Lululemon Athletica Inc.

Latest Lululemon Athletica Inc. News and Updates

Susquehanna: Under Armour Changes Are ‘Temporary Pause’ to Growth

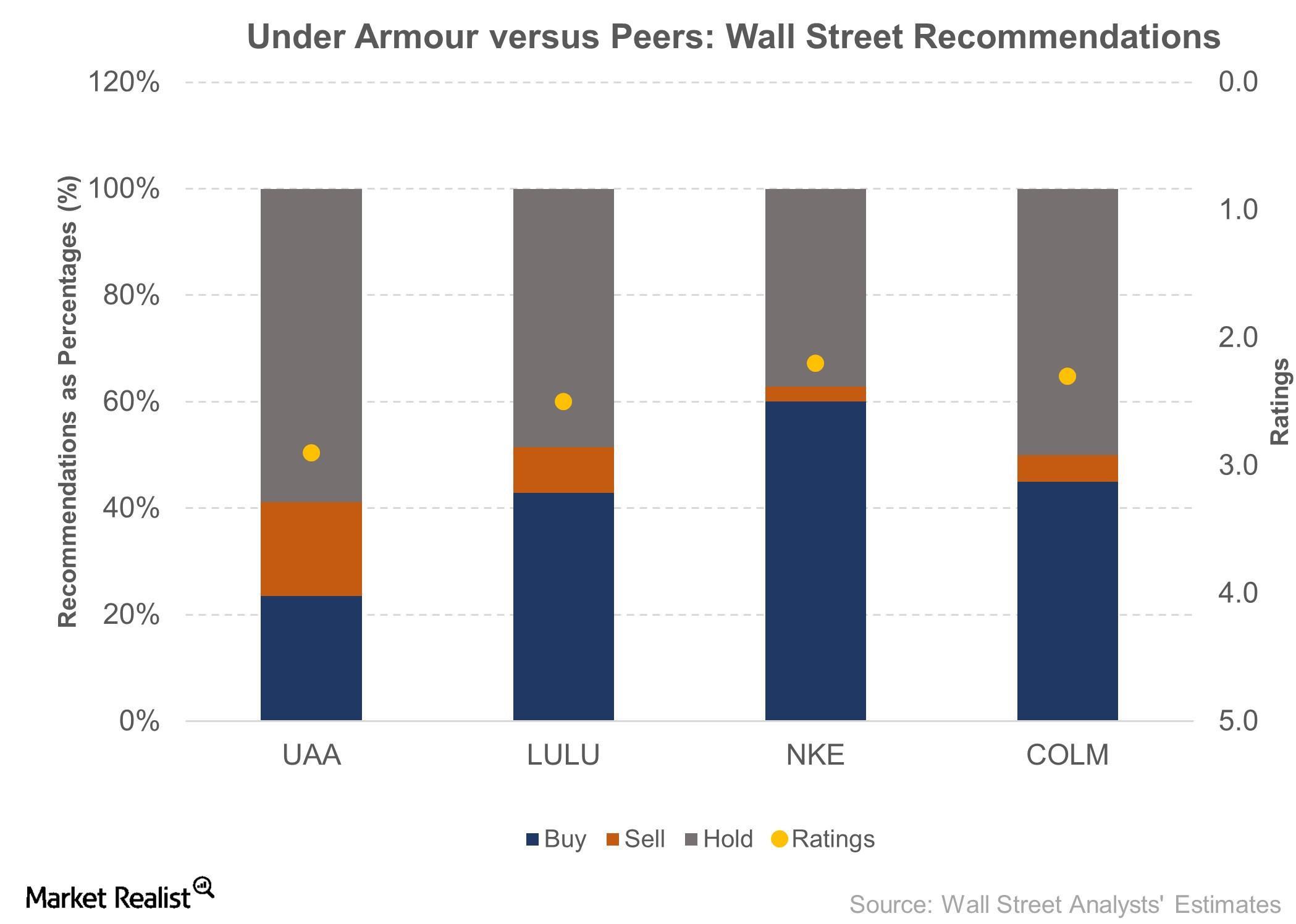

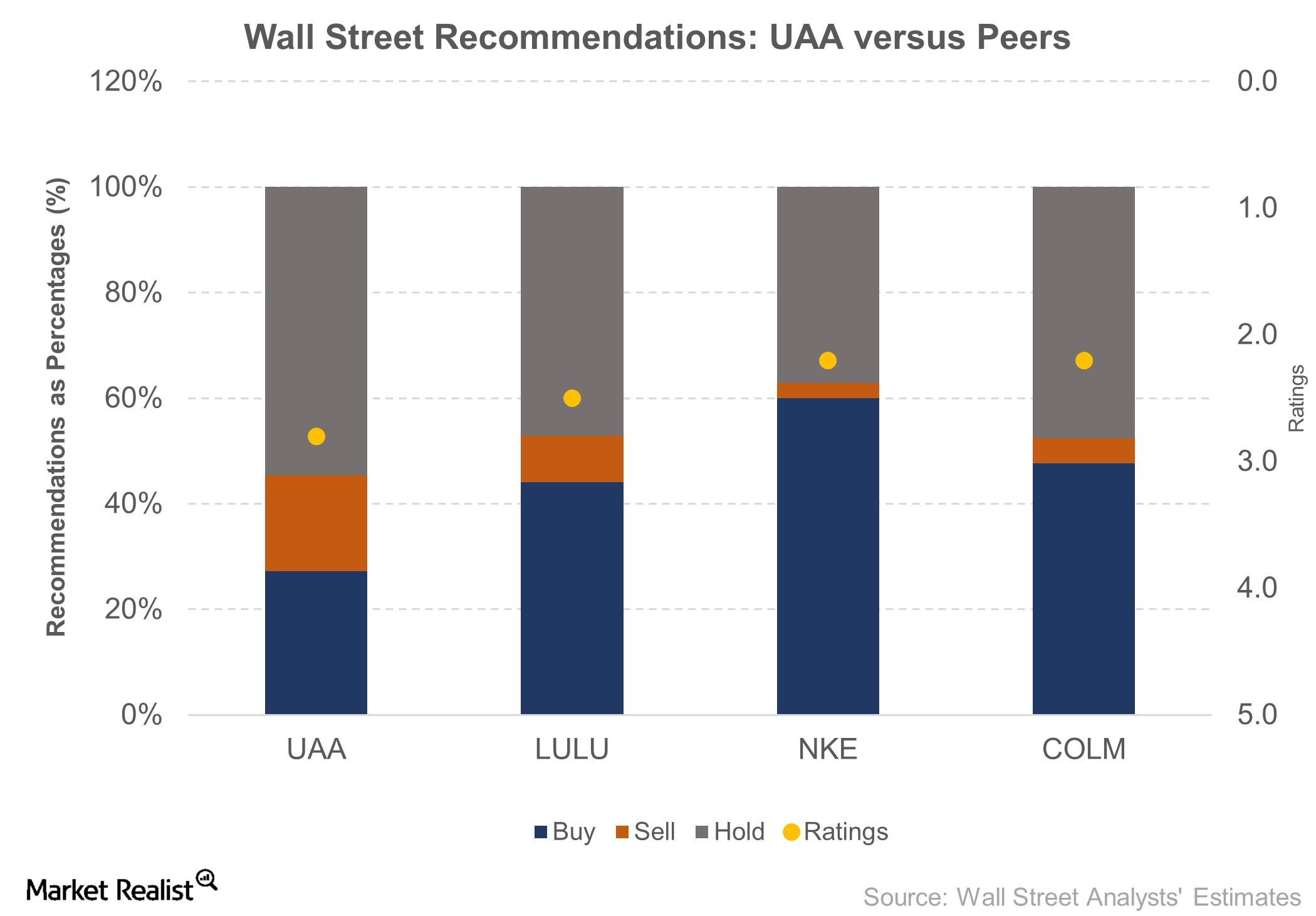

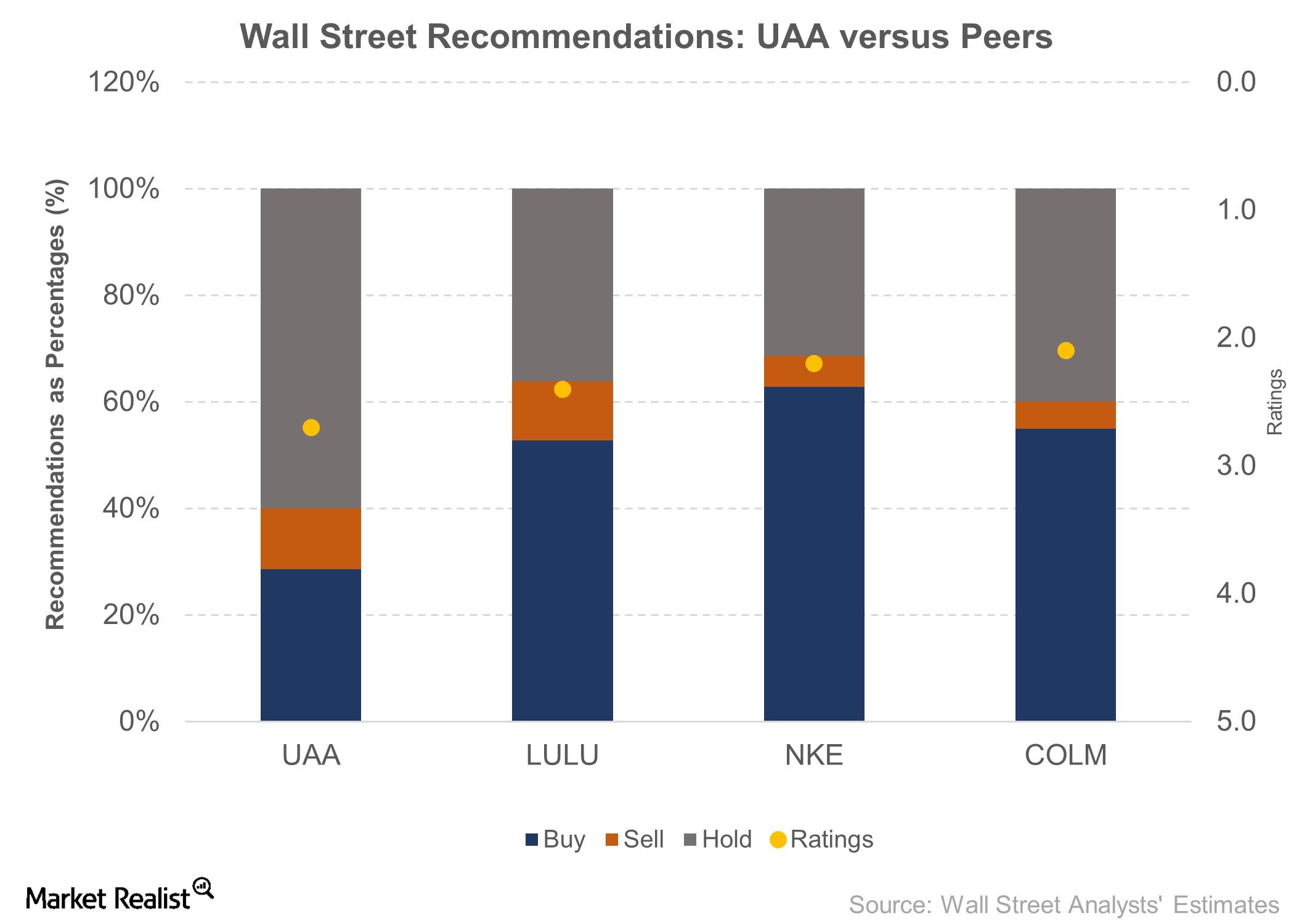

UAA is covered by 34 Wall Street analysts who together rate the company a 2.9 on a scale of 1.0 for “strong buy” to 5.0 for “sell.”

Under Armour Trading 40% Lower Than a Year Ago

Under Armour (UAA) stock remained unfazed after the company announced its new senior level executives, rising ~1.0% and closing at $25.06.

Under Armour’s Stock Surges after 1Q17 Earnings

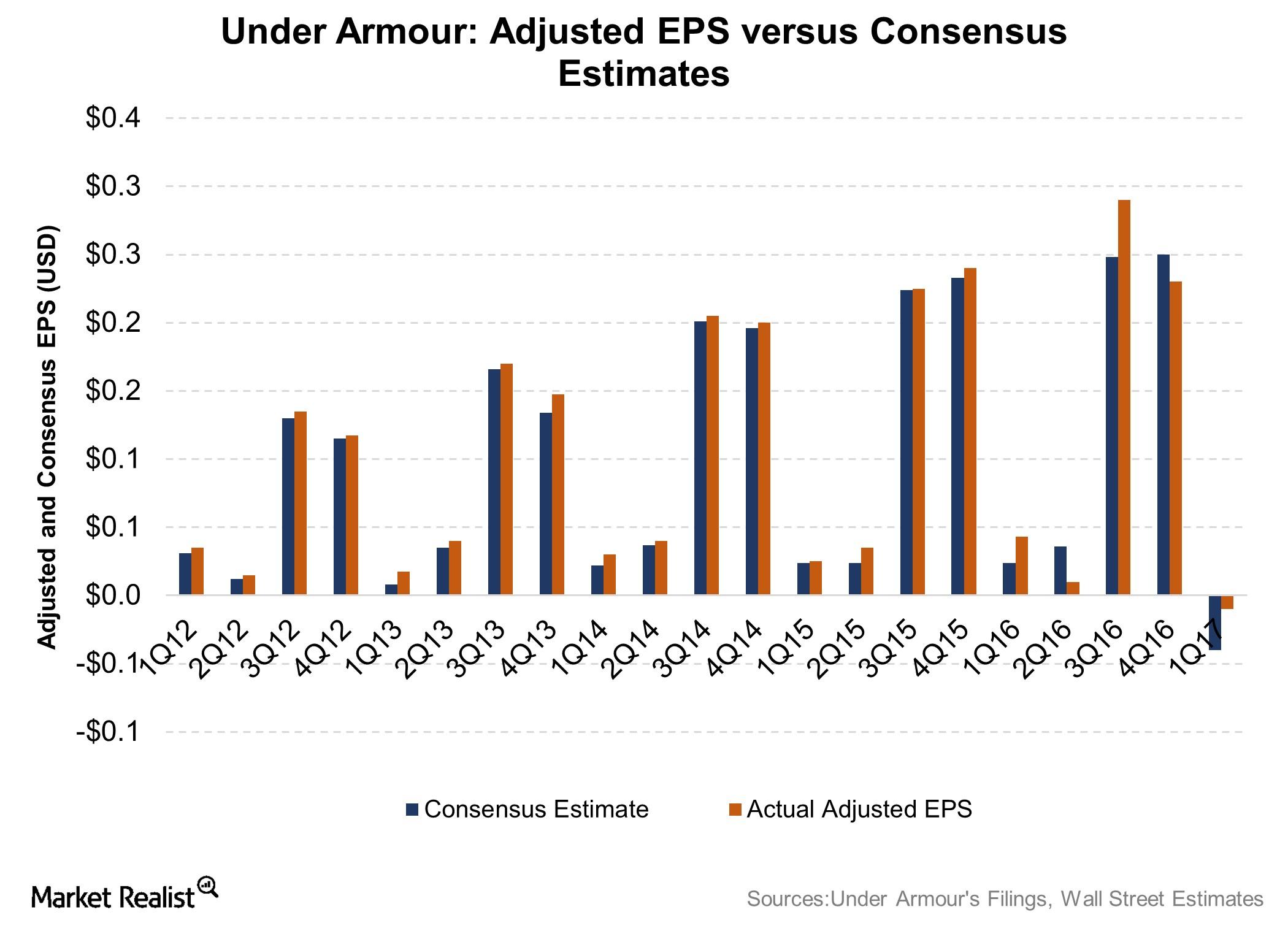

Under Armour’s (UAA) stock rose 10% as the company reported better-than-expected 1Q17 top and bottom lines and maintained its fiscal 2017 guidance.

Under Armour Beats 1Q17 Earnings and Revenue

The Baltimore-based Under Armour (UAA) reported its results for 1Q17 on Thursday, April 27. Here’s what you need to know.

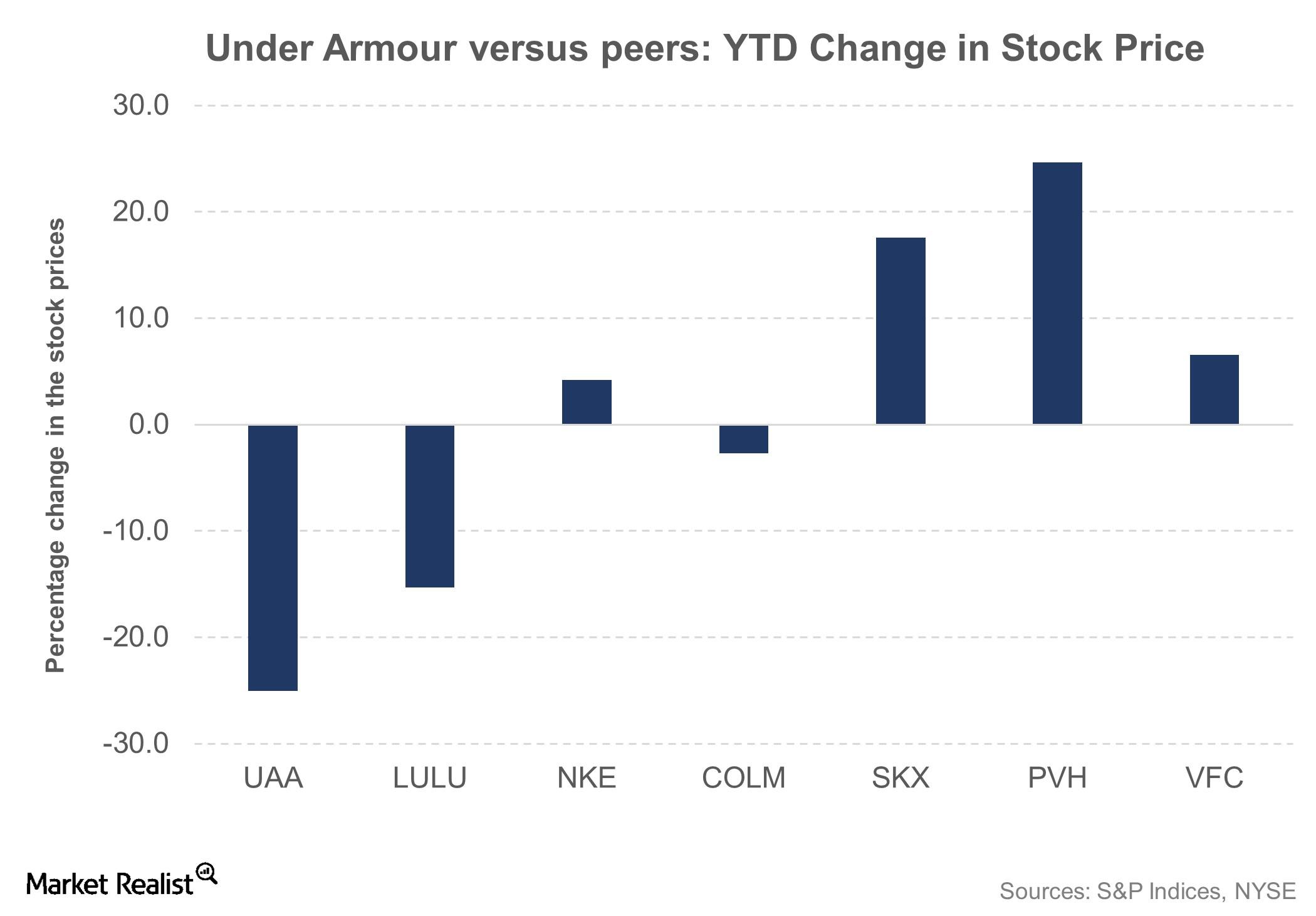

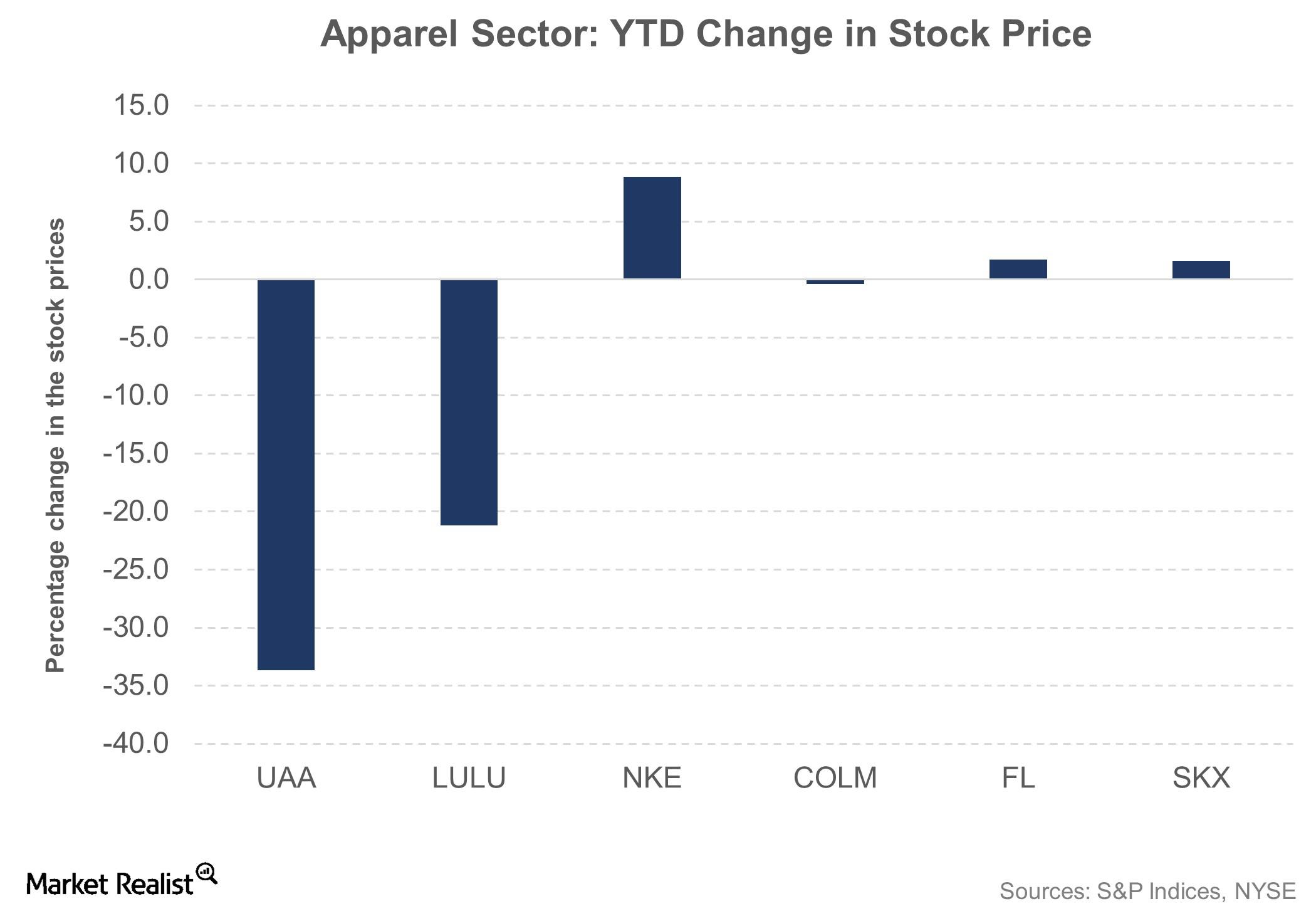

Behind Under Armour’s Poor Stock Performance

Under Armour (UAA) was among the worst performers on the S&P 500 Index (SPY) in 2016, losing 30% of its value during the year.

Underneath Under Armour’s Compressed Margins

Under Armour’s (UAA) gross margin fell 160 basis points to 46.5% in fiscal 2016, and its gross margin took the worst hit in the fourth quarter of 2016.

Under Armour Stock Lost 29% during the Week after Its 4Q16 Results

Under Armour (UAA), which is covered by 35 Wall Street analysts, has ten “buy” recommendations, four “sell” recommendations, and 21 “hold” recommendations.

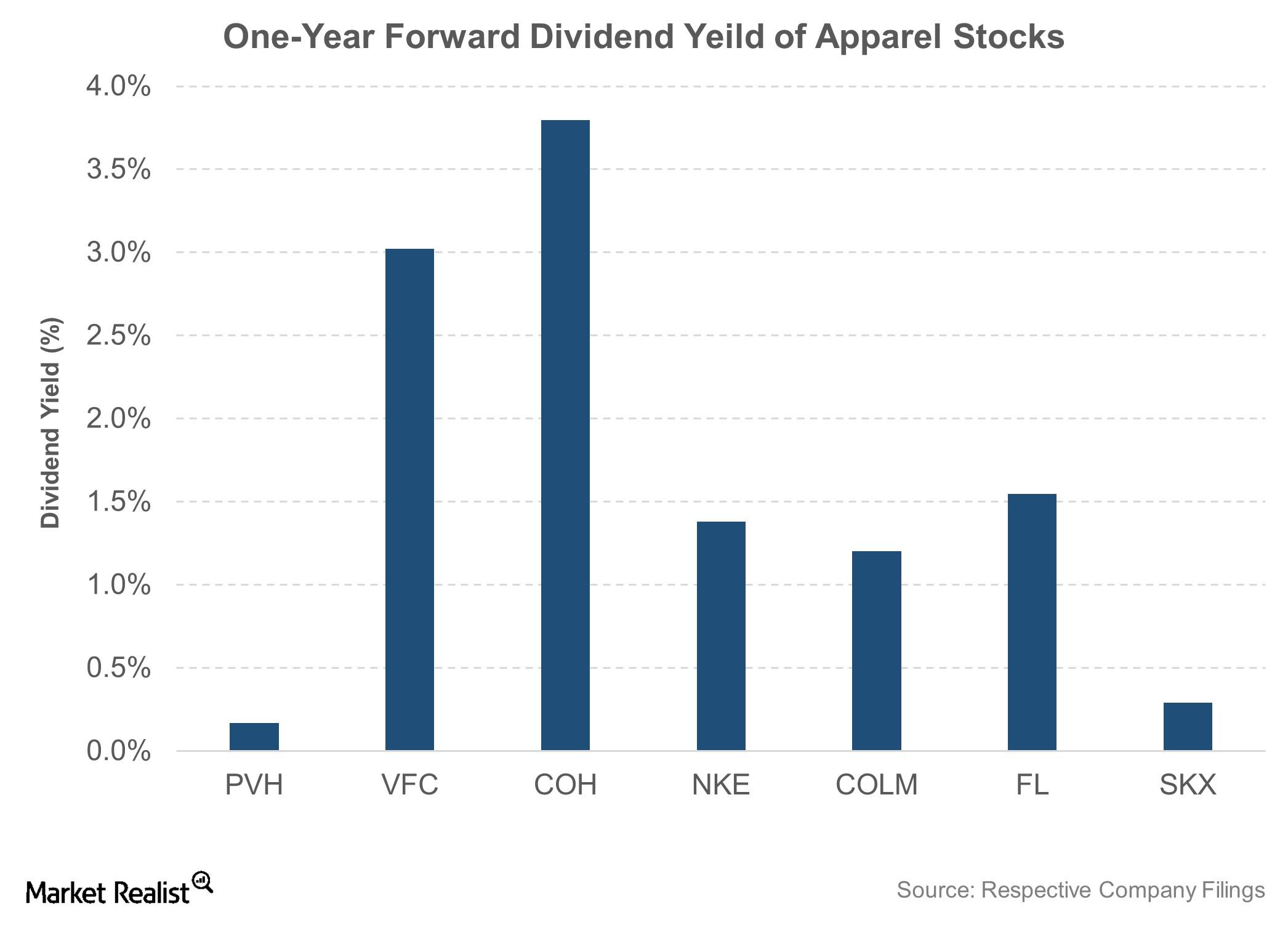

What’s Nike’s Dividend Policy?

Nike (NKE) is a consistent dividend payer and has increased dividends over the last 14 years.

Sidoti Upgrades Nu Skin Enterprises to ‘Buy’

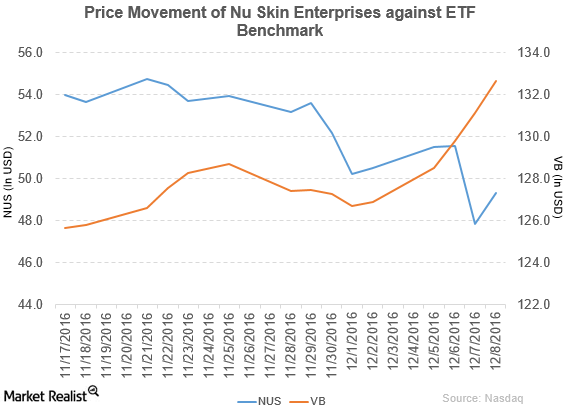

Price movement Nu Skin Enterprises (NUS) has a market cap of $2.7 billion. It rose 3.1% to close at $49.32 per share on December 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.8%, -7.9%, and 34.7%, respectively, on the same day. NUS is trading 6.3% below its 20-day moving average, […]

Nu Skin Enterprises Made Changes in Its Management

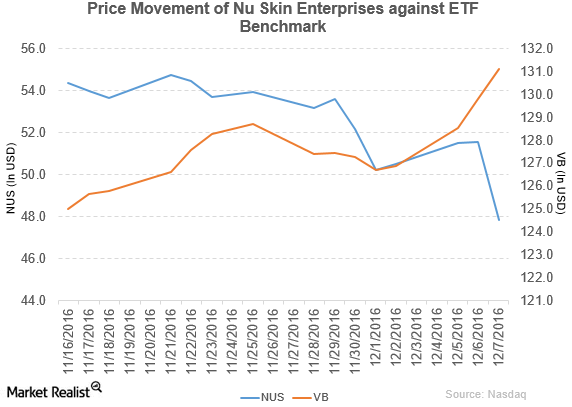

Nu Skin Enterprises (NUS) has a market cap of $2.6 billion. It fell 7.2% to close at $47.85 per share on December 7, 2016.

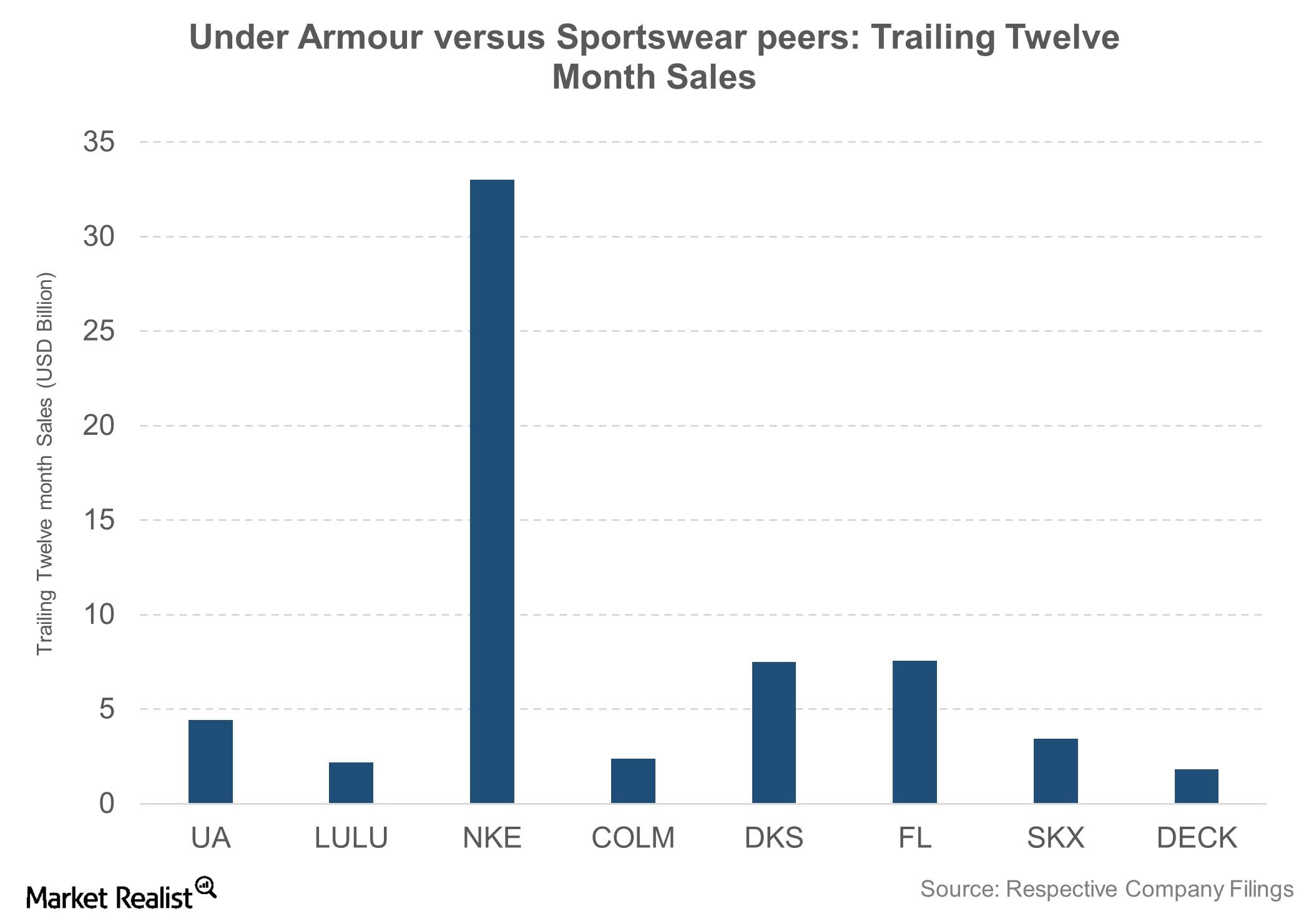

Nike May Have Jordan, but Under Armour Boasts Phenom Curry

Although it’s a relatively new player in the sportswear industry, Under Armour has given tough competition to industry pioneers such as Nike (NKE) and Adidas (ADDYY).

Why Star Power and Sponsorships Are Key for Nike

Endorsement deals and sponsorships have been key for Nike since the beginning.

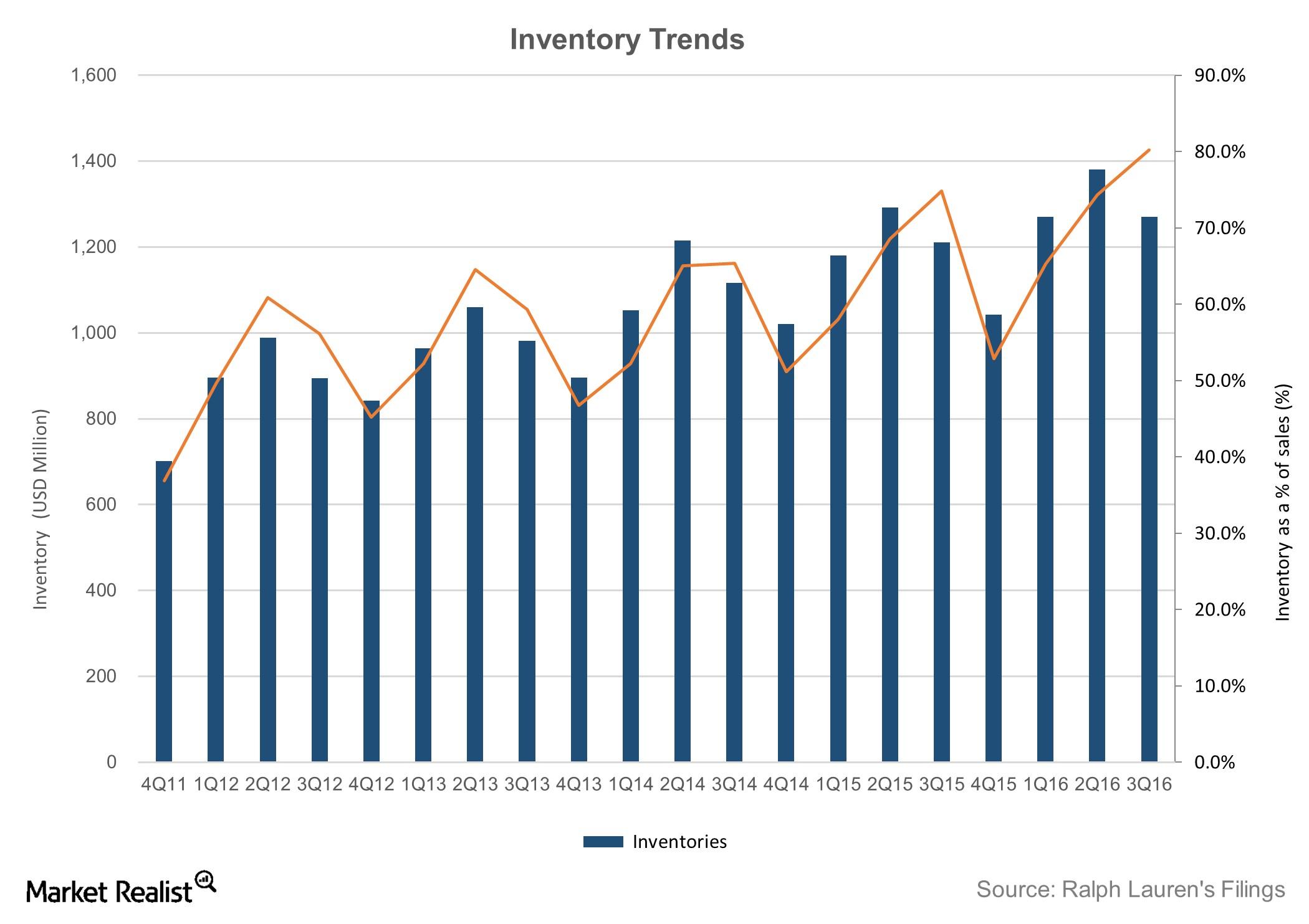

Ralph Lauren’s Strategies and Initiatives: The Story behind the Story

Ralph Lauren’s long-term strategies include expanding global presence, extending direct-to-consumer reach, and expanding apparel and accessory portfolio.

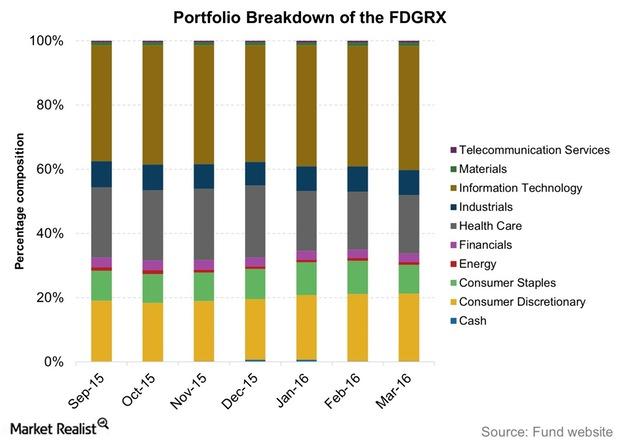

What Moves Did FDGRX Make Leading Up to 1Q16?

FDGRX’s assets were invested across 394 holdings as of March 2016, two more than a quarter ago. It was managing assets worth $37.8 billion as of March’s end.

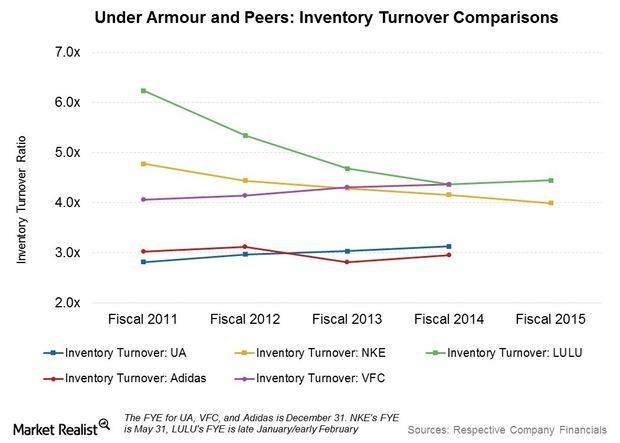

What’s Different about Under Armour’s Inventory Management?

Under Armour (UA) anticipates higher inventory growth over the next few quarters. It has made a number of changes on the inventory and supply chain side.

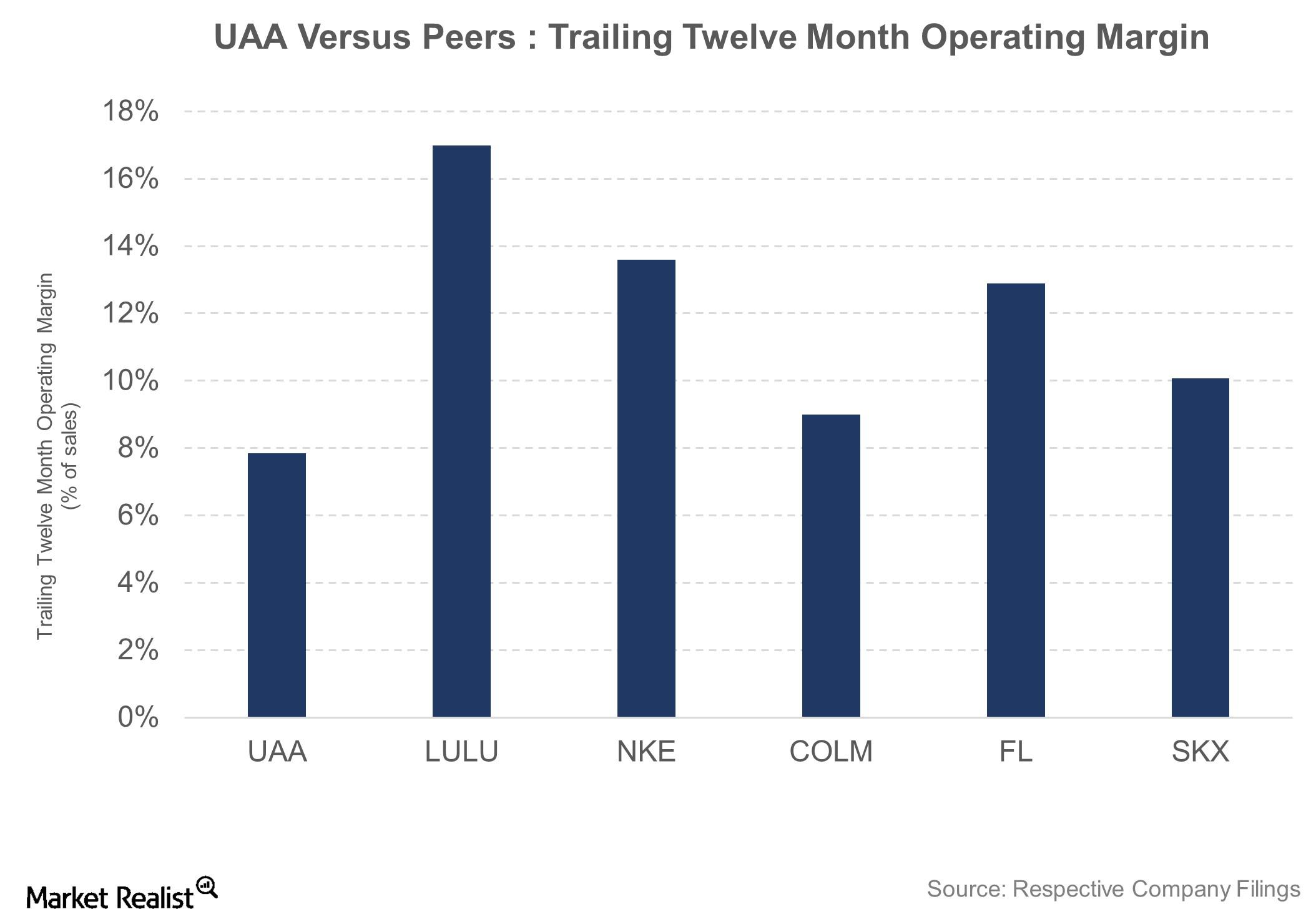

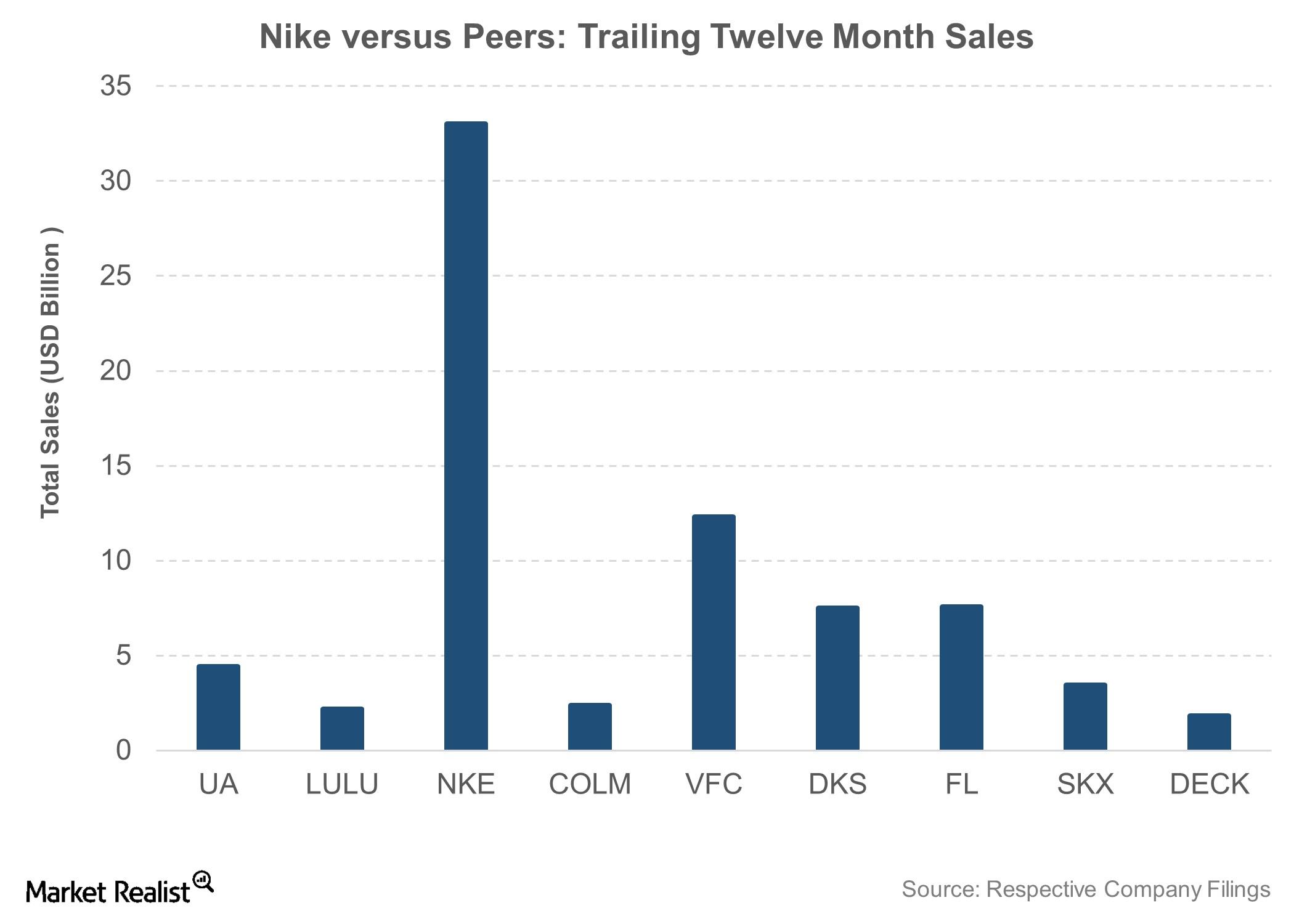

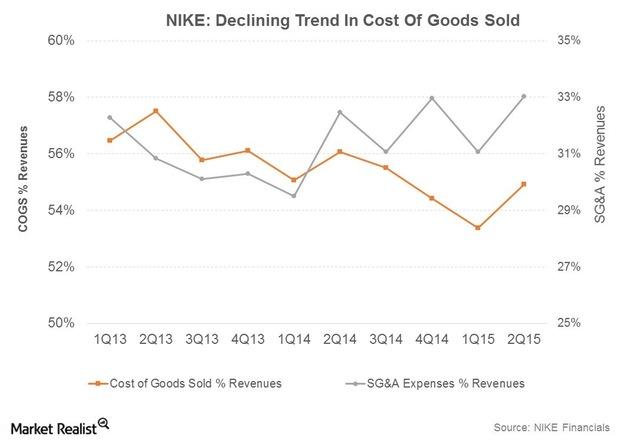

Reasons for NIKE’s Rising Profitability

NIKE is working to improve its profitability, as its margins trail industry peers such as Lululemon Athletica (LULU) and VF Corporation (VFC).

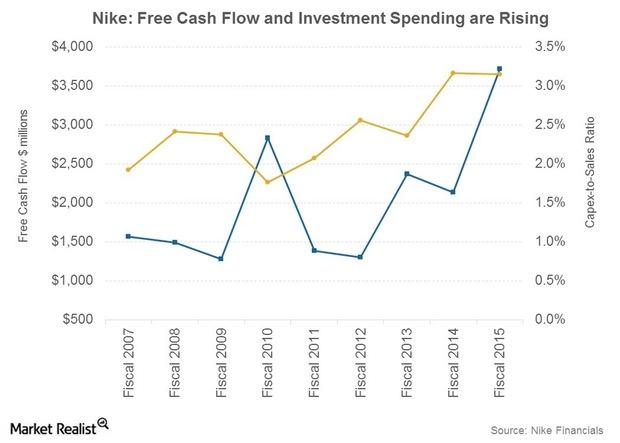

Nike’s Free Cash Flow Outlook and Projected Growth Investments

Nike expects to grow its Free Cash Flow, or FCF, at a faster pace compared to net income over the next five years through fiscal 2020. In fiscal 2015, FCF grew by ~74%.

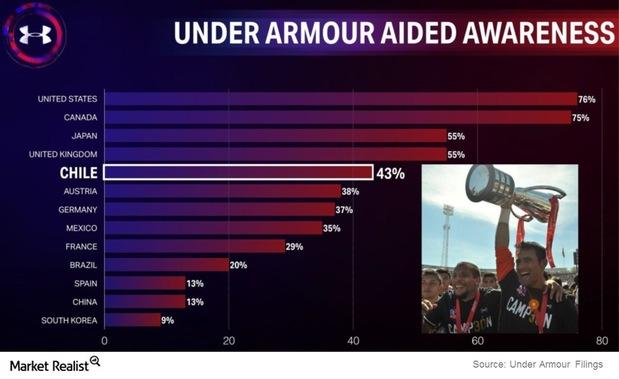

Why Under Armour Unveiled a Blueprint for International Expansion

Under Armour’s (UA) international operations are among its fastest-growing businesses.

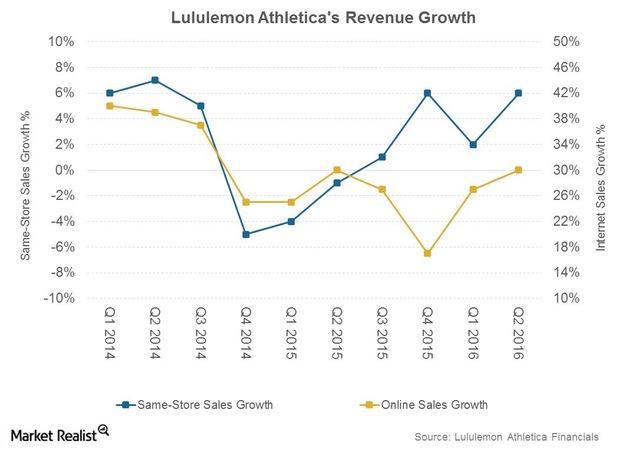

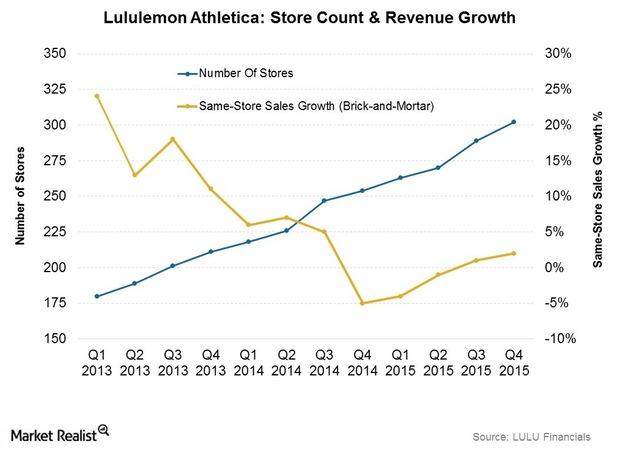

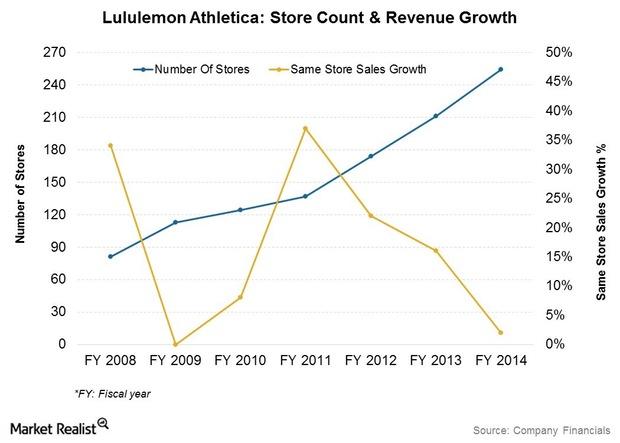

Can Lululemon Keep Seeing Traction in Same-Store Sales?

Lululemon’s same-store sales performance was healthy in 2Q16. There’s been a reversal in the negative trend that dogged the retailer for much of last year, particularly in its brick-and-mortar channel.

Analyzing Lululemon Athletica’s Revenue Performance this Year

Lululemon Athletica (LULU) reported revenue of $423.5 million in 1Q16, up 10% year-over-year.

Why Nike Is Expanding Its Direct Retail Store Presence

Nike sales growth was fueled by new store openings, higher store comps, and growth in the e-commerce channel.

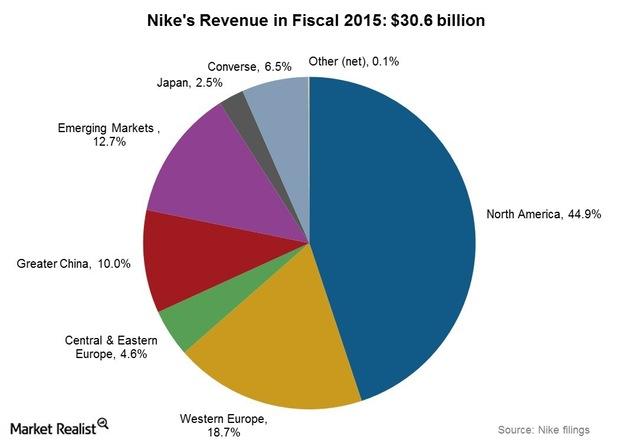

How Was Nike’s 4Q15 and 2014 Sales Performance in North America?

Nike’s sales performance was the strongest in the key markets of North America, Western Europe, and Greater China.

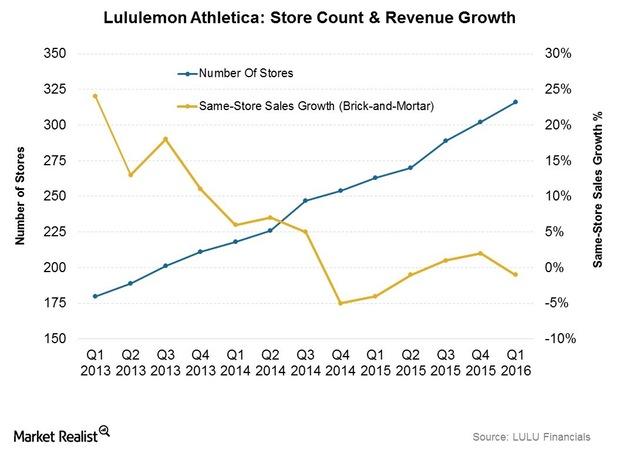

Why Store Expansion is a Critical Driver for Lululemon Athletica

Despite having negative comps in 1H15, Lululemon’s revenue growth for its physical stores was positive at 9.7% year-over-year in fiscal 2015.

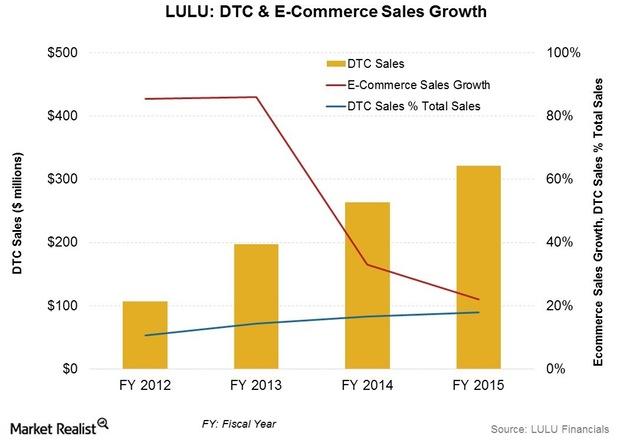

Analyzing Lululemon’s Omni-Channel and E-Commerce Differentiators

Lululemon is testing RFID (radio frequency identification) technology and plans to implement the technology, which is currently used in ~13 stores.

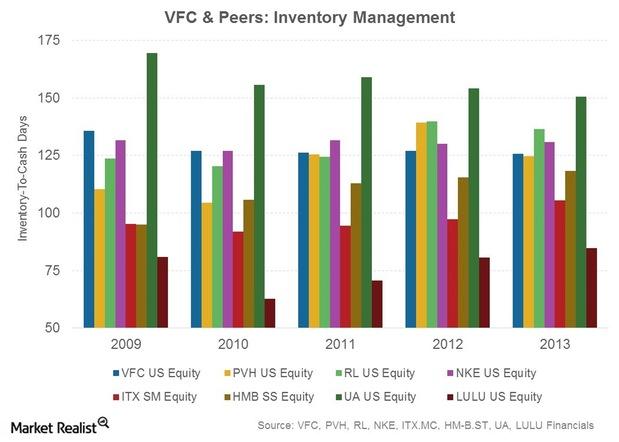

Inventory Management Is Critical Zone For VF Corp. And Its Peers

For fashion and apparel firms, inventory management, or tracking inventory levels, is critical. Inventory levels signify whether products are in demand or not.

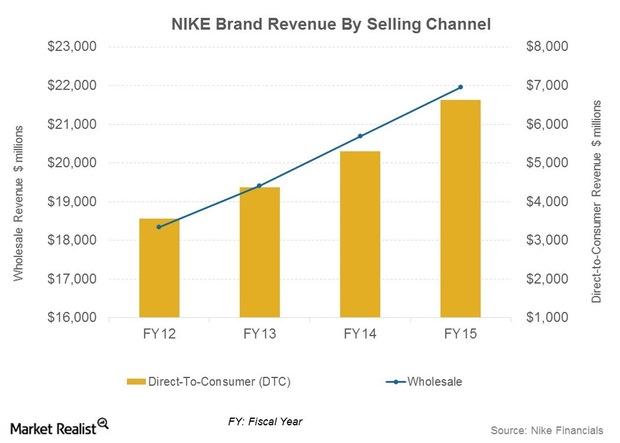

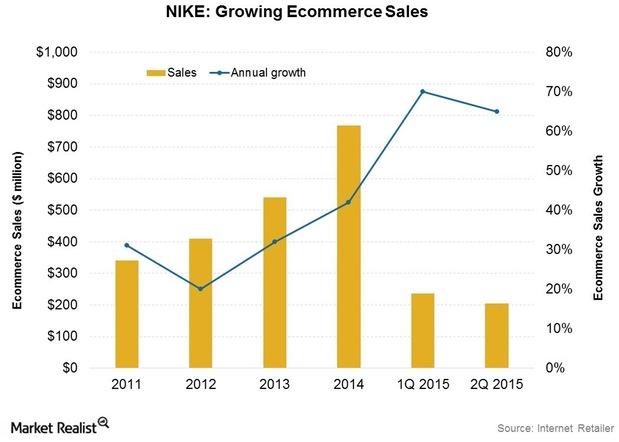

E-commerce: A Critical Growth Driver At NIKE

NIKE plans to grow DTC revenues to $8 billion by fiscal 2017, including e-commerce revenues of $2 billion. E-commerce grew 65% in 2Q15 to ~$205 million.

Headwinds And Tailwinds For Lululemon Revenues This Year

Lululemon Athletica announced an increase of 10.4% in its revenues to $419.4 million in the third quarter of fiscal 2015 compared to $379.9 million in 3Q14.

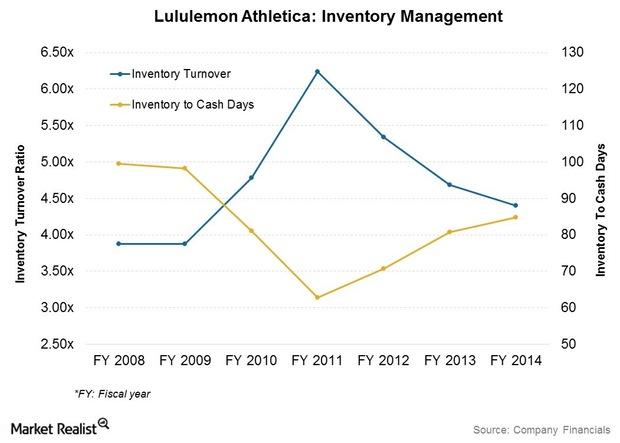

Lululemon’s Retail Inventory Management Strategies Are Crucial

These changes should lower future inventory levels and probably result in higher inventory turnover and lower inventory-to-cash days.

Why Lululemon Is Looking At A Global Store Footprint

LULU’s global store count was estimated at 289 at the end of 3Q15. Stores are company-owned, with most located in the US (201) and Canada (57).

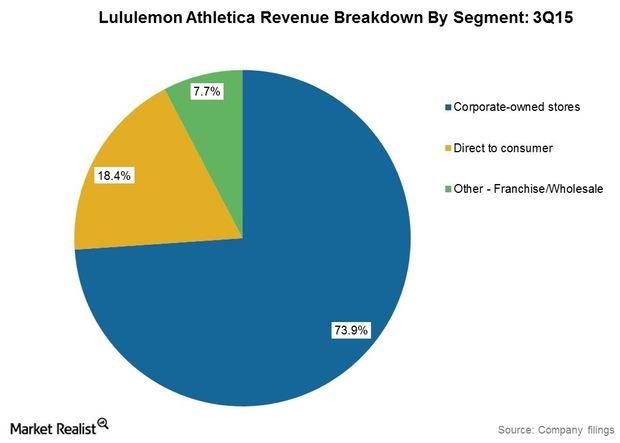

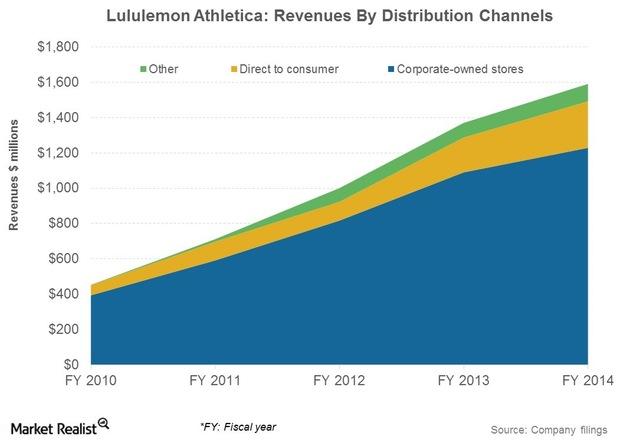

Why Lululemon’s Distribution Channels Are A Competitive Advantage

LULU’s sale through wholesale channels is much lower than its competitors VF Corporation, NIKE, and Under Armour. This is why LULU’s margins are higher.

Lululemon Supplier, Manufacturer, And Distribution Overview

Manufacturer base: There were about 35 manufacturers producing the company’s products as of the fiscal year ending February 2, 2014.

Lululemon Builds Brands Through Unique Marketing Strategies

For relatively new companies competing in an industry with many players, building a well-recognized and reputed brand is essential.

Overview: Lululemon’s Target Market And Product Assortment

Major product lines include fitness pants, shorts, tops and jackets. It also has a range of fitness-related accessories like bags, socks, and yoga mats.

Lululemon Attempts To Reinvigorate Its Interrupted Growth Model

In this series, we’ll provide an overview of Lululemon Athletica, its financials (including its latest quarterly results), and its strategies.

Porter’s 5 Forces: Under Armour And The Sportswear Industry

Porter’s 5 Forces, developed by Harvard Business professor M. Porter, is a model of analysis used to gauge the level of competition within an industry.