GlaxoSmithKline PLC

Latest GlaxoSmithKline PLC News and Updates

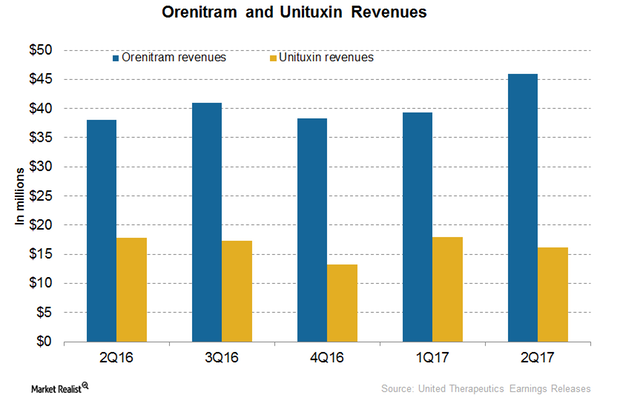

How Did United Therapeutics’ Orenitram and Unituxin Perform in 2Q17?

In 2Q17, United Therapeutics’ (UTHR) Unituxin generated revenues of around $16 million, a 10% decline on a year-over-year (or YoY) basis and an 11% decline on a quarter-over-quarter basis.

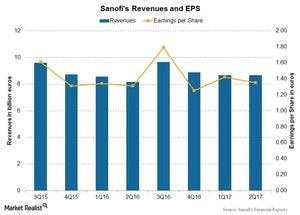

A Look at Sanofi’s Post-2Q17 Valuation

Sanofi (SNY), one of the world’s largest pharmaceutical companies, reported operational growth of 5.5% to reach revenue of 8.7 billion euros in 2Q17.

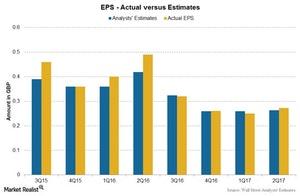

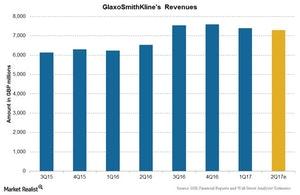

GlaxoSmithKline’s Valuations after Its 2Q17 Earnings

On July 28, 2017, GlaxoSmithKline (GSK) traded at a forward PE multiple of 13.4x, which is slightly lower than the industry average of 15.2x.

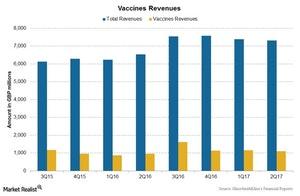

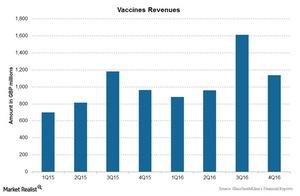

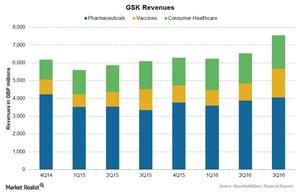

GlaxoSmithKline’s 2Q17 Earnings: Vaccines Business

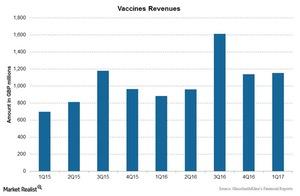

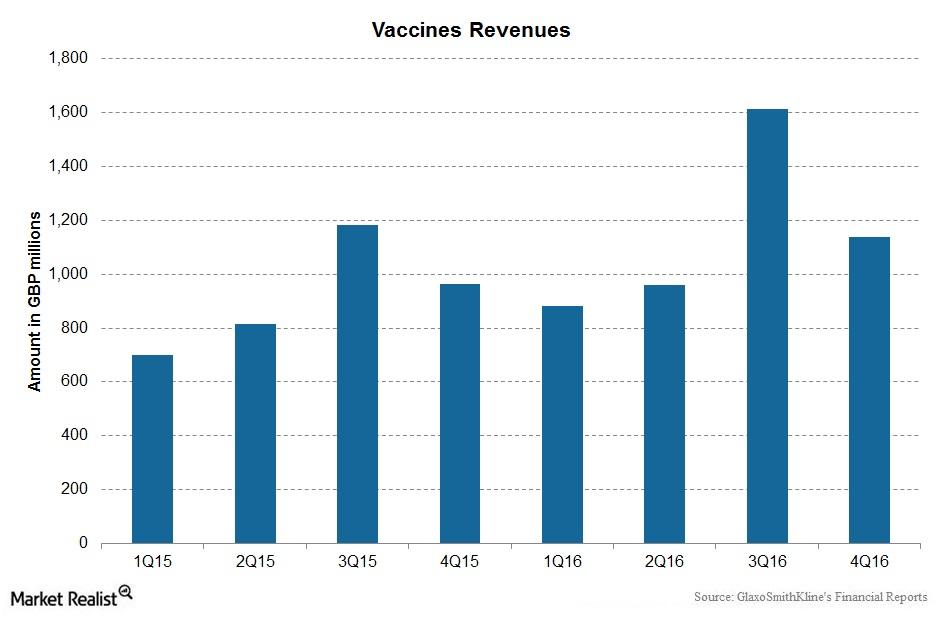

GSK’s Vaccines business reported 16.0% growth to ~1.1 billion pounds in 2Q17, including 5.0% growth at constant exchange rates and 11.0% positive impact of foreign exchange.

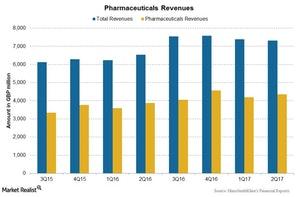

GSK’s 2Q17 Earnings: Pharmaceuticals Segment

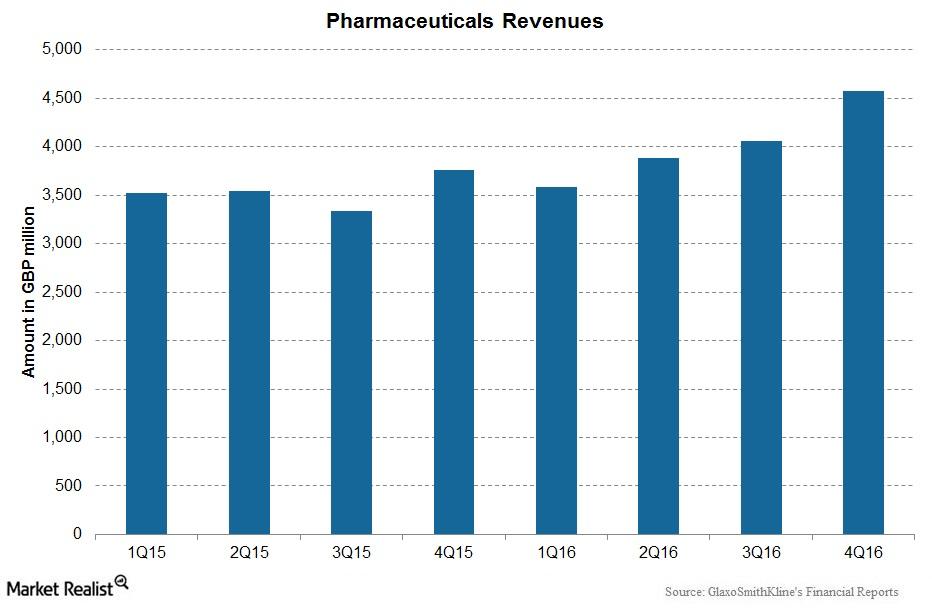

GSK’s Pharmaceuticals segment’s contribution to the company’s total revenues was 59.5% in 2Q17.

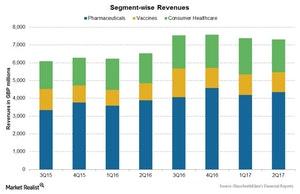

GlaxoSmithKline’s 2Q17 Earnings: Business Segments

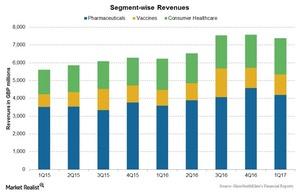

GSK reported operational growth of 3% in its revenues to ~7.3 billion pounds for 2Q17.

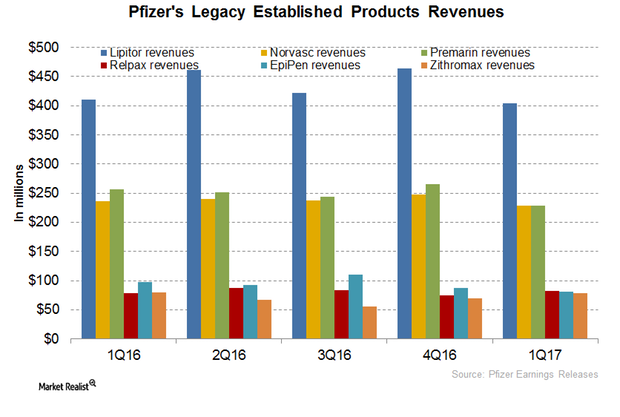

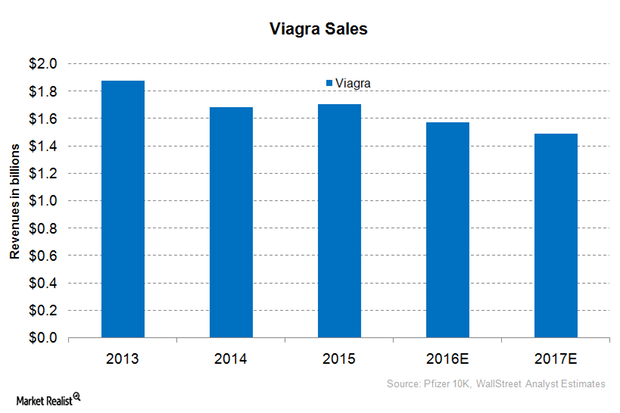

Behind Pfizer’s Legacy Established Products Performance in 2017

In 2016, Pfizer’s (PFE) Lipitor reported revenues of ~$1.8 billion, which represented a ~5% YoY (year-over-year) fall.

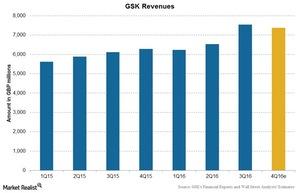

Unpacking GlaxoSmithKline’s 2Q17 Revenue Expectations

Analysts expect to see a growth of ~11.4% in GlaxoSmithKline’s (GSK) 2Q17 revenues, which are expected to total nearly 7.3 billion British pounds.

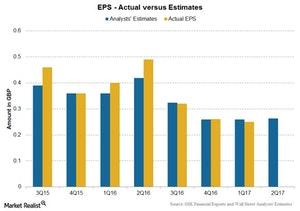

Inside GlaxoSmithKline’s 2Q17 Earnings Estimates

For 2Q17, analysts estimate that GSK’s revenues will rise ~11.4% to ~7.3 billion pounds, as compared to ~6.5 billion pounds for 2Q16.

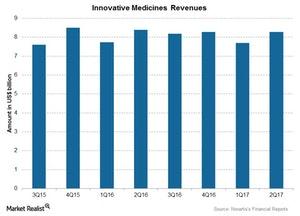

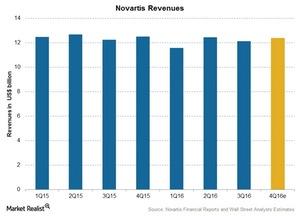

Novartis in 2Q17: Performance of Innovative Medicines

The overall contribution of the Innovative Medicines segment was ~67.6% at $8.28 billion for 2Q17.

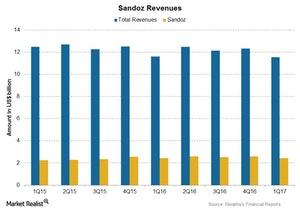

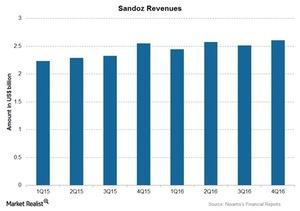

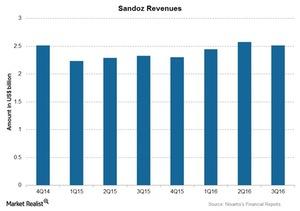

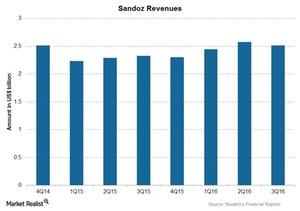

Novartis’s 2Q17 Estimates: How Sandoz Might Perform

Revenues for Sandoz are expected to report operational growth in 2Q17 following an increased demand for biopharmaceuticals.

Novartis Stock in 2Q17: How Has It Performed?

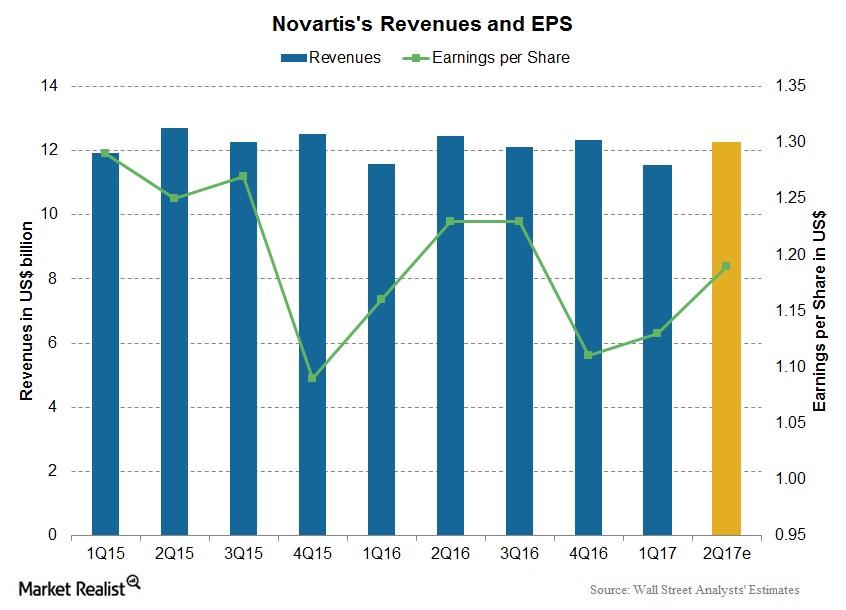

A look at Novartis Headquartered in Basel, Switzerland, Novartis (NVS) is a pharmaceutical company specializing in the research, development, manufacturing, and marketing of a broad range of healthcare products, mainly pharmaceuticals. The company has segregated its business into three segments: Innovative Medicines, Sandoz (generic), and Alcon (eye care). Stock price performance Novartis’s stock price has […]

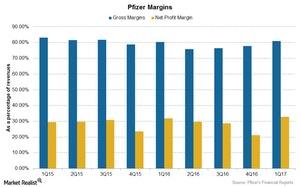

Pfizer’s Profitability in 1Q17

Pfizer’s gross margin for 1Q17 was 81.0%, a 0.70% rise compared to 80.3% in 1Q16.

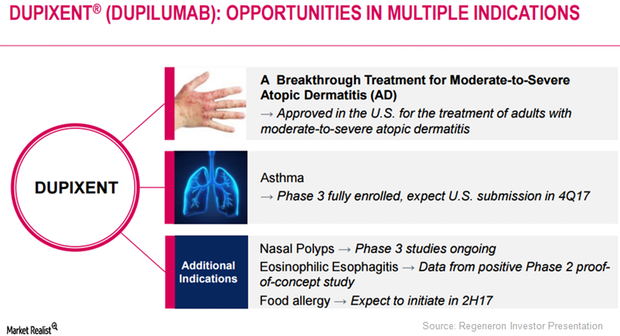

Dupixent May Prove Effective in Multiple Diseases

Regeneron plans to discuss Dupixent’s innovative mechanism-based treatment approach with regulatory authorities.

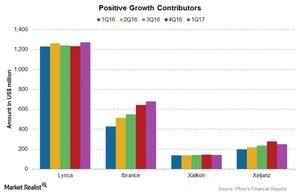

What Drove Pfizer in 1Q17?

Growth drivers for Pfizer (PFE) include products contributing to operational growth, such as BMP2, Celebrex, Ibrance, Lyrica, and Xeljanz.

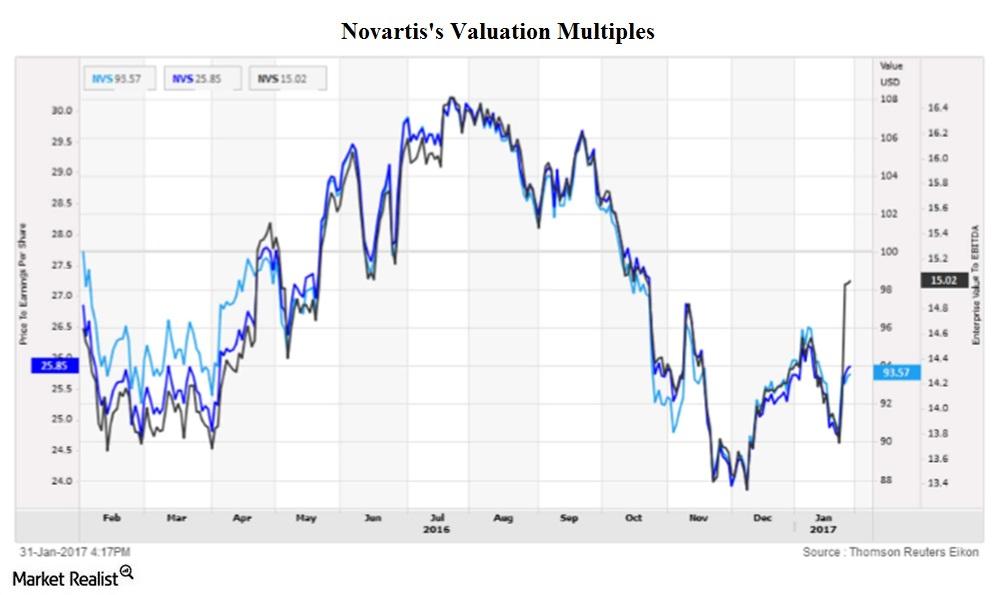

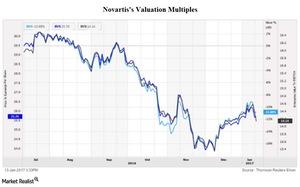

What Happened to Novartis’s Valuation after 1Q17?

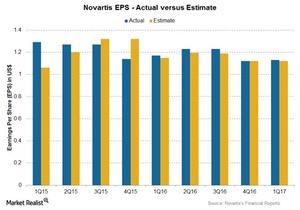

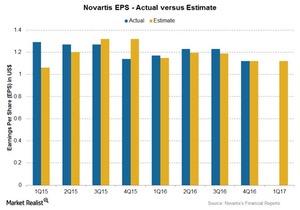

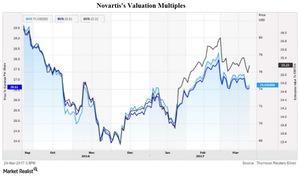

Novartis reported EPS of $1.13 on revenues of $11.54 billion for 1Q17, which represents 2% YoY operational growth in revenues.

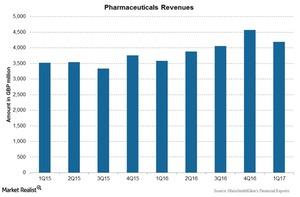

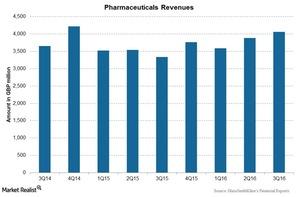

GlaxoSmithKline’s Pharmaceuticals Segment in 1Q17

The Pharmaceuticals segment reported an operational growth of 4.0% and a 13.0% positive impact of foreign exchange, resulting in a rise of 17.0% in revenues.

GlaxoSmithKline’s Segment Performances in 1Q17

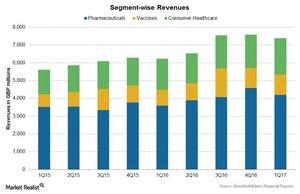

GlaxoSmithKline (GSK) reported a 19.0% rise in 1Q17 revenues to ~7.4 billion pounds, driven by an operational rise of 5.0% and a favorable currency impact of 14.0%.

How AstraZeneca’s Growth Platforms Performed in 1Q17

A few of the segments AstraZeneca identifies as growth platforms include Respiratory products, new Cardiovascular and Metabolic Diseases products, and new Oncology products.

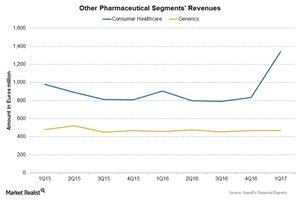

Sanofi’s Generics and Consumer Healthcare Business in 1Q17

Sanofi’s (SNY) Generics business contributes ~5% to the group’s total revenues.

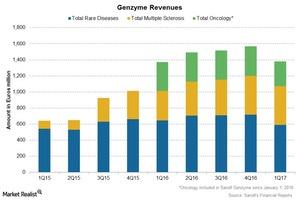

Performance of Sanofi Genzyme in 1Q17

Sanofi (SNY) reported growth of over 15% at constant exchange rates in its 1Q17 revenues from Genzyme.

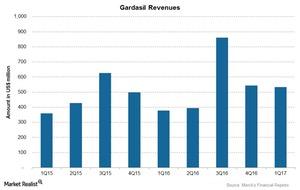

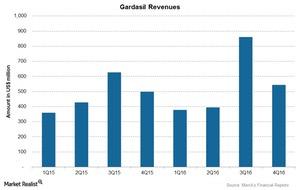

Gardasil and Merck’s Vaccines Business in 1Q17

Gardasil is Merck’s (MRK) leading vaccine franchise. Total sales for Gardasil in 1Q17 were $532.0 million, a ~41.0% rise over $378.0 million in 1Q16.

How GlaxoSmithKline’s Vaccines Business Performed in 1Q17

GlaxoSmithKline (GSK) is focused on strengthening its vaccines business, so it acquired the meningitis and other vaccines business from Novartis (NVS).

How GlaxoSmithKline’s Business Segments Performed in 1Q17

The company reported operational growth of 5% in its revenues to 7.4 billion pounds for 1Q17.

GlaxoSmithKline’s 1Q17 Estimates: Vaccines Business

The Novartis acquisition has improved sales for GSK’s Vaccines business, mainly driven by the sales of meningitis vaccines Bexsero in Europe and Menveo in the US and Europe.

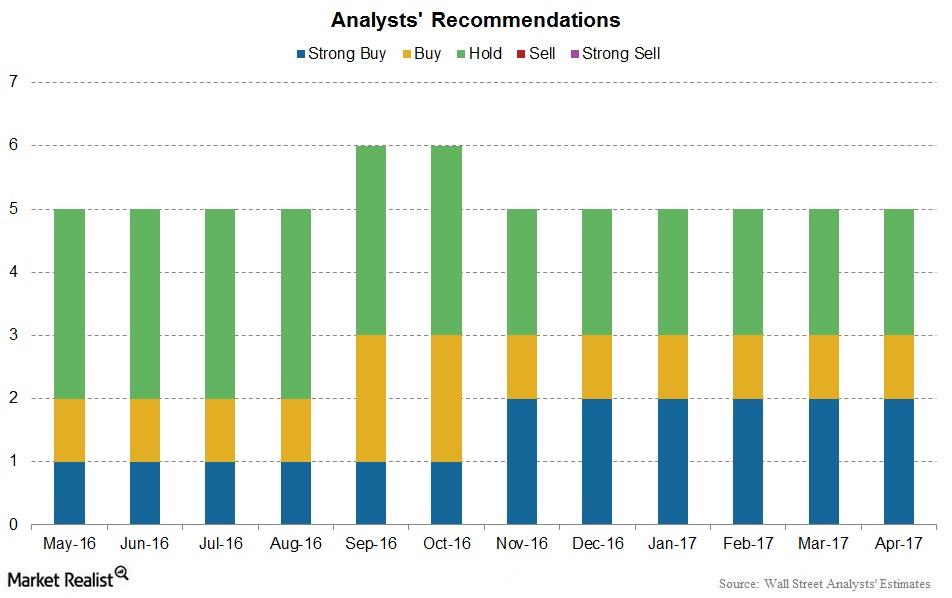

Analyst Ratings and Recommendations for Novartis

As of April 21, 2017, there are five analysts tracking Novartis. Of those, two have recommended a “strong buy,” and one has recommended a “buy.”

Analyst Estimates for Novartis’s 1Q17 Earnings

Novartis is set to release its 1Q17 earnings on April 25, 2017. Analysts estimate its 1Q17 EPS at $1.12 with revenues of ~$11.7 billion.

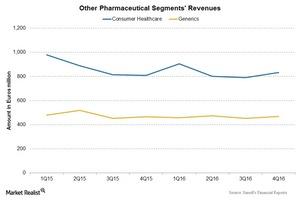

Why Sanofi’s Consumer Healthcare and Generics Segment Still Matters

Sanofi’s (SNY) Consumer Healthcare segment reported a 1.6% YoY (year-over-year) fall in revenues at 3.33 billion euros (about $3.56 billion) in 2016.

Performance of GlaxoSmithKline’s Vaccines Business in 2016

GSK’s Vaccines business reported growth of 14% to ~4.6 billion pounds in 2016.

GlaxoSmithKline’s Pharmaceuticals Segment Performance

Overall, the Pharmaceutical segment’s contribution to GSK’s total revenues was 57.7% in 2016.

This Is Driving Merck’s Vaccines Business

The Gardasil franchise is Merck’s (MRK) leading vaccines franchise.

Sandoz: Novartis’s Generics Business in 2016

Sandoz, the generics arm of Novartis (NVS), is the number two generic medicines provider worldwide, and it’s number one in differentiated generics.

Novartis’s Valuation Compared to Its Peers’

Novartis’s valuation has followed the industry’s overall trend over the last five years. Whether the healthcare sector’s valuation rises or falls, Novartis will definitely be affected.

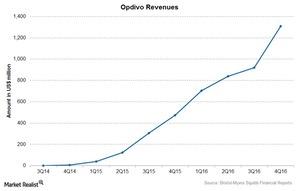

A Look at Opdivo’s Performance in 2016

Bristol-Myers Squibb’s (BMY) latest drug, Opdivo, was the seventh drug to be approved by the FDA for the treatment of melanoma.

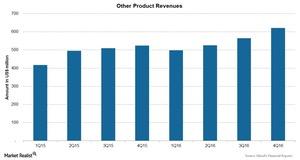

How Gilead’s Other Products Fared in 2016

The oncology portfolio includes the drug Zydelig, which is used in combination with rituximab for the treatment of chronic lymphocytic leukemia (or CLL).

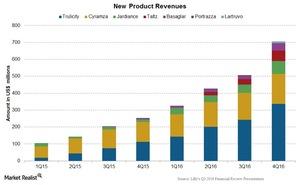

Eli Lilly and Co.’s New Products Portfolio

In 4Q16, Eli Lilly (LLY) reported Basaglar sales of $40 million from Japan and several European markets.

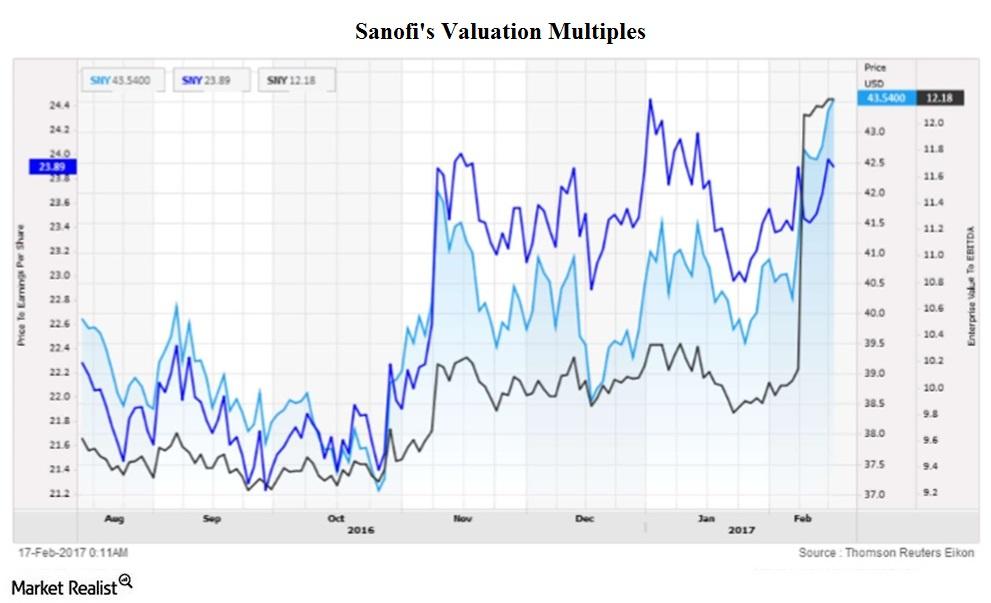

What Happened to Sanofi’s Valuation after 4Q16?

On February 16, 2017, Sanofi was trading at a forward PE multiple of ~13.9x, as compared to the industry average of 15.7x.

GlaxoSmithKline’s Vaccines Business Reported Growth in 4Q16

GSK’s Vaccines segment reported a rise of 18.0% to 1.1 billion pounds in 4Q16. The Novartis acquisition has improved sales for the segment.

4Q16 Performance of GlaxoSmithKline’s Business Segments

Revenues for GSK’s Pharmaceuticals segment saw a shift in product performance, falling due to lower sales of its key products Seretide and Advair.

Novartis’s Valuation after the 4Q16 Results

On January 31, 2017, Novartis was trading at a forward PE multiple of ~15.2x. Based on its last-five-year multiple range, this is neither high nor low.

Analysts Expect Negative Growth for Novartis in 4Q16

Analysts expect an ~1.1% decline in Novartis’s (NVS) 4Q16 revenues to ~$12.4 billion following the effects of the acquisition and divestiture of several products.

How Did Novartis’s Generics Business Perform in 3Q16?

Sandoz reported a decline of 1% in 3Q16 revenues at constant exchange rates.

How Does Novartis’s Valuation Compare to Peers?

On January 13, 2017, Novartis was trading at a forward PE multiple of ~15.1x.

How GlaxoSmithKline’s Pharmaceuticals Segment Has Performed

GlaxoSmithKline’s (GSK) Pharmaceuticals segment fell substantially in 2015 due to its divestment of its oncology business to Novartis (NVS) in March 2015.

Exploring GlaxoSmithKline’s Business Segments

GlaxoSmithKline’s (GSK) business is divided into three business segments: Pharmaceuticals, Vaccines, and Consumer Health.

GlaxoSmithKline’s Revenue Trend

GlaxoSmithKline reported a rise of 23% in its 3Q16 revenue. The company met Wall Street analysts’ consensus 3Q16 estimates for revenue and earnings per share.

How Sandoz Performed for Novartis in 3Q16

Sandoz, the generics arm of Novartis (NVS), is the number-two generic medicines provider worldwide. It’s number one in differentiated generics.

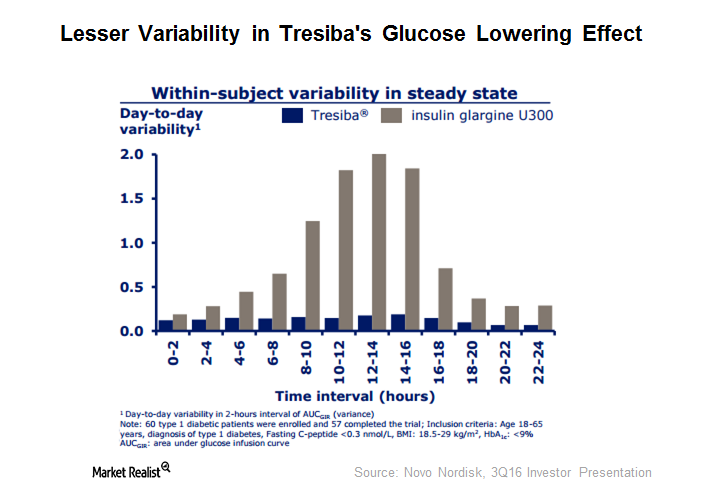

How Tresiba Helps Novo Achieve Its Growth Targets

During the first nine months of 2016, Novo’s (NVO) new generation portfolio garnered 2.8 billion Danish kroner.

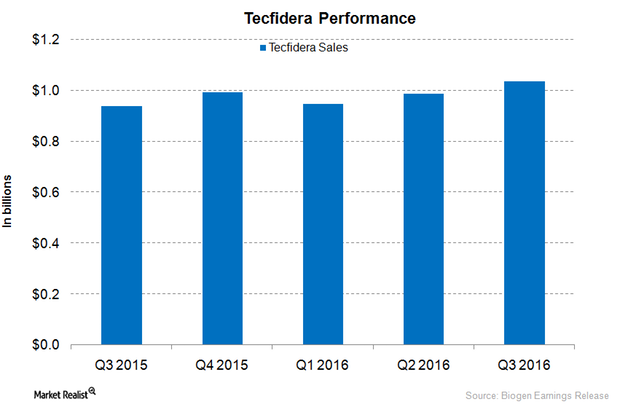

Tecfidera Continued to Lead in the Oral Multiple Sclerosis Market

In 3Q16, Biogen’s (BIIB) oral multiple sclerosis (or MS) drug, Tecfidera, managed to increase its global market share to ~15%, a year-over-year (or YoY) rise of about 1 point.

Viagra May Witness a Decline in Revenues in 2016

Wall Street analysts estimate that Viagra’s sales in 2016 will reach approximately $1.6 billion, which would be a year-over-year (or YoY) decline of about 7.7%.