Gordon Kristopher

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Gordon Kristopher

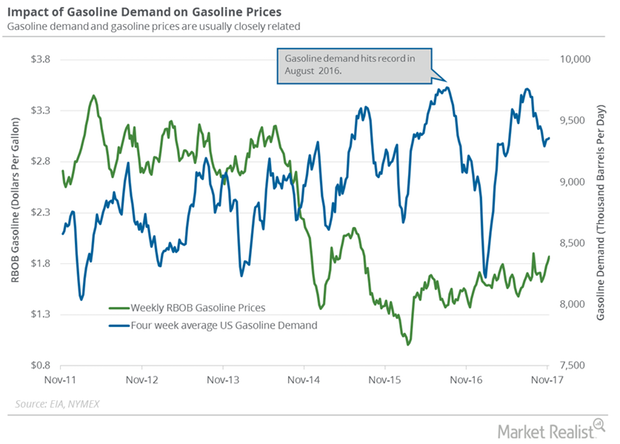

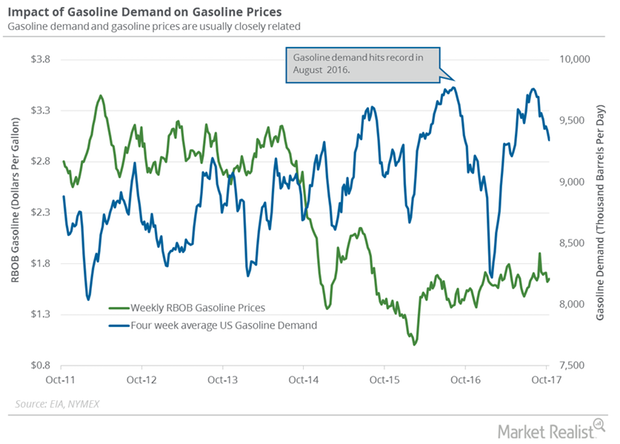

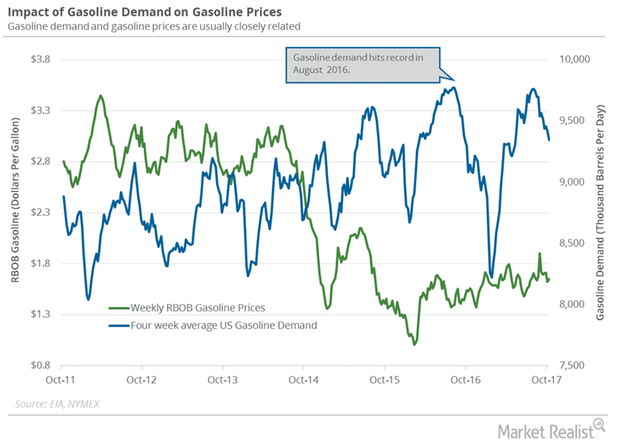

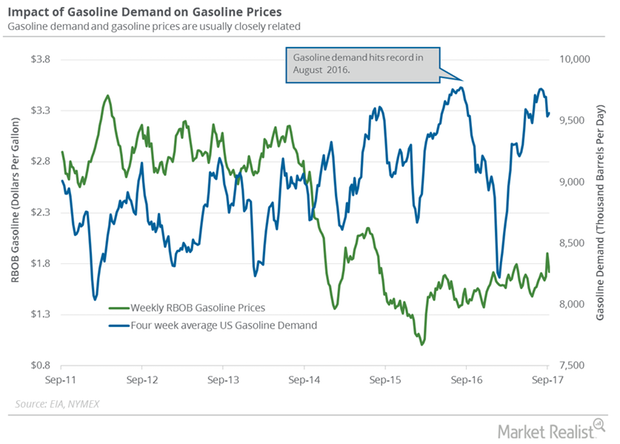

US Gasoline Demand Hit a Record in October 2017

According to the API, US gasoline demand averaged 9,300,000 bpd (barrels per day) in October 2017. It was the highest level ever.

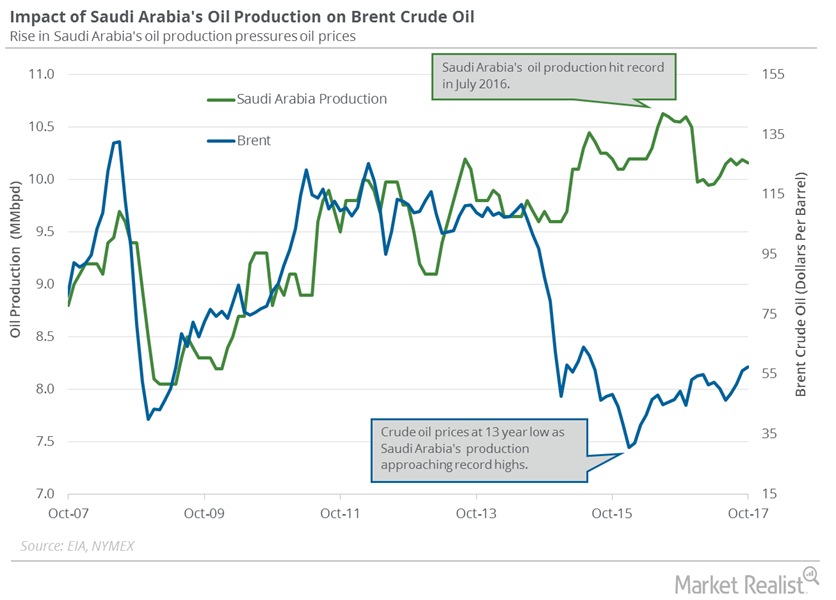

Saudi Arabia Could Help the Global Oil Market

Saudi Arabia’s crude oil exports to the US fell to 525,000 bpd in October 2017—the lowest in 30 years. Exports fell due to ongoing output cuts.

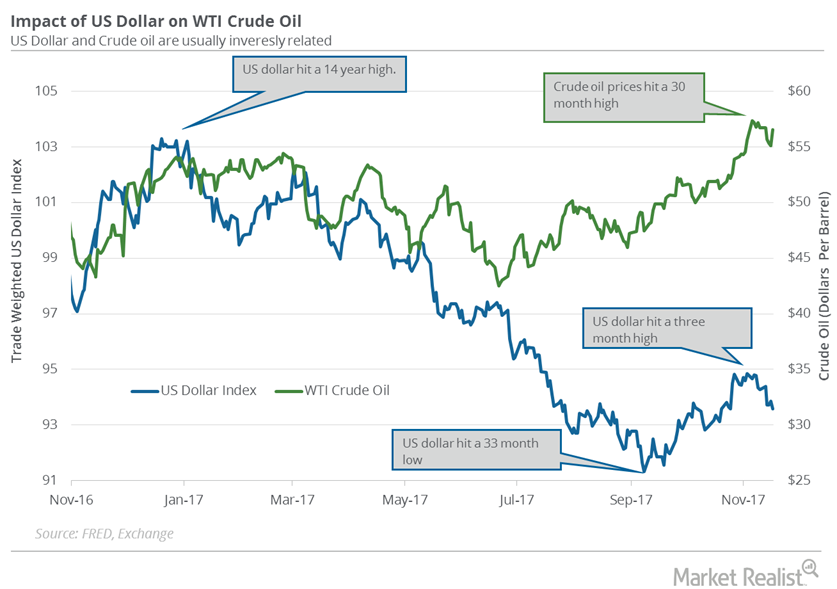

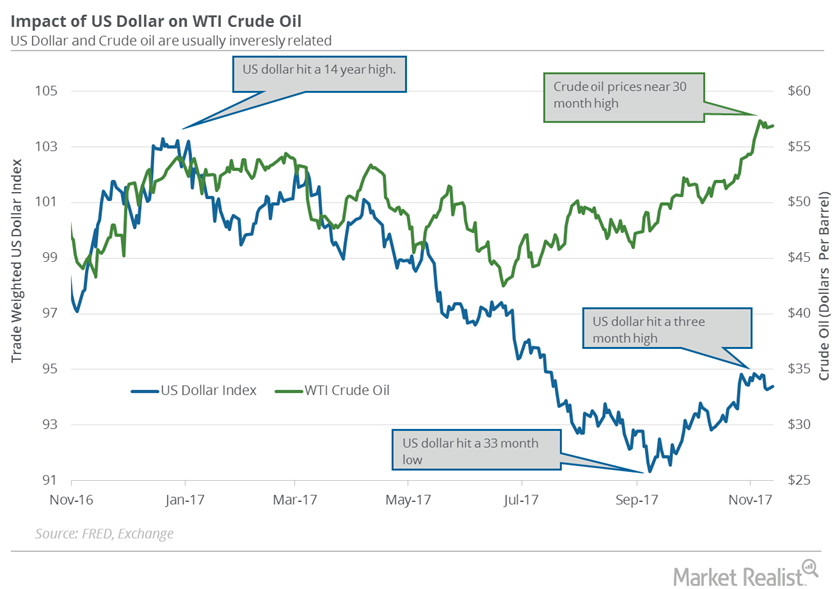

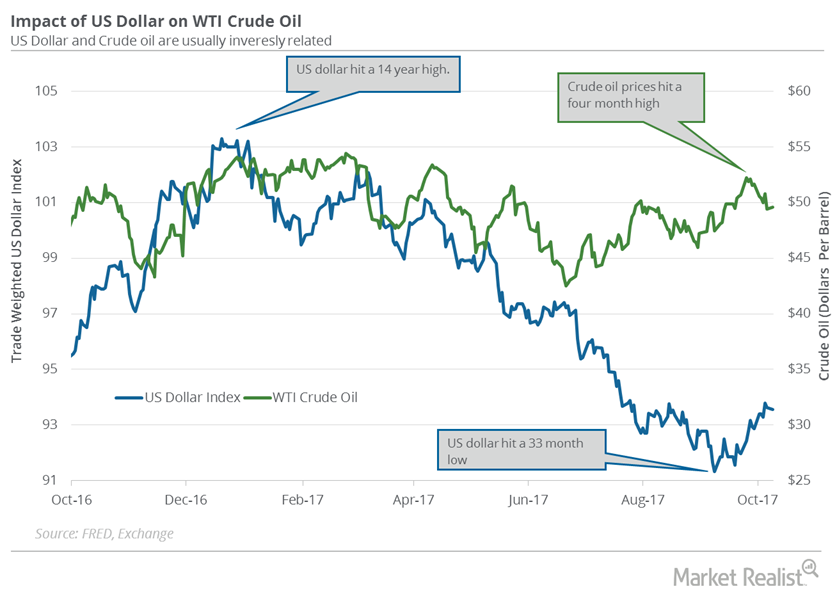

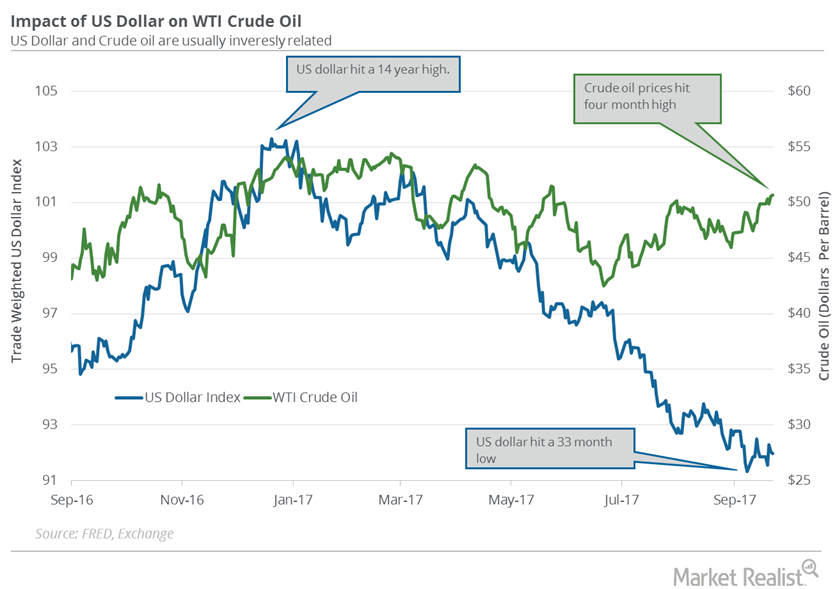

US Dollar Could Benefit Crude Oil Futures This Week

The US Dollar Index fell 0.3% to 94.4 on November 17, 2017. It supported US crude oil (DBO) (SCO) prices on the same day.

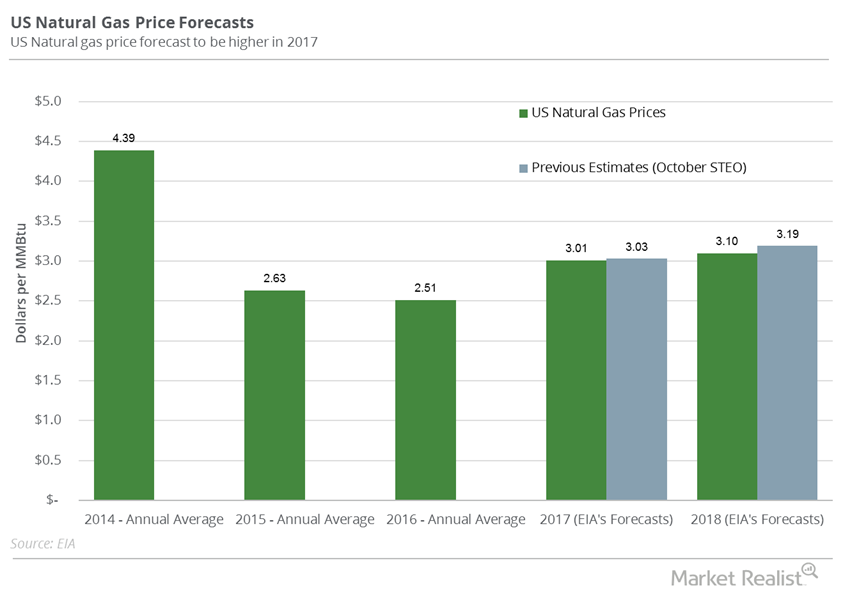

US Natural Gas Futures Might Continue to Fall Next Week

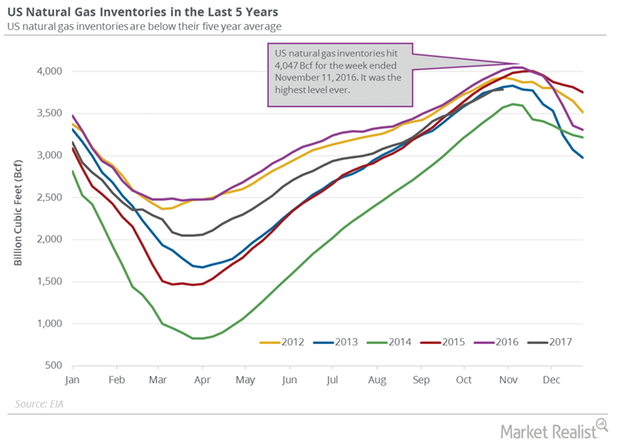

December natural gas (GASL) (BOIL) futures were below their 50-day and 100-day moving averages of $3.12 per MMBtu and $3.16 per MMBtu on November 16, 2017.

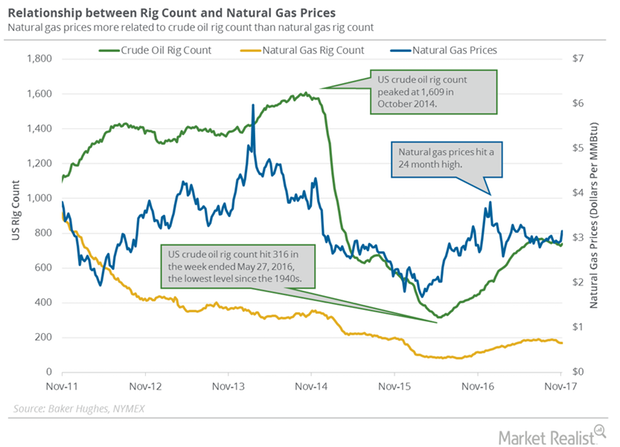

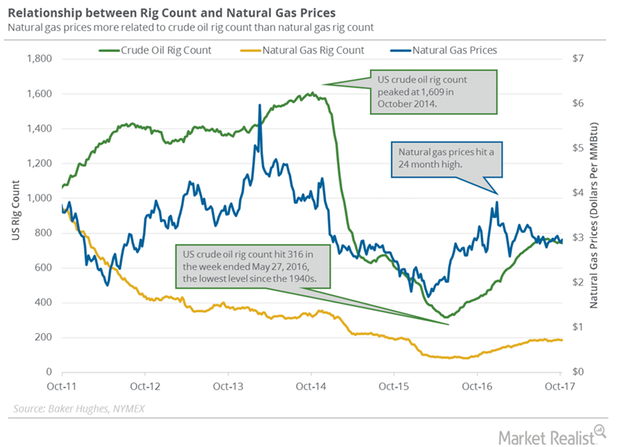

Will US Crude Oil and Gas Rigs Pressure Natural Gas Futures?

Baker Hughes will publish its US crude oil and natural gas rig count report on November 17, 2017. The rigs were flat at 169 on November 3–10, 2017.

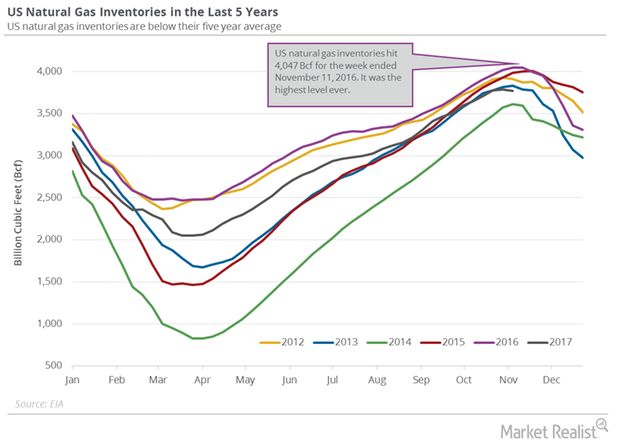

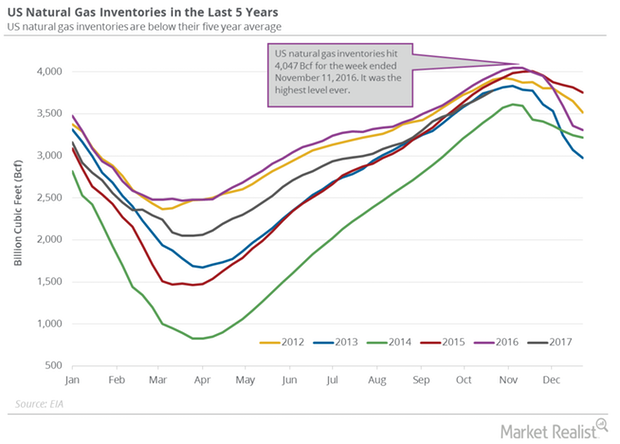

Traders Are Tracking US Natural Gas Inventories

The EIA reported that US gas inventories fell by 18 Bcf (billion cubic feet) to 3,772 Bcf on November 3–10, 2017.

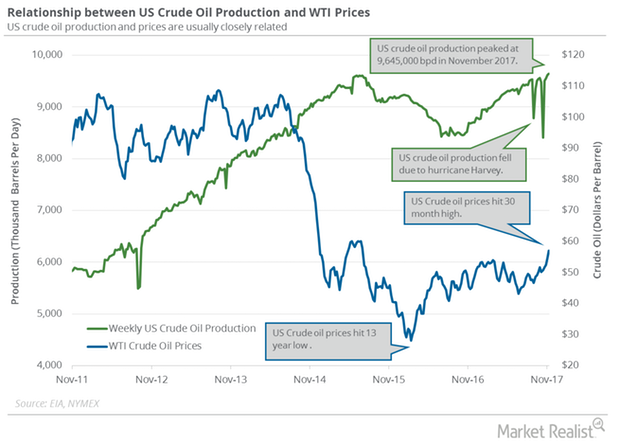

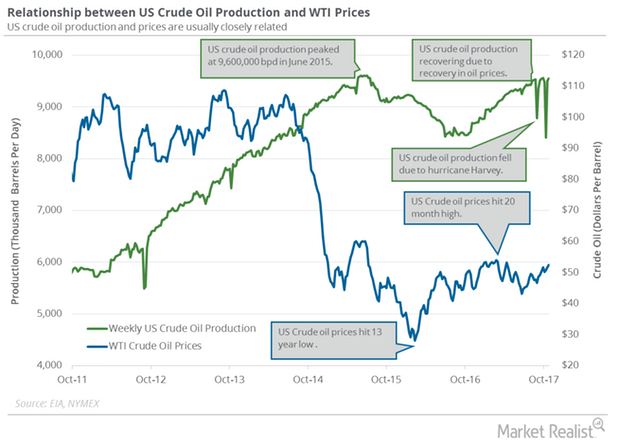

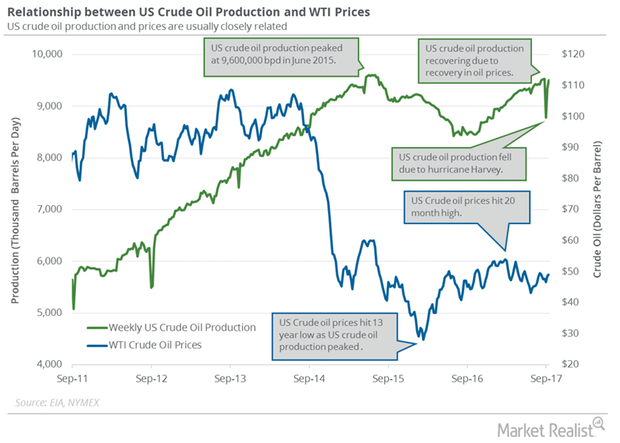

US Crude Oil Production: Bearish Driver for Oil Prices

The EIA estimates that US crude oil production rose by 25,000 bpd (barrels per day) or 0.3% to 9,645,000 bpd on November 3–10, 2017.

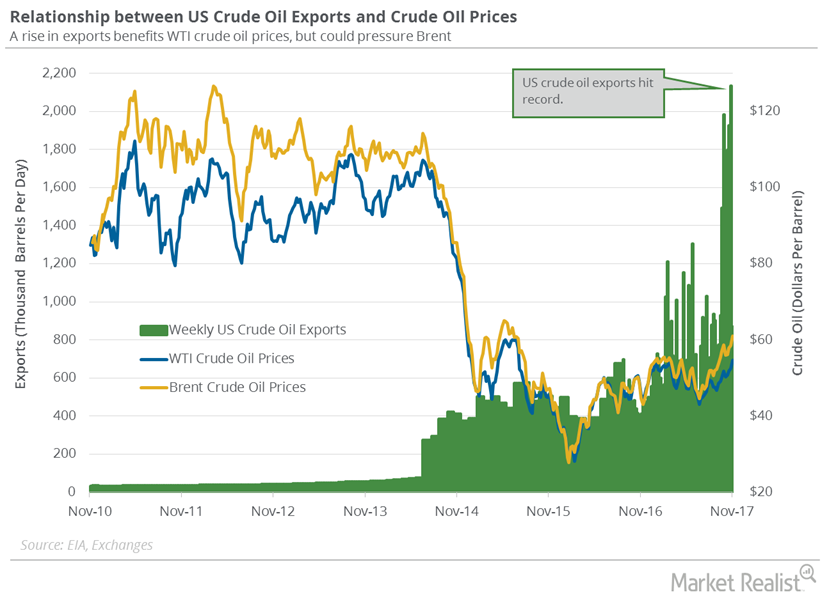

Russian and US Crude Oil Exports Are Important for Oil Bears

US crude oil exports fell by 1,264,000 bpd or 60% to 869,000 bpd on October 27–November 3, 2017. Exports rose by 459,000 bpd from the same period in 2016.

US Dollar Could Pressure Crude Oil Futures This Week

The US Dollar Index rose 0.13% to 94.4 on November 13, 2017. It limited the upside for US crude oil (UWT) (DWT) prices on the same day.

OPEC’s Monthly Oil Report: Positive or Negative for Crude Oil?

Higher crude oil demand, easing supplies and inventories, improving global crude oil demand, and economic growth could support oil prices.

Are US Natural Gas Inventories Bullish for Natural Gas Futures?

The EIA estimates that US gas inventories rose by 15 Bcf (billion cubic feet) or 0.4% to 3,790 Bcf on October 27–November 3, 2017.

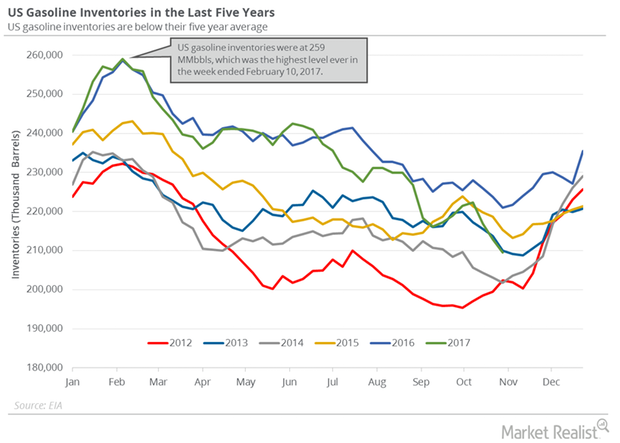

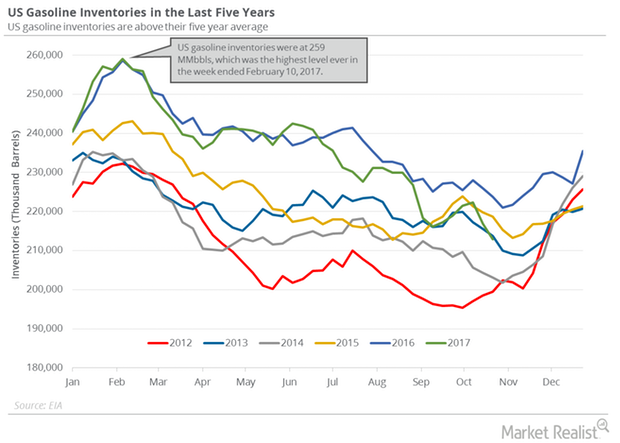

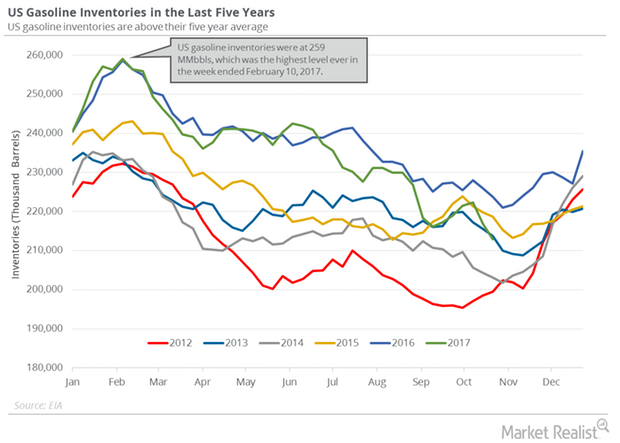

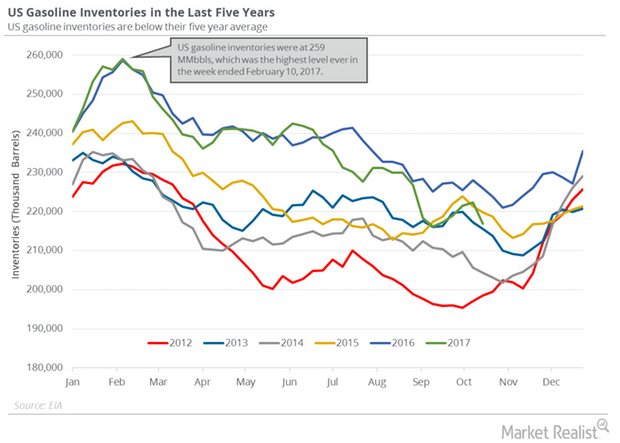

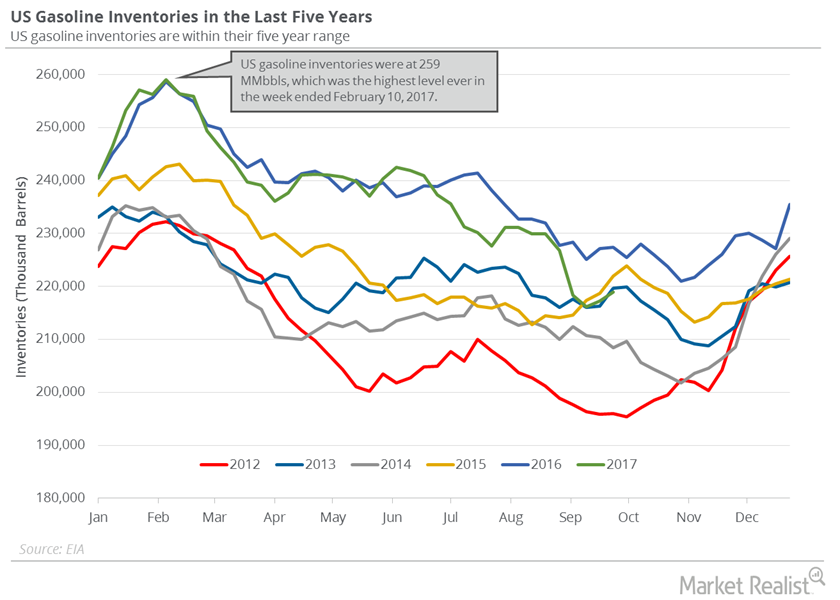

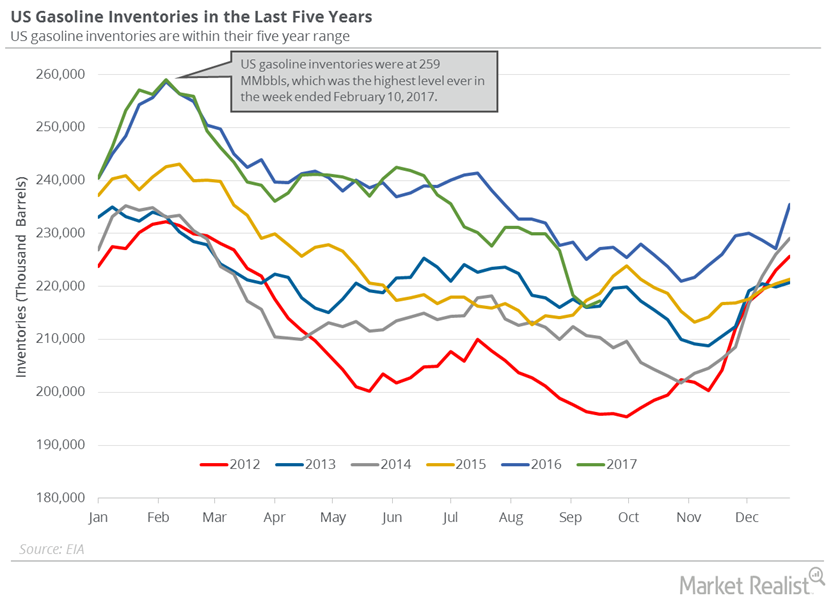

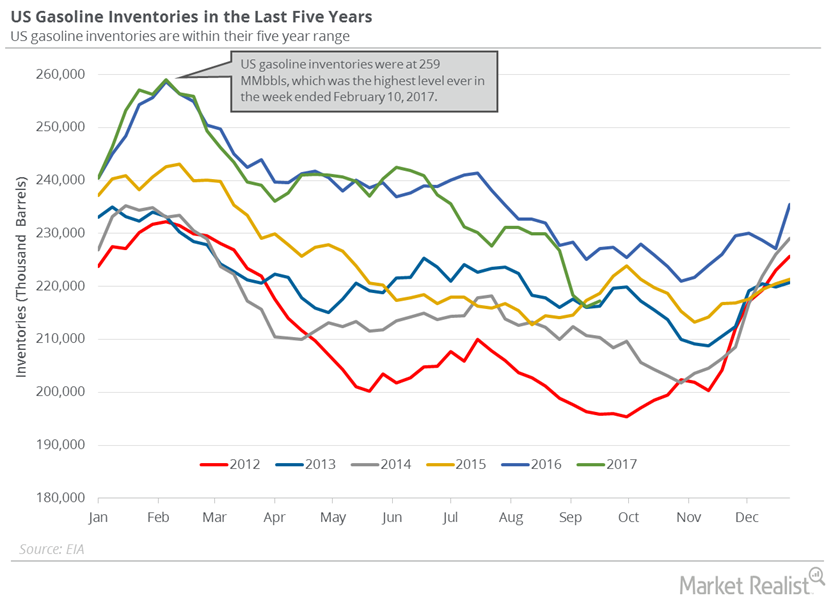

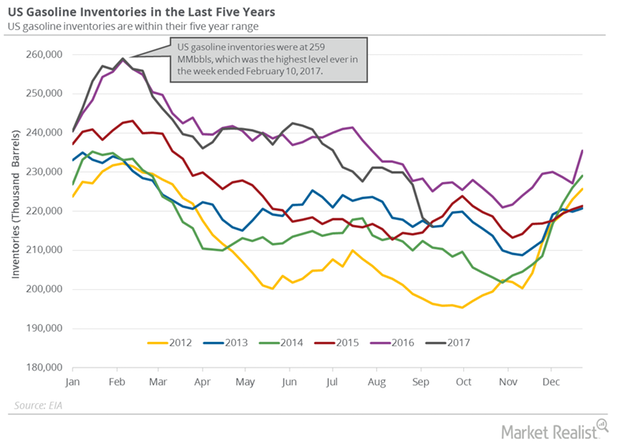

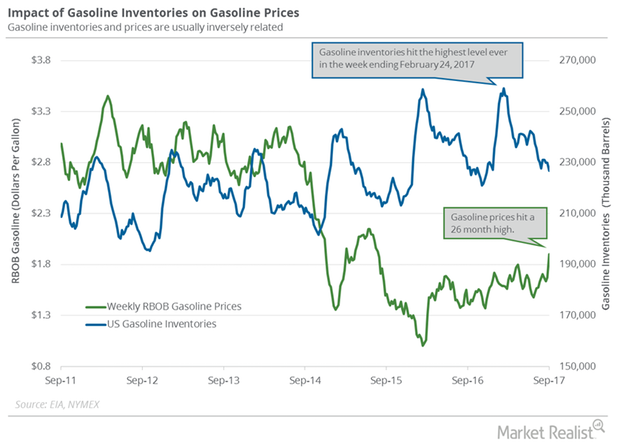

US Gasoline Inventories Hit 3-Year Low

The EIA reported that gasoline inventories in the US fell by 3,312,000 barrels to 209.5 MMbbls (million barrels) between October 27, 2017, and November 3, 2017.

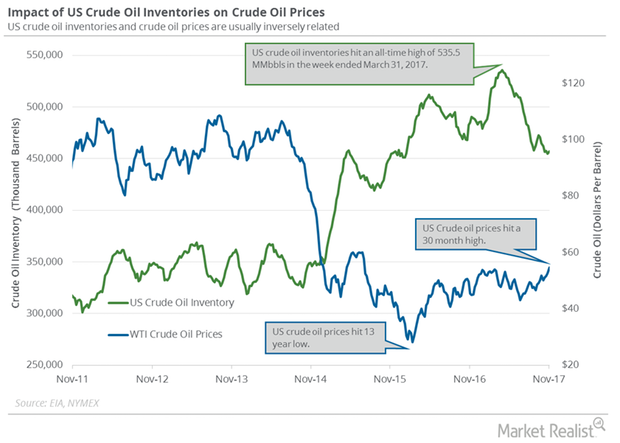

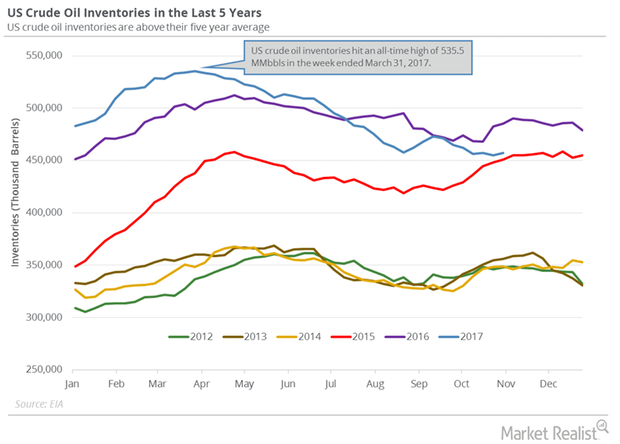

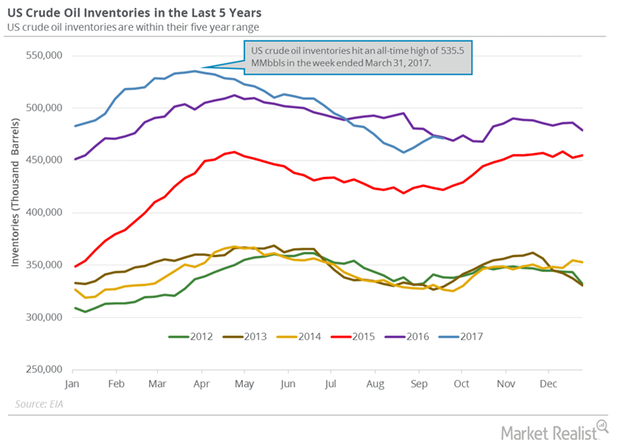

Unexpected Build in US Crude Oil Inventories Pressures Oil Futures

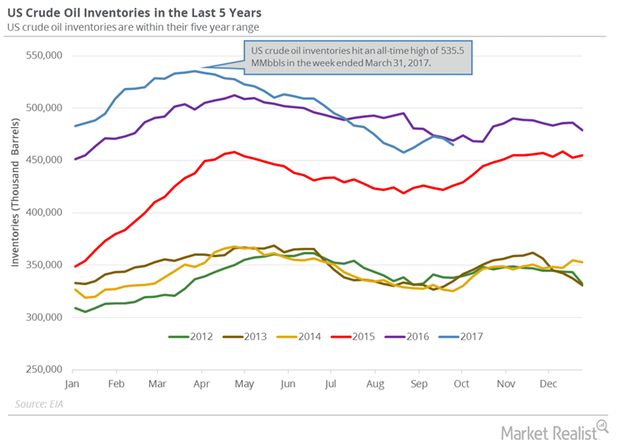

The EIA (or US Energy Information Administration) released its Weekly Petroleum Status Report on November 8, 2017.

US Gasoline Demand Could Drive Crude Oil Prices Higher

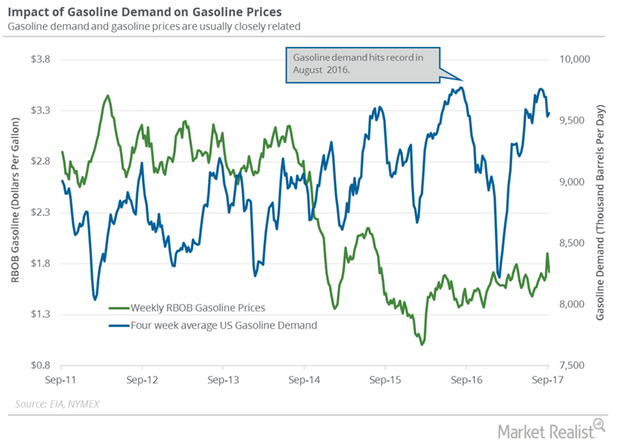

The EIA estimates that weekly US gasoline demand rose by 147,000 bpd (barrels per day) to 9,461,000 bpd on October 20–27, 2017.

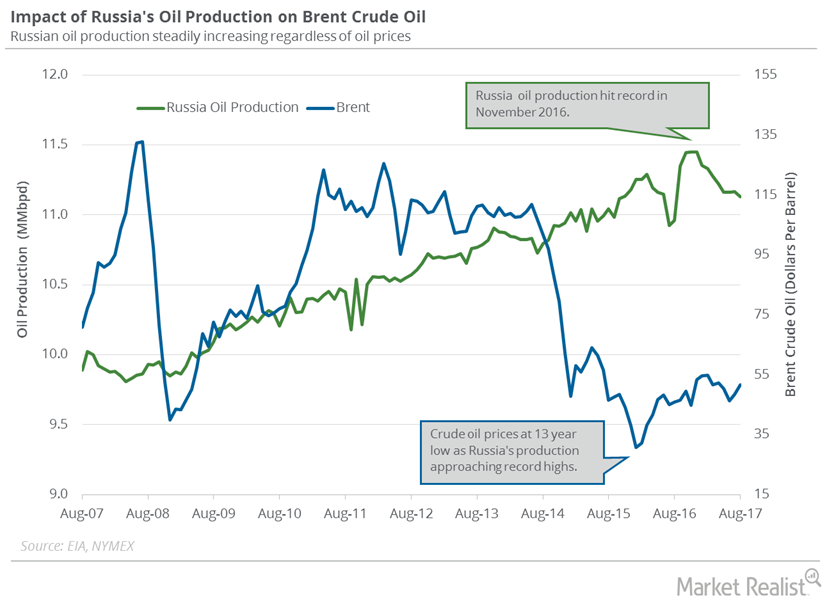

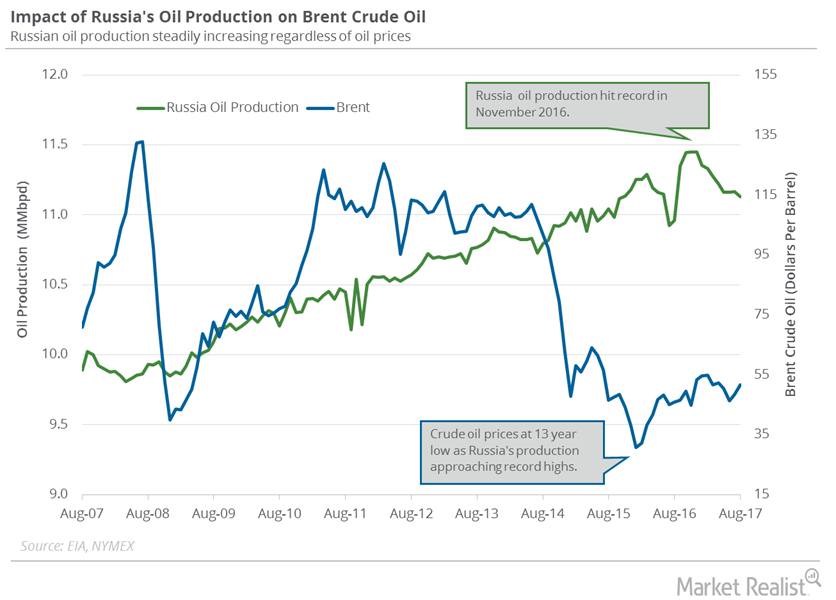

Russia’s Crude Oil Exports Could Pressure Oil Futures

Russia’s energy ministry estimates that the country’s crude oil exports rose 2% or by 160,000 bpd (barrel per day) in the first nine months of 2017.

Crude Oil and Gasoline Inventories Could Impact Crude Oil Futures

December US crude oil (DWT) (DBO) futures contracts fell 0.56% to $56.88 per barrel in electronic trade at 1:10 AM EST on November 8, 2017.

US Natural Gas Inventories Could Help Natural Gas Futures

The EIA reported that US natural gas inventories rose by 65 Bcf (billion cubic feet) to 3,775 Bcf on October 20–27, 2017.

Russia’s Crude Oil Production Rose in October

Russia’s crude oil production rose by 20,000 bpd (barrels per day) to 10,930,000 bpd in October 2017—compared to September 2017.

US Gasoline Inventories Fell 18%, Bullish for Crude Oil

The EIA (U.S. Energy Information Administration) estimates that US gasoline inventories fell by 4,020,000 barrels to 212.8 MMbbls on October 20–27, 2017.

Will Non-OPEC and US Crude Oil Production Impact Oil Prices?

The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 46,000 bpd to 9,553,000 bpd on October 20–27, 2017.

US Gasoline Demand Hit an All-Time High in August

On October 31, 2017, the EIA reported that US gasoline demand rose by 197,000 bpd to 9,770,000 bpd in August 2017—compared to the previous month.

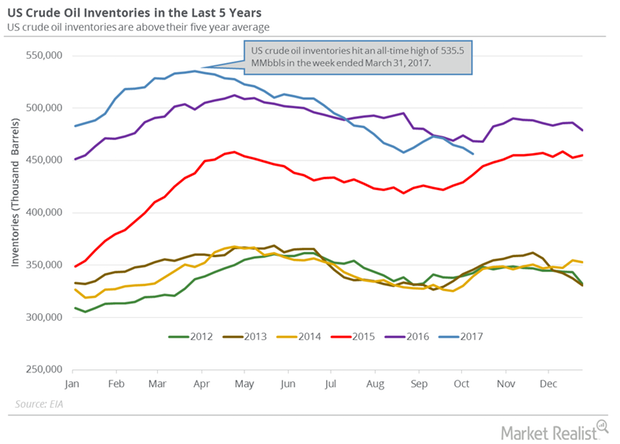

US Crude Oil Inventories and Production Impact Crude Oil Prices

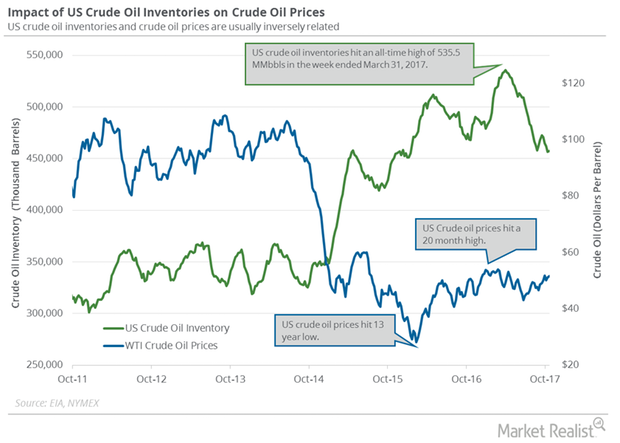

The market expects that US crude oil inventories could have fallen by 2.5 MMbbls (million barrels) on October 20–27, 2017.

US Gas Rigs Hit 5-Month Low: Good or Bad for Natural Gas Futures?

Baker Hughes is scheduled to release its weekly US oil and gas rig report on October 27, 2017.

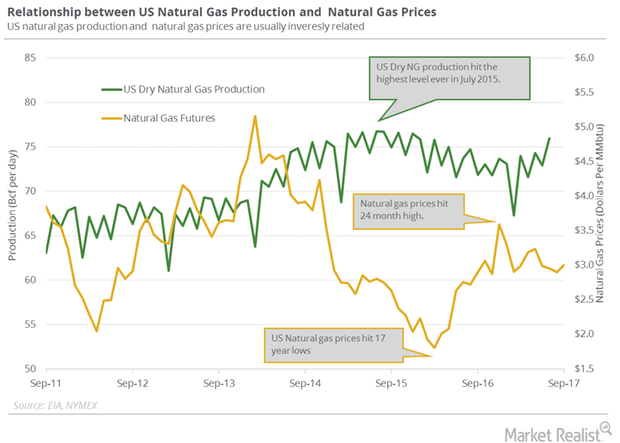

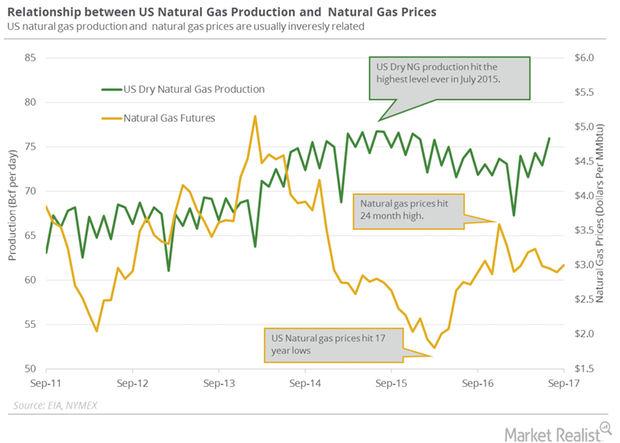

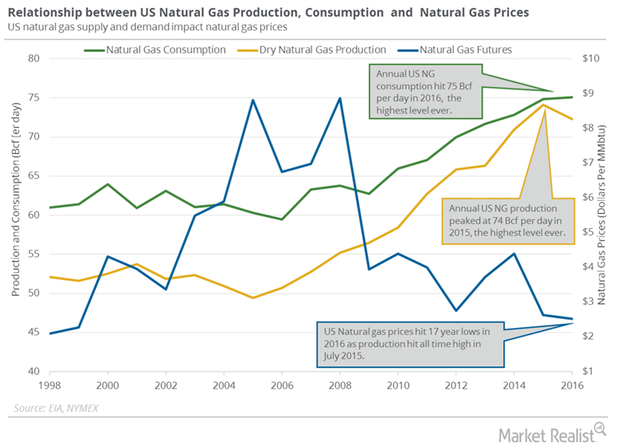

How Is US Natural Gas Production and Consumption Trending?

PointLogic estimates that weekly US dry natural gas production rose by 0.9 Bcf (billion cubic feet) per day to 74.6 Bcf per day between October 19 and October 25, 2017.

Massive Fall in US Gasoline Inventories Drove Gasoline Futures

The EIA reported that US gasoline inventories fell by 5,465,000 barrels or 2.5% to 216.8 MMbbls (million barrels) on October 13–20, 2017.

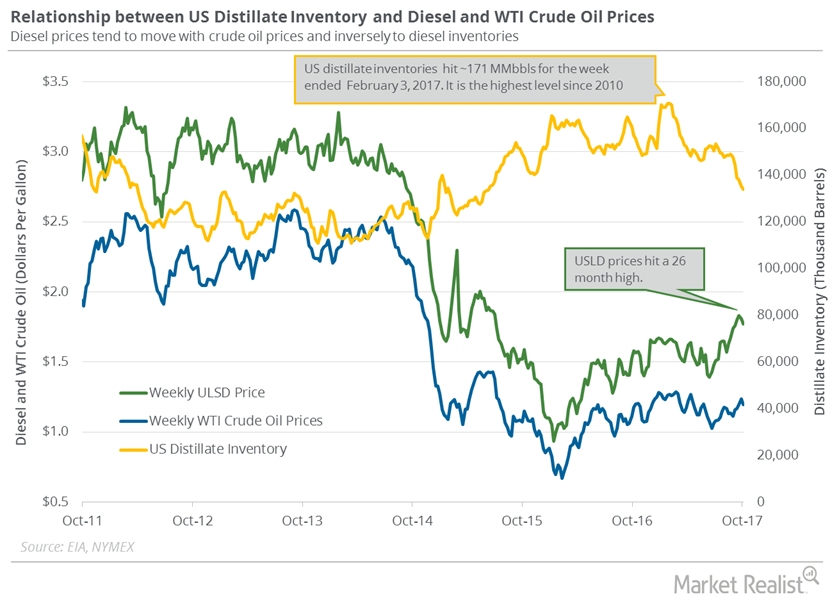

US Distillate Inventories Fell for the Seventh Time in 8 Weeks

US diesel futures fell on October 25, 2017, despite the massive fall in distillate inventories. They fell 0.2% to $1.81 per gallon on the same day.

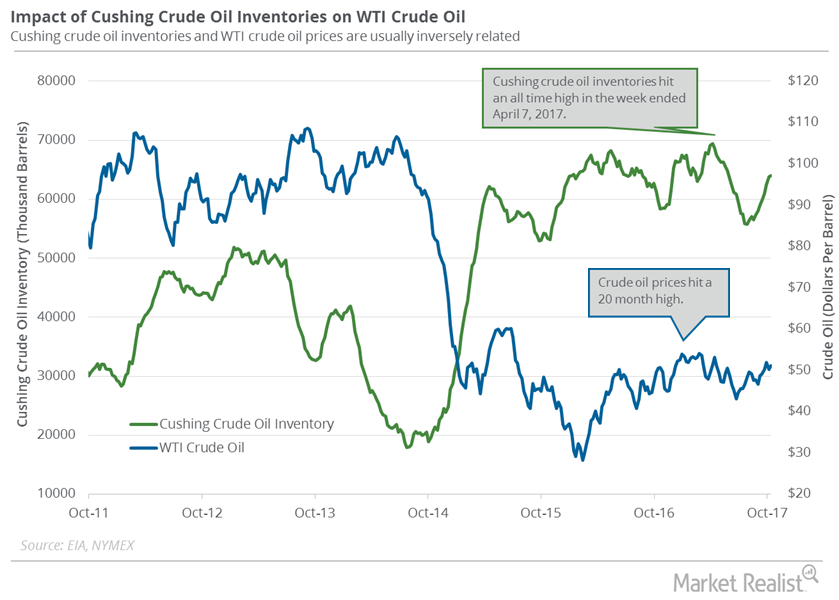

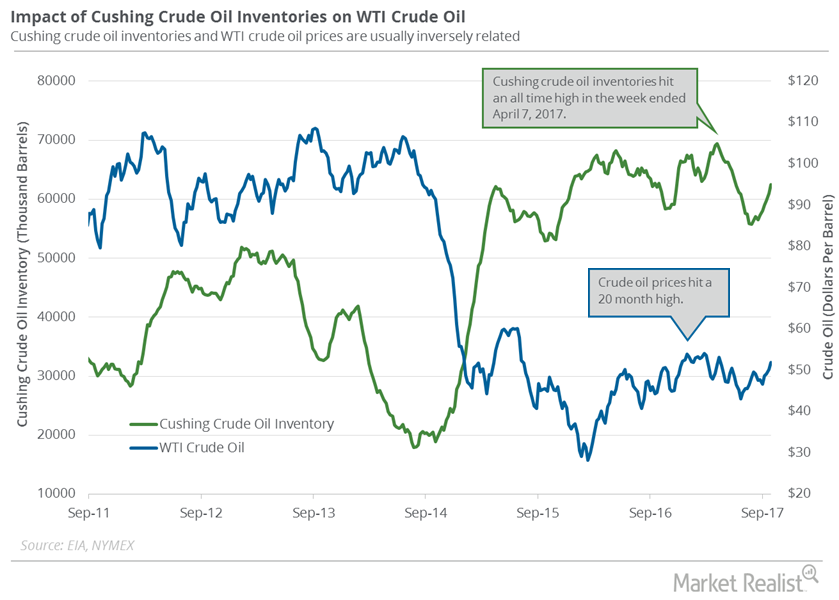

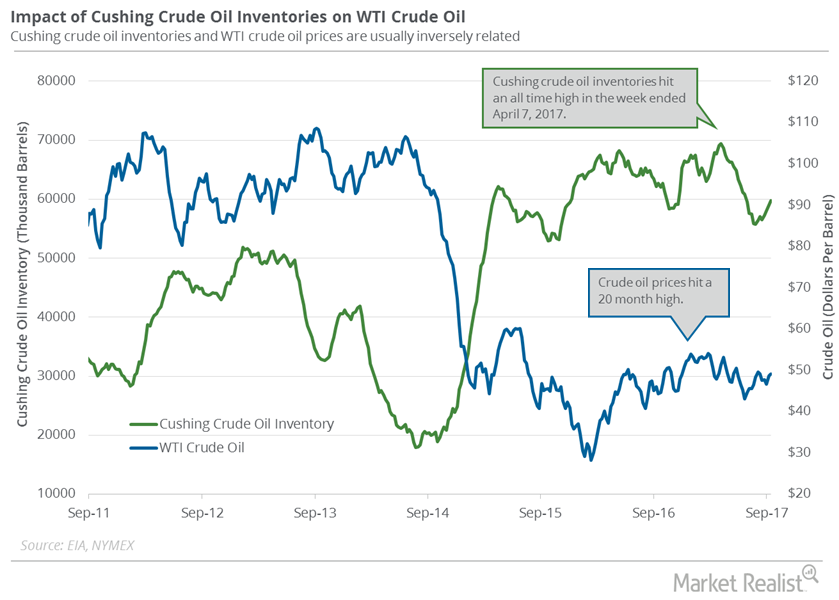

Cushing Inventories Are Near 5-Month High: Bearish for Oil

Wall Street analysts expected that crude oil inventories at Cushing would rise between October 13, 2017, and October 20, 2017.

Is US Natural Gas Production Bearish for Natural Gas?

US dry natural gas production will likely average ~73.6 Bcf/d in 2017. It will likely rise by 4.9 Bcf/d or 6.6% to 78.5 Bcf/d in 2018.

Lower US Crude Oil Inventories Help Crude Oil Bulls

The EIA estimates that crude oil inventories fell by 5.7 MMbbls to 456.4 MMbbls on October 6–13, 2017—the lowest levels since August 25, 2017.

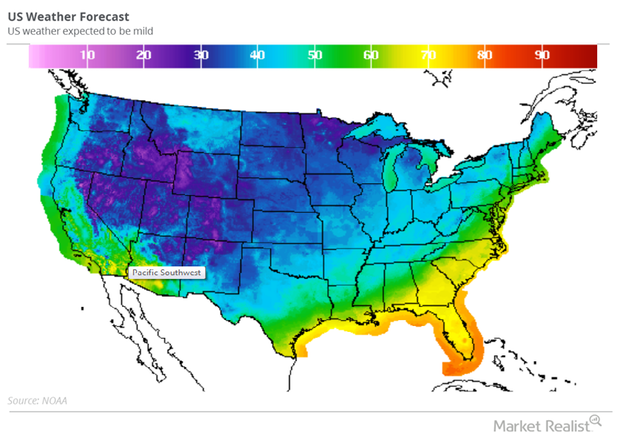

Will Weather Surprise Natural Gas Bulls?

November natural gas (UGAZ)(DGAZ) futures contracts fell 1.13% to $2.96 per MMBtu (million British thermal units) in NYMEX electronic trading at 2:05 AM EST on October 16.

Will President Trump Rescue the Crude Oil Market?

November WTI crude oil (DBO)(DWT)(USO) futures contracts rose 0.71% and were trading at $50.96 per barrel in electronic trading at 2:06 AM on October 13.

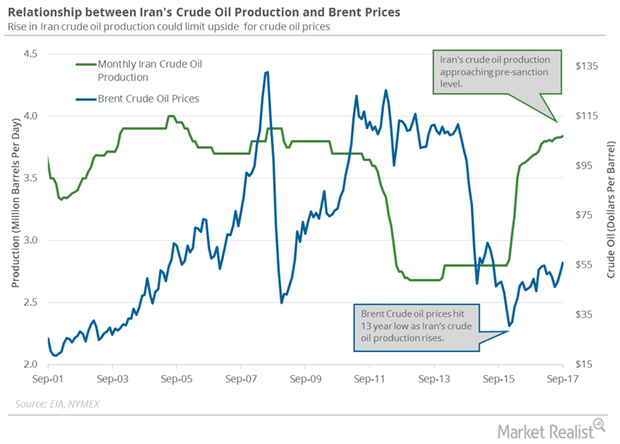

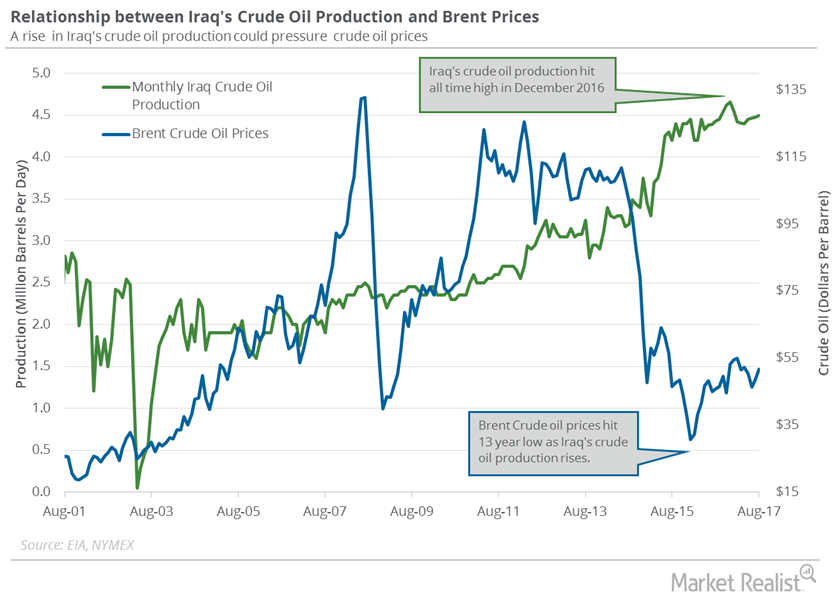

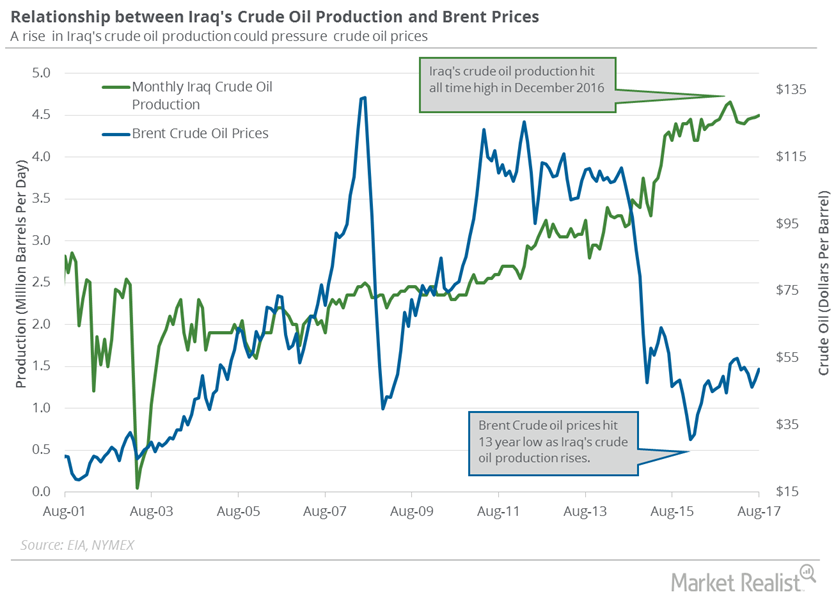

How Iran and Iraq’s Crude Oil Exports Could impact crude Oil Prices

Iraq’s crude oil exports hit 3.98 MMbpd (million barrels per day) in September 2017, according to Bloomberg—its highest level since December 2016.

US Dollar Is near a 10-Week High, Could Upset Crude Oil Bulls

The US Dollar Index fell 0.1% to 93.55 on October 9, 2017. However, it rose almost 1.1% last week. The US dollar (UUP) is near a ten-week high.

Cushing Inventories Are above Their 5-Year Average

Cushing crude oil inventories rose for the sixth consecutive week. Any rise in Cushing inventories is bearish for crude oil (USO) (USL) (SCO) prices.

Oil Prices Fell despite the Draw in US Crude Oil Inventories

US crude oil (USL) (DBO) (OIL) prices fell on October 4, 2017, despite the massive draw in US crude oil inventories.

Are US Gasoline Inventories a Pain for Crude Oil Bulls?

The EIA (U.S. Energy Information Administration) estimates that US gasoline inventories rose by 1.6 MMbbls to 218.9 MMbbls on September 22–29, 2017.

Gasoline Inventories Could Pressure Crude Oil Prices

The API estimates that US gasoline inventories rose by 4.19 MMbbls on September 22–29, 2017. The market expected a build by 1.08 MMbbls.

US Gasoline Demand: Are the Crude Oil Bears Taking Control?

Weekly US gasoline demand rose by 81,000 bpd to 9.5 MMbpd on September 15–22, 2017. Gasoline demand rose by 642,000 bpd or 7.2% YoY.

How Record US Crude Oil Exports Are Impacting Crude Oil Inventories and Prices

On September 27, the EIA released its weekly report, estimating that US crude oil inventories fell to 470.9 MMbbls from September 15–22, 2017.

How US Natural Gas Production and Consumption Are Driving Prices

Market data provider PointLogic estimates that weekly US dry natural gas production fell by 0.2 Bcf (billion cubic feet) per day to 74.3 Bcf per day from September 21 to 27, 2017.

Understanding the Rising US Gasoline Inventories

The EIA estimated on September 27 that US gasoline inventories rose 1.1 MMbbls (million barrels) to 217.2 MMbbls from September 15–22, 2017.

US Gasoline Demand Today: Bullish or Bearish for Crude?

The EIA estimates that weekly US gasoline demand fell 178,000 bpd (barrels per day) to 9.4 MMbpd between September 8 and September 15.

Why Kurdish Regions Are Crucial for Iraq’s Crude Oil Exports

Iraq is the second-largest OPEC producer. The EIA (U.S. Energy Information Administration) estimates that Iraq’s crude oil production rose by 25,000 bpd (barrels per day) to 4,500,000 bpd in August 2017.

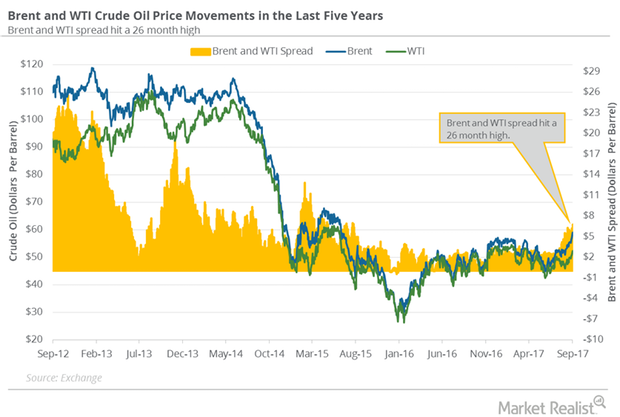

Why the Brent and WTI Crude Oil Spread Hit a 26-Month High

November WTI (West Texas Intermediate) crude oil (UWT)(DWT)(DBO) futures contracts fell 0.2% and were trading at $52.12 per barrel in electronic trading at 2:20 AM EST on September 26.

Cushing Crude Oil Inventories Rose for the Fourth Week

Cushing crude oil inventories rose on September 15–22, 2017. A rise in Cushing crude oil inventories is bearish for crude oil (UWT) (DWT) (USO) prices.

US Dollar Could Help Crude Oil Futures

The US Dollar Index fell 0.1% to 91.97 on September 22, 2017. However, the US dollar rose 0.7% on September 20, 2017, after the FOMC’s meeting.

US Gasoline Inventories Fell for 4th Time in 5 Weeks

The EIA (U.S. Energy Information Administration) estimates that US gasoline inventories fell 2.1 MMbbls (million barrels), or 1%, to 216.1 MMbbls between September 8, 2017, and September 15, 2017.

US Crude Oil Production Near 4-Week High: Another Bearish Factor

The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 157,000 bpd (barrels per day), or 1.7%, to 9,510,000 bpd between September 8, 2017, and September 15, 2017.

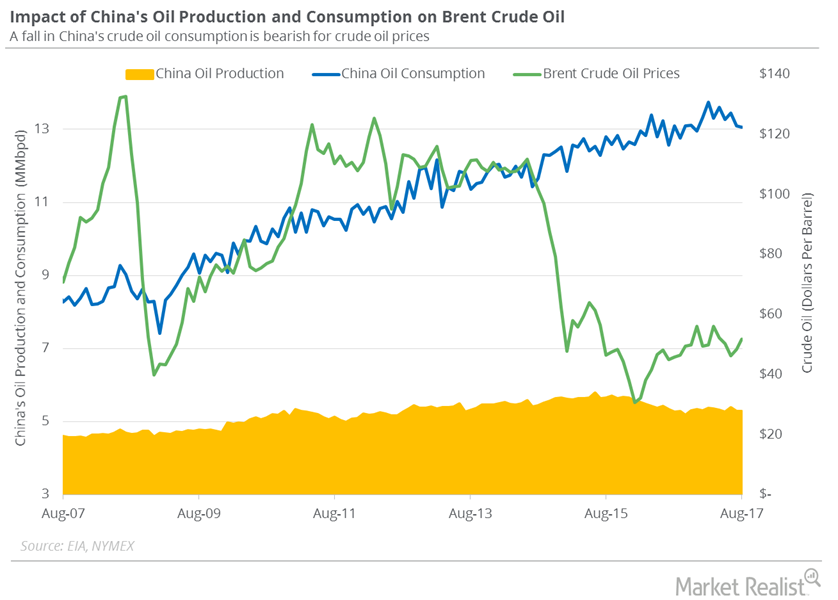

China’s Crude Oil Imports Hit a 2017 Low

China’s General Administration of Customs estimates that China’s crude oil imports fell by 180,000 bpd to 8 MMbpd in August 2017—compared to July 2017.

Are Crude Oil Futures Signaling a Breakout?

November US crude oil (UWT) (DWT) (USO) futures contracts rose 0.8% to $50.3 per barrel in electronic trading at 2:10 AM EST on September 20, 2017.