Why Financial Agility Is Becoming the Defining Edge for Modern Companies

Financial agility has become the difference between firms that lead and those that quietly fade.

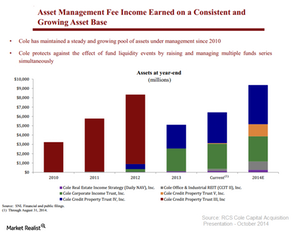

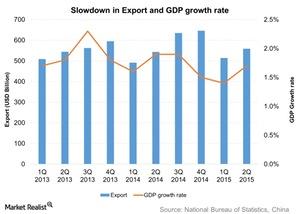

Market Realist covers stock and business developments in financial services from mature established firms to the latest fintech startups.

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.