Best Buy’s Valuation: How Does It Compare to Peers?

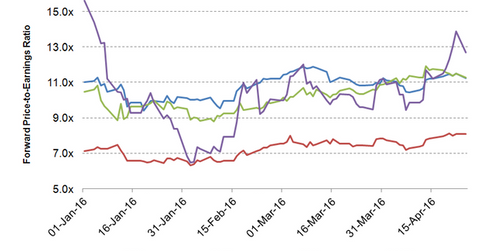

As of April 25, Best Buy (BBY) was trading at a 12-month forward PE (price-to-earnings) ratio of 11.3x.

Nov. 20 2020, Updated 11:26 a.m. ET

Current valuation

As of April 25, Best Buy (BBY) was trading at a 12-month forward PE (price-to-earnings) ratio of 11.3x. The company’s valuation multiple has risen 2.1% since the start of the year. We discussed the movement in the company’s stock price and total return in Parts 1 and 4 of this series, respectively.

In February 2016, Best Buy exceeded analysts’ sales and earnings estimate for 4Q16, which ended January 30, 2016. Despite lower revenue, the company’s adjusted EPS rose 3.4% in 4Q16 due to a higher gross margin and a periodic profit-sharing benefit of $0.19 relating to the company’s services plan portfolio. The company’s 4Q16 adjusted EPS also benefitted from a share repurchase benefit of $0.06.

Comparison with peers

As of April 25, specialty retailers GameStop (GME), Aaron’s (AAN), and Conn’s (CONN) were trading at forward PEs of 8.1x, 11.3x, and 12.7x, respectively. Analysts expect Best Buy’s revenue to fall 1% in fiscal 2017 and adjusted EPS to rise 3%. The Consumer Discretionary Select Sector SPDR Fund (XLY) has 0.4% exposure to Best Buy.

For the comparable fiscal year, analysts expect the adjusted EPS of GameStop, Aaron’s, and Conn’s to grow 3%, 6%, and 8%, respectively.

Growth strategy

Best Buy is implementing the next phase of its Renew Blue strategy, which involves enhancing the company’s multichannel capabilities and driving cost reduction and efficiencies. To improve its multi-channel capabilities, Best Buy is taking on some initiatives across merchandising, marketing, digital, stores, services, and supply chain. For instance, the company has been collaborating with key vendors and opening several stores-within-stores, which provide consumers a wider choice and an enhanced shopping experience.

Best Buy’s cost reduction and gross profit optimization program, called Renew Blue Phase 2, aims to generate annualized savings of $400 million over three years. The company had delivered cost reduction of $1 billion under the Phase 1 program. In fiscal 2016, the company achieved $150 million of annualized savings. The company aims to achieve further productivity savings through simplifying its core business processes.

For more updates, visit our Consumer Discretionary page.