Enersis SA

Latest Enersis SA News and Updates

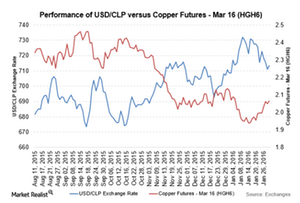

Chilean Peso Falls on Weak Economic Data

The Chilean peso depreciated against the US dollar on January 29, 2016, as reports indicated that copper production fell 5.5% in December 2015.

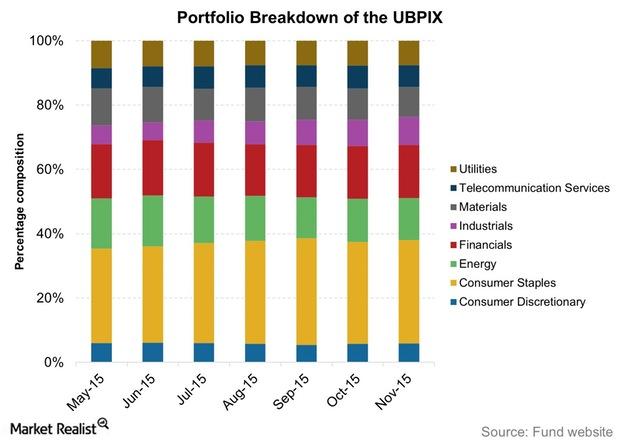

Portfolio Composition of UBPIX through November 2015

UBPIX’s assets were invested across 35 stocks as of November 2015, and it was managing assets worth $12.0 million.

How OPEC’s Crude Oil Reserves Affect the Crude Oil Market

OPEC countries control 40% of global crude oil production and have around 81% of global crude oil reserves, as of 2014.

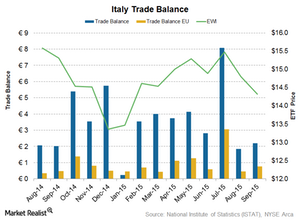

Italy’s Trade Surplus Widened with Declining Imports in September

According to the National Institute of Statistics (or ISTAT), Italy’s goods and services surplus rose to 2.2 billion euros in September 2015 compared to 2.0 billion euros a year ago.

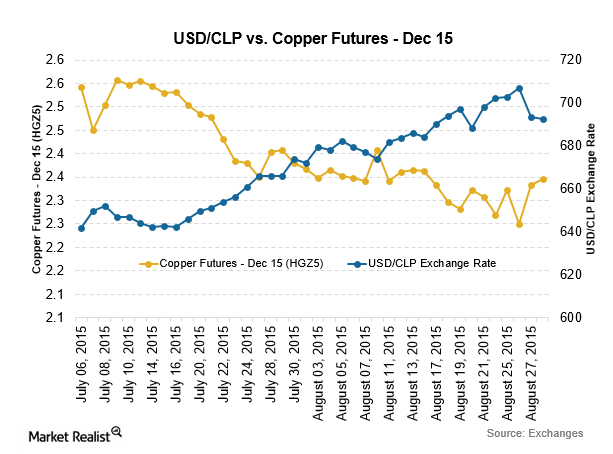

The High Correlation between the Chilean Peso and Copper Prices

Any variation in copper demand or supply directly affects the value of the Chilean peso against the US dollar.