Mitsubishi UFJ Financial Group Inc

Latest Mitsubishi UFJ Financial Group Inc News and Updates

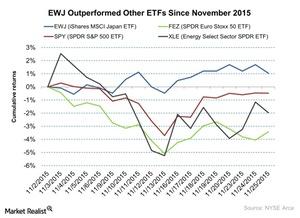

Overall Snapshot of the Market on November 25

On November 25, the SPDR S&P 500 ETF closed on a flat note ahead of the holiday. It closed at $209.3. The Energy Select Sector SPDR ETF fell by 0.81% on the day.

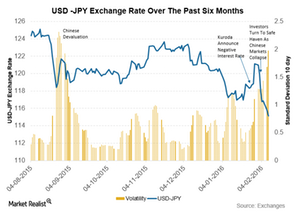

Why the High Volatility of the Japanese Yen in Recent Months?

The US dollar–Japanese yen currency pair has been one of the most volatile developed country currencies in the past six months. The Japanese yen saw heavy appreciation in August.

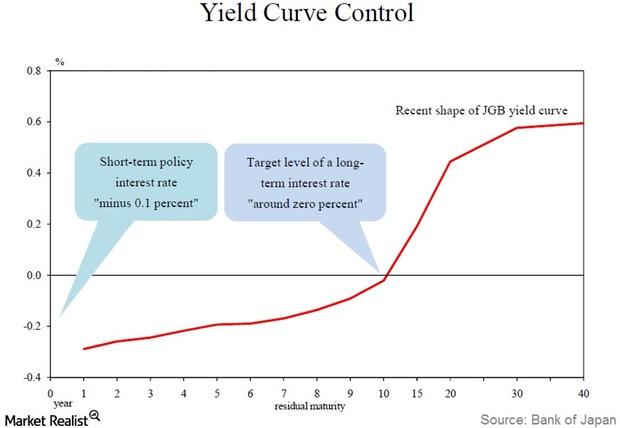

Key Highlights of Japan’s QQE with Yield Curve Control

The Bank of Japan will set two interest rates: a short-term policy rate and an operating target for long-term interest rates. These rates will serve as guidelines for market operations.

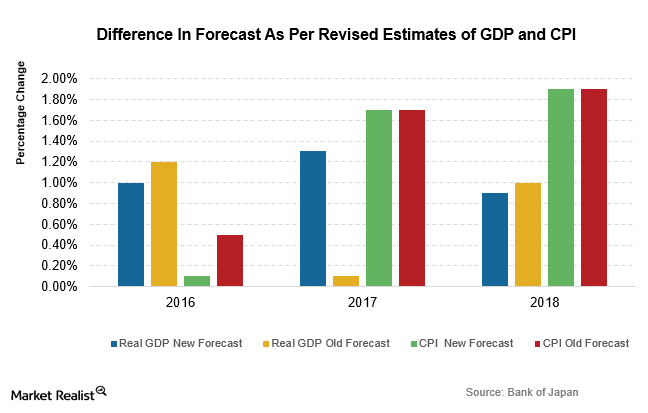

What Are the BoJ’s Projections for Economic Activity in Japan?

The Bank of Japan gave its economic outlook after the monetary policy meeting on July 29. The weak data are due to the slowdown in emerging economies.

Which Parts of Japan’s Economy Most Need Reform Right Now?

Japan needs to work on reducing the regulatory, political, and social barriers that hinder productivity and profitability in its economy.