PowerShares S&P 500 High Quality ETF

Latest PowerShares S&P 500 High Quality ETF News and Updates

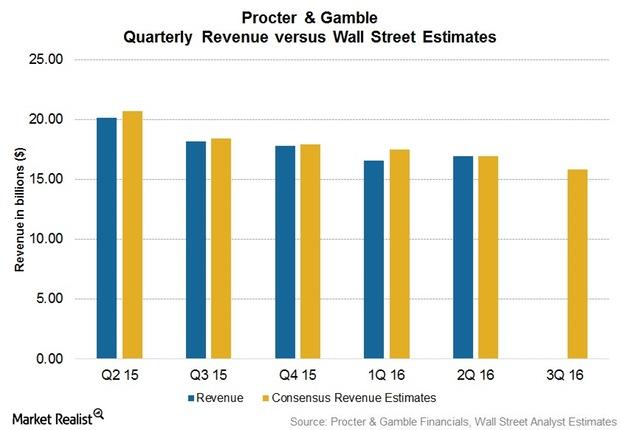

Procter & Gamble: Can Focus on 10 Product Categories Help 3Q16?

Procter & Gamble (PG) is set to release its fiscal 3Q16 earnings before the Markets open on April 26, 2016. In fiscal 2Q16, P&G missed revenue estimates for the fifth consecutive quarter.

Target’s Signature Categories Beat Overall Business in Fiscal 2Q

Target’s (TGT) Signature Categories include Style, Baby, Kids, and Wellness. Target’s Signature Categories outpaced the total business by 3 percentage points in fiscal 2Q16.

What Do Analysts Recommend for Kellogg after Fiscal 2Q16 Results?

The average broker target price for Kellogg for the next 12 months has risen to $83.93 from $79. This is 1.4% higher than the closing price of $82.71 on August 5.

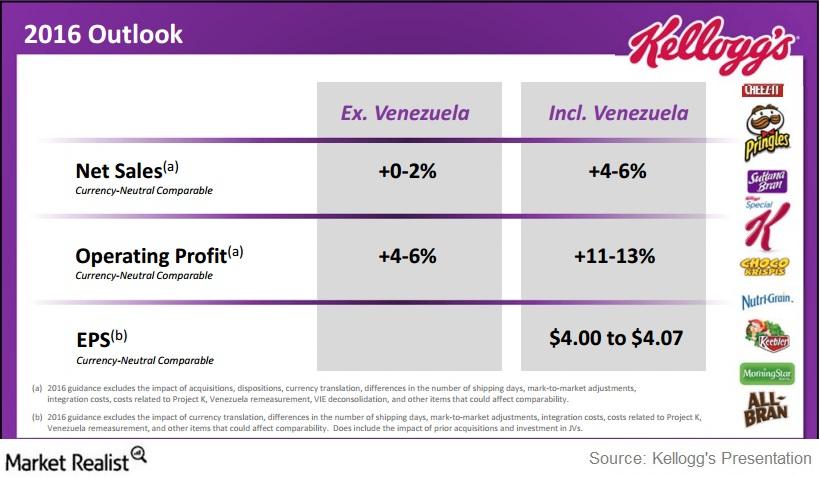

What Made Kellogg Update Its Fiscal 2016 Guidance?

In its fiscal 2Q16 earnings release, Kellogg stated that it expects its fiscal 2016 cash flow from operating activities to be ~$1.7 billion.

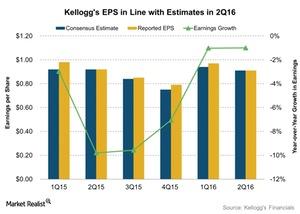

Did Kellogg’s Earnings Beat Estimates in Fiscal 2Q16?

In fiscal 2Q16, Kellogg Company (K) reported EPS (earnings per share) of $0.91, in line with analysts’ estimates.

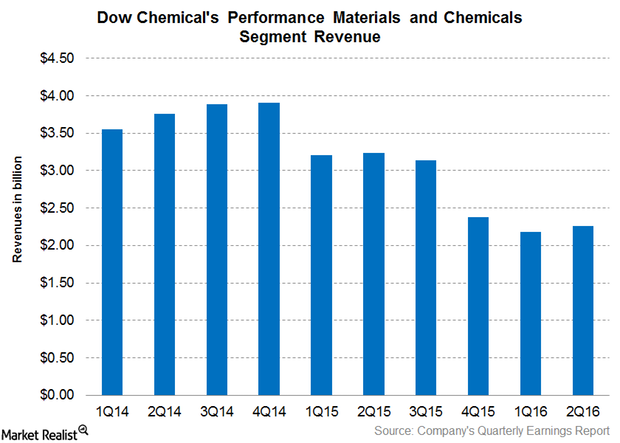

Why Dow’s Performance Materials and Chemicals’ Revenue Fell

Dow Chemical’s Performance Materials and Chemicals segment is the second largest revenue contributor to its total revenue.

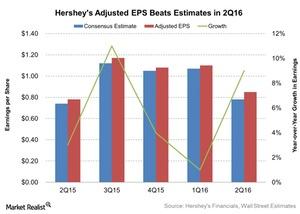

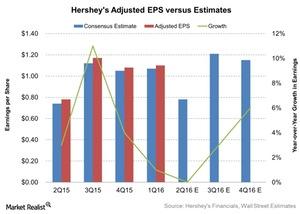

Hershey’s Earnings Surpassed Estimates in Fiscal 2Q16

Hershey (HSY) reported its fiscal 2Q16 earnings on July 28, 2016. Adjusted EPS came in around $0.85 for 2Q16, a growth of 9% compared to $0.78 in 2Q15.

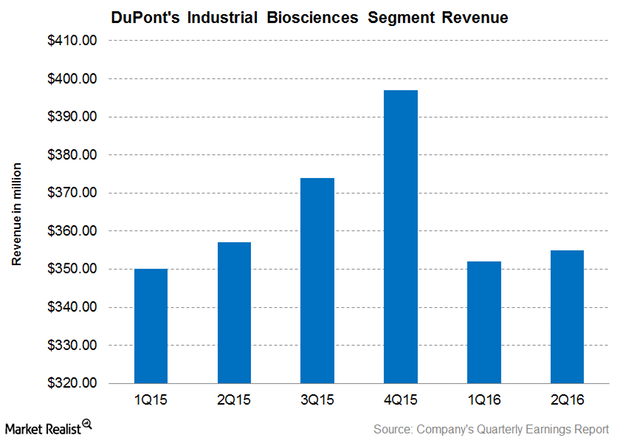

Why Did DuPont’s Industrial Biosciences Segment Revenue Fall in 2Q16?

For 2Q16, DuPont’s Industrial Biosciences segment reported revenues of $355 million, representing 5% of the company’s total revenue.

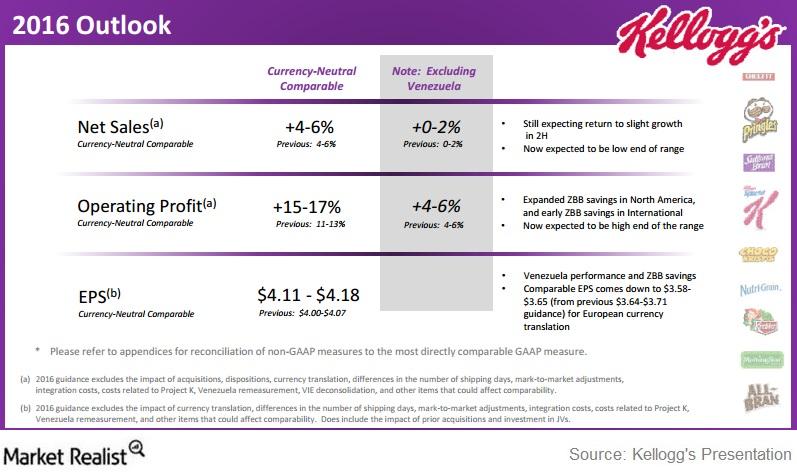

What’s Kellogg’s Updated Guidance for Fiscal 2016?

Kellogg (K) updated its fiscal 2016 guidance for currency-neutral comparable net sales, operating profit, and earnings per share.

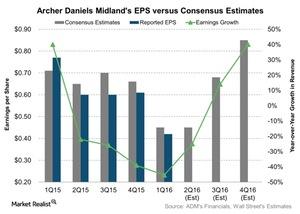

What Could Cast a Shadow over Archer Daniels Midland’s 2Q16 EPS?

Analysts expect Archer Daniels Midland’s adjusted EPS in 2Q16 to be $0.45—compared to $0.60 in 2Q15. It represents a massive decline of 25%.

Why Hershey’s Earnings Could Have Been Pressured in 2Q16

Analysts expect Hershey’s adjusted EPS to be $0.78, which is in line with 2Q15 EPS.

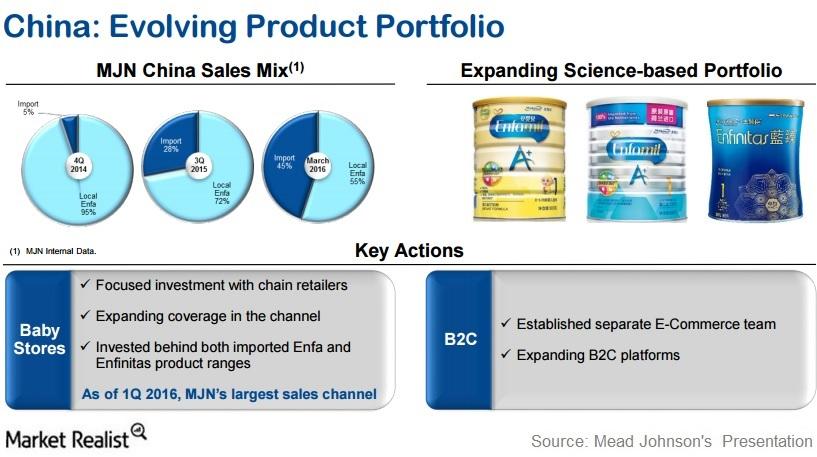

How Is Mead Johnson Improving Its Product Portfolio in China?

China accounts for around one-third of Mead Johnson’s global business.

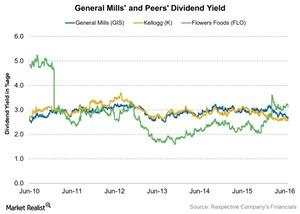

General Mills Declared Increased Dividend in Fiscal 4Q16

With its fiscal 4Q16 earnings release, the General Mills board approved a quarterly dividend of $0.48 per share. It will be paid on August 1, 2016.

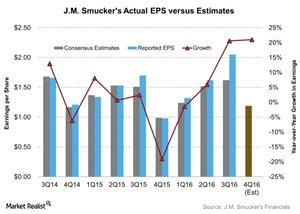

What Could Benefit J.M. Smucker’s 4Q16 Earnings?

Analysts are expecting J.M. Smucker’s adjusted EPS to be $1.19 in fiscal 4Q16—compared to 4Q15 EPS of $0.98. It represents a tremendous rise of 21%.

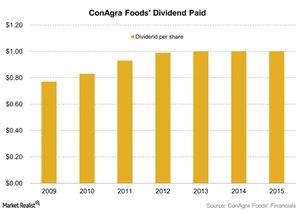

ConAgra Foods’ Dividend, Outlook, and Expectations

ConAgra Foods (CAG) has a dividend yield of 2.45% as of December 17, 2015. The company’s management raised the dividend at an average annual rate of 4.6%.

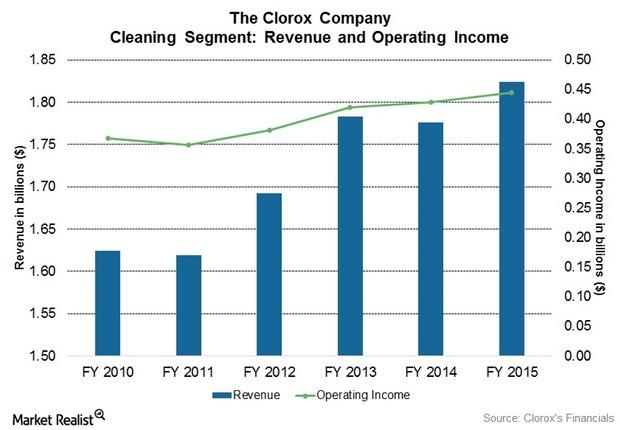

Clorox’s Largest Operating Segment: Cleaning

The Cleaning segment contributed 32.3% to the total consolidated sales of Clorox, the highest among all the segments. The increase was primarily due to higher volume growth.