Chevron Corp

Latest Chevron Corp News and Updates

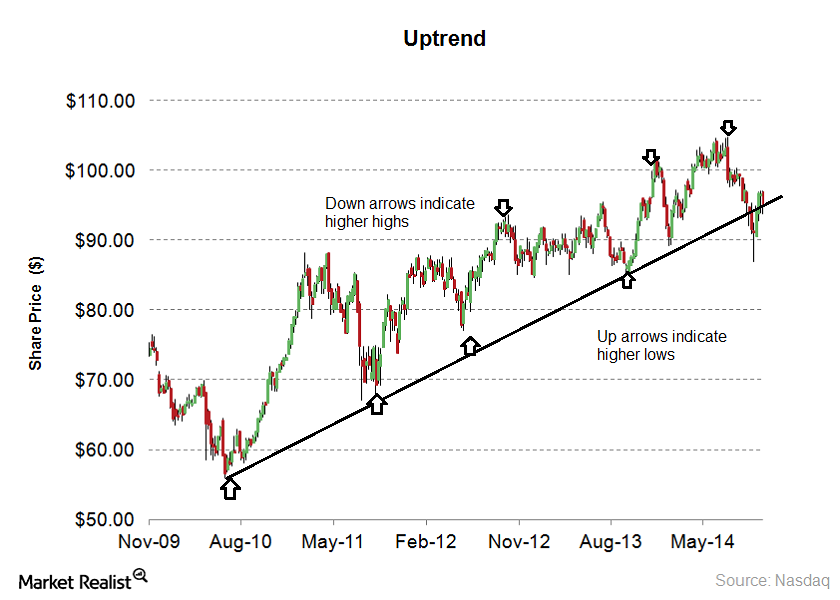

Why investors should buy stocks during an uptrend

Stocks are in an uptrend when they’re making higher highs and higher lows. An uptrend forms when psychological or fundamental factors are improving.

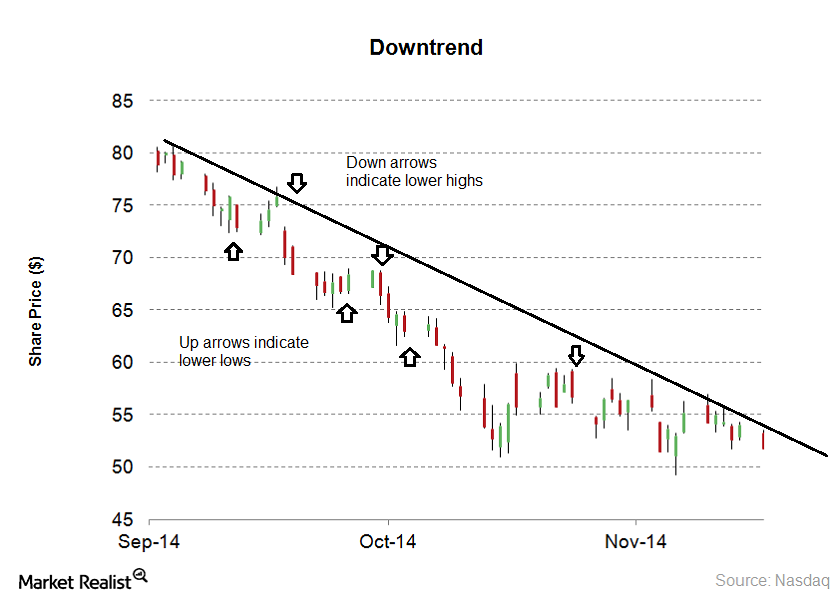

Why downtrends and sideways trends impact investors

It’s advisable to sell stocks on bounces when the stock is in a downtrend. In a sideways trend, it’s advisable to buy stock at support levels and sell at resistance levels.

Chevron: Is It a Good Time to Invest in the Stock?

Currently, Chevron stock trades at 18.5x its 2019 forward EPS and at 17.2x its 2020 forward EPS. The stock is higher than most of its peers.

Oil Prices and ExxonMobil Stock: What’s the Correlation?

ExxonMobil stock and oil prices have a strong correlation. The one-year correlation coefficient between the stock and WTI crude oil prices stood at 0.54.

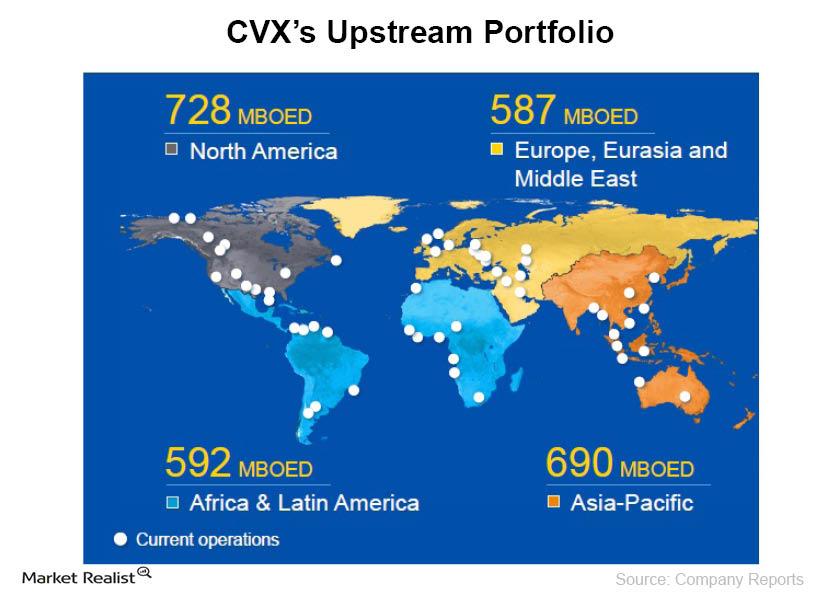

Must-know: An overview of Chevron Corporation

CVX is headquartered in San Ramon, California. It’s an energy company that engages in oil and gas exploration, production, refining, marketing, and transportation of oil and gas.

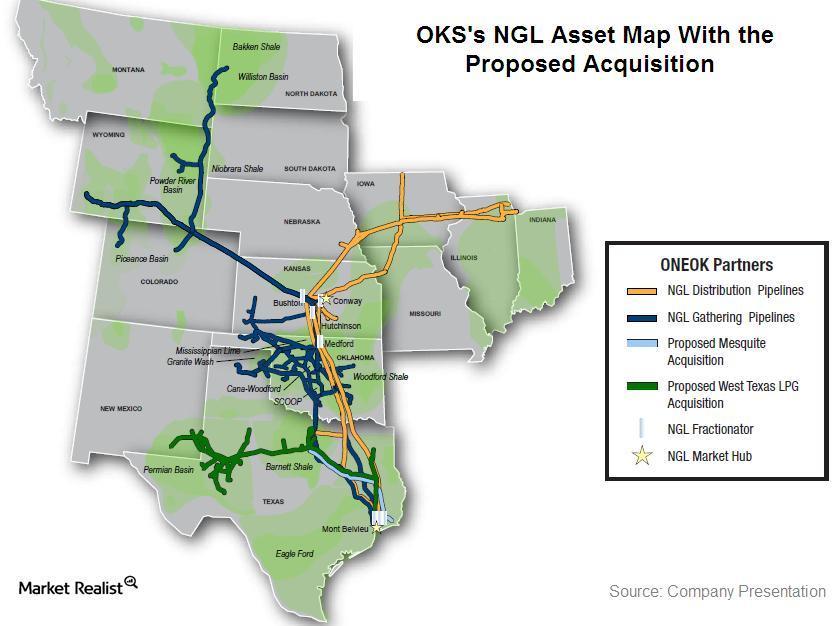

Why ONEOK Partners acquires Permian assets from Chevron

On October 27, ONEOK Partners (OKS) announced that it agreed to acquire Chevron Corporation’s (CVX) natural gas liquids (or NGLs) pipeline assets.

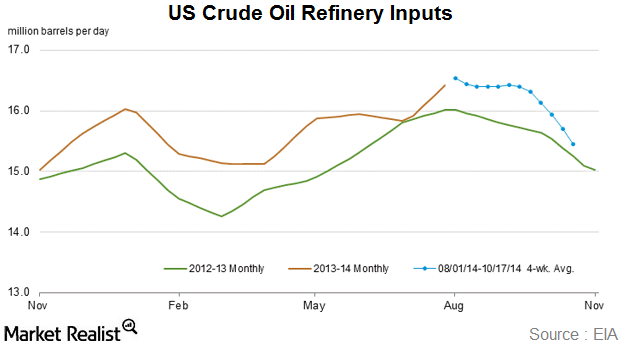

Why peak refinery maintenance season affects crude inventory

U.S. crude oil refinery inputs averaged 15.2 million barrels per day during the week ending October 17. Input levels were 113,000 bpd less than the previous week’s average.

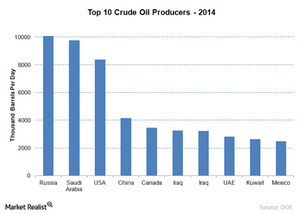

Which Country Has the Most Oil?

Let’s take a look at the countries that own the most proven oil reserves and see why that matters for investors. You might find some surprises!

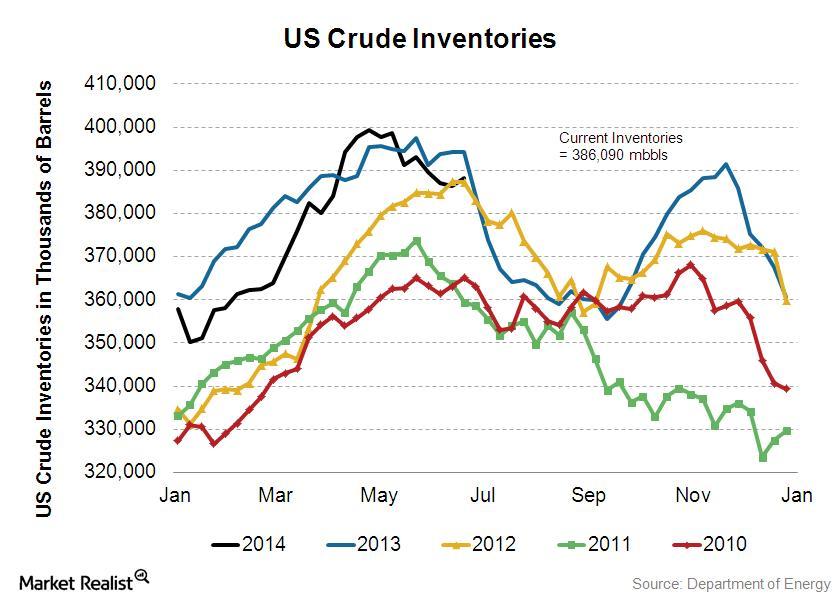

Must-know: Why crude oil inventories can affect prices

Every week, the U.S. Energy Information Administration (or EIA) reports figures on crude inventories, or the amount of crude oil stored in facilities across the United States.

Why is OPEC important to the price of crude oil?

High market share gives OPEC bargaining power to price oil above a competitive market. It can sway crude oil prices by increasing or decreasing production.

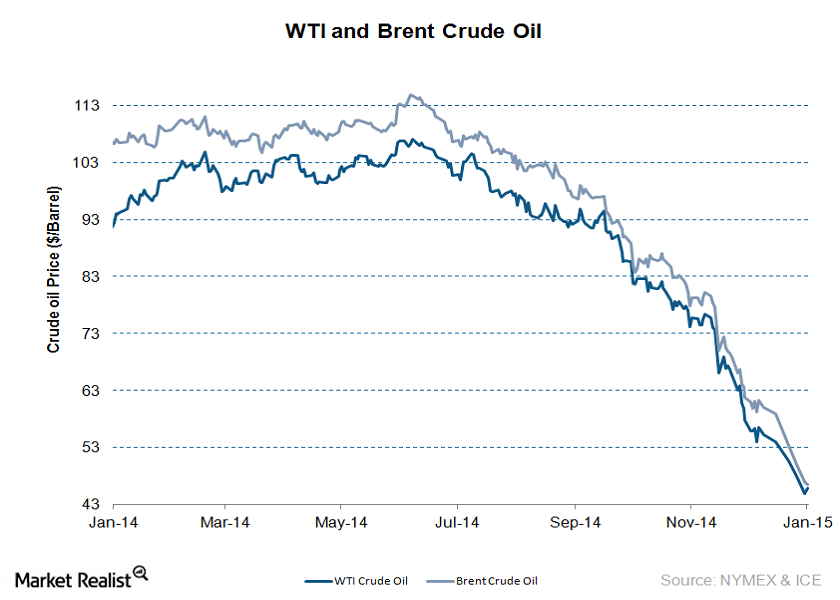

The crude oil market: An overview

Crude oil prices have been on a roller coaster ride in 2014. This series will help crude oil investors recognize key factors that are impacting oil prices.

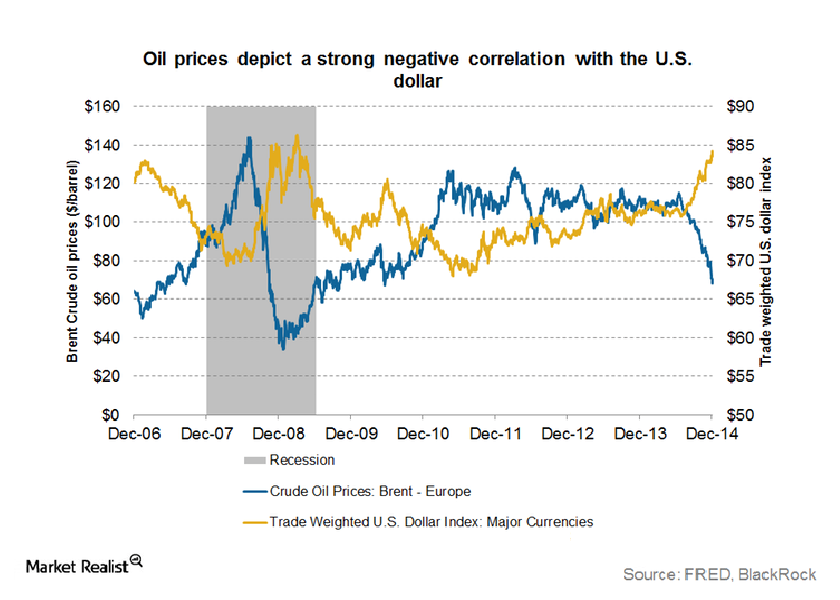

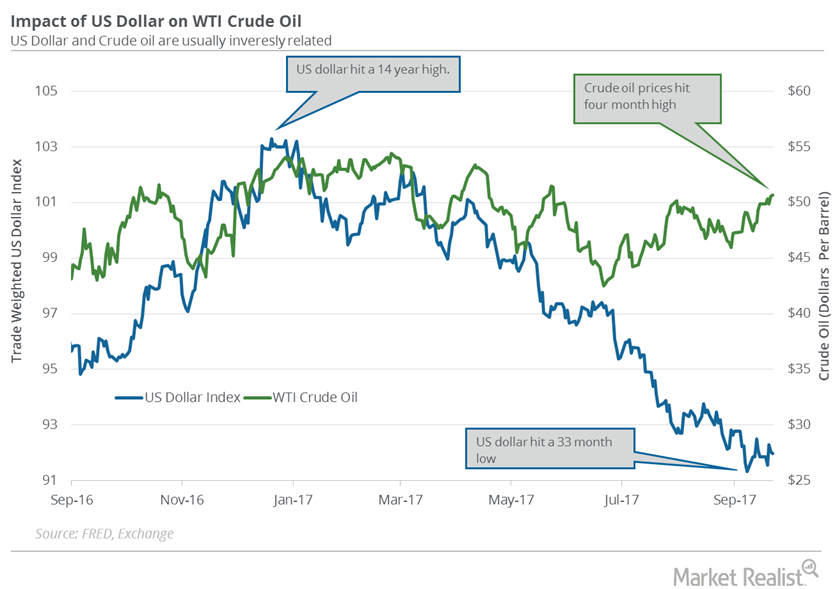

How the strengthening US dollar is impacting crude oil prices

The US dollar plays a major role in the price movements of commodities such as gold and crude oil. A strengthening US dollar is often seen as negative.

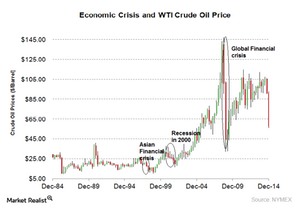

How an economic crisis affects the price of crude oil

The common factor during an economic crisis is that economic growth slows down. Demand declines, which has a negative impact on oil prices.

Get Real: From Huawei’s Reprieve to the Future of HP

Respite for Huawei is big news for tech stocks, but China’s facing other problems. Plus, one company’s fight for survival and much more.

Get Real: Roller Coaster Continues This Earnings Season

AT&T stock is prospering, while Netflix’s problems could be rising. We also have the latest earnings including U.S. Steel and Chevron today.

Chevron Stock Could Enter the ‘Buy’ Zone Soon

Chevron stock (XOM) closely relates to oil prices, so investors sometimes use this highly liquid, well-regarded stock as a trading vehicle for oil.

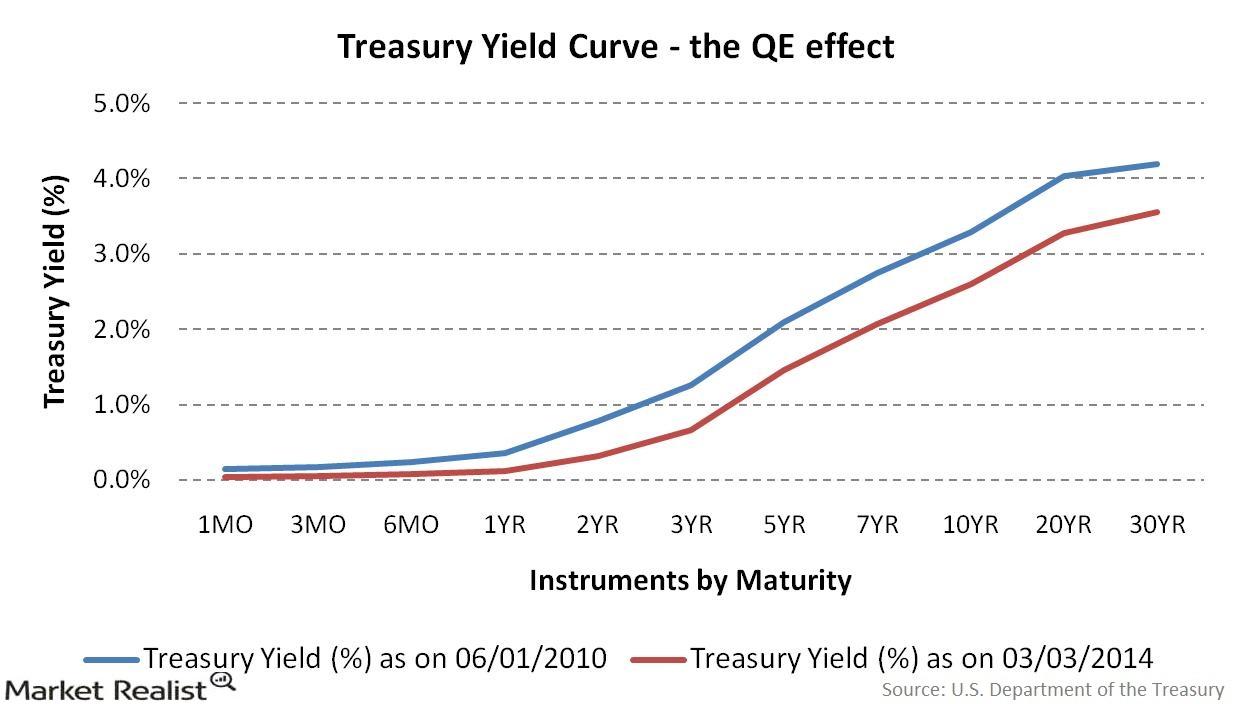

The Fed taper: How quantitative easing affects the yield curve

QE is an unconventional form of monetary easing—the Fed’s way of putting in more money into circulation in the economy.

These 5 Refiners Make Half the Crude Oil in the US

The total refiners capacity in the US is around 18.8 million barrels per calendar day. The refinery utilization rate in 2018 was 93%.

Must-Know: The Top 10 Refineries in the US

US crude oil production has more than doubled since 2009 and grew by 1.1% over the last year. Currently, there are 133 operable refineries in the US.

ExxonMobil and Chevron: Do Moving Averages Show a Breakout?

Leading energy stocks like ExxonMobil (XOM) and Chevron (CVX) are facing bleak business conditions. Oil prices have been weaker in the third quarter.

ExxonMobil and Chevron: Upstream Portfolio Positioning

Integrated oil companies ExxonMobil and Chevron have strong upstream portfolios, which play a vital role in determining their profitabilities.

BP Stock: Should You Buy It Now?

BP (BP) stock rose 3.9% on Monday due to higher oil prices. The drone attack on Saudi Arabia’s oilfield increased WTI crude oil by about 13%.

Dow Jones Index Falls after Rising for Eight Days

The Dow Jones Industrial Average Index has fallen 0.4% or by 115 points today. The index is trading lower after rising for eight consecutive trading sessions.

Robotaxis: Voyage versus Ford, Waymo, and Tesla

Autonomous ride-sharing and robotaxi startup Voyage has raised about $31 million in the Series B round, according to its press release.

The US Energy Sector: An Overview

To understand the US energy sector, it’s essential first to understand the country’s energy needs. The US uses various energy sources to meet its energy needs.

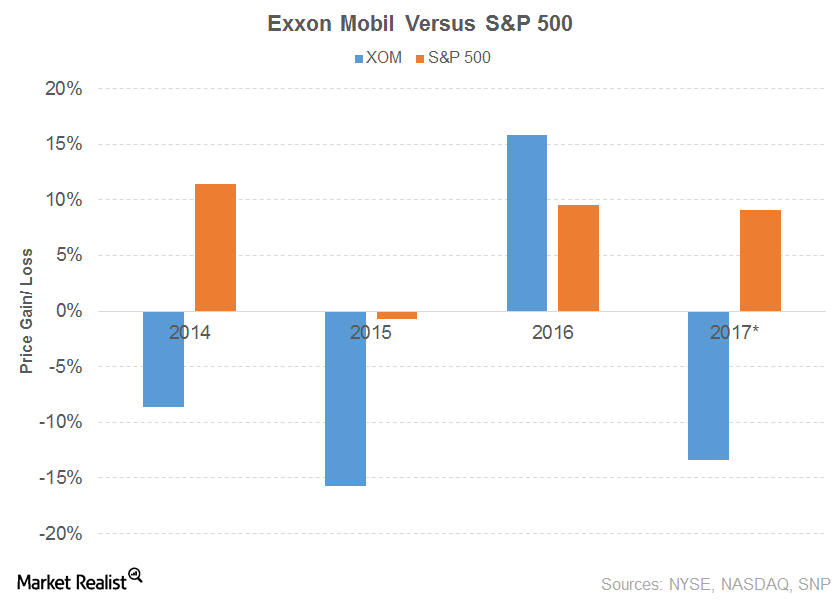

ExxonMobil or Chevron: Which Is the Better Buy?

ExxonMobil and Chevron slumped 7.9% and 4.9%, respectively, in August. The stocks took a beating due to weaker markets and tumbling crude oil prices.

Energy Stocks Fall: Right Time to Invest?

The recent slump in energy stocks provides investors with an opportunity to invest in well-placed stocks. Shell looks like an attractive investment option.

Can the US-China Trade War Spiral into a Crude Oil War?

Although the US doesn’t export much crude oil to China, the additional supply of cheap Iranian oil could pressure both Brent and WTI crude prices.

ExxonMobil Stock: JPMorgan Chase Cut Its Target Price

ExxonMobil’s (XOM) earnings fell in the second quarter. After the earnings, JPMorgan Chase cut its target price on ExxonMobil stock from $85 to $83.

BP’s Earnings Beat Analysts’ Expectations

BP (BP) reported its second-quarter results today. Its earnings per American depositary share of $0.84 beat analysts’ estimate by about 7%.

Total SA Stock Fell Marginally After Q2 Earnings

Total SA stock fell 0.9% on Thursday—its earnings release day. The stock was impacted by a 20% YoY fall in its earnings.

Suncor’s Earnings Rise but Miss Estimate in Q2

Suncor Energy (SU) posted its second-quarter earnings results on July 24. In the quarter, its revenue missed Wall Street’s estimate by 4%.

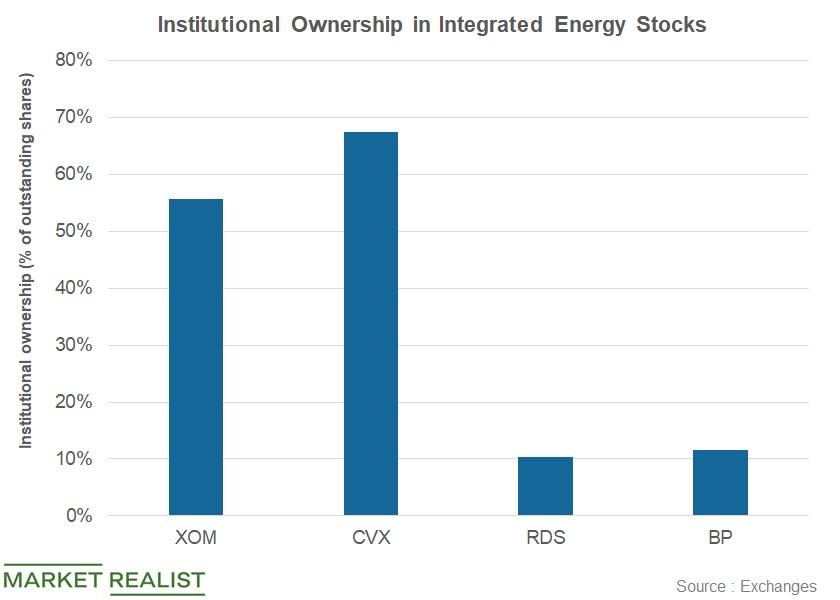

Which Institutions Raised Holdings in Integrated Stocks?

Institutional ownership in ExxonMobil and BP stands at ~56% and ~12%, respectively.

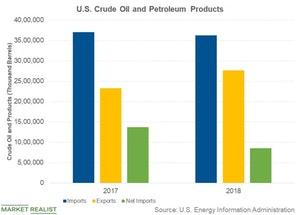

Why the United States Imports Oil

Several factors contributed to the rising crude oil exports in 2018.

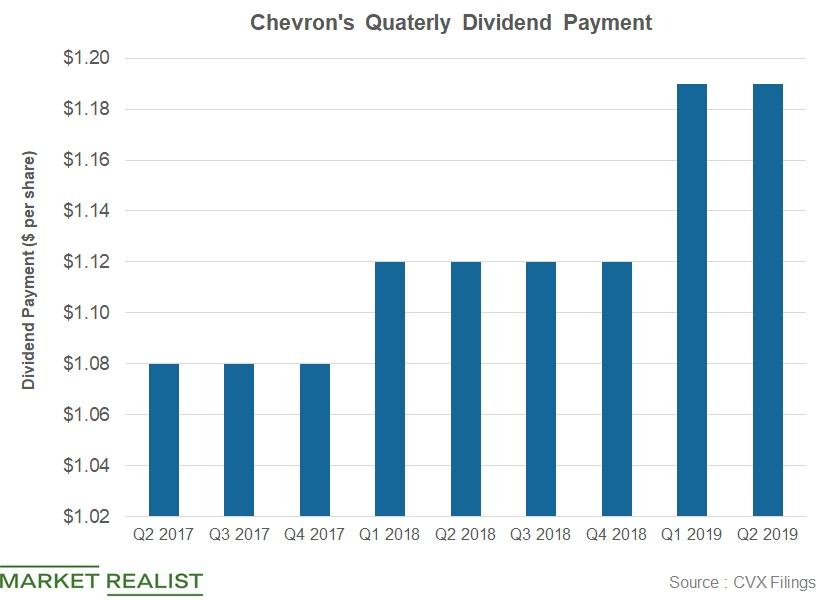

How Will Chevon’s Dividend Payment Trend in Q2?

Chevron (CVX) released its first-quarter earnings on April 26. The company paid $2.2 billion in dividends in the first quarter.

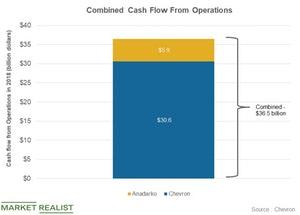

How Will the Anadarko Acquisition Benefit Chevron?

Chevron (CVX) has agreed to acquire Anadarko (APC) in a cash and equity deal.

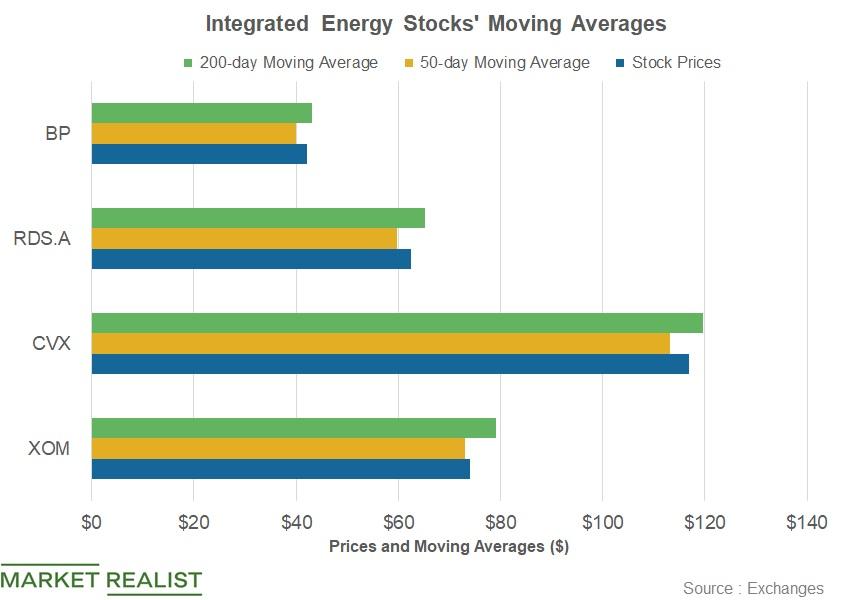

XOM, CVX, Shell, BP: What Do Moving Averages Suggest?

In the first quarter so far, integrated energy stocks ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) have risen due to the rise in oil prices.

Chevron: Analysts Expect Higher Q3 Earnings

Chevron (CVX) is expected to post its third-quarter results on November 2. Chevron is expected to post an EPS of $2.1 in the third quarter.

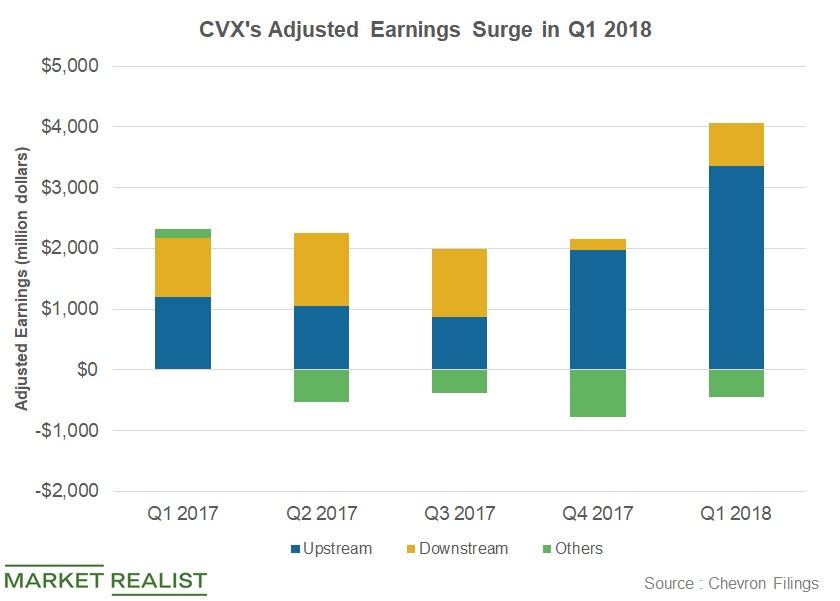

Will Chevron’s Upstream and Downstream Earnings Rise in Q2 2018?

Before we proceed with Chevron’s (CVX) second-quarter segmental outlook, let’s briefly look at its first-quarter segmental performance.

Integrated Energy Stocks: The Top Eight Dividend Yielders

In this series, we’ll look at eight integrated energy stocks and rank them on dividend yields. Royal Dutch Shell (RDS.A) holds the top spot.

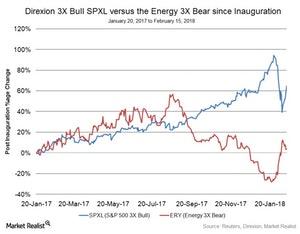

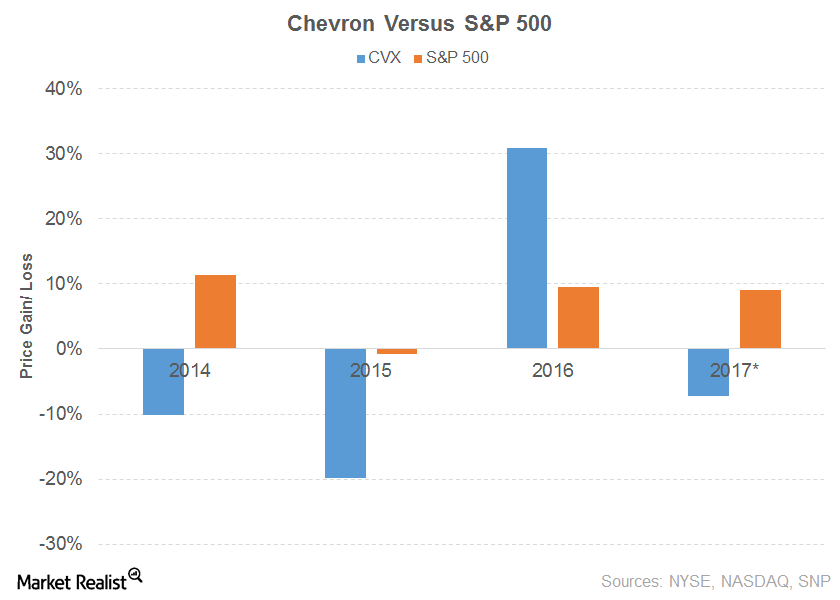

Could Energy Continue Its Wild Ride in 2018?

From the presidential election in November 2016 through August 2017, the energy sector saw its worst time.

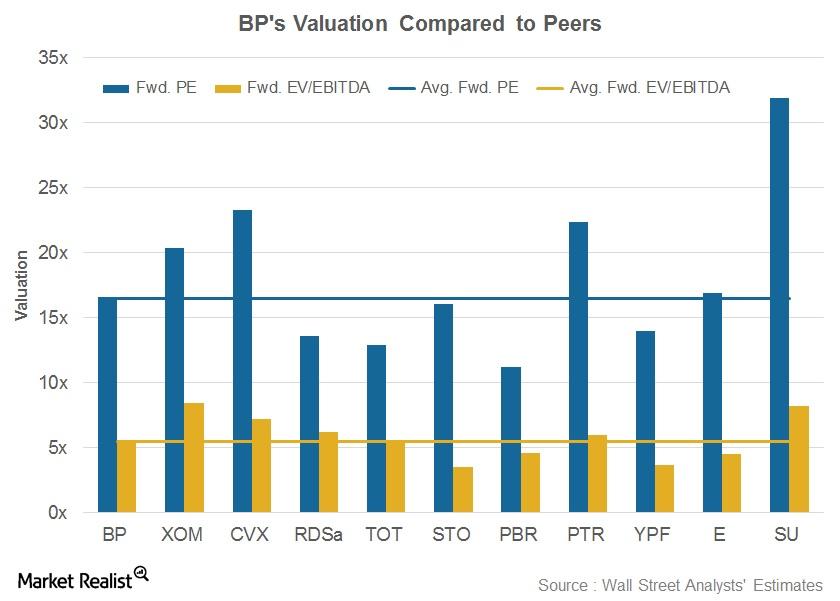

What’s BP’s Valuation?

BP (BP) is now trading at a forward PE (price-to-earnings ratio) of 16.6x, above its peer average of 16.5x.

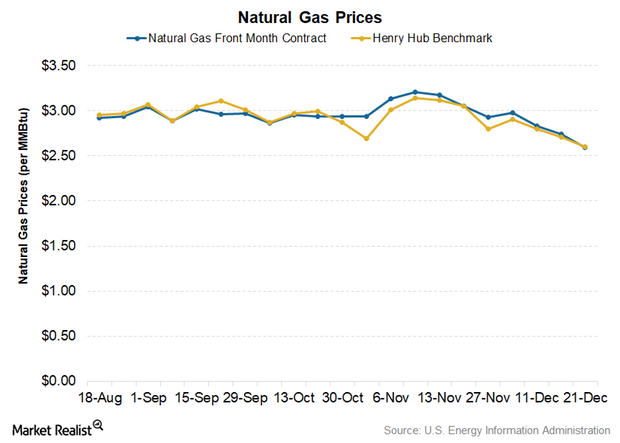

Natural Gas Prices Continue to Fall

In the EIA’s STEO report, it predicted that the Henry Hub natural gas benchmark price would average $3.12 per MMBtu in 2018.

Understanding KBR’s Business Segments

Business segments KBR’s (KBR) business is classified into three core segments (government services, technology and consulting, and engineering and construction) and two non-core segments (non-strategic business and other business). Government services The government service segment’s primary focus is providing support solutions to US, UK, and Australian government agencies. According to KBR’s Form 10-K, the segment offers “full […]

A Look at KBR’s Subsidiaries

Primary subsidiaries Previously, we discussed various acquisitions completed by KBR (KBR). Let’s now take a look at some of KBR’s subsidiaries and how they fit into the big picture for the company. Energy and construction Granherne, a KBR technology and engineering subsidiary, operates in the oil and gas industry. Granherne provides front-end engineering and design services […]

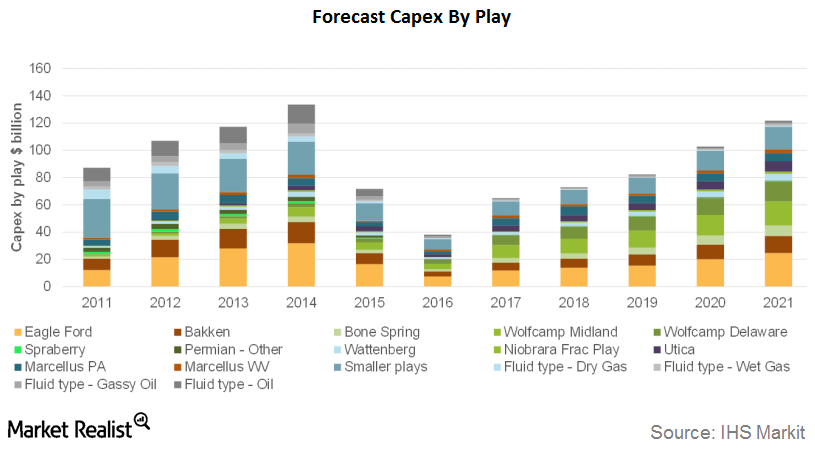

Forecasts for Capital Spending in the Permian Basin

According to a report released by IHS Markit, Permian investments are expected to increase from $8 billion in 2016 to more than $41 billion in 2021.

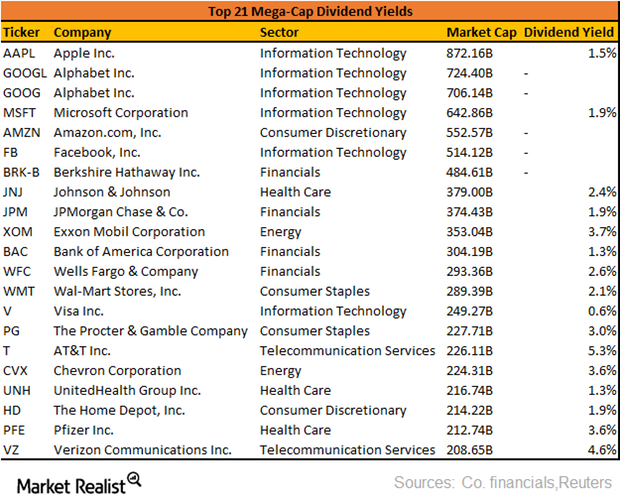

What Are the Dividend Yields of the Top 10 Mega-Cap Stocks?

Donald Trump’s promises of financial deregulation, infrastructure spending, and tax cuts played a major role in the stock market rally this year.

US Dollar Could Help Crude Oil Futures

The US Dollar Index fell 0.1% to 91.97 on September 22, 2017. However, the US dollar rose 0.7% on September 20, 2017, after the FOMC’s meeting.

How Good Is Chevron as a Dividend Payer?

Chevron’s (CVX) total sales and other operating revenues for 2016 fell 15.0% due to volatility in commodity prices.

ExxonMobil’s Journey as a Dividend Aristocrat

ExxonMobil’s (XOM) story is similar to Chevron’s. The company’s sales and other operating revenue for 2016 fell 16.0%.