GlaxoSmithKline PLC

Latest GlaxoSmithKline PLC News and Updates

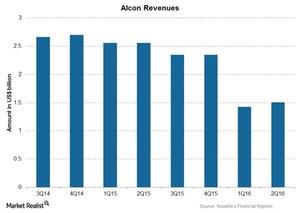

Novartis’s 3Q16 Estimates: Will Alcon Recover Its Growth?

Alcon, Novartis’s (NVS) eye care segment, researches, develops, manufactures, and markets eye care products in over 180 countries worldwide.

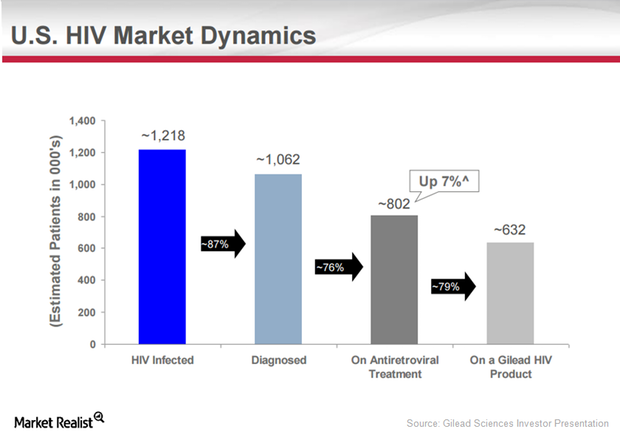

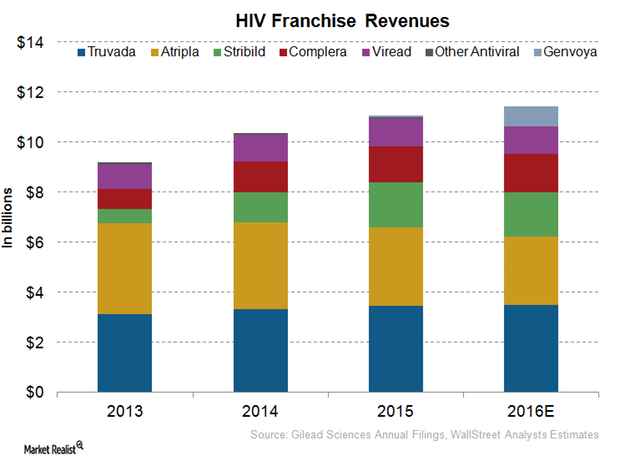

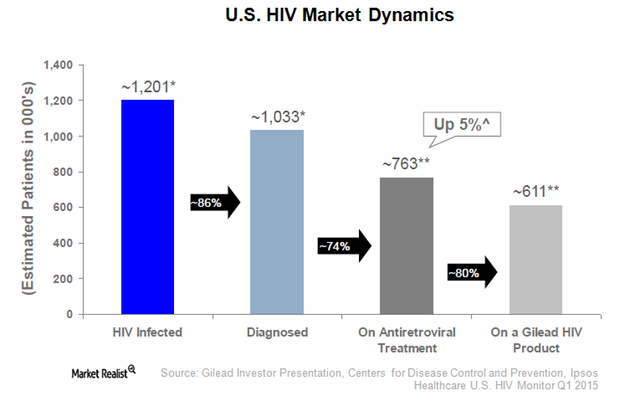

How GILD Plans to Battle through Impending HIV Patent Cliff

Gilead Sciences (GILD) is the leading biotechnology player in the global HIV market.

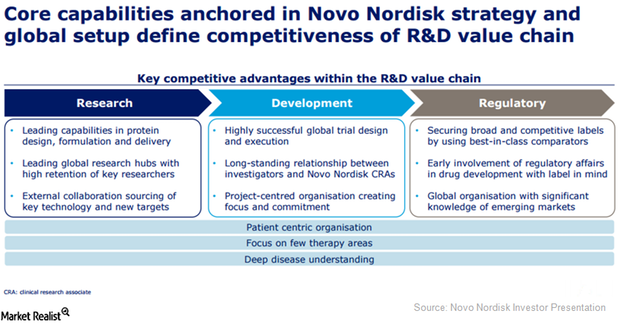

Will Novo Nordisk’s Core Capabilities Be Enough to Differentiate Its Research Pipeline?

Novo Nordisk’s search for new molecules through partnerships and other alliances has proven instrumental in strengthening its R&D pipeline.

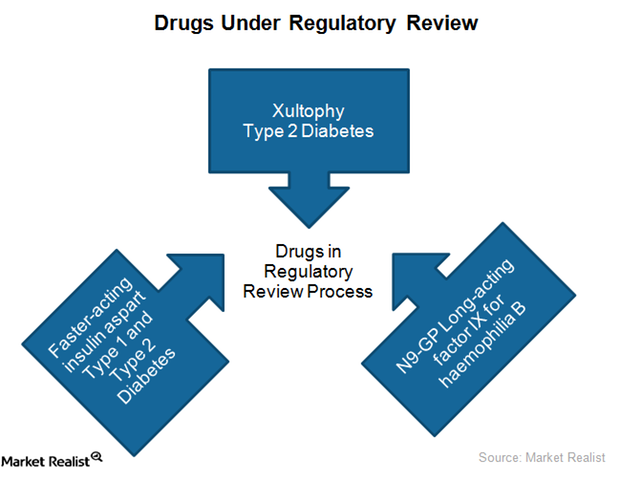

Novo Nordisk Expects to Witness Strong Growth from New Product Launches

In addition to its robust drug portfolio, Novo Nordisk boasts a strong research pipeline in the diabetes, hemophilia, obesity, and growth disorder segments.

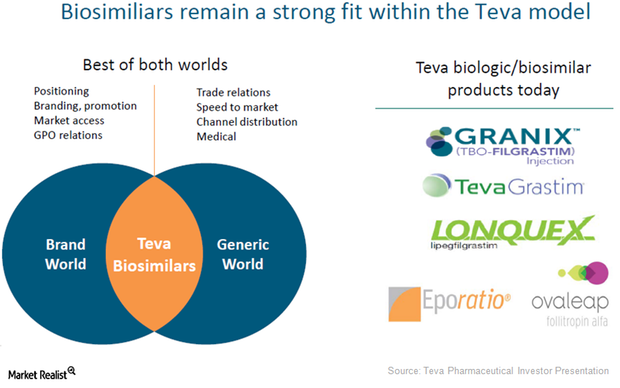

A Look at Teva’s Dominance in the Biosimilar Space

As one of the early entrants in biosimilars, Teva Pharmaceutical Industries (TEVA) has managed to become one of the biggest players in the biosimilar space.

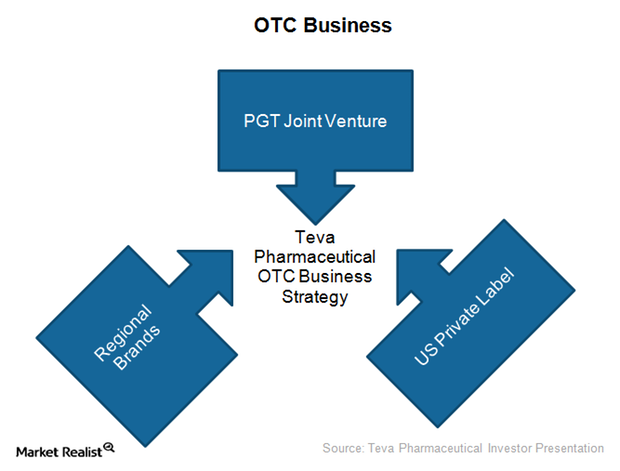

Teva’s OTC Business Is Playing out to Be a Key Growth Driver

In addition to its generic pharmaceutical business, Teva Pharmaceutical also has a significant presence in the major categories of the OTC drug business.

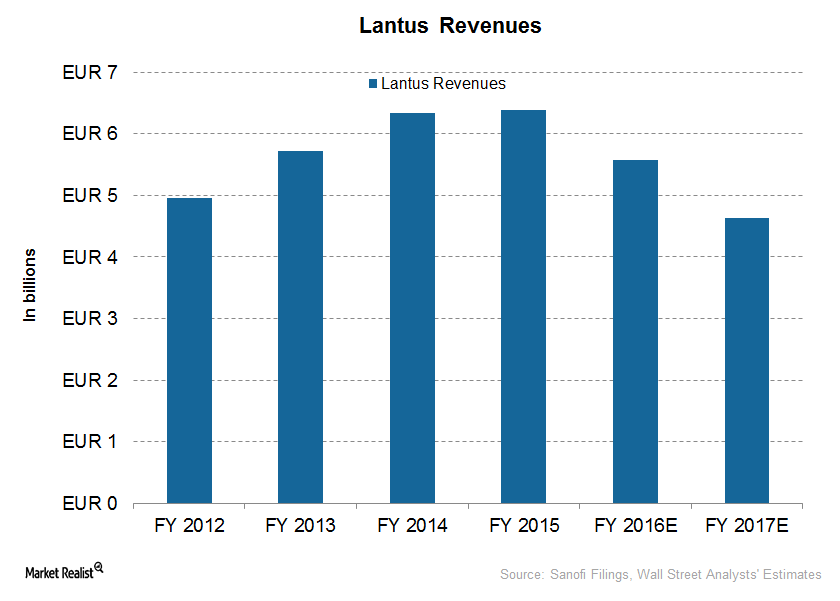

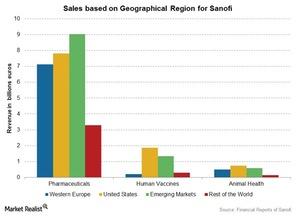

Will Sanofi See More Growth from Its Blockbuster Insulin Drug?

Sanofi’s diabetes franchise includes Lantus, Toujeo, Amaryl, and Apidra. Lantus, a glargine insulin, contributed 17% of total revenues in fiscal 2015.

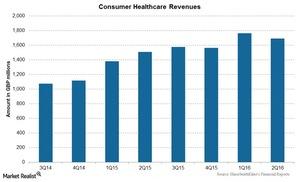

GSK Optimistic about Future of Its Consumer Healthcare Segment

With improvements in the supply chain and successful launch of new products, GlaxoSmithKline (GSK) is optimistic about its consumer healthcare segment performance.

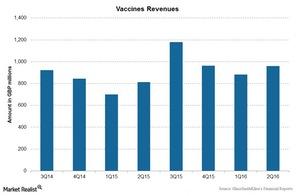

GlaxoSmithKline Giving a Shot to Its Vaccines Business

GlaxoSmithKline (GSK) is focused on strengthening its vaccines business, so it acquired Novartis’s (NVS) meningitis and other vaccines business.

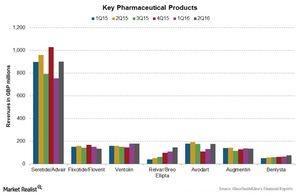

Performance of GSK’s Global Pharmaceuticals Franchises Mixed

The global pharmaceuticals franchise is GlaxoSmithKline’s (GSK) largest revenue contributor.

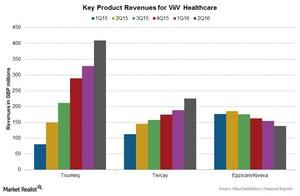

GlaxoSmithKline’s Combo Treatment for HIV Faces Stiff Competition

GlaxoSmithKline’s (GSK) HIV medicines business is managed by ViiV Healthcare, a global specialist company in HIV medicines.

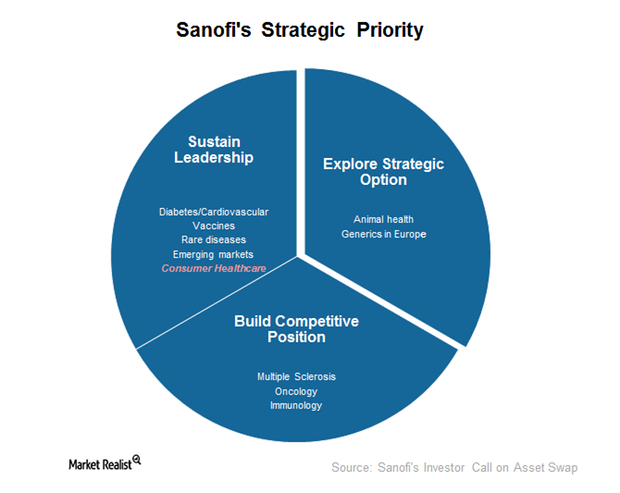

Understanding Sanofi’s Strategic Priority

As of June 30, 2016, the animal health business was Sanofi’s operating segment. It will remain an operating segment until the transaction closes.

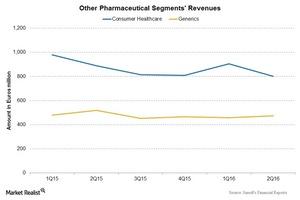

What Happened to Sanofi’s Consumer Healthcare and Generics Franchise in 2Q16?

Sanofi’s Consumer Healthcare segment includes Allegra, Doliprane, Nasacort, and other products. It reported a 4.3% decline in revenues to 800 million euros.

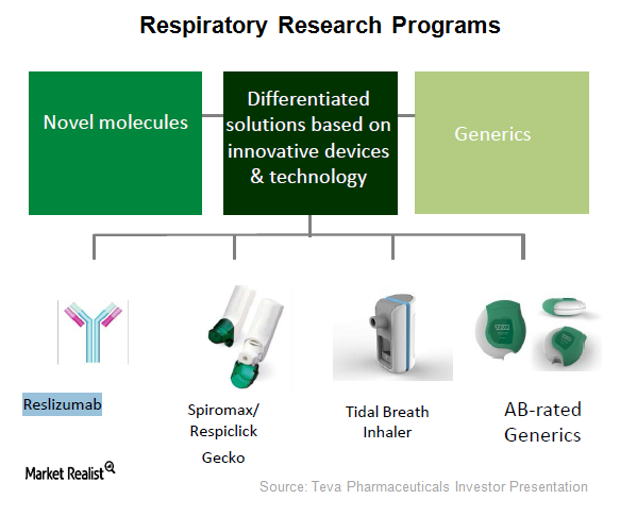

Teva’s Asthma Segment: What Could Boost Its Revenues in 2016?

On March 23, 2016, the FDA approved Cinqair (reslizumab) as a maintenance therapy for patients with severe asthma.

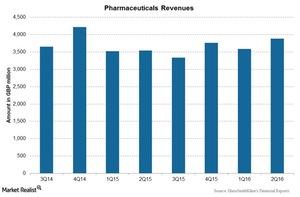

How Did GlaxoSmithKline’s Pharmaceuticals Segment Do in 2Q16?

GlaxoSmithKline’s (GSK) Pharmaceuticals segment declined substantially in 2015 due to the divestment of its oncology business to Novartis (NVS) in March 2015.

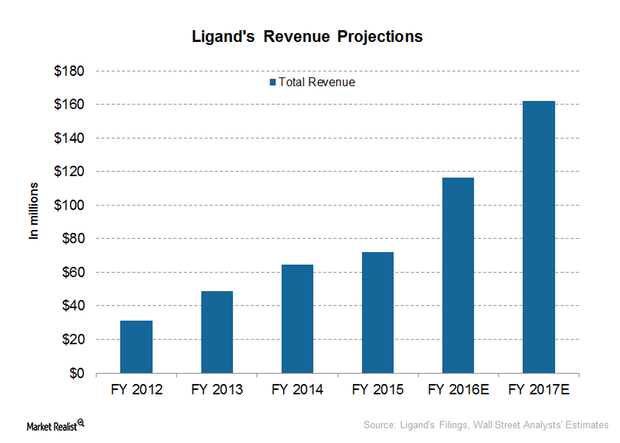

What Is Ligand Pharmaceuticals’s Expected Revenue Growth in 2016?

Ligand Pharmaceuticals (LGND) is a high-growth company with a comparatively low-risk business model. It earns most of its revenue from royalty and license fees.

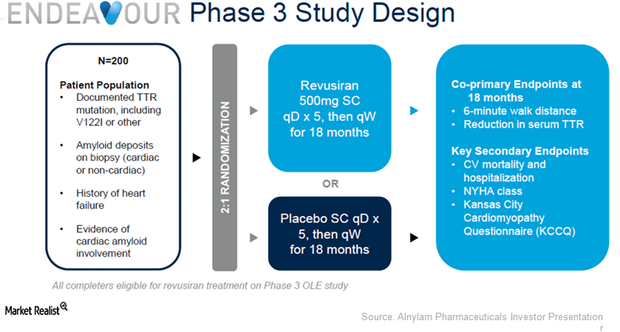

ALNY Should Complete Revusiran’s Endeavour Trial Enrollment in Late 2016

If the Endeavour study results in positive data, Alnylam Pharmaceuticals may become a major rare disease player like its peers United Therapeutics (UTHR) and Vertex Pharmaceuticals.

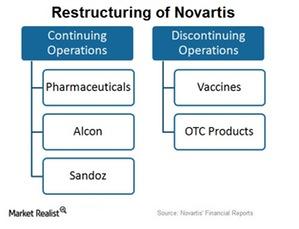

What’s Novartis’s New Structure?

Novartis (NVS) has restructured its entire business into two parts: continuing operations and discontinuing operations.

What Risks Does Novartis Face?

Novartis is exposed to legal risks, including patent litigations, other product-related litigation, commercial litigation, government investigations, and prohibition rules.

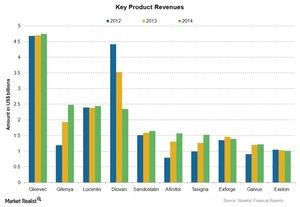

Which Products Contribute the Most to Novartis’s Revenues?

Novartis (NVS) has recorded direct product sales of over $1 billion for each of its ten pharmaceutical products in the last year.

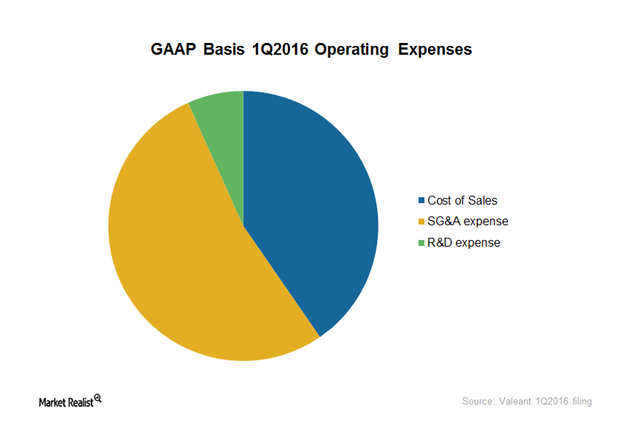

What’s behind Valeant’s Operating Expenses?

Valeant’s major operating expenses include cost of sales, SG&A (selling, general, and administrative) expenses, and R&D (research and development) costs.

Inside Gilead Sciences’ Involvement in TAF Therapies

On March 01, 2016, the FDA approved Gilead Sciences’ TAF-based HIV drug, Odefsey, for the treatment of certain HIV-1 afflicted patients.

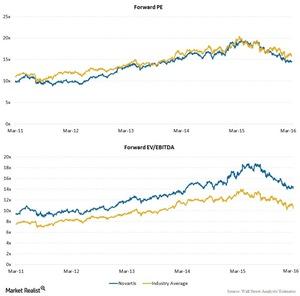

What Are Novartis’s Valuation Multiples?

Based on the last five-year multiple range of ~9x to ~20x, Novartis’s current valuation is neither high nor low.

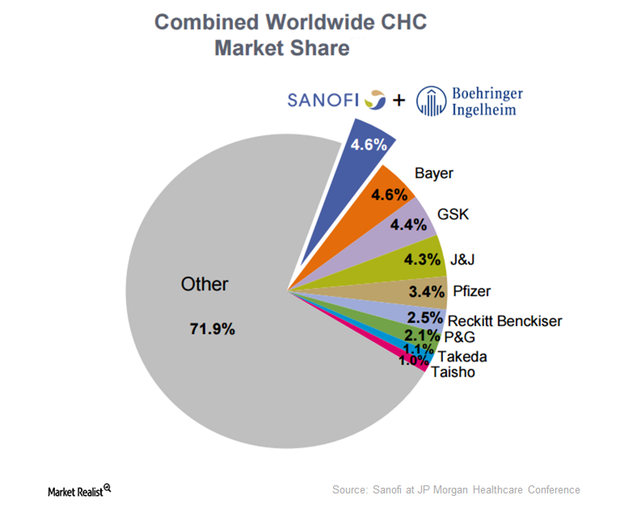

Can Consumer Healthcare Drive Sanofi’s Revenue?

The CHC (consumer healthcare) market forms a part of Sanofi’s (SNY) pharmaceutical segment.

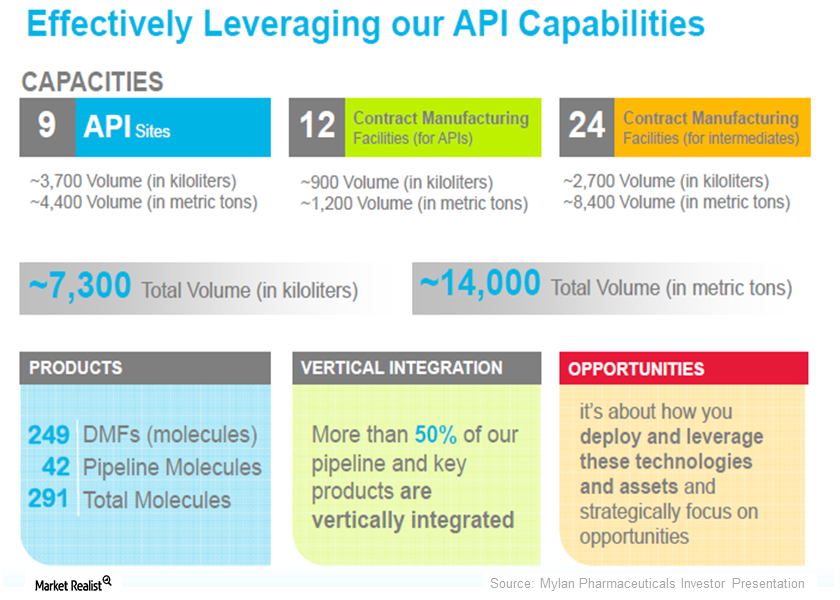

How Has Manufacturing Its Own Active Pharmaceutical Ingredients Helped Mylan?

Mylan is one of largest API (active pharmaceutical ingredient) manufacturers in the world, with nine API and intermediate manufacturing facilities.

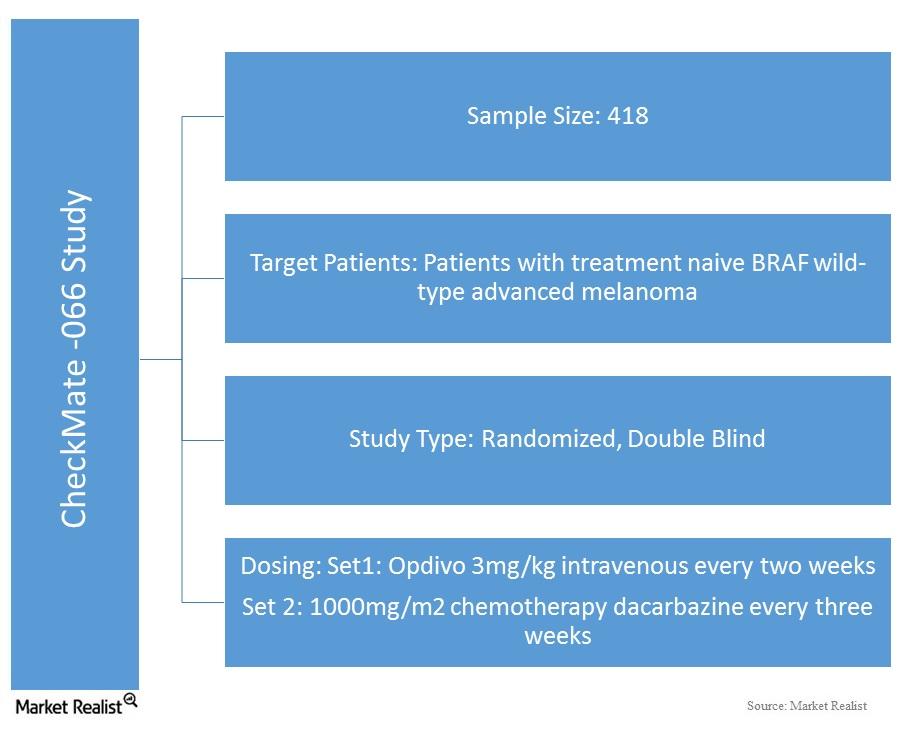

CheckMate -066 Study Supports Opdivo’s Approval

The FDA has now approved Opdivo for the treatment of BRAF WT (wild-type) melanoma, based on the results of a phase 3 study called CheckMate -066.

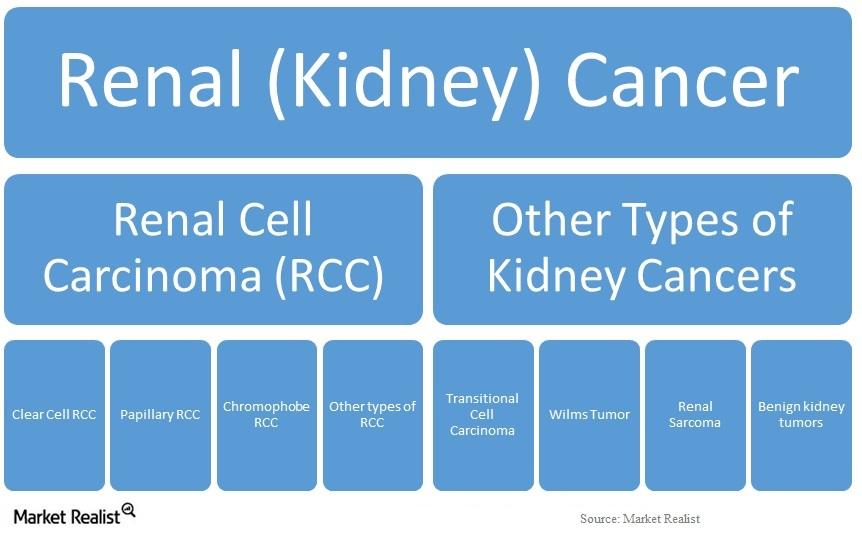

Existing Drugs for Renal Cell Carcinoma

The FDA has accepted Bristol-Myers Squibb’s (BMY) supplemental biologics license application, or sBLA, for Opdivo for the treatment of patients with advanced renal cell carcinoma.

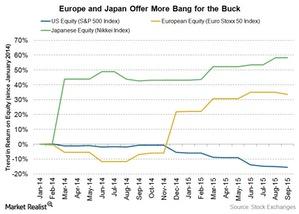

Japanese and European Equities Offer Relative Value

A Janus Capital (JNS) report for 2015 outlook by Bill Gross stated, “We like Japanese and European equities due to cheap valuations and monetary boosters.”

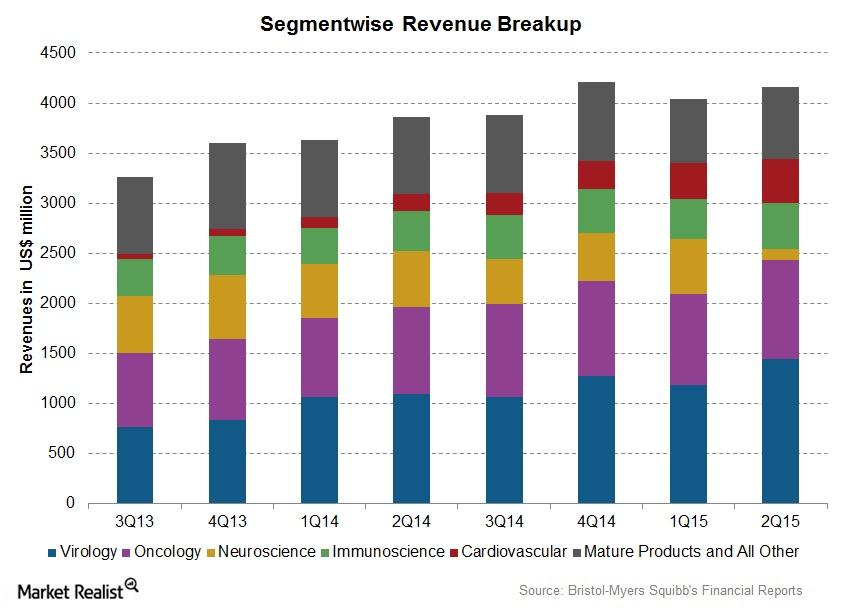

Bristol-Myers Squibb’s Business Segment Performance

Bristol-Myers Squibb (BMY) has classified its business into virology, oncology, immunoscience, cardiovascular, and neuroscience segments.

Gilead: Global Leader in the HIV Market

Gilead Sciences (GILD), a biotechnology leader in the human immunodeficiency virus, or HIV, market, offers drugs to eight out of every ten HIV naïve patients in the US.

Sanofi’s Segment-Wise Sales by Region

Sanofi (SNY) products are sold in over 120 countries. The company’s markets are classified into four geographical regions for reporting purposes.

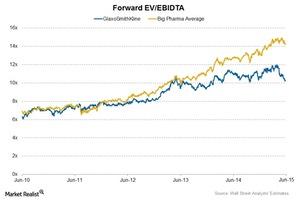

Risks for GlaxoSmithKline

GSK operates in over 170 countries and is subject to political, socioeconomic, and financial factors and risks across the globe.

Comparing GlaxoSmithKline with Its Peers

Pharmaceutical companies like GlaxoSmithKline are capital-intensive, with high debt on their balance sheets due to heavy setup costs and huge research and development expenses.

GlaxoSmithKline: The British Multinational Pharmaceutical Company

GlaxoSmithKline is a British multinational pharmaceutical company with a significant presence in the US. GSK has over 100,000 employees in operations around the world.

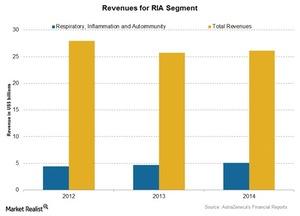

AstraZeneca’s Position Compared to Its Peers

The forward EV/EBIDTA multiple for AstraZeneca is ~13x, which is slightly lower than the industry average of ~14x.

AstraZeneca’s Respiratory, Inflammation, and Autoimmunity Segment

The respiratory, inflammation, and autoimmunity (or RI&A) franchise contributed nearly 19.2% of AstraZeneca’s (AZN) total assets in 2014.

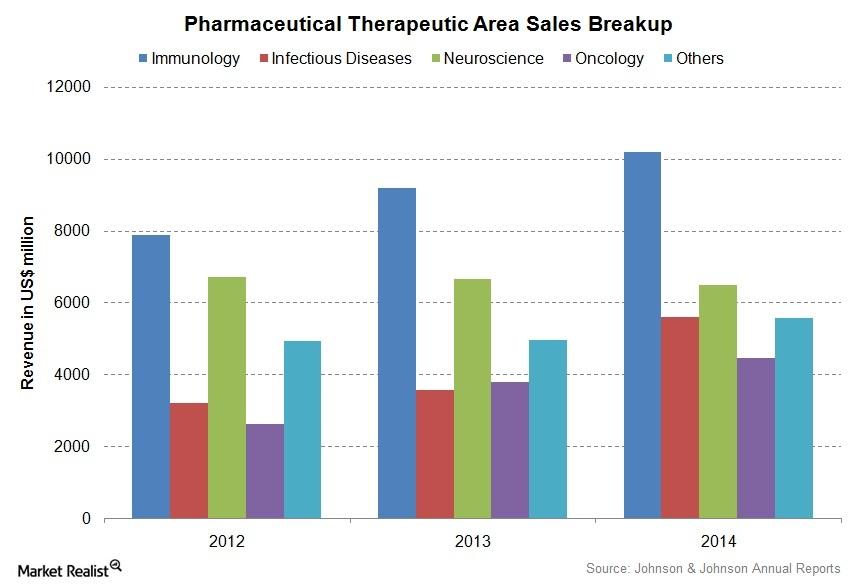

Exploring Johnson & Johnson’s Pharmaceuticals Segment

Johnson & Johnson (JNJ) is the largest pharmaceutical company in the US. The Pharmaceuticals segment contributes over 43% of the company’s revenue.