David Ashworth

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From David Ashworth

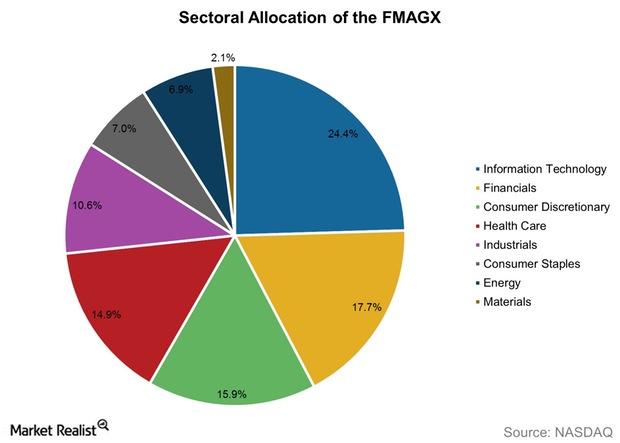

Need-to-Know Facts about the Fidelity Magellan Fund

The Fidelity Magellan Fund (FMAGX) invests primarily in common stocks of US and foreign issuers. It invests in either growth stocks, value stocks, or both.Company & Industry Overviews How Has 2016 Treated HLMNX So Far?

The HLMNX’s standard deviation, or the volatility of returns, in the one-year period until February 29 was 15.2%.

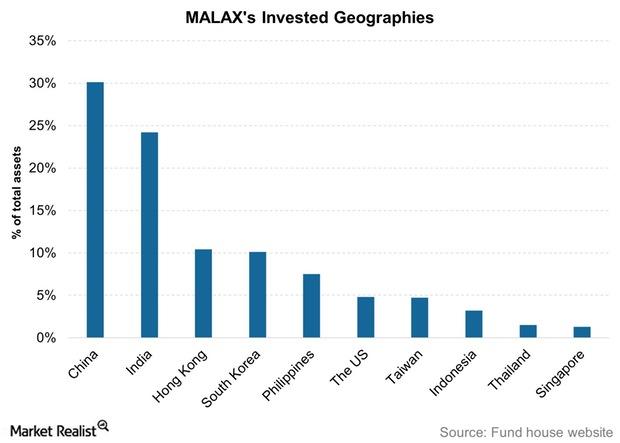

Must-Know Facts about MALAX

MALAX aims to invest in sector leaders, stocks that “can maintain, or achieve in the future, a dominant position within their respective market.”

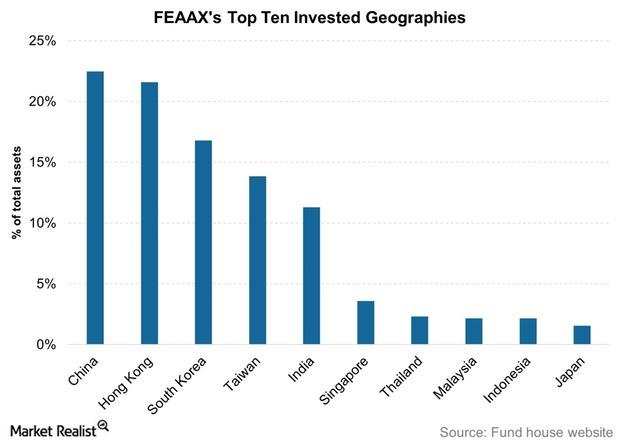

What You Should Know about FEAAX

FEAAX has existed since March 1994 and has an expense ratio of 1.4%. You require a minimum of $2,500 to invest in this fund via Class A shares

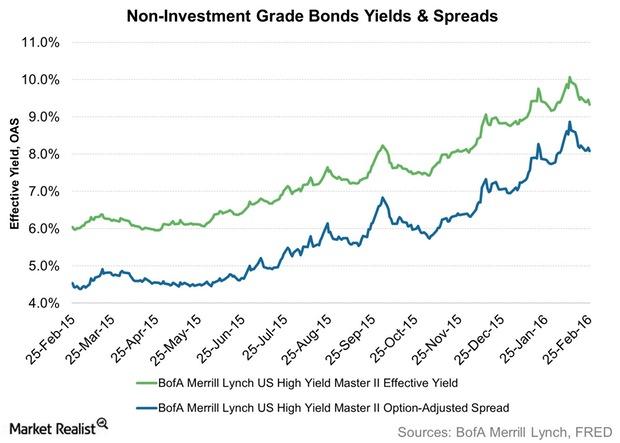

A Recap of High-Yield Bonds Year-to-Date in 2016

High yield debt issuers have been wary of volatile market conditions. High-yield bonds worth $11.9 billion have been issued as of February 19, 2016.

Should You Look to European Stocks for Growth?

European stocks began the year with a lot of hope pinned on them for providing capital appreciation in the year.Company & Industry Overviews AEPGX’s Low Volatility and Low Returns: What Does This Mean?

The American Funds EuroPacific Growth Fund (AEPGX) has been in existence since April 1984.Company & Industry Overviews The Energy and Materials Sectors Pulled VEURX into the Red in 2015

The Vanguard European Stock Index Fund was the worst performer for 2015 among the ten funds in this review.

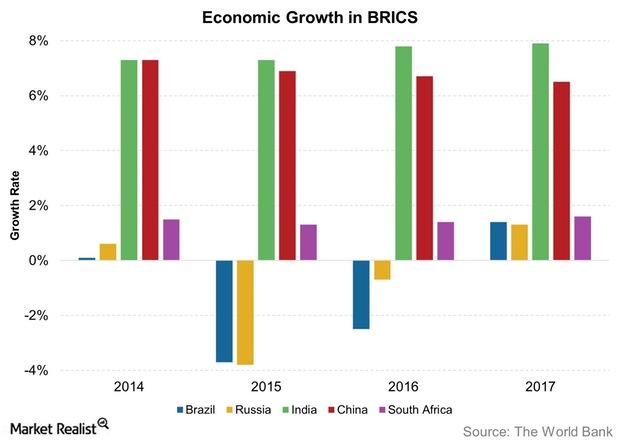

Are the BRICS Nations Standing on a Shaky Foundation?

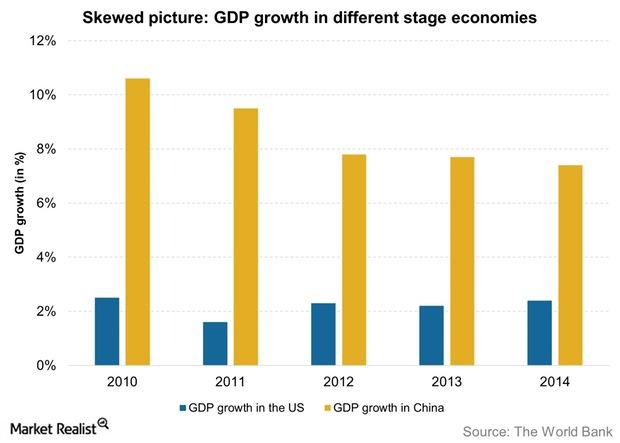

Among the BRICS, the most concerning at this point in time is China. The world’s second largest economy is slowing down and undergoing a structural shift.

High-Yield Bonds and You in 2016

High-yield bonds, also known as Junk bonds, have an iffy repayment ability, even if they are at the higher end of the junk rating scale.

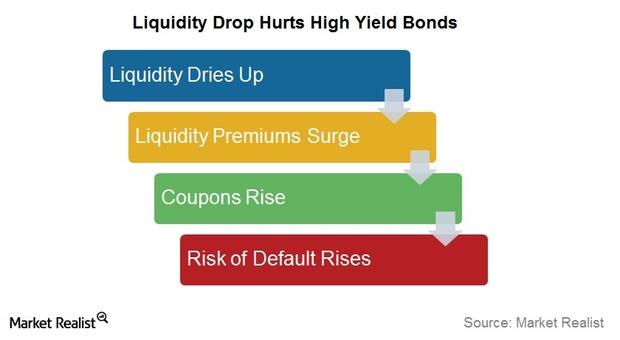

Investors in Junk Bond Mutual Funds Should Worry about Liquidity

If liquidity declines for junk bonds, the liquidity risk premium would rise. This would increase the coupon set on the bond. It will raise the borrowing cost for a company.

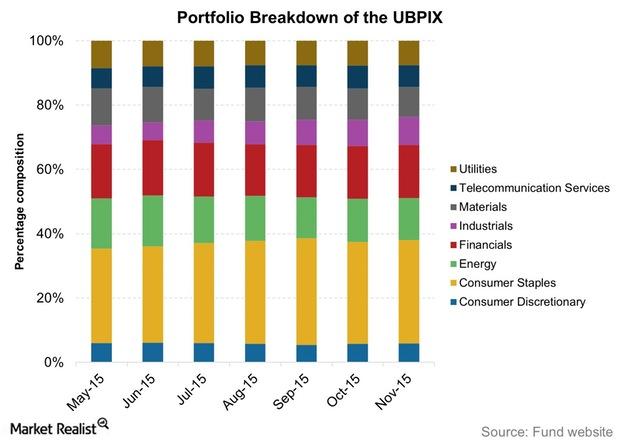

Portfolio Composition of UBPIX through November 2015

UBPIX’s assets were invested across 35 stocks as of November 2015, and it was managing assets worth $12.0 million.Macroeconomic Analysis Some Stock Picks Held OLGAX Back in YTD 2015

The JPMorgan Large Cap Growth Fund (OLGAX) emerged as the second best performer for November. However, it slipped a bit to the fourth spot in the YTD period.

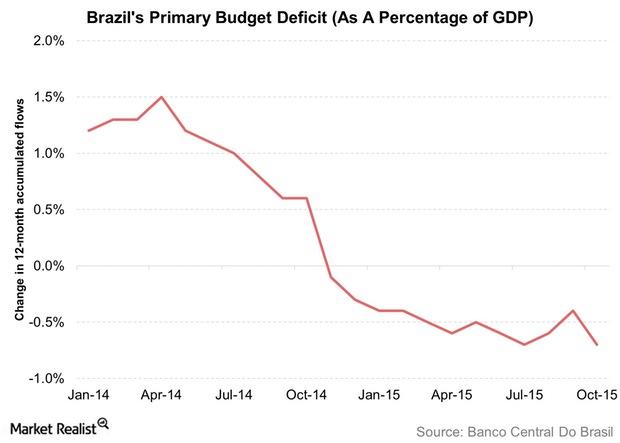

Brazil’s Budget Deficit Continues to Worsen

According to the latest reading, Brazil’s budget deficit for the 12 months through October 2015 was 0.7% of GDP.

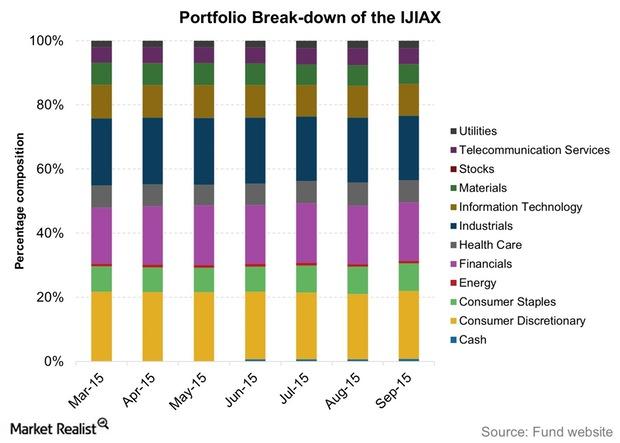

The Voya Japan TOPIX Index Portfolio Class A (IJIAX): Historical Overview

The Voya Japan TOPIX Index Portfolio Class A is an index fund, not an actively managed mutual fund, so it necessarily tracks its benchmark index.

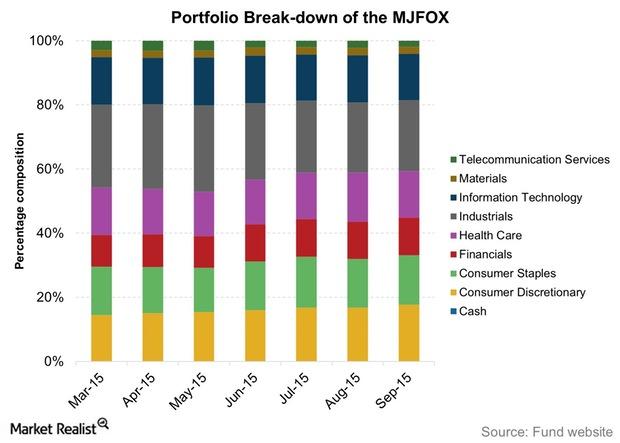

The Matthews Japan Fund Investor Class (MJFOX): Historical Overview

An introduction The Matthews Japan Fund Investor Class (MJFOX) seeks “long-term capital appreciation,” by investing “at least 80% of its total assets, which include borrowings for investment purposes, in the common and preferred stocks of companies located in Japan.” While describing its approach towards investing in Asia, the fund house believes that popular equity indices […]

Introducing Liquidity: Must-Know Ins and Outs

Liquidity, or “financial market liquidity,” refers to the ease with which you can buy or sell a security in financial markets at minimal cost.

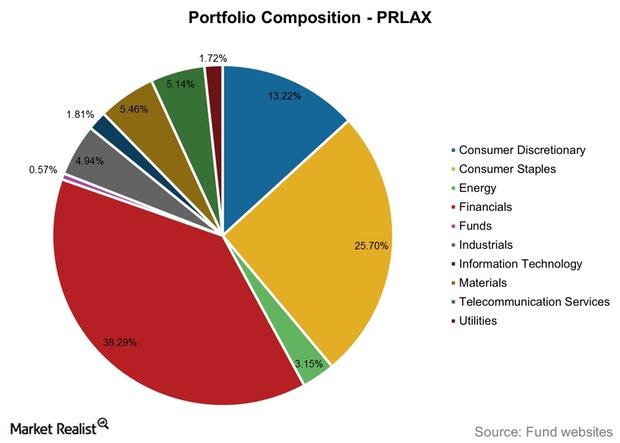

The T. Rowe Price Latin America Fund (PRLAX): Important Facts

The T. Rowe Price Latin America Fund (PRLAX) is offered by T. Rowe Price. The fund seeks long-term growth of capital.

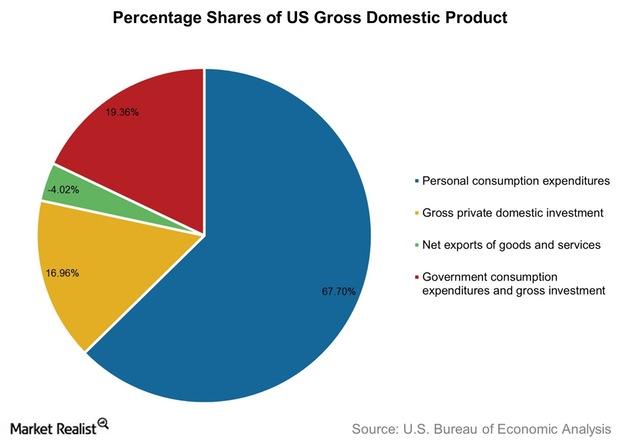

Importance of Spending on US GDP and Related Mutual Funds

Nearly 68% of the US GDP is composed of PCE or consumer spending. The negative value of net exports shows that the United States imports more than it exports, and this eats into the total economic output.

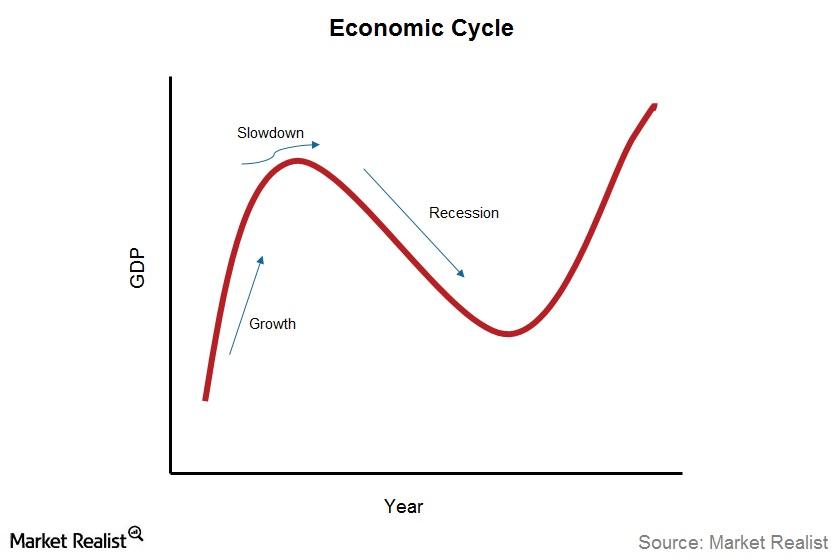

How an Economic Cycle Can Impact Mutual Funds

All that goes up must come down. And this applies to economic cycles as well. No boom lasts forever, and all economies experience a slowdown.

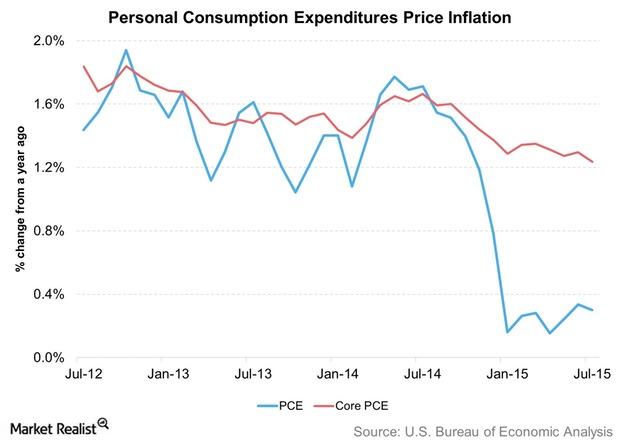

Import Prices and Crude Oil Keep US PCE Inflation Down

When the Fed refers to “inflation,” it’s talking about the rate of change in PCE (personal consumption expenditure) inflation. This is the price index for PCE.

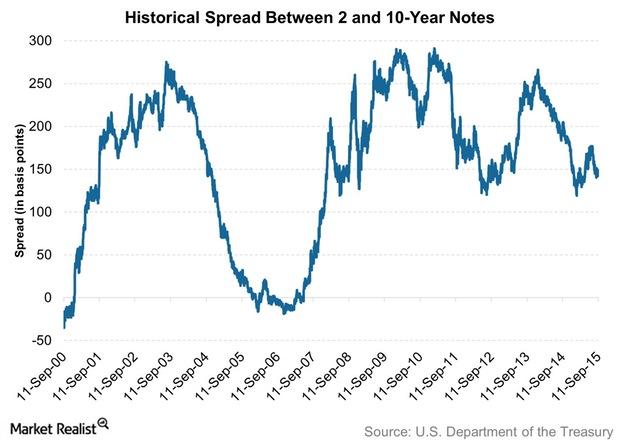

What Do Yield Spreads between 2-Year and 10-Year Notes Indicate?

While a section of the market is readying itself for a rate hike in the upcoming meeting of the FOMC, there are others who don’t believe that a rate hike would be implemented and instead, are focused on falling inflation.

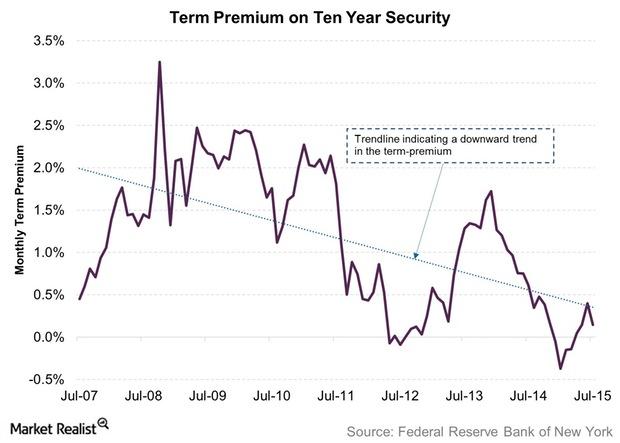

What Does US Term Premium Indicate?

Over an eight-year period, the term premium on a ten-year US security rose to 3.25% in October 2008. It saw a low of -0.37% in January 2015.

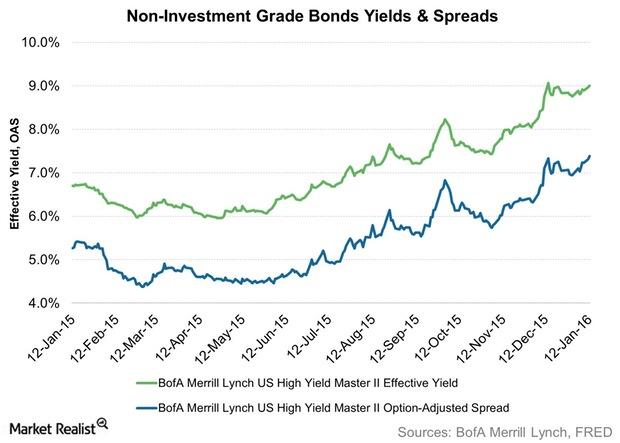

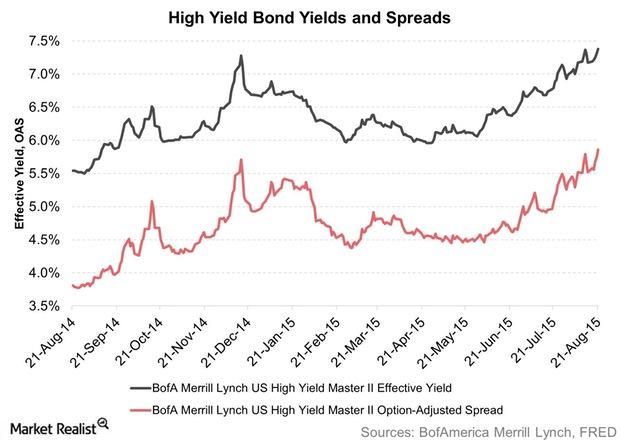

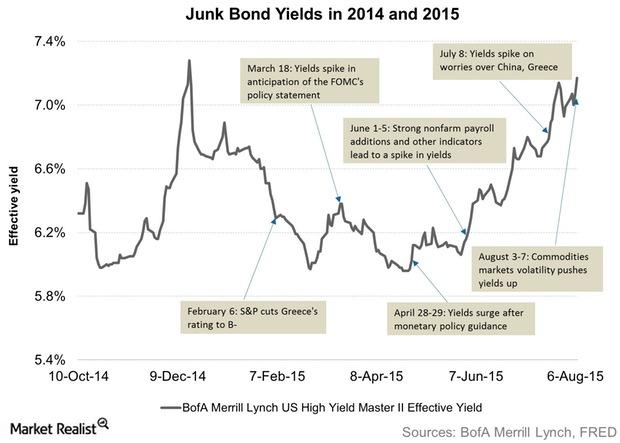

Widening High-Yield Bond Spreads: Opportunity or Threat?

Investors should note that high-yield bonds are risky securities to begin with. The add-on risk of widening spreads may not suit all types of investors.

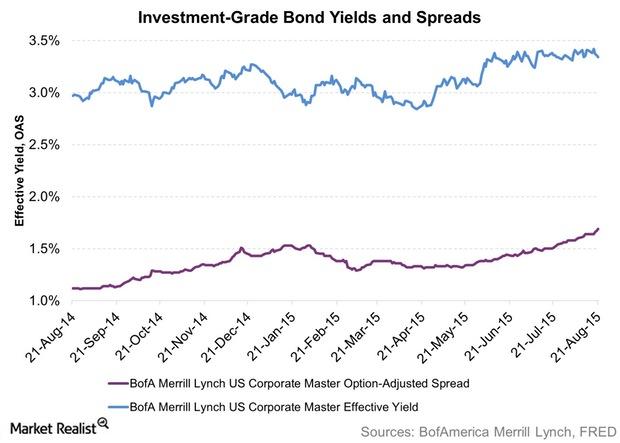

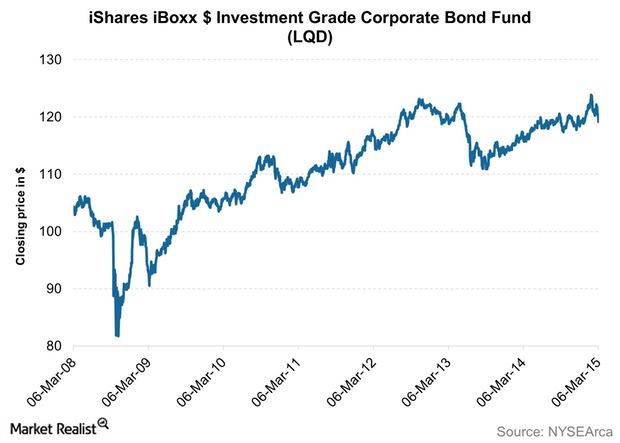

Spreads between High-Grade Bonds and Treasury Yields

If spreads widen further, high-grade bonds will become more attractive because yields and prices are inversely related. A rise in yields indicates falling prices.

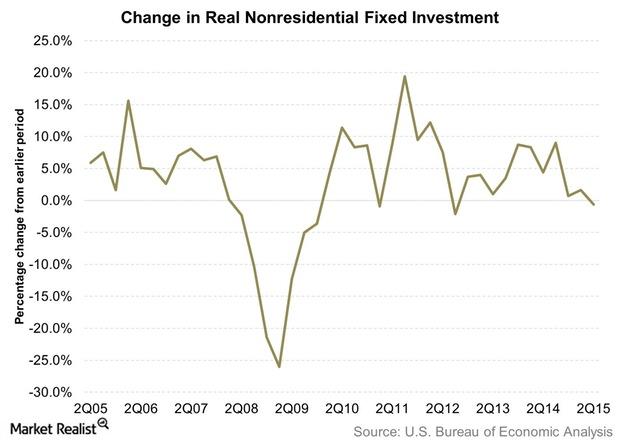

Why Is US Business Fixed Investment Subdued?

Business fixed investment represents business spending on plants, equipment, and machines. It forms an important component in the calculation of economic output.

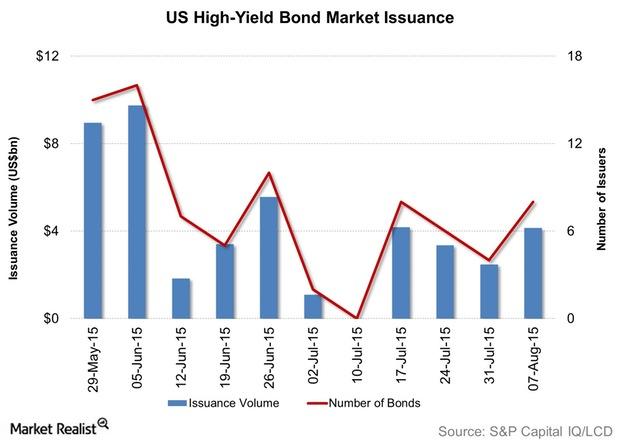

First Data was the Highest Junk Bond Issuer: Week to August 7

Junk bond issuance activity rose in the week ending August 7 after two weeks of subdued activity. The broad market conditions improved.

High-Yield Bond Issuers Return to the Primary Market

High-yield bond issuance rose in the week ending August 7, 2015, to the most in three weeks, as market conditions improved.

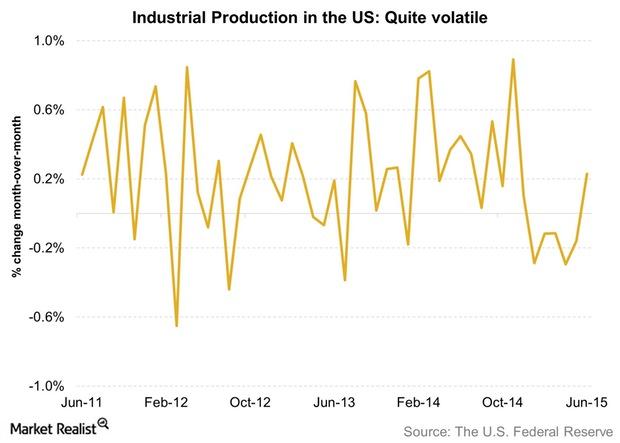

What Does Industrial Production Say about an Economy?

Industrial production—or in some cases, manufacturing production—provides important input about a nation’s economic output, irrespective of its business cycle.

Economic Growth: Why Is It Important?

Economic growth can be considered among the most crucial indicators that are released. It indicates the growth in economic output.

The Booming Indian Stock Market: Will It Last?

Indian stocks had a strong run in the last half of 2014 through early 2015, but the ride since then hasn’t been smooth. The INDA is up only 2.6% in the one year ended June 2015.

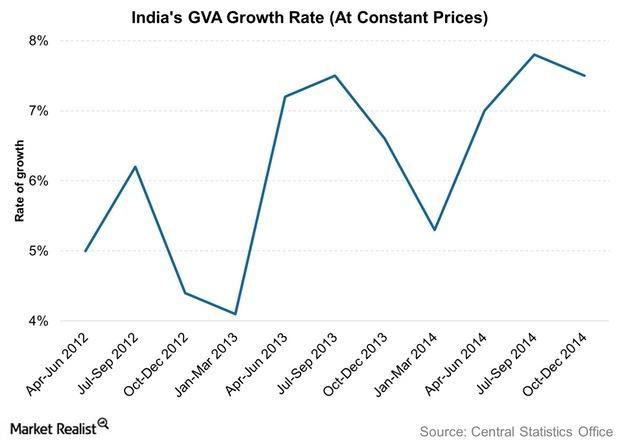

India Now Uses Gross Value Added to Calculate Economic Output

The Indian economy has certainly seen a change since the new government took over. India now uses what is known as GVA (gross value added) to calculate economic output.

What are investment-grade bonds?

Investment-grade bonds are both U.S. Treasuries issued by the U.S. Treasury Department and corporate bonds issued by high-quality corporate borrowers.

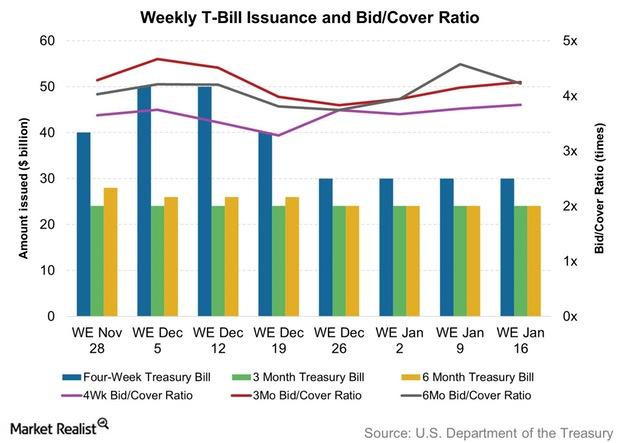

The bid-to-cover ratio rose at the 13-week T-bills auction

The US Department of the Treasury auctioned 13-week, or three-month, Treasury bills (BIL) (MINT), or T-bills, worth $24 billion on January 12.

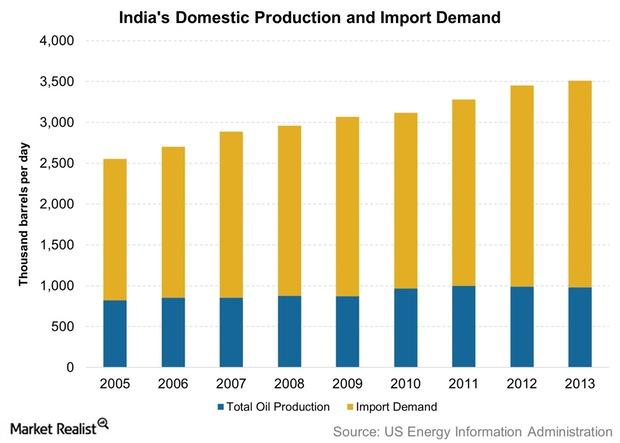

What amount of crude oil does India produce?

India produces a little under a quarter of its crude oil demand. The EIA estimates that India had close to 5.7 billion barrels of proven oil reserves at the beginning of 2014.

Analyzing India’s oil consumption

In India, the consumption of oil products saw steady growth over the years. The CAGR (compound annual growth rate) for the ten years ending in March 2014 is above 3.5%.

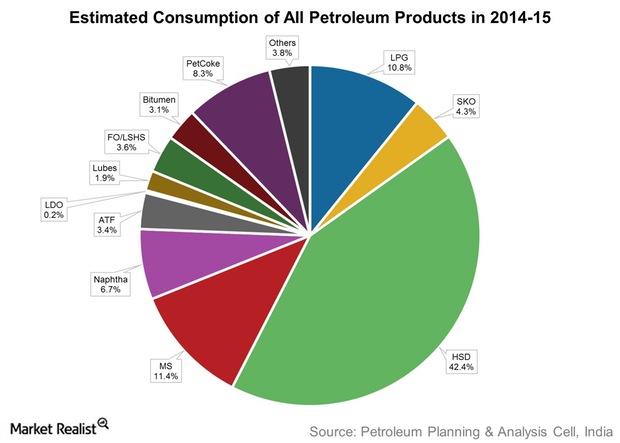

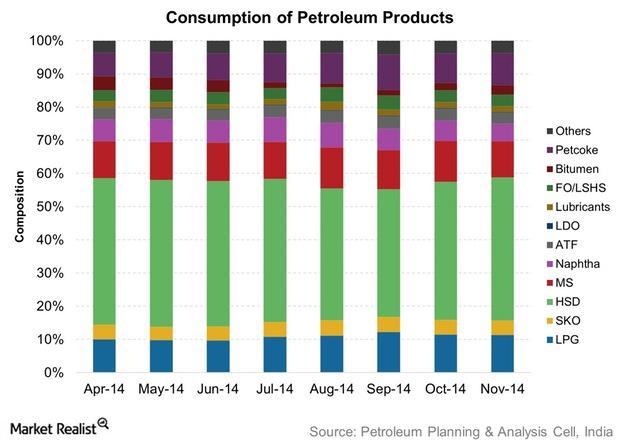

What products does India produce and consume?

Before moving on to India’s petroleum consumption, production, and refining, it would be beneficial to take a look at the various products that India produces and consumes.

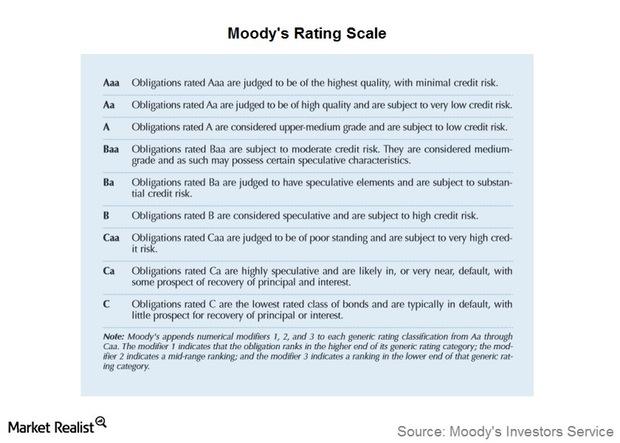

What rating action did Moody’s announce for Japan?

On December 1, 2014, Moody’s Investors Service, a business unit of Moody’s Corporation (MCO), downgraded Japan’s debt rating by one notch, from Aa3 to A1, with a stable outlook.Macroeconomic Analysis Why India’s poor infrastructure is a detractor

The primary reason for India’s slow infrastructure development is poor implementation.Macroeconomic Analysis To do or not to do business in India

Doing business has been a major concern for international businesses interested in setting up shop in India.

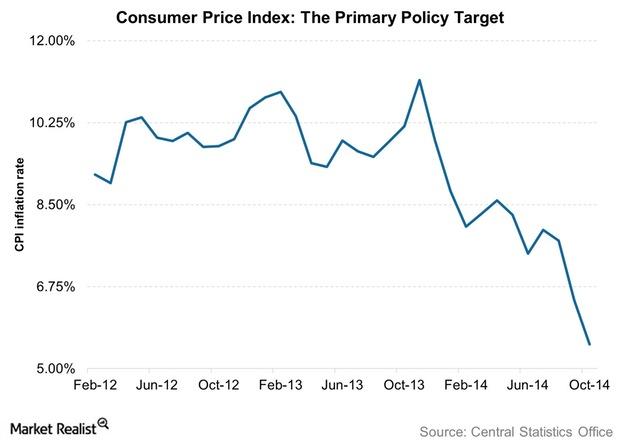

Must-know: India’s monetary policy

The RBI is India’s central bank. It used to announce its monetary policy twice in a financial year. In India, a financial year begins in April and ends in March the next year.Macroeconomic Analysis Where India spends and earns its revenues

Plan expenditure is closely associated with economic growth. It focuses on investment in order to enhance productive capacity. Non-plan expenditure is mainly obligatory in nature.Macroeconomic Analysis Why India’s industrial production is important

In India, production changes are measured by the IIP. It’s released on a monthly basis. This is an important indicator for assessing the health of the industrials sector.Macroeconomic Analysis Understanding India’s political system—making decisions

In India, the decision-making process isn’t fast. It’s affected by the current assembly’s constitution. Slow decisions hurt a nation’s image.