Keisha Bandz

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Keisha Bandz

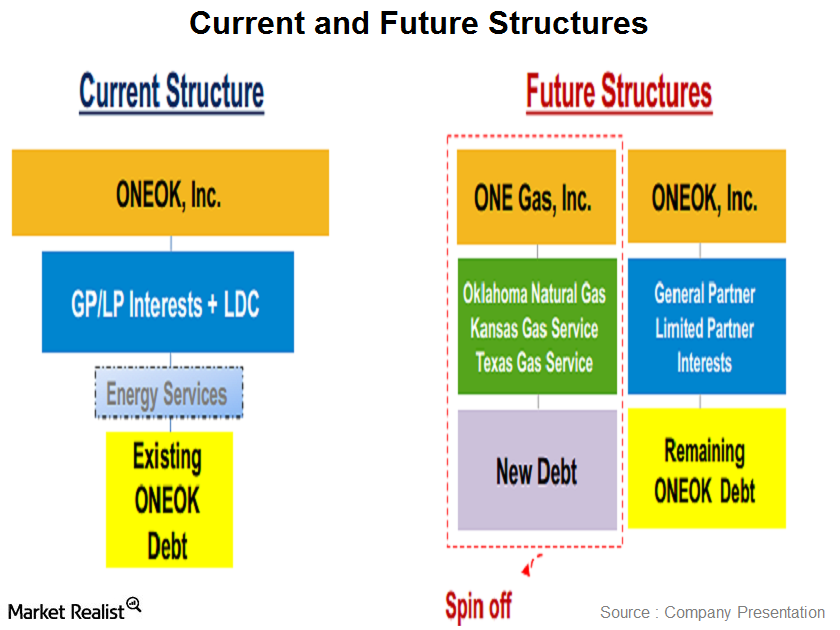

Must-know: Why ONEOK restructured its business, creating ONE Gas

Earlier this year, ONEOK (OKE) created a new stand-alone publicly traded company called ONE Gas (OGS), separating its natural gas distribution business into a separate dedicated company. The company believes that by having two separate companies, each of the companies will have a greater focus on its individual strategy, financial strength, and growth potential.

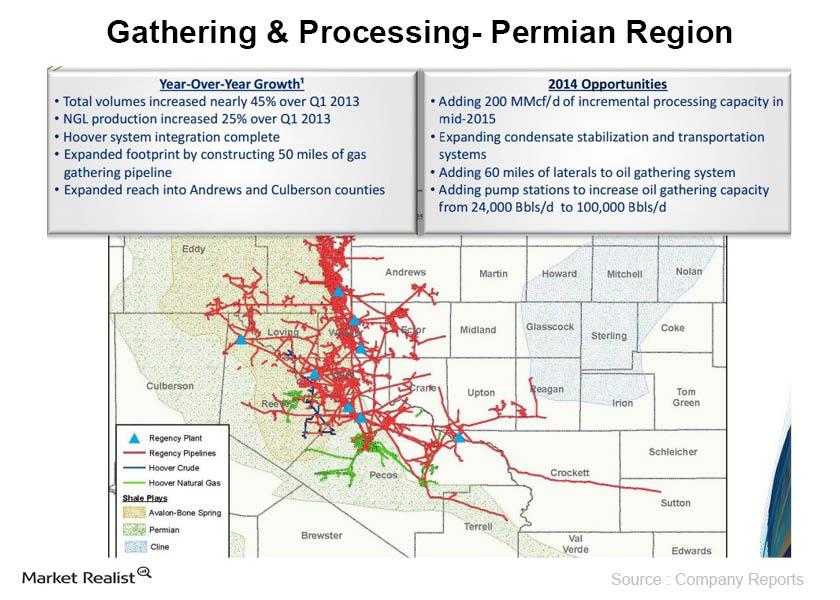

Overview: Regency’s growth projects in 2014

For the full year of 2014, Regency announced growth capex expenditures of $1.2 billion.

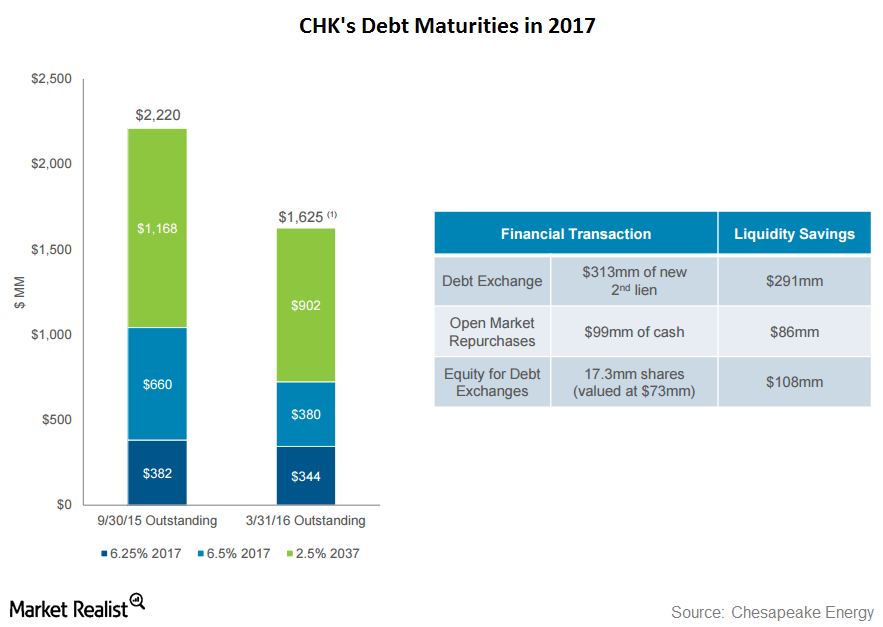

Inside Chesapeake’s Strides toward Debt Reduction and Debt Swaps

On Thursday, May 12, Chesapeake Energy (CHK) disclosed in a regulatory filing that it plans to issue 4.1% of its outstanding equity in exchange for debt.

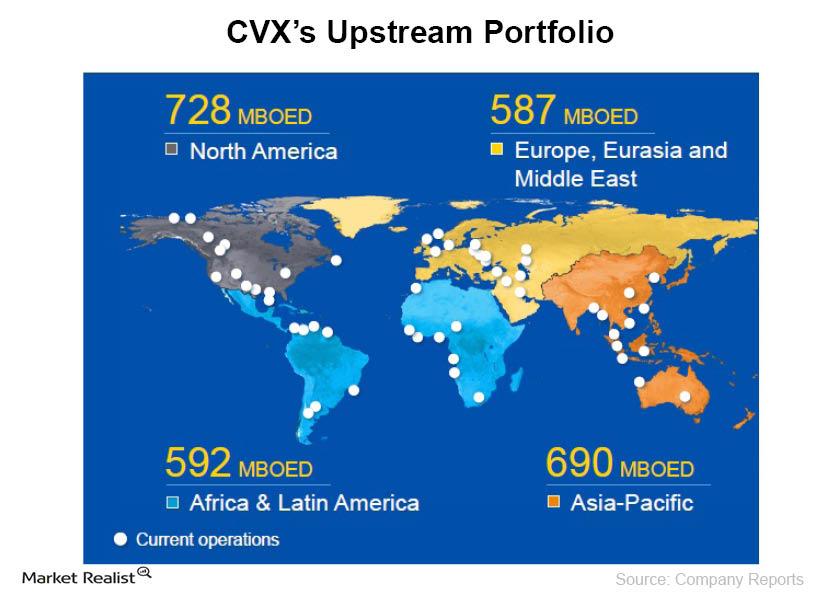

Must-know: An overview of Chevron Corporation

CVX is headquartered in San Ramon, California. It’s an energy company that engages in oil and gas exploration, production, refining, marketing, and transportation of oil and gas.

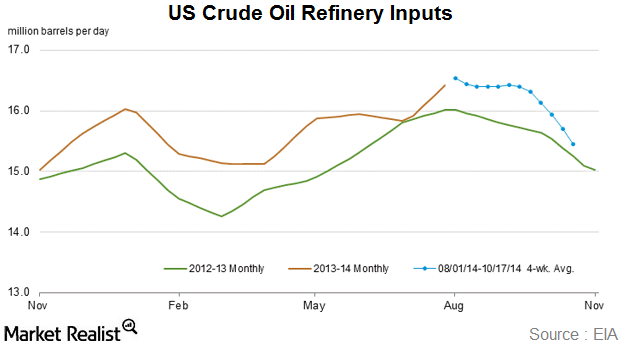

Why peak refinery maintenance season affects crude inventory

U.S. crude oil refinery inputs averaged 15.2 million barrels per day during the week ending October 17. Input levels were 113,000 bpd less than the previous week’s average.

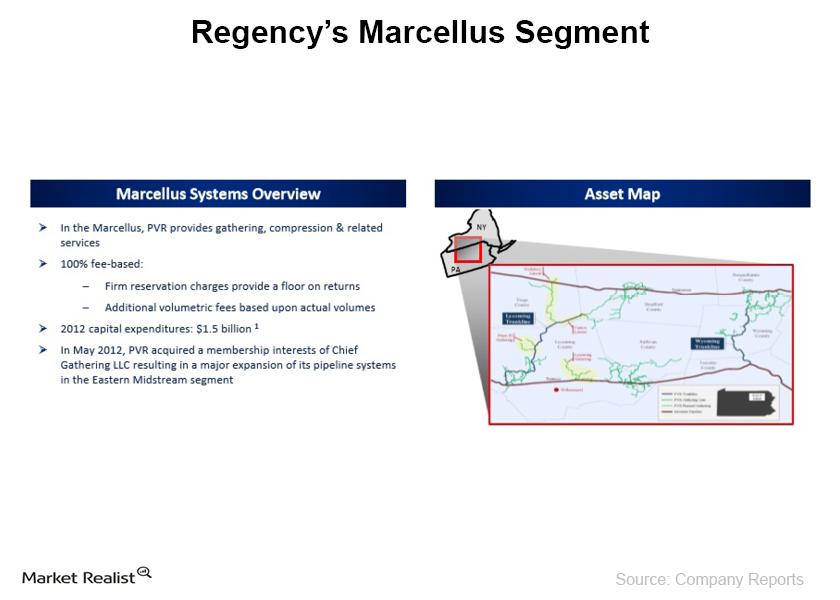

Regency’s PVR Midstream acquisition means Marcellus Shale exposure

Regency recently acquired a foothold in the Marcellus by buying PVR Partners LP in March this year in a deal worth $5.6 billion, specifically to boost its footprint in the Appalachian Basin.

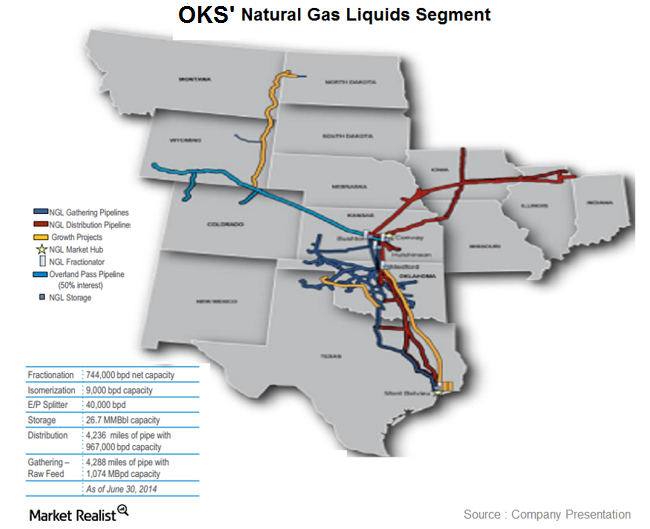

Overview: ONEOK Partners’ natural gas liquids segment

ONEOK Partners’ (OKS) natural gas liquids segment provides natural gas liquid gathering, fractionation, transportation, marketing, and storage services to its producers.

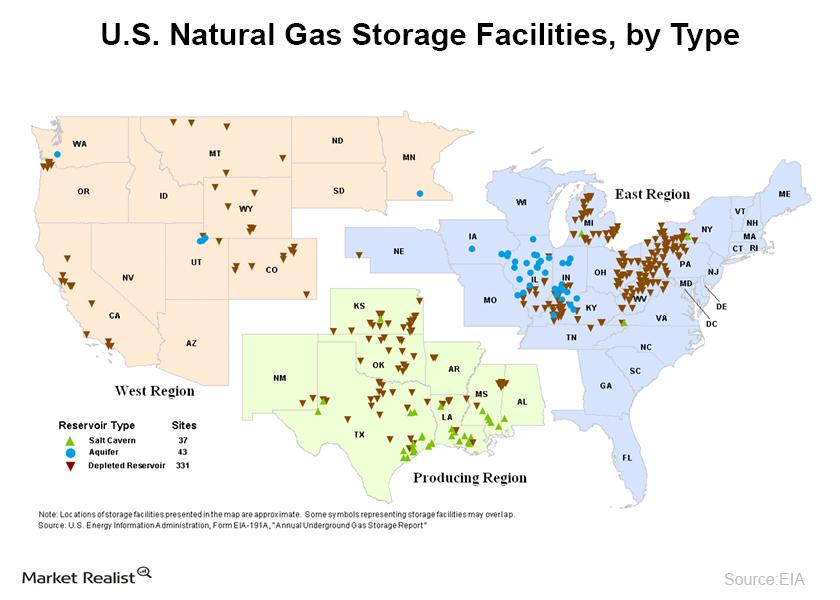

Must-know: Natural gas storage in the U.S.

Natural gas can be stored for an indefinite period of time for later consumption.

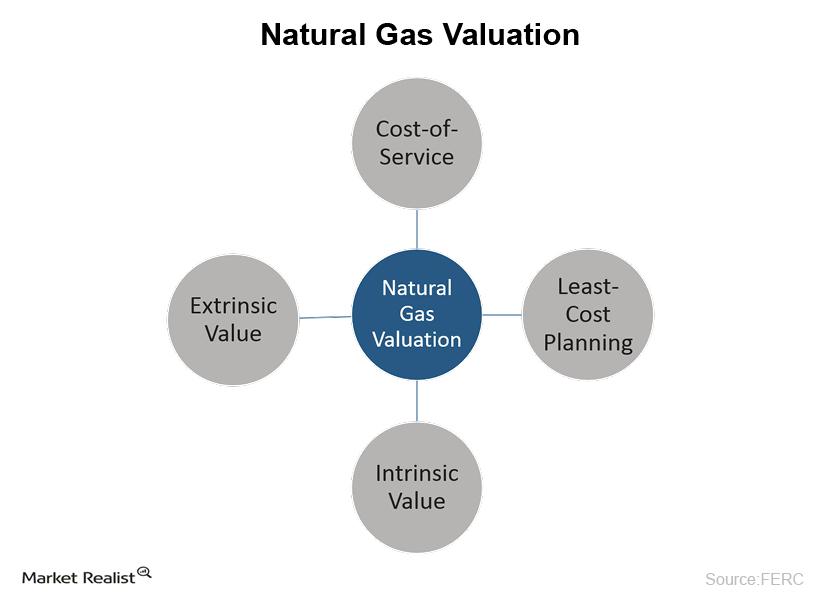

Must-know : A brief overview of natural gas storage contracts

High volatilities in prices increase the extrinsic value of storage assets because it creates more opportunities for profitable storage optimization.

Overview: Plains All American Pipeline’s gas storage services

PAA’s storage facility falls under its supply and logistics segment, which is primarily a margin based segment, which makes it more volatile.

Overview: Magellan Midstream Partners L.P.

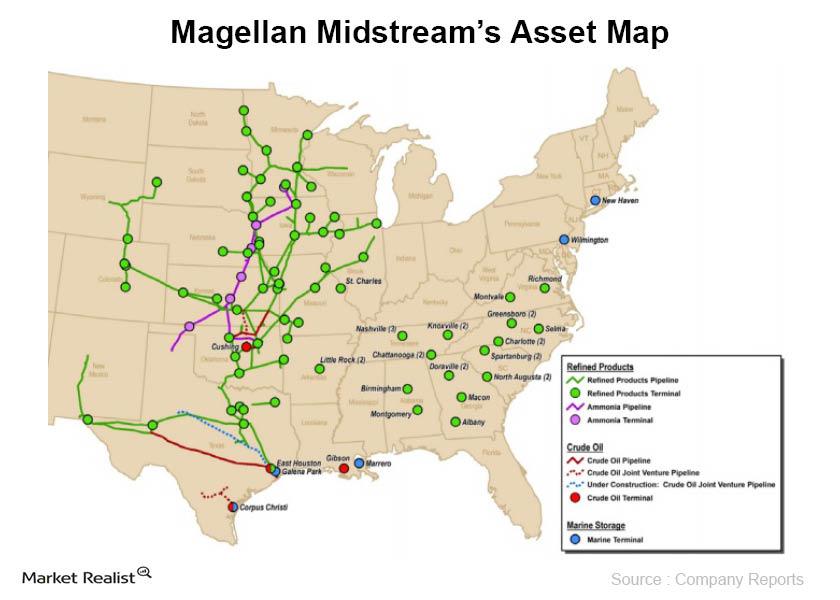

Magellan Midstream Partners L.P. (MMP), is a master limited partnership (or MLP) that owns and operates a diversified portfolio of energy infrastructure assets.

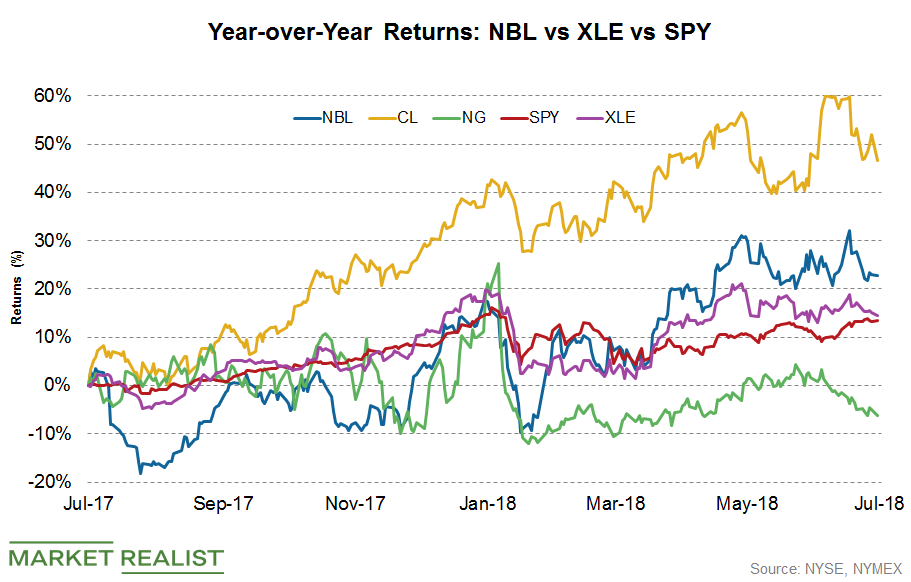

How Has Noble Energy Stock Been Performing Recently?

Year-over-year, NBL stock has risen ~22.7%, while crude oil prices have surged 46.5% in the same period.

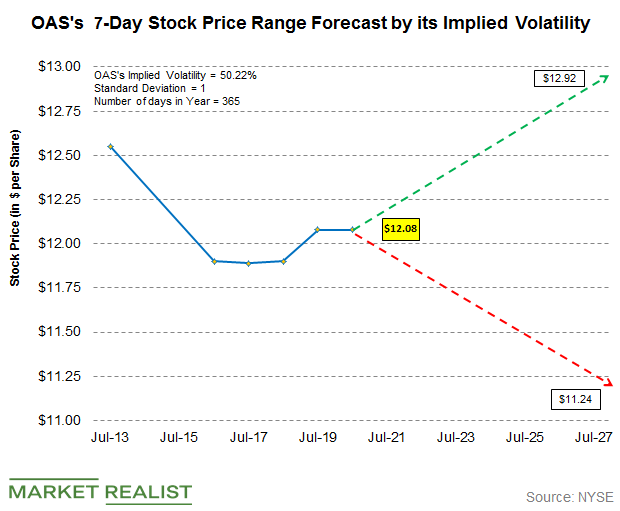

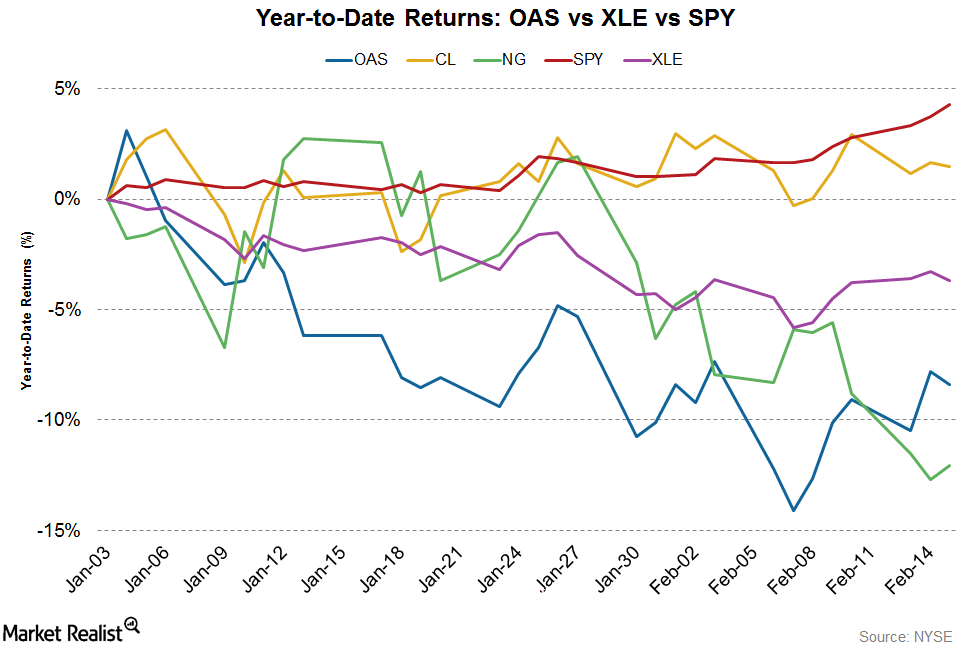

Using Implied Volatility to Forecast Oasis’s Stock Price Range

Oasis Petroleum (OAS) stock’s current implied volatility is ~ 50.22%, which is ~2.08% higher than its 15-day average of 49.19%.

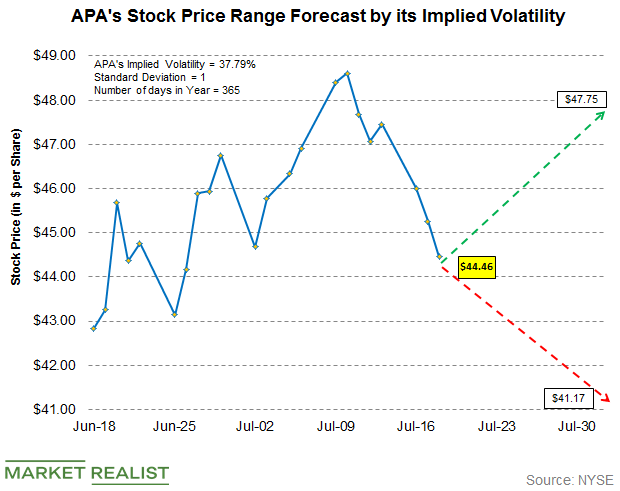

Forecasting Apache’s Stock Price Range

The current implied volatility in Apache’s stock (APA) is ~37.79%. In comparison, the Energy Select Sector SPDR ETF (XLE) has an implied volatility of 17.8%.

Analysts’ Price Targets for Cabot Oil & Gas’s Next 12 Months

Approximately 66.66% of analysts covering Cabot Oil & Gas (COG) recommend “buy,” and 33.33% recommend “hold.”

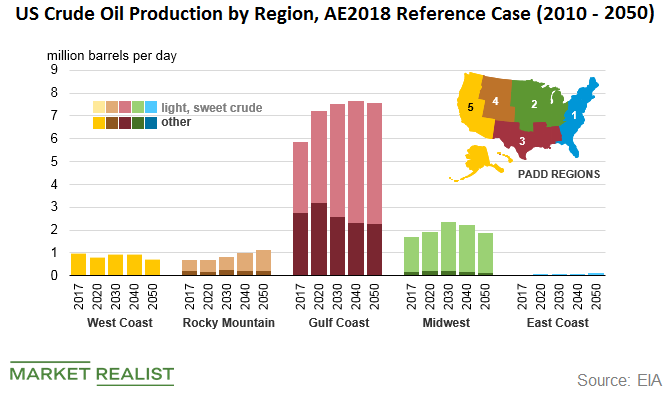

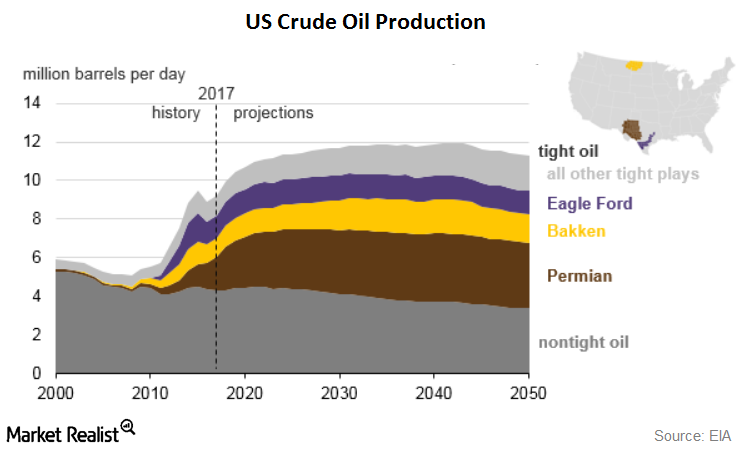

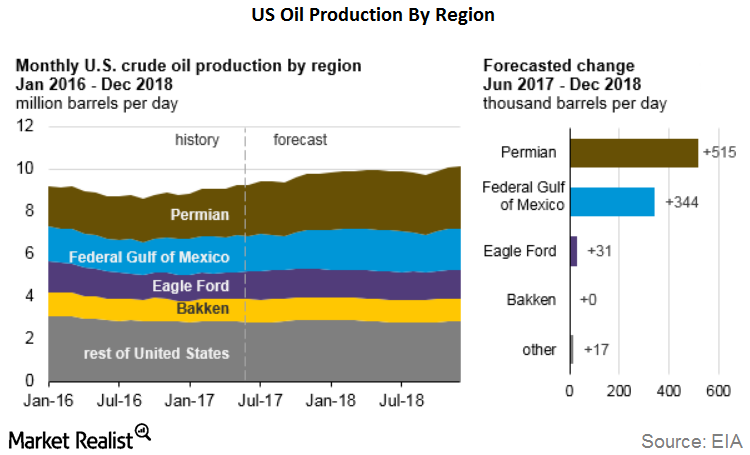

Light Sweet Crude Oil Drives US Crude Oil Production Growth

According to the EIA (U.S. Energy Information Administration), recent growth in US crude oil production has been driven primarily by light, sweet crude oil.

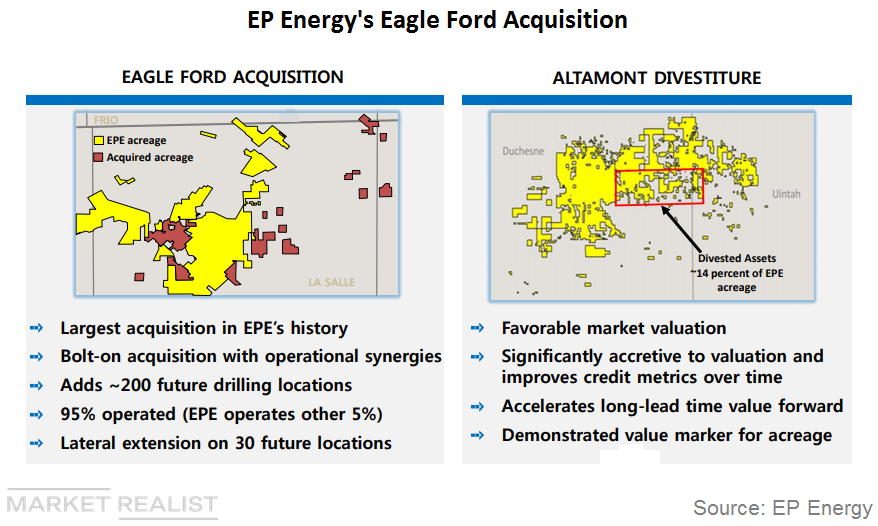

Is EP Energy Increasing Its Focus on Eagle Ford?

In February, EP Energy (EPE) announced that it had closed the acquisition of Carrizo Oil & Gas’s (CRZO) Eagle Ford assets.

Analyzing the Top 5 Upstream Energy Companies

Penn Virginia (PVAC) has the highest forecast capex growth in 2018. The company forecast a capex budget of $340 million in 2018.

Tight Oil Contribution to Rise to 70%: Key Permian Basin Driver

In its “Annual Energy Outlook 2018,” the US Energy Information Administration (EIA) has forecast that US tight oil production will mostly increase through early 2040.

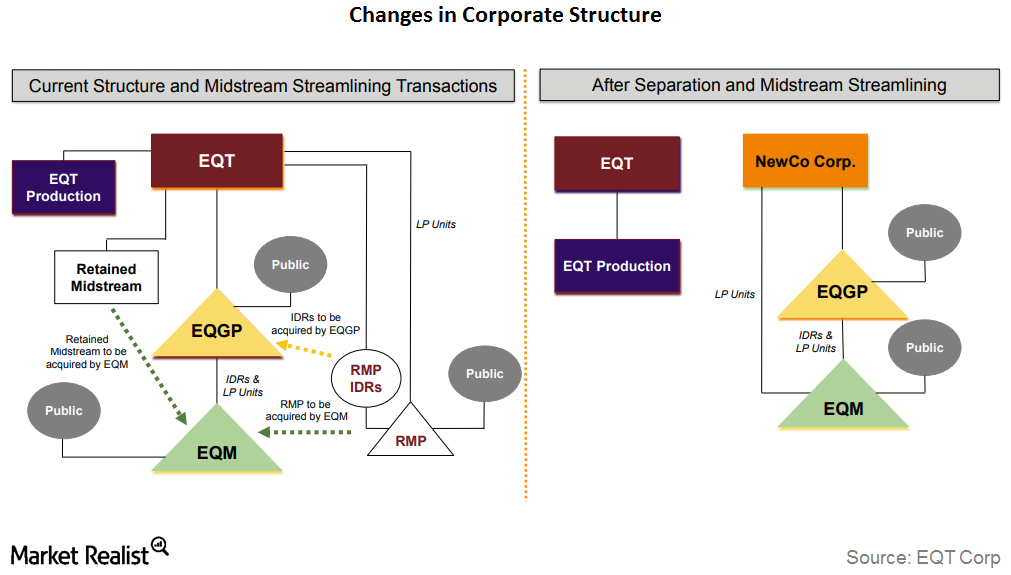

How Will EQT Corporation’s Organizational Structure Change?

After the EQT and Rice Energy merger closes, shareholders of EQT stock will own 65% of the combined company. Rice Energy shareholders will own 35%.

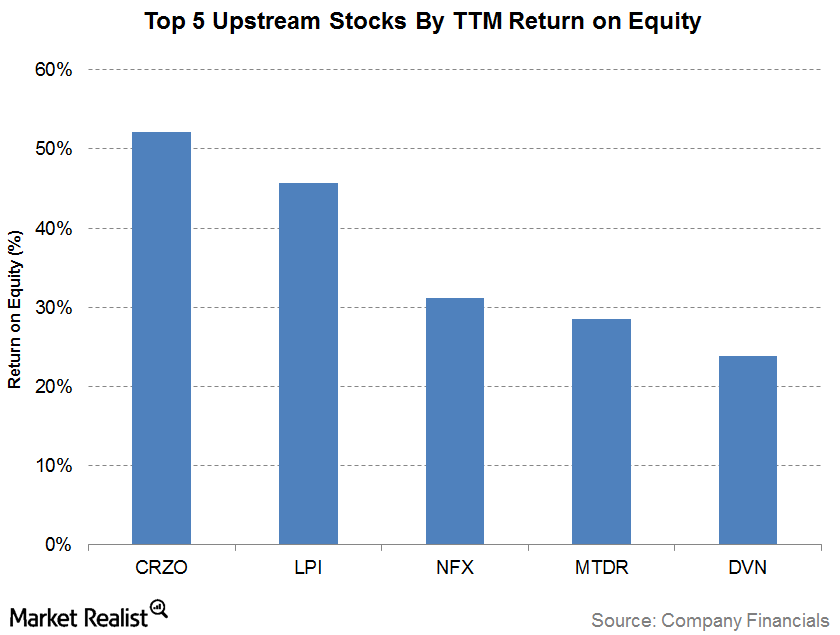

The Top 5 Upstream Companies Based on Return on Equity

The company with the highest trailing 12-month ROE (return on equity) as of 3Q17 is Carrizo Oil & Gas (CRZO) with an ROE of 52.1%.

A Look at Breakeven Prices and Trends i n Eagle Ford Well

According to IHS, the top quintile wells are dominated by EOG Resources (EOG), Marathon Oil (MRO), and ConocoPhillips (COP).

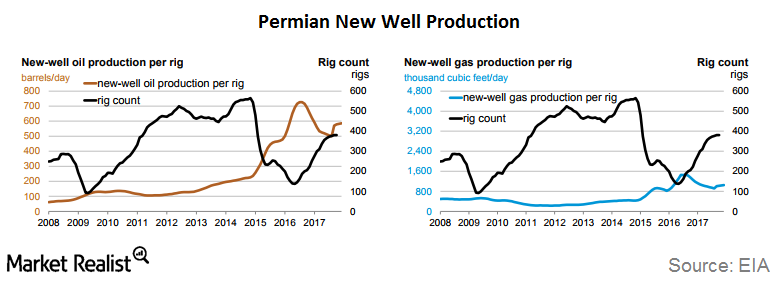

A Look at the Trends in Permian Rig Counts

In the latest US rig count report released by Baker Hughes (BHI), the number of active US rigs drilling for oil rose by two to 751 in the week ended December 8, 2017.

Could Permian Basin Drive Growth in US Crude Oil Production?

In its November Short-Term Energy Outlook (or STEO) report, the EIA forecast that US crude oil production in 2017 would average 9.2 million barrels per day.

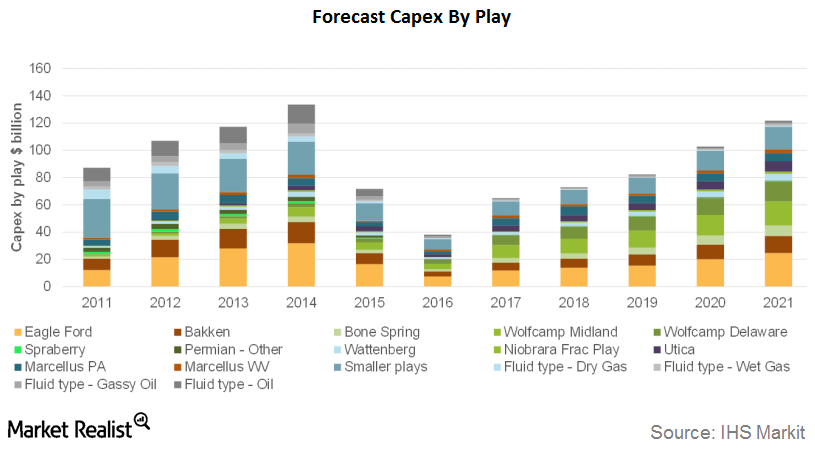

Forecasts for Capital Spending in the Permian Basin

According to a report released by IHS Markit, Permian investments are expected to increase from $8 billion in 2016 to more than $41 billion in 2021.

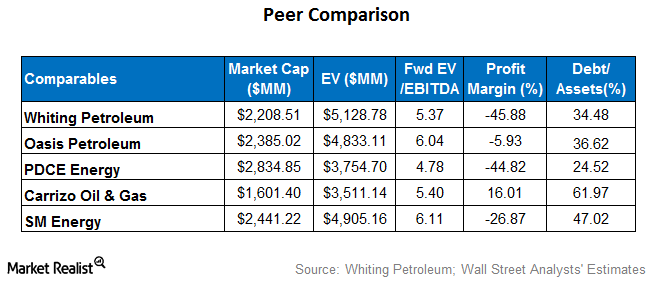

Where Whiting Petroleum Stands Next to Peers

Whiting Petroleum’s (WLL) forward EV-to-EBITDA multiple of ~5.4x is mostly in line with the peer average of 5.5x.

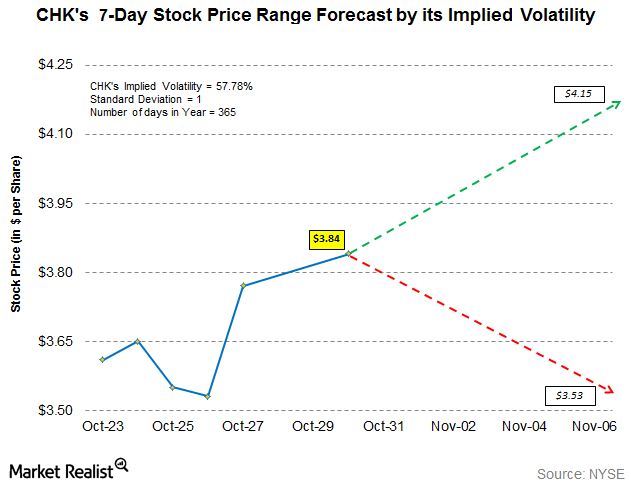

Chesapeake’s Implied Volatility: Stock Price Range Forecast

Chesapeake Energy’s (CHK) implied volatility as of October 30, 2017, was ~58%—9% higher than its 15-day average of ~53%.

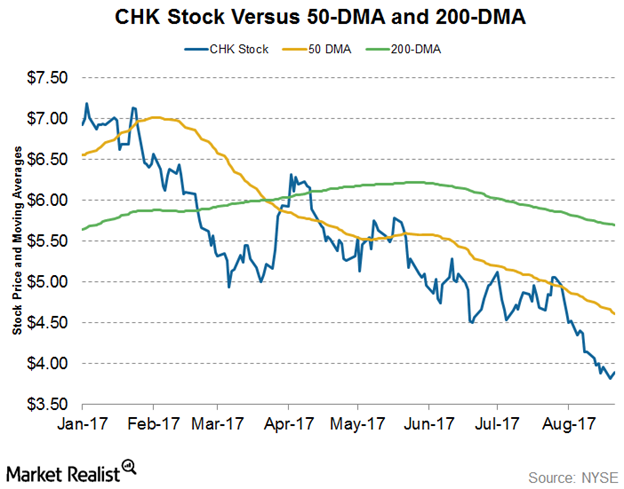

Can Chesapeake Energy Stock Rise from the Doldrums?

Chesapeake Energy stock (CHK) has fallen for most of this year. It picked up slightly in April but wasn’t able to hold those levels.

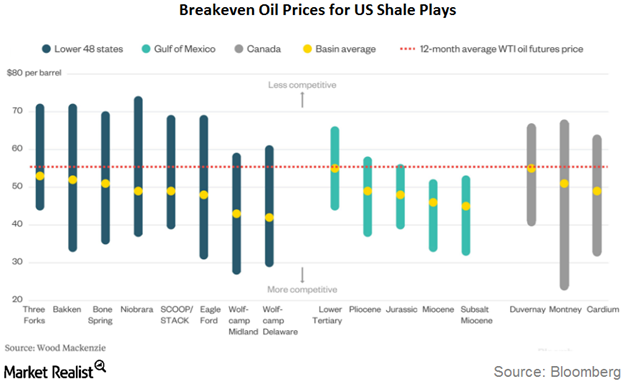

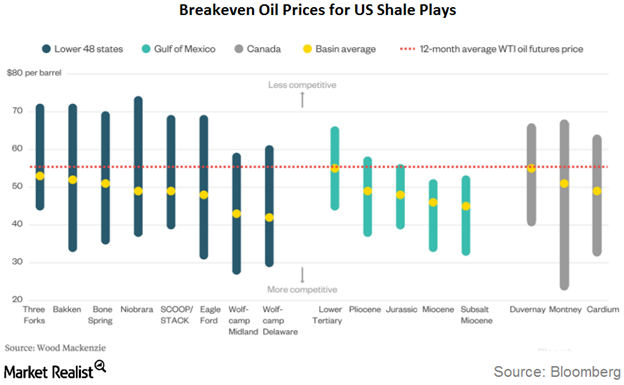

Behind the Break-Even Price Trends for the Permian and Top US Shale Plays

The Midland and Delaware Basins, which are sub-basins of the Permian Basin, had the lowest break-even prices.

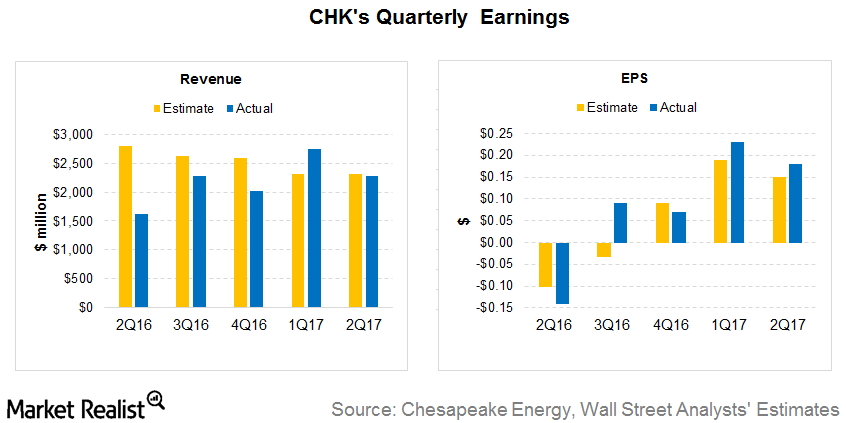

Analyzing Chesapeake’s 2Q17 Revenue and Earnings

On August 3, 2017, Chesapeake Energy (CHK) reported its 2Q17 earnings. The company reported revenue of ~$2.3 billion—in line with analysts’ estimates.

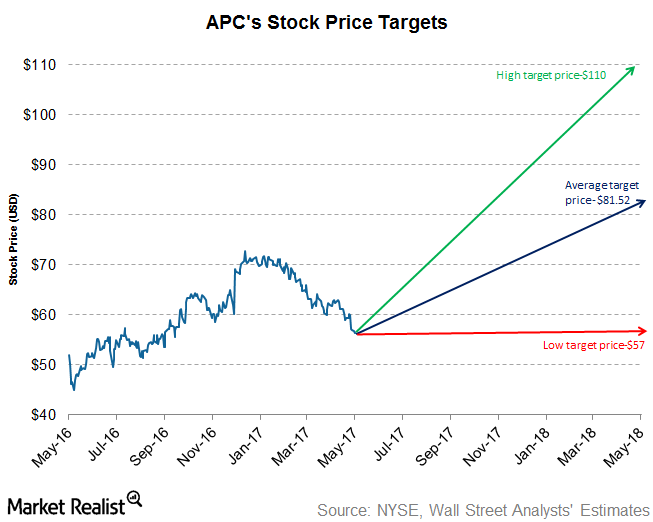

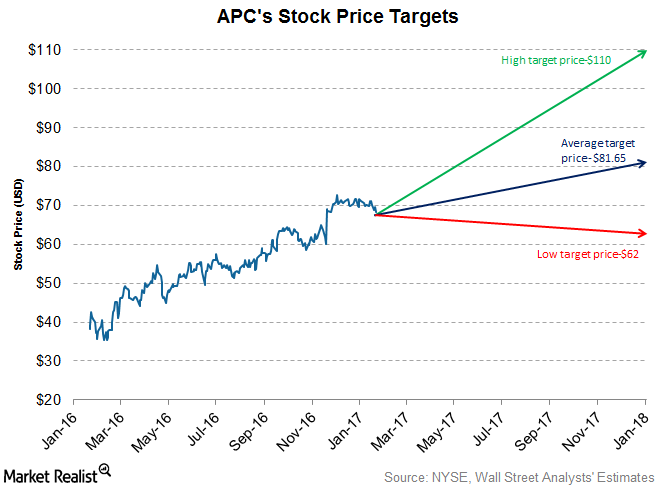

Analyst Recommendations for Anadarko Petroleum after 1Q17

Approximately 83.0% of analysts have rated Anadarko Petroleum (APC) a “buy.” The average broker target price is $81.52.

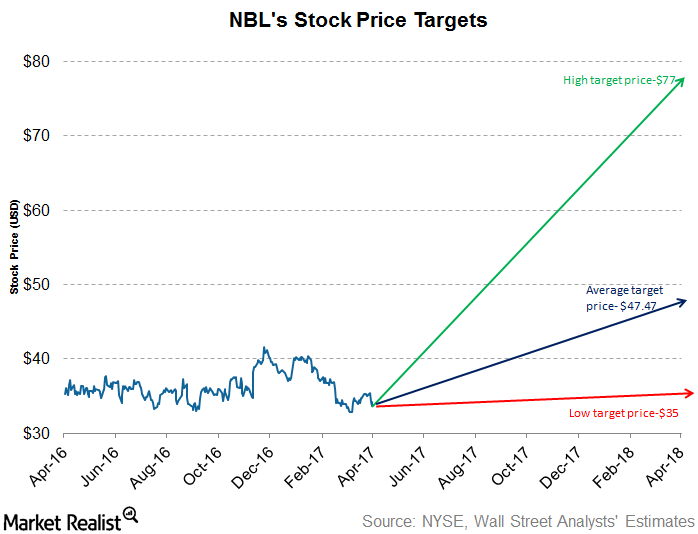

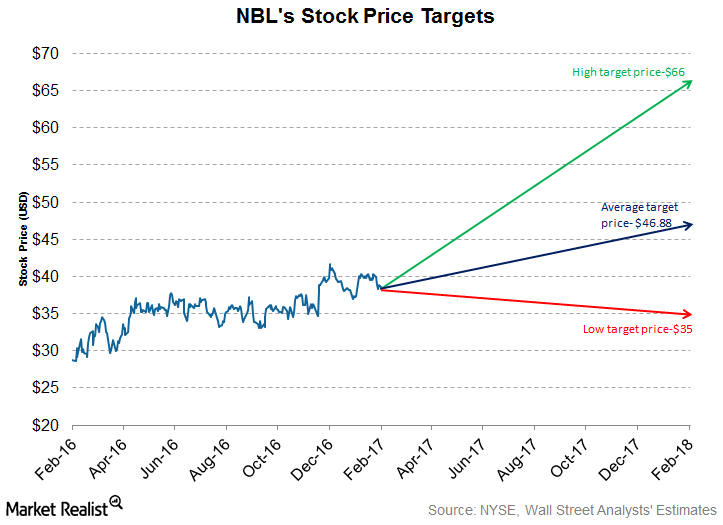

What Are Analysts’ Recommendations for Noble Energy?

Approximately 53% of the analysts rate Noble Energy (NBL) as a “buy” and 32.3% rate it as a “hold.” The average broker target price is $47.47.

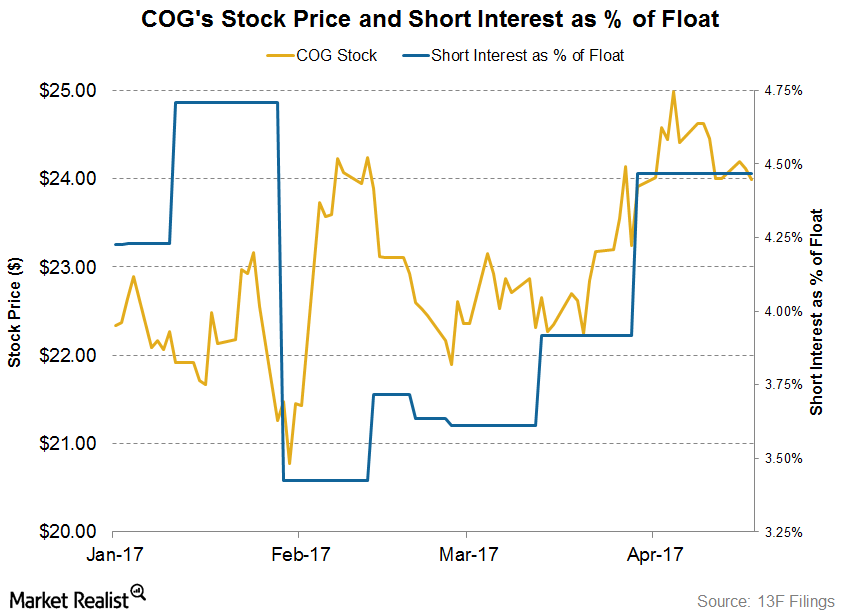

Short Interest Trends in Cabot Oil & Gas Stock

On April 19, Cabot Oil and Gas’s short interest as a percentage of its float was ~4.5%. At the beginning of the year, its short interest ratio was 4.2%.

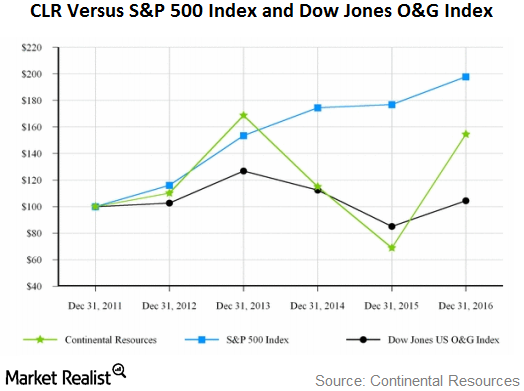

How Has CLR Performed Compared to S&P 500 and Dow Jones?

Let’s take a look at Continental Resources’ (CLR) stock performance in comparison to the performances of the S&P 500 Index and the Dow Jones Oil & Gas Index since 2011.

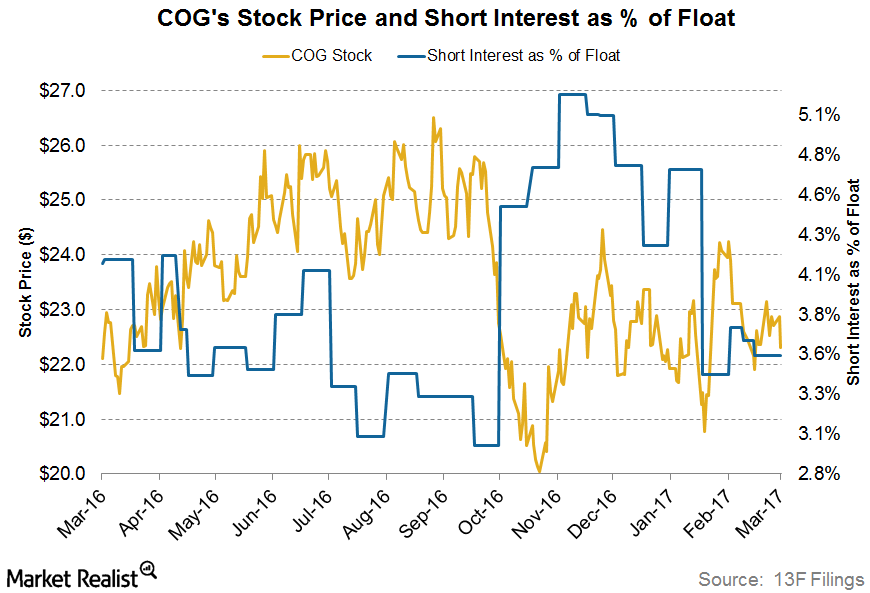

How Short Interest in COG Stock Has Been Trending

On March 14, 2017, Cabot Oil and Gas’s (COG) short interest as a percentage of its float (or its short interest ratio) was ~3.5%.

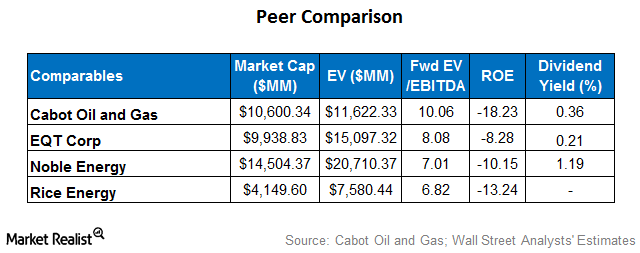

How Cabot Oil and Gas’s Relative Valuation Compares to Peers

A peer group comparison shows that Cabot’s forward EV-to-EBITDA multiple of ~10.1x is higher than that of its peers.

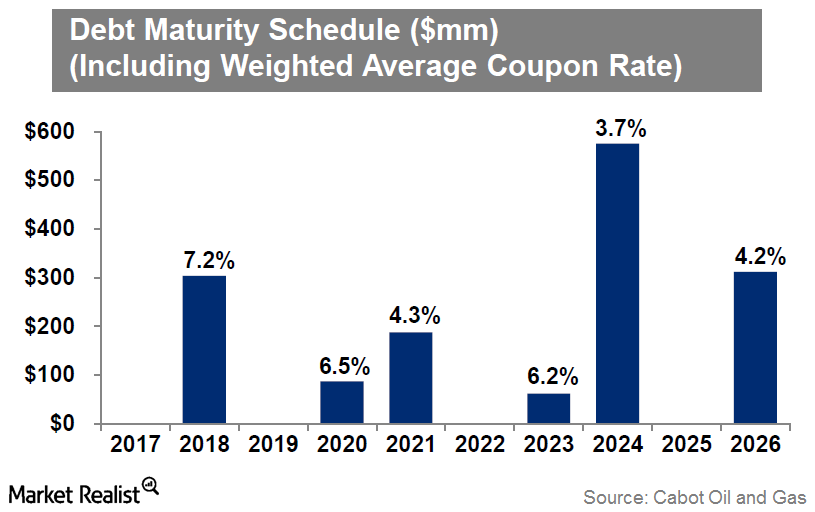

Analyzing Cabot Oil and Gas’s Debt Maturity Profile

Cabot Oil and Gas (COG) noted that it doesn’t have any debt maturing until 2018.

What Do Analysts Recommend for Whiting Petroleum?

Approximately 38.5% of the analysts rated Whiting Petroleum (WLL) as a “buy,” while ~56.4% rated it as a “hold.” The average broker target price is $14.28.

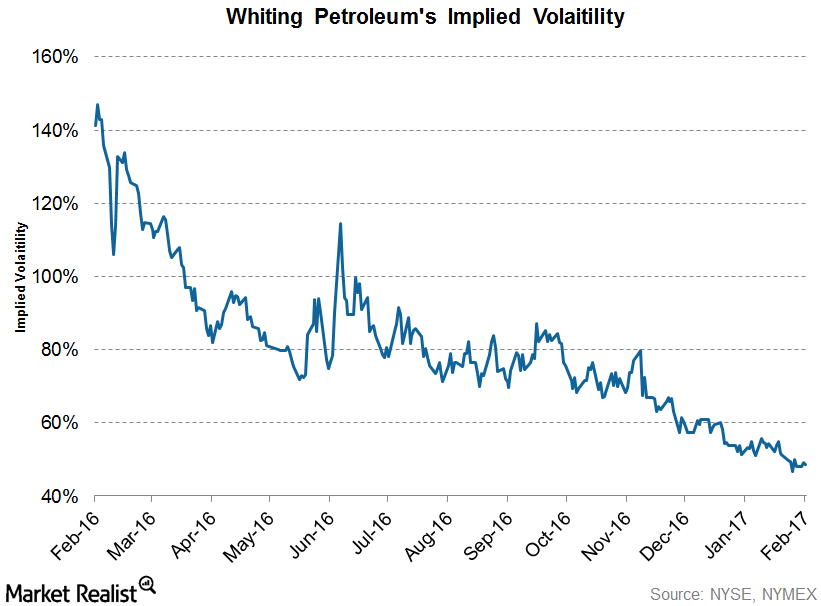

Whiting Petroleum’s Implied Volatility: Key Trends

Whiting Petroleum’s (WLL) implied volatility as of February 22, 2017, was 48.5%, which was ~4.3% lower than its 15-day average of 50.7%.

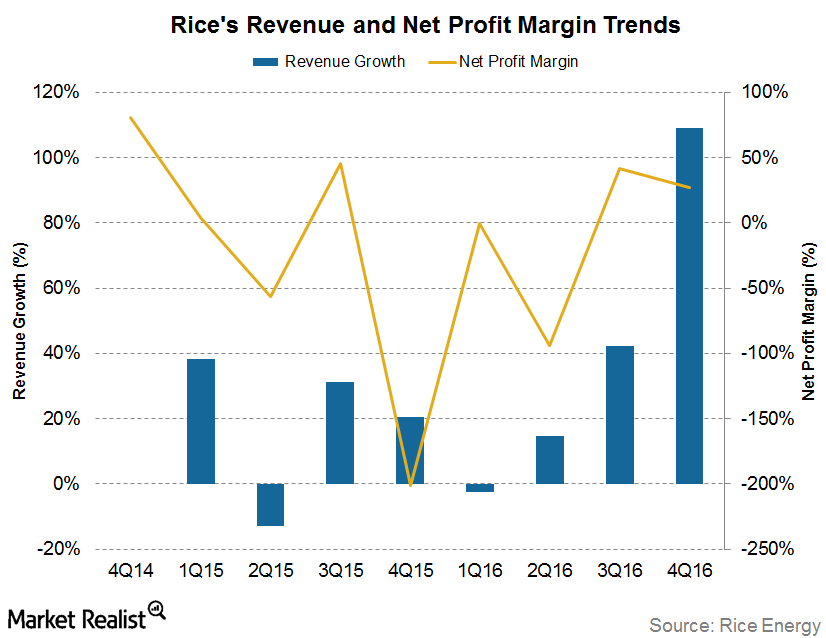

Rice Energy’s Revenue Growth and Net Profit Margin Trends

Rice Energy’s (RICE) 4Q16 revenue rose ~109.0% YoY (year-over-year).

Is Oasis Petroleum Stock Worth the Bet?

Oasis Petroleum (OAS) hasn’t had a good 2017 so far. In early February, the stock declined with several other energy stocks.

What Analysts Recommend for Noble Energy after Its Earnings

Approximately 67.0% of the analysts rate Noble Energy (NBL) as a “buy” and 33.0% rate it as a “hold.” The average broker target price is $46.88.

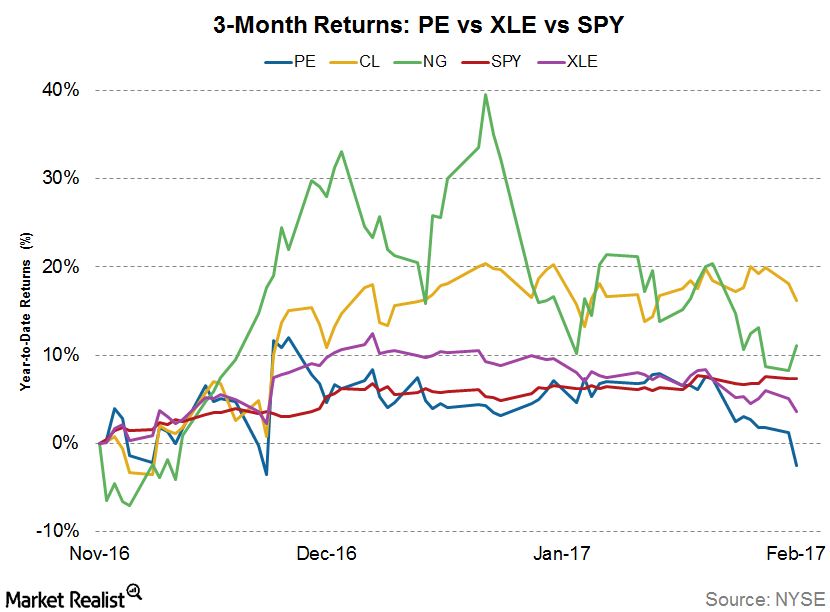

How Did Parsley Energy’s Stock React to Acquisition News?

Parsley Energy’s (PE) latest acquisition news came after markets closed on February 7, 2017.

What Analysts Recommend for Anadarko after Its 4Q16 Earnings

The average broker target price of $81.65 for Anadarko Petroleum implies a potential return of ~19.4% for the stock in the next 12 months.

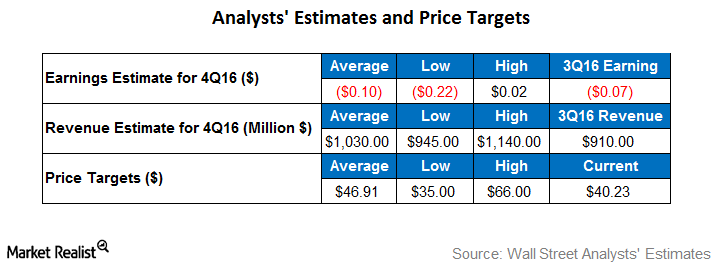

What Are Analysts’ Recommendations and Forecasts for NBL?

For 4Q16, analysts have an average earnings estimate of -$0.10 per share for Noble Energy (NBL). The low estimate stands at ~-$0.22 per share.

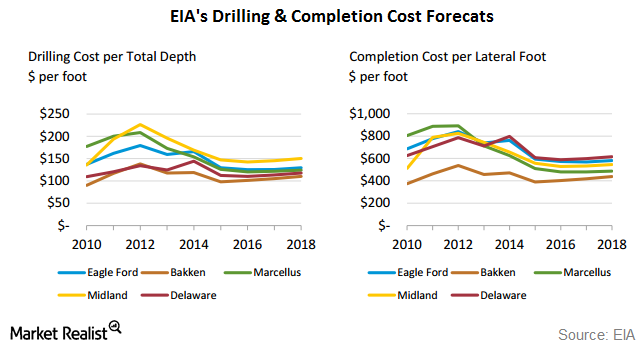

Well Cost Trends in the Permian Basin

The EIA and IHS Global have revealed that the average well-drilling and completion costs in major US regions, including the Permian, will likely decline.

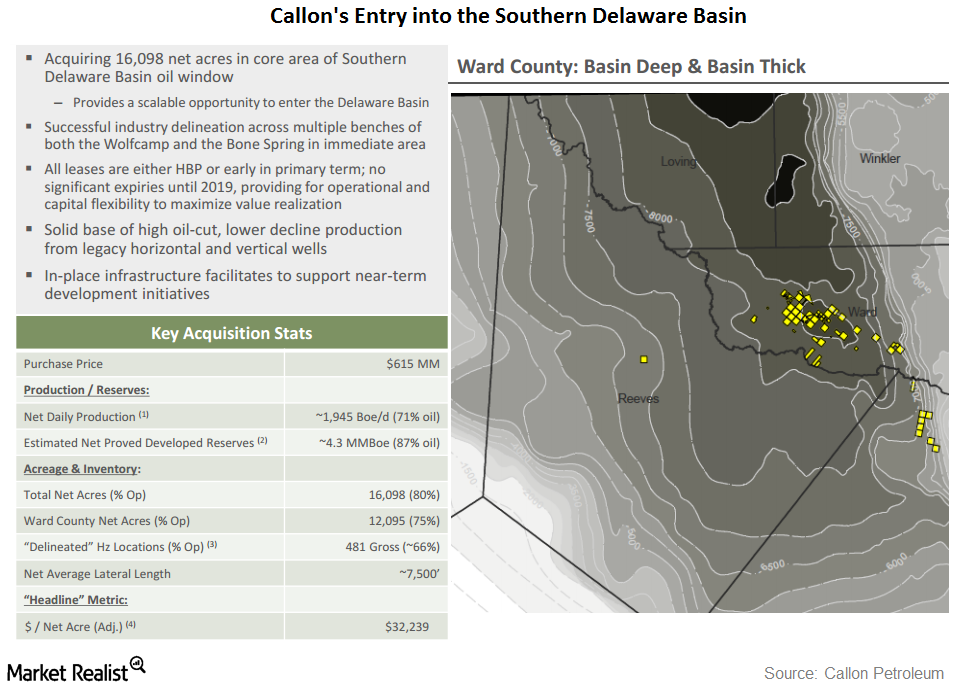

Callon Petroleum Makes Its First Delaware Basin Acquisition

On December 13, Callon Petroleum announced that it had agreed to acquire certain acreage positions and oil- and gas-producing properties from Ameredev.

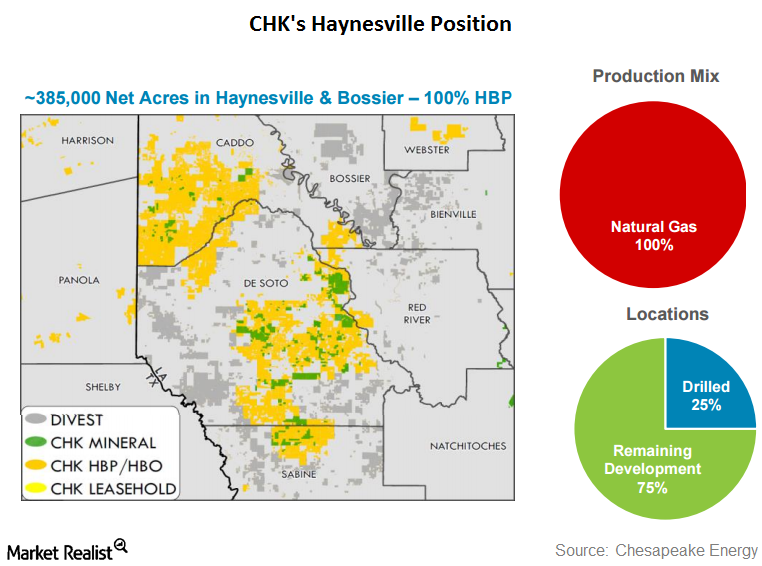

Chesapeake Energy Announces Haynesville Asset Divestiture

Chesapeake Energy (CHK) announced on December 5 that it had agreed to sell 78,000 net acres in Louisiana’s Haynesville Shale for $450 million. The buyer is an undisclosed private player.

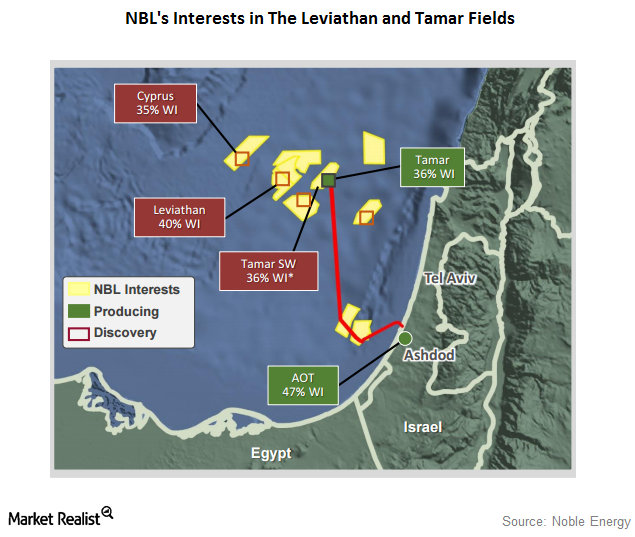

The Leviathan Gas Field: Noble Energy’s Key Discovery

In December 2010, Noble Energy (NBL) announced a major natural gas discovery at Leviathan, off the shore of Israel.

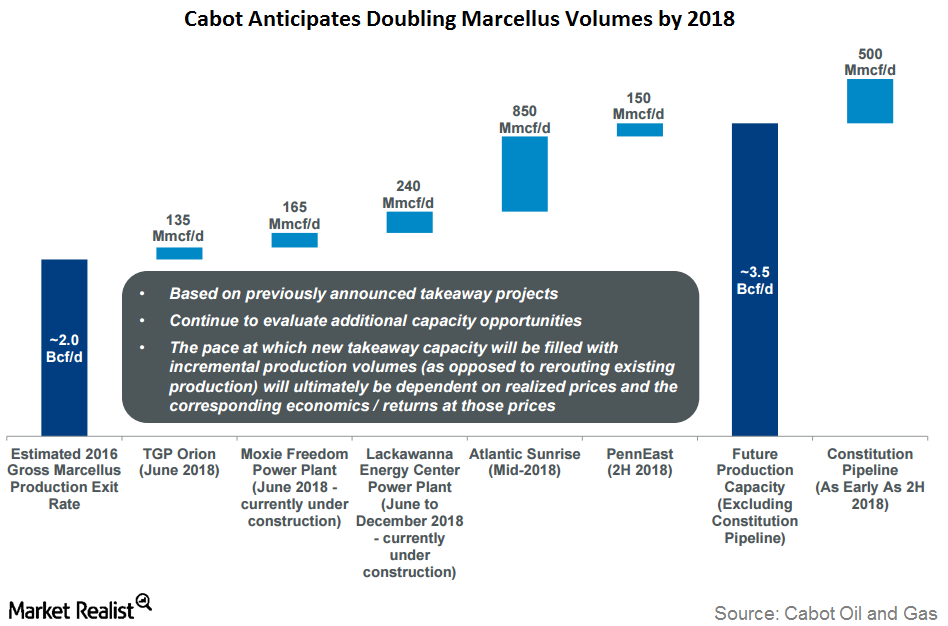

Why Cabot Awaits the Atlantic and Constitution Pipeline Projects

Cabot Oil & Gas’s stock price momentum has slowed, but its stock has recently been rising, mirroring natural gas prices.