Sushree Mohanty

I am Sushree Mohanty, a financial analyst with eight years of experience in finance, retail, and operations management. I first joined Market Realist in 2015. I covered macroeconomics, consumer stocks, and the real estate sector. Currently, I am fascinated with the cannabis industry. I love digging deeper into this vast marijuana sector and provide a detailed and interesting analysis. I have a bachelor’s degree in business management, specializing in finance. I am also a CFA Level 2 candidate.

Creativity is my forte. Besides financial writing, I also love writing on general topics, life-changing experiences, and spirituality. I am an artist-singer, painter, and dancer. I love traveling and learning about various cultures. I am also a fitness enthusiast and a fighter by passion.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Sushree Mohanty

Analysts’ Ratings of Mead Johnson Nutrition after 2Q16 Earnings

On August 1, 2016, Mead Johnson Nutrition Company (MJN) was trading at $87.72. After 2Q16 earnings, the average broker target price for Mead Johnson Nutrition increased by 4% to $94.90 from $91.0.

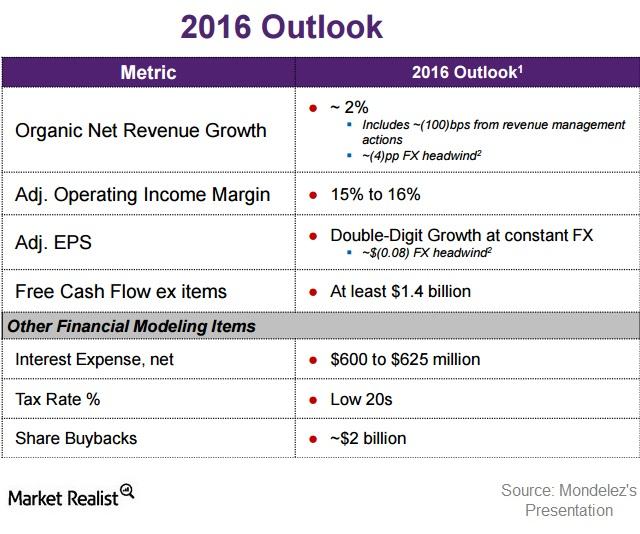

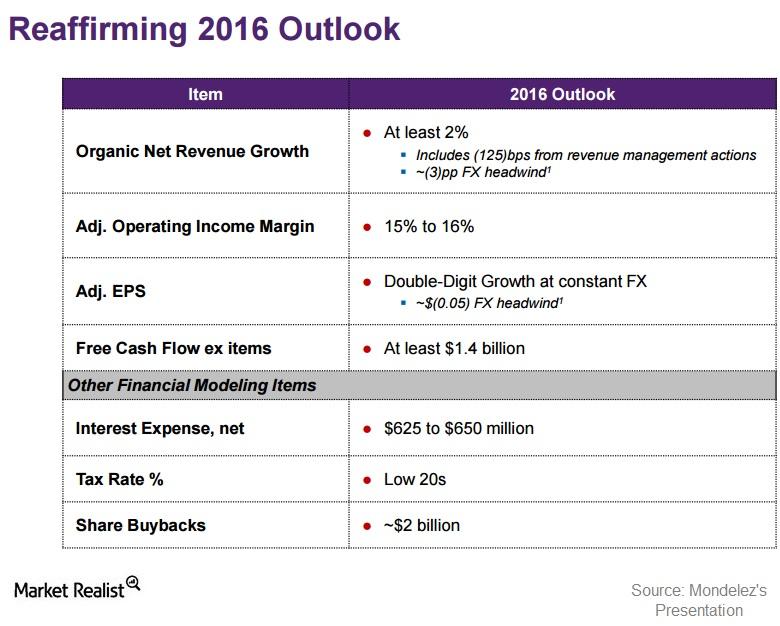

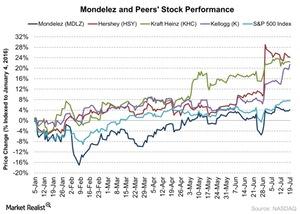

What’s Mondelez’s Outlook for Fiscal 2016?

Mondelez provided its fiscal 2016 outlook during the second quarter earnings call. It reduced its estimate for organic net revenue growth to ~2%.

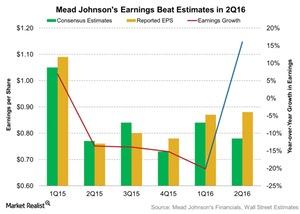

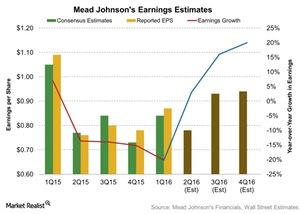

Why Did Mead Johnson Nutrition’s Earnings Rise 16% in 2Q16?

In 2Q16, Mead Johnson Nutrition’s (MJN) EPS (earnings per share) increased 16% to $0.88, compared to $0.76 in 2Q15.

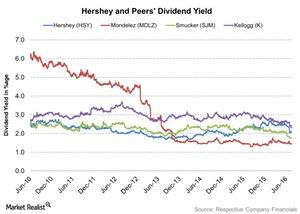

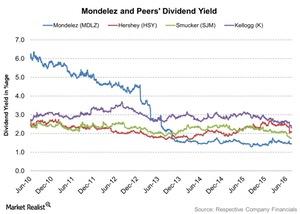

What’s Mondelez’s Increased Dividend for 2016?

A week before its 2Q16 results, Mondelez (MDLZ) declared a 12% increase in its quarterly dividend. It targets a dividend payout of 30% in 2016.

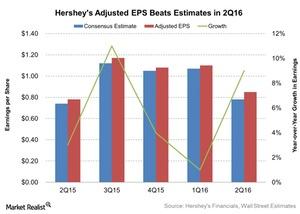

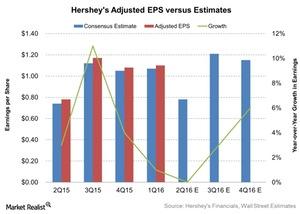

Hershey’s Earnings Surpassed Estimates in Fiscal 2Q16

Hershey (HSY) reported its fiscal 2Q16 earnings on July 28, 2016. Adjusted EPS came in around $0.85 for 2Q16, a growth of 9% compared to $0.78 in 2Q15.

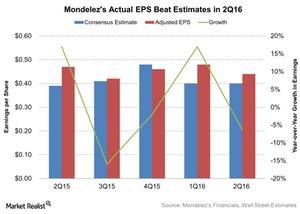

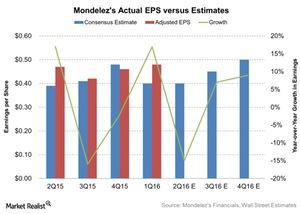

Did Mondelez’s Earnings Manage to Beat Estimates in 2Q16?

Mondelez exceeded analysts’ earnings estimates of $0.40 by 10% for 2Q16. The adjusted EPS (earnings per share) was ~$0.44 for the quarter.

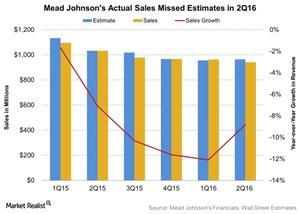

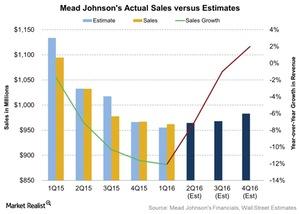

What Hurt Mead Johnson Nutrition’s Revenue in 2Q16?

In 2Q16, Mead Johnson (MJN) reported a drop in revenue of ~9% to $942 million, compared to revenue of ~$1.0 billion in 2Q15.

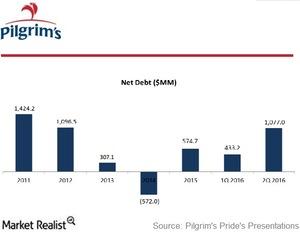

How Has Pilgrim’s Pride Made Room for Strategic Investments?

Consistent with its strategy to improve capital structure and generate shareholder value, Pilgrim’s Pride (PPC) paid $700 million, or $2.75 per share, in special dividends.

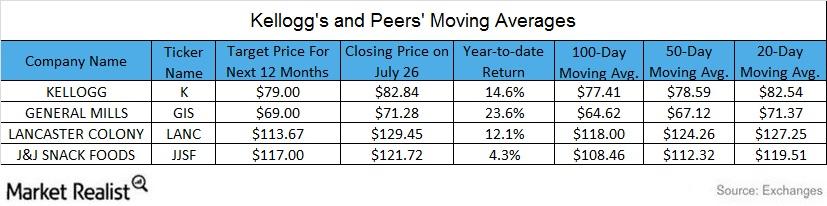

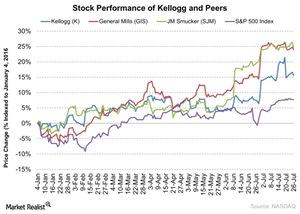

Key Moving Averages: Analyzing Kellogg versus Its Peers

Kellogg closed at $82.84 on July 26. It’s trading 7.0%, 5.4%, and 0.4% above its 100-day, 50-day, and 20-day moving averages. It has appreciated ~15% in 2016.

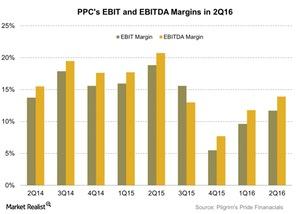

Did Pilgrim’s Pride Successfully Drive Margin Growth in 2Q16?

In its 2Q16 earnings call, Pilgrim’s Pride (PPC) said that despite the fall in margins, the company’s margins depict its ability to adapt to different market scenarios.

What’s Kraft Heinz’s Outlook for 2016?

Kraft Heinz’s management discussed its fiscal 2016 outlook during its last quarter’s earnings call. KHC remains on track or ahead in its areas of integration.

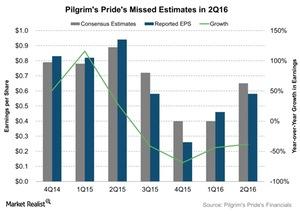

Pilgrim’s Pride in 2Q16: How Much Did Earnings Decline?

Pilgrim’s Pride’s earnings were hit hard again in the second quarter. They fell far below analysts’ expectations, missing estimates by 11%.

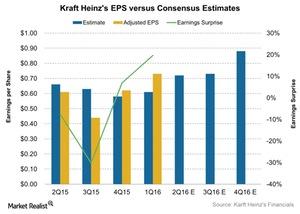

What Could Benefit Kraft Heinz’s Earnings in 2Q16?

Analysts’ expectations for KHC’s earnings look optimistic for the rest of 2016. Its earnings are expected to rise by 70% and 44% in 3Q16 and 4Q16.

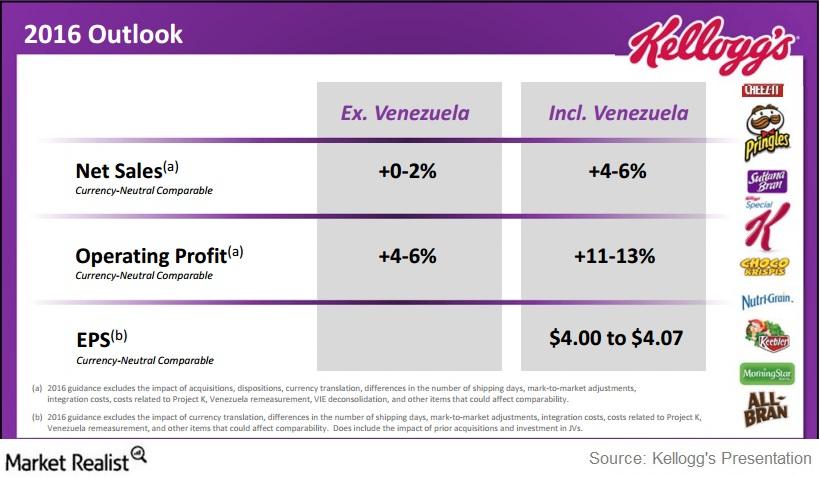

What’s Kellogg’s Updated Guidance for Fiscal 2016?

Kellogg (K) updated its fiscal 2016 guidance for currency-neutral comparable net sales, operating profit, and earnings per share.

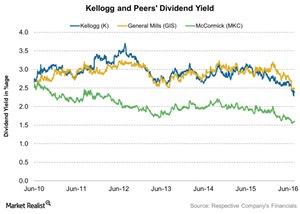

How Much Did Kellogg Return to Shareholders?

Kellogg announced a quarterly dividend of $0.50 per share on its common stock—paid on June 15 to shareowners of record at the close of business on June 1.

What Can Investors Expect from Kellogg’s 2Q16 Results?

Kellogg Company (K) is headquartered in Battle Creek, Michigan. It’s set to report its fiscal 2Q16 results on August 4, 2016, before the market opens.

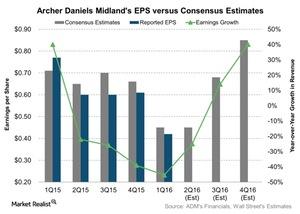

What Could Cast a Shadow over Archer Daniels Midland’s 2Q16 EPS?

Analysts expect Archer Daniels Midland’s adjusted EPS in 2Q16 to be $0.45—compared to $0.60 in 2Q15. It represents a massive decline of 25%.

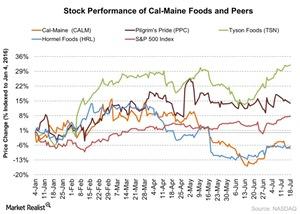

How’s Cal-Maine Trading Compared to Its Key Moving Averages?

As of July 18, 2016, Cal-Maine Foods (CALM) closed at $44.18. It traded 8.3% below its 100-day moving average and 0.7% below it 50-day moving average.

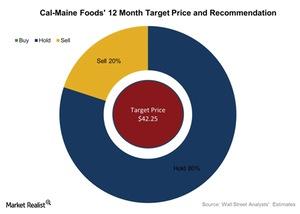

What Do Analysts Recommend for Cal-Maine Foods after 4Q16?

The average broker target price for Cal-Maine Foods rose slightly to $42.25 from $41.5—4.5% lower than the closing price of $44.18 on July 18, 2016.

Hershey Shareholders Thrive on 346 Straight Dividend Payouts

On May 4, Hershey (HSY) announced that its board of directors approved quarterly dividends of $0.58 on the common stock and $0.53 on the Class B common stock.

Why Hershey’s Earnings Could Have Been Pressured in 2Q16

Analysts expect Hershey’s adjusted EPS to be $0.78, which is in line with 2Q15 EPS.

Mondelez’s Revenue Expectations for Rest of Fiscal 2016

In its fiscal 1Q16, Mondelez International (MDLZ) reaffirmed the fiscal 2016 outlook it announced during its 4Q15 results.

How Did Cal-Maine Foods Stock React to Its Fiscal 4Q16 Results?

Cal-Maine Foods reported its fiscal 4Q16 results on July 18. There wasn’t impact on the stock price even though the company reported a loss for the quarter.

How Hershey Benefits from the barkTHINS Acquisition

The company expects that the barkTHINS acquisition will be dilutive in 2016 and 2017, before turning accretive in 2018.

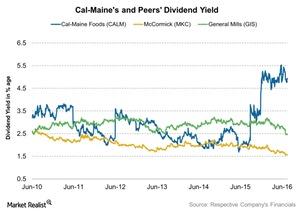

How Much Did Cal-Maine Return to Shareholders in Fiscal 2016?

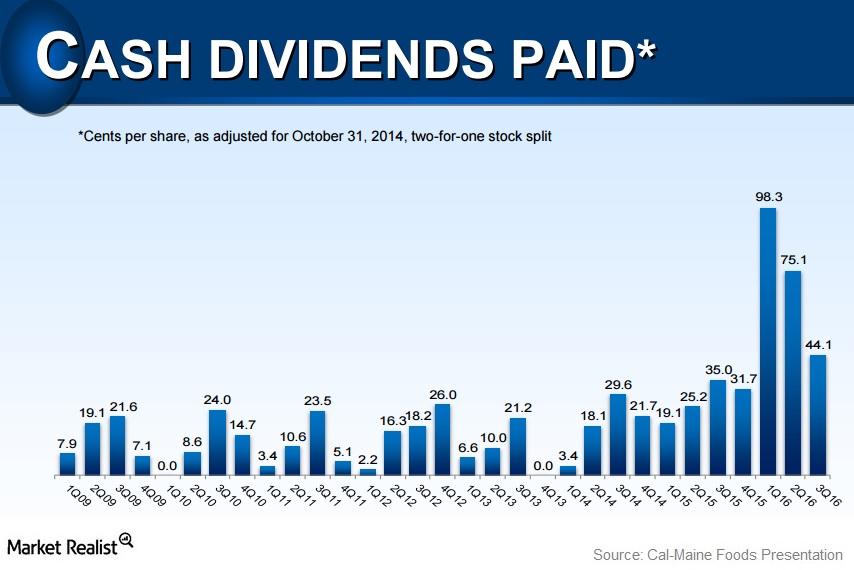

Cal-Maine Foods has a dividend yield of 4.0% as of July 18, 2016. Management raised the dividend at a CAGR (compound annual growth rate) of 15.3% over five years.

What Analysts Recommend for Mead Johnson ahead of 2Q16 Results

As of July 15, 2016, Mead Johnson (MJN) was trading at $91.38.

What’s Expected of Mondelez’s Earnings for 2Q16?

Analysts expect Mondelez’s adjusted EPS to be $0.40 compared to $0.47 in 2Q15.

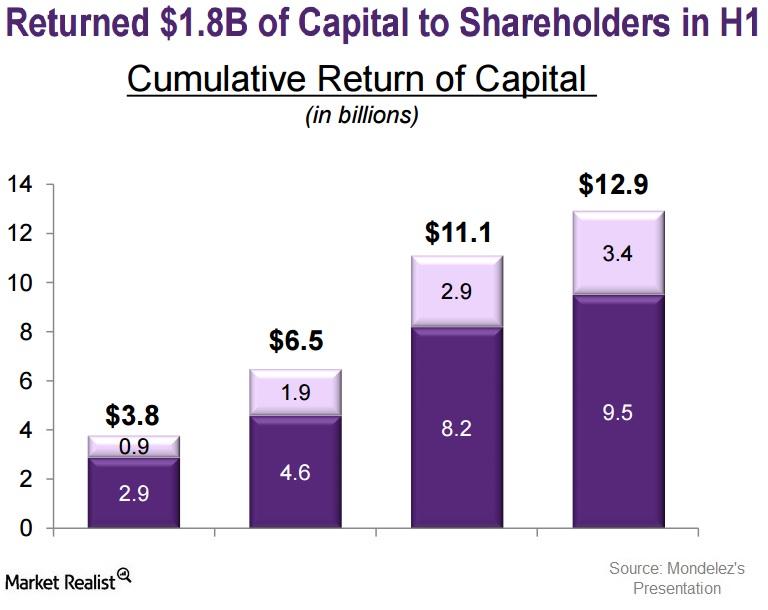

Mondelez Returns Billions of Dollars in Capital to Shareholders

In fiscal 1Q16, Mondelez returned a total of $1.5 billion in capital to shareholders through dividends and share repurchases.

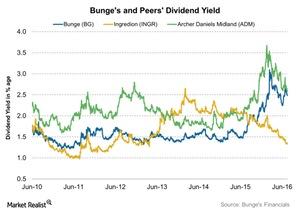

Bunge Consistently Returns Value to Shareholders

On May 24, Bunge announced that its board of directors approved a 10.5% increase in the company’s regular quarterly common share cash dividend.

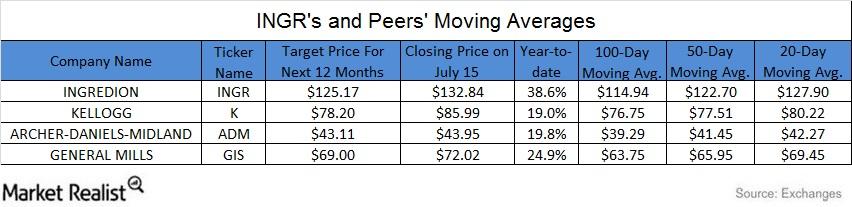

How Does Ingredion Compare to Peers on Key Moving Averages?

On July 15, 2016, Ingredion (INGR) closed at $132.84. It traded 15.6% above its 100-day moving average, 8.3% above its 50-day moving average, and 3.9% above its 20-day moving average.

What Could Help Mead Johnson’s Earnings in 2Q16?

Analysts are expecting Mead Johnson’s adjusted EPS to be $0.78 compared to $0.76 in 2Q15.

What Will Hurt Mead Johnson’s 2Q16 Revenue?

Analysts are expecting Mead Johnson’s revenue to be $964 million for 2Q16. That’s a fall of 7% compared to 2Q15 revenues of $1.0 billion.

Did Oreo Cookies, Trident Gum Sales Boost Mondelez’s 2Q Earnings?

Mondelez International (MDLZ), maker of Cadbury chocolates and Oreo cookies, is all set to report its fiscal 2Q16 earnings results on July 27 before the market opens.

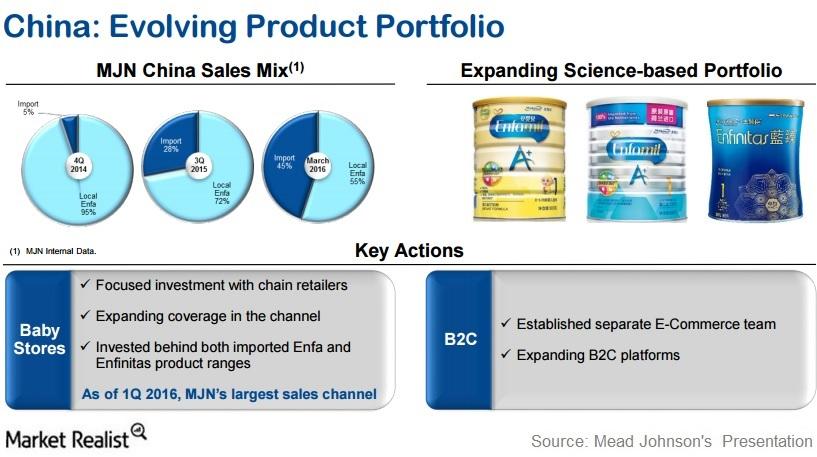

How Is Mead Johnson Improving Its Product Portfolio in China?

China accounts for around one-third of Mead Johnson’s global business.

How Has Mead Johnson Grown through Innovation?

Mead Johnson (MJN) participated and discussed some key strategies in the Deutsche Bank Global Consumer Conference held last month.

What’s behind Ingredion’s Impressive 2016 Stock Prices?

Ingredion (INGR) is set to report its fiscal 2Q16 results before the Market opens on July 28, 2016. So far in 2016, Ingredion stock has risen 43%.

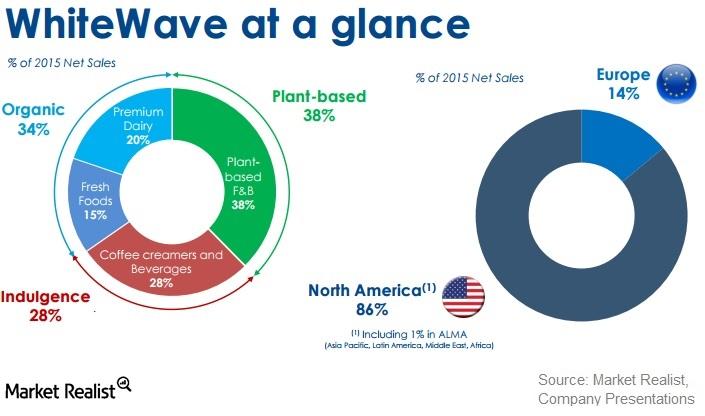

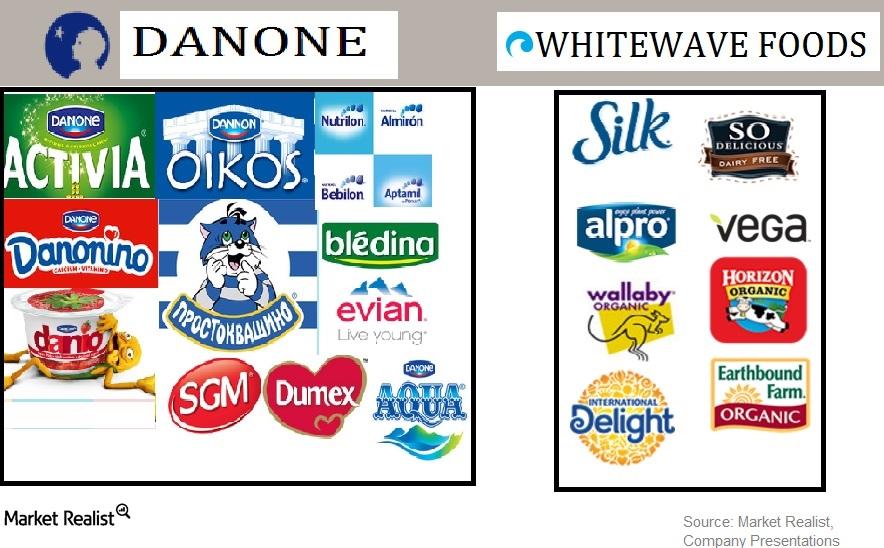

How Can WhiteWave Foods Add to Danone’s Business?

WhiteWave Foods (WWAV) currently generates around 80%–85% of its total revenue and operating profit from North America alone.

Why Are Analysts So Positive about General Mills?

About 64% of analysts rate General Mills a “hold,” 18% rate it a “sell,” and 18% rate it a “buy.”

Analyzing Cal-Maine Foods’ Variable Dividend Policy

Cal-Maine has a variable dividend policy in place. It has a dividend yield of 5.8% as of June 28. Management raised the dividend at a CAGR of 15.3% over five years.

Why Are So Many Analysts Rating B&G Foods a ‘Hold’?

Approximately 78% of analysts rate B&G Foods a “hold,” and 22% rate it a “buy.” None of the analysts rate it a “sell.”

What Are the Benefits of Danone’s WhiteWave Acquisition?

Danone will be acquiring WhiteWave Foods for $56.25 per share in an all-cash transaction. This makes WWAV’s total enterprise value ~$12.5 billion.

Why Did JPMorgan Chase Downgrade WhiteWave Foods?

On July 8, 2016, JPMorgan Chase (JPM) downgraded WhiteWave Foods’ (WWAV) stock to a “neutral” rating from an “overweight” rating.

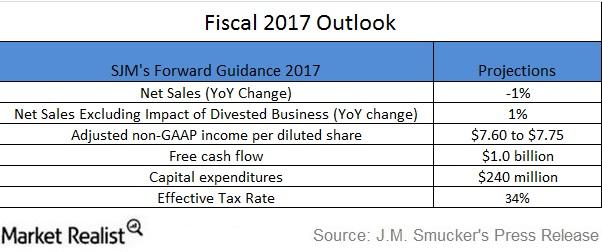

What Are J.M. Smucker’s Expectations for Fiscal 2017?

During its fiscal 4Q16 earnings release and in its investor presentation last week, the J.M. Smucker Company (SJM) discussed its outlook for fiscal 2017.

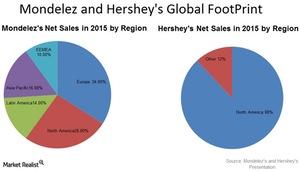

Why Was Mondelez Interested in Hershey?

Mondelez wanted a greater share in the North American market to recover from its declining revenue growth. Hershey would have benefited Mondelez’s revenue.

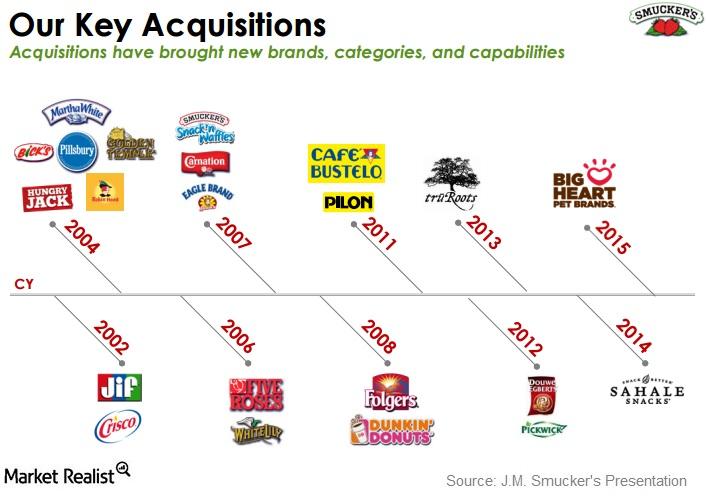

How Did Acquisitions and Innovations Lead J.M. Smucker’s Revenue?

The J.M. Smucker Company has made some key acquisitions since 2002. These acquisitions have brought in new brands, categories, and capabilities.

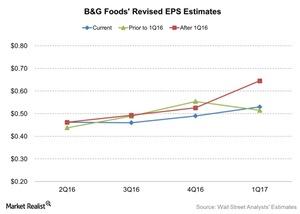

Analysts Have Revised EPS Estimates for B&G Foods: Why?

B&G Foods’ (BGS) earnings estimates have been on an upward trend since its fiscal 1Q16 impressive results. The Green Giant acquisition contributed to the results.

Cal-Maine Plans to Increase Its Value-Added Specialty Egg Business

Cal-Maine Foods (CALM) plans to grow its specialty egg business by meeting consumer demand in the rapidly growing segment.

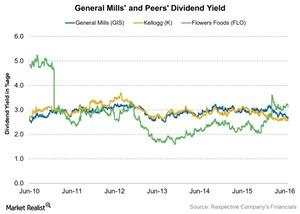

General Mills Declared Increased Dividend in Fiscal 4Q16

With its fiscal 4Q16 earnings release, the General Mills board approved a quarterly dividend of $0.48 per share. It will be paid on August 1, 2016.

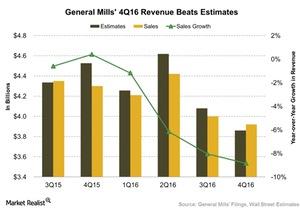

What Drove Down General Mills’ Revenue Growth for Fiscal 4Q16?

General Mills’ (GIS) net sales for fiscal 4Q16 fell 9% year-over-year. However, they beat analysts’ estimates by 2%.

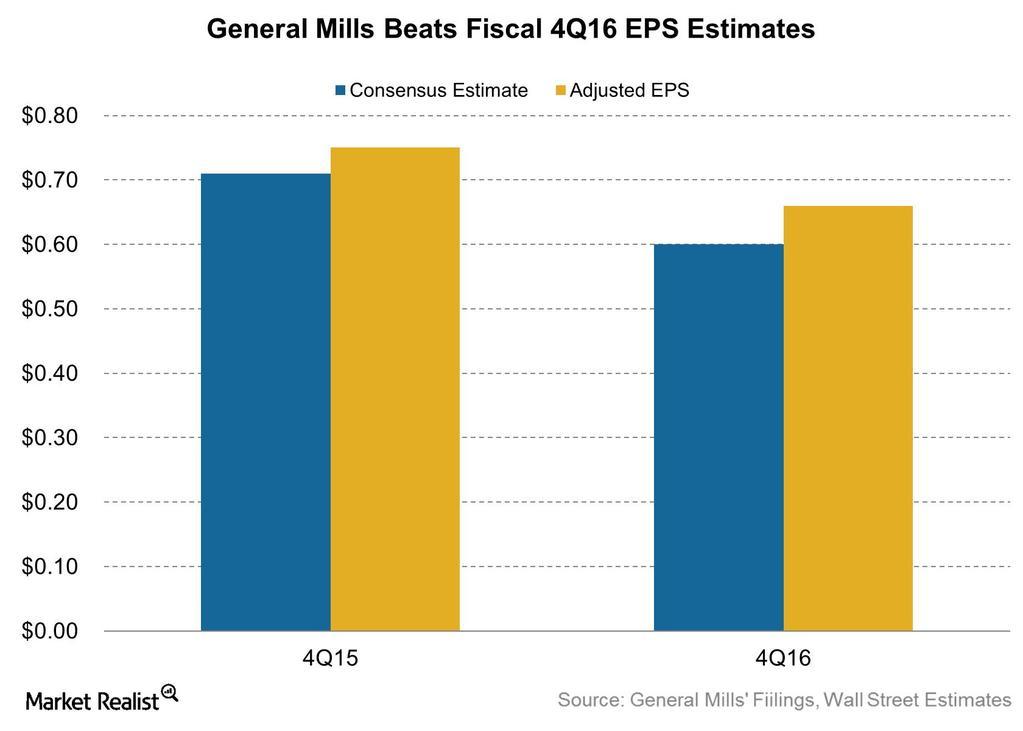

Why Did General Mills’ Earnings Fall in Fiscal 4Q16?

General Mills’ (GIS) fiscal 4Q16 earnings beat estimates by 10%. Adjusted EPS, however, declined 12% compared to fiscal 4Q15.