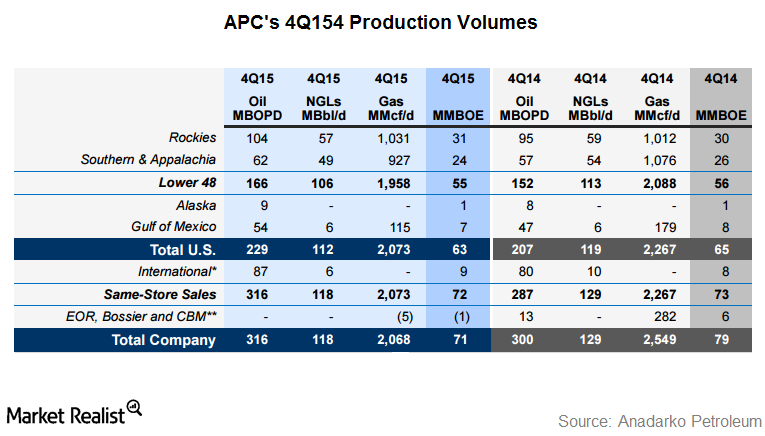

Anadarko Petroleum’s (APC) 2016 capex (capital expenditures) budget is $2.6 billion–$2.8 billion, a 50% reduction from $5.4 billion in 2015.

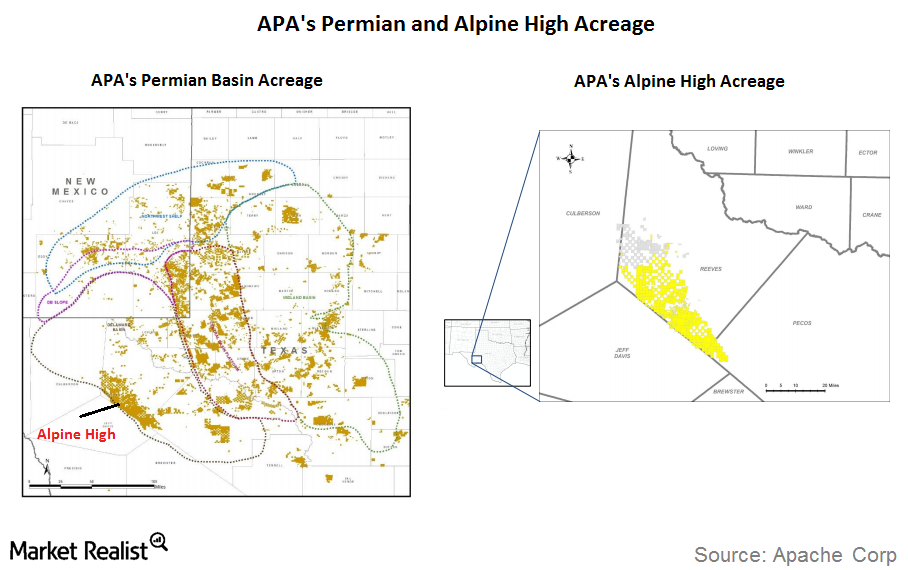

Permian Basin: Is It a Sweet Spot for Apache and US Producers?

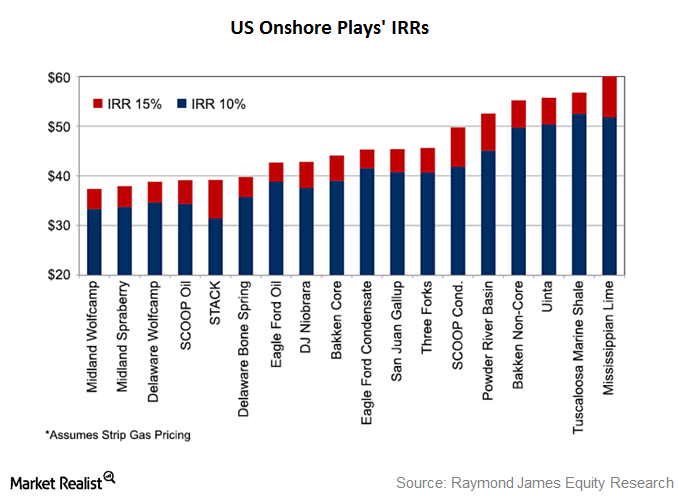

The Midland and Delaware basins, which are sub-basins of the Permian, had IRRs of 15% even at sub-$40 oil prices. Apache (APA) has significant operations in both of these basins.

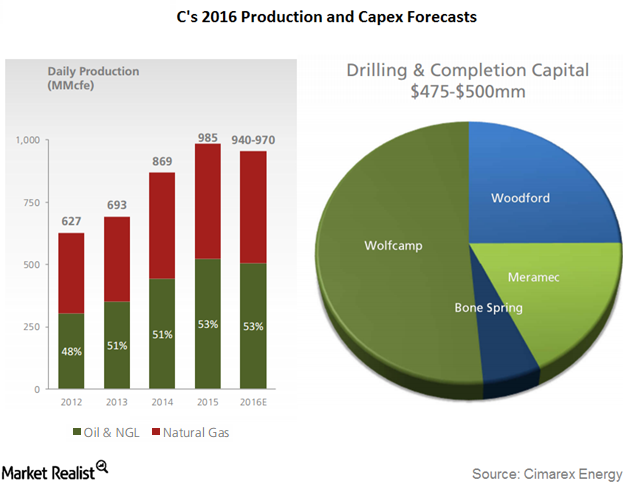

What Happened to Cimarex’s 1Q16 Production Volumes and Realized Prices?

Cimarex Energy’s (XEC) total production volume in 1Q16 was 973 MMcfe (millions of cubic feet equivalent). This represents a rise of ~3% YoY

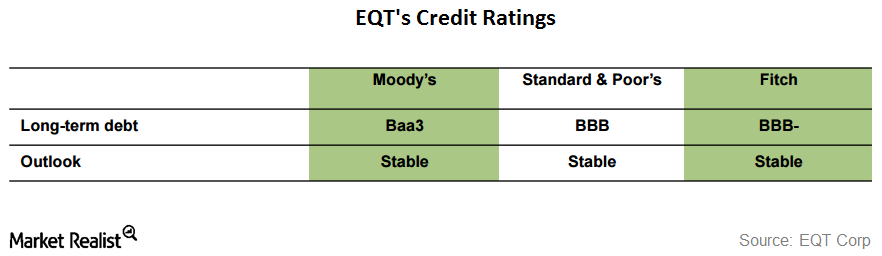

What Are Credit Rating Agencies Saying about EQT?

For EQT (EQT), Moody’s has provided a Baa3 rating. Standard & Poor’s has given it a BBB credit rating, and Fitch has given it a BBB- rating.

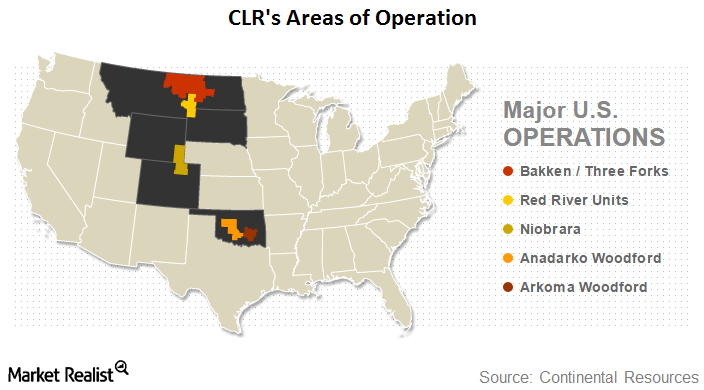

Continental Resources: An Introduction

In this series, we will analyze how badly Continental Resources (CLR) was hit by weak oil prices, and what measures it has taken to counter this situation. In 2015, crude oil accounted for 66% of CLR’s total production and 85% of its revenues.

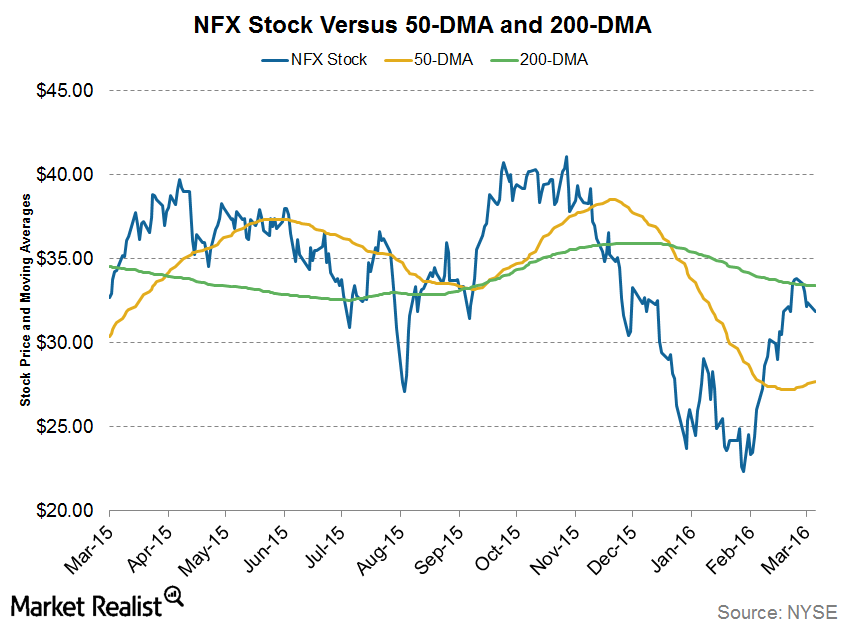

Newfield Exploration Stock Is Up, but for How Long?

With the recent rally in crude oil prices, Newfield Exploration (NFX) stock has been on an uptrend. On March 1, 2016, it crossed its 50-day moving average for the first time in 2016.

Anadarko Petroleum Slashes Its 2016 Capital Expenditure Budget

Anadarko Petroleum’s preliminary capex (capital expenditure) budget for 2016 is $2.8 billion—nearly 50% less than 2015 levels.

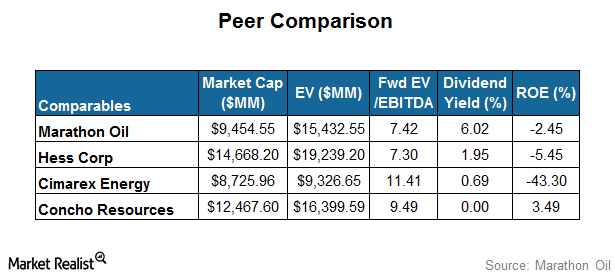

Marathon Oil’s Relative Valuation: A Comparison with Its Peers

In this part of the series, we’ll look at Marathon Oil’s (MRO) relative valuation against its peers’ multiples.

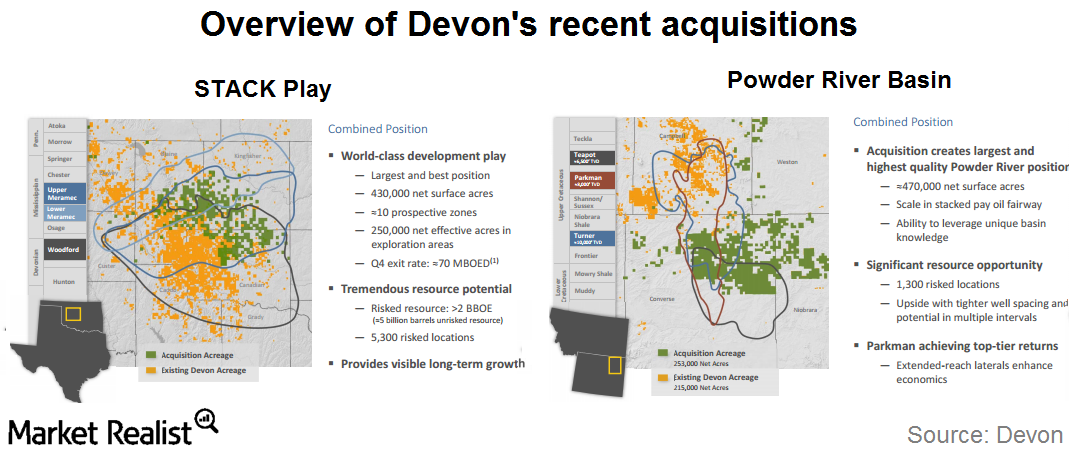

Devon Energy Announces Acquisitions to Strengthen Oil-Rich Assets

On December 7, 2015, in a bid to expand its oil-rich asset base, Devon Energy (DVN) announced acquisitions of oil-focused leaseholds in the STACK and Powder River Basin plays.

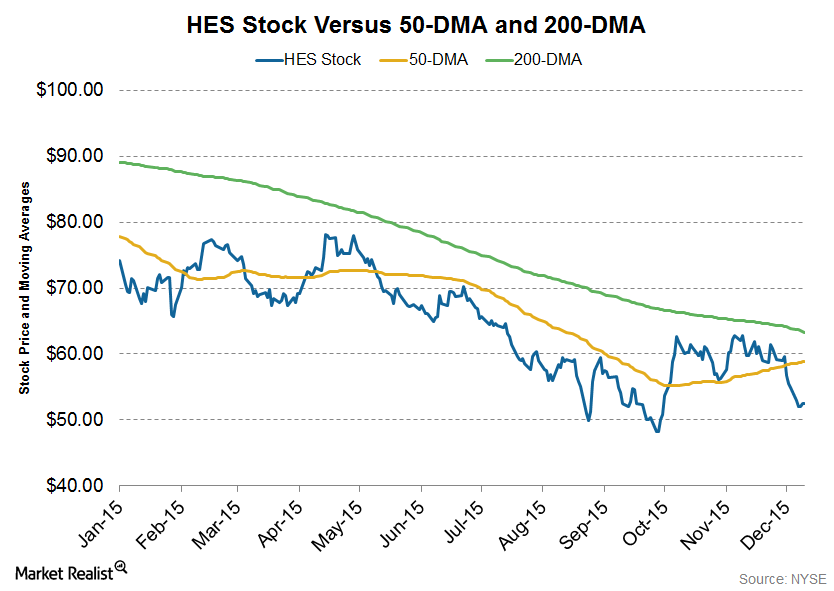

Hess Moves below its 200-Day Moving Average

On December 11, 2015, Hess was trading 17% below its 200-day moving average, a strong upside resistance for the stock. It has narrowed the gap considerably since October.

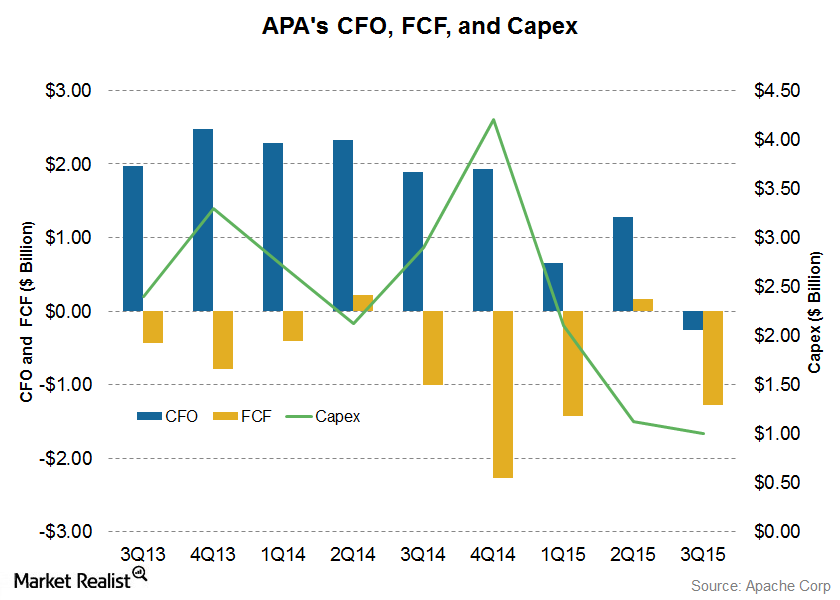

An Analysis of Apache’s Free Cash Flow Trends

Apache’s free cash flow has been mostly negative in the past nine quarters. In 2Q15, it reported FCF of $157 million despite weakness in commodity prices.

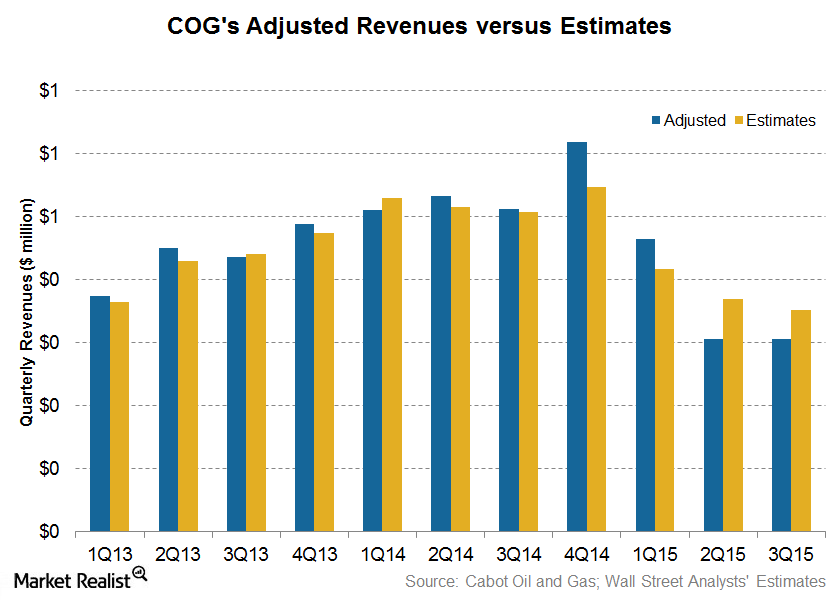

3Q15 Earnings: Cabot Oil and Gas’s Revenue Missed Estimates

Wall Street analysts’ estimate for Cabot Oil and Gas’s revenue was ~$352 million for 3Q15. The company announced adjusted revenue of ~$305 million.

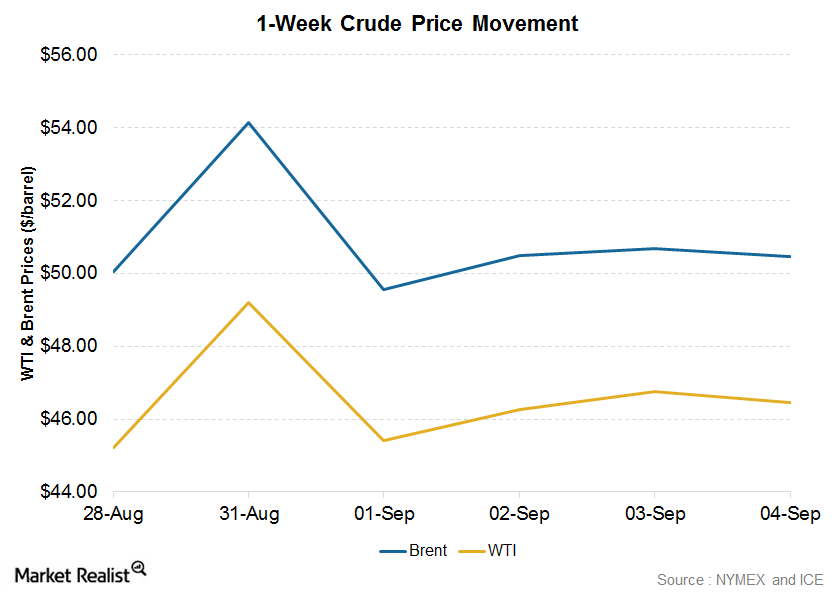

A Volatile Week for Crude Oil Prices: Analyzing the Key Reasons

WTI crude oil prices closed 1.83% higher on a weekly basis at $46.05 per barrel in the week ended September 4. Brent crude fell by 0.87% on a weekly basis, closing at $49.61 on September 4.

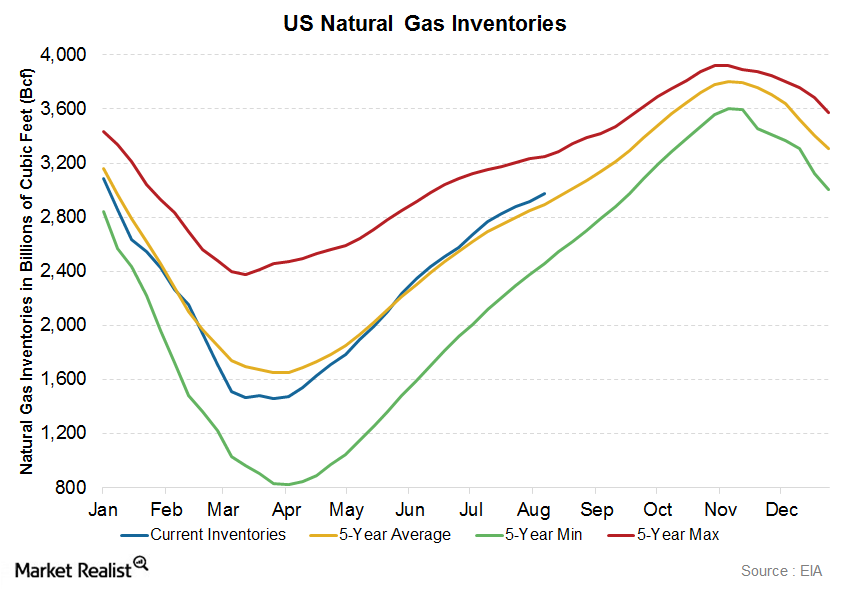

Natural Gas Inventories Beat Expectations: How Will Prices React?

On Thursday, August 13, the EIA (U.S. Energy Information Administration) published its “Natural Gas Weekly Update” for the week ended August 7.

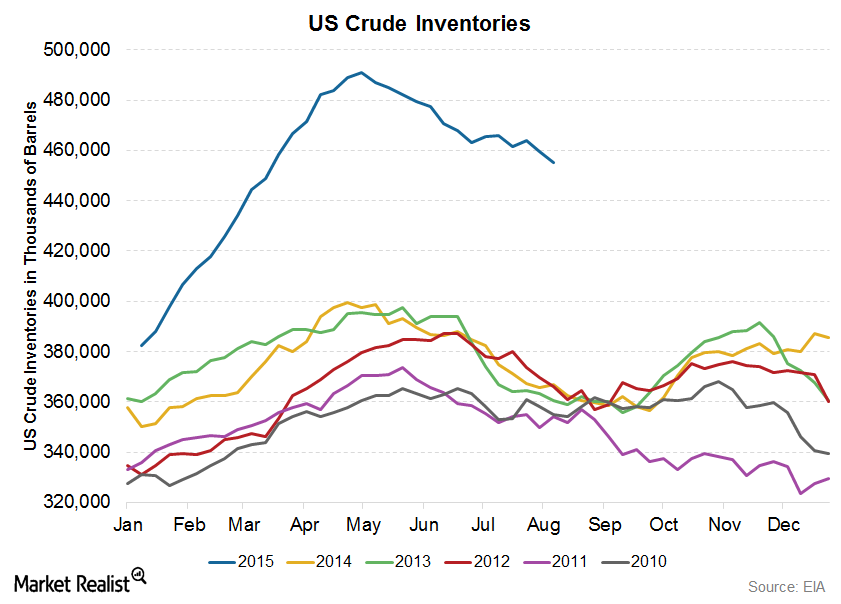

Crude Oil Inventories Fell, but Why Did WTI Crude Prices Slump?

The U.S. Energy Information Administration reported a decrease of 4.4 million barrels in crude oil inventories for the week ended July 31.

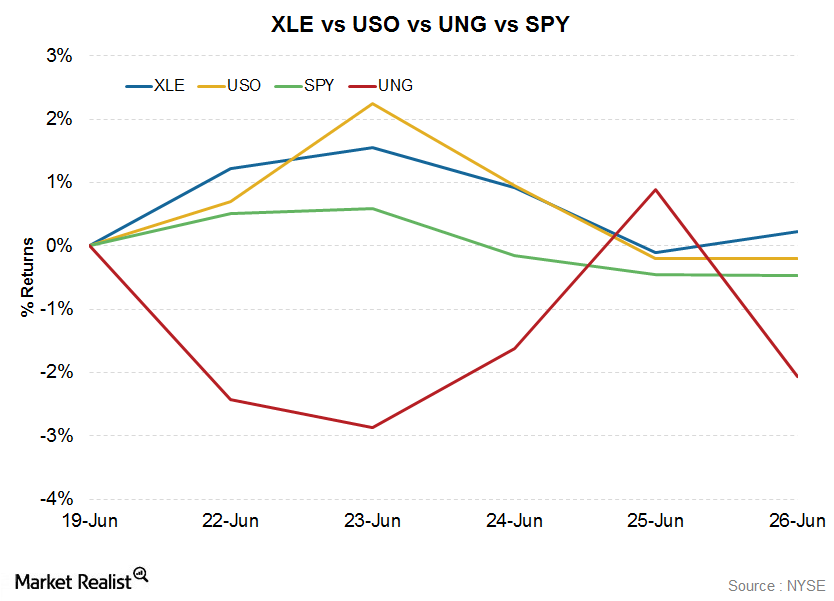

XLE Is Up Even as Commodity ETFs Track Energy Prices Lower

The Energy Select Sector SPDR ETF (XLE) rose 0.22% in the week to June 26. The ETF tracks a diverse group of ~45 of the largest US energy stocks.

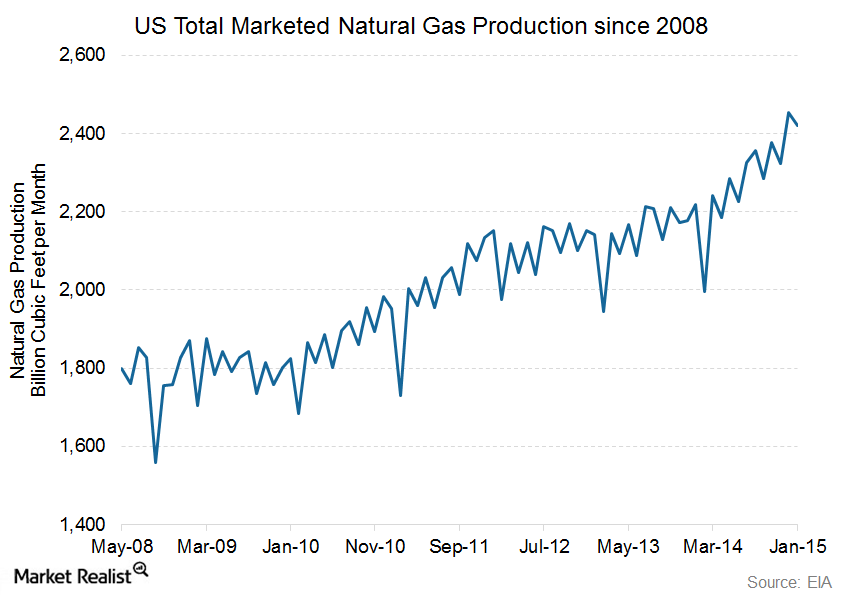

EIA Reports a Slight Decline in Natural Gas Production

Continued production growth set a grim scenario for natural gas prices. High production levels are bearish for natural gas prices.

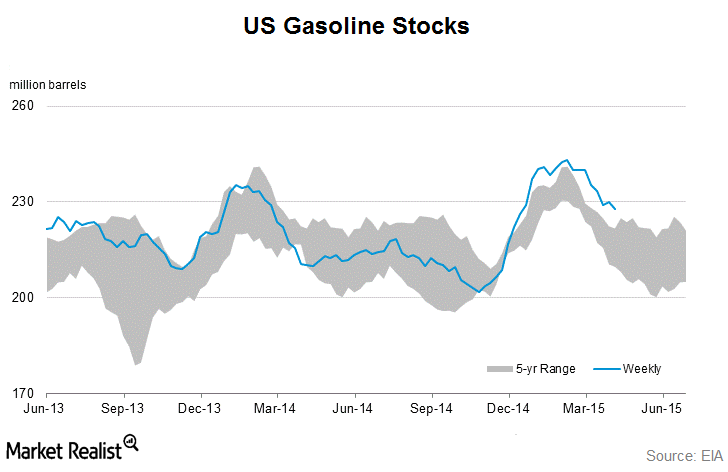

Gasoline Inventories Returned to Downtrend Last Week

Gasoline demand increased from ~8.61 MMbpd to ~8.91 MMbpd last week. Gasoline inventories remain outside the five-year range despite the draw in inventories reported on Wednesday.

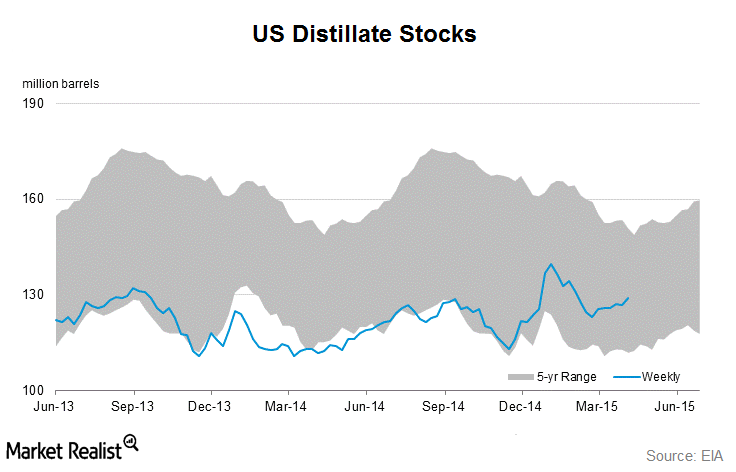

Distillate Inventories Increased Last Week

Distillate demand drives crude demand and crude prices. So, energy investors watch distillate inventories closely.

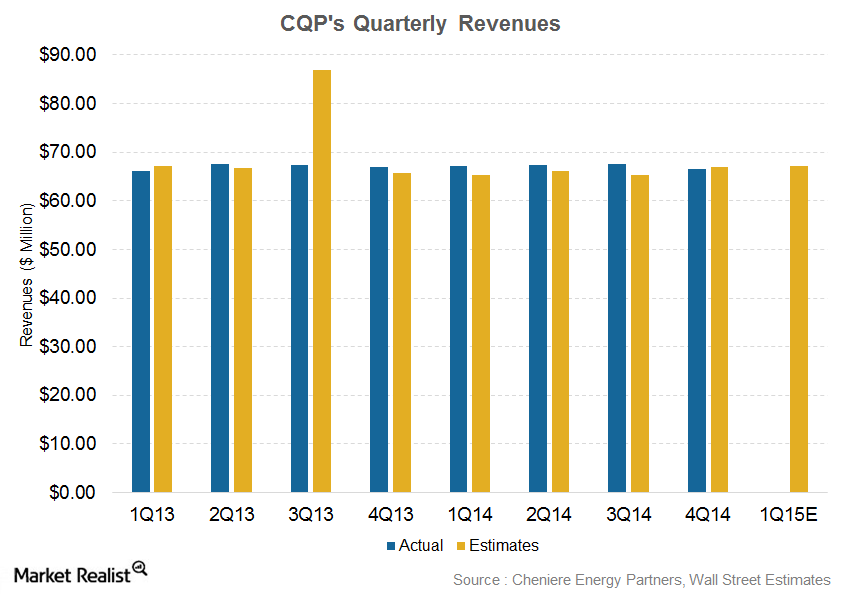

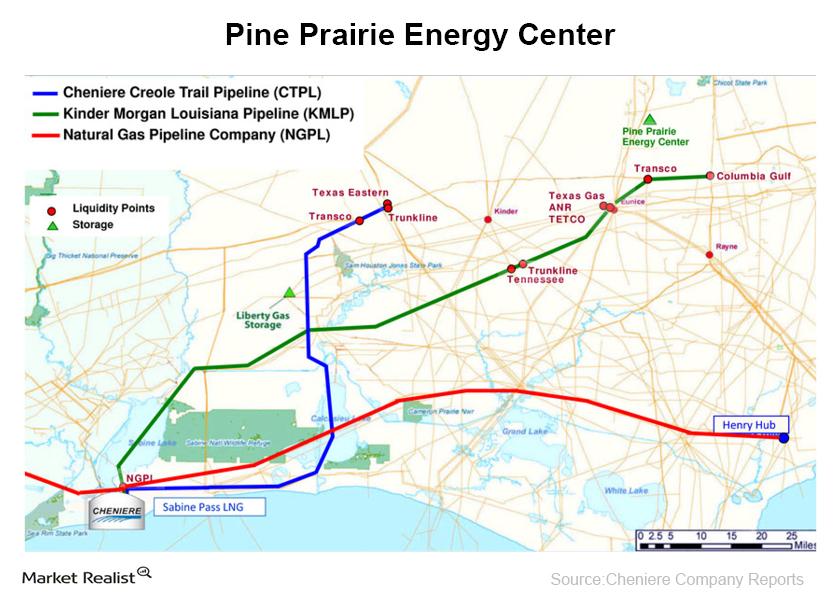

Analyzing Cheniere Energy Partners’ Historical Performance

For 1Q15, analysts are expecting Cheniere Energy Partners’ revenue to come in at $67.1 million. The loss per share estimates have been pegged at -$0.113.

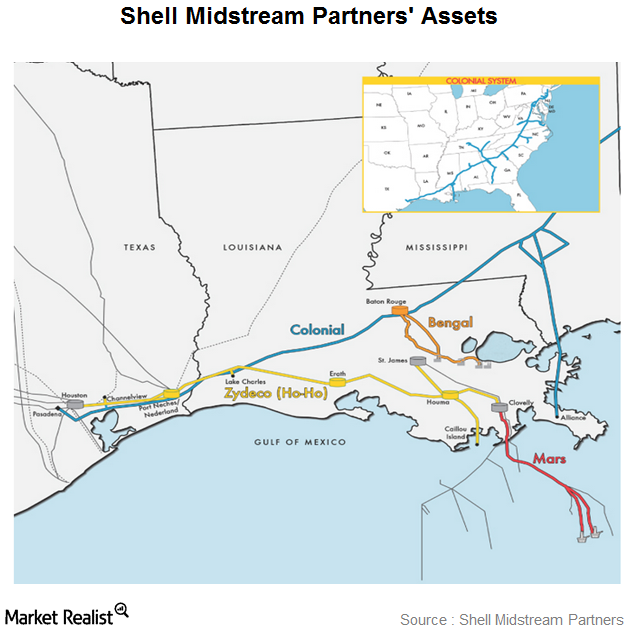

A Brief Overview of Shell Midstream Partners

Shell Midstream Partners (SHLX) is a MLP formed by Shell Pipeline Company, an affiliate of the international integrated energy giant, Royal Dutch Shell.

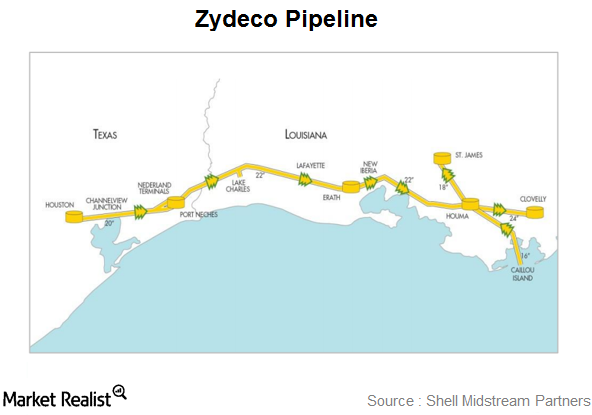

Zydeco Pipeline: A Shell Midstream Partners Key Asset

Shell Midstream Partners (SHLX) has a 42% ownership in the Zydeco pipeline, and Shell Pipeline Company, or SPLC, owns the remaining 57% interest.

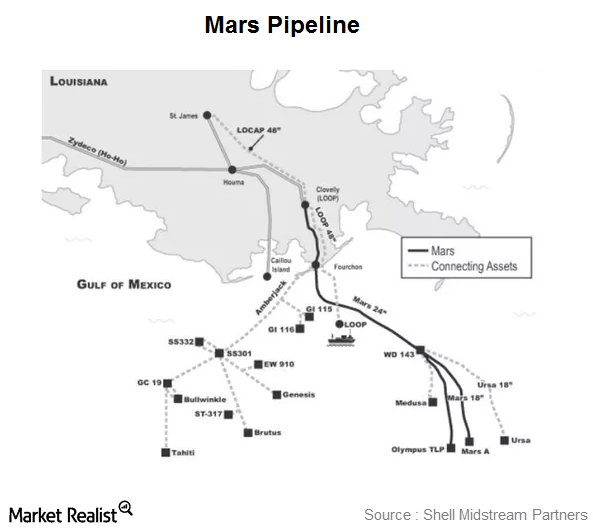

Shell Midstream’s Mars: A Corridor Pipeline Servicing the Gulf

Shell Midstream Partners (SHLX) has a 28.6% ownership in the Mars pipeline, and Shell Pipeline Company has a 42.9% interest.

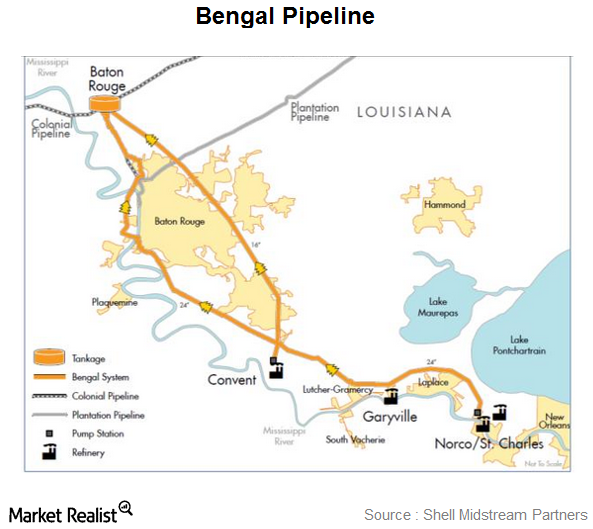

Shell Midstream Partners Refined Products Pipeline Systems

The Colonial pipeline system is the largest refined products pipeline in the US based on barrels per mile transported.

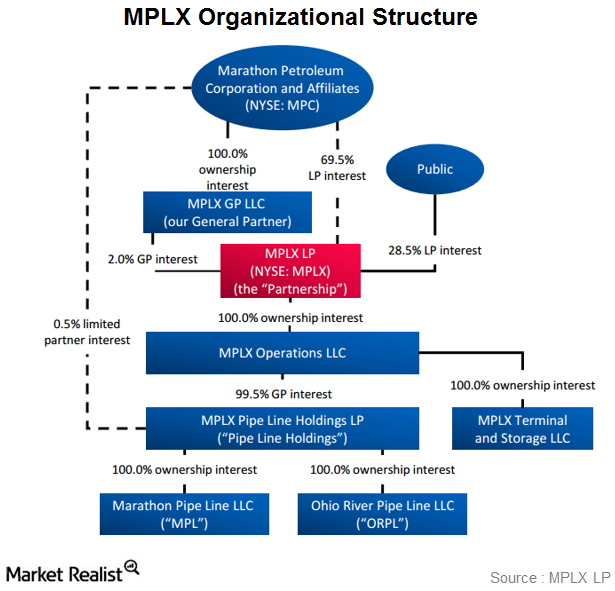

MPLX LP: The Midstream Link in Marathon Petroleum’s Chain

MPLX LP (MPLX) is a master limited partnership, or MLP. It was formed by independent refiner Marathon Petroleum Corporation (MPC).

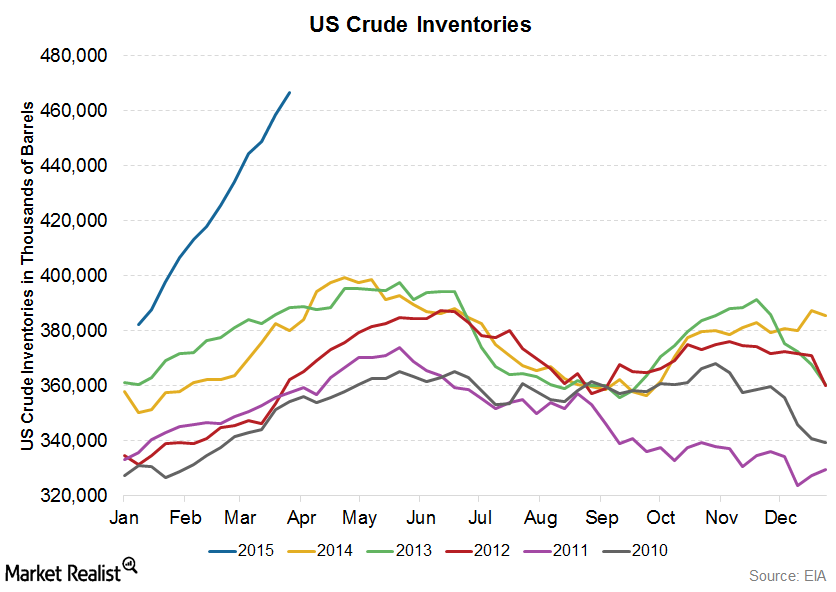

EIA Crude Oil Inventory Report: Essentials for Energy Investors

Crude oil inventory levels change based on demand and supply trends. Demand comes primarily from refineries that process this crude into refined products.

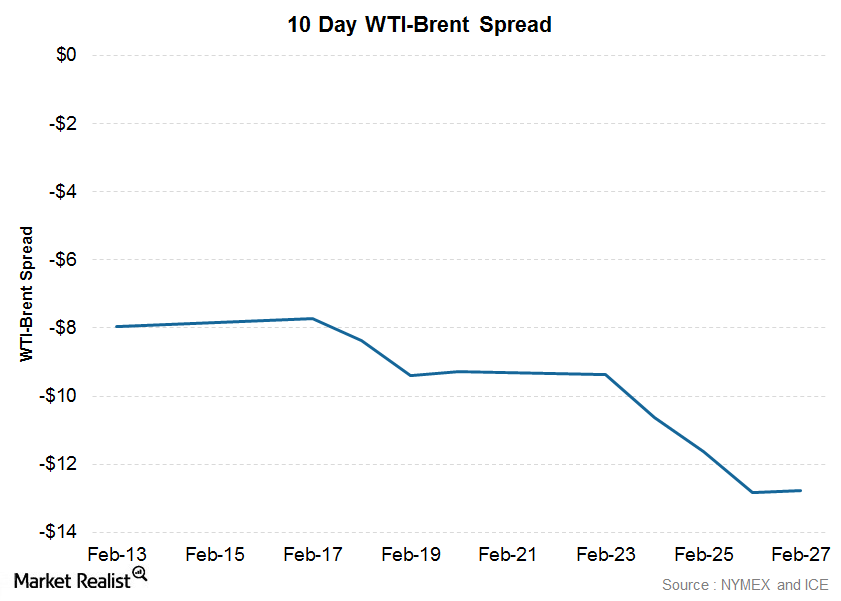

What caused the WTI-Brent spread to widen?

Capping the month with a gain of 3.1% since January 30, WTI’s (West Texas Intermediate) increase has been small compared to Brent’s 18% increase.

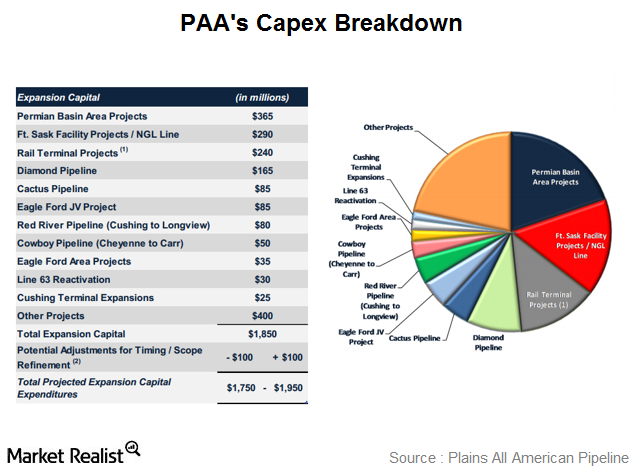

Plains All American Pipeline’s capex plan for 2015

Plains All American Pipeline expects to spend $1.85 in capex in 2015, highlighted by several projects in multiple geographic regions or resource plays.

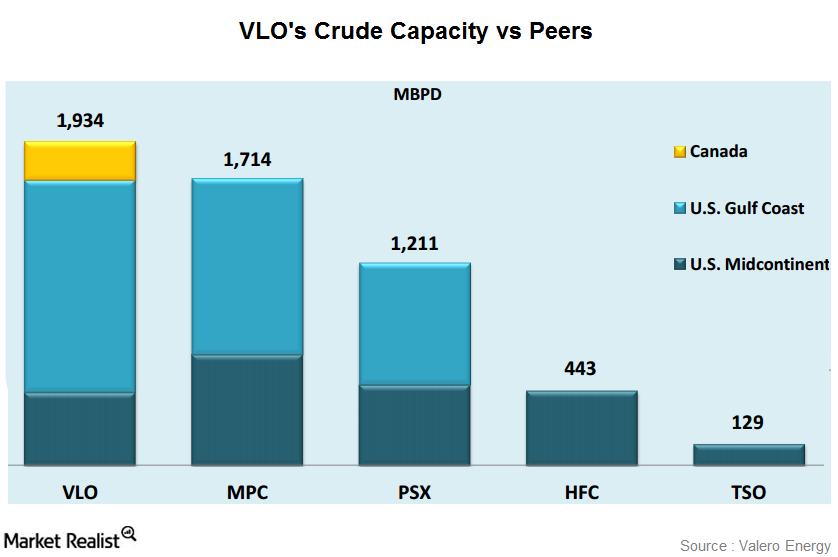

Why Valero Energy benefits from export opportunities

Location-advantaged refiners like Valero Energy (VLO), Phillips 66 (PSX), and Marathon Petroleum (MPC), with refineries along the Gulf Coast, can export refined products.

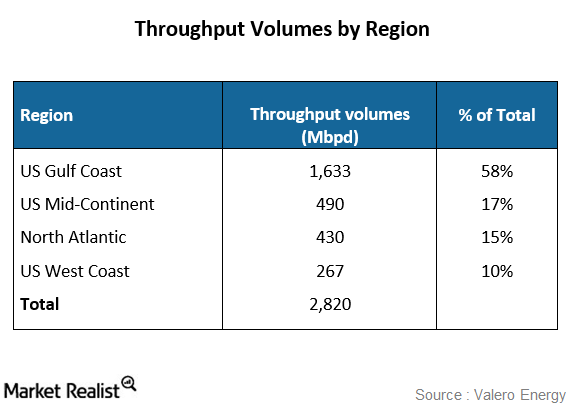

Analyzing Valero Energy’s operational performance in 4Q 2014

Valero Energy’s (VLO) refining segment’s throughput volumes increased by 41,000 barrels a day compared to the previous year’s fourth quarter.

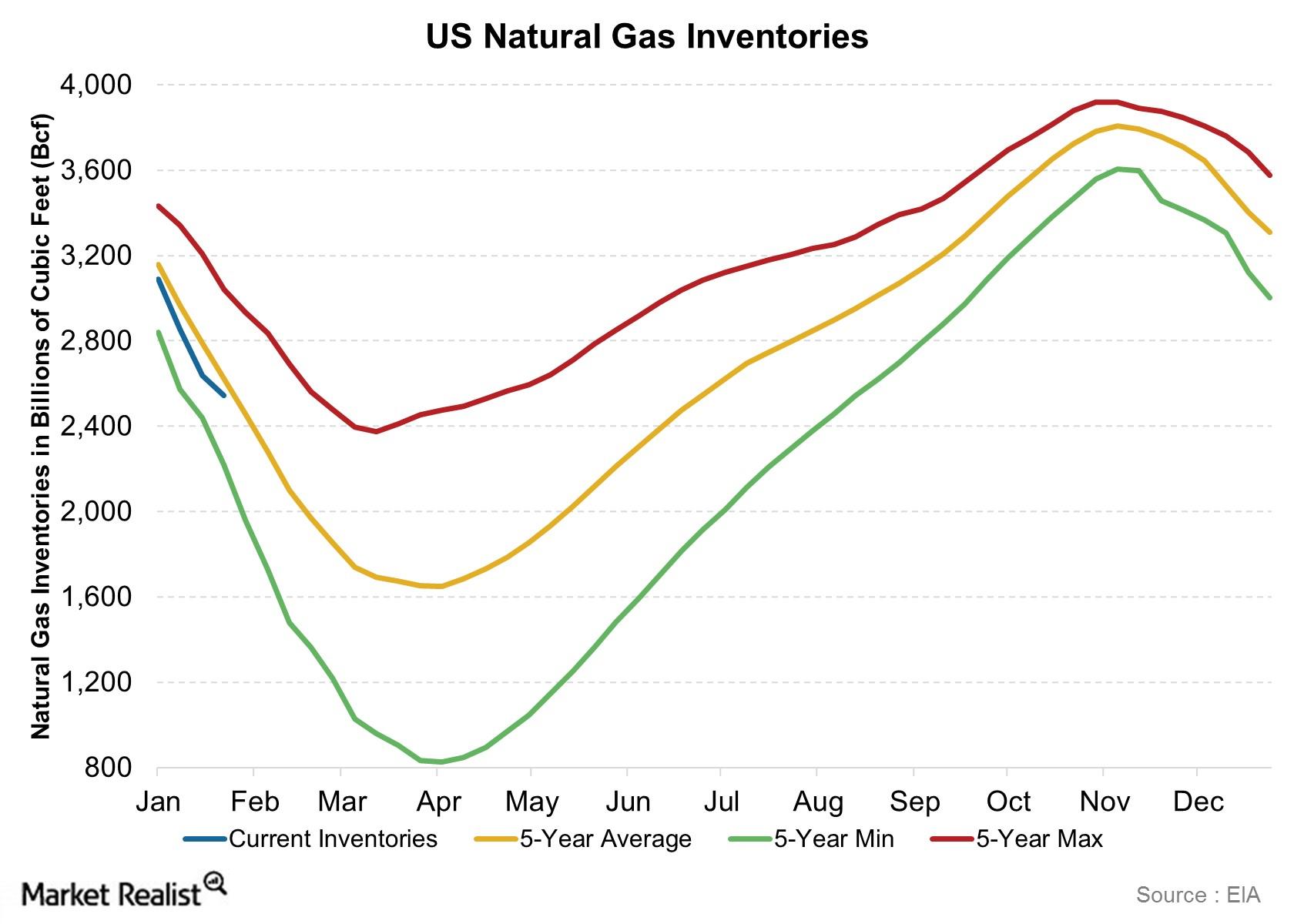

The EIA natural gas inventory report: Why should I care?

Natural gas inventory levels have a direct bearing on natural gas prices, which in turn affect the profitability of natural gas producers.

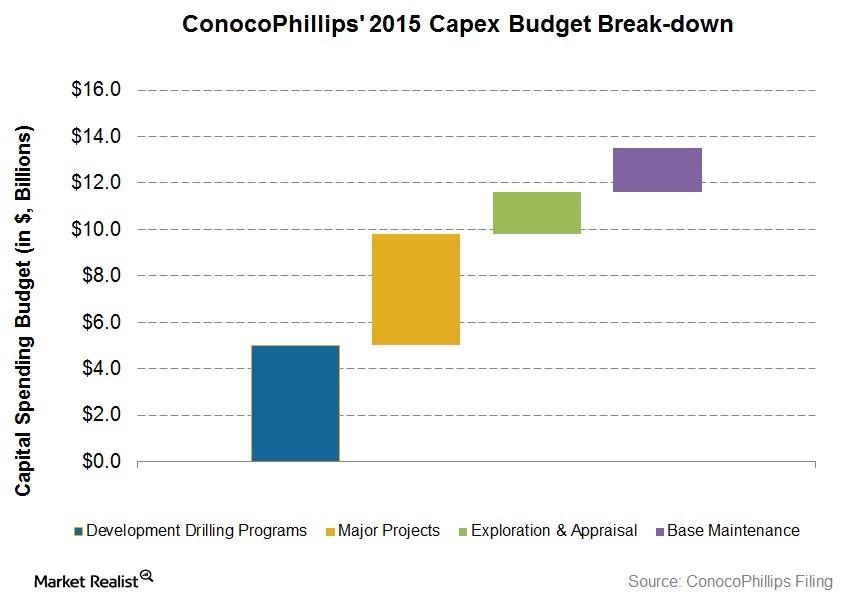

A key analysis of ConocoPhillips’ capex breakdown for 2015

ConocoPhillips’ capex breakdown for 2015 includes major projects, development drilling, exploration and appraisal, and base maintenance.

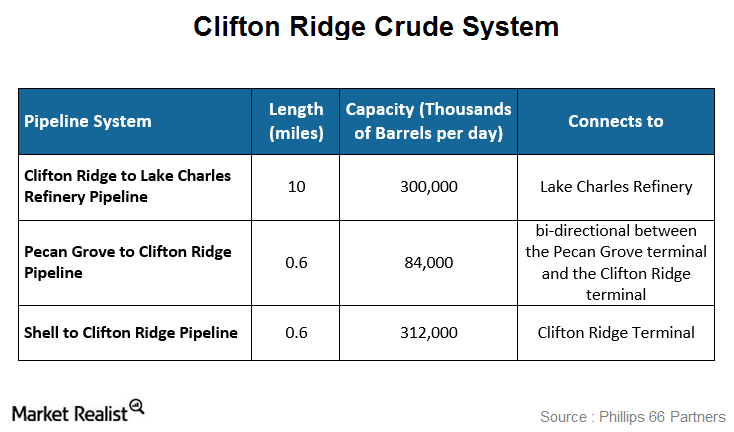

Phillips 66 Partners: The Clifton Ridge crude system

The Clifton Ridge crude system is made up of three pipelines and two terminals. It supports the Lake Charles refinery in Westlake, Louisiana.

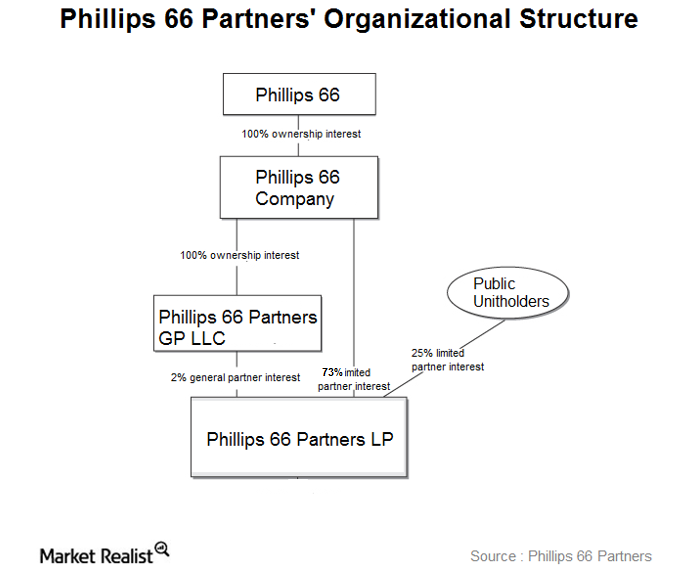

Business overview: Phillips 66 Partners

Phillips 66 Partners (PSXP) is a master limited partnership formed by Phillips 66 (PSX). PSXP operations are integral to PSX refineries.

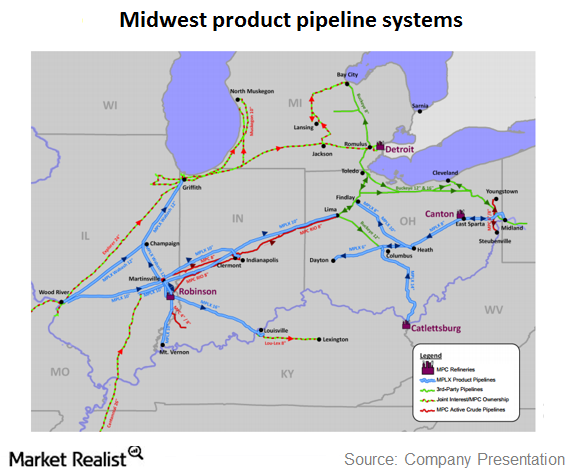

The MPLX Midwest product pipeline systems

Canton to East Sparta consists of two parallel pipelines that connect MPC’s Canton refinery with the MPLX East Sparta, Ohio, breakout tankage and station.

Overview: Plains All American Pipeline’s gas storage facilities

Currently, there are three major publicly traded independent storage firms, Plains All American Pipeline’s (PAA) natural gas storage subsidiary (PAA Natural Gas Storage), Niska Gas Storage Partners (NKA), and Crestwood Equity Partners (CEQP). PAA is part of the Alerian MLP (or master limited partnership) ETF (AMLP), while CEQP is part of the Global X MLP ETF (MLPA).

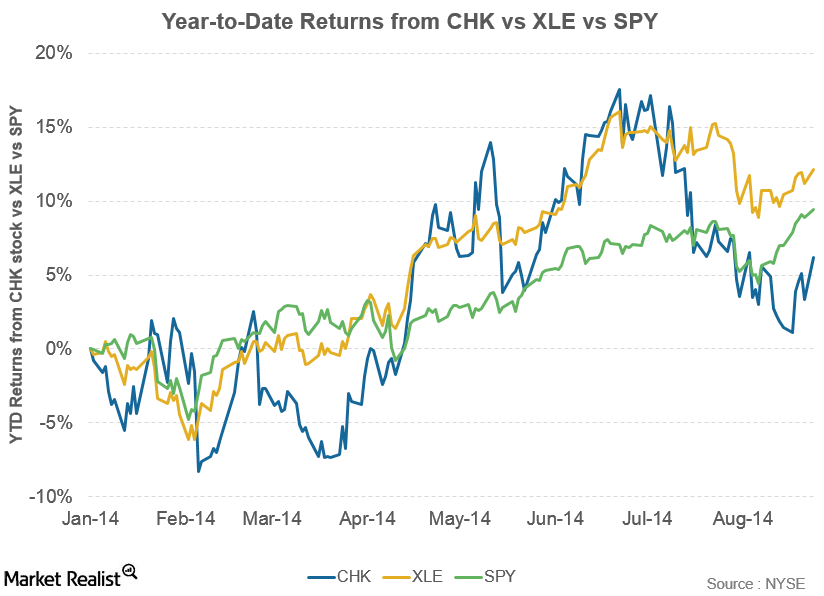

An investor’s must-read introduction to Chesapeake Energy

Chesapeake Energy (CHK) is an eminent energy exploration and production company in the U.S. Its operations span across the Marcellus, Utica, Niobrara, Mississippian Lime, Eagle Ford, Barnett, and Haynesville shales.

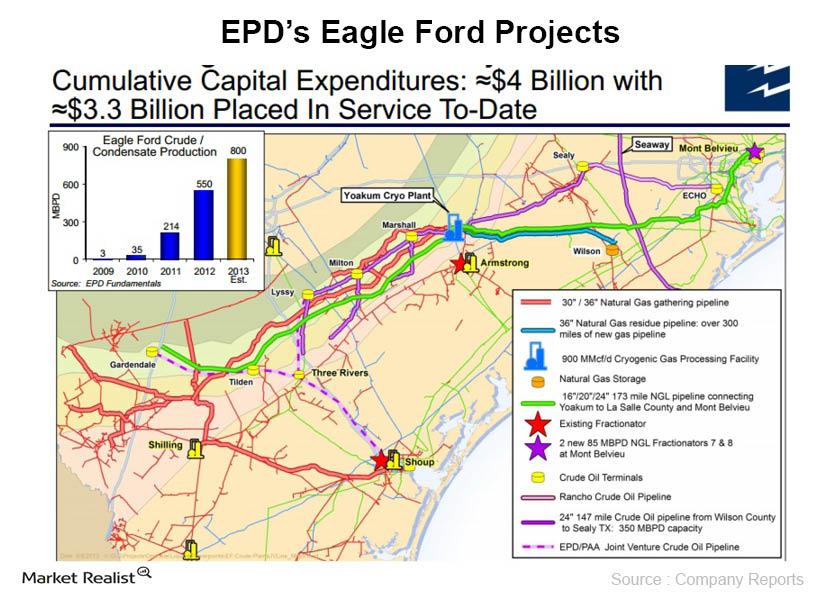

Why Enterprise Products has growth projects in the Eagle Ford

In 2012, EPD entered into a 50:50 joint venture with Plains All American Pipeline (PAA), to service the Eagle Ford Play.