Gamestop Corporation

Latest Gamestop Corporation News and Updates

Is GameStop Shutting Down Shop in 2023? Layoff Rumors Surface

Many skeptics want to know if GameStop is going out of business. Let's debunk the rumors. The company is actually transforming its business.

Games and Crypto Unite: GameStop FTX Deal, Explained

GameStop announced it has a new partnership with cryptocurrency exchange FTX. GameStop will sell FTX gift cards and collaborate on marketing initiatives with FTX.

GameStop Removes NFT Collection That Resembles 9/11 Photo

GameStop already made people skeptical when it announced its NFT platform, but now with a strange 9/11 NFT release, there will be even more skeptics.

What's Happening with GameStop? Stock Split, Layoffs, and More

The news just keeps coming for GameStop (GME), which announced major layoffs and fired its chief financial officer amid a stock split.

GameStop Stock Rises After Stock Split Announcement, Michael Burry Pokes Fun at It

GameStop announced a 4:1 stock split on July 6, driving share prices up on on July 7. GameStop investor Michael Burry also recently made headlines.

Ryan Cohen’s RC Ventures Buys 100,000 GameStop Shares

GameStop chair Ryan Cohen’s venture capital company just made a big purchase of GameStop shares.

GME Stock Trends on WallStreetBets — Is Another Frenzy About to Unfold?

Rumor has it, WallStreetBets traders have started investing in the struggling retailer once again. Will we see another surge in GameStop stock?

WallStreetBets or Ryan Cohen: Who Saved GameStop?

GameStop is now a debt-free company with reasonably sound financials. Did WallStreetBets or Ryan Cohen save GameStop? Here's what we know.

Ryan Cohen Is a Wealthy Man Thanks to Retailers Chewy and GameStop

Chewy and Gamestop helped Ryan Cohen grow him net worth into the billions. What's the Gamestop chairman's net worth today?

GameStop Stock Short Squeeze — What Happened in 2021?

It's tough not to talk about GameStop, meme stocks, and WallStreetBets in one breath. What happened with the GME short squeeze in 2021?

GameStop Partners With Immutable X for NFT Marketplace

GameStop has partnered with Immutable X to soon launch its highly anticipated NFT marketplace. Where can you buy Immutable X crypto?

SEC Meme Stock Report: No Policy Changes, Forecasts Potential Shifts

The SEC released a report about the meme stock debacle of early 2021. What does the SEC have to say?

Does Roaring Kitty Still Own GME Holdings Amid MassMutual's Fine?

Massachusetts regulators have fined MassMutual, which is Keith "Roaring Kitty" Gill's former employer. Does he still own GME holdings?

Here’s What History Says About a Short Squeeze in GameStop After Its Earnings Report

GameStop is scheduled to release its earnings on Sep. 8. The stock's forecast is bearish, and GME doesn’t look like a short-squeeze candidate.

GME’s Stock Price Prediction in 2021—Will It Continue to Go Up?

GameStop (GME) stock gained 8 percent on June 22 after the company said it raised $1.1 billion in stock. How high can GME stock go?

GME or AMC: Which Is a Better Stock to Buy in Short Squeeze 2.0?

Investors want to know if GameStop (GME) stock will go up like AMC stock in what appears to be short squeeze 2.0. Which is a better stock to buy?

Is It Possible to Predict a Short Squeeze? — Here's How

Scanning for short squeezes is doable, but you'll have to keep some tricks up your sleeve. Here are some ways to predict a short squeeze.

GameStop Could Be the Next Hot NFT Stock—Here's Why

A new job opening from GameStop is looking for software engineers with crypto, blockchain, and NFT experience. Is GameStop launching NFTs?

GameStop's Ryan Cohen Keeps His Private Life Private, Wife Included

New GameStop CEO Ryan Cohen knows how to make waves where he wants to, but what about his wife and personal life?

GameStop (GME) Stock Forecast 2025: Cohen Might Create Another Chewy

GameStop stock has been surging amid the short squeeze. What's the 2025 forecast for GME stock? Will Cohen create another success story?

GME's Earnings Are Coming: Will It Be Mayday for Shorts or WallStreetBets?

GameStop is scheduled to release its earnings for the fourth quarter of 2020 on March 23. Should you buy or sell the stock ahead of the earnings?

GS2C Versus GME: Where Investors Are Making Money Now

At times, an arbitrage opportunity opens between German stock market-listed GameStop stock (GS2C) and NYSE-listed GME. Will GS2C beat GME?

What's Driving the Wild Rally in GameStop (GME) Stock?

Game Stop stock has doubled in less than five trading days. Is the GameStop (GME) stock short squeeze to blame for the stock’s recent rally?

GME Stock Is Still Shorted, Investors Have Renewed Enthusiasm

GameStop stock might just be the defining moment of 2021 markets. As of March, GME stock is still being shorted. What can investors expect in 2021?

How German Investors View GameStop and WallStreetBets

So far in 2021, German investors have been buying more GameStop stock alongside U.S. investors. How did WallStreetBets impact German investors?

GameStop's Stock Forecast in 2021: Should You Buy the Dip?

GameStop stock has seen tremendous volatility in 2021. What's the forecast for GME? Will it keep falling or has the stock bottomed out?

Mark Cuban's Advice for Retail Investors as GameStop Stock Plunges

Billionaire investor Mark Cuban sees a new breed for retail traders emerging. Cuban shared his advice for them after the sharp fall in GME stock.

Jimmy Kimmel Angers Viewers With 'Russian Disruptors' GameStop Claim

In an episode of 'Jimmy Kimmel Live!' recently, Kimmel claimed that GameStop's stock price surged due to "Russian disruptors" buying the stock.

GameStop Stock Got a Boost After Elon Musk's Tweet

A single Elon Musk tweet led to investors jostling for GameStop (GME) stock as short-sellers continue to count losses. Is Musk buying GameStop stock?

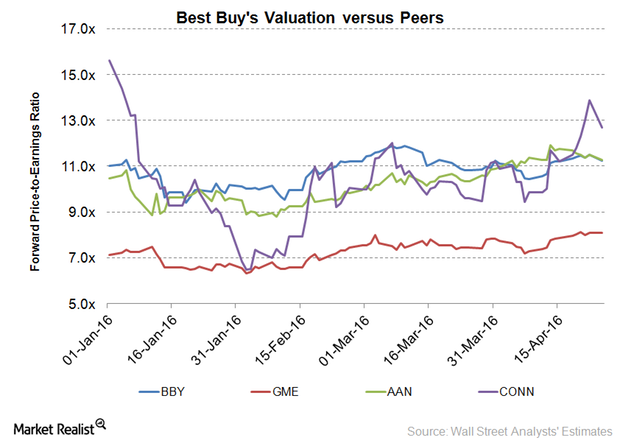

Best Buy’s Valuation: How Does It Compare to Peers?

As of April 25, Best Buy (BBY) was trading at a 12-month forward PE (price-to-earnings) ratio of 11.3x.

Get Real: Third-Quarter Roller Coaster

In today’s Get Real, we saw that several third-quarter results are out and all over the board. We also have recommendations for stocks to watch going forward.

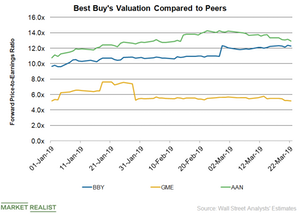

How Best Buy’s Valuation Compares with Peers’

As of March 22, Best Buy’s (BBY) 12-month forward PE ratio was 12.3x, while specialty retail peers GameStop (GME) and Aaron’s (AAN) had PE ratios of 5.2x and 12.9x, respectively.

Why Wall Street Fell in Love with Electronic Arts Stock

Electronic Arts (EA) gained 6.8% today as of 10:45 AM EST.

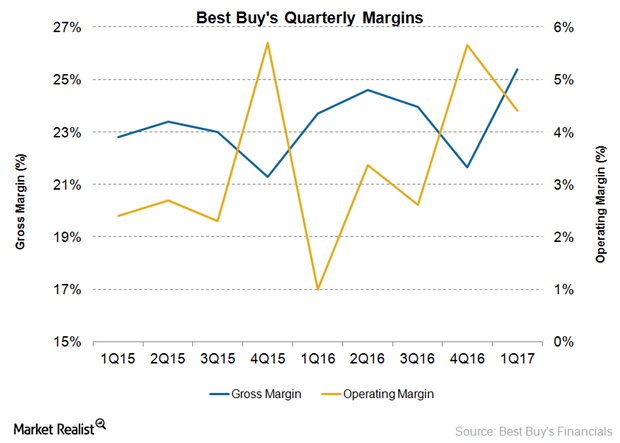

Can Best Buy’s Margins Improve amid Challenging Conditions?

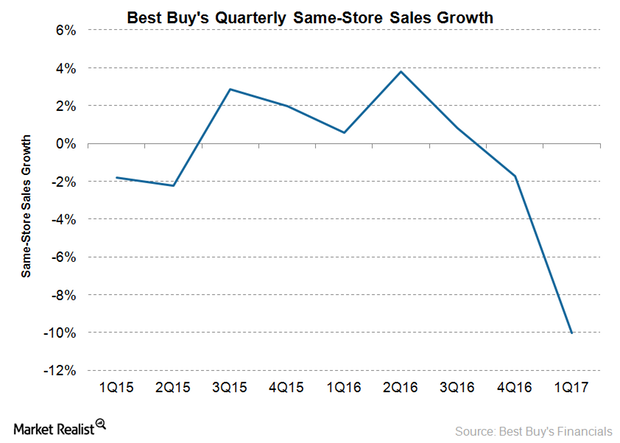

Despite lower sales, Best Buy’s gross margin improved from 23.7% in fiscal 1Q16 to 25.4% in fiscal 1Q17.

Best Buy Wants to Improve Sales: What’s It Got up Its Sleeve?

Best Buy plans to improve its sales through a series of initiatives across merchandising, marketing, online channels, stores, supply chain, services, and customer care.

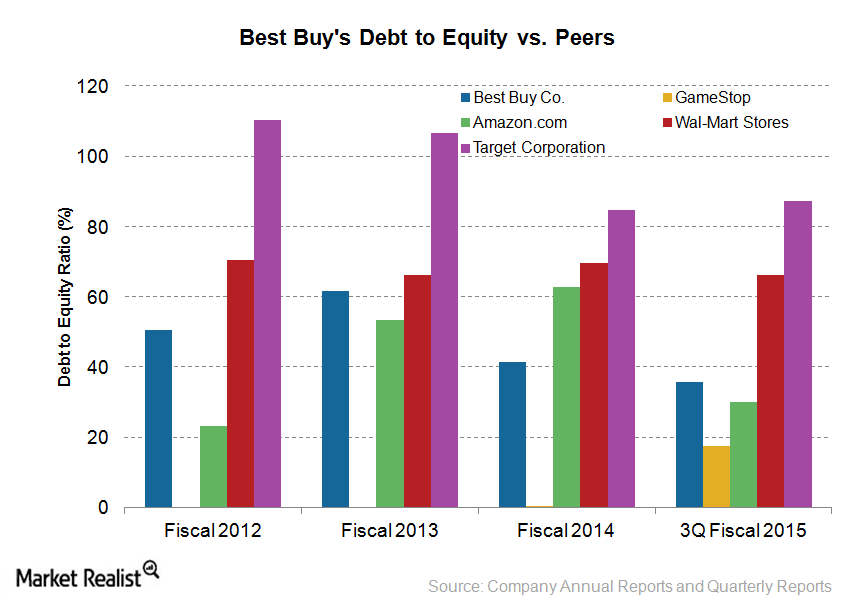

Assessing Best Buy’s debt profile

Gauging a company’s debt levels is crucial to understanding its financial health. Maintaining high debt levels in uncertain times can be damaging.

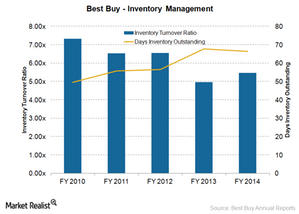

Best Buy attempts to optimize inventory levels

At Best Buy, returns, replacements, and damages account for nearly 10% of revenues and have cost the company over $400 million in losses each year.

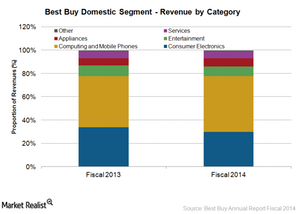

Understanding Best Buy’s revenue mix

The computing and mobile phone category is the largest of Best Buy’s revenue mix, accounting for 48% of the Domestic segment’s fiscal 2014 revenues.