Key Highlights of Japan’s QQE with Yield Curve Control

The Bank of Japan will set two interest rates: a short-term policy rate and an operating target for long-term interest rates. These rates will serve as guidelines for market operations.

Sept. 29 2016, Updated 2:04 p.m. ET

Controlling the yield curve

While explaining the Bank of Japan’s new policy framework of QQE (quantitative and qualitative monetary easing) with yield curve control, Haruhiko Kuroda pointed out that new tools have been introduced for the framework.

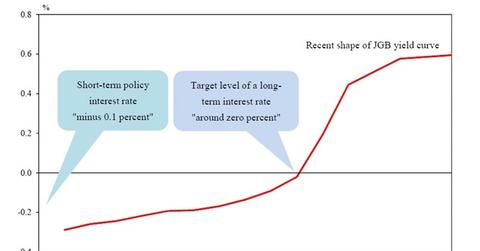

The central bank will set two interest rates: a short-term policy rate and an operating target for long-term interest rates. These rates will serve as guidelines for market operations. The short-term policy rate is presently -0.1%, the same as what’s applied to policy-rate balances in current accounts held by financial institutions with the central bank. The ten-year JGB (Japanese Government Bond) yield, set by the central bank, will be the operating target for the long-term rate. Presently, this rate is around 0%.

To facilitate controlling the yield curve, the Bank of Japan will conduct market operations such as buying JGBs at designated prices. Buying them will help control the prices of bonds and “cap long-term rates when necessary.”

Different from the earlier framework

In Japan’s earlier monetary policy framework, the purchase of JGBs was specified by “the amount of increase in the amount outstanding of JGBs held by the Bank.” But since the purchase amount was fixed, its impact on long-term yields varied depending on financial market conditions and a reading of the economic situation.

However, since the central bank is trying to control the yield curve, it will purchase JGBs in order to “achieve the target level of interest rates specified by the guideline for market operations at the time.” This would mean that the pace of its purchases may change in order to ensure that the yield curve remains where the central bank deems it appropriate.

Kuroda said that the new framework will provide flexibility in purchases of JGBs to the central bank. He said it will also improve the policy’s effectiveness, since the bank will be better able to tackle a change in circumstances.

The new framework will also take into account the profit of financial institutions (MTU) (MFG) (SMFG) that have taken a hit with the introduction of negative interest rates from January 2016. This may help get back consumer and business confidence, which may result in increased international investor interest in Japan (EWJ) (DBJP).

The new framework gave new direction to its strategy on inflation. Let’s look at that in the next part.