Gordon Kristopher

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Gordon Kristopher

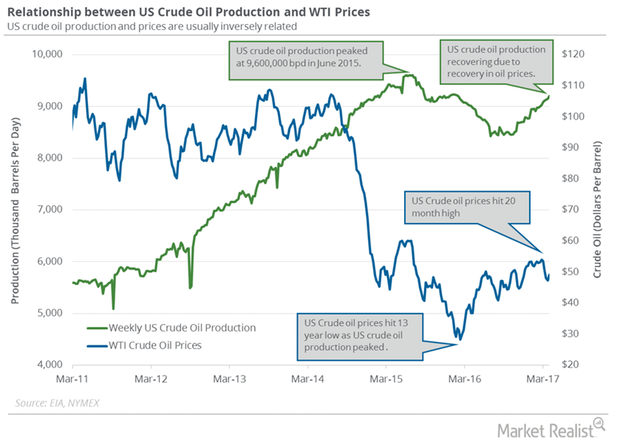

Why US Crude Oil Output Hit a High from January 2016

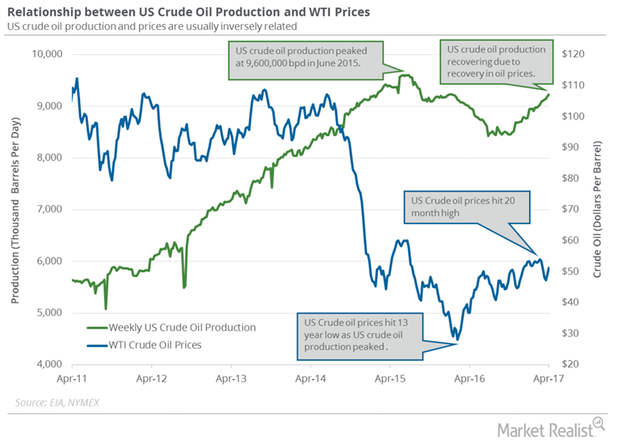

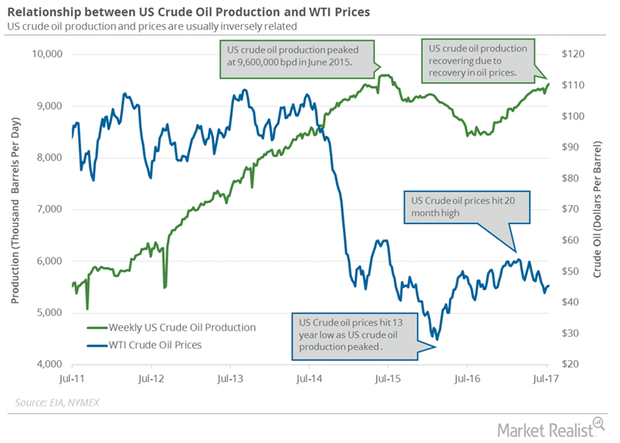

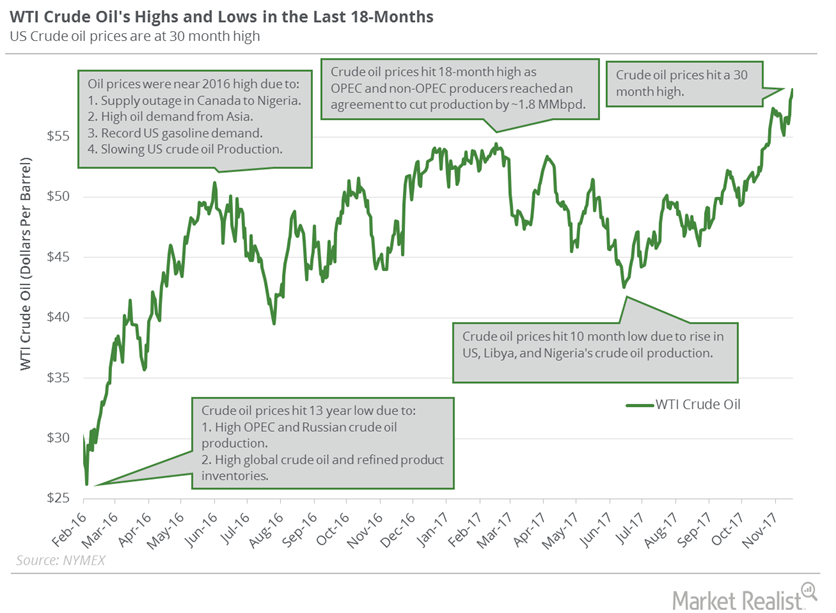

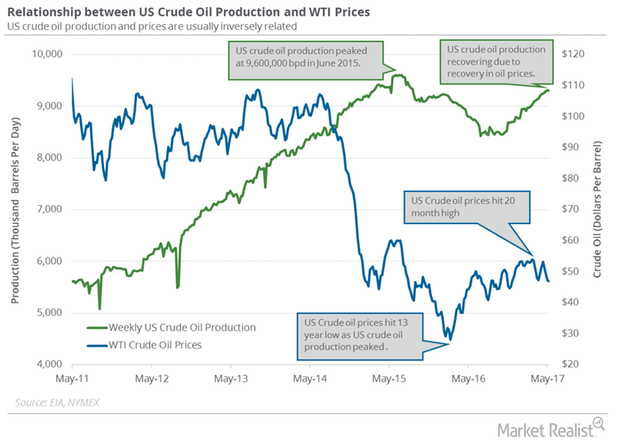

US crude oil output is at the highest level since January 25, 2016. The rise in crude oil output is the biggest bearish driver for crude oil prices in 2017.

What’s Impacting S&P the 500 and Crude Oil?

The SPDR S&P 500 ETF (SPY) rose ~1.7% to $271.28 during the first half of the year. SPY aims to track the performance of the S&P 500 Index.

Will Crude Oil Futures and S&P 500 Move in the Same Direction?

February US crude oil (UWT) (USL) futures contracts rose 0.5% to $61.73 per barrel on January 8. Prices are near the highest level since December 2014.

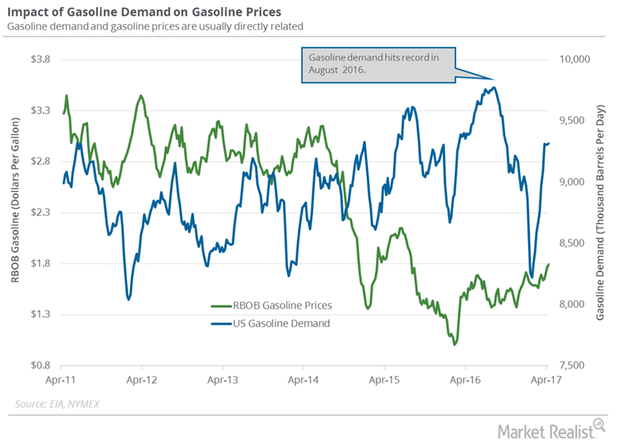

US Gasoline Demand: Bullish or Bearish for Oil Prices?

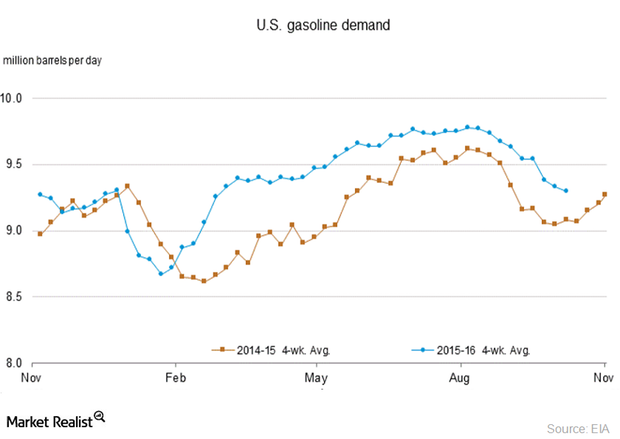

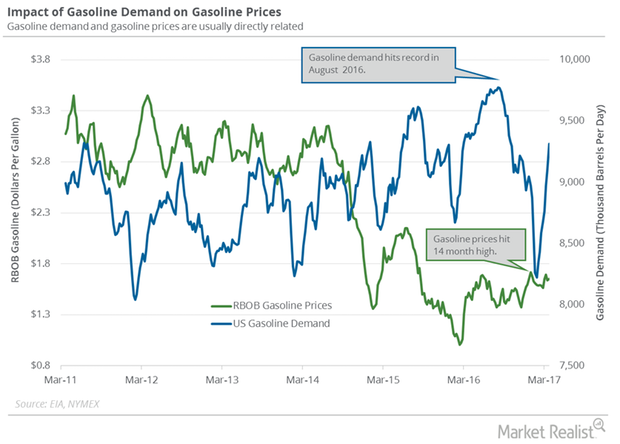

The EIA (U.S. Energy Information Administration) estimated that four-week average US gasoline demand rose by 6,000 bpd to 9,317,000 bpd on April 7–14.

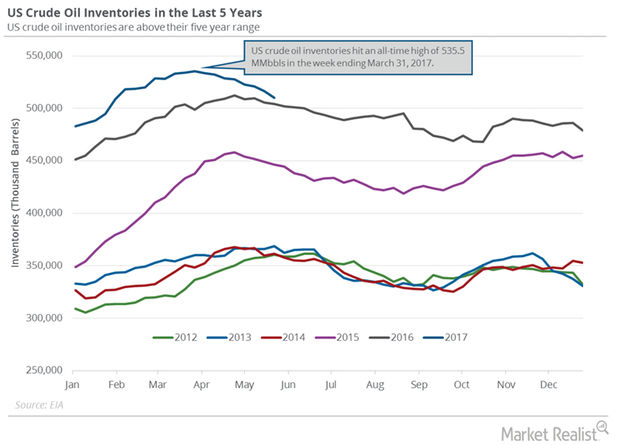

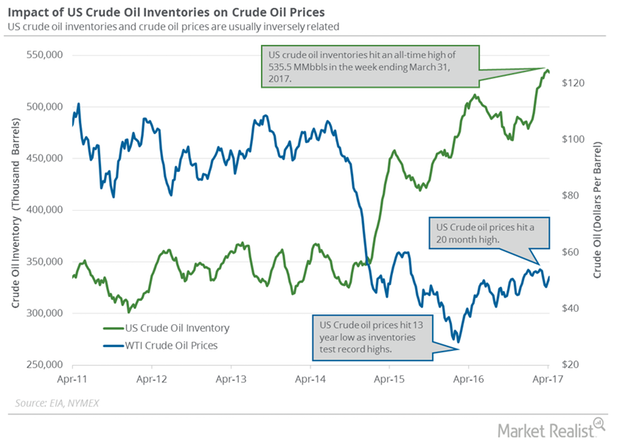

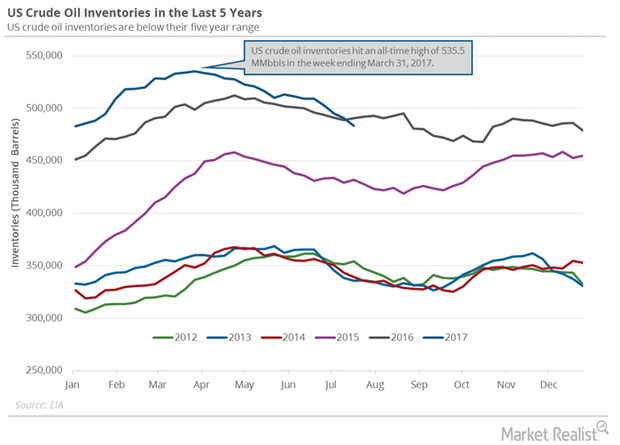

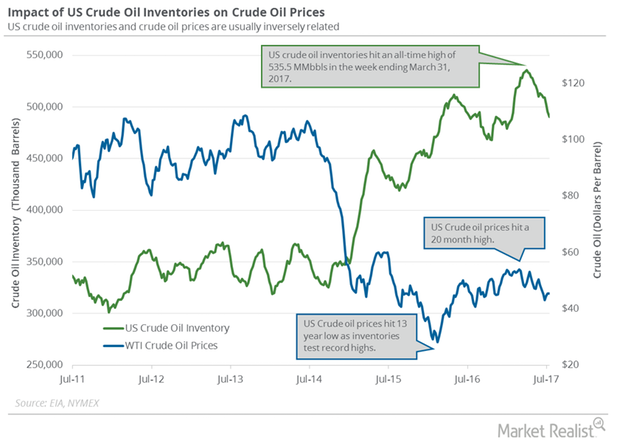

US Crude Oil Inventories: Lower than the Market’s Expectation

The EIA reported that US crude oil inventories fell by 6.4 MMbbls (million barrels) to 509.9 MMbbls on May 19–26, 2017.Financials Understanding the simple moving average in technical analysis

The simple moving average (or SMA) is an average of the closing price of a stock over a specified number of periods. The moving average smooths the short-term fluctuations in the stock prices.

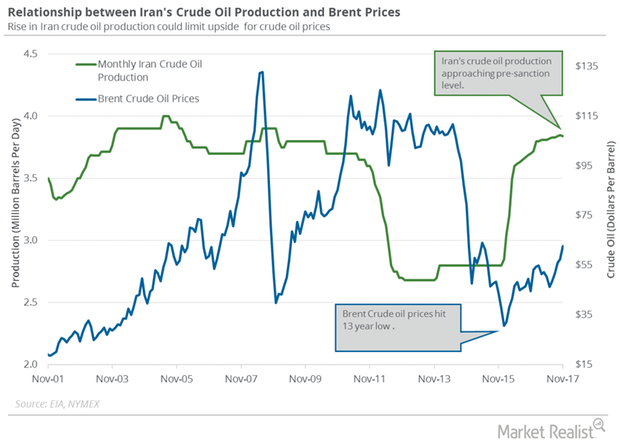

Geopolitical Tension Could Drive Brent and US Crude Oil Futures

Brent crude oil futures fell 0.7% to $49.61 per barrel on July 4, 2017. August WTI crude oil (XLE) (XOP) (PXI) futures contracts rose in electronic trading.

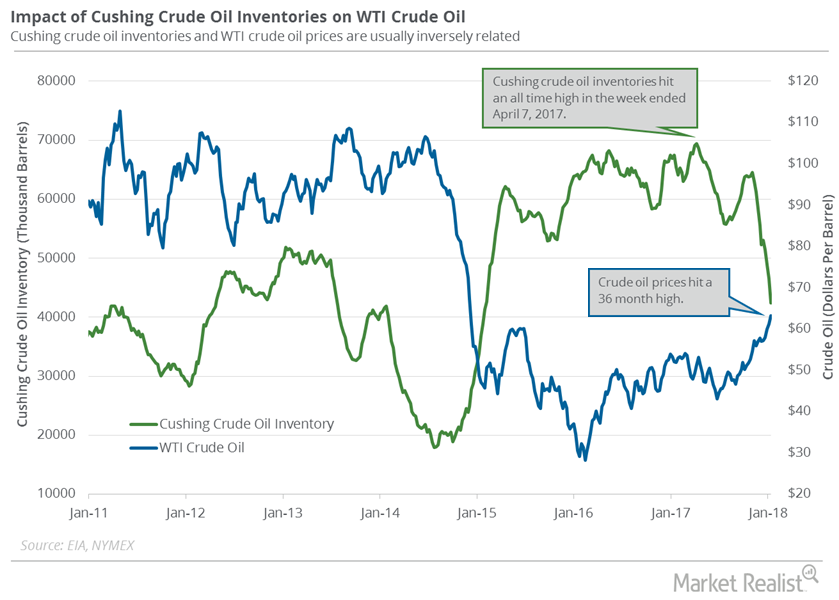

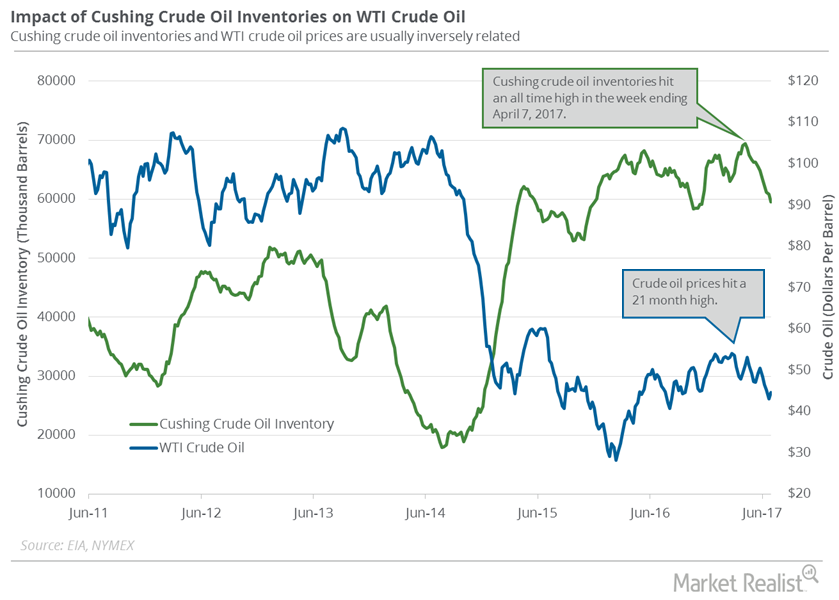

Cushing Inventories Hit January 2015 Low

A Bloomberg survey estimates that the crude oil inventories at Cushing could have declined by 2.3 MMbbls (million barrels) on January 12–19, 2018.

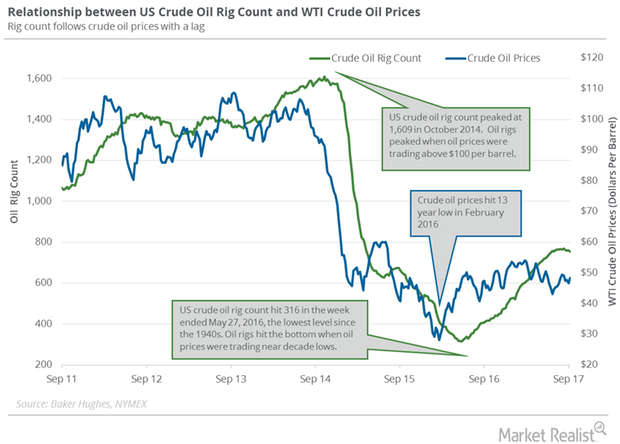

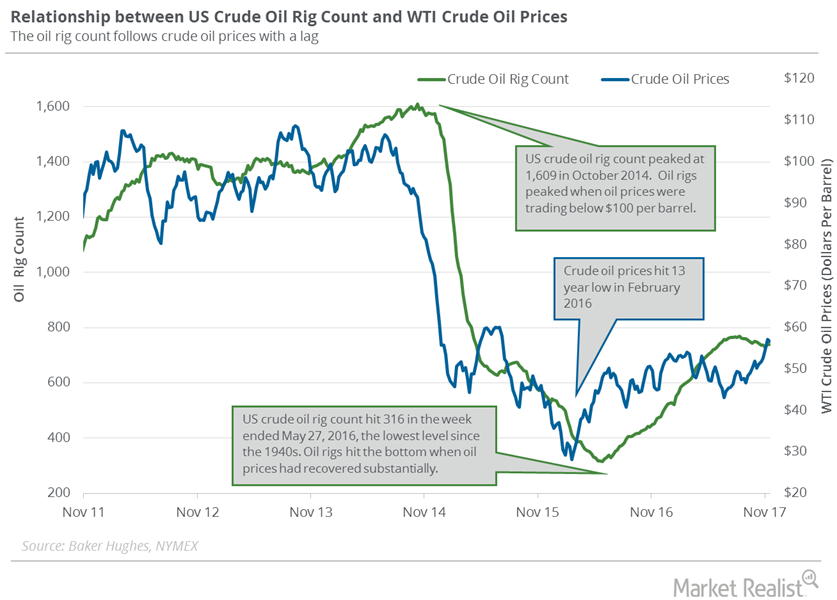

US Crude Oil Rig Count Could Be Slower in 4Q17

On September 29, 2017, Baker Hughes (BHI) reported that the US crude oil rig count rose by six to 750 on September 22–29, 2017.

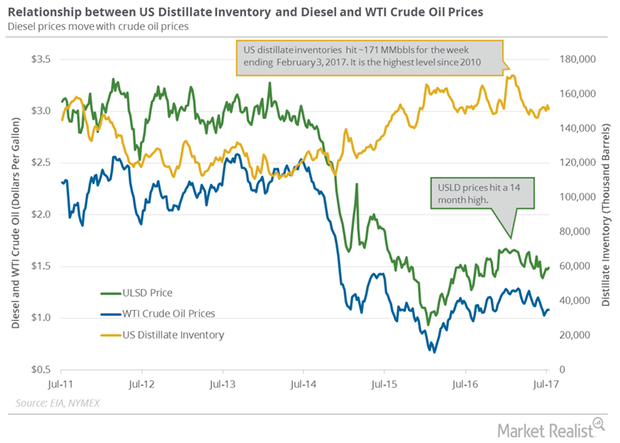

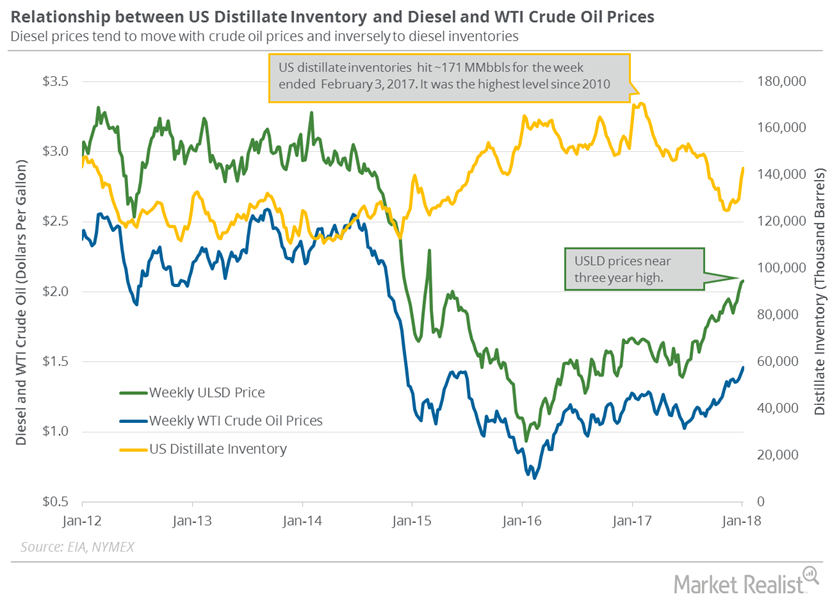

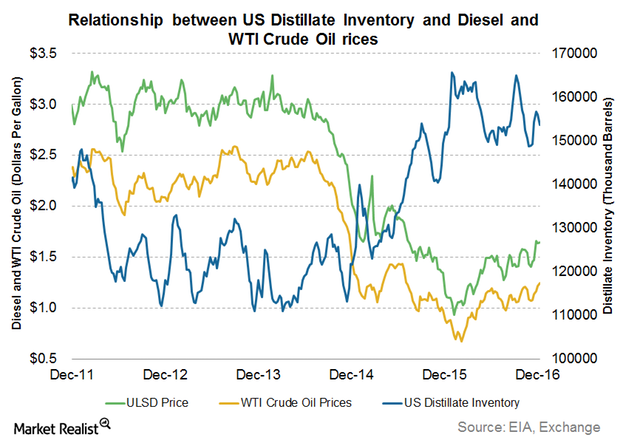

US Distillate Inventories Support Diesel and Crude Oil Futures

US distillate inventories fell for the third time in the last five weeks. Inventories fell 1.4% for the week ending July 14, 2017.

September US Gasoline Consumption Hits Record for This Time of Year

The EIA reported that the four-week average US gasoline demand fell by 36,000 bpd (barrels per day) to 9,296,000 bpd between September 30 and October 7, 2016.

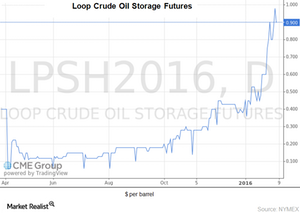

Crude Oil Storage Costs Rose 9 Times, US Crude Tests New Limits

Limited crude oil storage facilities caused crude oil storage costs to rise to $0.90 per barrel on February 9, 2016—compared to $0.10 per barrel in August 2015.

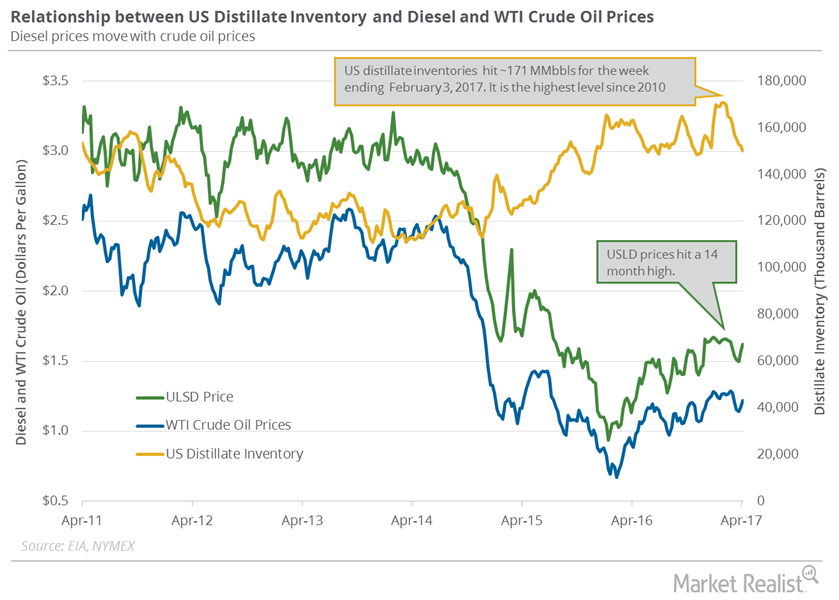

How US Distillate Inventories Affect Diesel and Oil Prices

The EIA (U.S. Energy Information Administration) reported that US distillate inventories fell by 2.2 MMbbls (million barrels) to 150.2 MMbbls between March 31 and April 7, 2017.

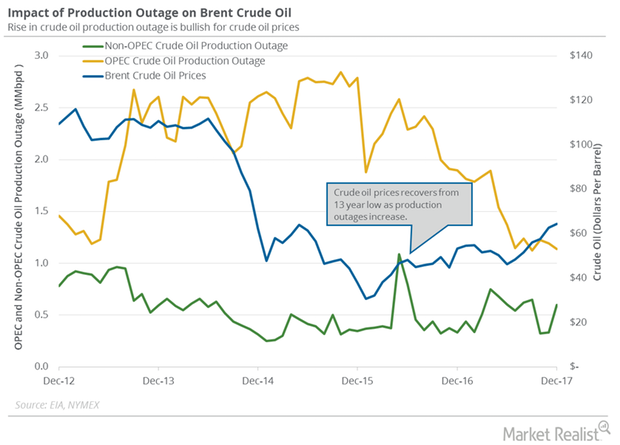

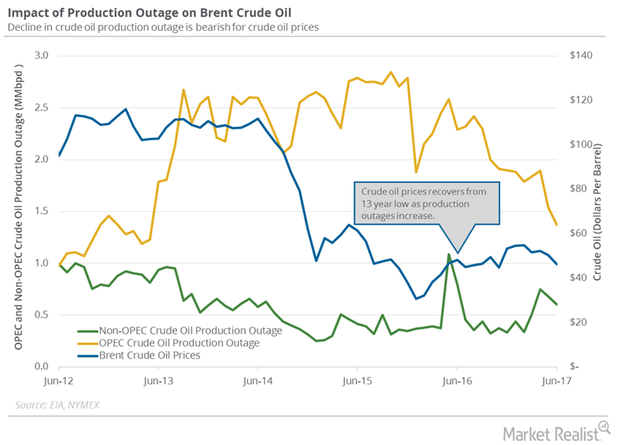

Global Crude Oil Supply Outages Are near a 4-Month High

Global crude oil supply outages increased by 208,000 bpd (barrels per day) to 1,738,000 bpd in December 2017—compared to the previous month.

Will the EIA’s Crude Oil Inventories Support Crude Oil Bulls?

On April 18, 2017, the API released its weekly crude oil inventory report. It reported that US crude oil inventories fell by 0.84 MMbbls from April 7–14.

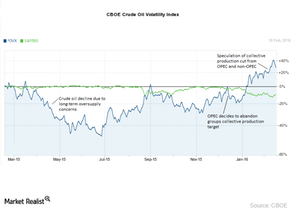

Why Did the Crude Oil Volatility Index Test a Record High?

The Crude Oil Volatility Index rose to the highest level in seven years on February 12, 2016. Crude oil’s price volatility started to dip in early December 2015.

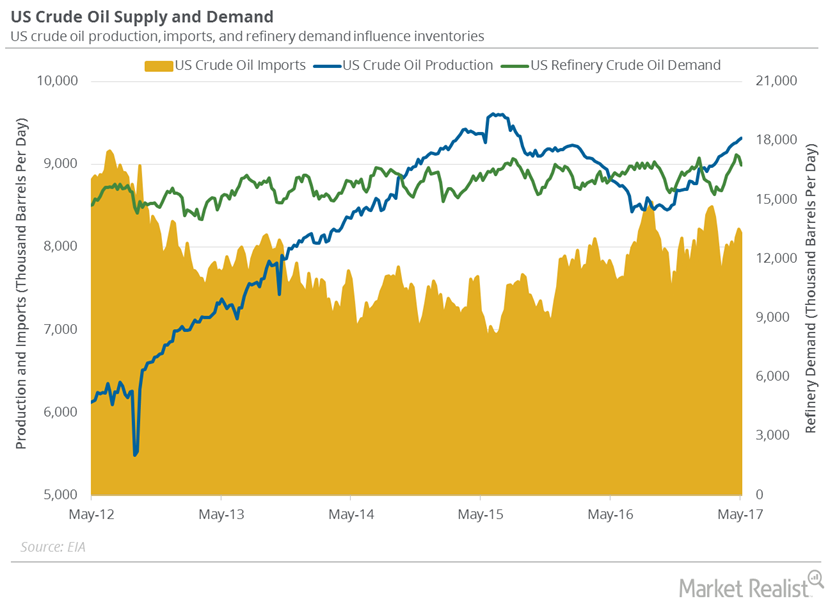

Fall in US Refinery Demand and Imports Impacted Inventories

US refineries operated at 91.5% of their operable capacity in the week ending May 5, 2017. The US refinery demand fell for the second consecutive week.

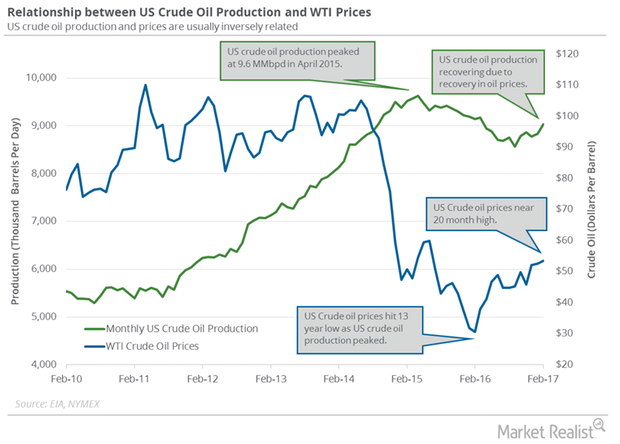

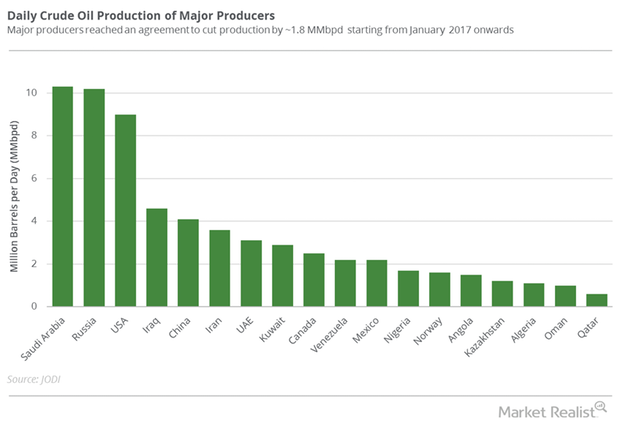

Could US Crude Oil Production Push Production Cut Deal Past 2017?

The EIA reported that monthly US crude oil production rose 196,000 bpd to 9.0 MMbpd in February 2017.

All Eyes on the OPEC and Non-OPEC Monitoring Meeting

September WTI (West Texas Intermediate) crude oil (RYE)(VDE)(UCO) futures contracts fell 2.5% to $45.77 per barrel on July 21, 2017.

Will Crude Oil Prices Hit a New High?

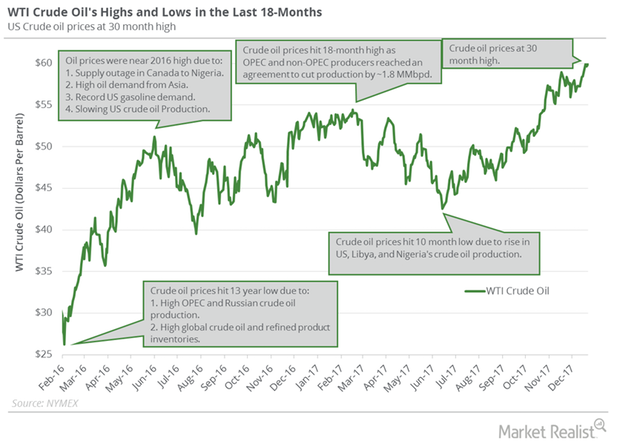

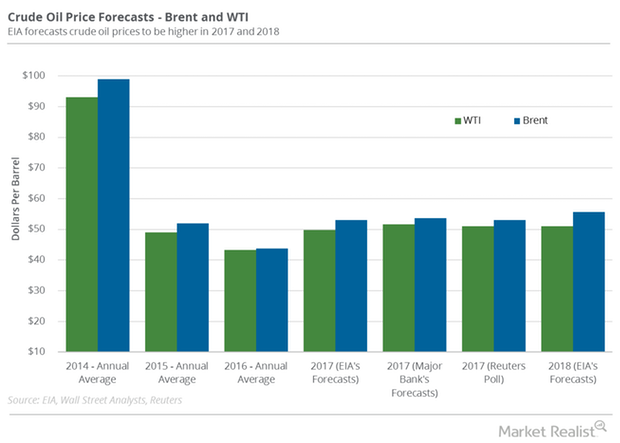

US WTI crude oil prices were at $54.45 per barrel on February 23—the highest level since June 2015. As of April 10, prices were 2.5% below their high.

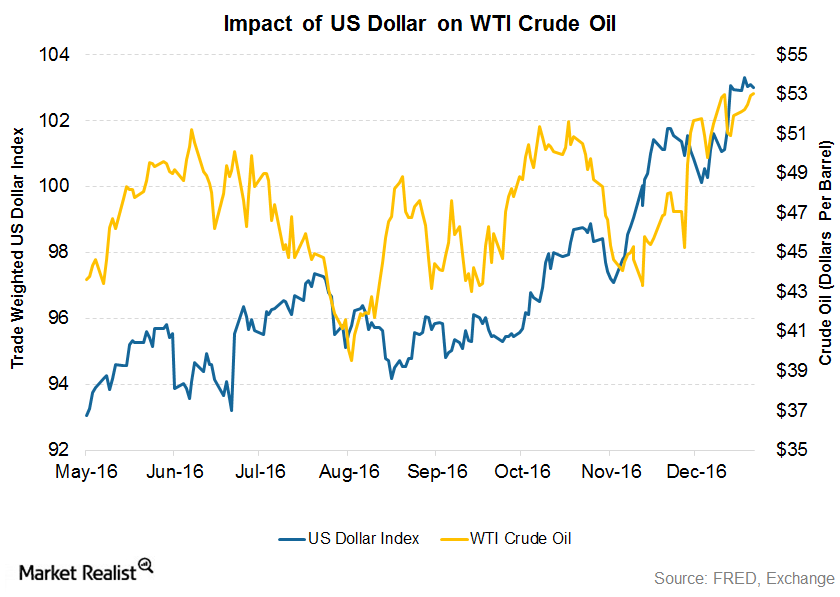

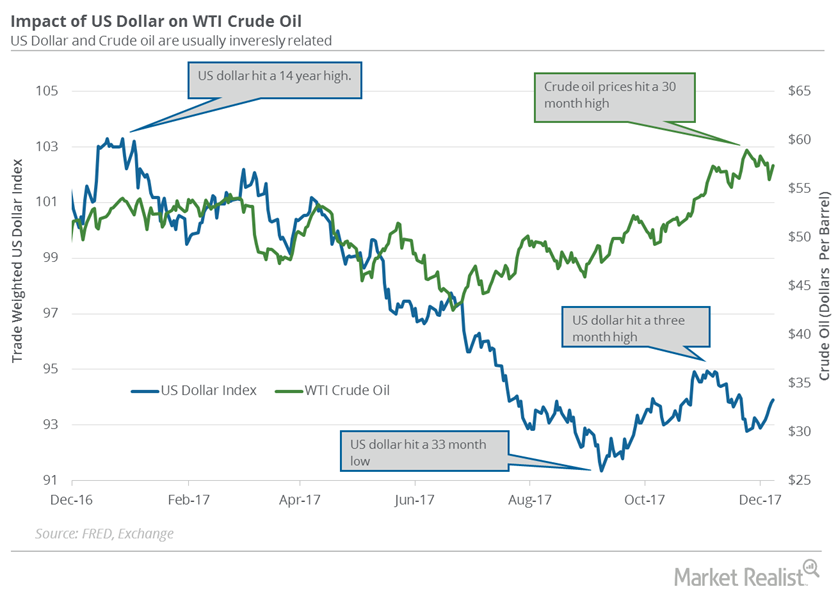

How Will the US Dollar Affect Crude Oil Prices in 2017?

February 2017 WTI (West Texas Intermediate) crude oil (PXI) (ERX) (USL) (ERY) futures contracts rose 0.1% and settled at $53 per barrel on December 23, 2016.

Will US Crude Oil Futures Test a 3-Year High?

US crude oil (USO) futures hit $60.73 per barrel in early morning trade on January 2, 2018—the highest level since June 2015.

Global Crude Oil Supply Outages Near 5-Year Low

The US Energy Information Administration estimates that global crude oil supply outages fell by 247,000 bpd (barrels per day) to 2.0 MMbpd (million barrels per day) in June 2017.

EIA Raises Estimates for US Crude Oil Production in 2018

The EIA (U.S. Energy Information Administration) reported that US crude oil production rose by 36,000 bpd (barrels per day) to 9,235,000 bpd between March 31 and April 7, 2017.

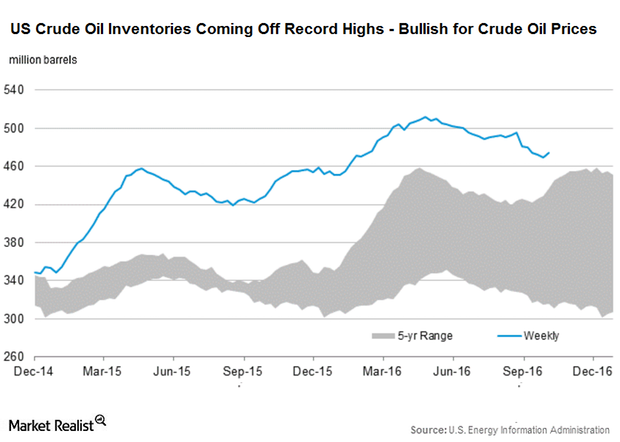

US Crude Oil Inventories Fell below the 5-Year Average

The EIA reported that US crude oil inventories fell by 7.2 MMbbls to 483.4 MMbbls on July 14–21, 2017. Inventories fell below the five-year range.

US Crude Oil Rigs Were Flat Last Week

Baker Hughes reported that US oil rig counts were flat at 738 on November 10–17, 2017. The rigs rose 63.3% from the same period in 2016.

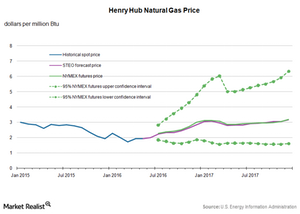

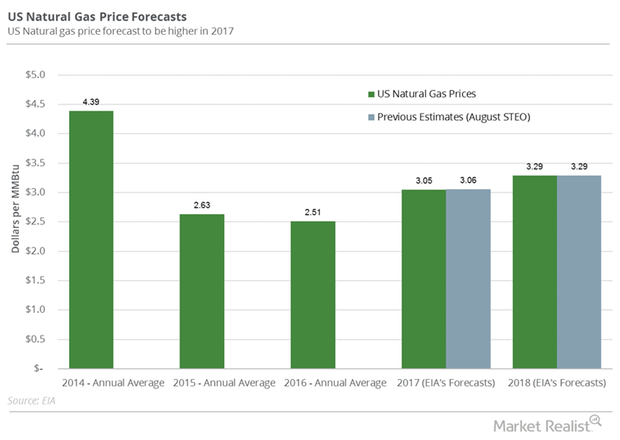

Natural Gas Prices Are Trading above Key Moving Averages

US natural gas inventories are 25% higher than their five-year average. High natural gas inventories could also limit the upside for US natural gas prices.

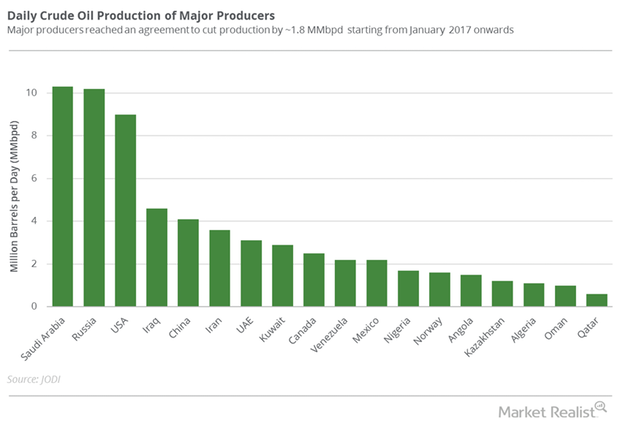

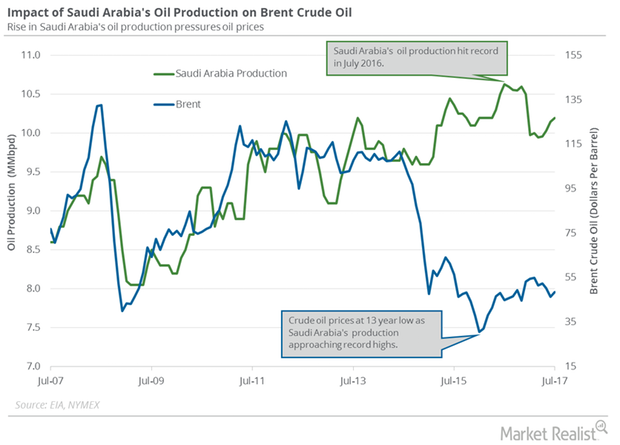

Will Saudi Arabia’s Production and Exports Support Crude Oil Futures?

The EIA (U.S. Energy Information Administration) estimates that Saudi Arabia’s crude oil production rose by 50,000 bpd (barrels per day) to 10.20 MMbpd (million barrels per day) in July 2017 compared to the previous month.

Crude Oil and Product Inventories Impact Crude Oil Futures

US crude oil futures have risen 6% from the ten-month low on June 21, 2017. Futures have also risen 2% in the last month.

Gold Prices Extend Rally on Depreciating Dollar

This is the fifth up day for gold prices in the last ten days. Prices increased by 0.72% more on the average up days than on the average down days over the last ten trading sessions.

US Crude Oil Production Could Hit a Record

The EIA reported that US crude oil production rose by 32,000 bpd (barrels per day) to 9,429,000 bpd on July 7–14, 2017. Production is at a two-year high.

Crude Oil Futures: What Could Drive Volatility This Week?

US crude oil (DWT) (UCO) futures hit $58.95 per barrel on November 24, 2017—the highest level in nearly three years.

Crude Oil Bear Market: Worst Case Scenarios for 2016

Goldman Sachs (GS) suggests crude oil prices could test $20 per barrel in a worst case scenario in 2016.

US Distillate Inventories Rose for the Seventh Time in 8 Weeks

US distillate inventories rose by 4.2 MMbbls (million barrels) to 143.1 MMbbls between December 29, 2017, and January 5, 2018.

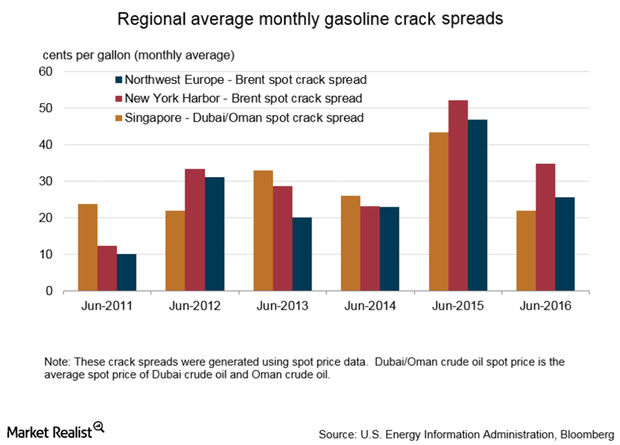

How Lower Refinery Margins Impact Crude Oil Prices

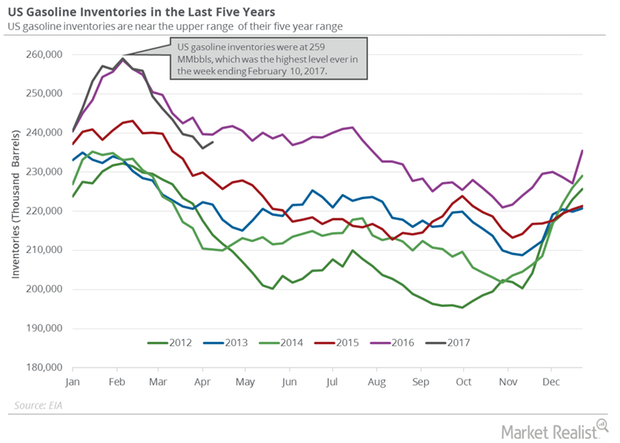

Gasoline production increased due to lower crude oil prices in 2015 and 1H16. This stemmed from higher refinery margins for oil refiners.

US Crude Oil Imports from Saudi Arabia Hit a 7-Year Low

US crude oil imports have fallen 4.5% YTD. US crude oil imports from Saudi Arabia are at a seven-year low at 524,000 bpd for the week ending July 14, 2017.

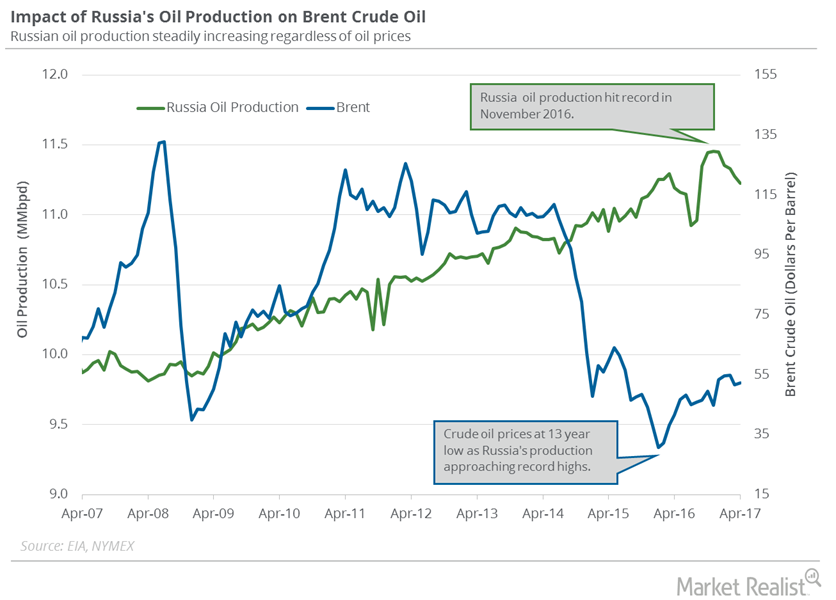

Russia Could Leave OPEC’s Production Cut Deal

Rosneft is Russia’s largest oil producer. On June 1, a Rosneft board member stated that Russia wouldn’t extend the production cut deal beyond March 2018.

Cushing Inventories: Lowest Level since November 2016

Cushing inventories could have fallen on June 30–July 7, 2017. Crude oil inventories at Cushing have fallen for the seventh straight week.

US Crude Oil Production Fell for the First Time since February

US crude oil production fell by 9,000 bpd to 9,305,000 bpd on May 5–12, 2017. Production fell 0.1% week-over-week, but rose 5.8% year-over-year.

FOMC Meeting Could Surprise Crude Oil Traders

US crude oil (UCO) (USL) futures contracts for January delivery rose 0.7% and were trading at $58.4 per barrel at 1:02 AM EST on December 12, 2017.Energy & Utilities Why the triple top and triple bottom patterns are important

The triple top pattern is formed in the uptrend. In this pattern, three consecutive peaks are formed. The peaks have roughly the same price level.

OPEC’s Monthly Report Could Pressure Oil Prices

OPEC will release its Monthly Oil Market Report on July 12, 2017. OPEC’s crude oil production rose in June 2017.

Energy Sector and Crude Oil Prices Helped the S&P 500

The S&P 500 rose ~0.7% to 2,733.01 on May 21 due to the rise in industrial stocks and crude oil prices—the highest level in more than two months.

US Diesel Futures Follow Crude Oil Prices

February 2017 NY Harbor ULSD futures fell and settled at $1.66 per gallon on December 21. Diesel futures fell despite the fall in distillate inventories.

Hedge Funds Cut Their Net Long Positions before OPEC’s Meeting

Hedge funds cut their net bullish positions on US crude oil futures and options by 5,872 contracts or 1.7% to 343,840 contracts on November 14–24, 2017.

US Distillate Inventories Fell for the Tenth Straight Week

The EIA (U.S. Energy Information Administration) reported that US distillate inventories fell by 2 MMbbls to 148.3 MMbbls on April 7–14, 2017.

Will the OPEC and Non-OPEC Meeting Drive Crude Oil Futures?

September WTI (West Texas Intermediate) crude oil (RYE) (VDE) (UCO) futures contracts rose 1.1% to $49.58 per barrel on August 4, 2017.

US Gasoline Demand: Key Crude Oil Driver in 2017

The EIA estimated that four-week average US gasoline demand rose by 210,000 bpd (barrels per day) to 9,312,000 bpd from March 17–24, 2017.

How Hedge Funds Feel about Natural Gas Right Now

On September 29, the CFTC (U.S. Commodity Futures Trading Commission) is slated to release its weekly “Commitment of Traders” report.

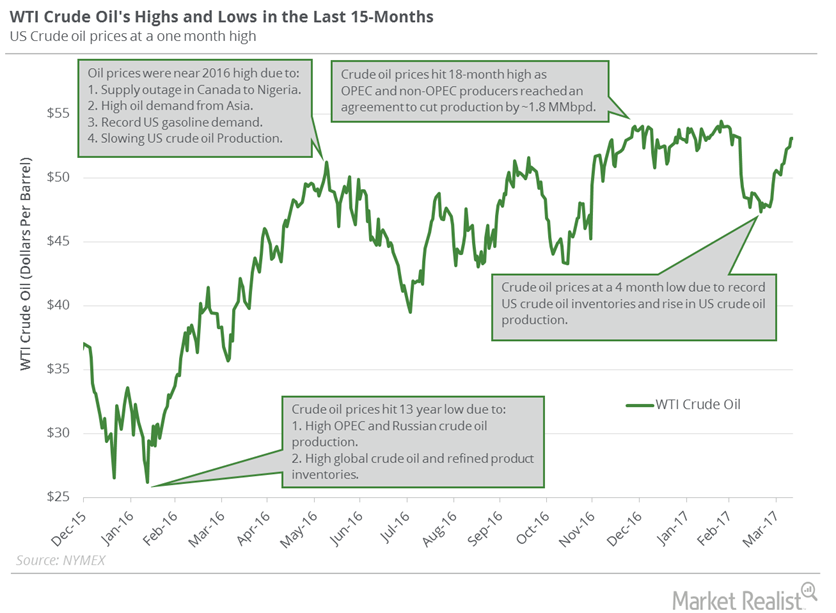

US Crude Oil Prices Are Trading Near a 2016 High!

November WTI (West Texas Intermediate) crude oil futures contracts rose 0.5% and settled at $50.44 per barrel on October 13.