PowerShares DB US Dollar Bullish ETF

Latest PowerShares DB US Dollar Bullish ETF News and Updates

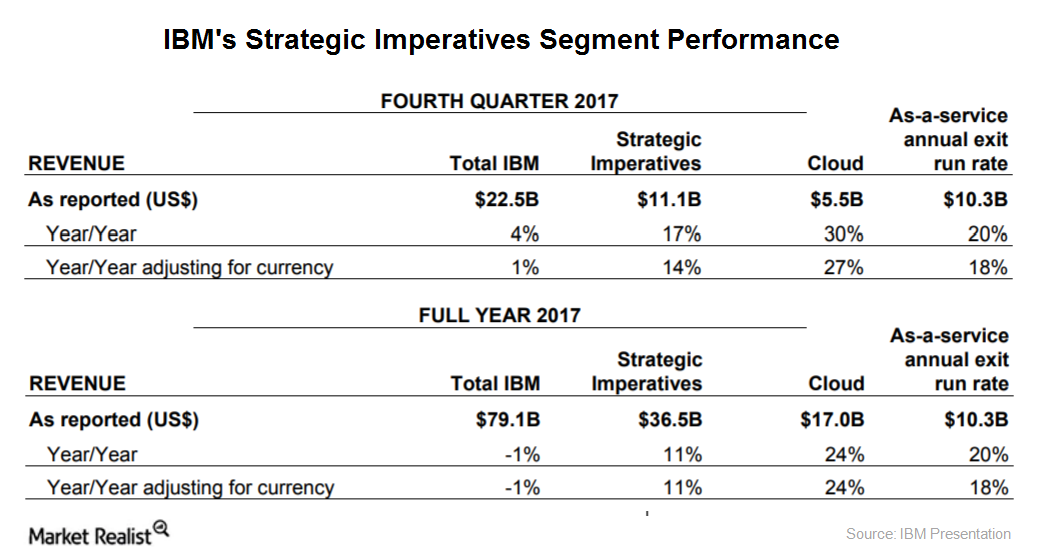

How IBM’s Strategic Imperatives Performed in Fiscal 4Q17

Earlier in the series, we discussed IBM’s (IBM) geographical revenues and the impact of currency fluctuations, especially the US dollar’s (UUP) impact on the company’s fiscal 4Q17 results.

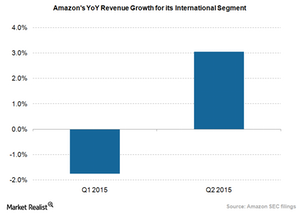

Amazon’s International Segment Saw Improvement in 2Q15

The year-over-year revenue growth trend for Amazon’s International segment was falling until last quarter.

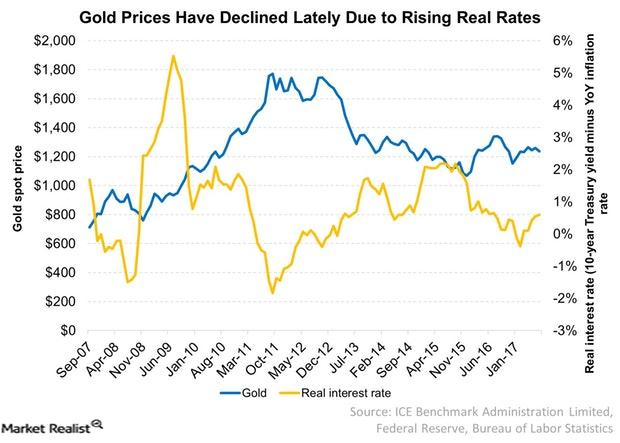

Gold Prices Have Been Flat despite the Weak Dollar

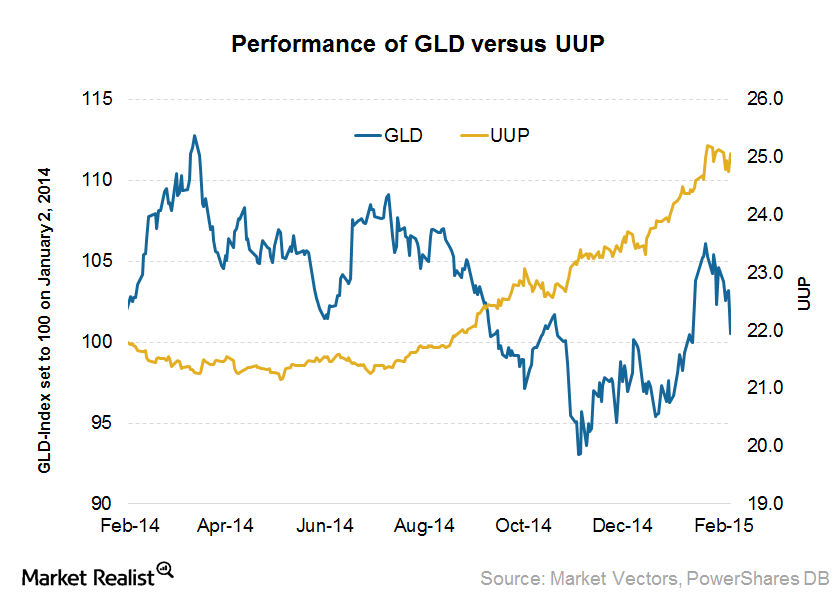

Gold (IAU) (GLD) prices usually have a strong negative correlation with the US dollar (UUP). Gold, like other commodities, is denominated in the dollar.

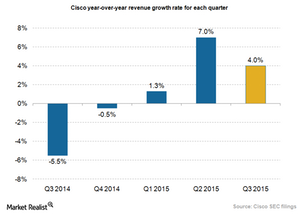

Can Cisco Beat Its Own Revenue Forecast in Fiscal 3Q15?

Cisco is expected to announce its fiscal 3Q15 earnings on May 13. Cisco expects its year-over-year revenue growth to be 3%–5% in the quarter.

Why the US Economy Stalled in 1Q15

The US economy stalled in 2014 for several reasons, including seasonality, weather, strength of the dollar, the West Coast port strike, and the oil price slump.

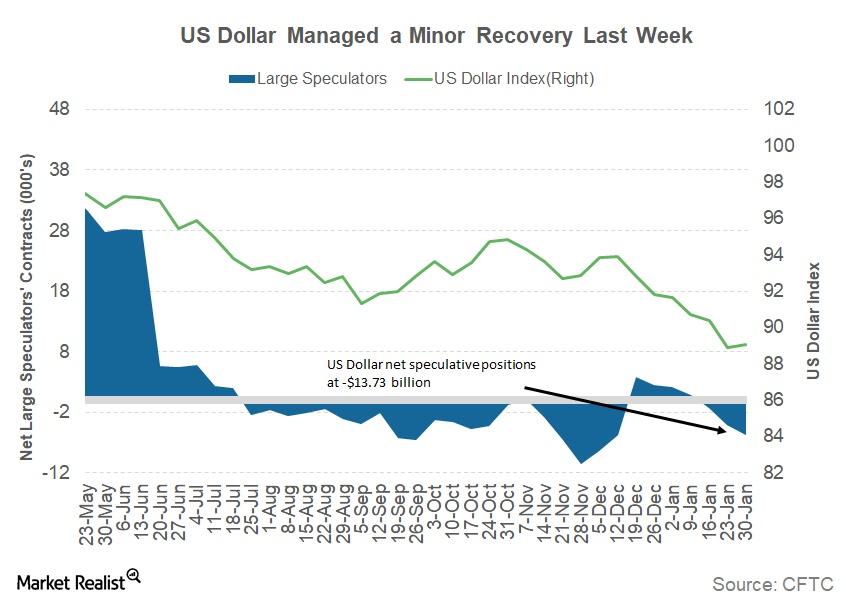

Have We Seen a Short-Term Bottom for the Dollar?

The US Dollar Index (UUP) managed to close in positive territory in the week ended February 8, 2018, after posting seven consecutive weekly losses.

How Will the Fed Affect the Earnings Recovery Environment?

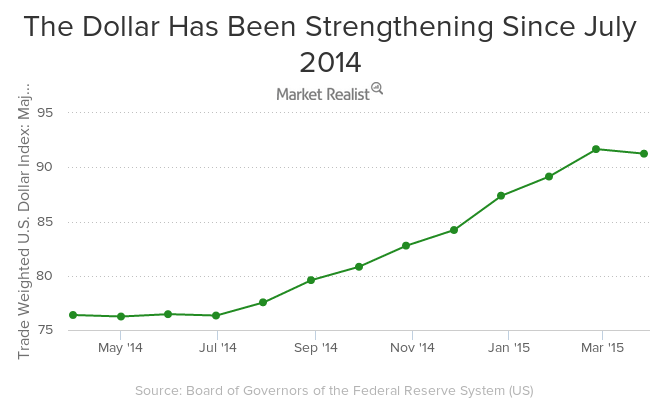

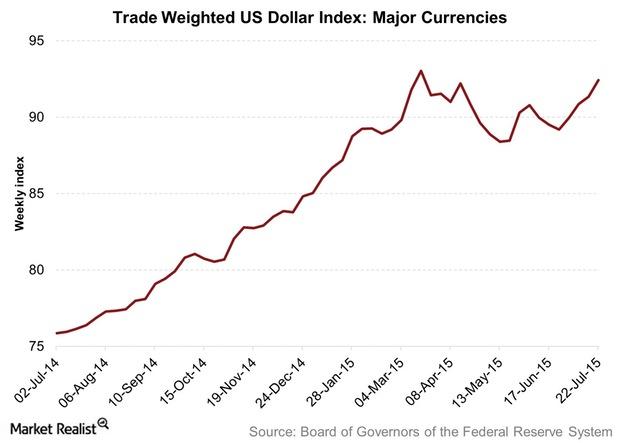

The dollar index (UUP) rallied about 22% between October 2014 to July 2016.

Once Again, Soros Makes Money off the UK’s Woes

Four days before the UK (EWU) decided to leave the European Union (VGK), Soros warned the markets of a “Black Friday” and a crash in the pound.Must-know: Why the Fed drove up emerging market asset prices

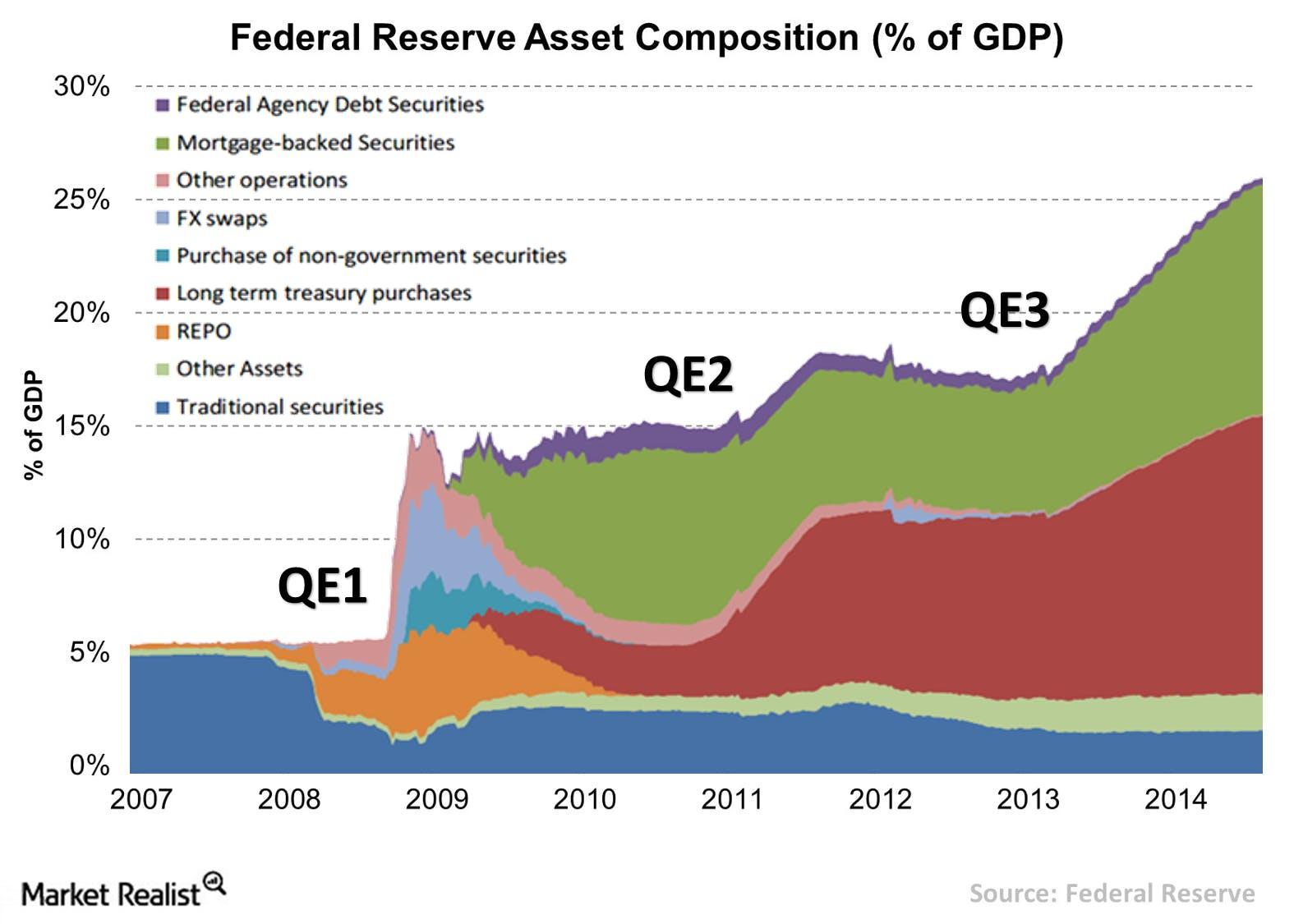

Many economists, like the Nobel Prize–winning Paul Krugman, believe that the Fed acted as a “white knight” in 2008, saving the global economy in the dire aftermath of the financial crisis.

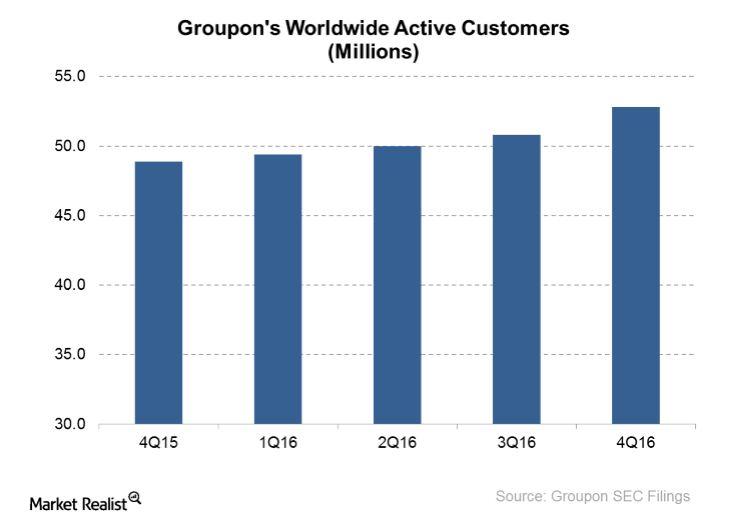

A Look at Groupon’s Marketing Strategy

Groupon (GRPN) is pumping millions of dollars (UUP) into marketing and customer acquisition efforts as it seeks to conquer the North American daily deals market.

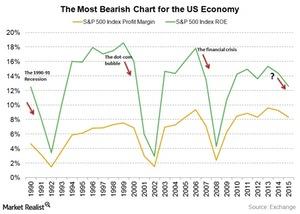

Why the S&P 500 Net Profit Margin May Predict a US Recession

Over a good four decades, the S&P 500’s net profit margin has fallen notably when the economy was on the verge of, or already into, a recession.

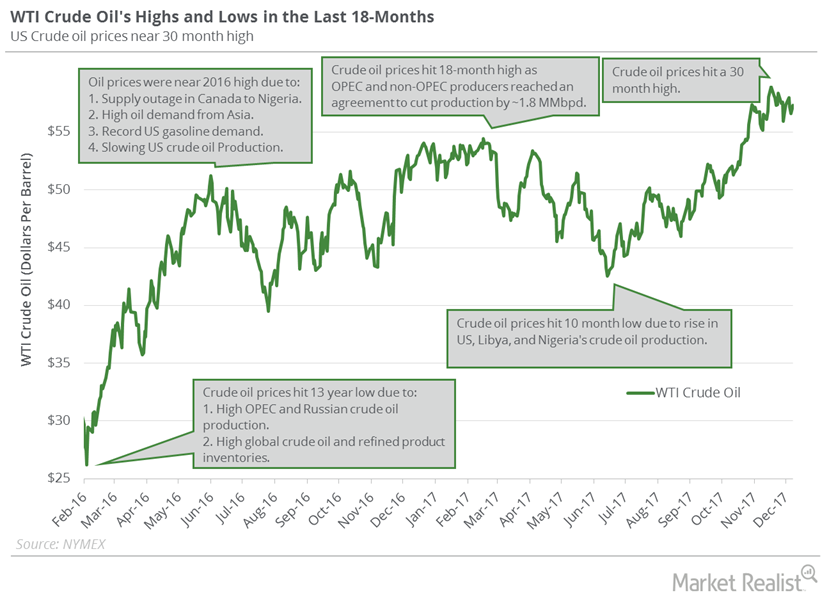

Will US Crude Oil Futures Be Range Bound This Week?

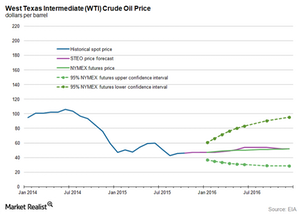

WTI crude oil (USO) futures hit $58.95 per barrel on November 24, 2017—the highest level in nearly three years.

Crude Oil Futures Near 7-Week High

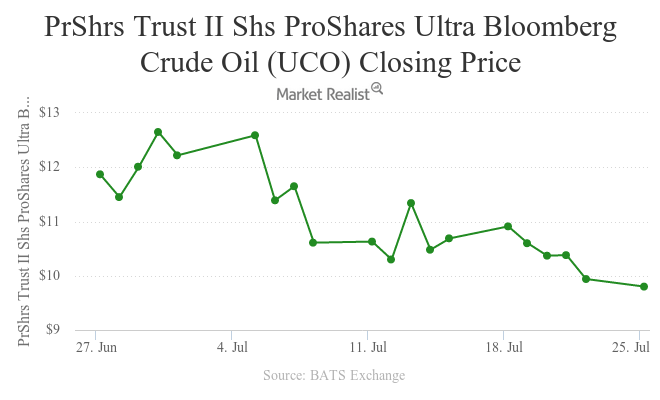

September US crude oil (RYE) (VDE) (BNO) futures contracts rose 3.3% to $47.8 per barrel on July 25, 2017.

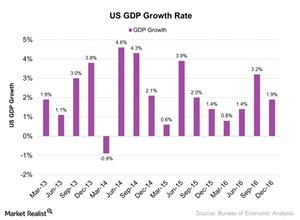

What Does Jack Bogle Predict for US Real GDP?

In 4Q16, US (SPY) (QQQ) (IVV) (VFINX) real GDP grew at an annual rate of 1.9% compared to a 3.5% rise in 3Q16.

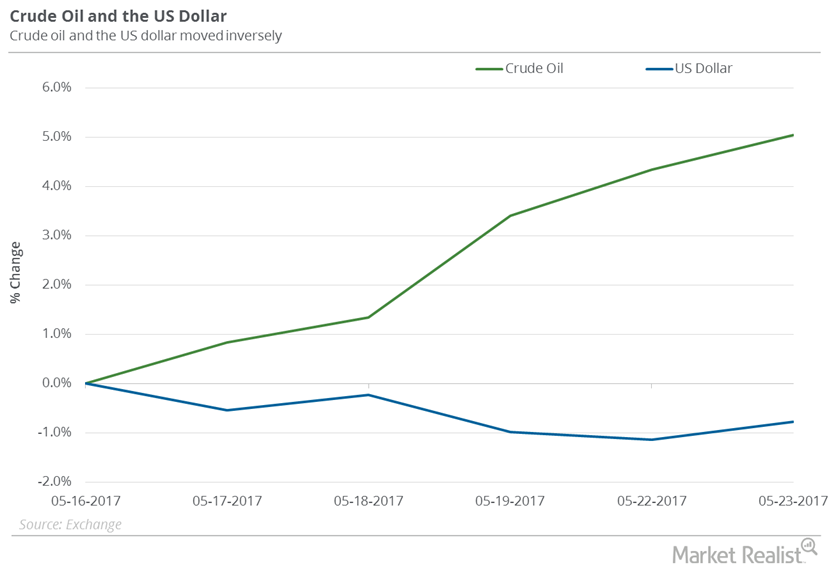

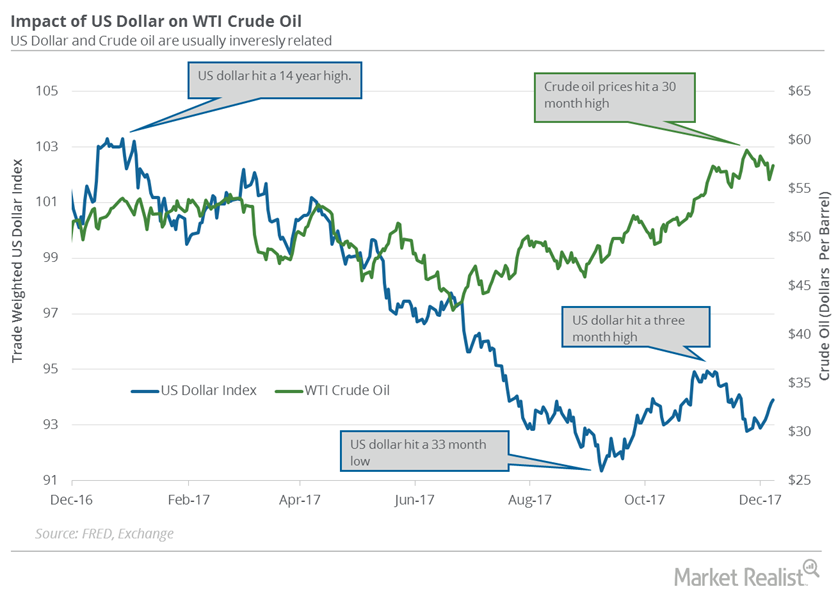

How the Dollar Is Affecting Oil

US crude oil (DBO) (USL) (OIIL) July futures rose 5% between May 16 and May 23, 2017.

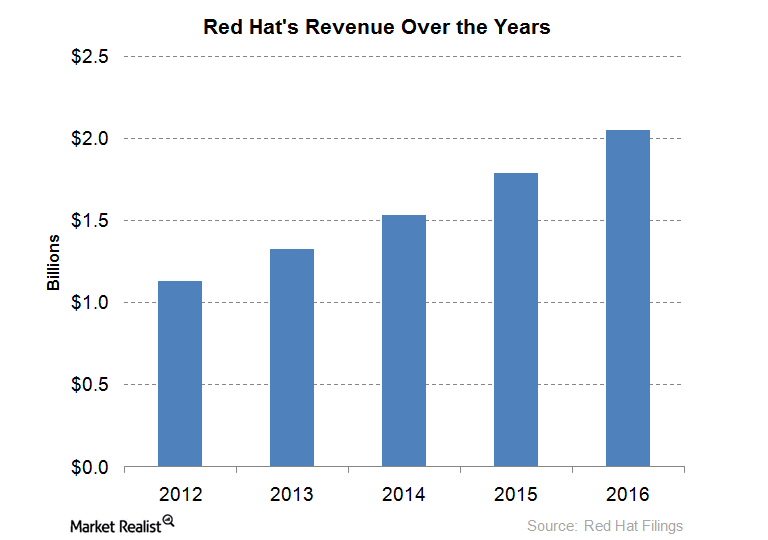

Red Hat: 56th Consecutive Quarter of Revenue Growth

Red Hat (RHT), a leading Linux software and open-source provider, was the latest in the technology space to announce its fiscal 4Q16 earnings.

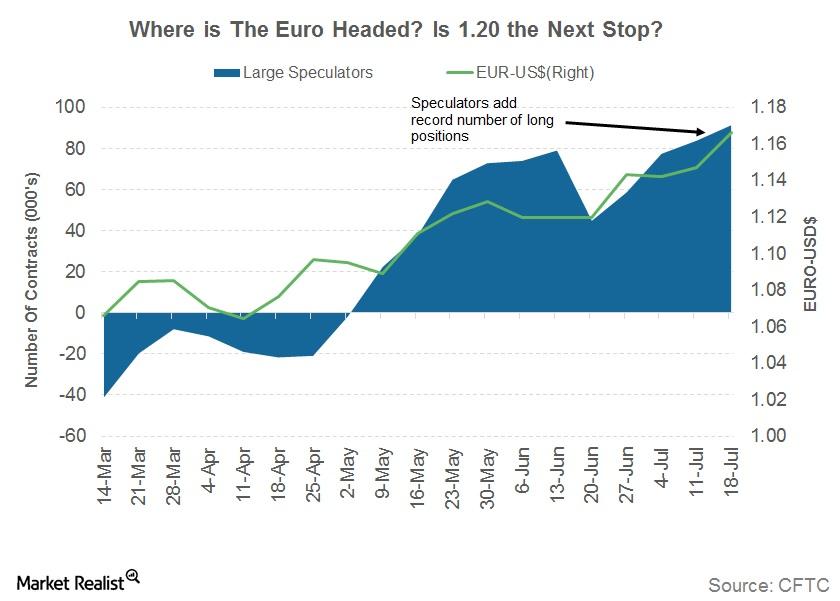

Euro Reaches 23-Month Peak: Could It Climb Higher?

Euro rallies to a 23-month peak Last week, the euro (FXE) closed at 1.17, appreciating by 1.7% against the US dollar (UUP). The currency has appreciated by more than 10% against the US dollar this year, making it one of the strongest developed market currencies. Improving economic conditions and a stable political climate turned the […]

Sharp Fall in Crude Oil Price Dictate the Currencies Markets

Looking at the performance of the major commodity-driven currencies on July 25, the Nigerian naira was the biggest casualty.

Currency warfare: A ‘beggar-thy-neighbor’ situation

In a currency war, the “beggar-thy-neighbor” strategy is about increasing the demand for a nation’s exports at the expense of other countries’ export share.

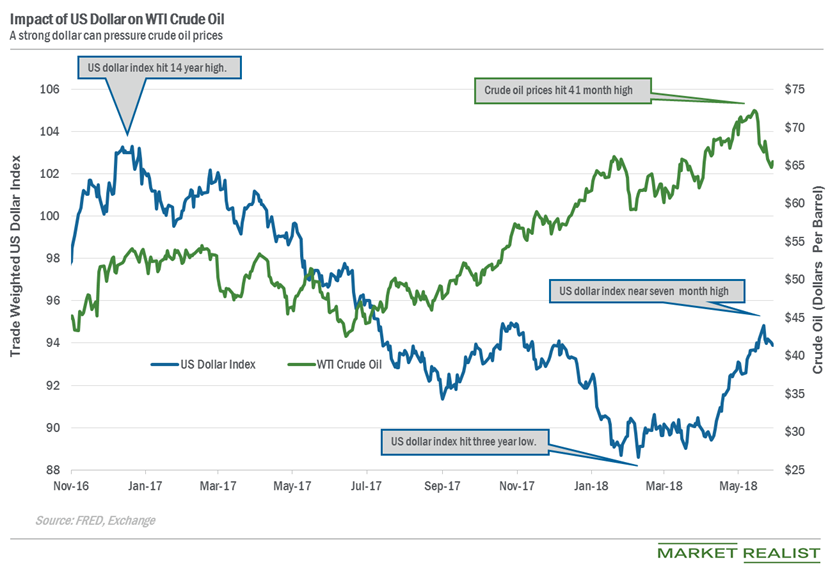

Can the US Dollar Index Help WTI Crude Oil Prices?

The US Dollar Index fell ~0.13% to 93.89, and July WTI oil futures rose ~1.2% on June 5.

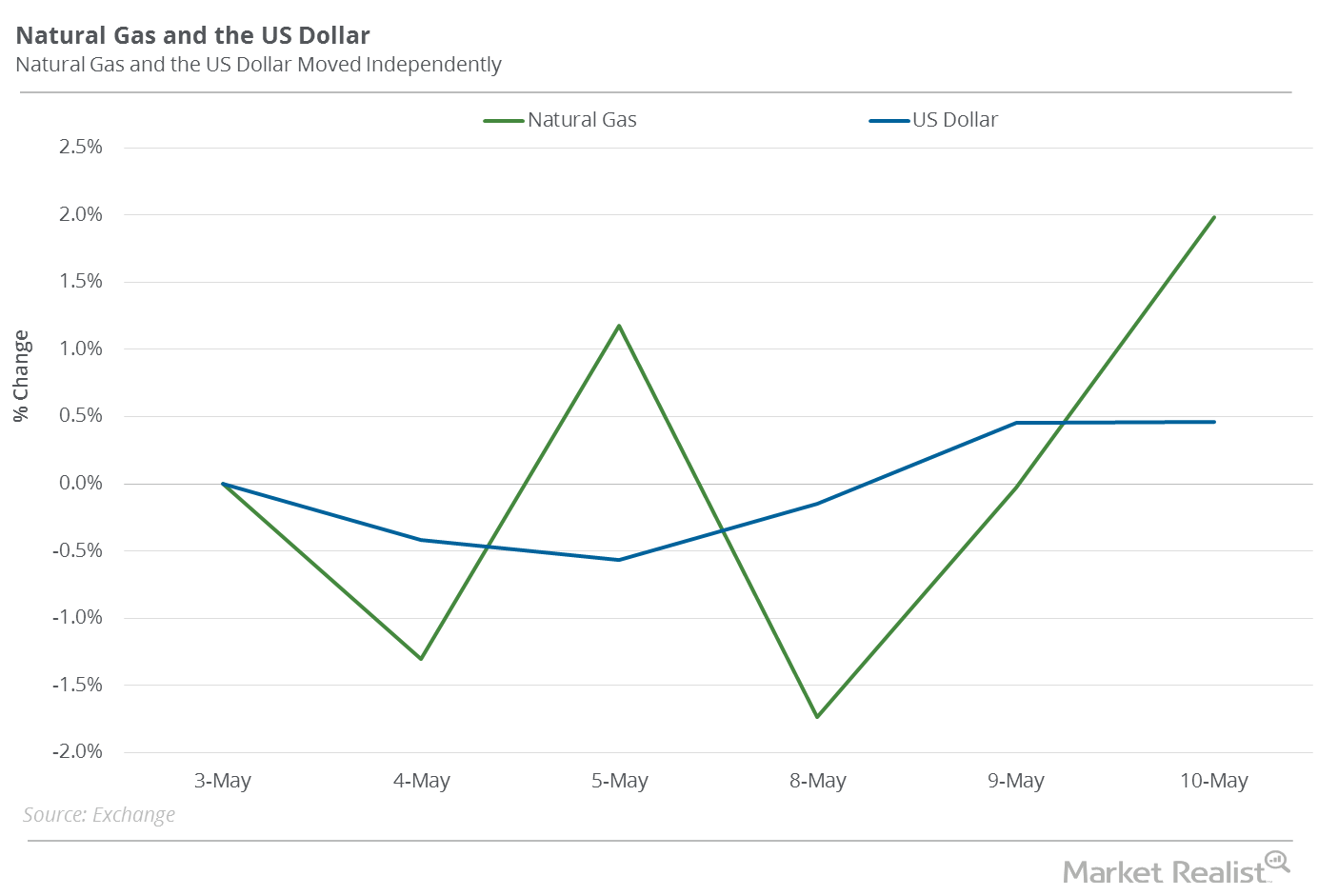

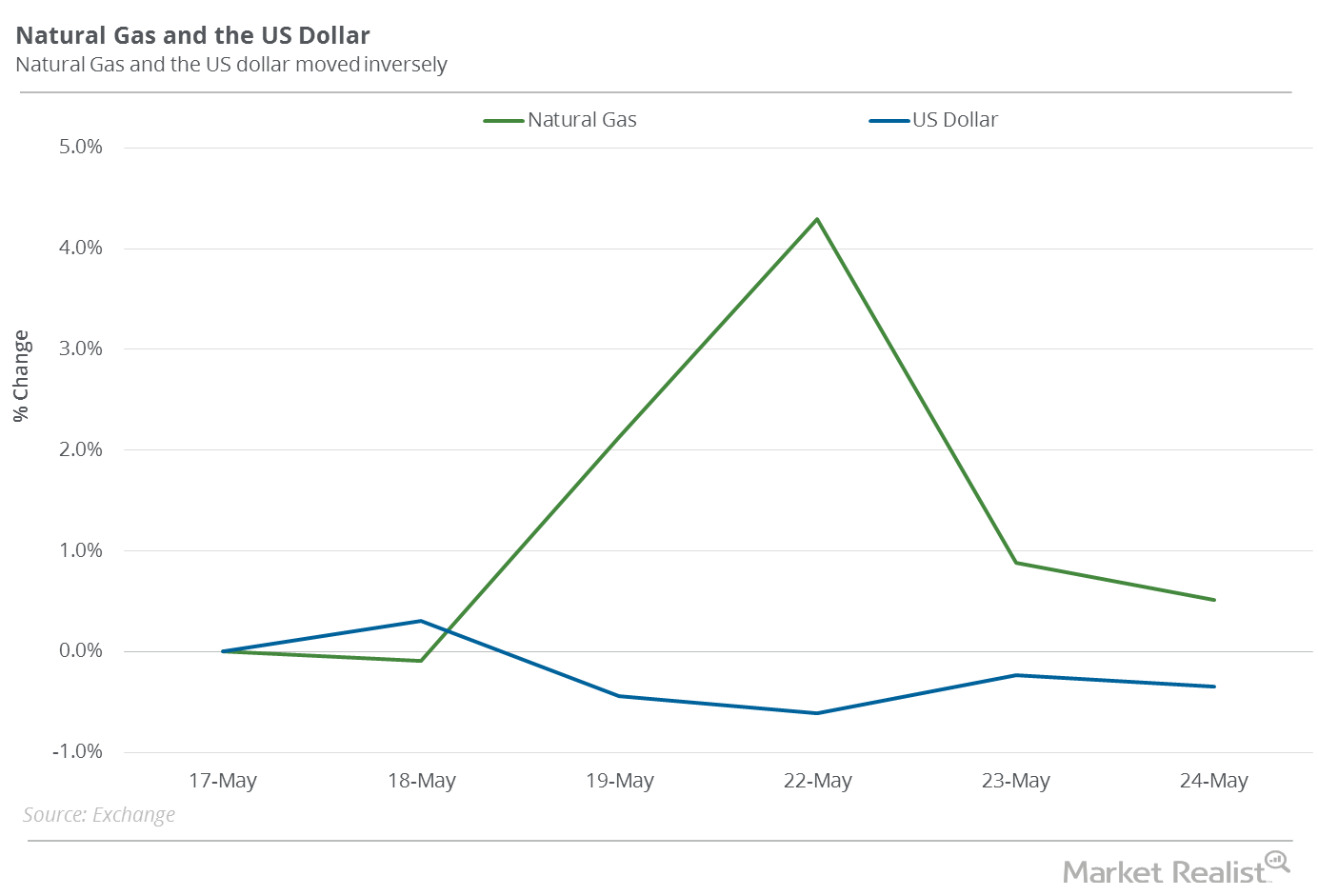

Natural Gas Prices Are Impacted by the US Dollar

Between May 3 and May 10, 2017, natural gas (GASX) (FCG) (GASL) June futures rose 2%. The US dollar (UUP) (UDN) (USDU) rose 0.5% during that period.

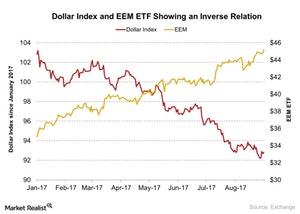

Stanley Druckenmiller Exited Position in EEM

Stanley Druckenmiller also sold his position in the iShares MSCI Emerging Markets ETF (EEM).

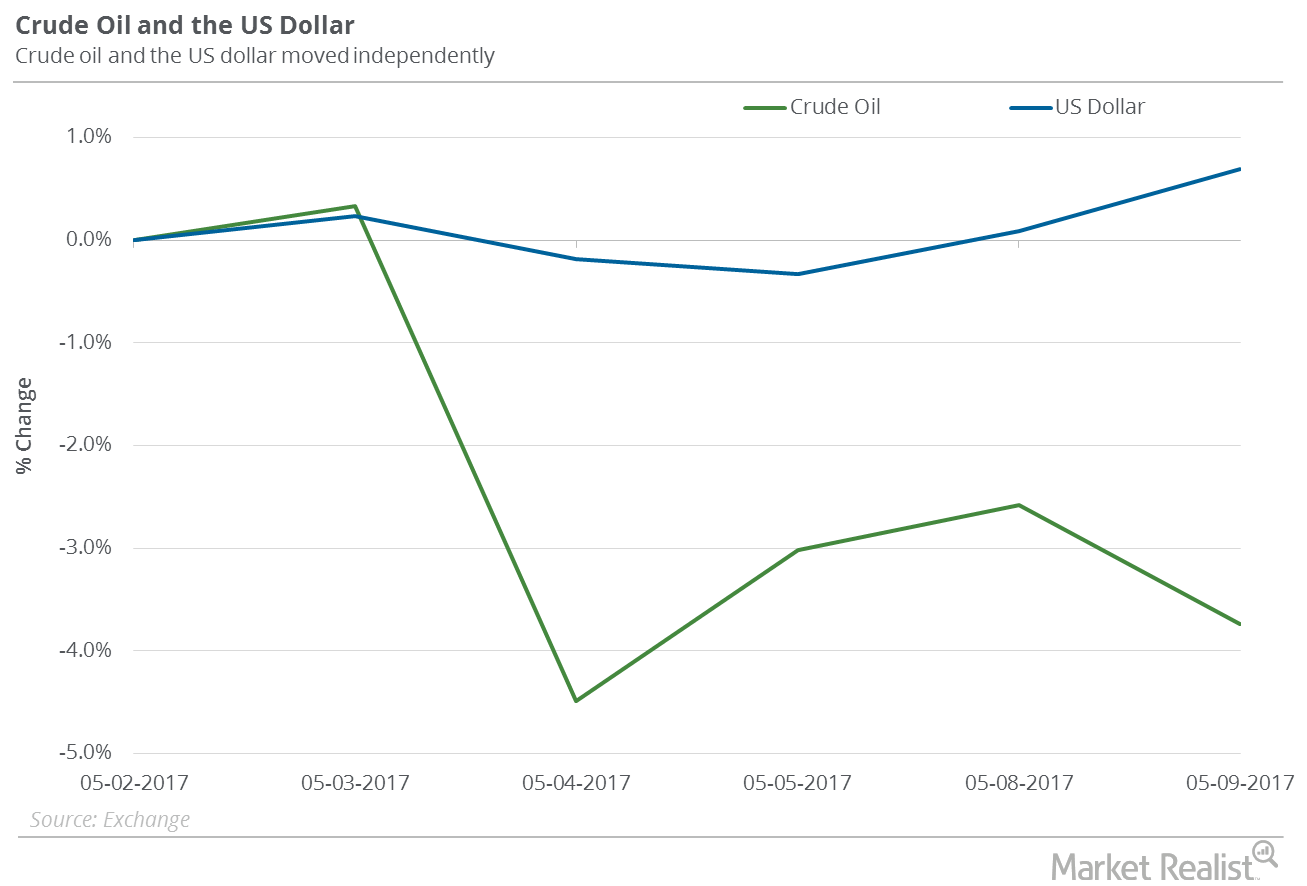

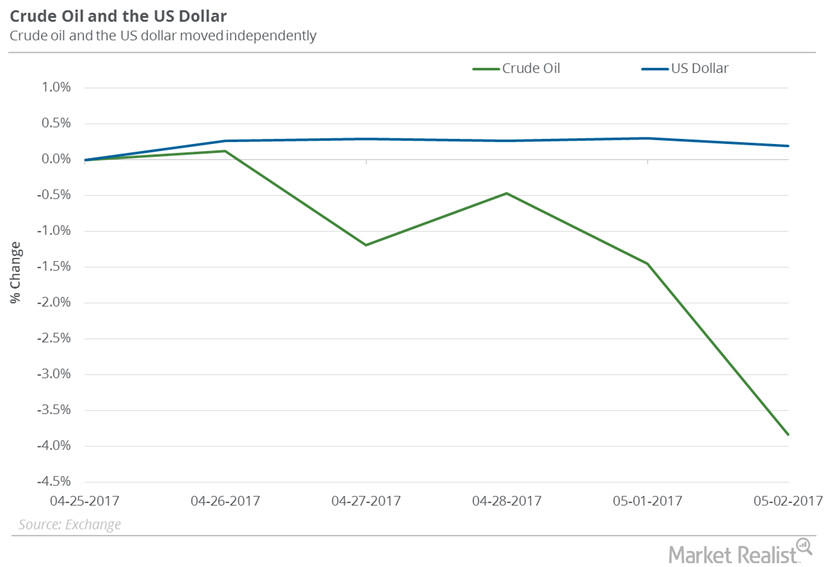

Oil Bulls, Don’t Worry About the Rising US Dollar

US crude oil futures contracts for June 2017 delivery fell 3.7% between May 2, and May 9, 2017, while the US Dollar Index rose 0.7%.

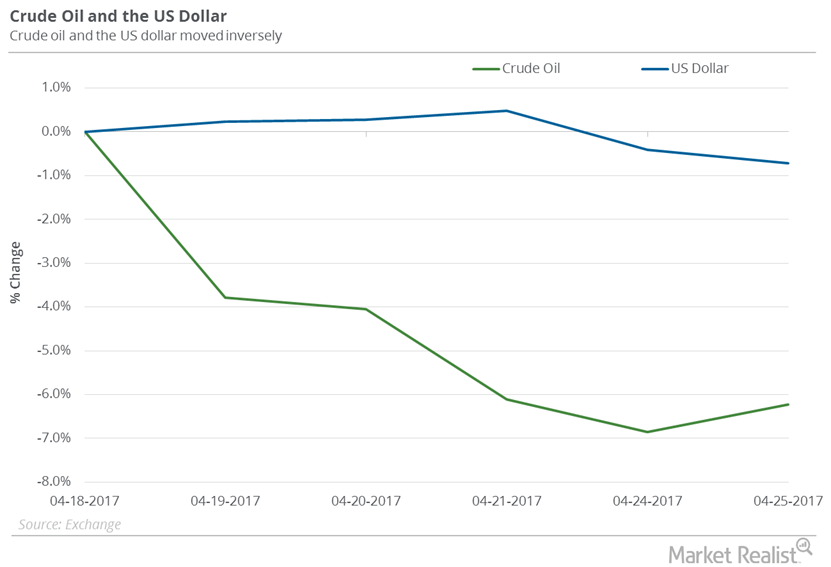

How the US Dollar Could Be Crucial to Oil Investors

US crude oil futures contracts for June delivery fell 6.2% between April 18, 2017, and April 25, 2017. Meanwhile, the US Dollar Index fell 0.7%.

Crude Oil Prices Rise: Is It Time for a Collapse?

WTI crude oil prices have risen 9.4% since June 21, 2017. Brent and US crude oil prices are near a three-week high.

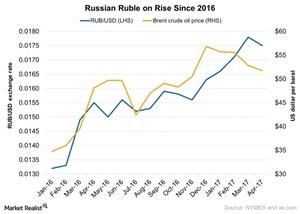

Why the Ruble Is on the Rise

The recovery of oil prices in the latter half of 2016 has helped the Russian ruble to appreciate along with improved exports.

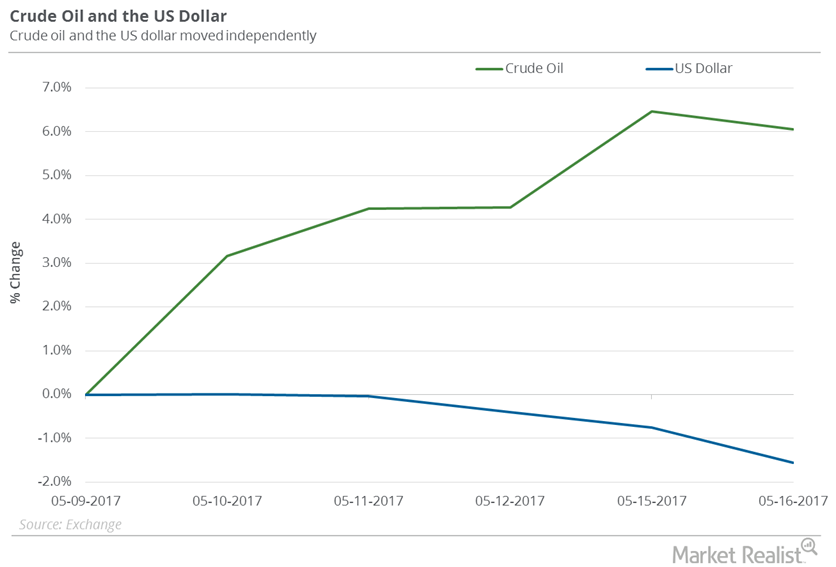

How the Dollar Could Impact Oil’s Recovery

US crude oil (DBO) (USL) (OIIL) futures contracts for June 2017 delivery rose 3.7% between May 10 and May 17, 2017.

Did the US Dollar Impact Oil Prices Last Week?

US crude oil (DBO) (USL) (OIIL) futures contracts for June 2017 delivery fell 3.8% between April 25, 2017, and May 2, 2017.

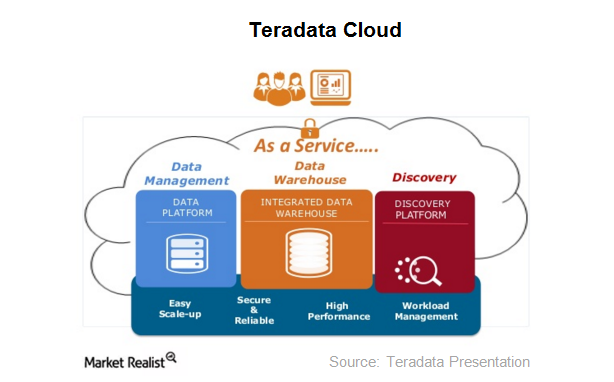

Teradata Struggles as Cloud Adoption Increases

Teradata primarily generates revenues from data and analytics and marketing applications. Its core business is struggling, as data warehouses are increasingly moving toward the cloud.

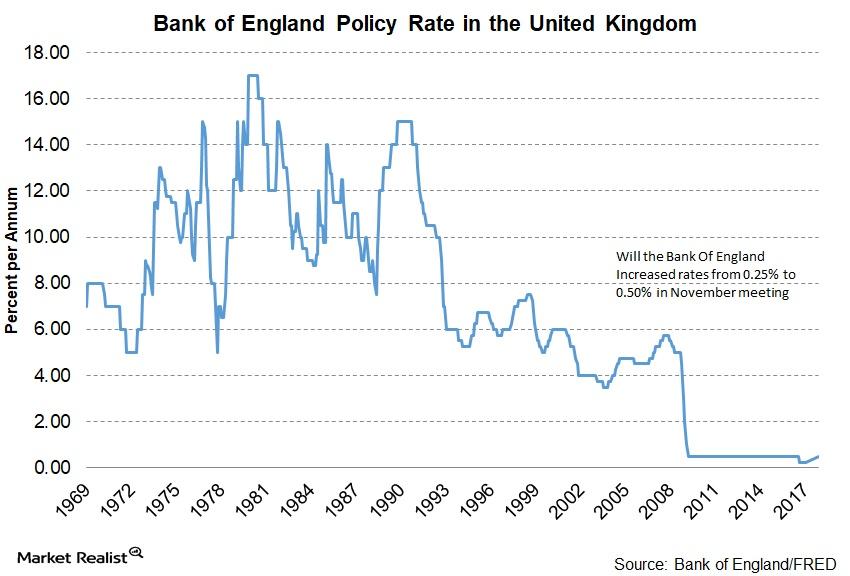

Bank of England Raises Interest Rate to 0.50%

The BOE (Bank of England) in its November meeting increased its benchmark interest rates from 0.25% to 0.50%.

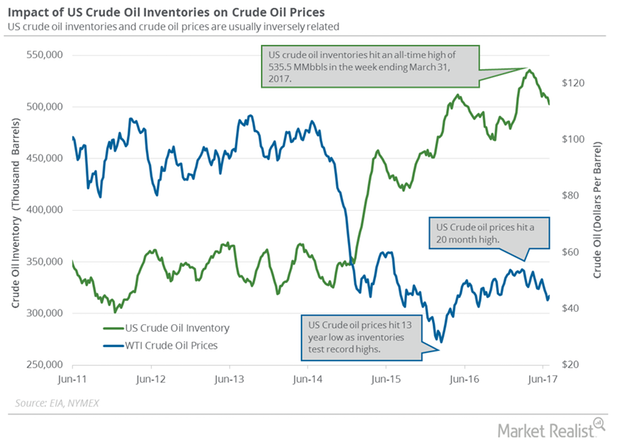

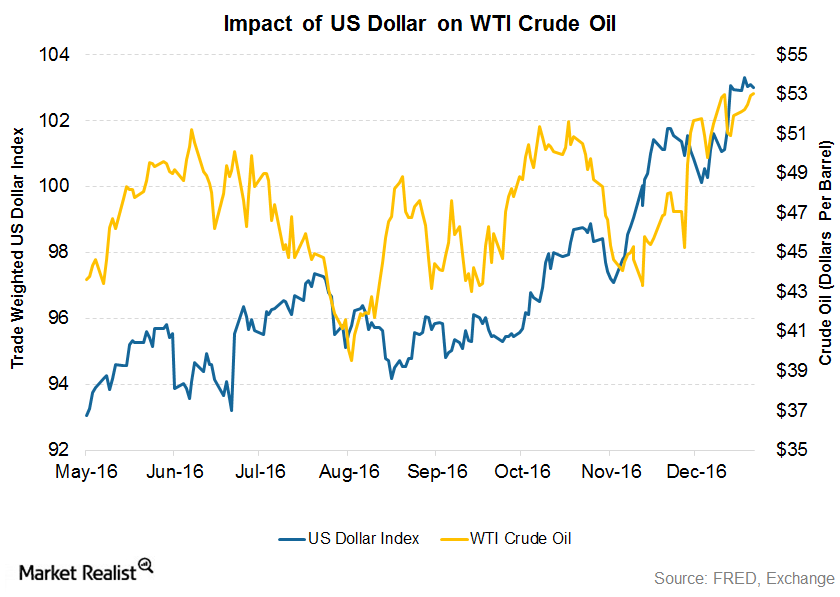

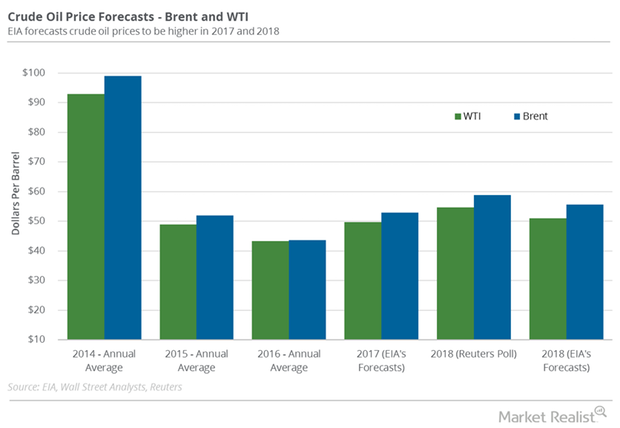

How Will the US Dollar Affect Crude Oil Prices in 2017?

February 2017 WTI (West Texas Intermediate) crude oil (PXI) (ERX) (USL) (ERY) futures contracts rose 0.1% and settled at $53 per barrel on December 23, 2016.

Crude Oil and Product Inventories Impact Crude Oil Futures

US crude oil futures have risen 6% from the ten-month low on June 21, 2017. Futures have also risen 2% in the last month.

Crude Oil Bear Market: Worst Case Scenarios for 2016

Goldman Sachs (GS) suggests crude oil prices could test $20 per barrel in a worst case scenario in 2016.

FOMC Meeting Could Surprise Crude Oil Traders

US crude oil (UCO) (USL) futures contracts for January delivery rose 0.7% and were trading at $58.4 per barrel at 1:02 AM EST on December 12, 2017.

Net Exports: Why They Matter and What Drives Them

A country’s net exports measure the value of total exports less the value of its total imports. It’s positive if exports are larger in value than imports.

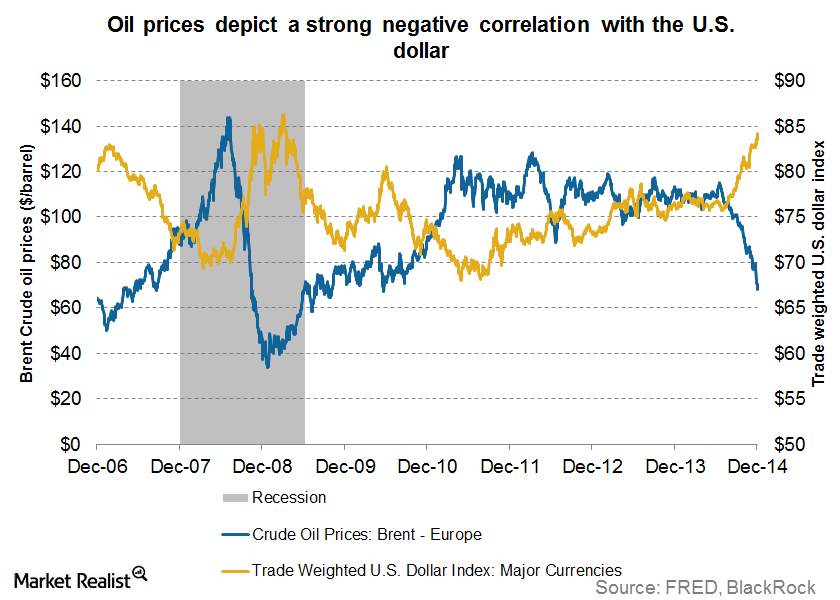

How The Rising Dollar Is Causing Oil Prices To Fall

A rising dollar has and will continue to put downward pressure on oil prices, causing trouble for the energy sector (XLE).

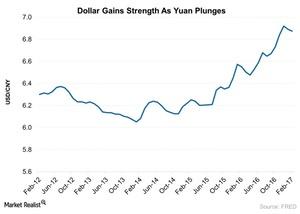

How Much Is China Really Devaluing Its Currency?

China had pegged its currency, the yuan, to the US dollar as it was a developing nation.

Recent Fall in the US Dollar: Crucial for Natural Gas?

Natural gas (GASX) (FCG) (GASL) July futures rose 0.5% on May 17–May 24, 2017. During this period, the US dollar (UUP) (UDN) (USDU) fell 0.3%.

Crude Oil Prices Could End 2017 on a High Note

A Reuters poll estimated that WTI crude oil (USL) prices could average $54.78 per barrel in 2018 after extending the production cuts.

Investing in gold? Watch the US Dollar Index

Tracked by the Federal Reserve, the weekly US Dollar Index measures the value of the dollar compared to the currencies of its significant trading partners.

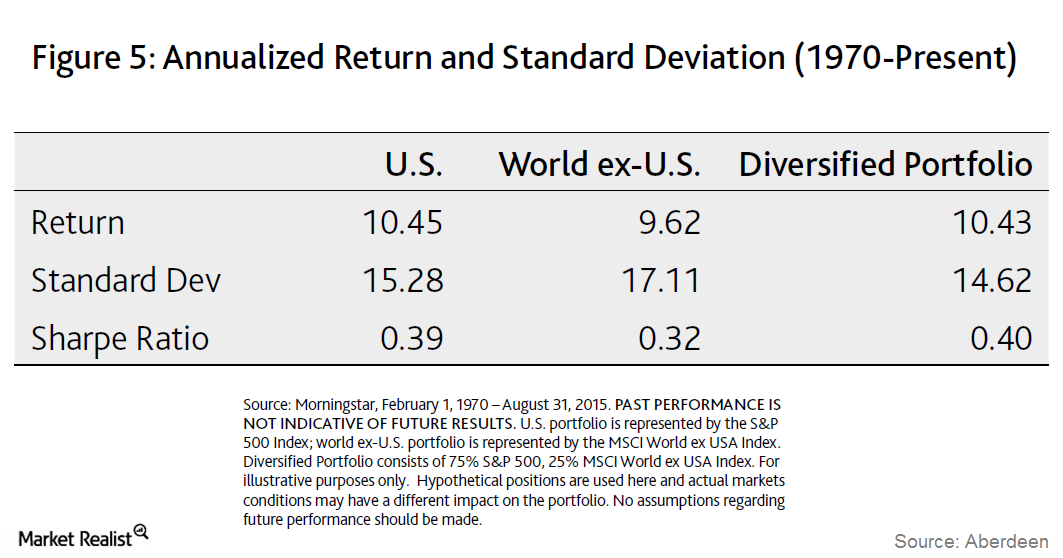

Risk and International Assets in a Portfolio

Although international investing does tend to mitigate risk and diversify portfolios, there are certain risks involved.

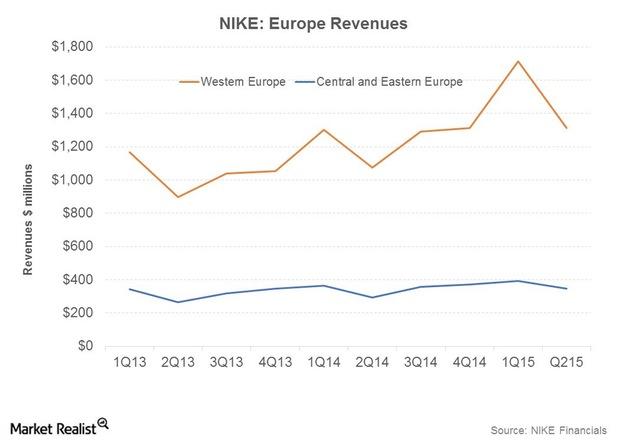

NIKE Defies Macro Headwinds In Europe

NIKE is in the midst of transforming the Western Europe market. It’s looking to improve profitability by increasing the premium on its brand.

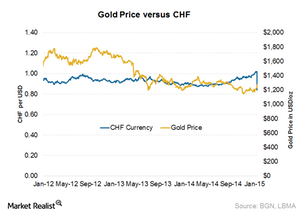

Why the Swiss National Bank removed the cap against the euro

A cap was put in place to stop the currency’s appreciation. An appreciating local currency is detrimental to exporters.

China’s De-Dollarization amid Trade War: Gold’s Upside?

China continued buying gold for the tenth consecutive month in September. The country also continued its de-dollarization bid.

Trump, Trade War, Powell: More Upside for Gold Prices?

Gold hit a fresh six-year high on Friday as trade tensions between the US and China escalated. The SPDR Gold Shares ETF (GLD) closed up 2%.

The Dollar Is Strengthening: How Will It Affect Markets?

The US Dollar Index, which measures the strength of the dollar against a basket of other currencies, has risen 2.2% in the past month.

Powell’s Speech Ignites a Rally in Equities and Metals

Markets had been worried about the Fed’s continued aggressive stance on rate hikes, which could shorten economic expansion.

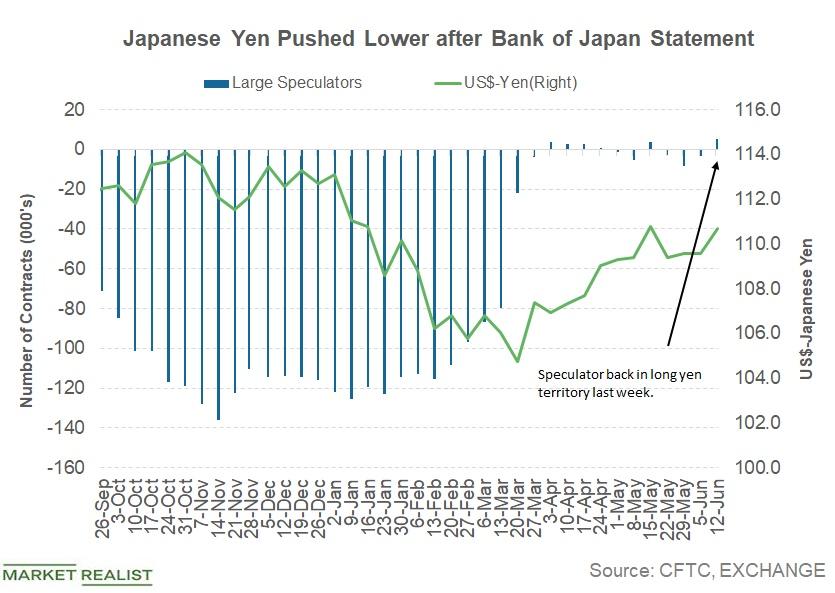

Why the Yen Depreciated against the Dollar

Last week, the Japanese yen (JYN) succumbed to the US dollar’s strength. The Japanese yen (FXY) closed the week at 110.67.Miscellaneous How Is the Dollar Affecting Precious Metals?

Besides ongoing geopolitical concerns, a crucial factor that gold keeps looking to for directional moves is the US dollar.

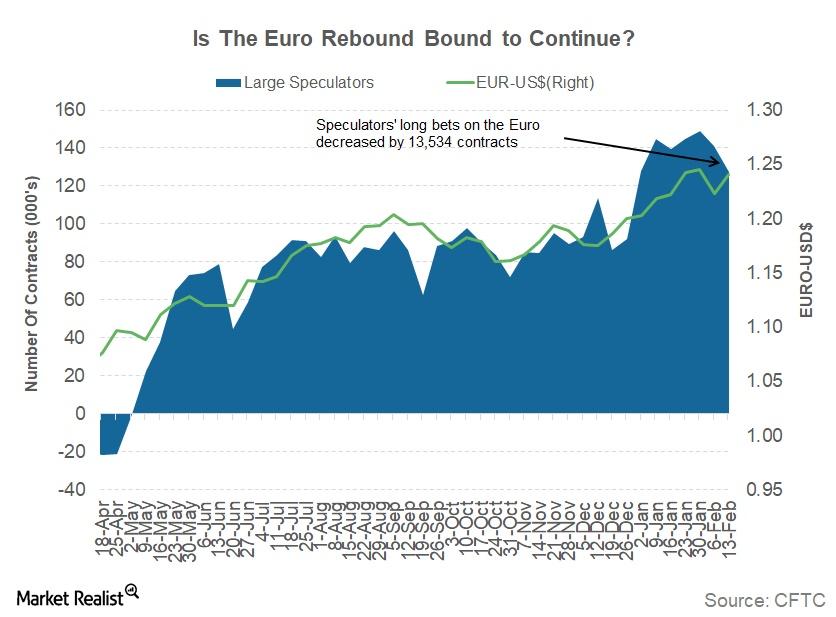

What to Expect from the Euro This Week

The euro-dollar (FXE) exchange rate closed the week ending February 16 at 1.24, an appreciation of 1.4% against the US dollar (UUP).