Is It Possible to Predict a Short Squeeze? — Here's How

Scanning for short squeezes is doable, but you'll have to keep some tricks up your sleeve. Here are some ways to predict a short squeeze.

April 27 2021, Published 2:36 p.m. ET

You'd be hard-pressed to find someone who didn't know about the GameStop (NYSE:GME) short squeeze in late January 2021. However, knowing about a short squeeze when it's too late doesn't do investors much good.

By the time a stock has risen ten or hundred-fold, your chances of reaping positive returns greatly diminishes. Knowing how to predict a short squeeze as it happens is helpful, but investors should be aware that the market will always have unexpected occurrences.

A stock needs to be shorted to be short squeezed.

A stock market squeeze doesn't happen in a vacuum. The equity needs to be shorted for the squeeze to occur.

An investor will short a stock if they think the share price will decrease. They'll make money off of the share price going down by borrowing a stock from a lender, selling it, repurchasing it at a lower cost, and then returning it to the lender. This makes sense for GameStop—while the company is now transitioning to e-commerce, it was a brick-and-mortar operation facing potential obsoletion.

Your first clue to finding a shorted stock is the short interest

You can find out how many shares of a stock are shorted by looking at its short interest.

The short-interest ratio is a metric that stems from the number of shares sold short divided by average daily volume. The short interest itself (sans the ratio) can come in the form of a percentage as a short percentage of float.

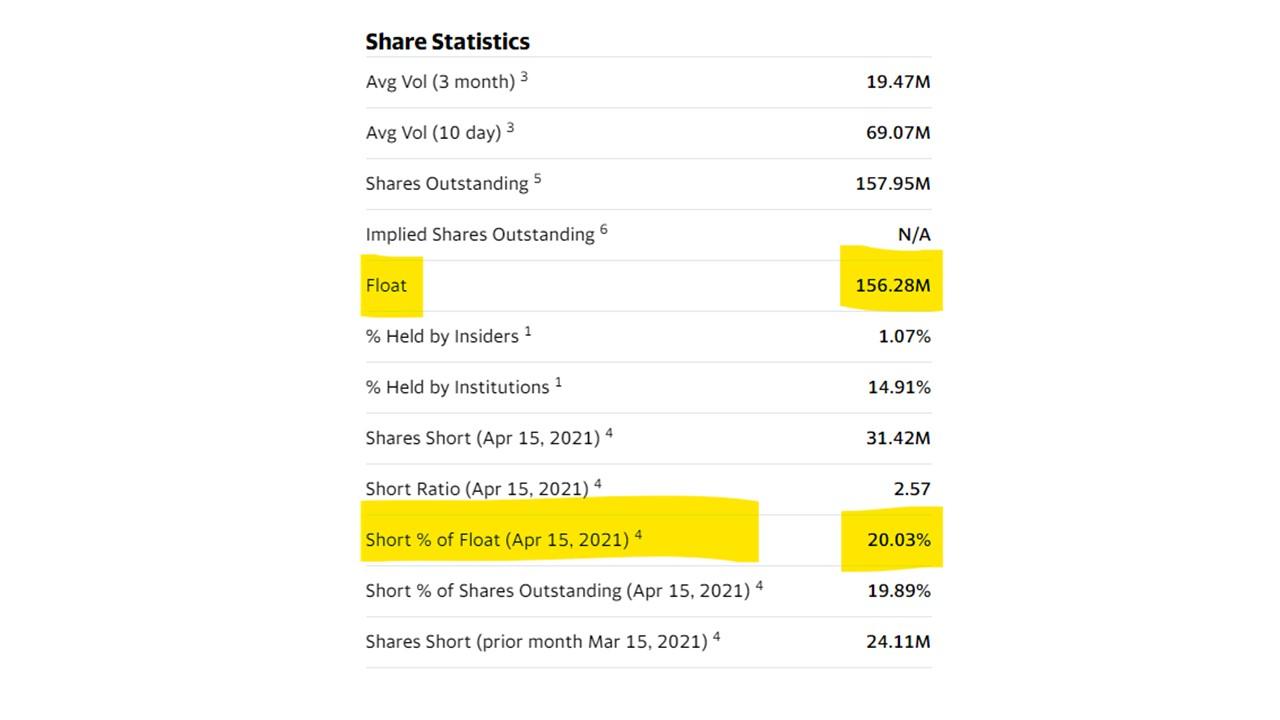

For the average investor, Yahoo Finance is a good place to start looking for the short interest. MicroVision (NASDAQ:MVIS) is currently experiencing a short squeeze courtesy of the WallStreetBets subreddit. If you go to the site and visit the "Statistics" tab, you'll find a section that reads "Share Statistics." From there, look for the "Float" (total number of outstanding shares) as well as the "Short % of Float."

For MicroVision on April 27, 20.03 percent of 156.28 million outstanding shares are being shorted, which is about 31.3 million shares. The short interest has likely decreased in the last week considering MVIS shares are up 93.07 percent from one week prior.

How do you know the short is being squeezed? Start with trading volume

It's one thing to determine the short interest of a stock, but how can you tell if retail investors are collectively squeezing it? By keeping a watchful eye on the trading volume.

Even if day changes are small, increasing trading volumes suggest that investors are gathering momentum to squeeze the short interest out of its position. Sudden increases in the number of shares being traded are a huge factor.

This usually happens when the short interest is above 20 percent, as evidenced by MicroVision.

Additional clues for predicting a short squeeze

Look at the short-interest ratio and see where it's at. If the ratio as days to cover is high (say, above 10), this means the short sellers don't have long until they should exit their positions.

Meanwhile, the RSI (relative strength index) will tell you if the stock is oversold. A low RSI below 30 means that a stock is particularly oversold and, as a result, trading at a lower price that's soon to increase.