David Ashworth

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From David Ashworth

Bernstein Weighs In on the Fed Being Blamed for Bull Market

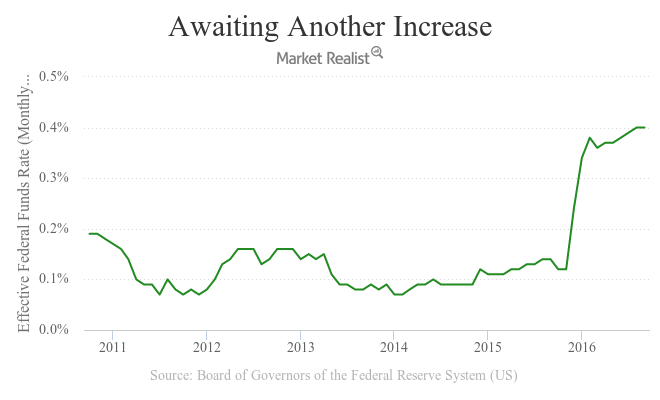

Rate cut and stocks Monetary accommodation is generally good for stocks. A cut in interest rates makes borrowing cheaper for households and businesses, pushing them to spend and invest. A rate cut is good for stocks because it allows companies to borrow money at lower interest rates and invest in new plants, machinery, or operation expansion, […]

No Tapering, No Extension: ECB Avoids Future Talk on QE

ECB chief Mario Draghi had nothing to say about either tapering or extension of the bond buying program.

Richard Bernstein: Don’t Fear the Bear Market

A legitimate bull market In this series, we’ve taken a look at Richard Bernstein’s views on investors’ fear of an impending bear market. In Richard Bernstein Advisors’ October Insights newsletter, he rejects the notion that the current rise in US stocks (SPLV) (OEF) has been brought about only by the Fed’s easy monetary policy. In the […]

How Delayed Monetary Accommodation Can Cause a Recession

Retracting monetary accommodation on time is crucial as well. This was the chief reason why three dissents took place in the September FOMC.

Why Were Fed Policymakers Worried about Clear Communication?

The credibility of the Federal Reserve was a concern raised by some policymakers at the September FOMC (Federal Open Market Committee) meeting.

Policymakers Are Getting Vocal about the Fed’s Credibility

The issue of the Fed’s credibility is not a new one. The effectiveness of the prolonged monetary accommodation has sparked a lot of debate in the past.

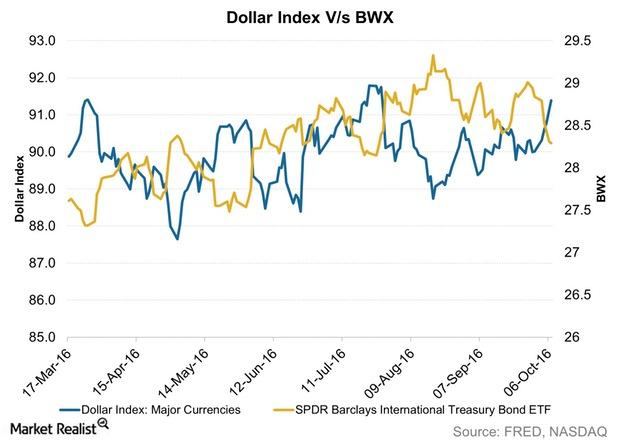

How Does a Strong Dollar Impact International Bonds?

When we talk about the relationship between the US dollar and bonds and how currency movements impact bonds, we’re essentially talking about international bonds.

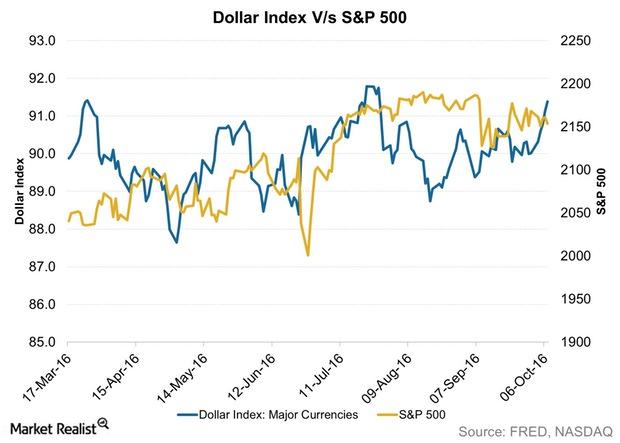

How Does a Strong Dollar Affect Stocks?

The relationship between the US dollar and US stock indexes can be best said to be complex. It’s mostly a change in the greenback that impacts stocks.

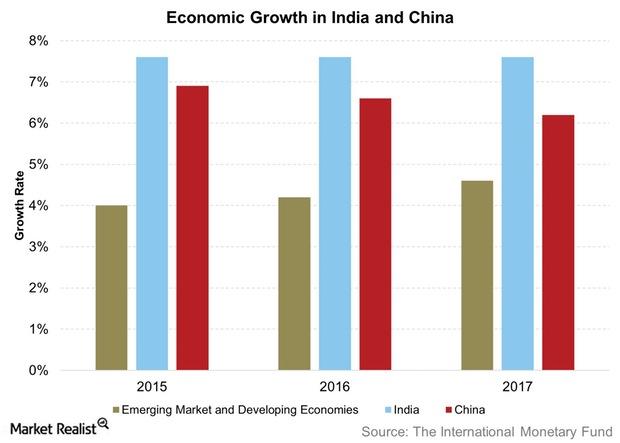

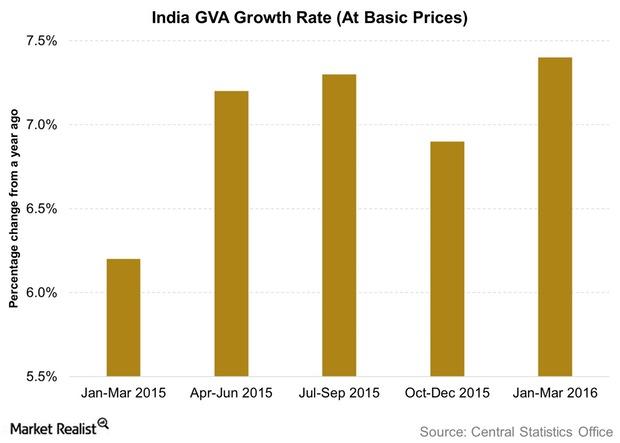

India’s Economic Growth Strong, While China’s May Be Stabilizing

In its October World Economic Outlook, the IMF projected that India’s economic growth would reach 7.6% in both 2016 and 2017.

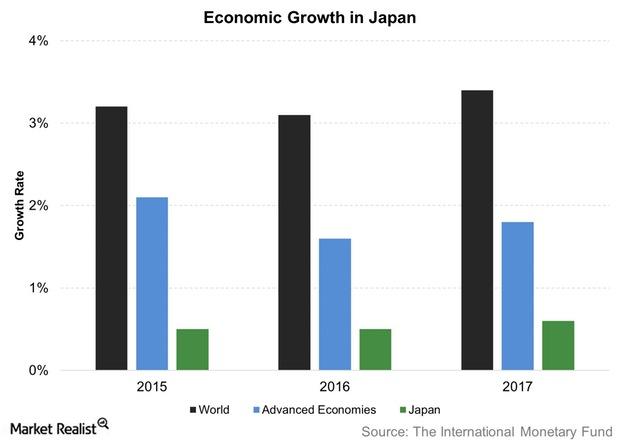

The IMF Sees Improvement in Japanese Economic Growth Forecasts

The IMF expects Japanese economic growth to be 0.5% in 2016—the same as in 2015—and to tick up to 0.6% in 2017.

Behind the Risks Affecting Global Economic Growth

The IMF cited the “fraying consensus about the benefits of cross-border economic integration” visible in the UK’s Brexit vote as a slowdown factor.

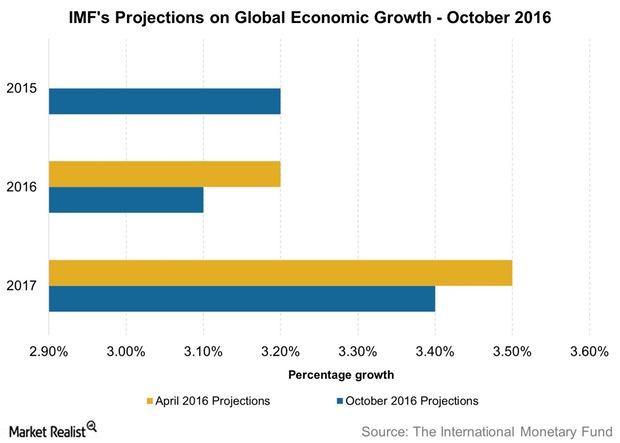

International Monetary Fund Weighs in on Slowing Global Economy

In its October World Economic Outlook report, the IMF estimated that the global economy will likely continue to slow down, reaching growth of 3.1% in 2016.

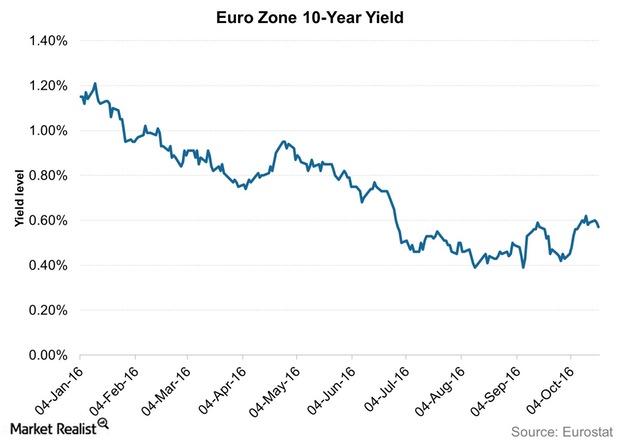

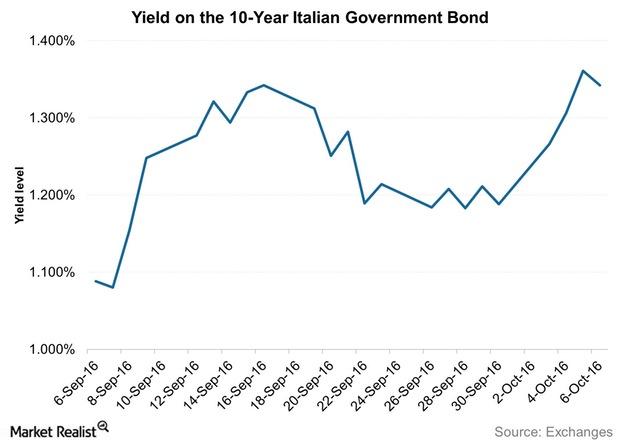

Why All the Talk about Tapering in Europe?

It’s important to remember that the ECB (European Central Bank) hasn’t officially announced that it’s discussing tapering

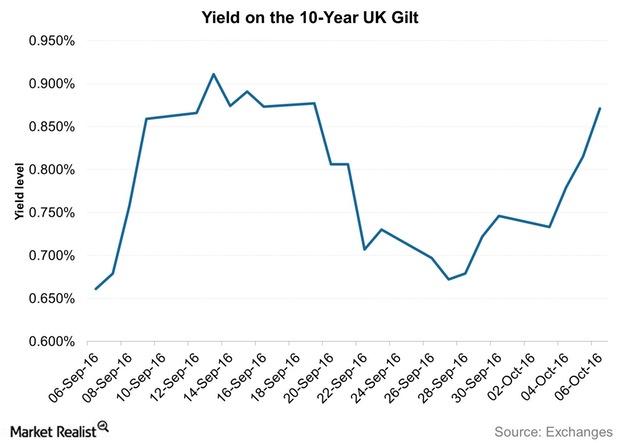

Should You Short European Bonds due to Taper Talks?

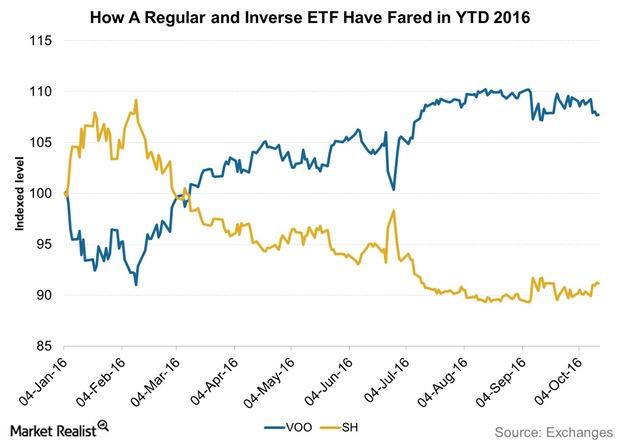

Like their equity peers, bonds can be short-sold as well. You can do it by either shorting an ETF or investing in an inverse ETF.

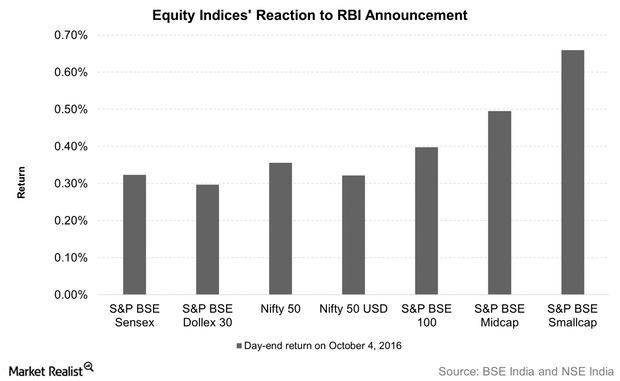

Indian Equities Rise after the RBI’s October 2016 Monetary Policy Announcement

Equities gain Indian equities rose on October 4, 2016, the day of the RBI’s (Rerserve Bank of India) latest monetary policy announcement. The central bank’s cut of its repo rate had a positive effect on equities, with bonds rising initially along with the Indian rupee. Banking and telecom stocks were among major gainers during the […]

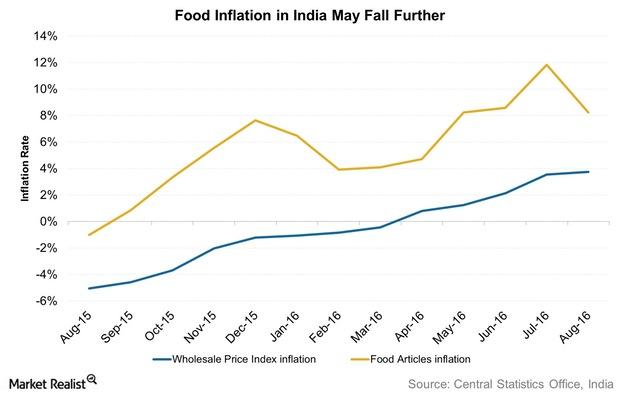

How Does the RBI See Food Inflation Panning out in India?

Components of inflation While food inflation in India has been pushing retail inflation up, fuel inflation (BP) (STO) (RDS.B), another important component, has been subdued. According to the October monetary policy statement issued by the RBI (Reserve Bank of India), “Fuel inflation has moderated steadily through the year so far.” The RBI has also announced […]

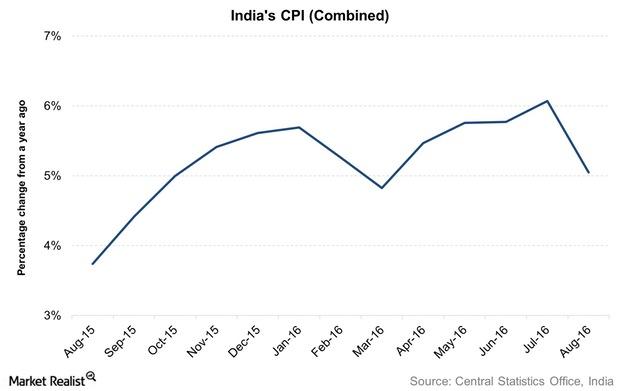

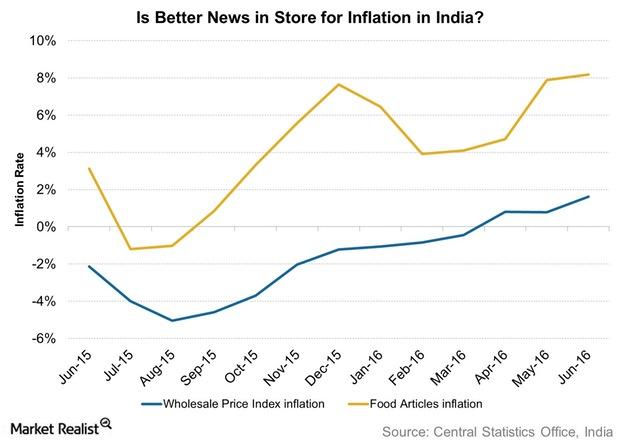

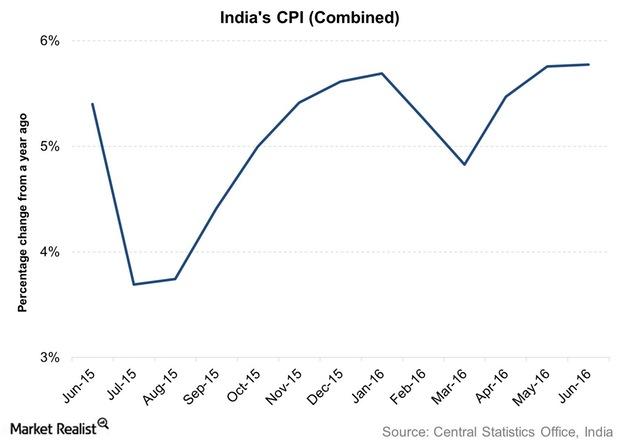

How the Fall in Inflation Helped the RBI Slash the Repo Rate in October

Measures of inflation in India The RBI (Reserve Bank of India) considers the CPI (consumer price index) as its primary gauge of measuring inflation. Prior to the RBI adopting the CPI, in India (PIN) (FINGX), another measure of inflation, the WPI (wholesale price index), was its key gauge of inflation and is still considered for […]

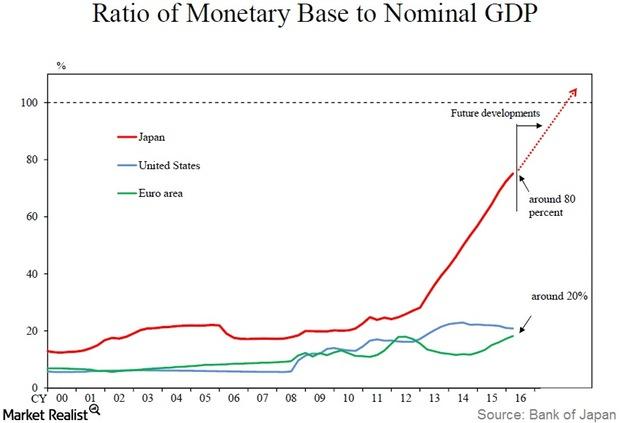

Why the Bank of Japan Wants to Overshoot Its Inflation Commitment

One of the key features of Japan’s new monetary policy framework is its inflation-overshooting commitment.

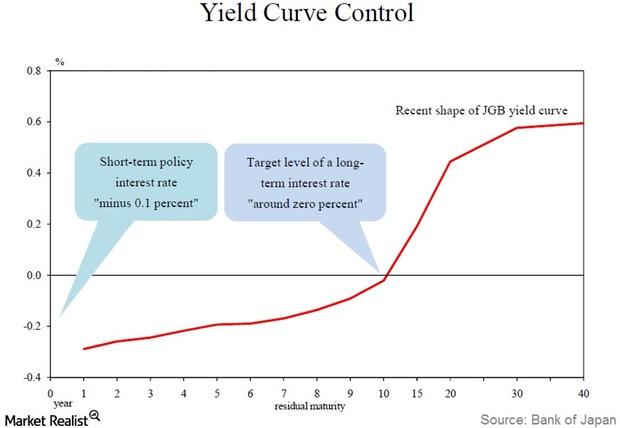

Key Highlights of Japan’s QQE with Yield Curve Control

The Bank of Japan will set two interest rates: a short-term policy rate and an operating target for long-term interest rates. These rates will serve as guidelines for market operations.

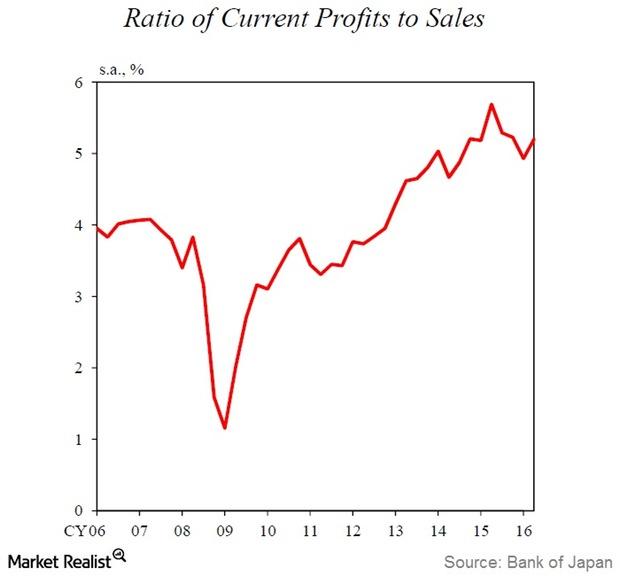

Why Haruhiko Kuroda Says Japan Is out of Deflation

According to Kuroda, “Japan’s economic activity and prices, as well as financial conditions, have improved substantially, and Japan’s economy is no longer in deflation.”

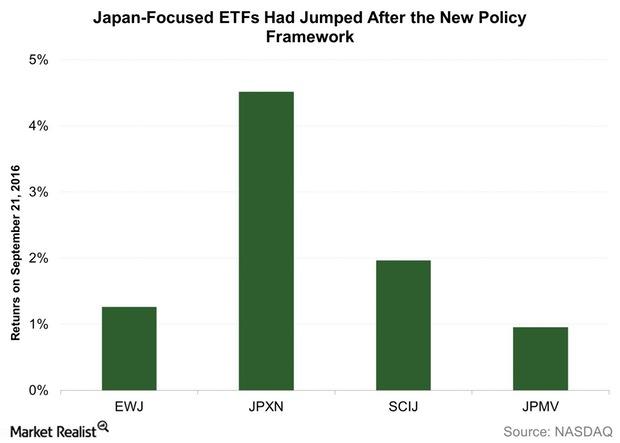

Haruhiko Kuroda Says Monetary Easing Has Helped Japan

Haruhiko Kuroda gave a new theme to Japan’s monetary policy in a September 21, 2016, meeting, focusing on yield curve and monetary accommodation.Company & Industry Overviews What Explains the Columbia Select Large Cap Growth Fund’s Poor Showing?

The short-term performance of the Columbia Select Large Cap Growth Fund – Class A (ELGAX) is excellent, and the past six months have been great for the fund.

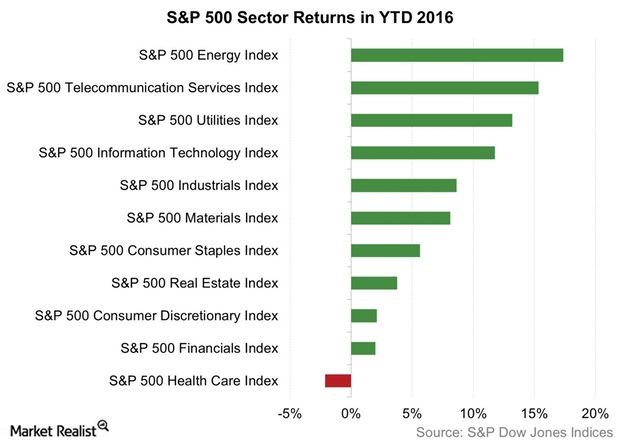

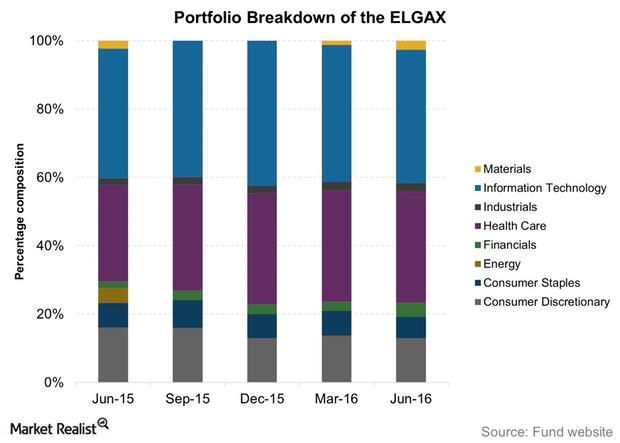

Columbia Select Large Cap Growth Fund: Sector Composition YTD 2016

The Columbia Select Large Cap Growth Fund (ELGAX) invests at least 80% of its assets in common stocks of US-based and foreign companies with market caps in the range of companies in the Russell 1000 Growth Index.Company & Industry Overviews Excellent Stock Picking Works Wonders for HLMNX

The past one month has been relatively poor for the Harding Loevner International Equity Portfolio – Investor Class (HLMNX).

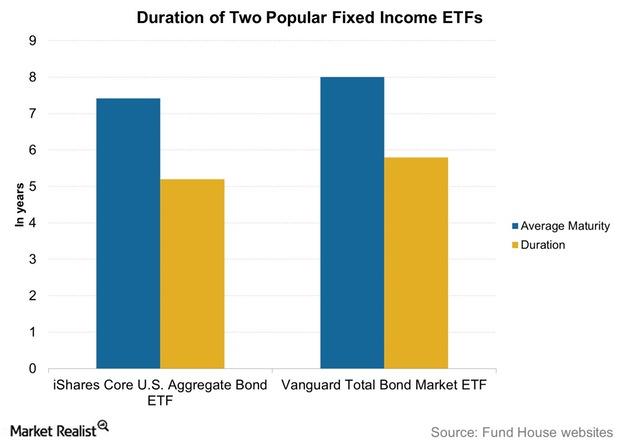

How Holding Duration Is Risky during Rising Inflation

Moving on to the fixed income space, the Janus team sees holding duration in portfolios as a risk.

Why Does Janus Think Inflation Is on the Rise?

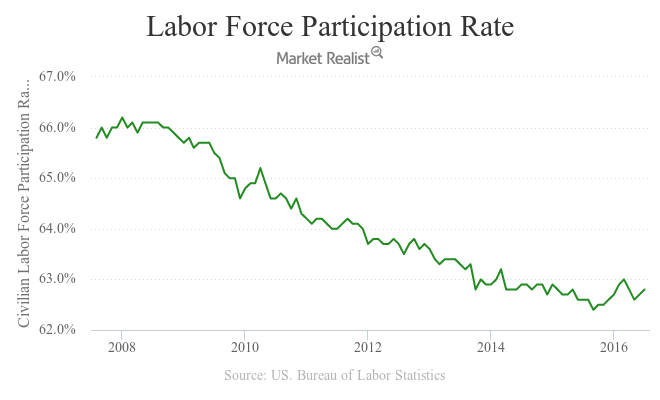

In the “Janus Market GPS,” the team had outlined its belief that a low unemployment rate signaled tighter labor market conditions.

Why Janus Thinks Ignoring Inflation Is a Mistake

In this series, we’ll look at the Janus Asset Allocation team’s views on inflation, policy measures, and asset allocation (ITOT) (NEAR), given its assertion that inflation pressures are building.

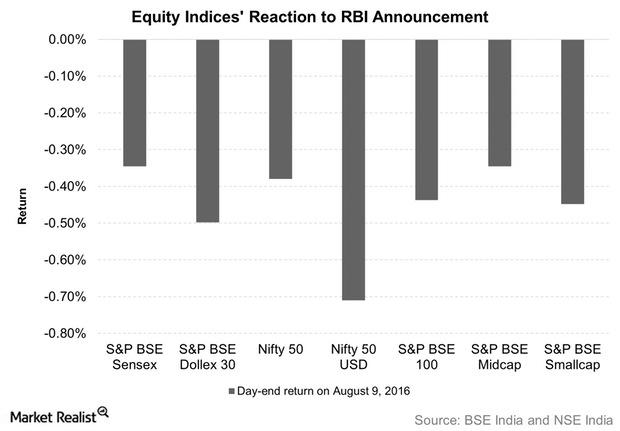

Indian Equities and Funds Fall after the August Monetary Policy

Indian equities fell on August 9, the day of the monetary policy announcement. Benchmark equity indices like the S&P BSE Sensex and the Nifty 50 fell 0.4%.

What Risks Does the RBI See for Retail Inflation?

The RBI thinks that risks to inflation are “tilted to the upside.” A subsequent rise in inflation could have a negative impact on consumer spending.

Inflation Stalled a Repo Rate Cut in India in August

The RBI looks at the CPI as its primary gauge for measuring inflation. The RBI has CPI growth targets to adhere to while deciding its monetary policy stance.Company & Industry Overviews Which Investments Have Hurt the Harbor Capital Appreciation Fund the Most in 2016?

The Harbor Capital Appreciation Fund Investor Class has tanked by 3.5% YTD in 2016, making it the second-worst performer YTD among our 12 funds.

Richard Bernstein Discusses the Risk of Seeking Safety

In his July 2016 Insights newsletter, Richard Bernstein stated, “Safe investments are safe until everyone wants them.”

Scenario Analysis: What to Expect after the Brexit Vote

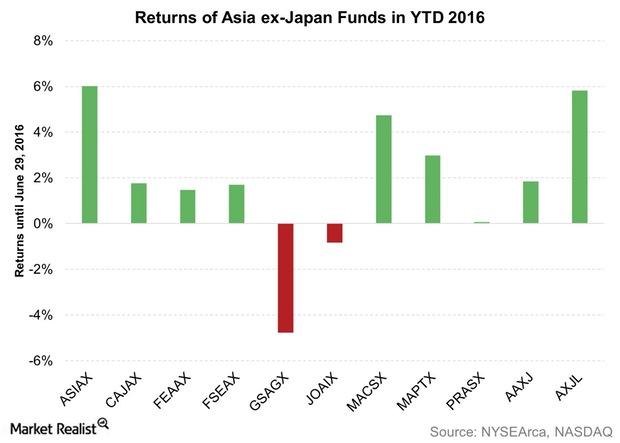

If negotiations after the Brexit vote pave a tough road for the United Kingdom, then other countries will be forced to rethink a referendum.Company & Industry Overviews What Has ASIAX Done Superbly Year-to-Date in 2016?

The Invesco Asia Pacific Growth Fund Class A (ASIAX) has had a great 2016 so far. It’s a top performer among the nine funds in this review.

Is Asia a Compelling Investment Proposition?

Given the diversity it can provide due to its composition, Asia makes a compelling investment destination for investors who are looking for growth.

Portfolio Moves of the AB International Growth Fund in YTD 2016

The AB International Growth Fund’s assets were spread across 57 holdings in May 2016, and it was managing $334.2 million in assets.

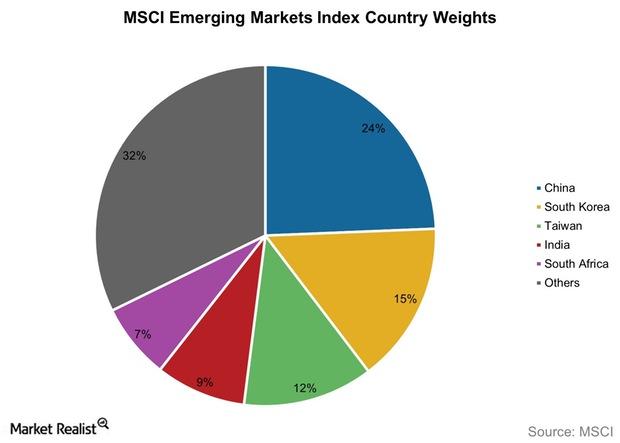

What China Has to Do to Get in the MSCI Emerging Markets Index

There have been significant steps toward the eventual inclusion of China A shares in the MSCI Emerging Markets Index.

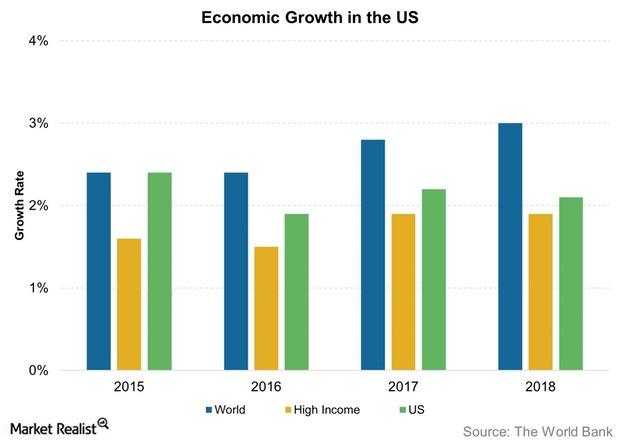

What the World Bank Thinks Now about US Economic Growth

The World Bank expects the pace of US economic growth to be 1.9% this year—a sharp correction from the 2.7% pace the bank projected in January 2016.

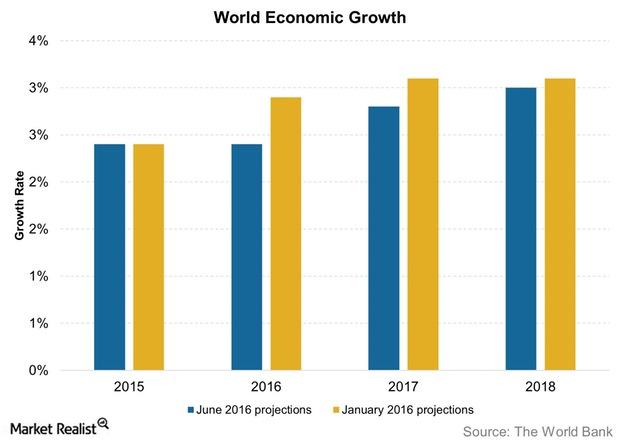

The World Bank Has News about the Global Economy, and It’s Not Good

In its 25th annual Global Economic Prospects report, the World Bank did not have many good things to say about the global economy in 2016.

Reserve Bank of India Sees India on Firm but Uneven Ground

Industrial production remains a problem for India, with the RBI (Reserve Bank of India) noting that the index measuring industrial production decelerated in fiscal 2015–16.

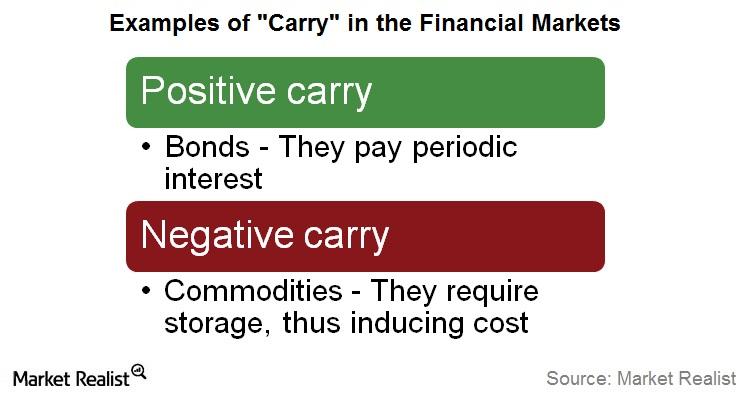

Why Is ‘Carry’ Compressed in Financial Markets?

In his investment outlook for June 2016, Bill Gross asserted that “carry” is compressed in nearly every form. It has more risk than return.

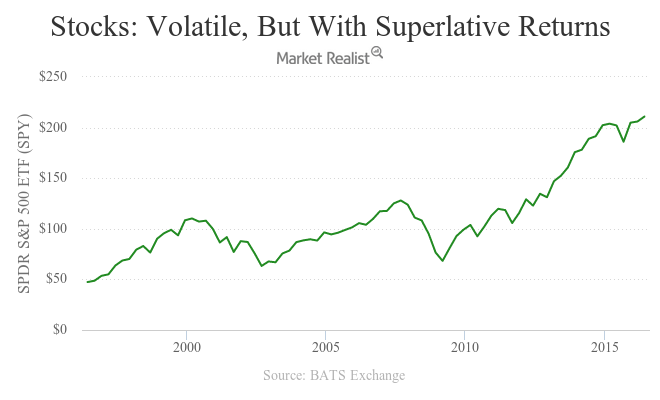

Why Bill Gross Thinks the Era of High Returns Is Over

Bill Gross thinks that the era of double-digit stock returns (SCHB) (USMV) and high single-digit investment-grade bond returns is over.

Bill Gross Talks about Compressed ‘Carry’ in Financial Markets

In his latest monthly investment outlook for June 2016, bond market veteran Bill Gross talked about “carry” in financial markets.

Bill Gross Reviewed Close Calls That Dotted a ‘Magnificent Era’

In his monthly investment outlook for June 2016, Bill Gross outlined that money managers who have decades of experience witnessed a “magnificent era.”

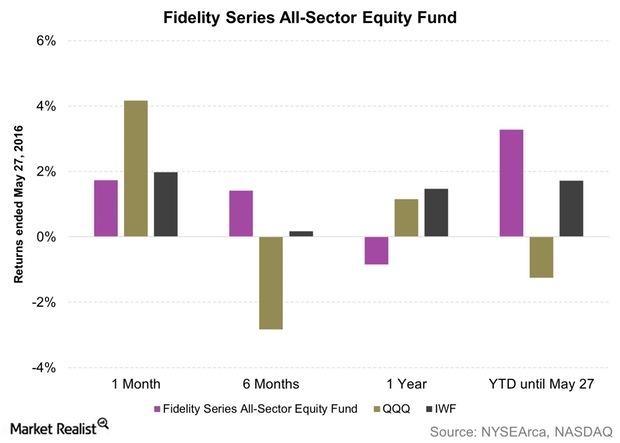

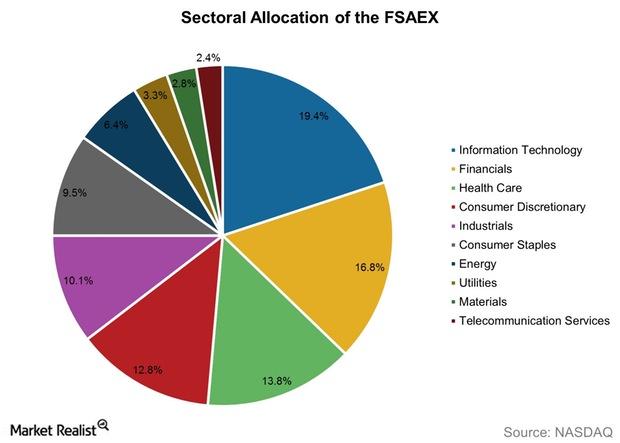

How Market Conditions Have Suited FSAEX Year-to-Date in 2016

As of May 27, 2016, FSAEX had risen by 3.3% YTD (year-to-date) in 2016, making it the second-best performer among the ten funds in this review.

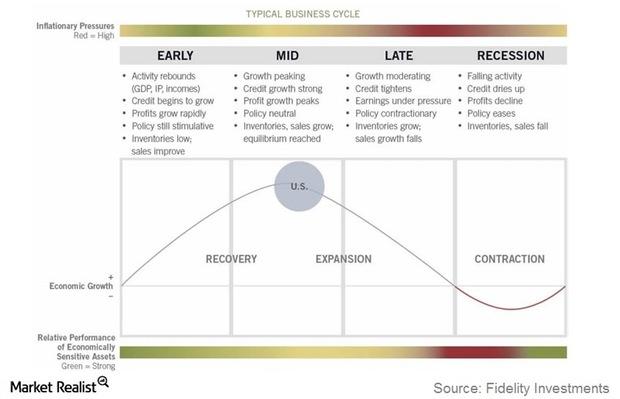

Portfolio Positioning with the Business Cycle

Although a particular business cycle can have distinct features, all seem to go through four broad and distinct phases: early, mid, late, and recessionary cycles.

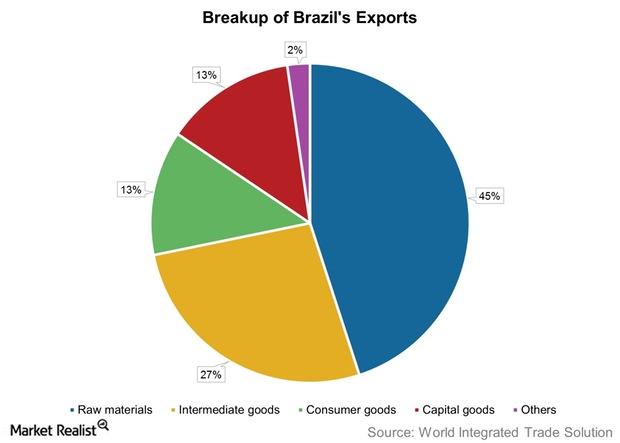

What Role Do Commodities Play in Brazil’s Economic Output?

Brazil’s top-exported commodities are soybeans, iron ore and concentrates, petroleum oil and products, raw cane sugar, and oil cakes and other solid residue.

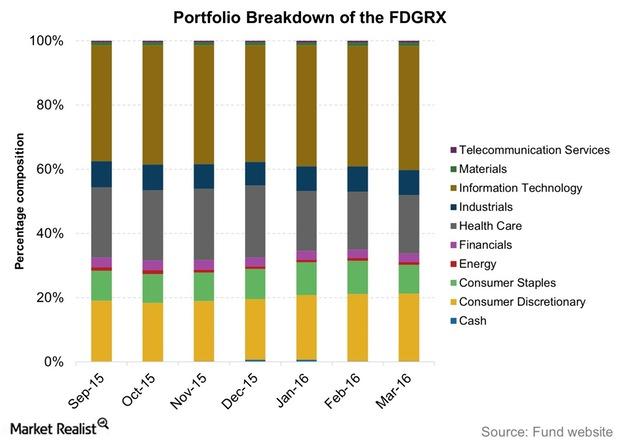

What Moves Did FDGRX Make Leading Up to 1Q16?

FDGRX’s assets were invested across 394 holdings as of March 2016, two more than a quarter ago. It was managing assets worth $37.8 billion as of March’s end.

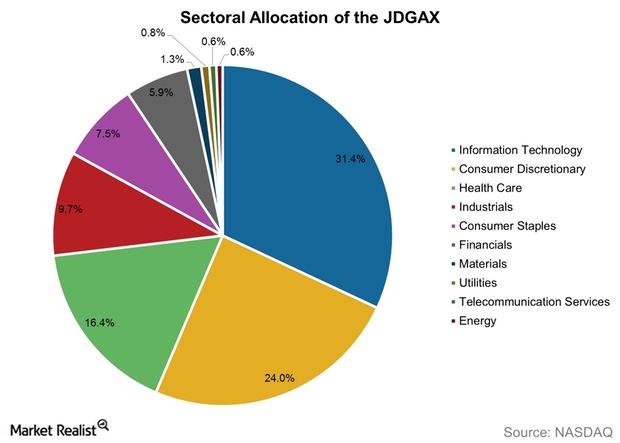

What You Should Know about the Janus Fund

The Janus Fund – Class A (JDGAX) was founded in February 1970 and has an expense ratio of 0.98%. There is a minimum of $2,500 to invest in this fund via Class A shares, but there is no minimum subsequent investment.

Fast Facts about the Fidelity Series All-Sector Equity Fund

The Fidelity Series All-Sector Equity Fund was founded in October 2008 and has an expense ratio of 0.67%. Shares of this fund are offered only to certain other Fidelity funds.