General Mills Declared Increased Dividend in Fiscal 4Q16

With its fiscal 4Q16 earnings release, the General Mills board approved a quarterly dividend of $0.48 per share. It will be paid on August 1, 2016.

July 1 2016, Updated 9:08 a.m. ET

Quarterly dividend increased

In this part of the series, we’ll take a look at General Mills’ (GIS) recent dividend increase. We’ll also look at the update of its cost-saving initiatives.

General Mills paid $1.1 billion in dividends in 2016. Dividends per share were $1.78, an increase of 7% from last year.

With its fiscal 4Q16 earnings release, the General Mills board approved a quarterly dividend of $0.48 per share. It will be paid on August 1, 2016, to stockholders of record as of the close of business on July 11, 2016. This represents an increase of 4% compared to the earlier quarterly dividend of $0.46 per share.

This marks the eighth increase by General Mills since 2010. For fiscal 2017, total dividends per share will be $1.92, including the increased quarterly dividend of $0.48. This annual dividend is an increase of 8% compared to the annual dividend of $1.78 paid in fiscal 2016.

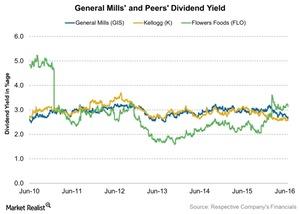

General Mills has a dividend yield of ~2.7% as of June 29, 2016. Management has raised the dividend at a CAGR (compound annual growth rate) of 11.5% over the last five years.

Share repurchases

General Mills (GIS) repurchased $435 million of shares in fiscal 2016. According to its guidance, the company reduced its average net shares outstanding by 1%. The company delivered around 79% of its free cash flow to its shareholders in fiscal 2016. Free cash flow totaled $1.9 million for the year, and the company returned a total of about $1.5 billion to shareholders.

Cost-saving initiatives

General Mills expects to achieve $600 million in cost savings by fiscal 2018. That’s higher than its earlier target of $500 million by 2018. The target was raised due to strong savings in fiscal 2016 and expectations of further savings over the next two years.

The company’s cost-saving initiative is linked to the combination of Project Century, Project Compass, and Project Catalyst. It’s also linked to the company’s policies and practices updates such as zero-based budgeting.

General Mills’ industry peers Kellogg (K) and Flowers Foods (FLO) have dividend yields of 2.6% and 3.2%, respectively, as of June 29, 2016. The PowerShares S&P 500 Low Volatility ETF (SPLV) and the PowerShares S&P 500 High Quality ETF (SPHQ) invest 1.1% and 0.87% of their holdings, respectively, in GIS.

In the next part, we’ll see why General Mills has an optimistic outlook for fiscal 2017 and fiscal 2018.