Lululemon Athletica Inc.

Latest Lululemon Athletica Inc. News and Updates

Inhale the Future, Exhale the Past: Who Owns Lululemon Now?

Lululemon's had its share of ups and downs over the years, and now they're debuting shirts made from plant-based nylon. So, who owns Lululemon now?

Experts See LULU Stock Holding Its Ground

Experts expect Lululemon stock to hold its ground amid economic uncertainty. Here's more on LULU's forecast.

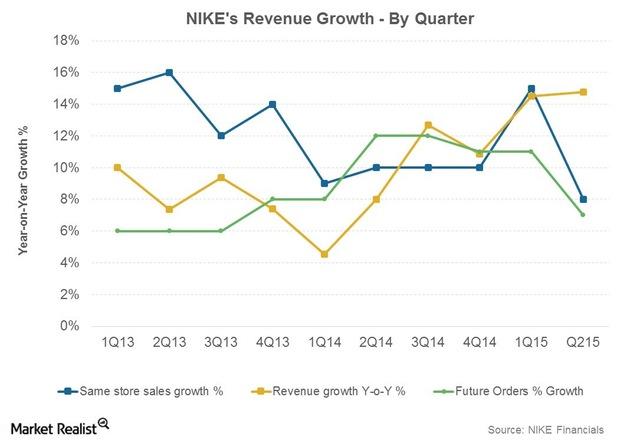

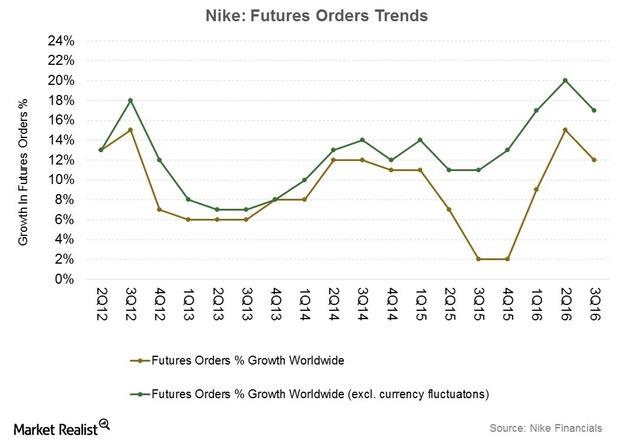

Analyzing the Prospects of Nike’s Geographic Segments

Most of Nike’s (NKE) incremental revenue was recorded in its North America market, Nike’s largest geographical segment.

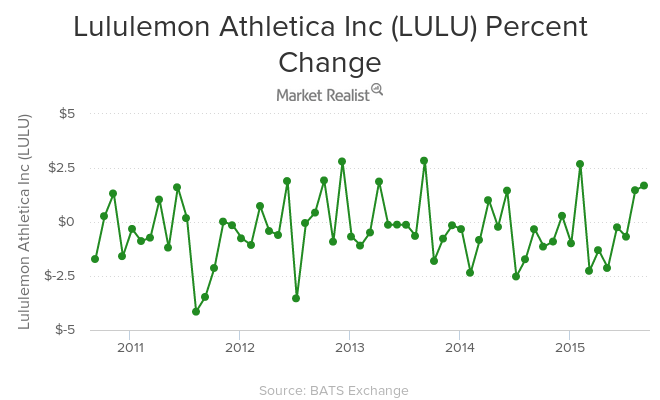

Lululemon: The Outliers Affecting LULU’s Stock Price Movement

On June 11, Lululemon Athletica (LULU) filed a shelf prospectus with the US Securities and Exchange Commission (or SEC).

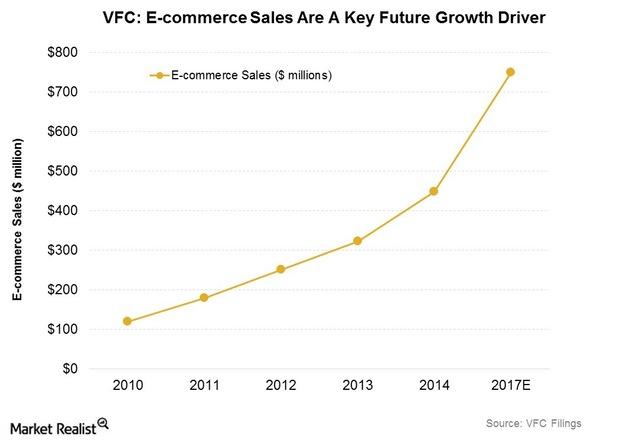

Will VF Corporation’s Vans Brand Spur Higher Growth in 3Q15?

VF Corporation saw sales of $2.5 billion in 2Q15, up 4.7% year-over-year. Its performance was boosted by top brands The North Face, Timberland, and Vans.

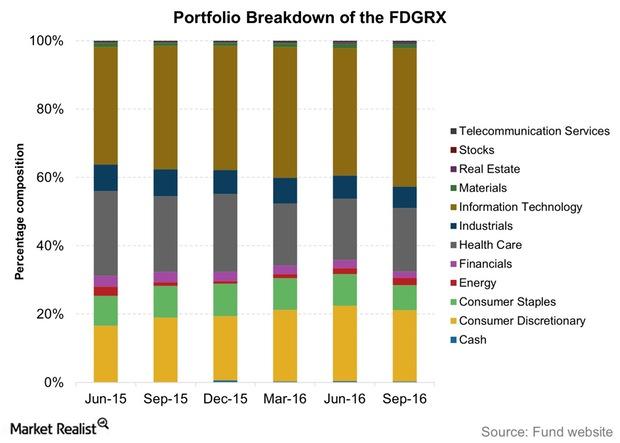

Inside the Fidelity Growth Company Fund Portfolio

FDGRX’s core sectors are information technology, consumer discretionary, and healthcare. The first two sectors make up a little over 60% of the portfolio.

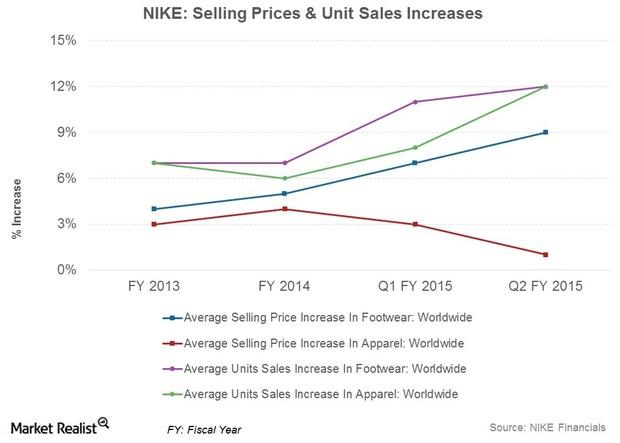

Why Nike Is Able To Sell More Products At Higher Prices

Revenue gains for Nike (NKE) in 1H15 were broad-based. Sales rose for almost all key product categories, with the notable exception of the golf category.

Overview of Nike Earnings, Leverage, and Valuation

Nike (NKE) has a positive earnings surprise history. In simple terms, the company has beat Wall Street’s earnings estimates in the past several quarters.

Who’s Taking a Bite Out of Nike’s Market Share?

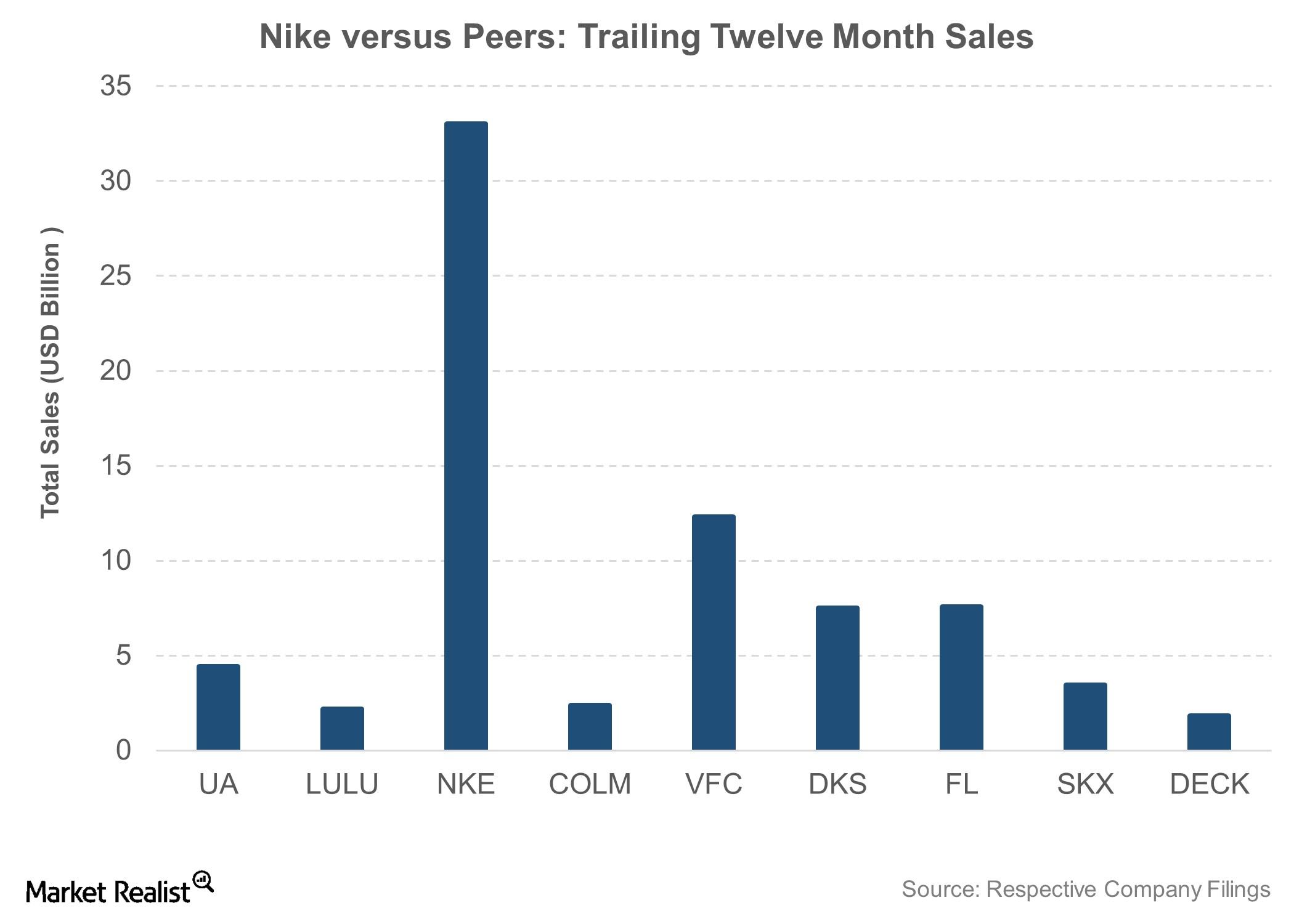

Nike is the world’s largest athletic footwear and apparel company. It dominates the sportswear market in Europe, China, and North America.

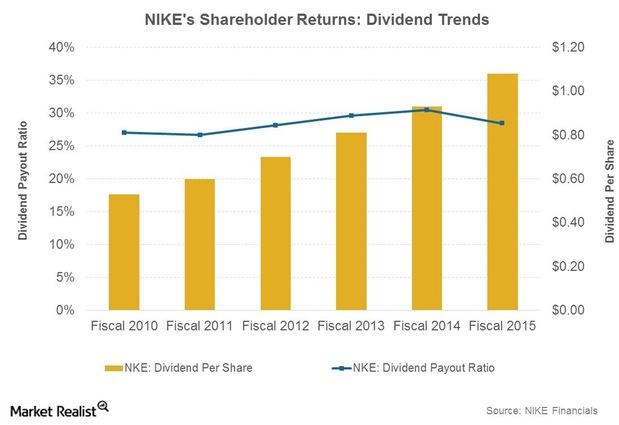

Nike: 5-Year Returns Targets for Shareholders

At its 2015 Investor Day held on September 14, Nike briefed the financial community on its targets for generating value for shareholders.

Under Armour’s Fitness App Platform Is the World’s Largest

Late last year and in early 2015, Under Armour acquired Endomondo and MyFitnessPal. Its fitness app user platform became the largest in the world.

Nike’s Target Markets: Everything You Need to Know

Nike (NKE) faces some challenges in its target markets. In the US, economic growth rates have tapered down, and the trade war could affect its China market.

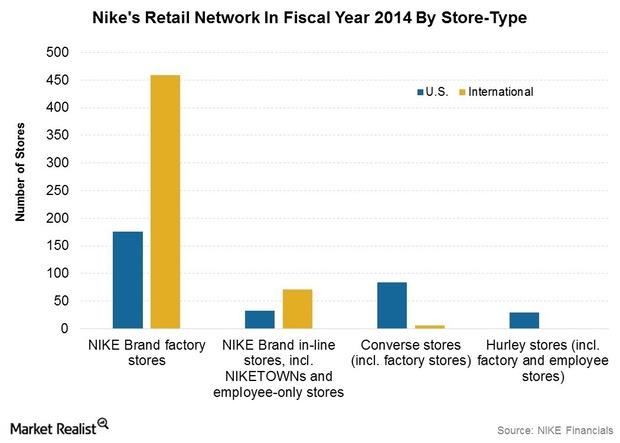

NIKE Scores Big Leveraging E-commerce, Retail Channels

The company is widening its retail footprint and growing e-commerce sales. NIKE’s store count stood at 858 stores at the end of fiscal 2014.

Nike’s Outlook: Category Offense All the Way

Consensus Wall Street analyst estimates project Nike’s adjusted diluted EPS to be $3.58 in fiscal 2015, an increase of 19.7% over the previous year.

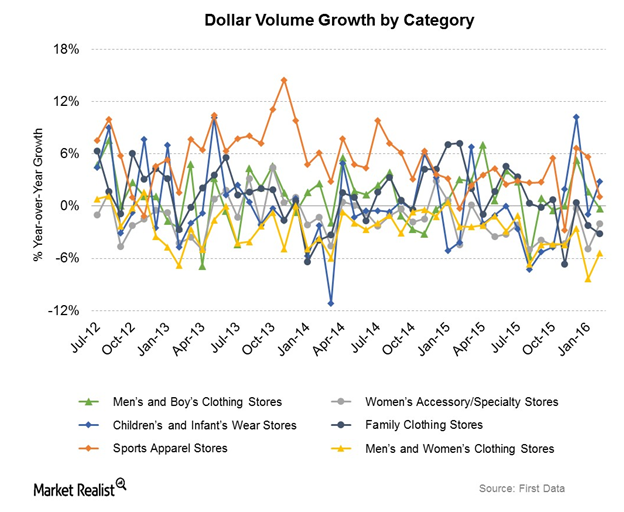

Key Drivers Impacting Under Armour’s Future Financial Performance

The impact of adverse forex movements on UA’s financial performance may be mitigated somewhat by the stronger retail environment in Europe.

Can Nike Regain Footing with Its Adaptive Lacing Footwear?

In early March, Nike showcased its new self-lacing footwear. Also known as “HyperAdapt 1.0,” the shoes tighten up when the foot is placed inside them.

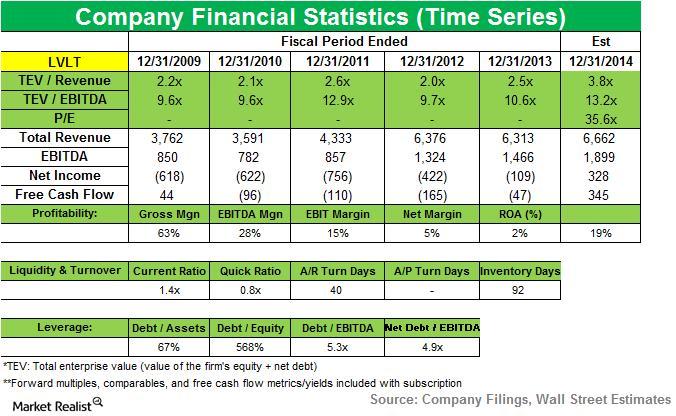

Coatue Management adds new position in Level 3 Communications

Coatue Management added a new position in Level 3 Communications Inc. (LVLT) during the third quarter. The stock accounted for 1.46% of the fund’s 3Q14 portfolio.

Why Is Under Armour Stock Facing Pressure?

J.P. Morgan expects Under Armour’s fiscal 2020 revenues to mark 3.8% growth. J.P. Morgan’s growth forecast is well below analysts’ consensus estimate.

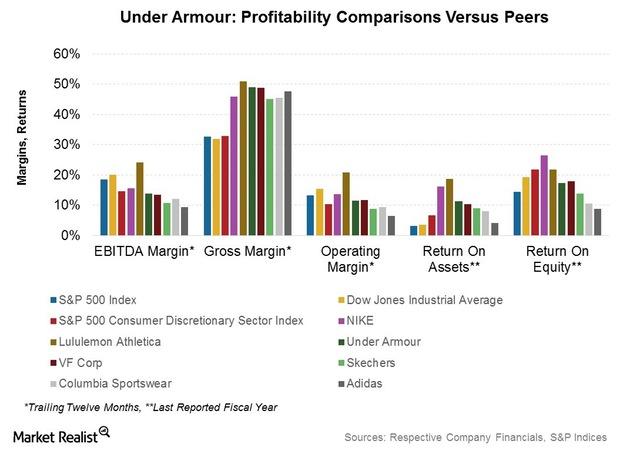

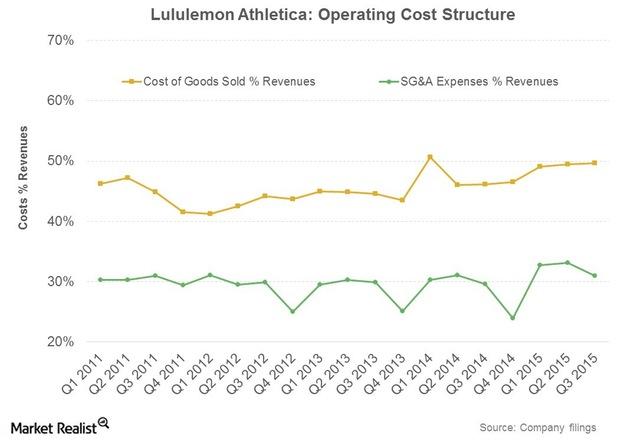

Why Lululemon’s Profit Margins Are Trumping The Company’s Peers’

LULU’s gross profit margin slipped from 55.7% in fiscal 2013 to 52.8% in fiscal 2014. The company’s operating profit margin slipped from 27.5% to 24.6%.

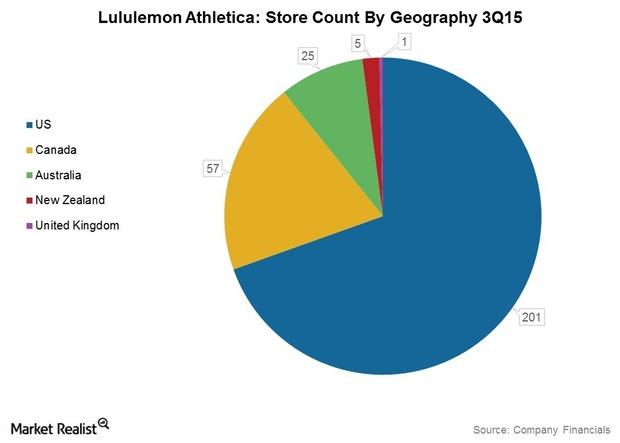

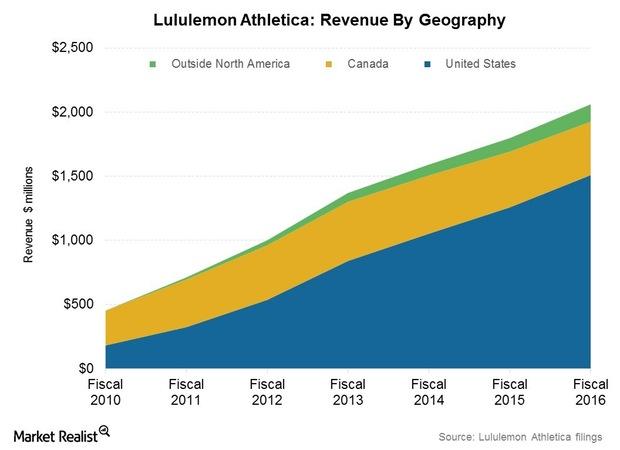

Analyzing Lululemon’s Revenues By Geographical Segment

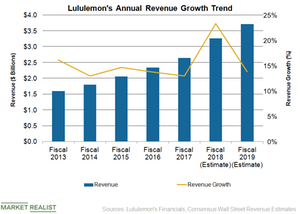

The company grew its revenues at a compound annual growth rate of more than 35% over the past five years to come in at $1.6 billion in fiscal 2014.

Lululemon Stock: What’s behind Its Exceptional Growth?

Lululemon stock is beating the broader markets by a wide margin. Barclays has initiated coverage on LULU with an “overweight” rating.

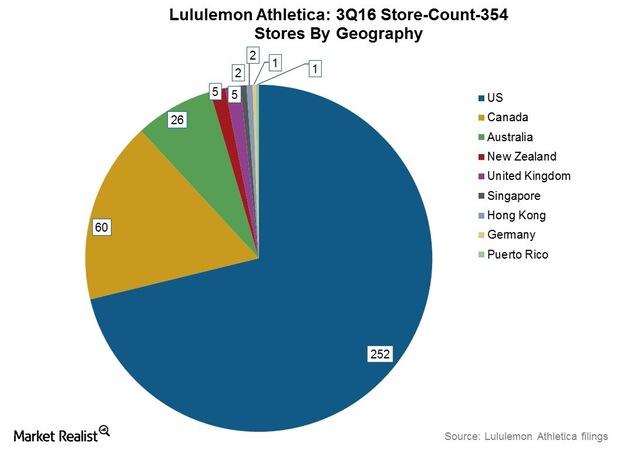

Why Lululemon Athletica Expects Stronger Sales in Fiscal 4Q16

Growth company Lululemon Athletica (LULU) has revised its fourth quarter (fiscal 4Q16) and full-year (fiscal 2016) revenue guidance upwards.

Five-Year Plan: Lululemon’s Long-Term Vision and Goals

Over the next five years, Lululemon Athletica (LULU) is aiming to double its revenue to $4 billion with an expected mid-single-digit growth rate in store comps.

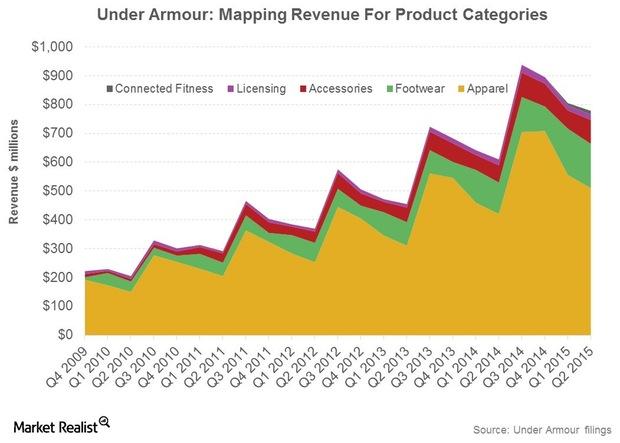

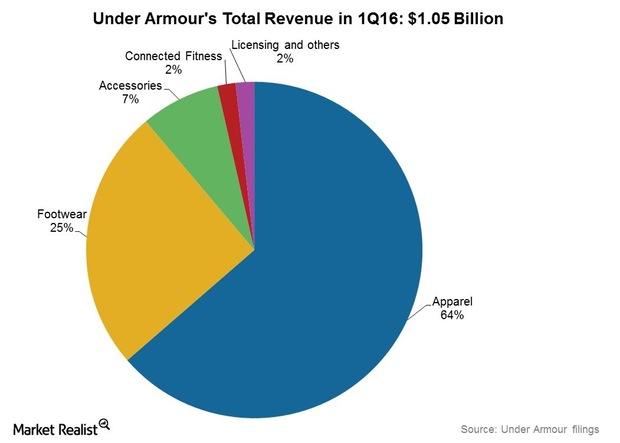

What Drove Under Armour’s 30% Revenue Jump in 1Q16?

Under Armour (UA) grew revenue by 30% to $1.05 billion in 1Q16. This was the company’s 24th straight quarter of more than 20% growth in its top line.

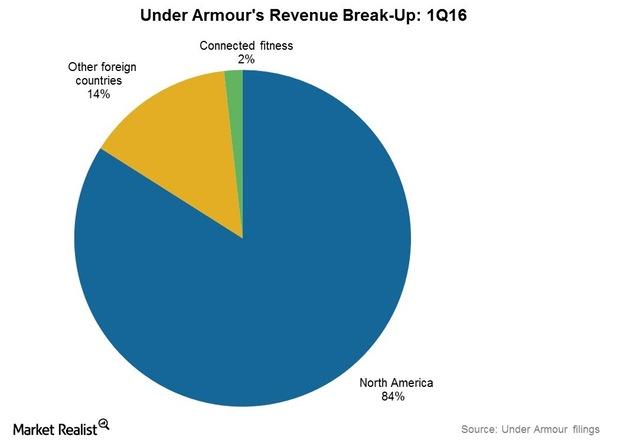

What Led to Under Armour’s Massive International Growth in 1Q16?

Under Armour’s (UA) international sales grew 55.6% to almost $150 million in 1Q16. Sales growth in overseas markets came in at 64.6% in currency-neutral terms.

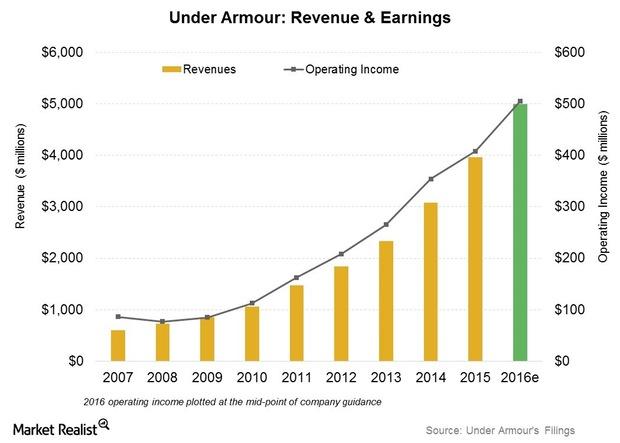

How Much Has Under Armour Increased Revenue Guidance?

Under Armour raised the higher end of its 2016 operating income estimate to $503 million–$507 million, implying a growth rate of 23.1%–24.1% over 2015.

Athleisurewear Giants: Which Companies Dominate Activewear?

The athleisurewear category has had a boost from higher interest in physical well-being globally and by increased participation by women in sports and other fitness activities.

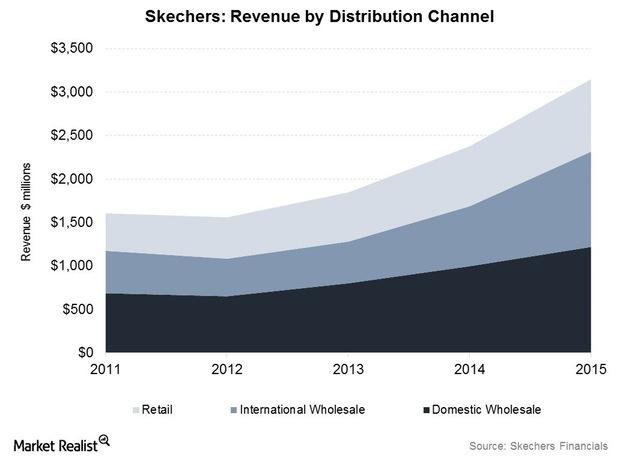

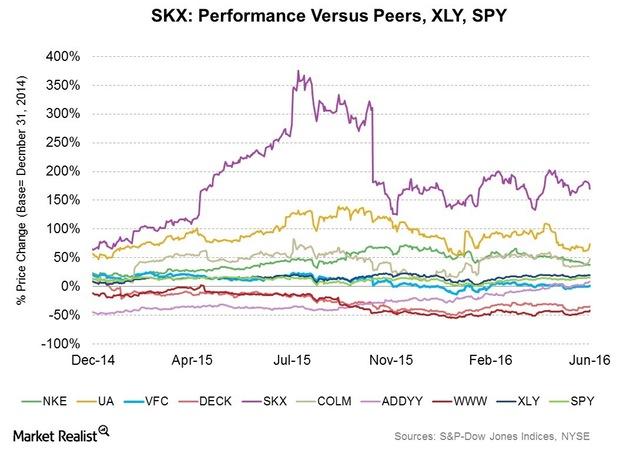

How Skechers Sells Its Products to Its Customers

In 2015, Skechers became the second-largest footwear company in the United States, trailing global market leader Nike (NKE).

Comparing Skechers’ Strengths and Weaknesses

Skechers is quickly establishing its presence in international markets. It made $3.1 billion in sales in 2015, of which 40.4% stemmed from overseas markets.

The Catalysts Powering Nike’s Growth Performance in Fiscal 2016

Nike (NKE) is expected to post sales of $8.3 billion in fiscal 4Q16, an increase of 6.4% year-over-year, according to the Wall Street analysts’ consensus.

Skechers Stock Falls on Mixed Third-Quarter Results

Skechers (SKX) stock was down 4.2% today in reaction to the footwear maker’s mixed third-quarter results. Find out what went wrong for the company.

Nike Manufacturing and Supply Chain Strategies

Nike’s manufacturing network has over 525 factories. Products move from several distribution centers across a network of thousands of retail accounts.

Nike’s Pricing Power and Brand Drive Its Economic Moat

Giving it a competitive advantage, Nike’s pricing power is supported through premium innovation and a shift toward the direct-to-consumer business.

Why Nike Stock’s Uptrend Could Persist

Bank of America Merrill Lynch upgraded Nike stock (NKE) to “neutral” from “underperform” yesterday and raised its target price to $98 from $70.

Is Lululemon Stock a ‘Buy’ after the Pullback?

Lululemon shares have fallen about 5% since September 6. Lululemon stock rose 8% on September 6. Since then, the stock has been on a downtrend.

Lululemon’s Growth Streak Continues in the First Quarter

Lululemon (LULU) impressed investors with upbeat results for the first quarter of fiscal 2019. The athletic apparel company announced its first-quarter results after the financial markets closed on June 12, and the stock rose 5.3% in after-market hours trading.

Can Lululemon Keep Up Its Strong Revenue Growth?

Lululemon’s (LULU) revenue increased 24.9%, 24.5%, and 20.8% in the first, second, and third quarters of fiscal 2018, respectively.

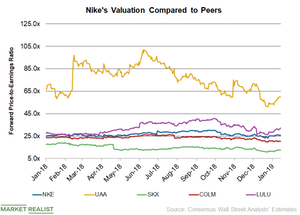

Comparing Nike’s PE Ratio with Its Peers

On January 14, Nike’s 12-month forward PE ratio was 25.8x. For fiscal 2019, analysts expect Nike’s adjusted EPS to increase 10.9% YoY to $2.65.

How Nike’s Valuation Compares to Those of Its Peers

In fiscal 2019, analysts expect Nike’s sales to rise 7.6% to $39.2 billion and its EPS to surge ~11.0% to $2.65.

Nike: Top Dow Stock in 2018

Currently, 37 analysts track Nike stock. Of these analysts, ~59% recommended a “buy,” 35% recommended a “hold,” and 5% recommended a “sell.”

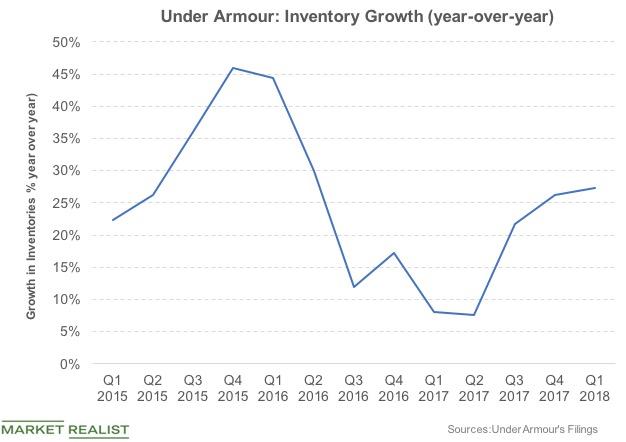

Under Armour: Inventory Management in Focus

Inventory backlog has been a critical pressing issue for Under Armour (UAA) for some time.

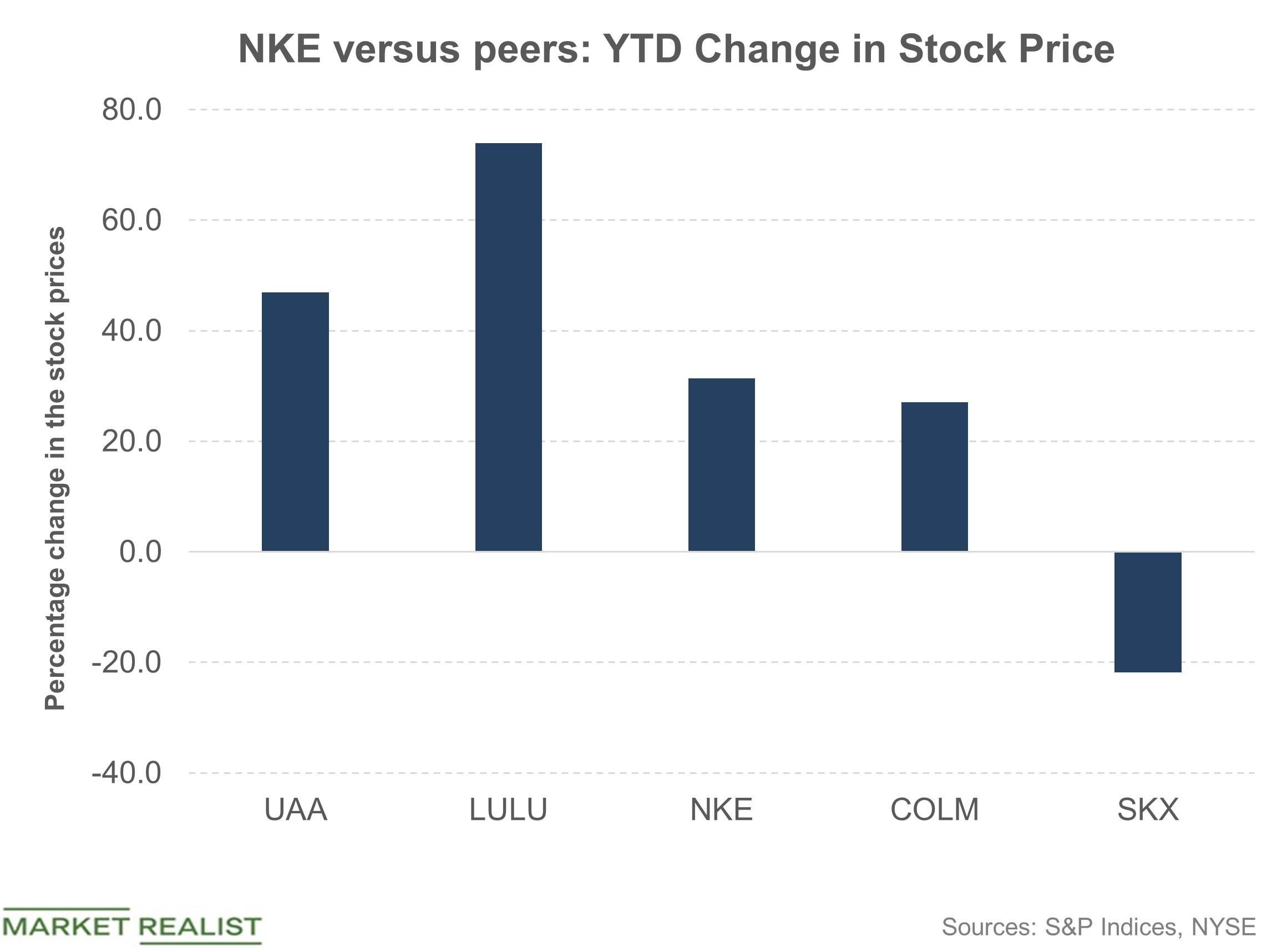

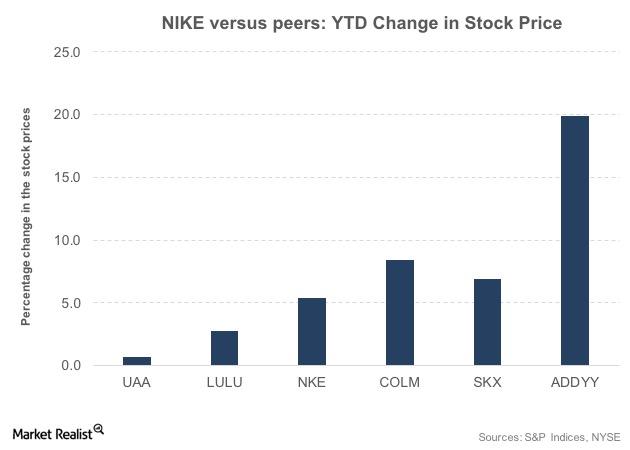

How Nike Stock Has Performed in 2018

Nike (NKE) delivered a strong performance in the stock market during 2017 with a 23% rise during the year.

Under Armour Stock Slides after Macquarie Downgrade

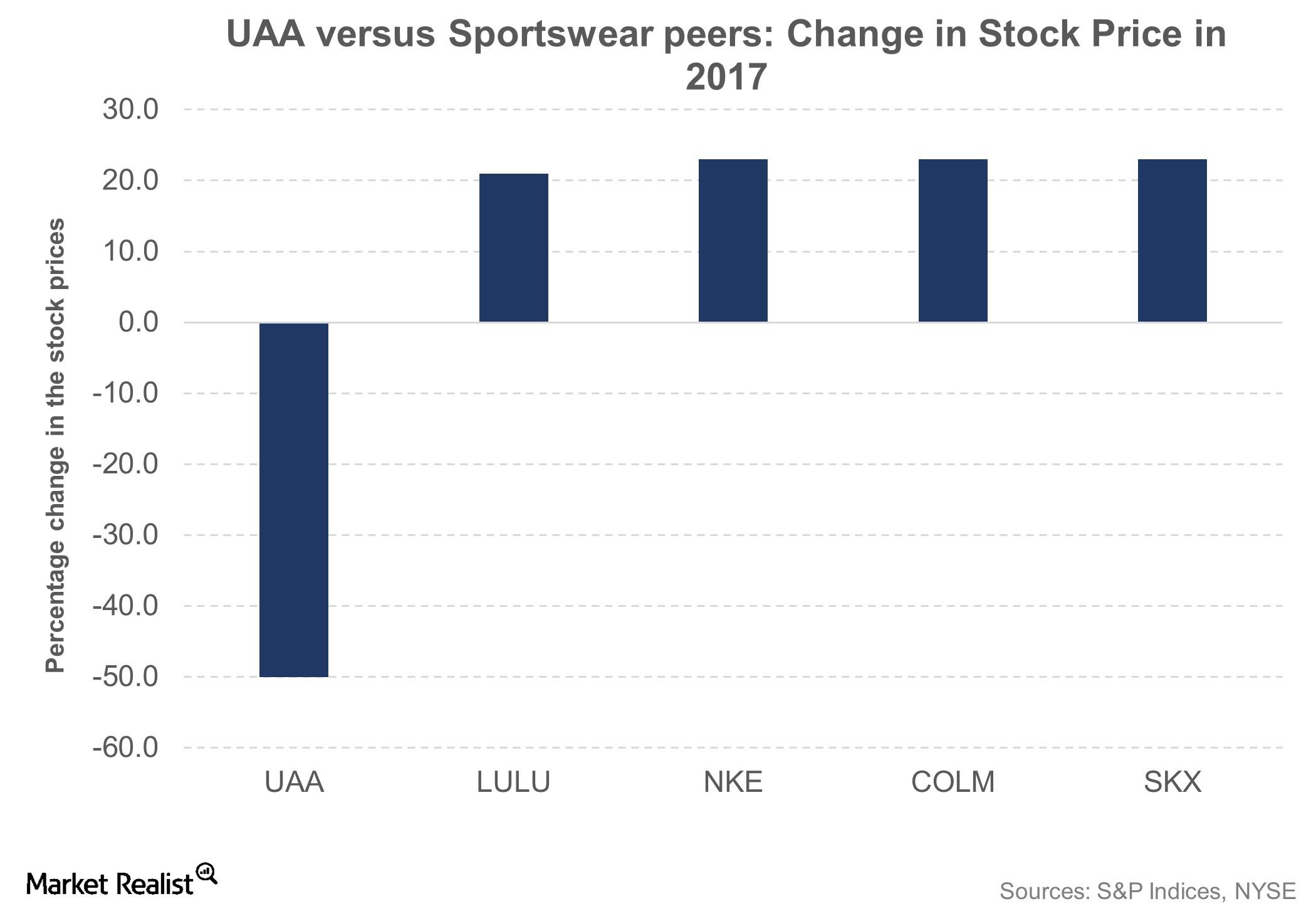

Under Armour (UAA) started 2018 on a positive note and surged more than 10.0% in the first three trading days of the new year.

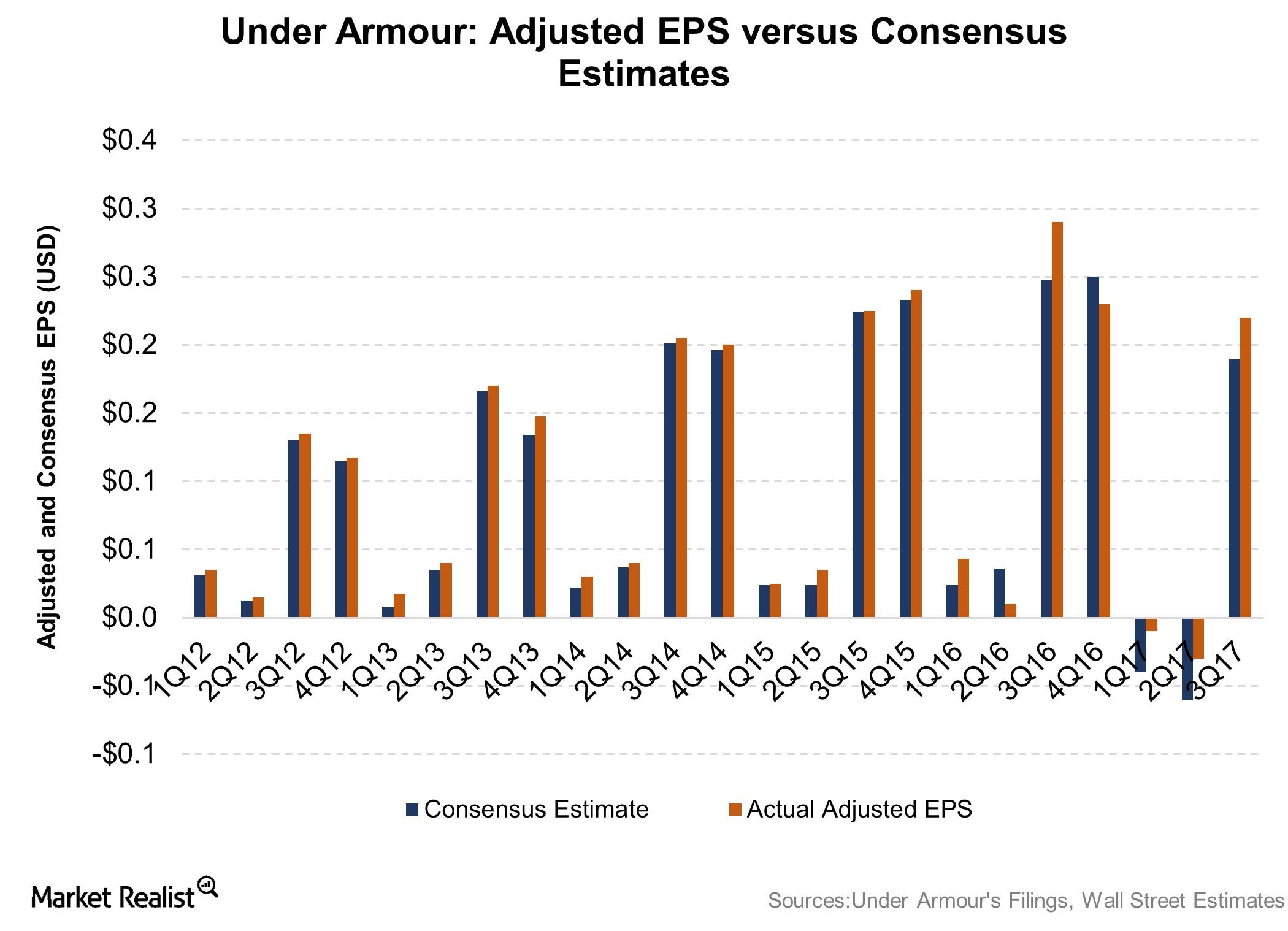

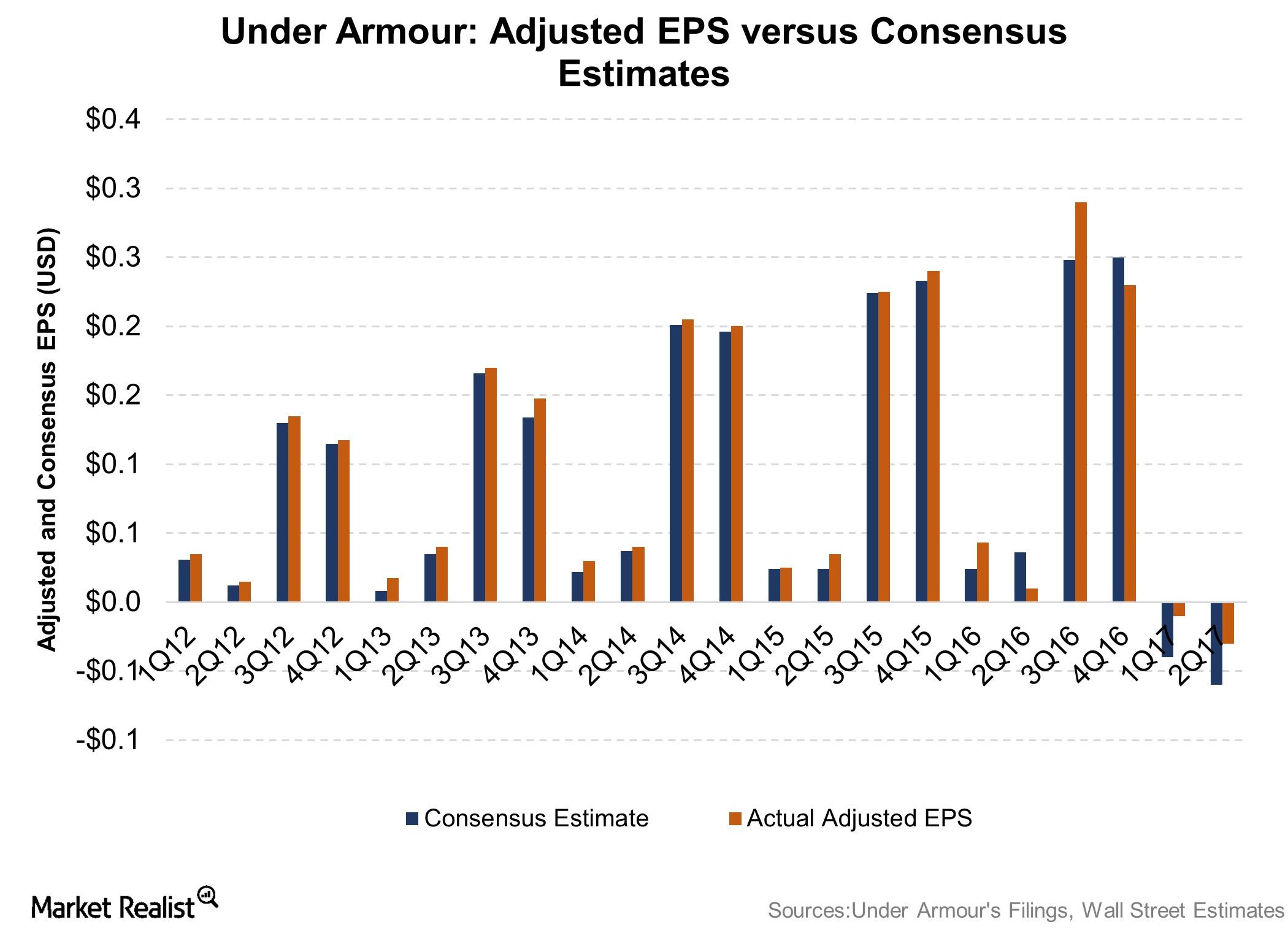

Under Armour Beats Earnings per Share Estimate by $0.03

Baltimore-based Under Armour (UAA) reported its 3Q17 results on October 31.

Under Armour Faces Target Price Cuts

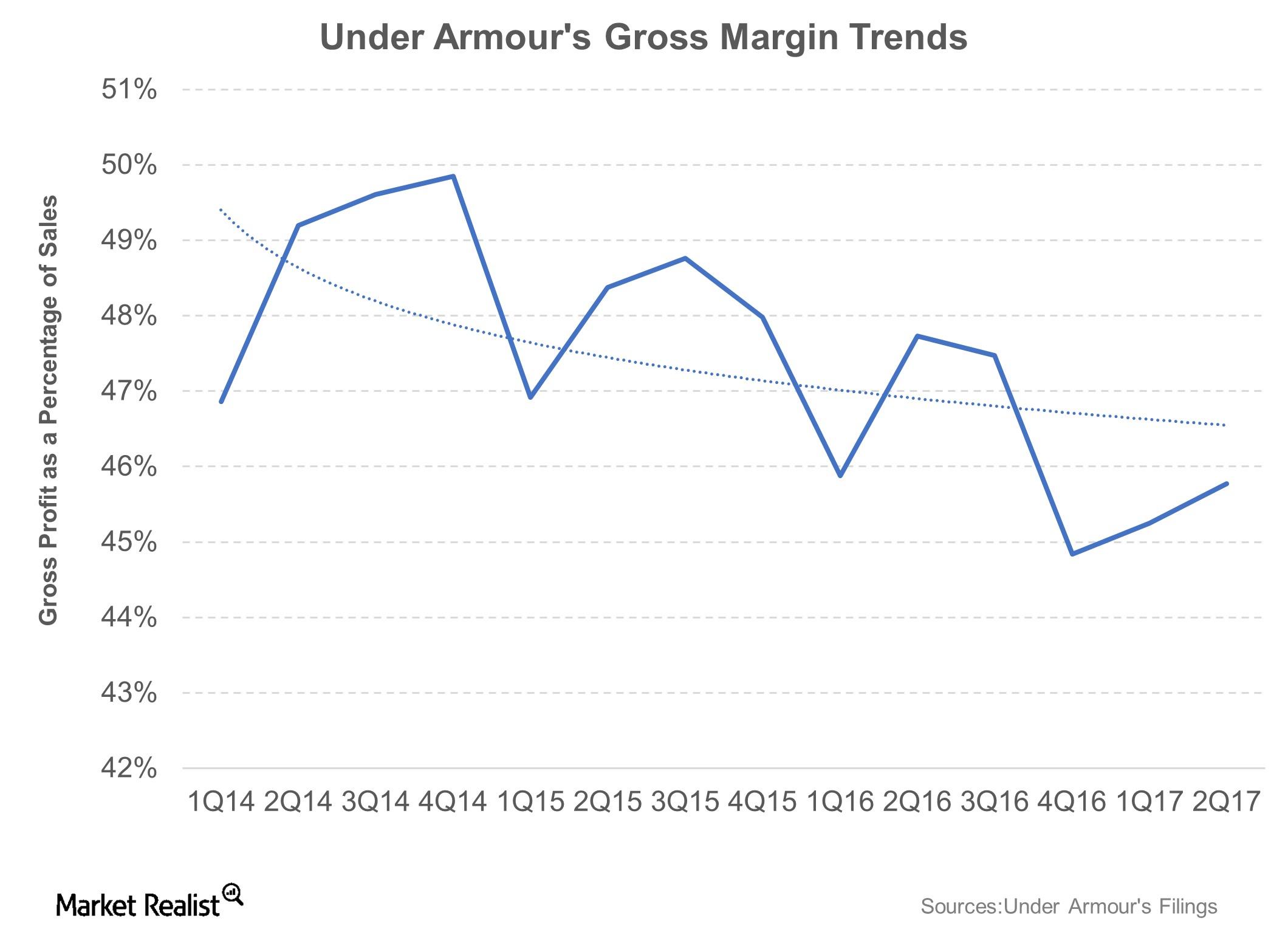

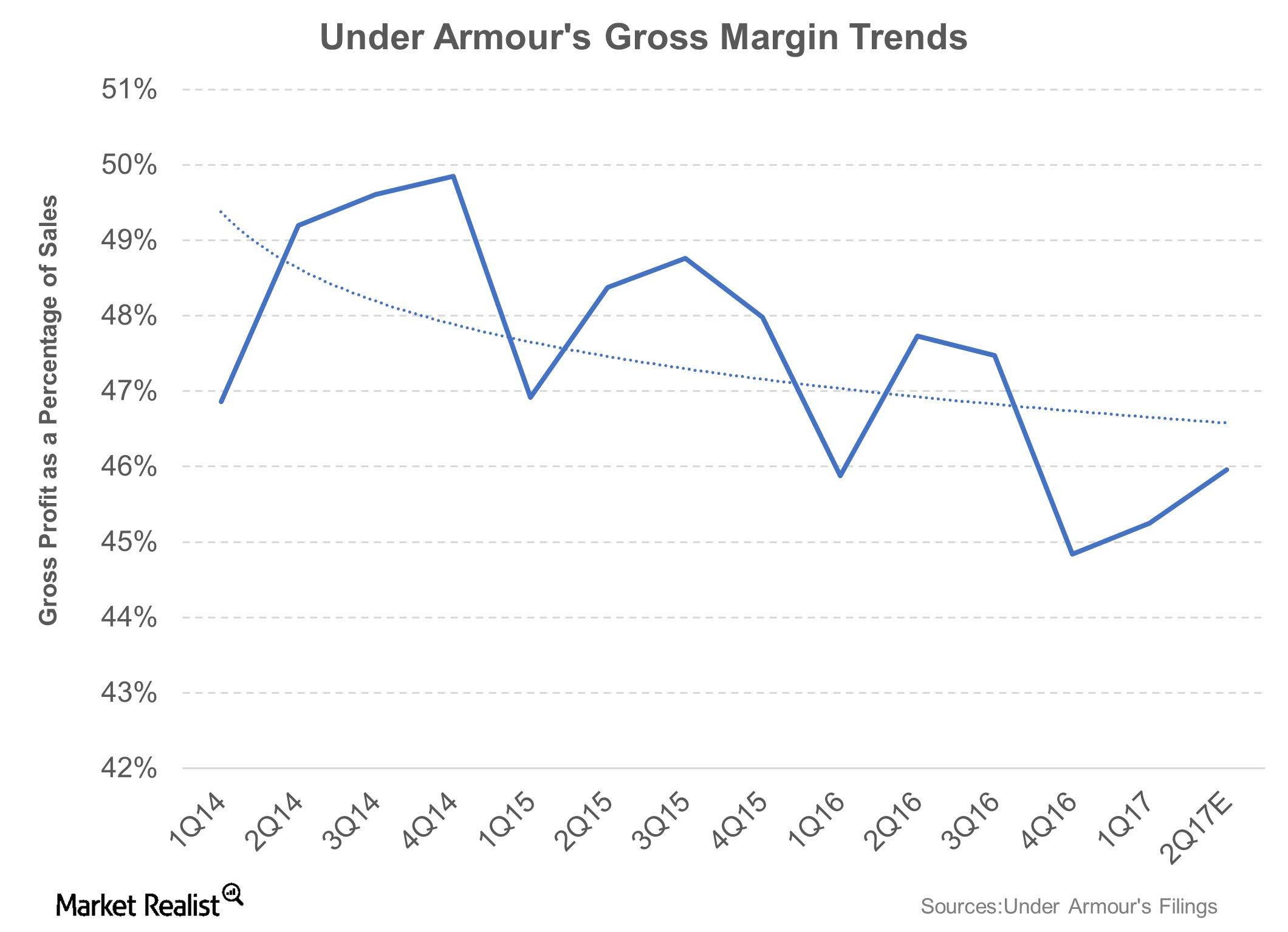

Wall Street’s reaction to 2Q17 earnings Under Armour’s (UAA) 2Q17 results were followed by a host of analyst actions, ranging from target price cuts to downward revisions. The stock’s target price was revised by UBS (from $21 to $19), Canaccord Genuity (from $21 to $18), Stifel (from $19 to $18), Wedbush (from $18 to $17), […]

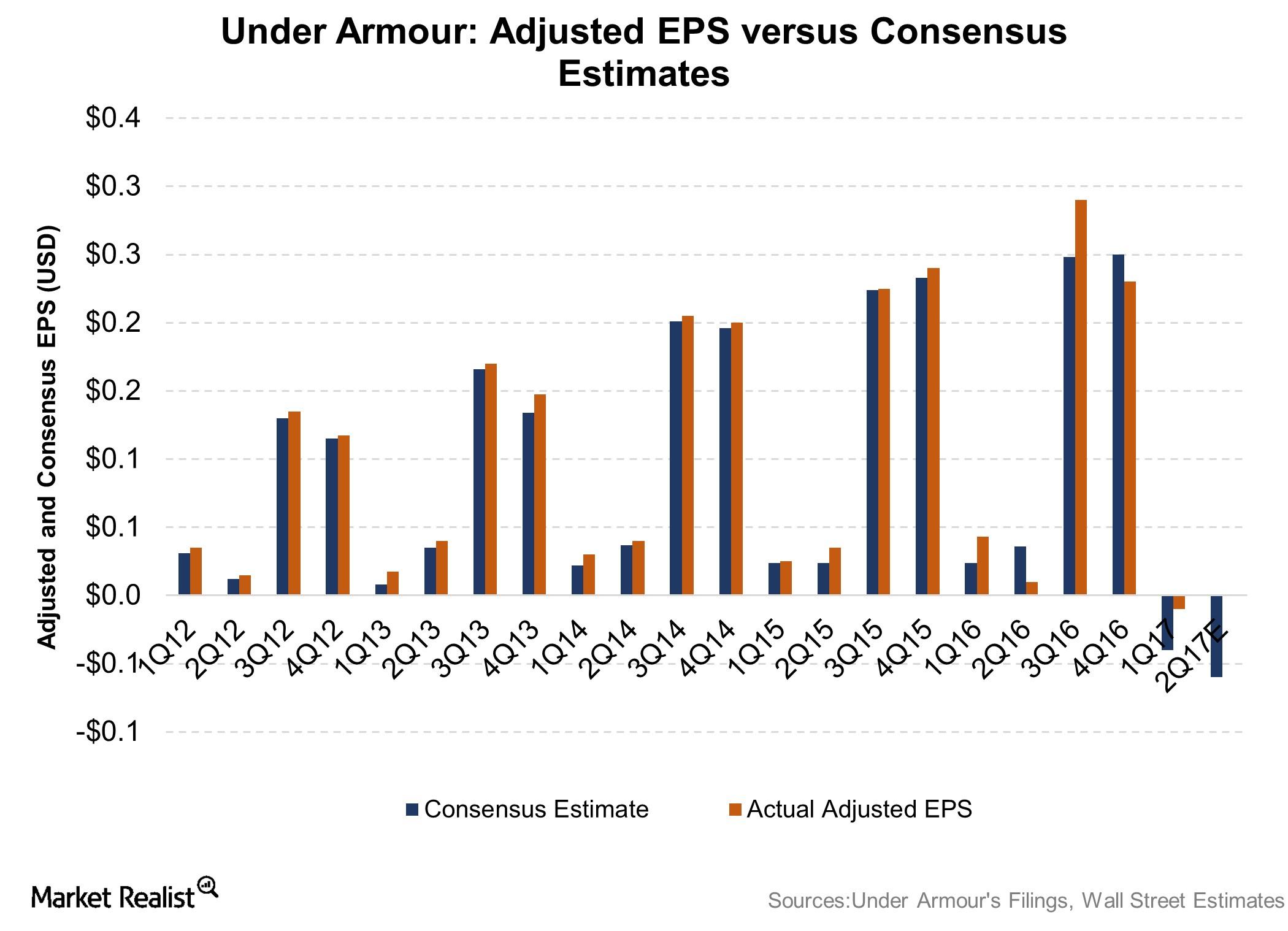

Under Armour Beats Top- and Bottom-Line Expectations

Baltimore-based Under Armour (UAA) reported its 2Q17 results on Tuesday, August 1. This series is an overview of Under Armour’s 2Q17 results.

Under Armour Reports a Loss Once Again in 2Q17

A look at Under Armour’s 2Q17 bottom line Under Armour (UAA), which released its 2Q17 results on August 1, reported net earnings of -$12 million, or EPS (earnings per share) of -$0.03. The company reported a weaker gross margin and a rise in SG&A (selling, general, and administrative) expenses. In comparison, it reported earnings of $19 […]

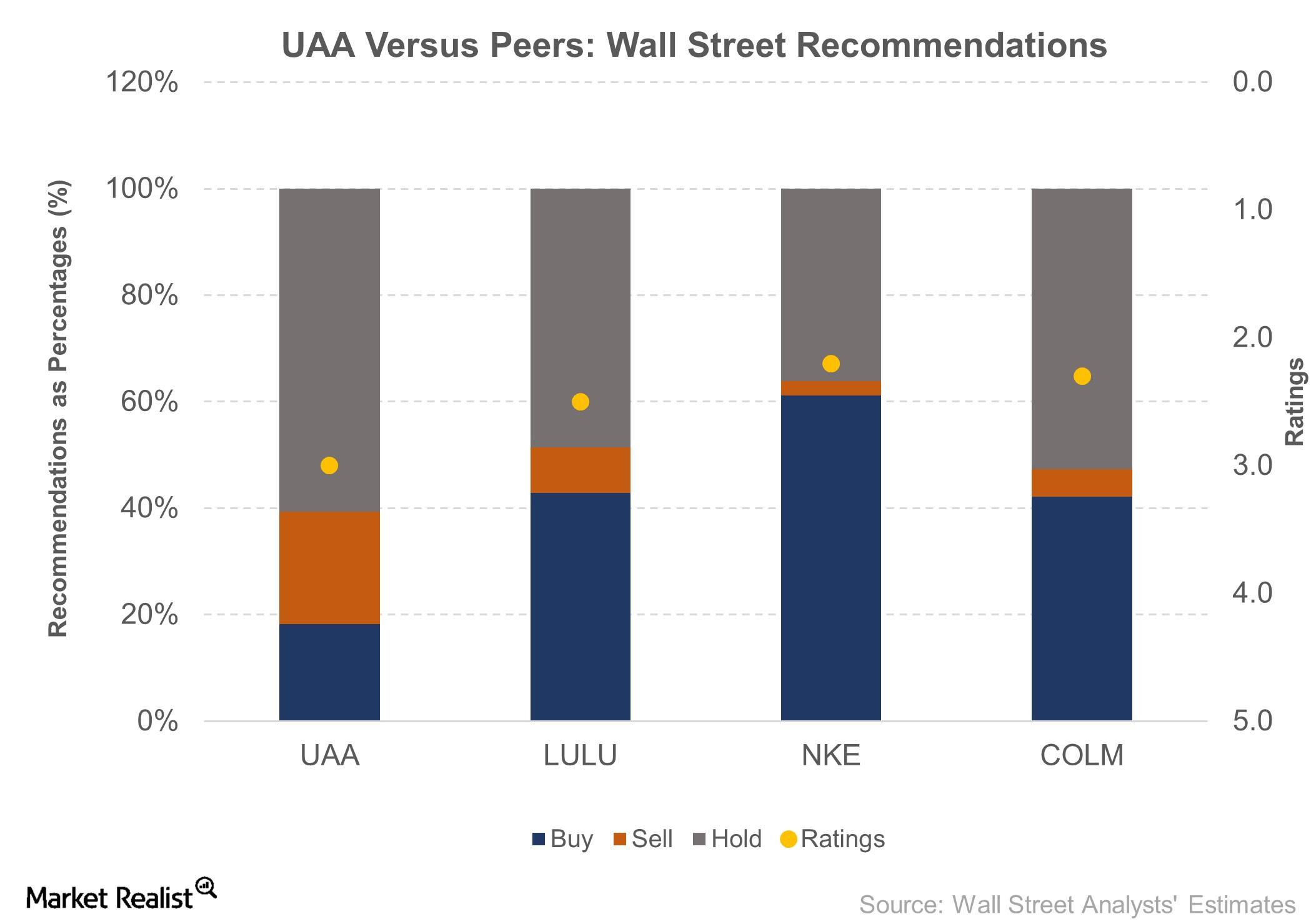

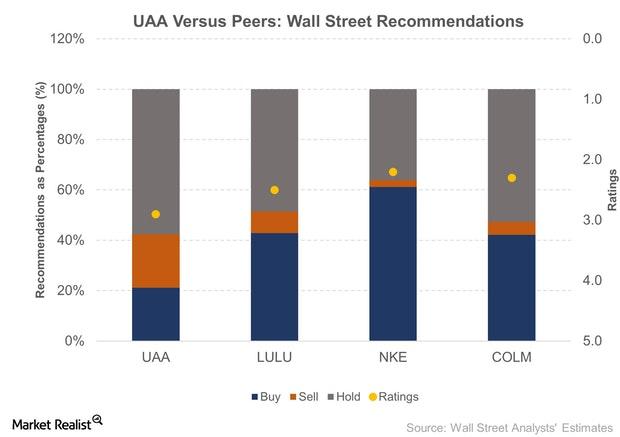

What Wall Street Thinks of Under Armour

Under Armour has a 2.8 rating on a scale where one is a “strong buy” and five is a “strong sell.”

Operating Loss Could Be in the Cards for Under Armour in 2Q17

Under Armour is expected to report a loss of six cents per share in 2Q17, which follows a loss per share of one cent during the first quarter.

Under Armour’s 2Q17 Earnings: What to Expect

Under Armour (UAA) is expected to report results for 2Q17 on Tuesday, August 1, 2017.