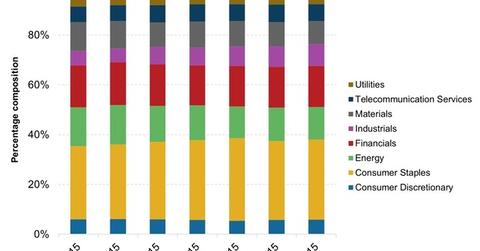

Portfolio Composition of UBPIX through November 2015

UBPIX’s assets were invested across 35 stocks as of November 2015, and it was managing assets worth $12.0 million.

Dec. 28 2015, Published 3:00 p.m. ET

ProFunds UltraLatin America

The ProFunds UltraLatin America Class A (UBPIX) seeks “daily investment results, before fees and expenses that are 2x the return of the BNY Mellon Latin America 35 ADR Index for a single day.”

This means that the fund aims at single-day returns only, and these returns are twice that of the underlying index. For instance, if the index rises by 2%, the fund will have returns close to 4%. The same applies for times when the index reports negative returns. The fund will fall nearly twice the amount, adjusted for fee and expenses.

The fund’s literature states that “For periods longer than a single day, the Fund will lose money when the level of the Index is flat, and it is possible that the Fund will lose money even if the level of the Index rises.”

This kind of a fund is known as a leveraged fund. These funds, by their very nature, are highly risky and are not suitable for conservative investors. Even aggressive investors should use caution when investing in these funds.

UBPIX’s assets were invested across 35 stocks as of November 2015, and it was managing assets worth $12.0 million. As of its July portfolio, the latest available, its equity holdings included Ultrapar (UGP), Bancolombia (CIB), Enersis (ENI), Empresa Nacional de Electricidad (EOC), and Embraer (ERJ), which formed a combined 13.2% of the fund’s portfolio.

Historical portfolios

For this analysis, we’ll be considering holdings as of July 2015, as that is the latest available sectoral breakdown. The holdings post-July reflect valuation-driven changes to the portfolio, not the actual holdings.

The fund mostly invests in ADRs (American depositary receipts). Investors should remember that it is an index-tracking fund. Hence, when we talk about its portfolio details, we’re essentially discussing the underlying index. Its passive nature is visible from the graph above as well, which shows nearly consistent portfolio composition.

The consumer staples sector is the largest sectoral holding of the fund, making up 32% of its portfolio. It is followed by the financials sector, whose exposure is nearly half that of the consumer staples sector. Due to the composition of the underlying index, a substantial 13% of the fund’s assets are invested in the energy sector. The fund does not have any investment in the healthcare or information technology sectors.

How did the fund fare through November year-to-date in 2015, and what contributed to its performance? Let’s look at that in the next article.