China Crude Imports Hit Record: How Will It Affect Global Market?

The slowing Chinese crude oil production and robust demand from teapot refineries will lead to a 4% rise in Chinese crude oil imports.

April 19 2016, Updated 11:07 a.m. ET

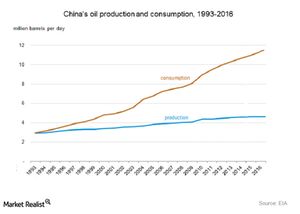

China crude oil production is expected to slow down

China’s crude oil production averaged 4.3 MMbpd (million barrels per day) in 2015. The country’s production is 2.8% higher than it was in 2014 as per the PetroChina (PTR) sources. China’s crude oil production is expected to slow down by 5% in 2016 due to lower crude oil prices. PetroChina is one of the largest oil producers in China. Its crude oil production is expected to decline by 2.6% in 2016 due to lower oil prices. To learn more, read Crude Oil’s Total Cost of Production Impacts Major Oil Producers. As a result of lower oil prices, production at the old oilfields wasn’t economical.

China’s crude oil imports

China is the second-largest crude oil consumer in the world after the US. It’s also one of the largest crude oil importers along with the US. China’s General Administration of Customs reported that China imported 7.3 MMbpd (million barrels per day) of crude oil in 1Q16, which is 6% more than 4Q15 and 13% more than 1Q15. However, crude oil imports fell by 4% in March 2016 compared to February 2016 to 7.7 MMbpd.

The key drivers for China’s crude oil imports are as follows:

- The rise in demand from Chinese teapot refineries led to the rise in China’s crude oil imports in 2015. Demand is expected to rise in 2016 due to frozen retail fuel prices despite lower crude oil prices.

- Building strategic reserves in China also led to the rise in crude oil imports. China increased its strategic reserves by 100 MMbbls (million barrels) in 2015, which is expected to increase its strategic crude oil reserves by 60 MMbbls in 2016.

- China’s exports in March hit their highest level so far in 2016, which suggests a stabilizing economy.

- Multiyear low crude oil prices motivated refiners to import more crude oil.

Crude oil demand forecasts for 2016

The slowing Chinese crude oil production and robust demand from teapot refineries will lead to a 4% rise in Chinese crude oil imports. Market surveys suggest that China’s crude oil imports could rise by 6.2% in 2016 compared to 2015. The devaluation of the Chinese yuan could also make crude oil expensive and hamper demand.

The volatility in crude oil prices impacts Chinese oil producers like PetroChina (PTR), CNOOC (CEO), and China Petroleum & Chemical (SNP). Prices also impact US oil producers like Cimarex (XEC), Denbury Resources (DNR), and Goodrich Petroleum (GDP). Plus, they also influence ETFs and ETNs like the ProShares UltraShort Bloomberg Crude Oil ETF (SCO), the Direxion Daily Energy Bull 3x Shares ETF (ERX), the iShares U.S. Oil Equipment & Services ETF (IEZ), and the VelocityShares 3x Inverse Crude Oil ETN (DWTI).

Read the next part of this series to learn more about the crude oil price forecast.