BTC iShares Gold Trust

Latest BTC iShares Gold Trust News and Updates

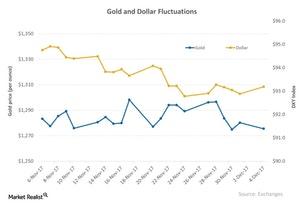

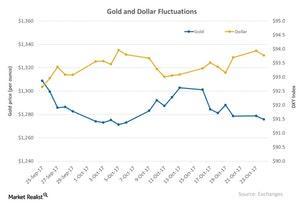

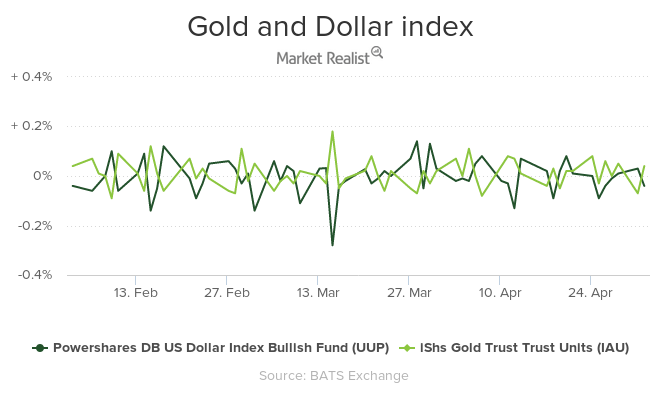

Gold Prices Have Been Flat despite the Weak Dollar

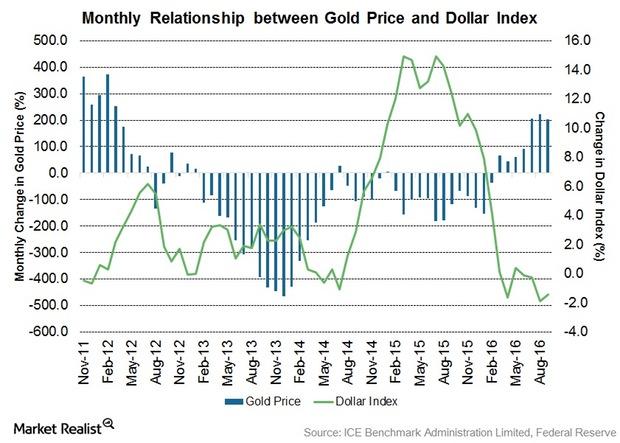

Gold (IAU) (GLD) prices usually have a strong negative correlation with the US dollar (UUP). Gold, like other commodities, is denominated in the dollar.

Yellen Wants to Keep Negative Rates on the Table, Helping Gold

When the Federal Reserve chair, Janet Yellen, testified to Congress on February 11, she affirmed the Fed’s consideration of negative interest rates. Under a negative interest rate scenario, investors would pay interest to the bank for holding their money.

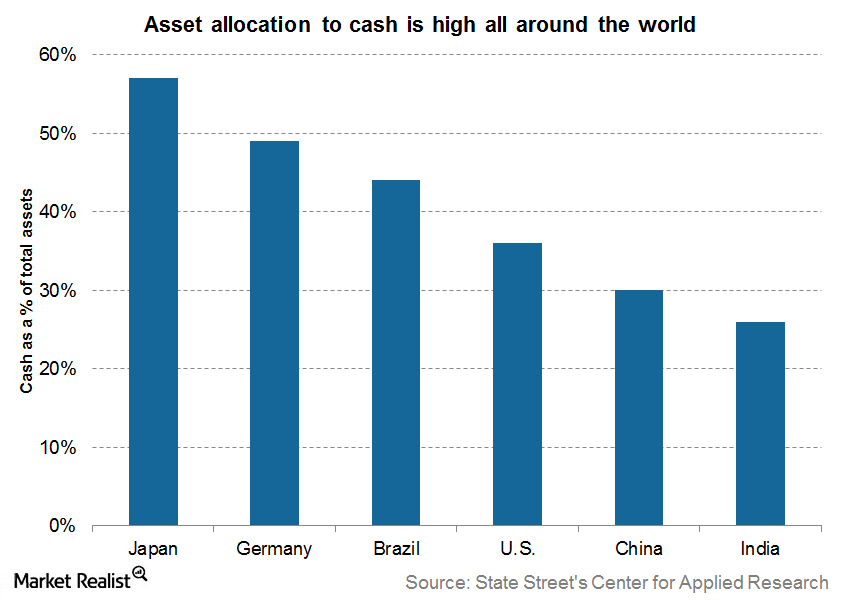

What Should Be The “Right Amount” of Cash Allocation?

If you’re preparing your portfolio for the short term, the allocation to cash should be high. As the horizon increases, allocation to cash should go down.

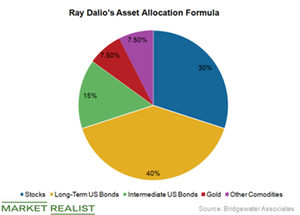

Ray Dalio Increased His Bets on Gold during Q1

Ray Dalio increased Bridgewater Associates’ stake in the SPDR Gold Shares (GLD) and the iShares Gold Trust ETF (IAU).

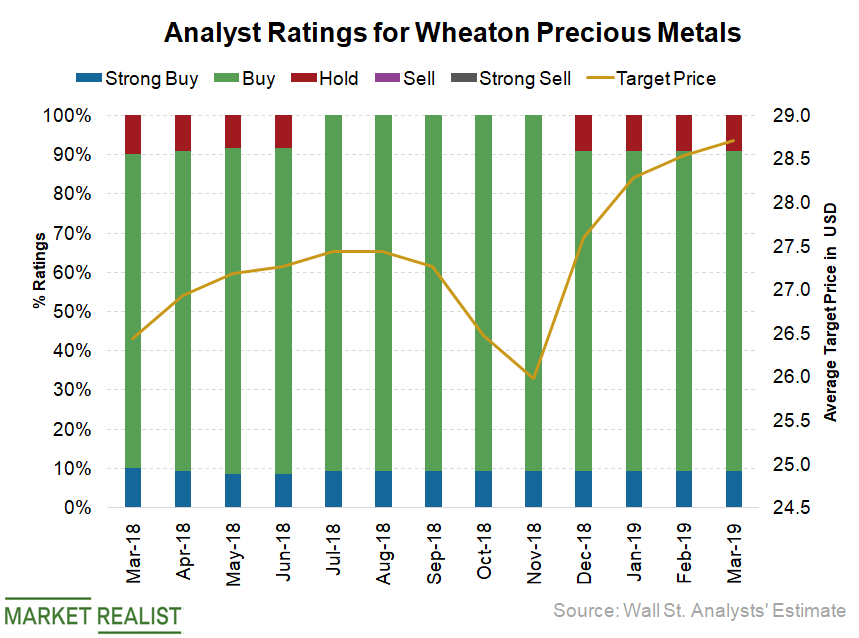

Why Wheaton Precious Metals Is Still Analysts’ Top Gold Bet

Among major gold (GLD)(IAU) mining and gold streaming companies (GOAU), Wheaton Precious Metals (WPM) is analysts’ favorite and has received the most “buy” recommendations at 91%.

Gold Prices Extend Rally on Depreciating Dollar

This is the fifth up day for gold prices in the last ten days. Prices increased by 0.72% more on the average up days than on the average down days over the last ten trading sessions.

How the Economic Sentiment Is Playing on Gold

During the past week, average hourly earnings, excluding the farming industry, were below analysts’ expectation of 0.10%.

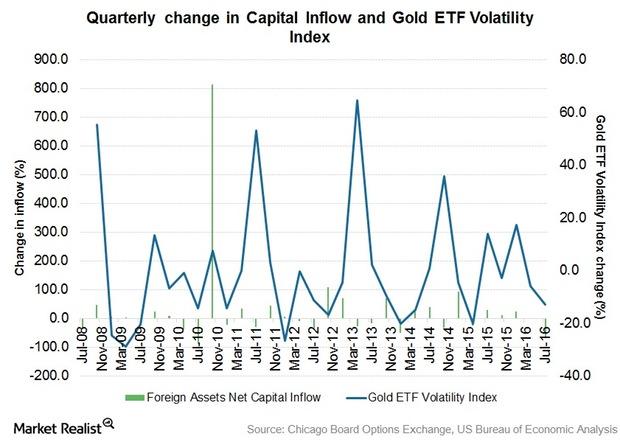

Why Gold ETFs See Robust Net Inflows against Actively Managed Gold Funds

One of the dominant financial trends of the past decade has been a move by investors out of actively managed funds and into passively managed index funds or exchange traded funds (ETFs).

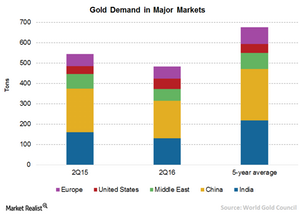

The Re-Emergence of Seasonal Gold Demand Trends

With selling pressure removed, normal gold demand trends may re-emerge Historically, there is a seasonal pattern to gold prices dependent on physical demand trends. Often, there is weakness in the summer when jewelry demand, primarily from China and India, is low and trading volumes decline. Seasonal strength often occurs from August to January, beginning with […]

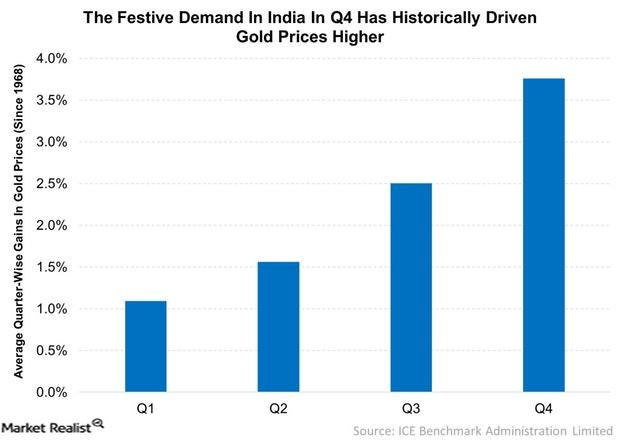

Gold Prices Could Test $1,300

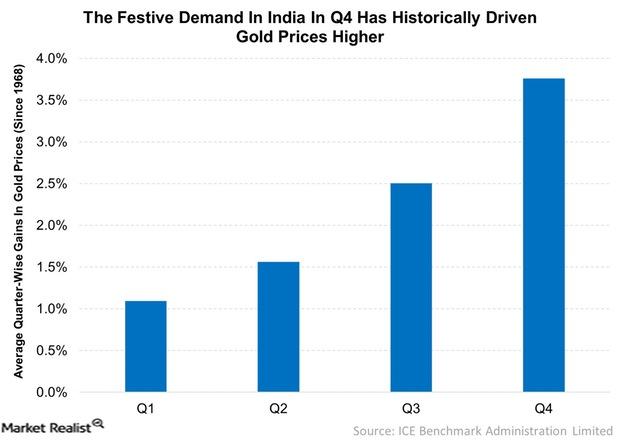

Gold prices tend to rise in the fourth quarter of the calendar year. Gold prices have gained an unannualized ~3.8% in the fourth quarter.Materials Is gold no longer an inflation hedge?

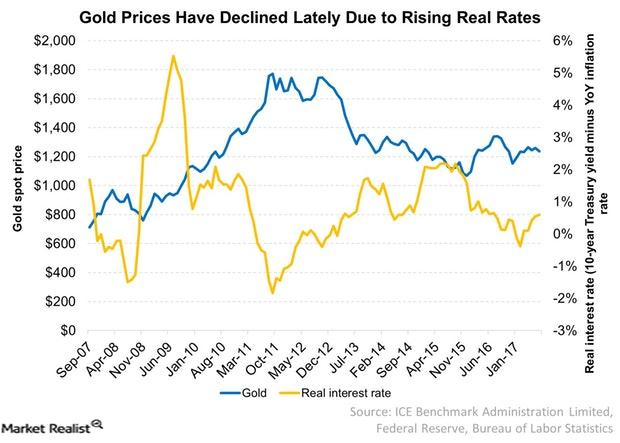

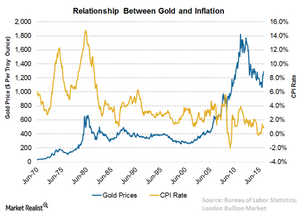

Gold certainly can be an inflation hedge, and it has worked in the past. Obviously, one of the reasons gold has been weak of late is that people are becoming less concerned about inflation.

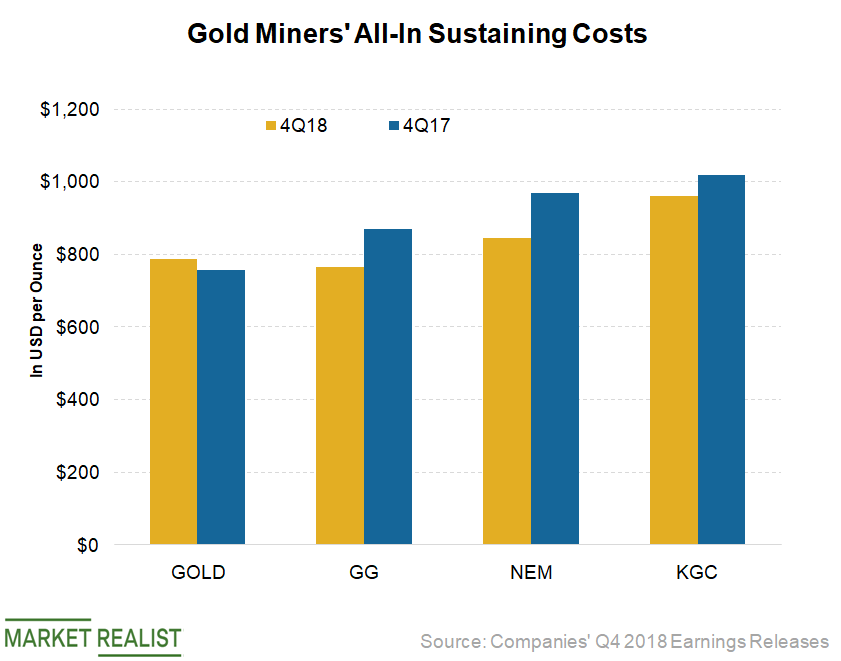

How Gold Miners’ Costs Stack Up

Barrick Gold (GOLD) reported AISC of $788 per ounce and a cost of sales of $980 per ounce in the fourth quarter.

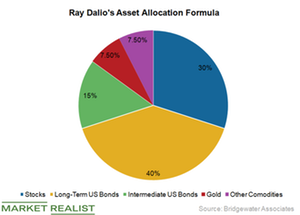

Buffett versus Dalio on Gold: Whose Advice Should You Take?

When it comes to investing in stocks, Berkshire Hathway’s (BRK.A) chair, Warren Buffett, and Bridgewater’s founder, Ray Dalio, have similar advice.

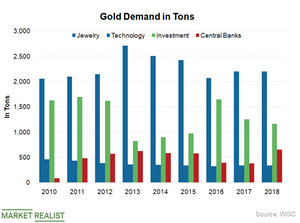

Central Banks Purchased the Most Gold in 50 Years in 2018

According to the gold demand trend released by the World Gold Council on January 31, annual gold demand increased by 4% in 2018.

A Quick Look at the Technicals of the 4 Precious Metals

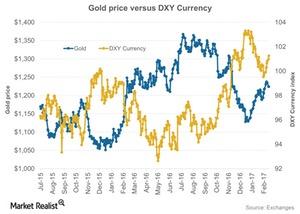

Gold’s price dipped 0.13% to $1,312.8 per ounce on May 9. The fall in gold was extended for a number of reasons.Miscellaneous How Is the Dollar Affecting Precious Metals?

Besides ongoing geopolitical concerns, a crucial factor that gold keeps looking to for directional moves is the US dollar.

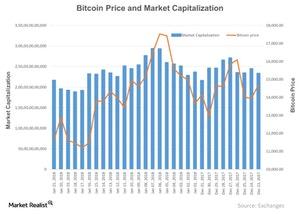

How Is Bitcoin Faring after Last Week’s Slump?

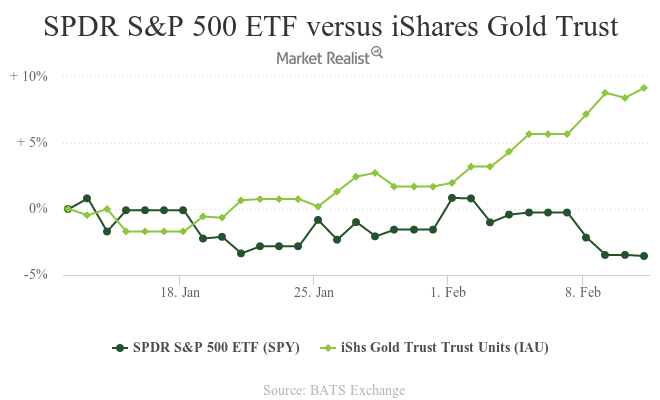

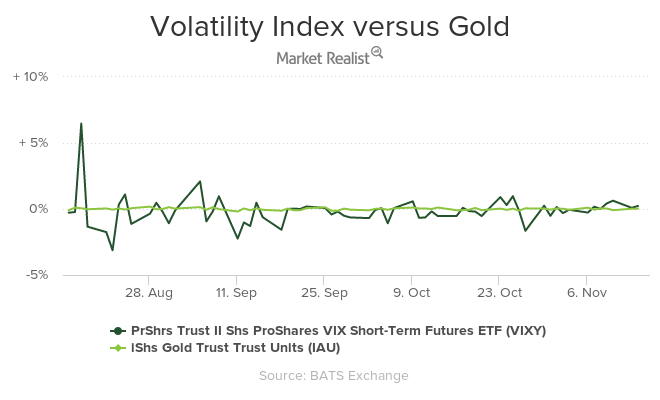

Investors (SPX-INDEX) around the world looked to gold (GLD) (IAU) for the rescue during the slump in bitcoin prices.

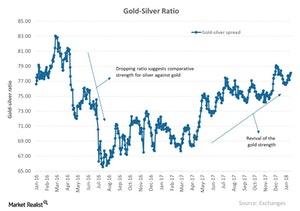

A Brief Analysis of the Gold-Silver Spread in January 2018

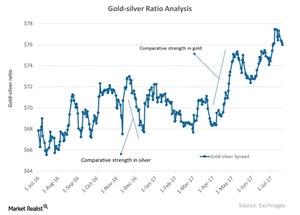

A quick look at the relationship between the two core precious metals, gold and silver, could also be helpful in the analysis of the overall precious metals market.

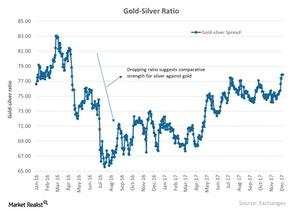

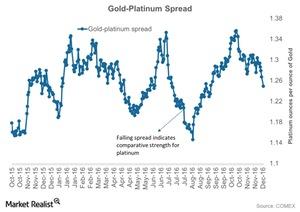

A Brief Look at December 2017’s Precious Metal Spread Measures

In this article, we’ll discuss the gold-silver, gold-platinum, and gold-palladium spreads. These three spreads stand at 77.9, 1.38, and 1.23, respectively.

How Eager Are Precious Metals to Hear the Fed’s Decision?

Gold, silver, and platinum all had a down day on Tuesday, December 13, mainly due to speculations over the Federal Reserve’s pending interest rate decision.

The Tax Reform Bill’s Impact on Precious Metals

All four precious metals saw a down day on Monday, December 4, 2017, after the US dollar, in which the four metals are priced, rose $0.39%, propelled by the Senate passing its tax reform bill.

India’s Gold Imports Have Fallen: What’s Going On?

For India, gold imports have fallen 16% in value to ~$2.9 billion in October 2017 compared to $3.5 billion in the corresponding month last year.

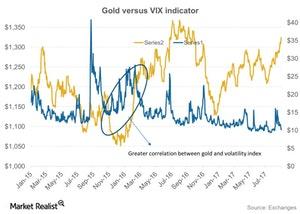

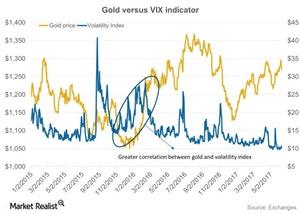

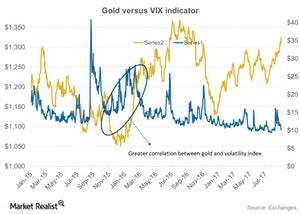

Analyzing Gold’s Market Performance

Besides the impact of interest rates, there are also other global indicators that could play on precious metals—the most important being the US dollar.

These Factors Are Affecting Gold

Gold, silver, platinum, and palladium have a five-day trailing loss of 0.67%, 0.44%, 1.1%, and 1.5%, respectively.

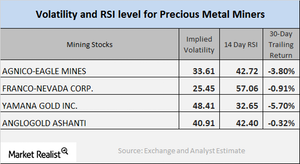

Mining Shares: RSI Numbers and Implied Volatility

As of October 19, Sibanye Gold, Agnico Eagle Mines, Silver Wheaton, and Randgold Resources had implied volatility readings of 63%, 33.6%, 30.8%, and 25%.

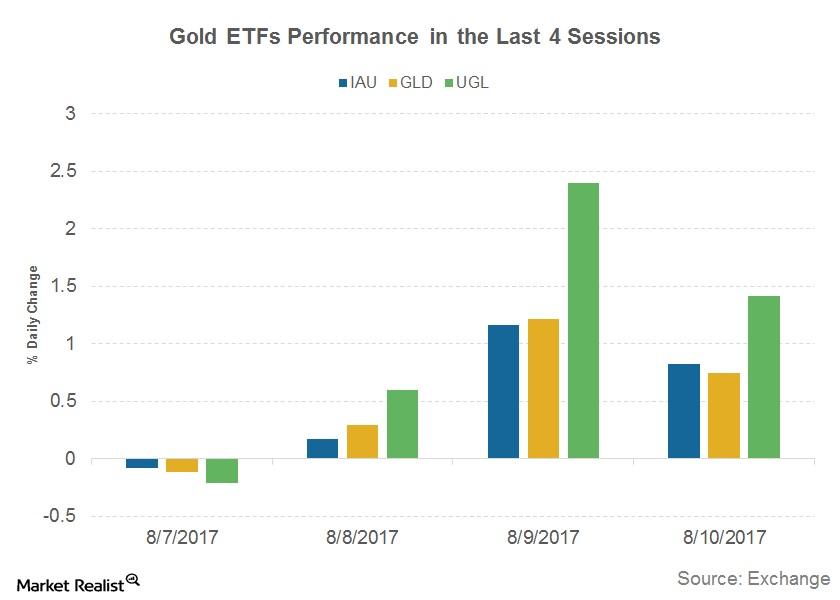

Are North Korea Tensions Continuing to Affect Precious Metals?

All the four precious metals saw an up day on Monday, October 9, 2017.

How Gold and Platinum Are Moving in Tandem

Like silver, platinum has industrial uses and has seen growing demand in China.

How Strongly Can North Korea Move the Precious Metals Market?

Gold futures for September expiration have risen ~3.9% over the past one-month period. Silver, platinum, and palladium have followed the same track as gold.

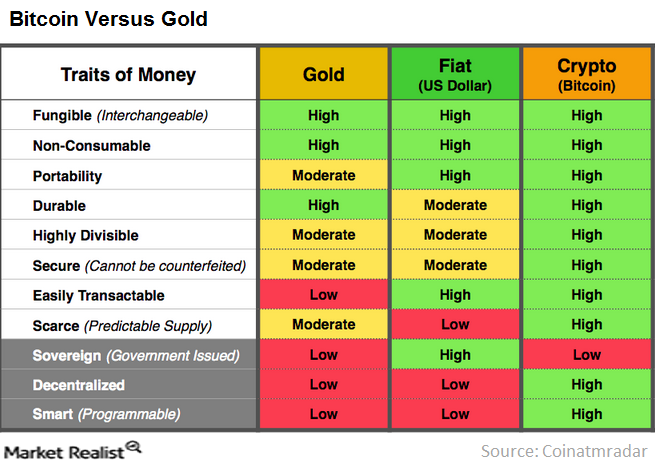

How Are Gold and Bitcoin Different?

Bitcoins can be sent across borders. Bitcoin payment will be the same as paying someone in the same country. People don’t use gold much anymore.

How Are Safe Havens Faring in This North Korea Fear?

The safe havens that benefit the most in times of uncertainty include gold (GLD) and U.S. Treasuries (GOVT).

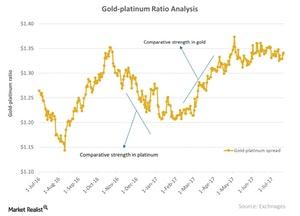

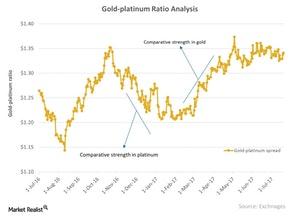

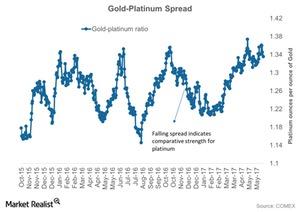

Platinum Market: Reading the Gold-Platinum Ratio

When reading the platinum market, it’s important to look at the relative performance of platinum and gold by using the gold-platinum ratio.

How the Gold-Silver Spread Is Trending

The gold-silver spread measures the price of one ounce of gold in relation to silver.

Inside the Gold-Platinum Spread Now

The platinum industry is now headed for its third-straight year of surplus, likely due to the higher demand for petroleum-based cars.

Global Tremors, the Dollar, and Gold in Early May

Geopolitical risks had been playing on haven bids for precious metals, but now, we may be seeing to be a temporary respite—however brief—from global worries.

Understanding the Fall in the US Dollar and How Precious Metal Reacted

All four precious metals witnessed a rise in price on Monday, March 20, as the US dollar slipped to its six-week low.

Analyzing the Gold-Platinum Ratio in 2017

The gold-platinum spread was ~1.2 on January 11, 2017. Platinum’s RSI (relative strength index) was 38.

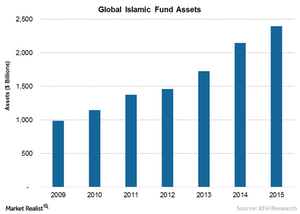

Will the Shari’ah Standard on Gold Be a Game-Changer?

In December, the AAOIFI and the WGC (World Gold Council) issued, for the first time, Shari’ah standard to deal with the use of gold (GDX) (GDXJ) as an investment in the Islamic finance industry.

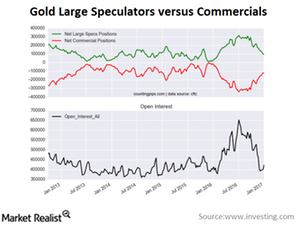

Reading Speculators’and Hedgers’ Positions in Gold

Large speculators and traders continued to reduce their bullish net positions in gold futures markets last week for the eighth consecutive week.

Why Did Gold Fluctuate in 2016?

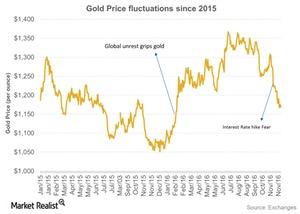

Gold prices for February expiration fell on the last trading day of the year. Gold fell 0.53% and closed at $1,152 per ounce on December 30, 2016.

India and Asia’s Festive Season Could Help Gold Prices in October

Gold has fallen below $1,300 per ounce and broken below the longer-term trend line that had been established this year.

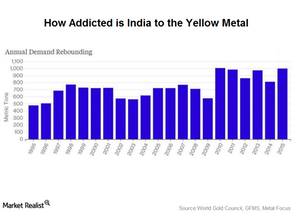

Demand from India Could Lend Support to the Gold Market

Demand from India Could Lend Support In the near term, India could lend support to the gold market. Indian gold demand has been very weak this year due mainly to the higher gold price. This suggests there is pent-up demand. A good monsoon season in India can lead to a bountiful fall harvest that typically […]

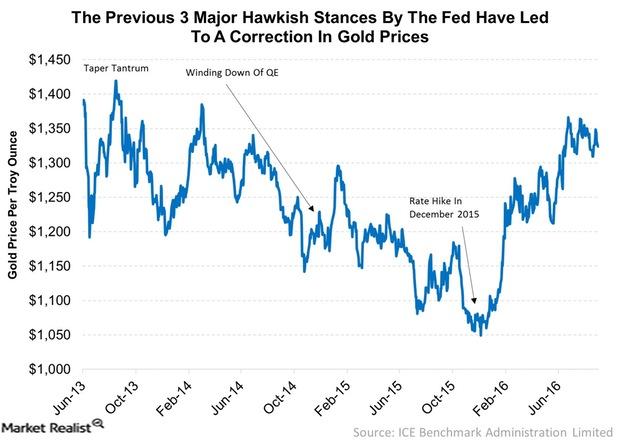

Where Gold Is Likely to Head If the Fed Hikes Rates

The Fed has probably never tightened rates in past cycles with indicators so weak. In fact, at this point in the business cycle, a more normal stance would be to hold steady, looking ahead to a time when it might cut rates. Because of this, we believe any decision to raise rates in 2016 will […]

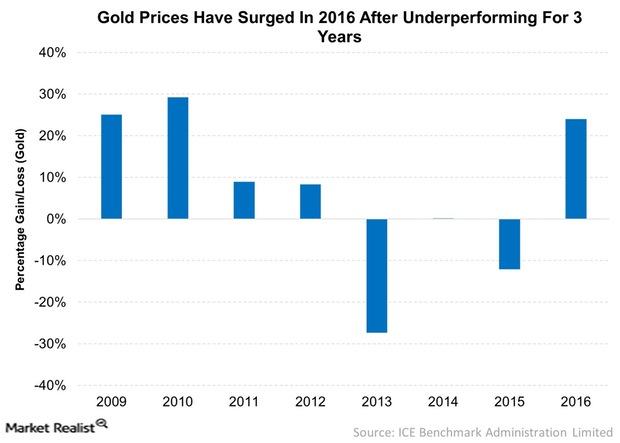

Gold Prices Moving North after 3 Years of Underperformance

This year, gold prices had risen by 24% as of September 19. Gold prices fell in August due to the Fed’s hawkish stance.

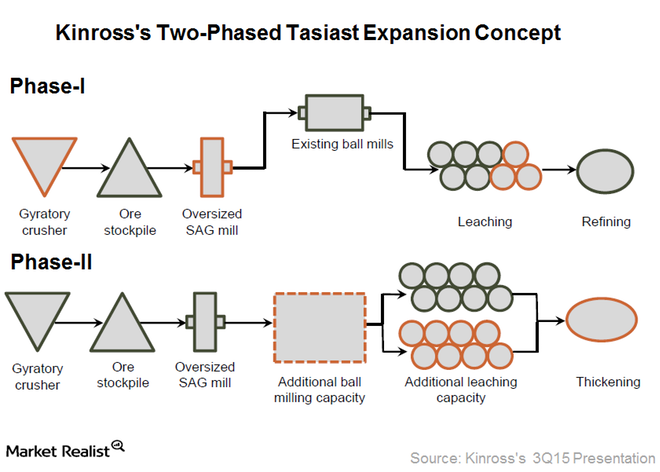

What Tasiast Mine Being Back in Full Swing Means for Kinross Gold

Kinross Gold (KGC) announced in June 2016 that it was temporarily halting its mining and processing activities at the Tasiast mine in Mauritania.

How Inflation Expectations Affect Gold Prices

In the 1990s and 2000s, when gold prices tracked inflation, although the correlation seems to be a bit weak compared to the 1970s and 1980s.

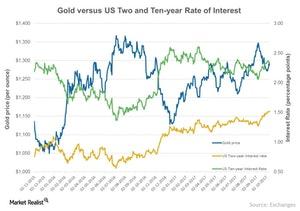

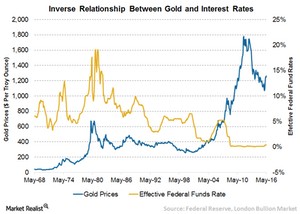

Why Gold Has Performed Better When Interest Rates Are Lower

J.P. Morgan’s analysis states that gold has outperformed equities, bonds, and a broad commodities index in a low interest rate environment.

Why Predicting Gold Returns Is a Dubious Exercise

Generally, gold is viewed as a hedge against rapid inflation and lower interest rates. That makes it hard to value gold as there are no cash flows or earnings associated with it.

India’s Gold Demand May Touch 1000 Tonnes in 2015

The World Gold Council predicted that India’s gold demand in the October–December quarter would be muted. Gold imports shrank 36.5% to $3.53 billion in November.

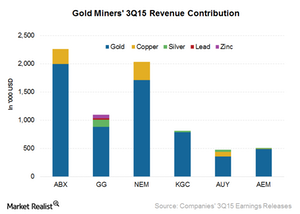

Why You Should Look Out for Gold Miners’ Commodity Exposure

It’s important to understand not only miners’ geography but also their revenue composition in terms of commodity exposure.

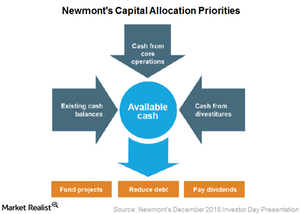

How Will Newmont’s Capital Allocation Priorities Look Like?

Newmont Mining outlined its capital allocation priorities. Management mentioned that they aim to fund their projects through cash generated from core operations.