BTC iShares Gold Trust

Latest BTC iShares Gold Trust News and Updates

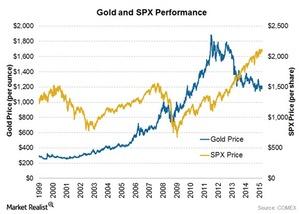

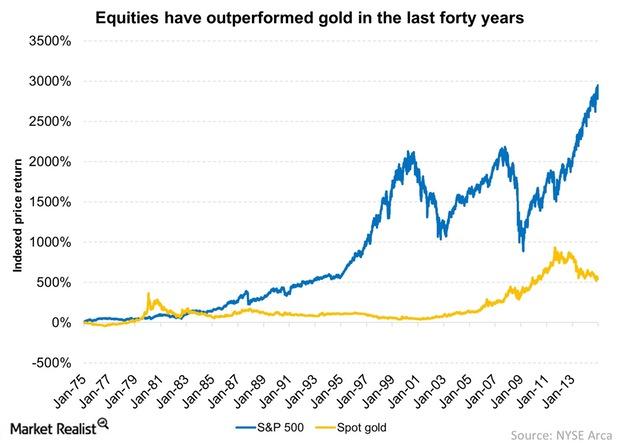

Gold’s Correlation to the Equity Markets

A look at gold and equity market performance demonstrates that a falling stock market isn’t necessarily a catalyst for a major rally in gold.

Did Strong Data Push Gold Prices South?

Gold prices don’t seem to have caught up with interest rate expectations, which have gone from 1.5% at the start of the year to about 0.5% today. The loosening monetary policy has probably worked in favor of gold.

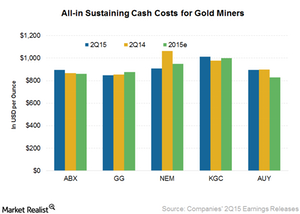

Comp: How Are Gold Miners Progressing on the Cost-Cutting Front?

For 2Q15, Newmont has been the most successful YoY in cost cutting. It had a reduction of 14.50%—mainly due to a rise in productivity and efficiency improvements.

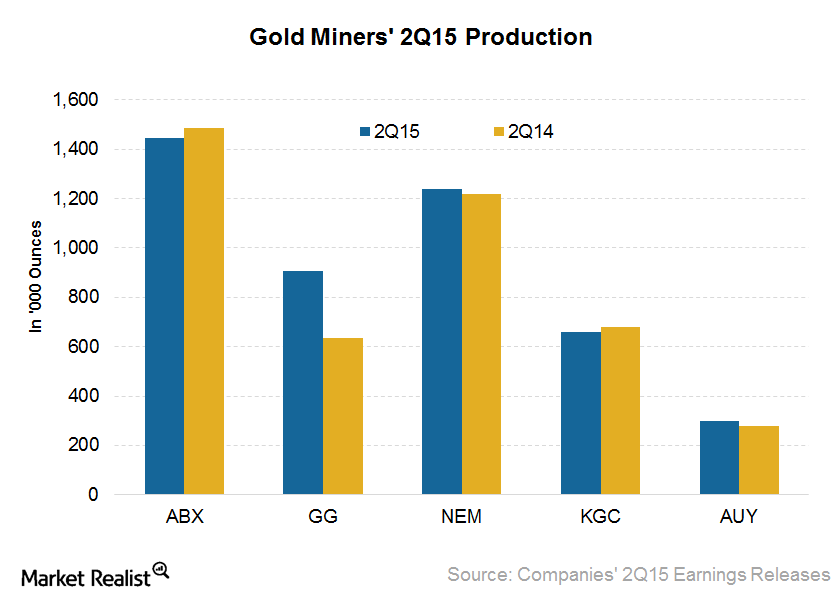

Comp: A Look at Gold Miners’ 2Q15 Production Profile

Gold miners’ (GDX) production profile is very important for investors. According to the WGC, gold mine production rose by 3% YoY to 786.6 tons in 2Q15.

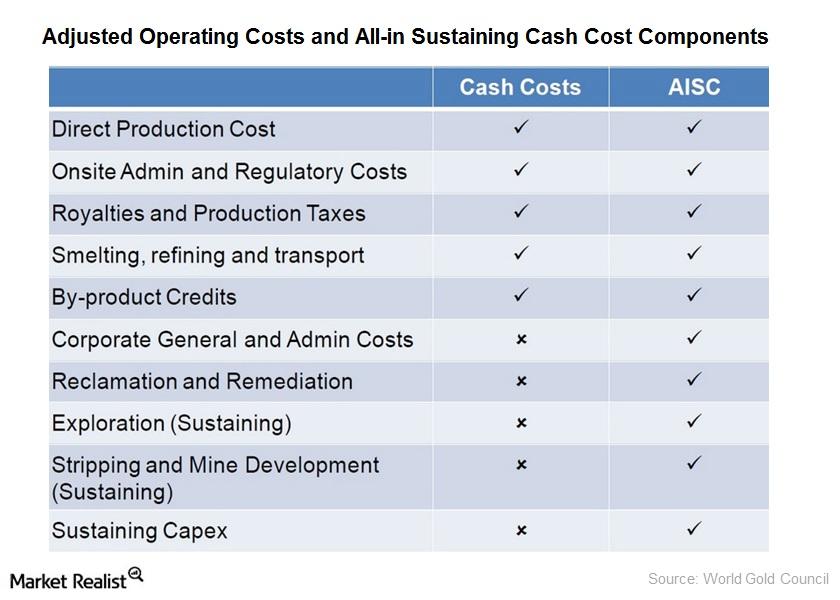

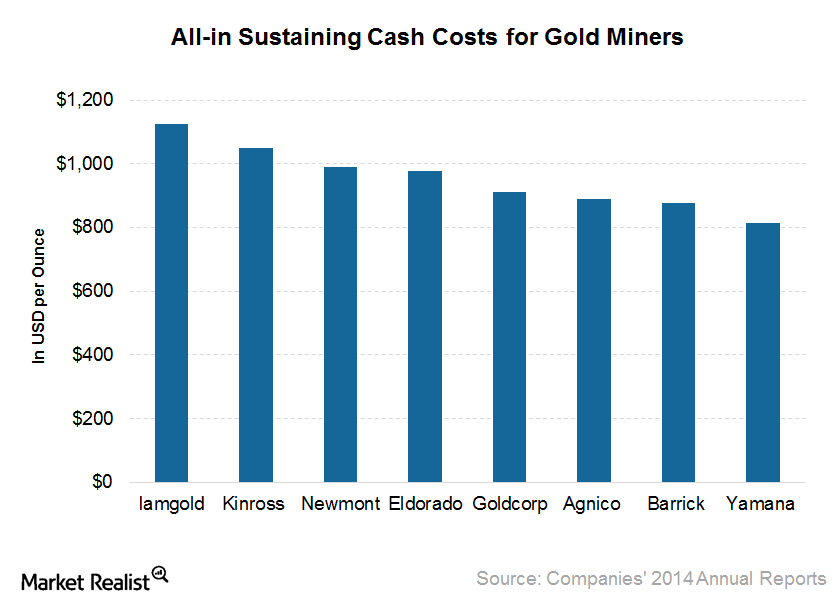

Key for Investors: Understanding Mining Cost Structures

The cash cost has been the dominant measure of the gold mining cost structure. It represents what the mine costs are for each ounce of gold.

At What Cost Are Gold Miners Digging Out Gold This Year?

The average AISC for eight significant gold miners for 2015, as guided, is $950 per ounce compared to $900 per ounce for 1Q15.

Broad Commodities Market Sell-Off: Impact on Gold

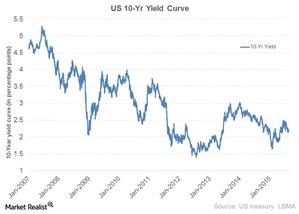

The benchmark US ten-year note yield fell by eight basis points, or 0.08%, to 1.96% as of Monday, August 24. Recent buying ended a bearish period in gold.

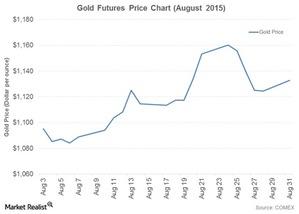

Gold Is Resilient to the Fed’s Likely Questionable Liftoff Move

With the confusing reviews from the Fed on Wednesday, gold on COMEX rose 2.20% on August 20 and closed at $1,153.20 per ounce. Silver for September expiry also rose.

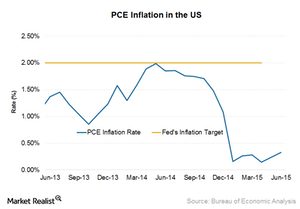

Could PCE Inflation Inspire Action at the Next Fed Meeting?

The BEA released the PCE inflation index for June on August 3, 2015. PCE inflation rose 0.30%—a pace that hasn’t been seen since December 2014.

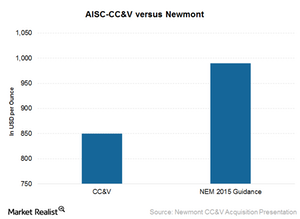

Newmont Mining’s Acquisition Makes Strategic Sense

The CC&V mine acquisition will help Newmont achieve a lower-cost profile. The mine’s cost attributable to sales and all-in sustaining costs are lower than Newmont’s current averages.

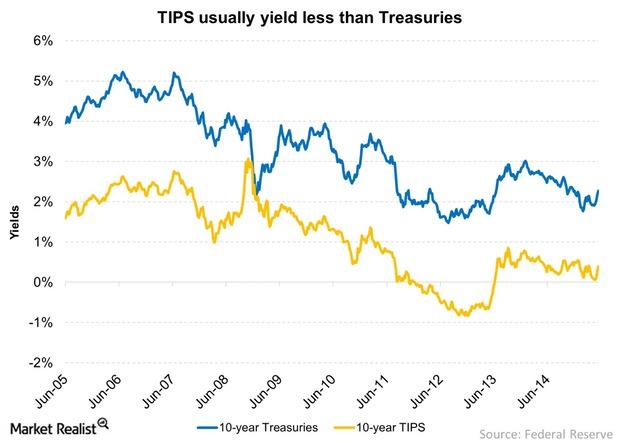

Comparing Treasury Inflation-Protected Securities and Treasuries

Yields on TIPS remain close to 0%, making them unattractive for some. However, considering that inflation rates could go up and remain there, these securities look attractive.

Equities are the best performing asset class in the long term

The CAGR for equity for the last 20 years is 7.8%. Equities outperformed investment-grade corporate bonds. Equities are the best performing asset class.