PowerShares S&P 500 Low Volatility ETF

Latest PowerShares S&P 500 Low Volatility ETF News and Updates

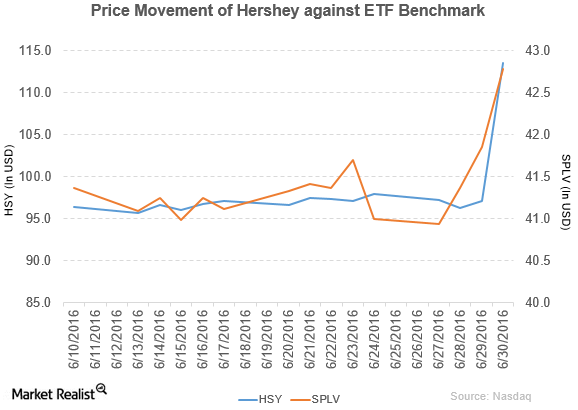

Why Did Hershey’s Stock Rise on June 30?

The Hershey Company (HSY) has a market cap of $24.2 billion. Its stock rose by 16.8% to close at $113.49 per share on June 30, 2016.

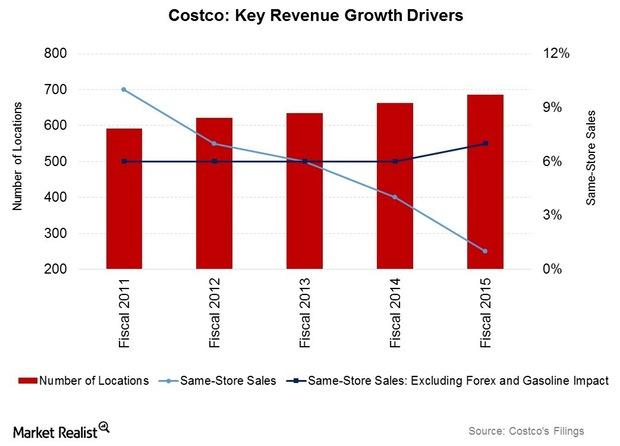

Costco’s Industry Positioning: A Porter’s 5 Force Analysis

Costco’s suppliers include companies like PepsiCo (PEP), Procter & Gamble (PG), and the Kraft Heinz Company (KHC). No single supplier accounts for over 5% of revenue.

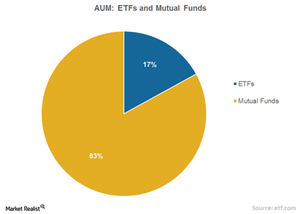

Why ETFs Are Seeing Increased Popularity

Mutual fund ownership of equities is at the lowest level in ~13 years, while ETFs (SPY) (IVV) are gradually increasing their share in the stock market.

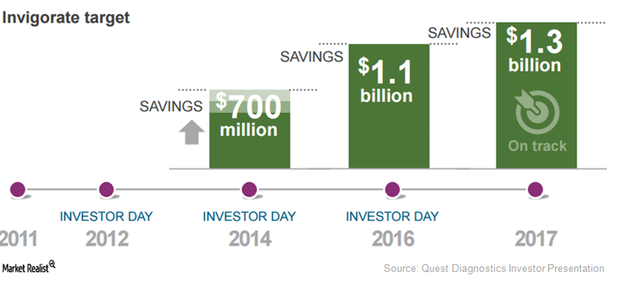

Quest Diagnostics Projects Run Rate Savings by End of 2017

Quest Diagnostics (DGX) has projected a run rate savings worth $1.3 billion by the end of 2017. In 2016, it managed to save up to $1.1 billion.

Narayana Kocherlakota on Trump and the Federal Reserve

Narayana Kocherlakota, 12th president of the Federal Reserve Bank of Minneapolis, said central banks have been able to control inflation better when left alone by the government.

Richard Bernstein: Don’t Fear the Bear Market

A legitimate bull market In this series, we’ve taken a look at Richard Bernstein’s views on investors’ fear of an impending bear market. In Richard Bernstein Advisors’ October Insights newsletter, he rejects the notion that the current rise in US stocks (SPLV) (OEF) has been brought about only by the Fed’s easy monetary policy. In the […]

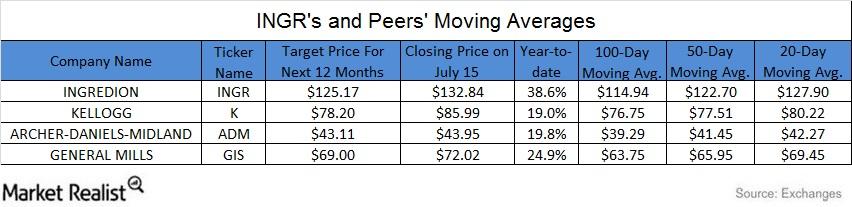

How Does Ingredion Compare to Peers on Key Moving Averages?

On July 15, 2016, Ingredion (INGR) closed at $132.84. It traded 15.6% above its 100-day moving average, 8.3% above its 50-day moving average, and 3.9% above its 20-day moving average.

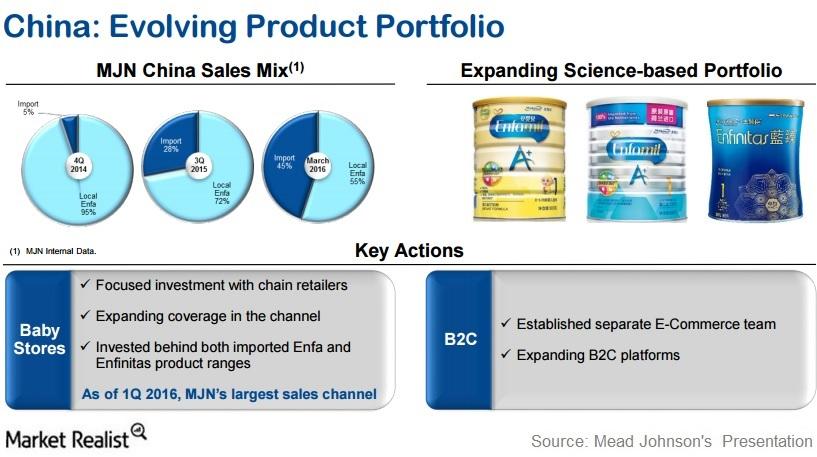

How Is Mead Johnson Improving Its Product Portfolio in China?

China accounts for around one-third of Mead Johnson’s global business.

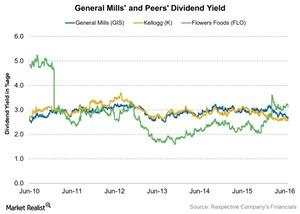

General Mills Declared Increased Dividend in Fiscal 4Q16

With its fiscal 4Q16 earnings release, the General Mills board approved a quarterly dividend of $0.48 per share. It will be paid on August 1, 2016.

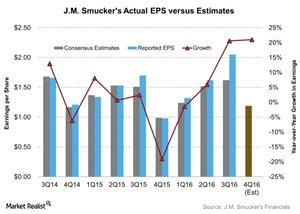

What Could Benefit J.M. Smucker’s 4Q16 Earnings?

Analysts are expecting J.M. Smucker’s adjusted EPS to be $1.19 in fiscal 4Q16—compared to 4Q15 EPS of $0.98. It represents a tremendous rise of 21%.

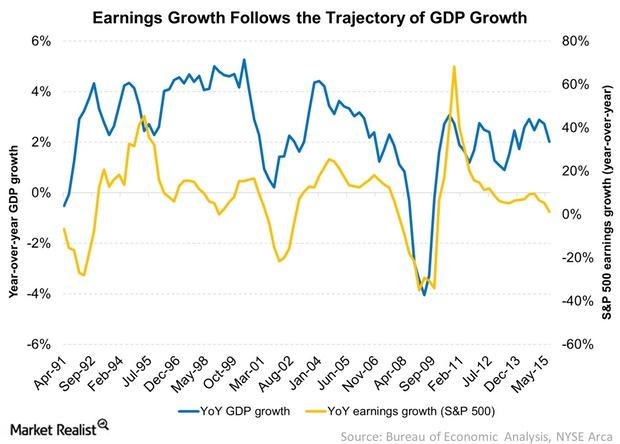

What’s the Biggest Driver of Earnings Growth?

Economic growth is the biggest driver of earnings growth. Earnings growth seems to follow the same trajectory of GDP growth.

Kraft Heinz: What Happened after the Merger?

The Pittsburgh-based, privately owned ketchup maker H.J. Heinz Holding Corporation acquired Kraft Foods last month.

What Happens to Waste? The Basics of Municipal Waste Management

In simple terms, municipal solid waste is trash or garbage discarded by households and commercial establishments.