Mizuho Financial Group Inc

Latest Mizuho Financial Group Inc News and Updates

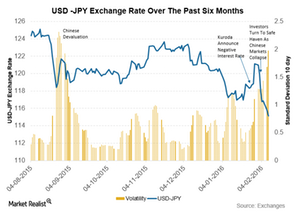

Why the High Volatility of the Japanese Yen in Recent Months?

The US dollar–Japanese yen currency pair has been one of the most volatile developed country currencies in the past six months. The Japanese yen saw heavy appreciation in August.

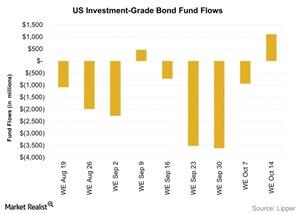

Investment-Grade Bond Funds Witness Inflows

Flows into investment-grade bond funds were positive for the week ending on October 14 after witnessing four consecutive weeks of outflows.

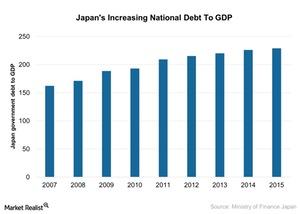

How Japan’s Fiscal Policies Can Help Achieve Its Economic Goals

Prime Minister Abe’s administration initially achieved coordination between the Bank of Japan’s QQE and fiscal stimulus.

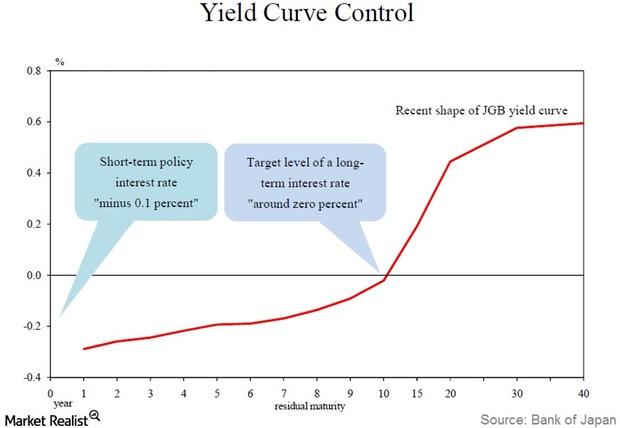

Key Highlights of Japan’s QQE with Yield Curve Control

The Bank of Japan will set two interest rates: a short-term policy rate and an operating target for long-term interest rates. These rates will serve as guidelines for market operations.