Anirudha Bhagat

Anirudha Bhagat has worked at Market Realist since July 2018, and his research focuses on industrial stocks. He has a post-graduate degree in finance and over ten years’ experience in the financial market. Before joining Market Realist, Anirudha worked for a leading investment research firm where he was covering the Retail and Technology sectors.

As a financial writer, Anirudha has over eight years of experience writing hundreds of financial reports and articles. He has written about diverse topics such as global macro topics, stock markets, and individual public companies.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Anirudha Bhagat

Boeing’s 737 MAX Grounding Is Hurting US Airlines

On June 26, United Airlines removed Boeing MAX planes from its schedule until September 3, which would lead to ~1,900 flight cancelations in August.

Boeing’s 777 Freighter Jets: New Orders from Qatar Airways

Boeing (BA) received more new orders for its 777 Freighter planes at the Paris Air Show. On June 19, Qatar Airways committed to buying five Boeing 777 Freighter jets.

New Orders Bring Relief for Boeing amid 737 MAX Crisis

Boeing (BA) has received major orders for its wide-body twin-aisle Dreamliner planes. The aircraft manufacturer desperately needed new orders for its other planes, as orders for its fast-selling single-aisle 737 MAX jets have been frozen following the Ethiopian Airlines crash on March 10.

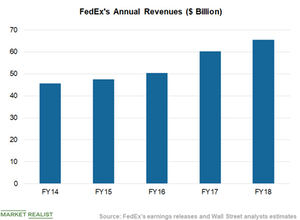

FedEx Is Enhancing Shareholders’ Wealth through Share Buybacks

Share repurchases are another strategy FedEx Corporation (FDX) uses to create wealth for its shareholders.

US Stock Market Could Fall Due to Global Trade Concerns

The trade war between the US and China and a new tariff warning on Mexico increased the concerns about a global economic slowdown.

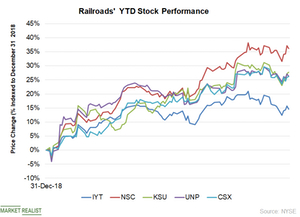

Railroad Stocks Have Outperformed in 2019

So far, railroad stocks have made a remarkable run in 2019. Most of the railroad stocks have outperformed the broader market returns.

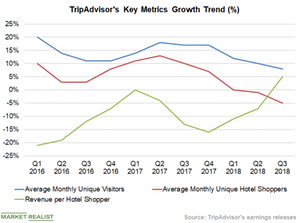

TripAdvisor’s Monthly Unique Visitors Fell in the First Quarter

TripAdvisor’s (TRIP) average monthly unique visitors fell 5% YoY to 411 million users in the first quarter due to its hotel marketing optimization initiatives.

Acquisitions Remain a Key Global Expansion Strategy for FedEx

Acquisitions have remained a key global expansion strategy for FedEx (FDX), expanding the delivery giant’s global footprint, enhancing its capabilities, establishing new business relationships, and adding customers.

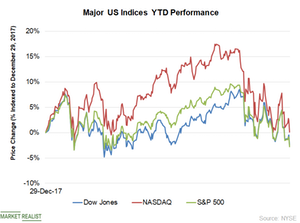

Dow Outperforms Other Indexes due to Surge in Boeing Stock

The Dow Jones Industrial Average registered minor gains on March 25, while other major US indexes fell.

FedEx Focuses on Cost-Cutting Measures to Boost Profitability

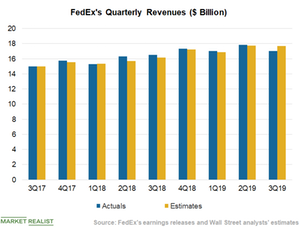

FedEx’s (FDX) fiscal 2019 third-quarter adjusted EPS of $3.03 fell 18.5% from its EPS of $3.72 in the third quarter of fiscal 2018.

Analysts Lower Target Price on FedEx after Its 2019 Outlook Cut

Most analysts reduced their target prices on FedEx after the delivery giant trimmed its fiscal 2019 earnings outlook.

Boeing Acquires Aviation Software Startup ForeFlight

On March 6, Boeing (BA) announced that it completed the acquisition of ForeFlight. Boeing didn’t disclose the financial terms of the deal.

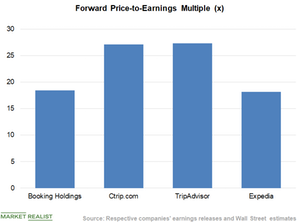

Where Does Booking Holdings Stand among Peers?

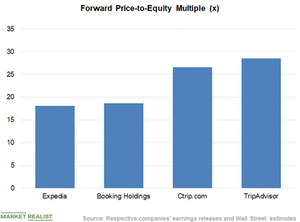

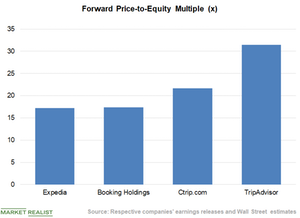

Booking Holdings (BKNG) stock is currently trading at a discounted PE valuation multiple to its peers Ctrip.com International (CTRP), TripAdvisor (TRIP), and Expedia (EXPE).

Southwest Stock Rose on Speculation about Warren Buffett Takeover

Southwest Airlines (LUV) rose over 4% yesterday on social media speculation that Warren Buffett’s Berkshire Hathaway is considering a takeover bid.

Norfolk Southern: Investors’ Industry Favorite in 2019

Norfolk Southern (NSC) has been investors’ industry favorite since the beginning of 2019. The stock has risen 21.3% YTD.

Expedia Has an Attractive Valuation Multiple

Expedia stock is trading at a PE ratio of 22.07x. At the current multiple, the stock is trading at a discounted valuation compared to its peers.

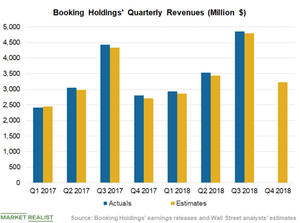

Booking Holdings’ Prepaid Business Model to Drive Q4 Revenues

Apart from a healthy travel demand environment, Booking Holdings’ (BKNG) sustained focus on investing in marketing, alternative accommodations, people, and technology could continue driving its revenues.

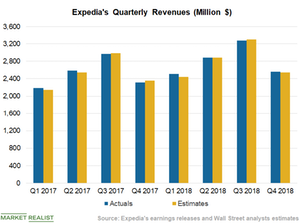

Analyzing Expedia’s Q4 Revenues

Expedia’s (EXPE) revenues rose 10% YoY (year-over-year) to $2.56 billion in the fourth quarter.

UPS Hikes Its Dividend

On February 15, UPS announced that it raised its quarterly dividend rate 5.5% to $0.96 from $0.91 paid in November.

Marketing and Product Design to Drive TripAdvisor’s User Base

TripAdvisor’s (TRIP) sustained focus on enhancing its mobile-centric product designs along with marketing initiatives will likely continue to attract new users and drive overall user base.

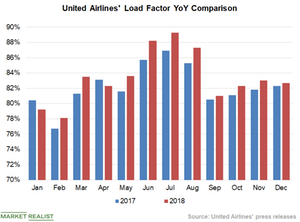

United Airlines’ Utilization Rate Continued to Expand

Disciplined capacity additions, promotional offers, and marketing strategies to drive traffic have helped United Airlines improve its utilization rate.

‘Dean of Valuation’ Says to Bet on NVIDIA, Boeing, and GE

Aswath Damodaran, better known as the “Dean of Valuation,” advised investors to consider NVIDIA (NVDA), Boeing (BA), and General Electric (GE) for long-term buys.

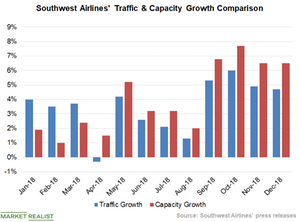

Southwest Airlines: Traffic Growth Lags the Capacity Growth Rate

Southwest Airlines’ (LUV) traffic or RPM continued to lag its capacity or ASM. The company reported its operating performance on January 8.

Expedia to Benefit from Rising Online Travel Demand

With such a massive product portfolio and partnerships, Expedia is well positioned to capitalize on the growth opportunities in the travel industry.

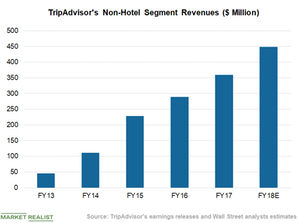

Non-Hotel Segment: TripAdvisor’s Key Revenue Growth Driver

For 2018, analysts expect TripAdvisor to report non-hotel revenues of $449 million—YoY (year-over-year) growth of ~25%.

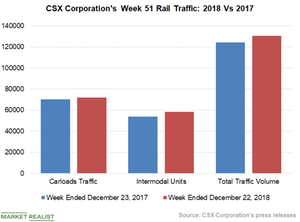

Strong Intermodal Growth Drove CSX’s Rail Traffic Higher

CSX reported strong rail traffic volume growth in week 51. The company’s freight rail traffic increased 5.1% YoY to 130,542 units in week 51.

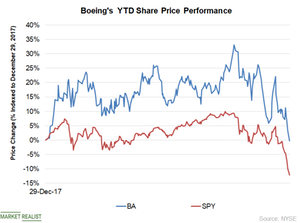

How Boeing Stock Has Fared in 2018

Boeing (BA) stock started 2018 on a positive note and carried this momentum forward up to November 7, with a return of ~26%.

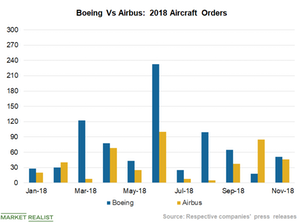

Boeing Winning the 2018 Aircraft Order Race against Rival Airbus

Boeing (BA) has been lagging behind Airbus in the order-booking race for the past few years. However, the company seems set on breaking that record this year.

What Triggered the Broader Market Sell-Off in December?

The broader market sell-off started on December 1 when Huawei Technologies’ CFO Meng Wanzhou was arrested by Canadian authorities.

How Top US Airlines Are Faring on the Valuation Front

With a return of more than 43% YTD (year-to-date), United Continental (UAL) shares have remained the biggest gainer in 2018.

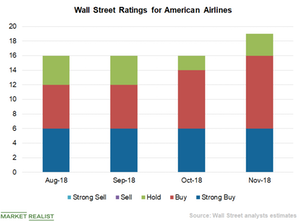

Wall Street Expects Double-Digit Price Surge in AAL Stock

American Airlines (AAL) has received a consensus “buy” rating from analysts polled by Reuters.

American Airlines’ Traffic Growth Outpaced Its Capacity Growth

American Airlines’ (AAL) traffic (revenue passenger miles) growth has exceeded its capacity (available seat miles) growth in the first nine months of 2018.

Where Expedia Stands among Its Peers

Currently, Expedia’s (EXPE) PE multiple stands at 20.63x. At its current multiple, the stock is trading at a premium valuation to its peers.

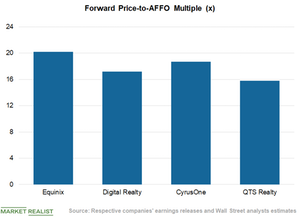

Equinix Trades at a Premium Valuation against Its Peers

Equinix (EQIX) has a TTM price-to-AFFO ratio of 20.2x.

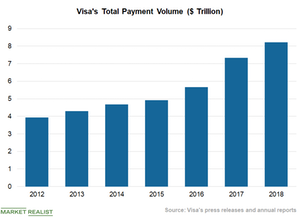

Digitization and Tech Investment Drove Visa’s Payment Volume

Visa’s (V) fourth-quarter results benefited from the growing global trend of cashless transactions.

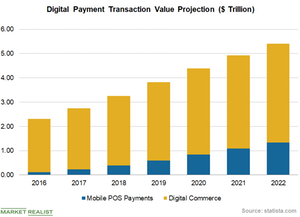

Rising Digital Payments to Support Mastercard’s Long-Term Growth

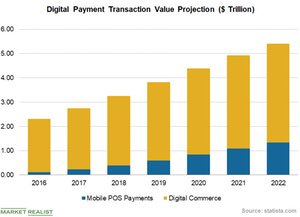

Statista projects that the total value of global digital payment transactions could increase to ~$5.41 trillion in 2022 from ~$2.75 trillion in 2017.

Rising Digital Payment Market to Support Visa’s Long-Term Growth

Visa (V) is poised to benefit from the growing trend of cashless transactions around the world.

Wells Fargo to Cut Over 600 Jobs amid Mortgage Business Slowdown

On August 23, Wells Fargo (WFC) announced that it planned to terminate the jobs of 638 employees in its home mortgage division.

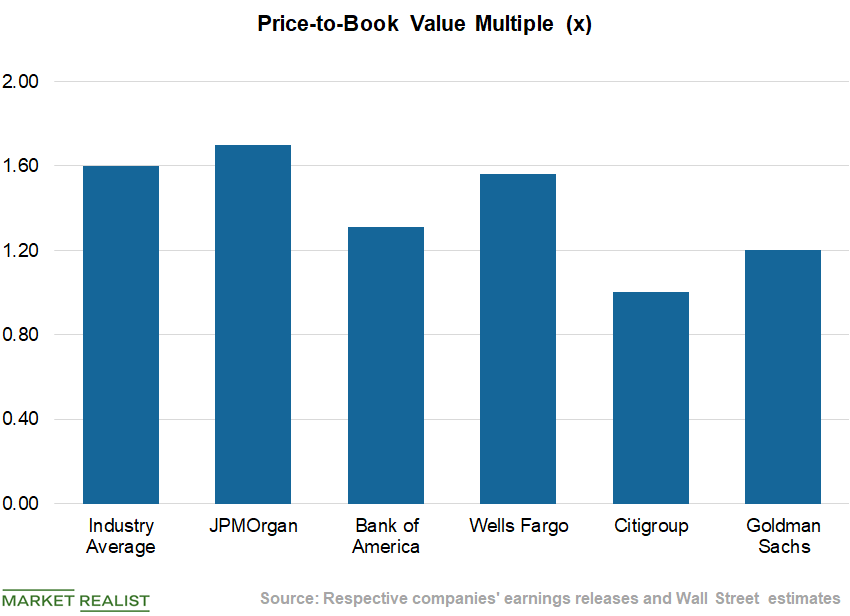

A Look at the Top Five US Banks’ Valuations

On a TTM basis, JPMorgan Chase trades at a price-to-book ratio of 1.7x, while the industry average stands at 1.6x.

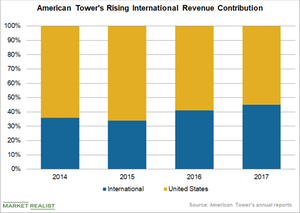

What American Tower’s Global Expansion Strategy Indicates

American Tower’s (AMT) global expansion strategy, which includes acquisitions and joint ventures in several countries (mainly in developing nations), is likely to continue supporting its top line.