Gordon Kristopher

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Gordon Kristopher

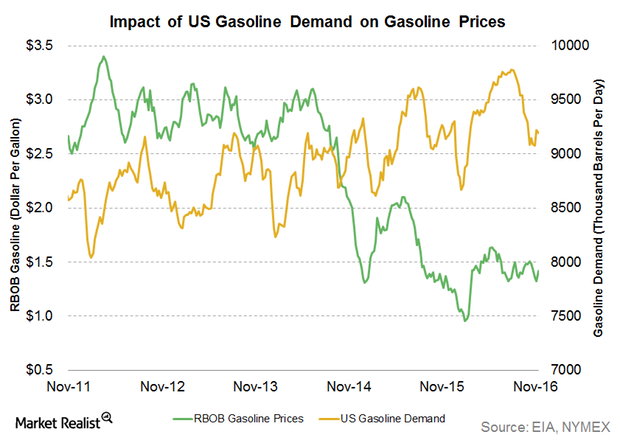

Gasoline Demand Impacts Crude Oil and Gasoline Prices

US gasoline prices hit $1.14 per gallon on February 8, 2016—the lowest in 12 years. As of November 29, 2016, prices rose 21.1% from their lows in February.

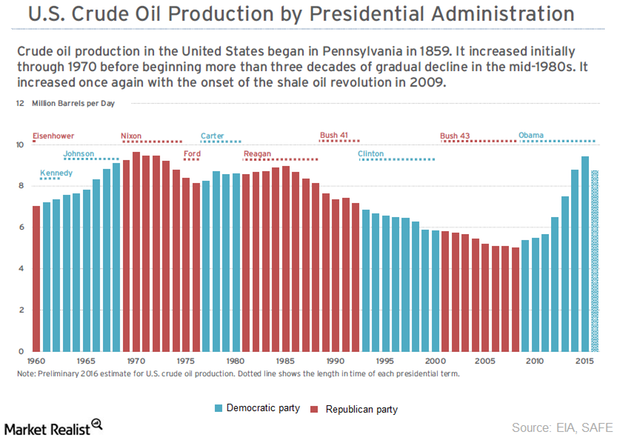

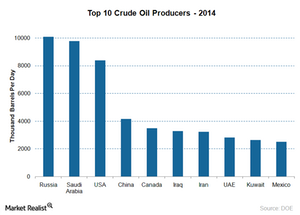

How Political Parties Impact US Crude Oil Production

Under President Obama’s tenure, US crude oil production rose 92% and peaked at 9.6 MMbpd (million barrels per day) in June 2015.

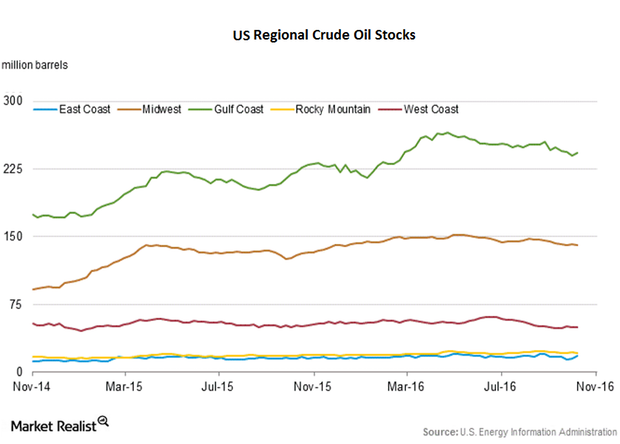

Analyzing US Crude Oil Inventories by Region: The Latest

The EIA divides the United States into five storage regions. Let’s assess the changes in crude oil inventories for these regions between September 30 and October 7.

This Week’s Energy Calendar for the Crude Oil and Gas Market

Volatility in crude oil prices impacts the earnings of oil and gas producers such as Northern Oil & Gas (NOG), Comstock Resources (CRK), Swift Energy (SFY), and Triangle Petroleum (TPLM).

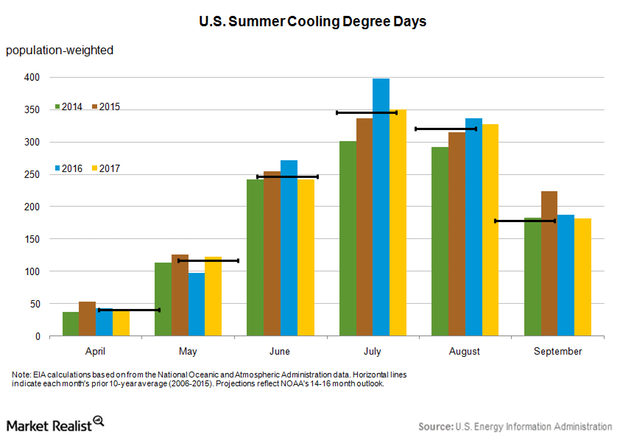

Why Did Natural Gas Prices Fall to 2-Month Lows?

Natural gas futures contracts for September delivery fell by 0.4% and settled at $2.55 per MMBtu on August 11. Natural gas prices tested two-month lows.

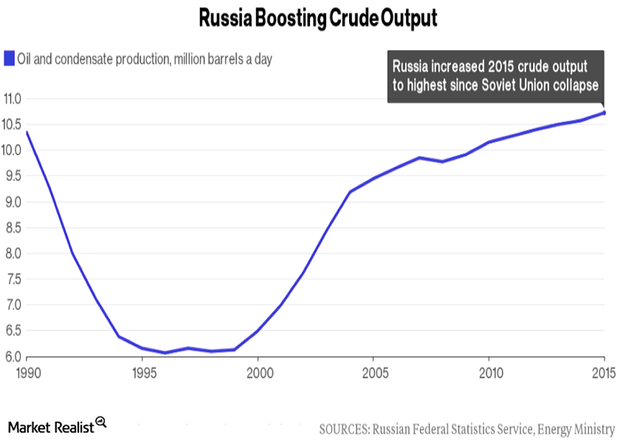

Russia’s Crude Oil Production Will Pressure the Crude Oil Market

Russia’s crude oil production rose to 10.84 MMbpd in June 2016—compared to the previous month—according to sources from the Russian Energy Ministry.

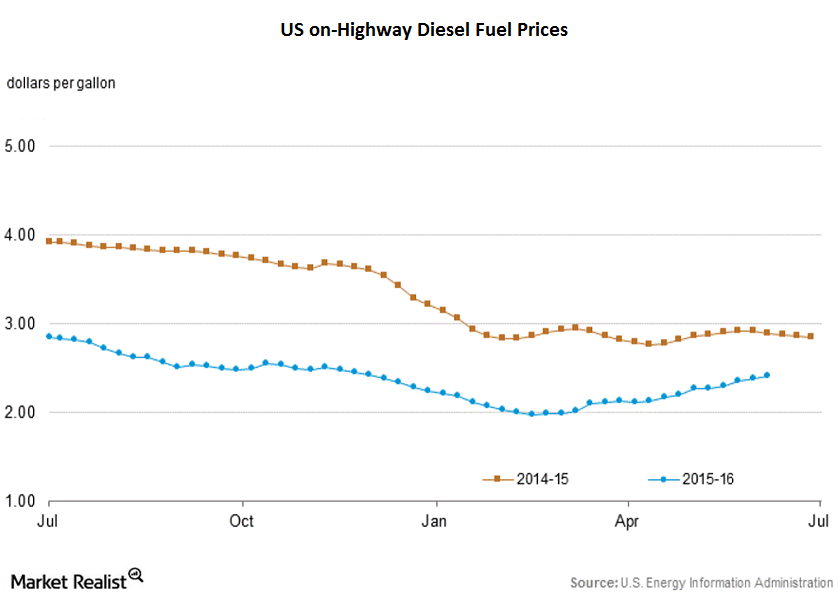

US On-Highway Diesel Fuel Prices Hit Fresh 2016 Highs

The EIA reported that US on-highway diesel fuel prices rose by 0.8% week-over-week and closed at $2.40 per gallon on June 6, 2016.

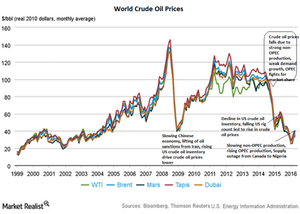

Why Did Crude Oil Prices Diverge before OPEC’s Meeting?

July WTI (West Texas Intermediate) crude oil futures contracts trading in NYMEX fell by 0.47% and settled at $49.1 per barrel on Tuesday, May 31, 2016.

How Will China and India Impact the Crude Oil Market in 2016?

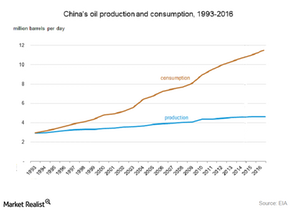

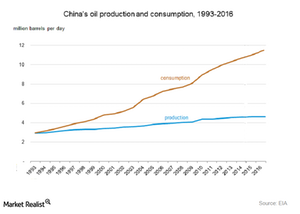

China’s crude oil production fell to the lowest level in four years. It fell by 5.6% YoY (year-over-year) to 16.6 metric tons in April 2016.

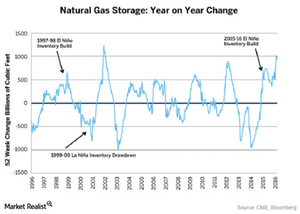

How Do El-Niño and La-Nina Impact Natural Gas Prices?

When El-Niño occurs, it keeps the sea surfaces warmer. This causes milder-than-normal cold temperatures across the sea and some parts of the US.

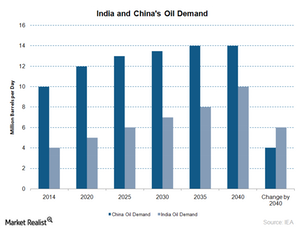

India’s Crude Oil Demand Will Likely Drive the Crude Oil Market

The EIA reported that India produced 1 MMbpd (million barrels per day) of crude oil in 2014 and 2015. It’s expected to increase marginally in 2016 and 2017.

China Crude Imports Hit Record: How Will It Affect Global Market?

The slowing Chinese crude oil production and robust demand from teapot refineries will lead to a 4% rise in Chinese crude oil imports.

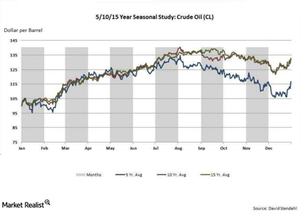

How Seasonality Impacts Crude Oil Prices

Seasonality plays a key role in influencing crude oil prices. Crude oil prices tend to rise in August due to the summer driving season, which results in a rise in gasoline demand.

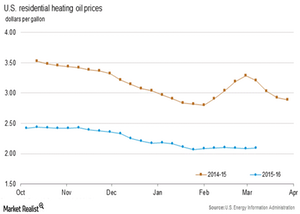

Why Did Heating Oil and Diesel Fuel Prices Rise?

US on-highway diesel fuel prices rose by 2% and were at $2.02 per on March 7, 2016. The current diesel prices are 46% lower than they were a year ago.

Crude Oil Supply and Demand Gap: Will It Narrow or Widen?

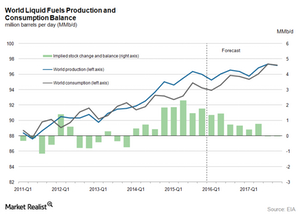

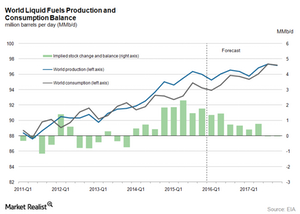

The consensus of slowing US crude oil production will continue to narrow the supply and demand gap as long as demand stays steady.

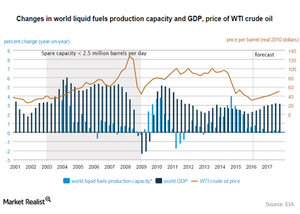

How Global Gross Domestic Product Affects Crude Oil Prices

The IMF (International Monetary Fund) forecasts that the world economy will grow by 3.4% in 2016 and 3.6% in 2017.

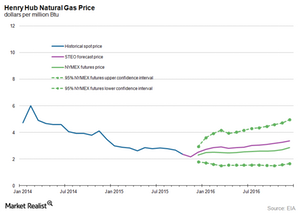

What’s the Long-Term Forecast for Natural Gas Prices?

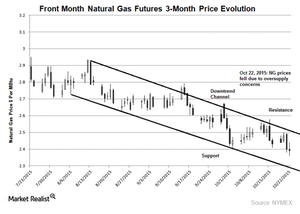

US natural gas prices have fallen for the third time in the last five trading sessions. Prices are following the long-term bearish trend and trading close to 16-year lows.

Why Is There a Crude Oil Supply and Demand Gap in 2016 and 2017?

The EIA estimates the global crude oil supply and demand gap to average 1 MMbpd in 2016 and 0.2 MMbpd in 2017. It reported that global consumption should grow 1.2 MMbpd in 2016 and 1.5 MMbpd in 2017.

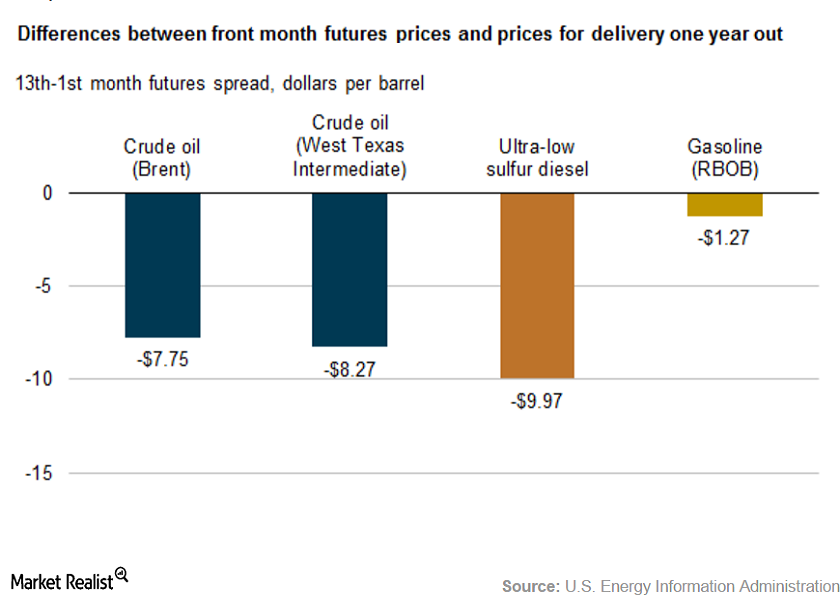

How Traders Benefit from the Crude Oil Contango Market

The EIA estimates that contango trade will be unviable until contango conditions reach $10–$12 per barrel. Citigroup suggests that if oil prices fall below $30 per barrel, it will be unviable to store crude oil at sea.

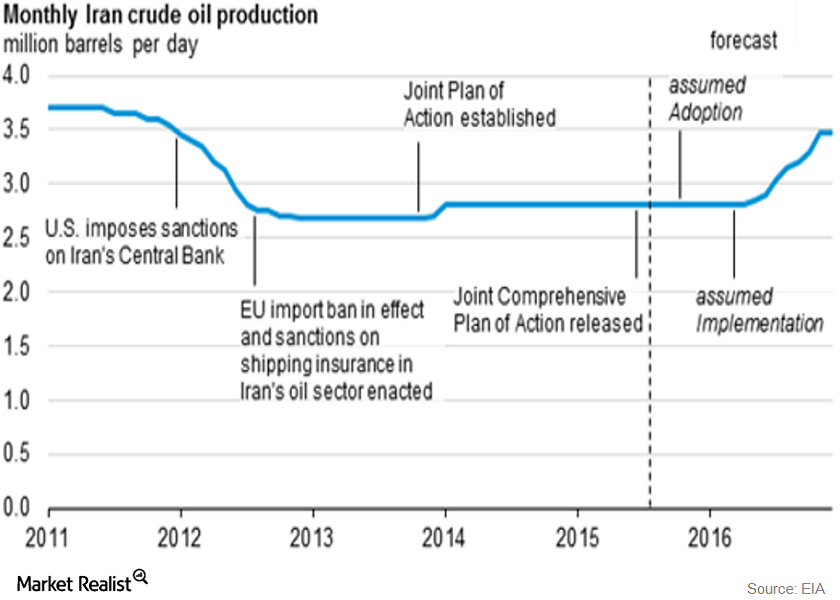

Iran’s Oil Sanctions Lifted: Brent Oil Prices Feel the Heat

Thus, Iran’s Western oil sanctions were lifted on Saturday, January 16, 2016. On Sunday, January 17, Iran stated that it would increase its crude oil production by 500,000 bpd (barrels per day) as soon as possible.

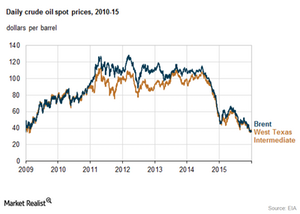

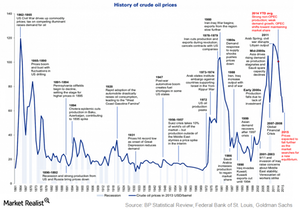

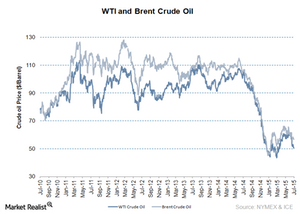

WTI and Brent Crude Oil Prices in 2015, Lowest since 2009

US benchmark WTI crude oil prices averaged at $49 per barrel in 2015. WTI and Brent crude oil prices closed below $40 per barrel in 2015.

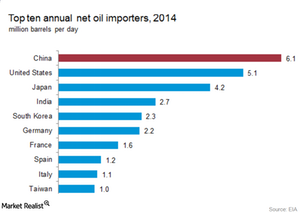

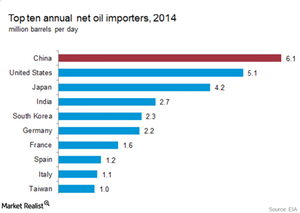

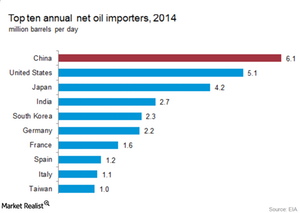

Top Crude Oil Importers’ Role in 2016

China and the United States are the largest crude oil importers in the world. In 2015, they consumed about 30.5 MMbpd (million barrels per day) of crude oil and liquid fuels, per the EIA.

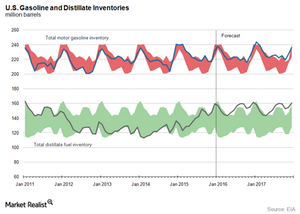

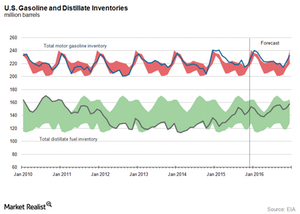

Gasoline and Distillate Inventories Overshadow Crude Oil Market

The EIA (U.S. Energy Information Administration) reported that the US gasoline inventory rose by 8.4 MMbbls to 240.4 MMbbls for the week ending January 8, 2016.

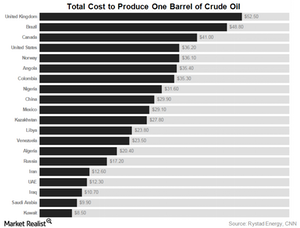

Crude Oil’s Total Cost of Production Impacts Major Oil Producers

OPEC members Nigeria, Libya, and Venezuela have the highest total cost of producing crude oil at $31.6 per barrel, $23.80 per barrel, and $23.50 per barrel.

Will the Gasoline and Distillate Inventory Pressure Crude Oil Prices?

The API (American Petroleum Institute) published its weekly crude oil, gasoline, and distillate inventory report on January 12, 2016.

China’s Crude Oil Imports: Bright Spot in 2016 Oil Market?

Market estimates from Bloomberg suggest that China’s crude oil imports in 2016 may rise by 8% to 7.2 MMbpd (million barrels per day).

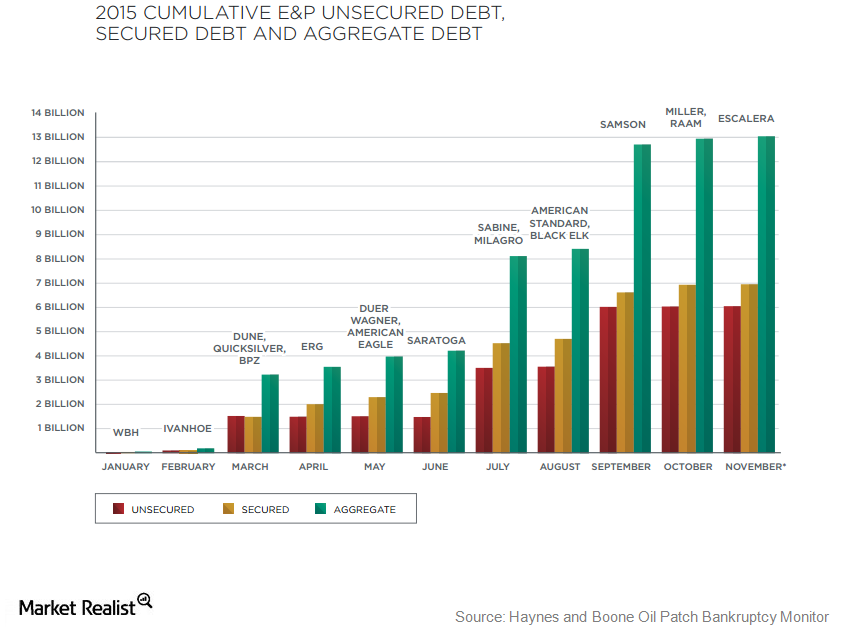

US Oil and Gas Companies’ Debt Exceeds $200 Billion

US oil and gas exploration and production companies are under severe pressure.

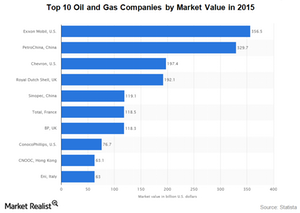

Bearish Crude Oil Market Has Put $5 Trillion at Risk

The depressed energy market has erased just over $1 trillion of market capitalization from oil and gas companies around the globe.

Why Roller Coaster Crude Oil Prices Are Nothing New

Crude oil prices like any other commodity are subject to changes based on the supply and demand dynamics.

How Top Crude Oil Producers Impact the Crude Oil Market

The world’s largest producer of crude oil is Russia. It is also among the largest crude oil exporters.

How Top Crude Oil Consumers Influence the Crude Oil Market

The US and China are the top oil consuming countries in the world. The demand from the US is expected to be robust in 2016.

How OPEC’s Crude Oil Reserves Affect the Crude Oil Market

OPEC countries control 40% of global crude oil production and have around 81% of global crude oil reserves, as of 2014.

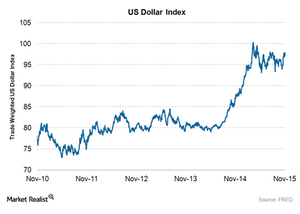

How Does the US Dollar Index Influence Crude Oil Prices?

Crude oil and the US Dollar Index are inversely related. The appreciation of the US dollar will negatively influence crude oil prices.

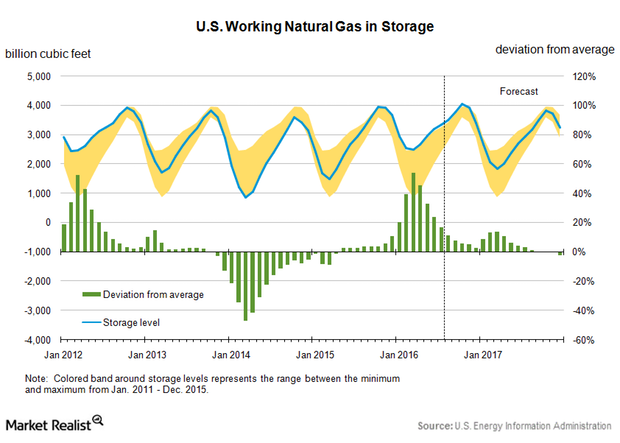

Will Natural Gas Prices Hit New Lows?

Cold winter weather could drive natural gas prices higher. But on the other hand, record natural gas stocks will push natural gas prices lower.

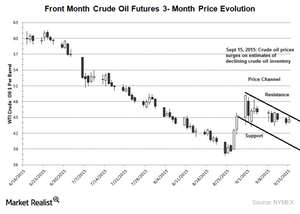

Crude Oil Prices Are Trading in a Downward Trending Range

October WTI crude oil futures rose for the first time after falling for two consecutive days. Slowing US crude oil production is driving crude oil prices.

Brent and WTI Crude Oil Prices Widen in the Depressed Oil Market

August WTI crude oil futures contracts fell by $0.74 and closed at $50.15 per barrel on July 20. Brent fell by $0.45 and settled at $56.65 at the close of trade.

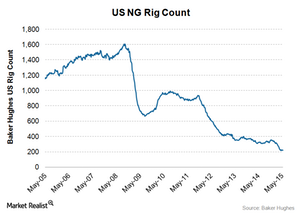

Natural Gas Rig Count Increases: Gas Prices Continue to Rise

On May 15, 2015, Baker Hughes (BHI) reported that natural gas rigs increased slightly by two to 223 for the week ending May 15.