CNOOC Ltd

Latest CNOOC Ltd News and Updates

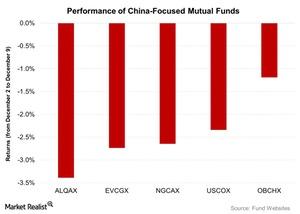

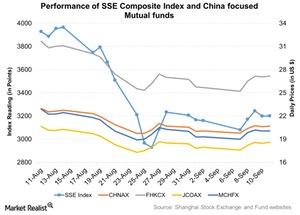

SSE Composite Index Falls despite China’s New IPO System

The SSE Composite Index fell by 1.8% from December 2 to December 9 and closed at 3,472.44 on December 9, 2015.

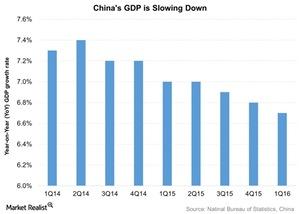

When China Sneezes, the World Catches a Cold!

China is the world’s second-largest economy. Its economy started going downhill due to sluggish global demand. This impacted its trading partners.

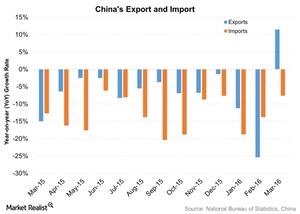

China’s Exports Jump: Can the Growth Be Maintained?

According to the General Administration of Customs, China’s exports, in US dollar terms, jumped 11.5% YoY (year-over-year) in March.

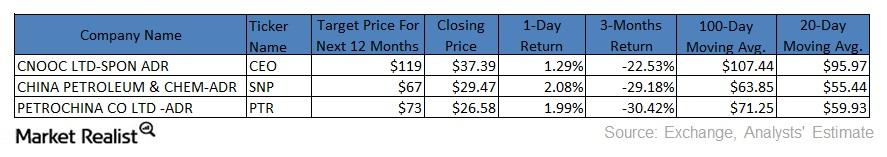

Moving Average Analysis of Chinese Energy Companies

Chinese energy companies CNOOC, China Petroleum & Chemical, and PetroChina Company have fallen below their 100-day and 20-day moving averages.

Turbulence in China’s Stock Market

Due to recent stock market turbulence in China’s stock market, the SSE (Shanghai Stock Exchange) Composite Index was down 22.7% month-over-month and ended at 3,200.23 points on September 11.