Conn's Inc

Latest Conn's Inc News and Updates

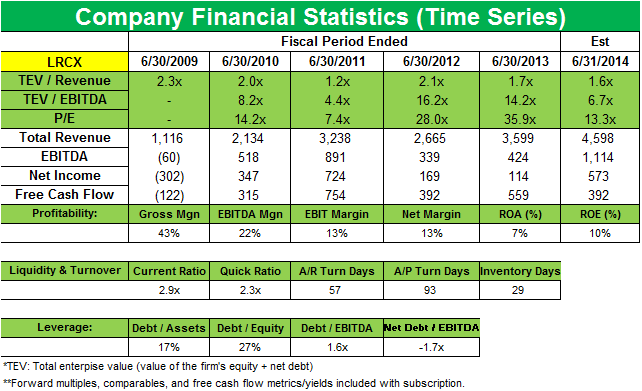

Why Greenlight started a new position in Lam Research Corporation

Greenlight disclosed a new position in Lam Research Corporation, which accounts for 1.01% of the fund’s 1Q 2014 portfolio.

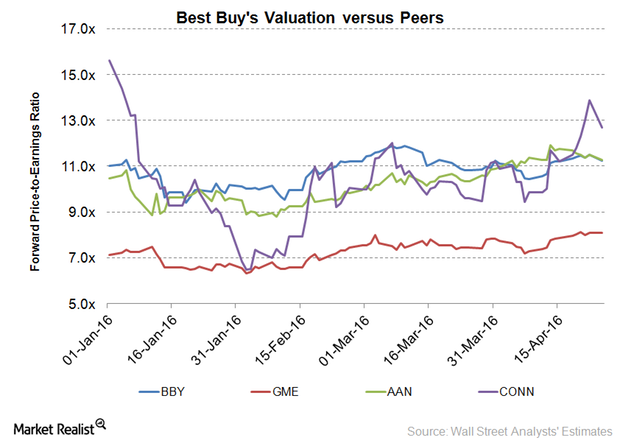

Best Buy’s Valuation: How Does It Compare to Peers?

As of April 25, Best Buy (BBY) was trading at a 12-month forward PE (price-to-earnings) ratio of 11.3x.

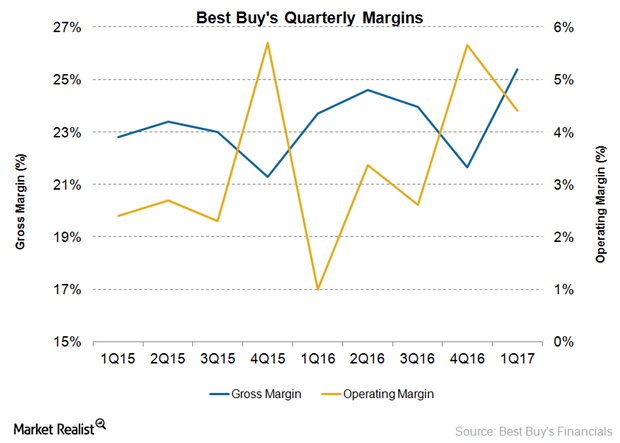

Can Best Buy’s Margins Improve amid Challenging Conditions?

Despite lower sales, Best Buy’s gross margin improved from 23.7% in fiscal 1Q16 to 25.4% in fiscal 1Q17.

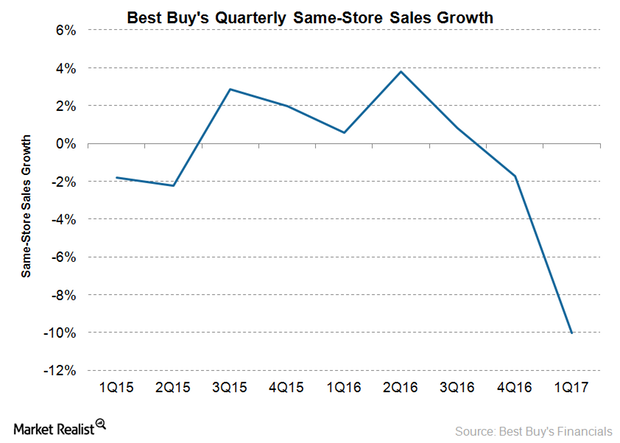

Best Buy Wants to Improve Sales: What’s It Got up Its Sleeve?

Best Buy plans to improve its sales through a series of initiatives across merchandising, marketing, online channels, stores, supply chain, services, and customer care.