Flowers Foods Inc

Latest Flowers Foods Inc News and Updates

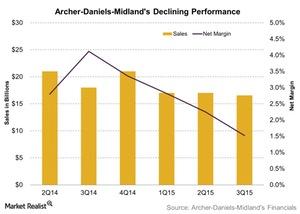

Archer Daniels Midland Reports Another Disappointing Quarter

In 3Q15, Archer Daniels Midland earned $684 million in operating profit, down $257 million from 3Q14. Its net revenue for the quarter was $16.6 billion.

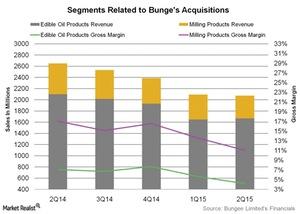

Will Bunge’s Acquisitions Help Revive Its Segment Margins?

Bunge North America, the North American operating segment of Bunge Limited (BG), announced that it had acquired Whole Harvest Foods.

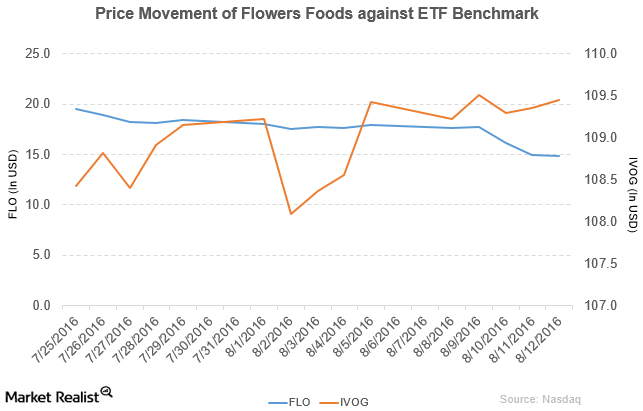

Stephens Reduces Flowers Foods’ Price Target to $14 per Share

Flowers Foods (FLO) has a market cap of $3.1 billion. It fell by 0.67% to close at $14.85 per share on August 12, 2016.

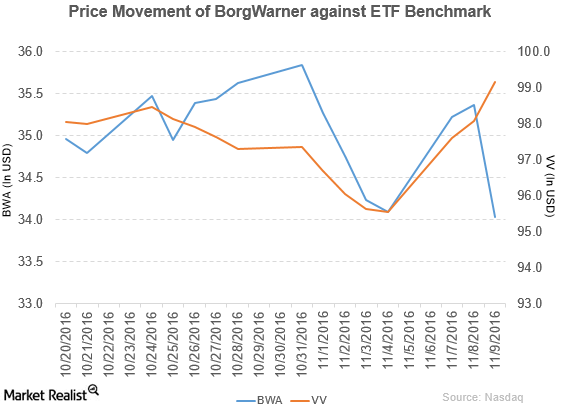

BorgWarner Declares Dividend of $0.14 Per Share

Price movement BorgWarner (BWA) has a market cap of $7.4 billion. It fell 3.8% to close at $34.03 per share on November 9, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -2.1%, -4.3%, and -21.3%, respectively, on the same day. BWA is trading 2.6% below its 20-day moving average, 2.8% below […]

Analysts’ Ratings of Mead Johnson Nutrition after 2Q16 Earnings

On August 1, 2016, Mead Johnson Nutrition Company (MJN) was trading at $87.72. After 2Q16 earnings, the average broker target price for Mead Johnson Nutrition increased by 4% to $94.90 from $91.0.

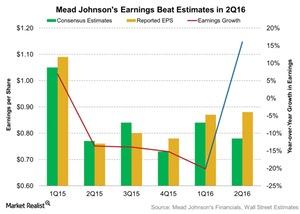

Why Did Mead Johnson Nutrition’s Earnings Rise 16% in 2Q16?

In 2Q16, Mead Johnson Nutrition’s (MJN) EPS (earnings per share) increased 16% to $0.88, compared to $0.76 in 2Q15.

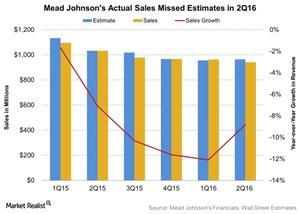

What Hurt Mead Johnson Nutrition’s Revenue in 2Q16?

In 2Q16, Mead Johnson (MJN) reported a drop in revenue of ~9% to $942 million, compared to revenue of ~$1.0 billion in 2Q15.

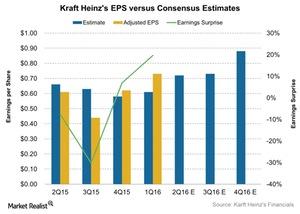

What Could Benefit Kraft Heinz’s Earnings in 2Q16?

Analysts’ expectations for KHC’s earnings look optimistic for the rest of 2016. Its earnings are expected to rise by 70% and 44% in 3Q16 and 4Q16.

What Analysts Recommend for Mead Johnson ahead of 2Q16 Results

As of July 15, 2016, Mead Johnson (MJN) was trading at $91.38.

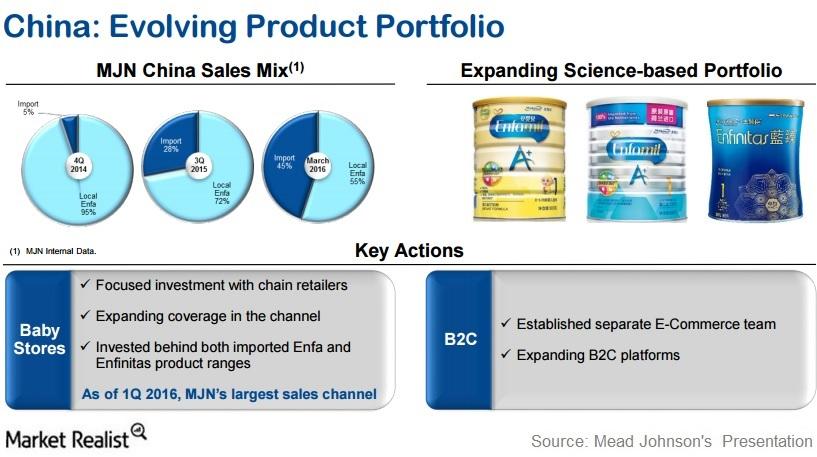

How Is Mead Johnson Improving Its Product Portfolio in China?

China accounts for around one-third of Mead Johnson’s global business.

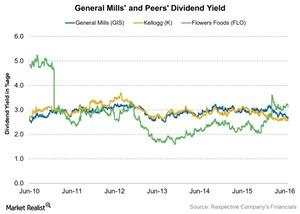

Why Are Analysts So Positive about General Mills?

About 64% of analysts rate General Mills a “hold,” 18% rate it a “sell,” and 18% rate it a “buy.”

Flowers Foods Made Changes in Its Management

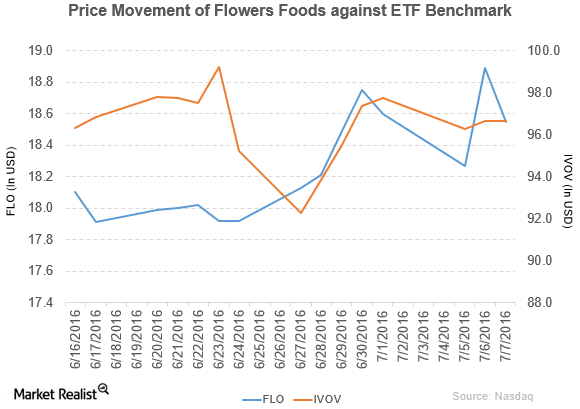

Flowers Foods fell by 1.8% to close at $18.55 per share on July 7. The stock’s weekly, monthly, and YTD price movements were 0.32%, 0.32%, and -12.2%.

General Mills Declared Increased Dividend in Fiscal 4Q16

With its fiscal 4Q16 earnings release, the General Mills board approved a quarterly dividend of $0.48 per share. It will be paid on August 1, 2016.

What Could Benefit J.M. Smucker’s 4Q16 Earnings?

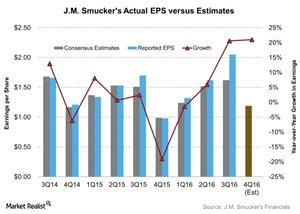

Analysts are expecting J.M. Smucker’s adjusted EPS to be $1.19 in fiscal 4Q16—compared to 4Q15 EPS of $0.98. It represents a tremendous rise of 21%.

What’s Kellogg’s 2020 Vision Strategy?

Kellogg plans to return its “Kashi” brand to growth in 2016. It aims to lead in plant-based nutrition and win with “food forward” consumers.