Gordon Kristopher

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Gordon Kristopher

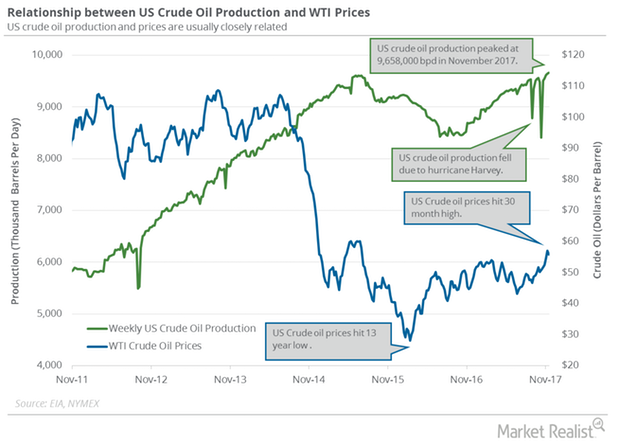

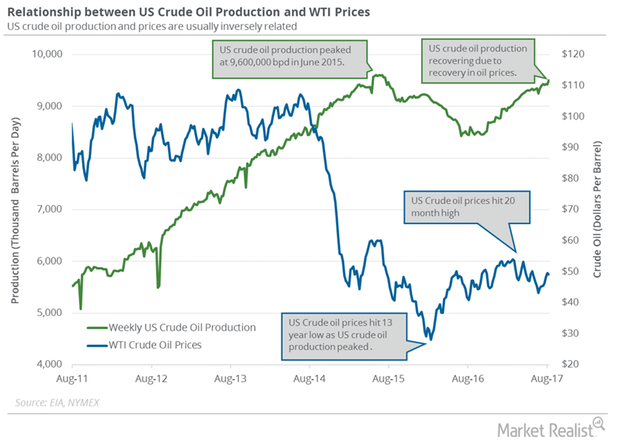

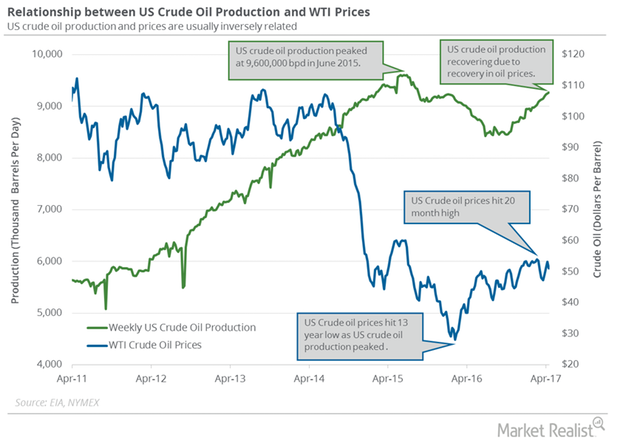

Why US Crude Oil Production Is Bearish for Oil Prices

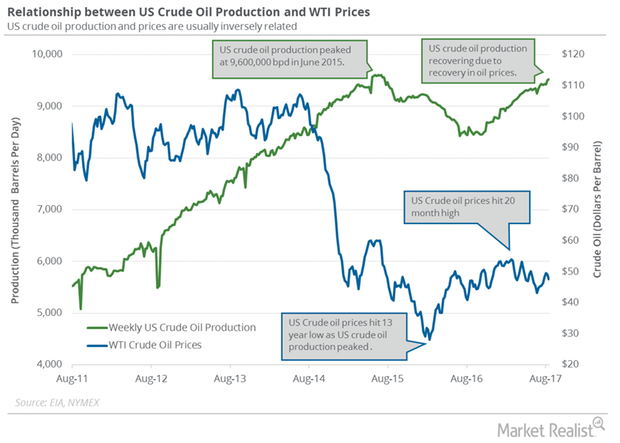

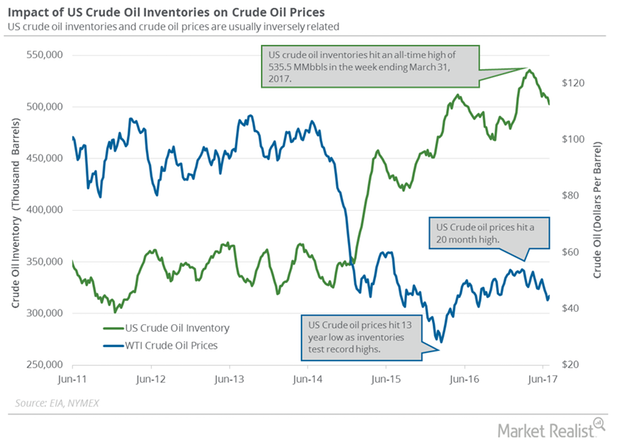

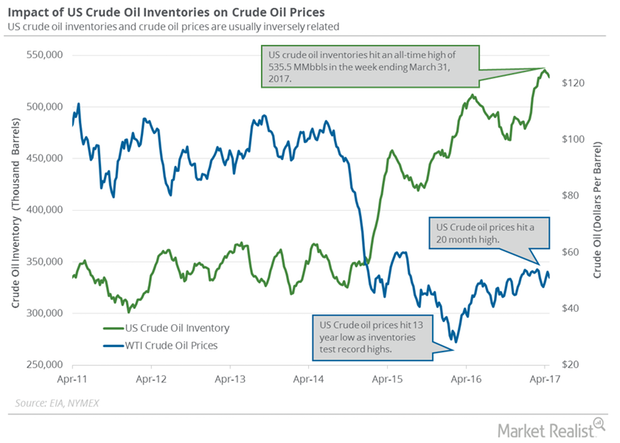

US crude oil production hit 9.6 MMbpd (million barrels per day) in June 2015, the highest level ever.

OPEC and Non-OPEC Meeting Could Drive Crude Oil Futures

August US crude oil futures contracts rose 0.4% and closed at $44.4 per barrel on July 10. Brent crude oil futures rose 0.4% to $46.8 per barrel.

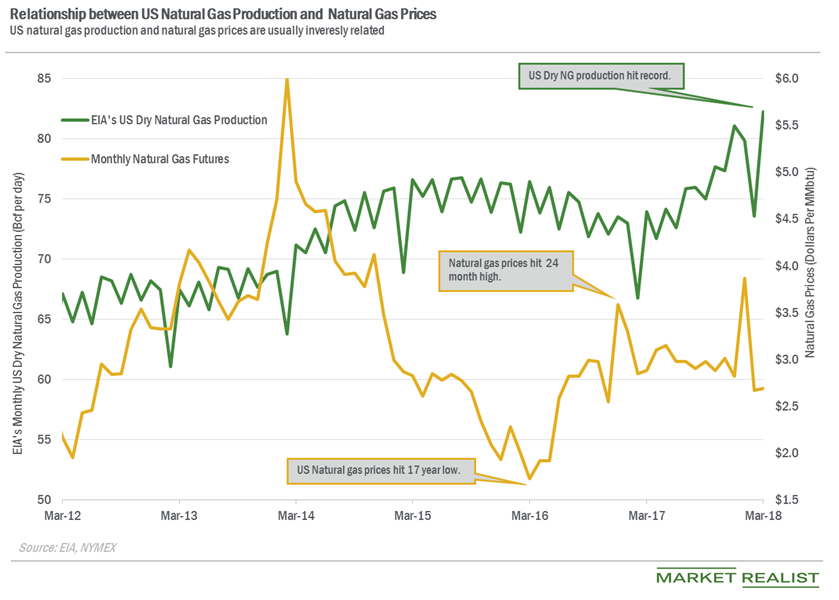

What’s the Long-Term US Natural Gas Price Forecast?

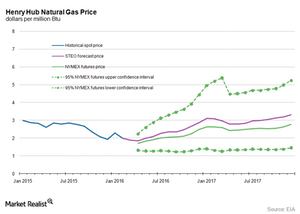

In its March Short-Term Energy Outlook report, the EIA forecast that the US natural gas supply-demand balance could average around 2.9 Bcf per day in 2016.

Crude Oil Futures Hit a 1-Week High

WTI (West Texas Intermediate) crude oil (RYE) (USO) (USL) futures contracts for August delivery rose 1.9% and closed at $44.24 per barrel on June 27, 2017.

Energy Calendar for Crude Oil and Natural Gas Traders

Oil and gas producers’ earnings such as Swift Energy, ConocoPhillips, and Continental Resources will depend on crude oil and natural gas prices.

Energy Calendar for Oil and Gas Traders: May 1–5

The energy sector contributed to ~6.3% of the S&P 500 (SPY) (SPX-INDEX) on April 28, 2017. Oil and gas are major parts of the energy sector.

Crude Oil Prices Rose for the Fifth Day: Is It a Bear Trap?

August WTI (West Texas Intermediate) crude oil (XOP) (RYE) (USO) futures contracts rose 1.1% and closed at $44.74 per barrel on June 28, 2017.

Geopolitical Tensions Impact Crude Oil Prices

On October 3, 2017, Iraq banned selling dollars to Kurdistan’s banks due to the vote in the referendum. Geopolitical tensions could impact crude oil prices.

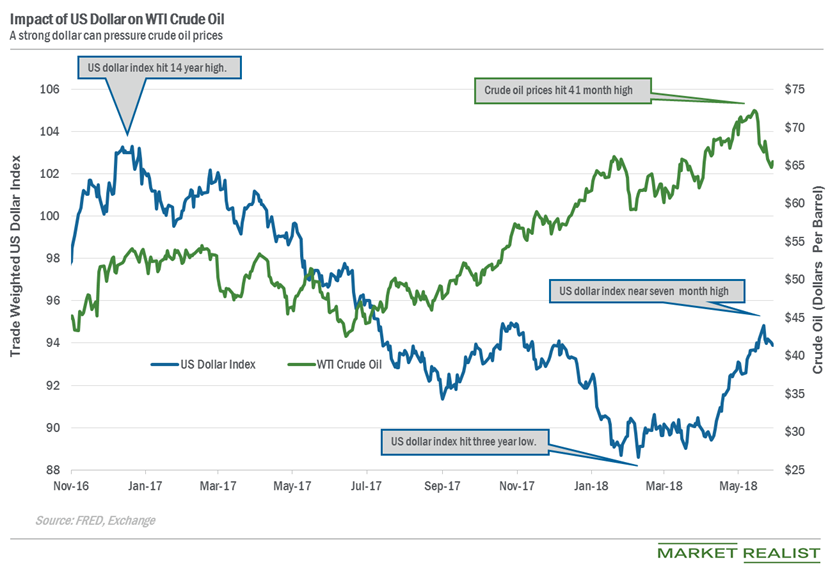

Can the US Dollar Index Help WTI Crude Oil Prices?

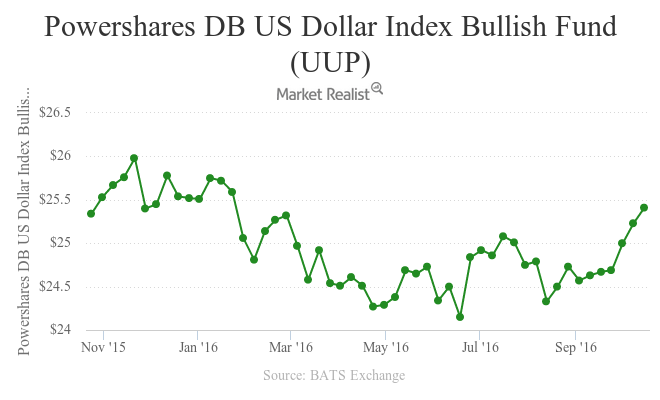

The US Dollar Index fell ~0.13% to 93.89, and July WTI oil futures rose ~1.2% on June 5.

Why US Crude Oil Production Could Hit a Record High in 2018

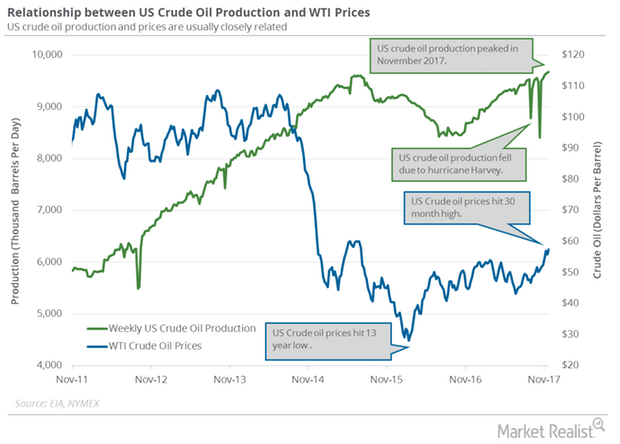

US crude oil production According to the EIA (U.S. Energy Information Administration), US crude oil production rose 13,000 bpd (barrels per day) to 9,658,000 bpd between November 10 and 17, 2017. Production, which rose for the fifth straight week, has been pressuring oil (SCO) prices in the last few weeks. Production has risen 977,000 bpd (11.3%) year-over-year. Any […]

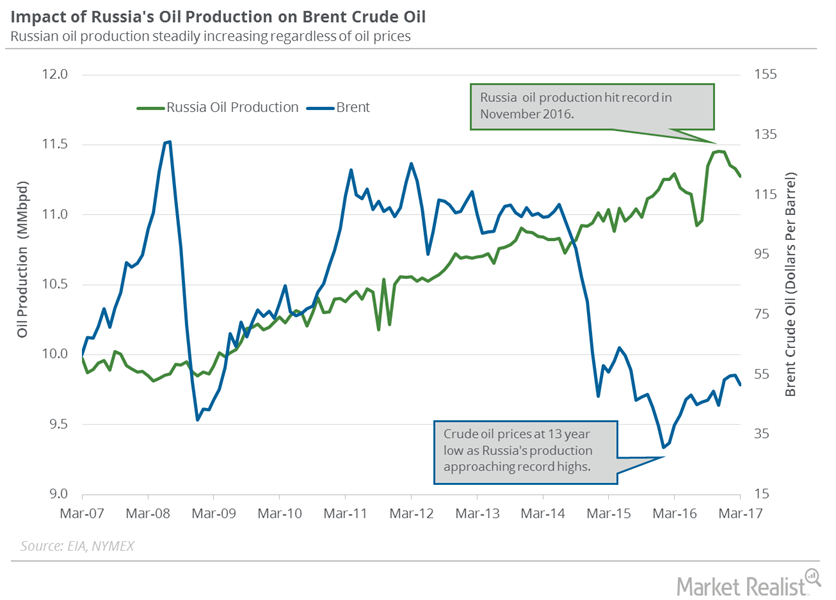

Will Russia’s Oil Production Fall in the Coming Months?

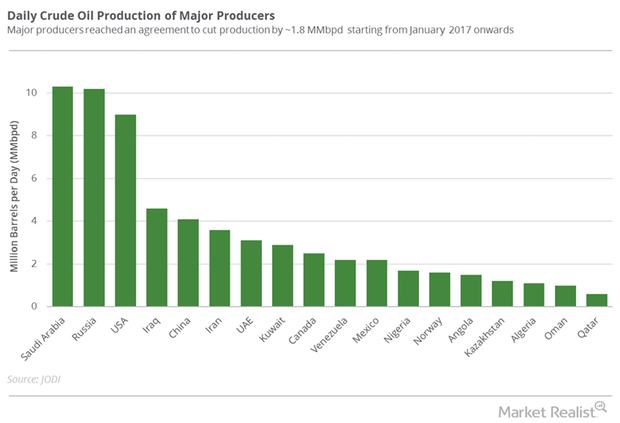

Russia’s Energy Ministry reported that its oil production fell in the first half of April 2017 due to major producers’ production cut deal.

What Could Drive US Crude Oil Futures This Week?

WTI (West Texas Intermediate) crude oil (UWT) (USL) active futures tested $57.35 per barrel on November 6, 2017—the highest level in almost three years.

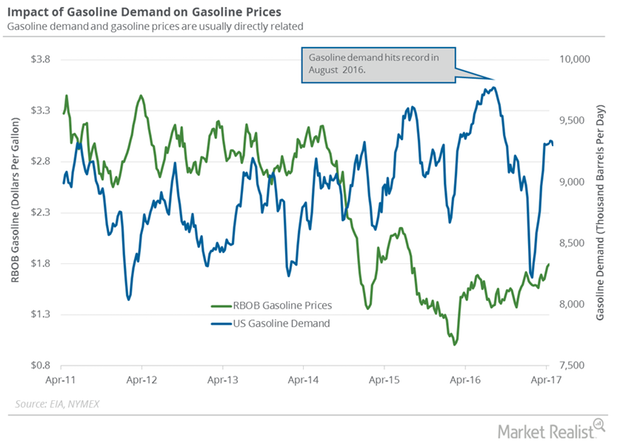

Why Investors Are Tracking US Gasoline Demand

The EIA (U.S. Energy Information Administration) estimated that four-week average US gasoline demand fell by 80,000 bpd to 9,237,000 bpd on April 14–21.

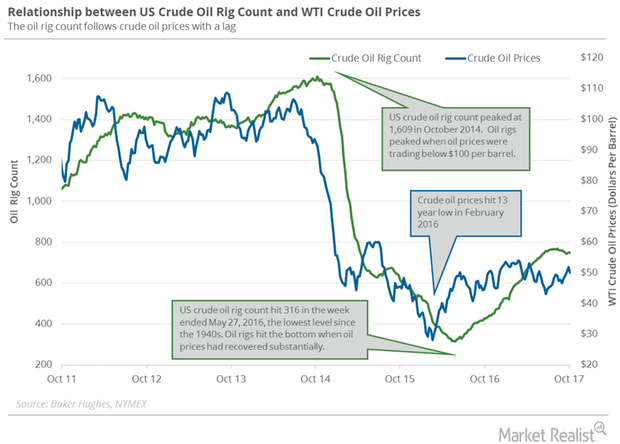

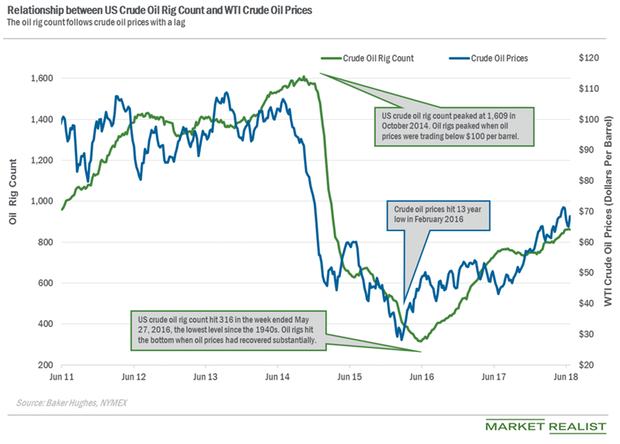

Will US Oil Rigs Support Crude Oil Bulls?

US crude oil rigs are near a five-month low. West Texas Intermediate (or WTI) crude oil (UWT) (DWT) prices are down 8.8% year-to-date (or YTD).

Hedge Funds’ Net Long Positions in US Crude Oil Rose Again

Hedge funds increased their net bullish positions in US crude oil futures and options rose by 36,834 contracts to 215,488 contracts on July 11–18, 2017.

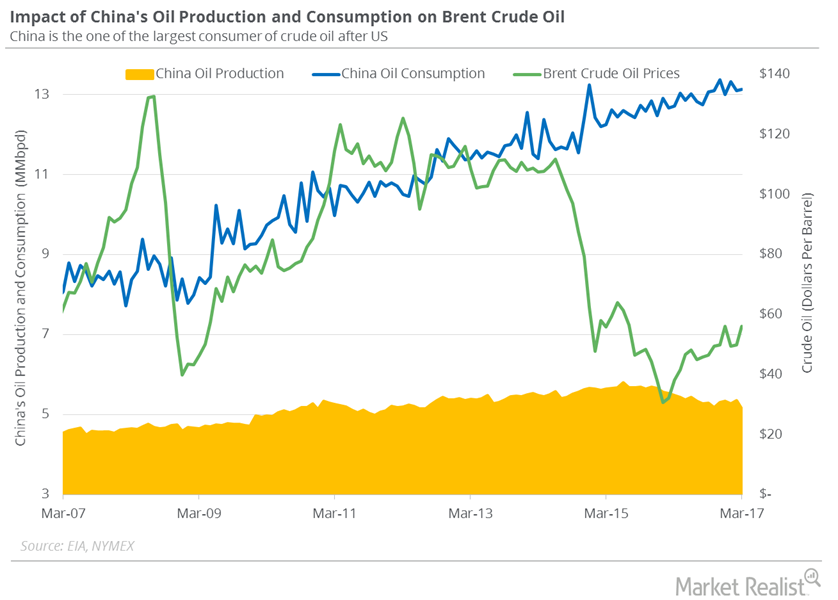

China’s Crude Oil Imports Hit a New Record

China’s General Administration of Customs reported that China’s crude oil imports rose to 9.21 MMbpd (million barrels per day) in March 2017.

How OPEC and Non-OPEC Producers Affect Crude Oil Prices

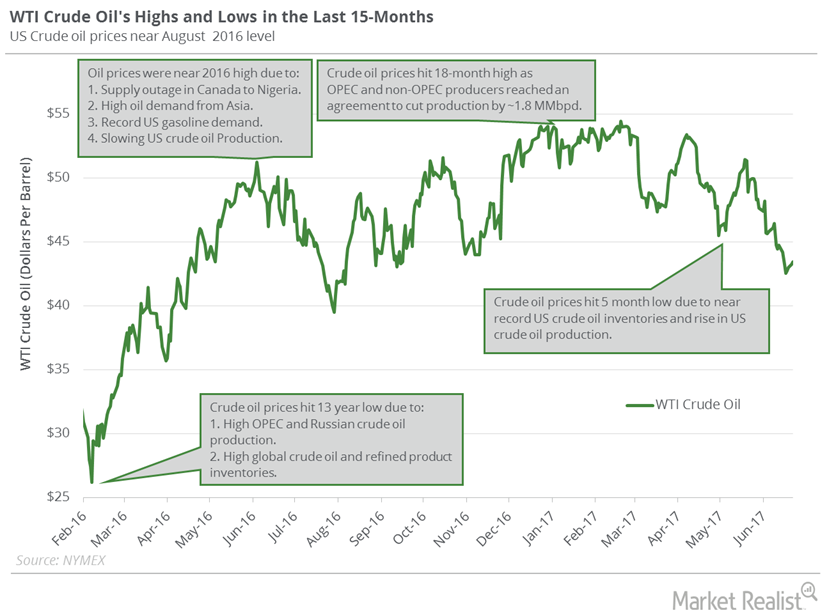

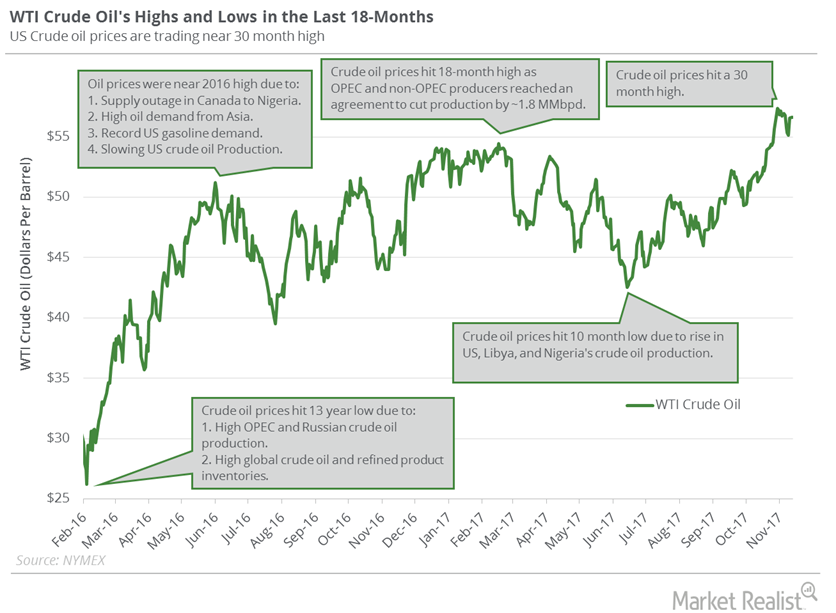

Crude oil (BNO) (PXI) (USL) (USO) (UCO) prices were up ~4% between December 7, 2016, and December 19, 2016.

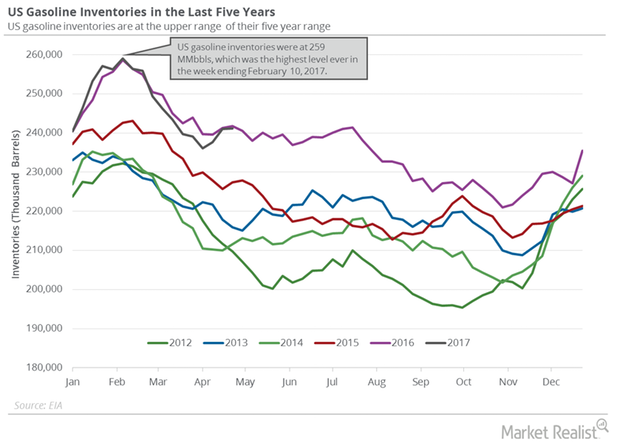

Why US Gasoline Inventories Rose for the Third Straight Week

A less-than-expected rise in gasoline inventories supported gasoline prices on May 3, 2017. Gasoline and crude oil (DIG) (SCO) (VDE) prices rose on May 3.

Will API Inventory Report Limit Upside for Crude Oil Prices?

November WTI (West Texas Intermediate) crude oil futures contracts rose 0.32% to $50.97 per barrel in electronic trade at 5:10 AM EST on October 12, 2016.

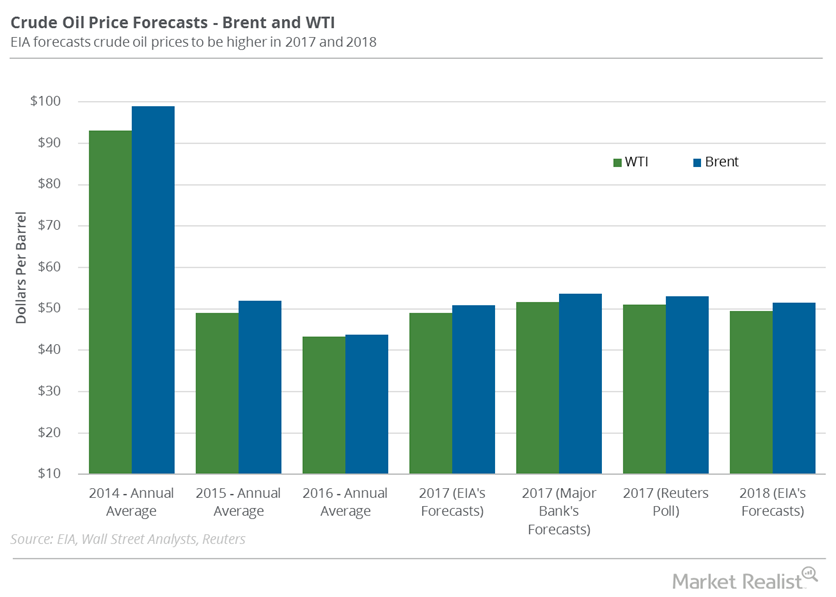

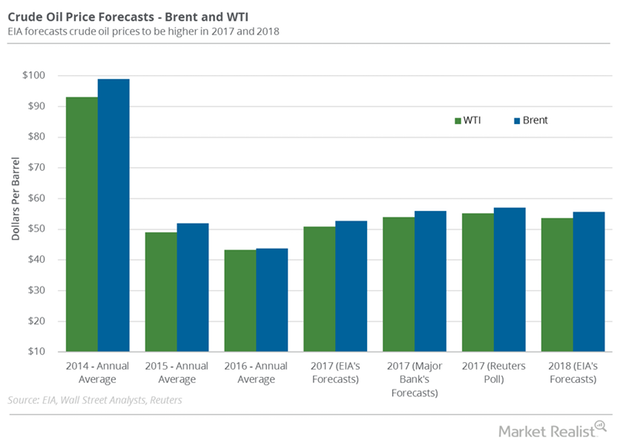

Will Brent and US Crude Oil Prices Rise in 2018?

November US crude oil (DWT)(UWT)(USO) futures are above their 20-day, 50-day, and 100-day moving averages at $49.25, $48.77, and $48.11 per barrel as of September 25.

Decoding US Natural Gas Consumption Trends

PointLogic estimates that US natural gas consumption rose ~2.1% to 57.8 Bcf (billion cubic feet) per day from May 31 to June 6.

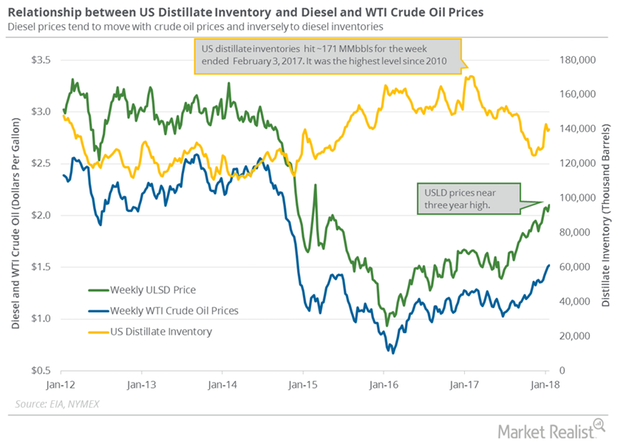

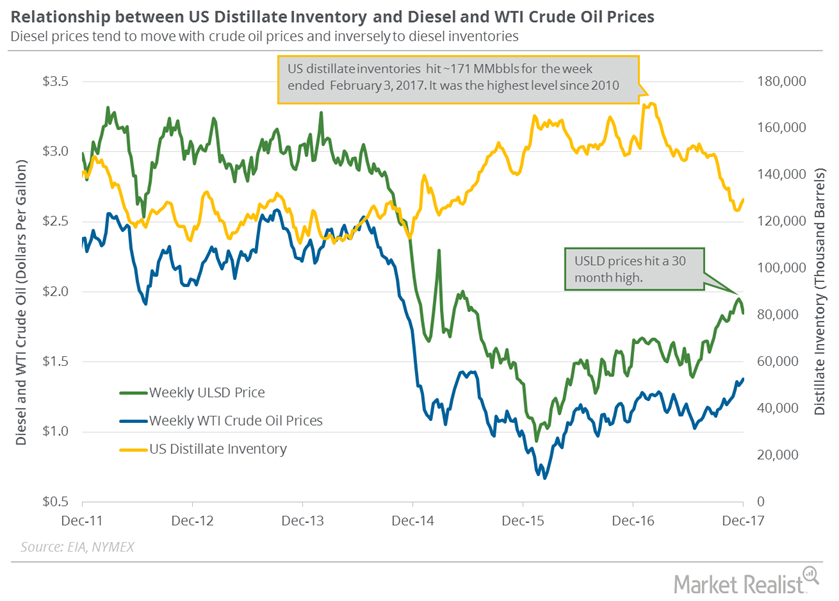

US Distillate Inventories Rose for the Eighth Time in 10 Weeks

US distillate inventories rose by 0.64 MMbbls (million barrels) to 139.8 MMbbls on January 12–19, 2018, according to the EIA.

Will US Crude Oil Futures Rise above $50 per Barrel This week?

September US crude oil prices are on a rollercoaster ride in 2017 due to bullish and bearish drivers. US crude oil prices are near a two-month high.

Crude Oil Prices Rise: Is It Time for a Collapse?

WTI crude oil prices have risen 9.4% since June 21, 2017. Brent and US crude oil prices are near a three-week high.

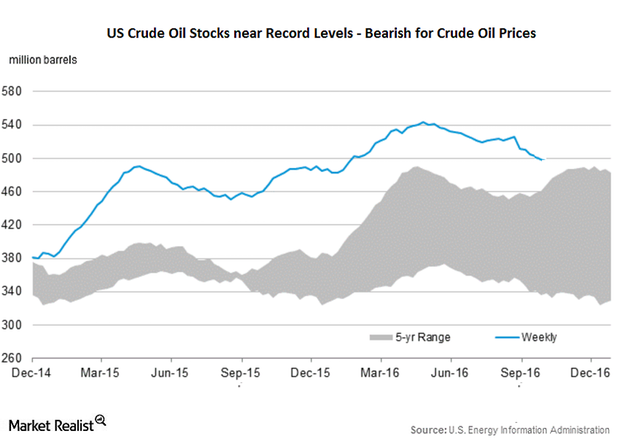

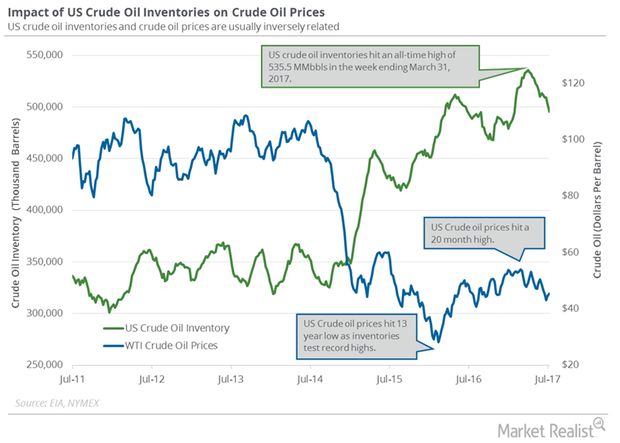

Near-Record US Crude Oil Inventory: Will Oil Blood Bath Continue?

June WTI crude oil futures contracts fell 0.40% and were trading at $48.68 per barrel in electronic trade at 2:35 AM EST on May 2, 2017.

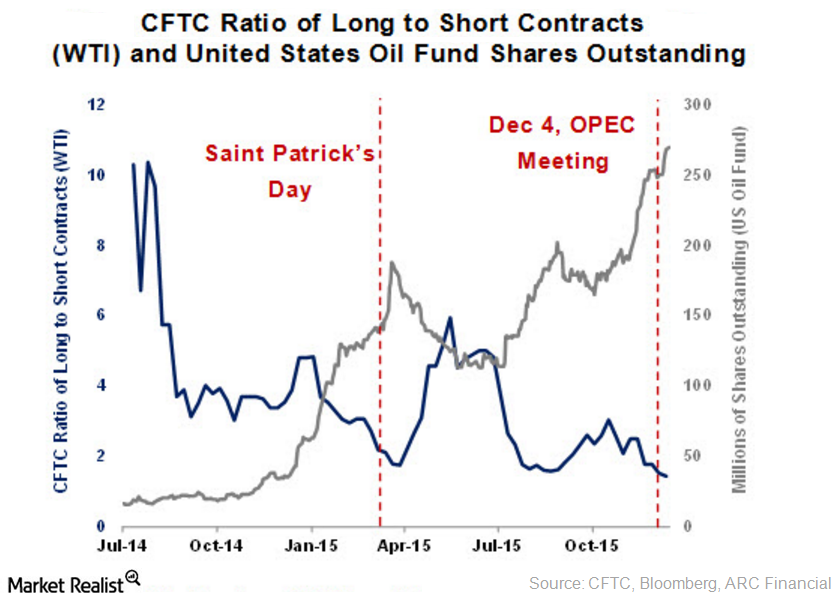

Long Positions Fall in the CFTC’s Commitment of Traders Report

The CFTC’s COT report states that hedge funds reduced their long positions for the week ending January 12, 2016. The net long positions fell by 20,673 contracts to 163,504 contracts during the week.

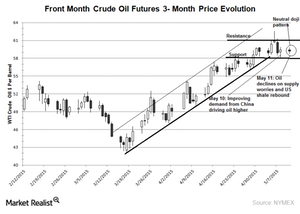

Uncertain Times for the Crude Oil Market: Neutral Doji Pattern

June WTI crude oil futures showed the neutral doji pattern on May 9. Oil prices are swinging due to the frequent change in supply and demand dynamics.

US Dollar near 9-Month High: Is It Bearish for Crude Oil Prices?

December WTI crude oil futures contracts rose on October 21, 2016, due to expectations of OPEC and Russia reaching an agreement to cap production.

Will US Crude Oil Futures Rise above $50 per Barrel This Week?

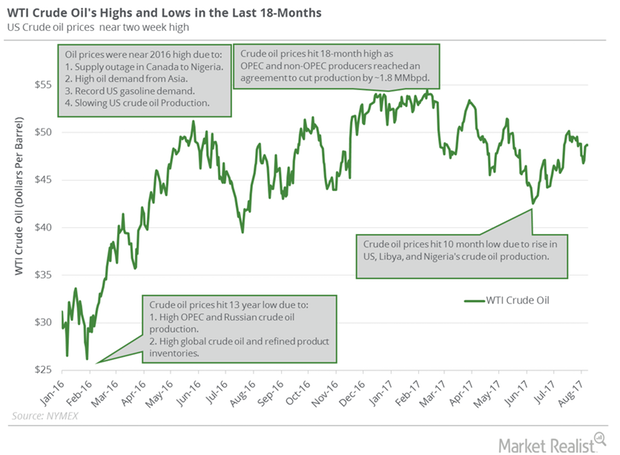

US active crude oil (PXI) (ERY) (FXN) futures hit $26.21 per barrel on February 11, 2016—the lowest level in more than 13 years.

Decoding the Major Oil Producers’ Meeting in Algeria

OPEC producers’ meeting was held from September 26–28, 2016. Crude oil prices rose 12% in August 2016 due to speculation about the meeting’s outcome.

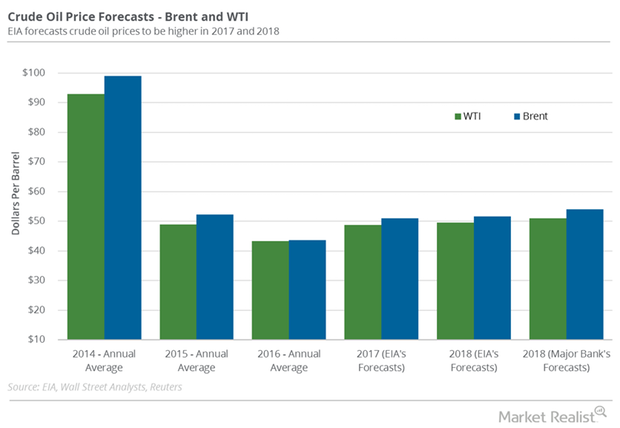

What to Expect from Crude Oil in 2017

WTI (West Texas Intermediate) crude oil (RYE) (IXC) (IEZ) futures for May delivery are near a four-month low as of March 27, 2017.

Energy Calendar for Oil and Gas Traders This Week

The energy sector contributed to ~6.6% of the S&P 500 (SPY) (SPX-INDEX) on April 7, 2017. Crude oil and natural gas are major parts of the energy sector.

Traders Track US Crude Oil Production and Exports

US crude oil production rose by 290,000 bpd (barrels per day) or 3.1% to 9,481,000 bpd in September 2017—compared to the previous month.

Will Crude Oil Prices Start 2018 on a Positive Note?

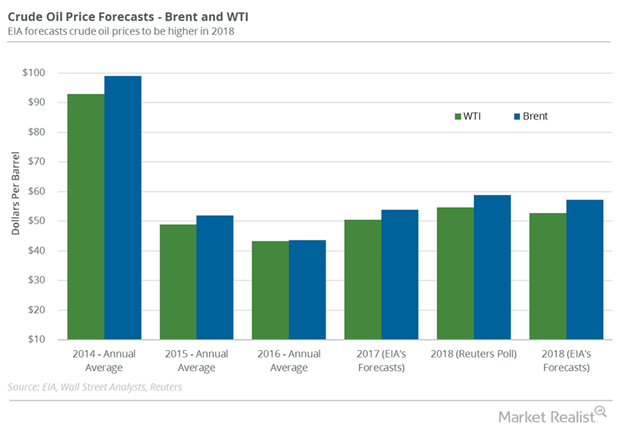

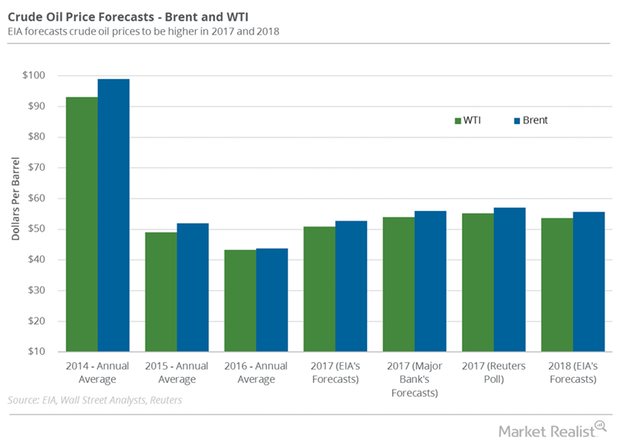

A Reuters survey estimated that Brent and US crude oil prices could average $58.84 per barrel and $54.78 per barrel in 2018.

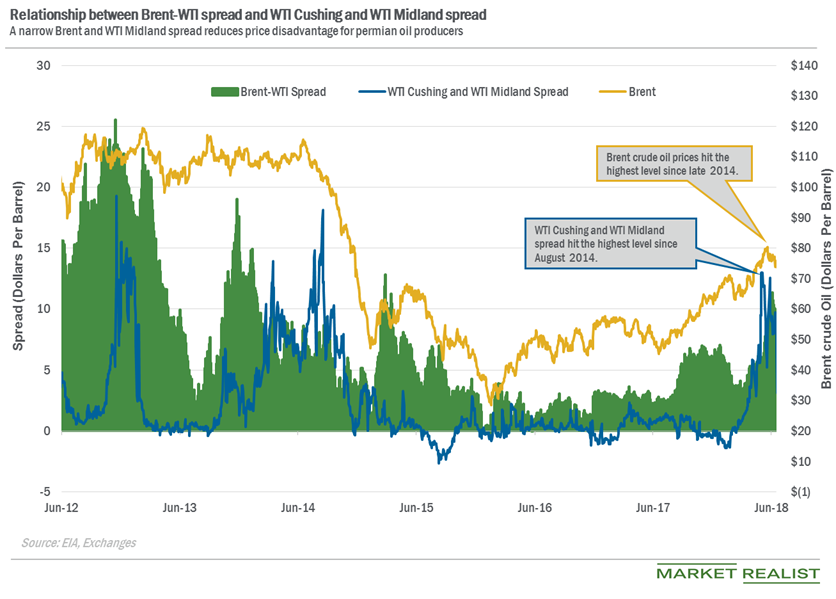

Why Did the WTI Cushing-WTI Midland Spread Drop?

The WTI Cushing-WTI Midland spread was at $4.12 per barrel on June 25—compared to $9.7 per barrel on June 18. The spread fell 58% on June 18–25.

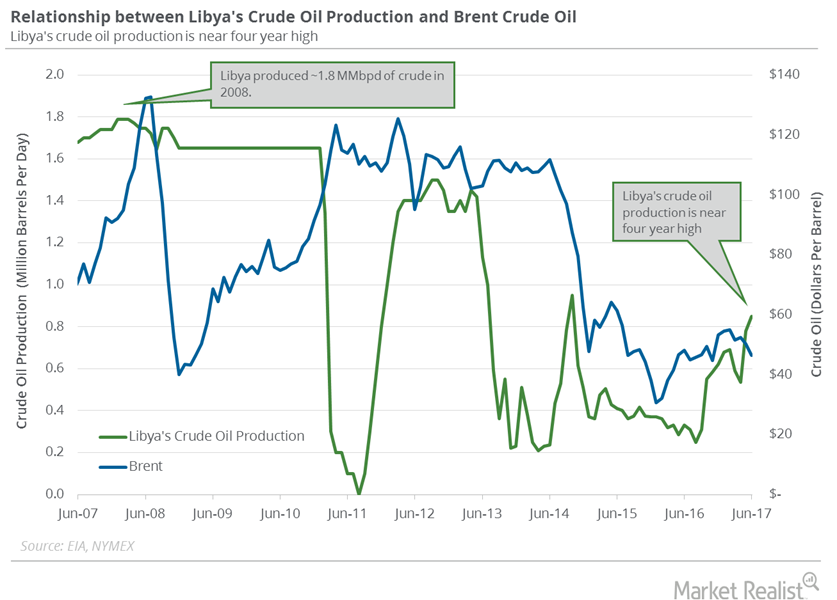

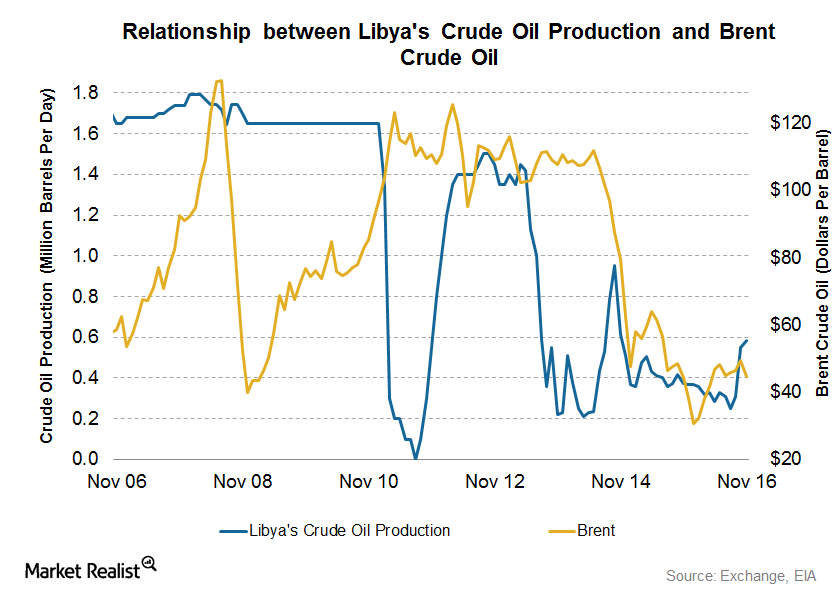

Libya’s Crude Oil Production Nears 4-Year High: What’s Next?

Libya is an OPEC member but was exempt from the production cut deal due to political and economic instability.

Supply, Demand: Will Crude Oil Futures Rally Be Short-Lived?

August WTI (West Texas Intermediate) crude oil futures contracts rose 1.0% and closed at $45.49 per barrel on Wednesday, July 12, 2017.

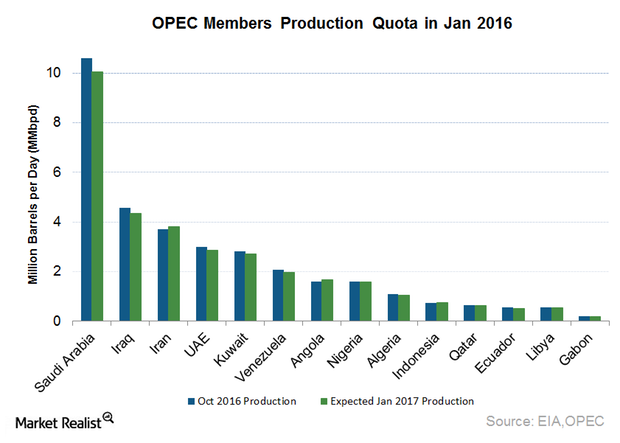

Crude Oil Prices Skyrocket as OPEC Agrees to Cut Production

Crude oil prices hit a one-month high as OPEC reached an agreement to cut production by 1.2 MMbpd in its meeting in Vienna.

Hedge Funds’ Net Long Positions in US Natural Gas

Hedge funds decreased their net bullish positions in US natural gas futures and options 1.9% to 186,799 on June 12–19.

Why Is US Crude Oil Production at a 2-Year High?

The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 79,000 bpd or 0.83% to 9,502,000 bpd on August 4–11, 2017.

Will US Crude Oil Prices Stay above $50 per Barrel?

WTI crude oil prices have fallen almost 12.0% year-to-date due to the rise in production for the United States, Libya, Nigeria, Brazil, and Canada in 2017.

Libya, Iran, and Nigeria Could Impact Crude Oil Prices in 2017

Libya’s crude oil production On December 20, 2016, Libya’s National Oil Corporation reported that pipelines leading from the Sharara and El Feel fields were reopened. The pipelines were closed for two years due to militant attacks. The pipelines are expected to add 270,000 bpd (barrels per day) of crude oil supply over the next three months. The […]

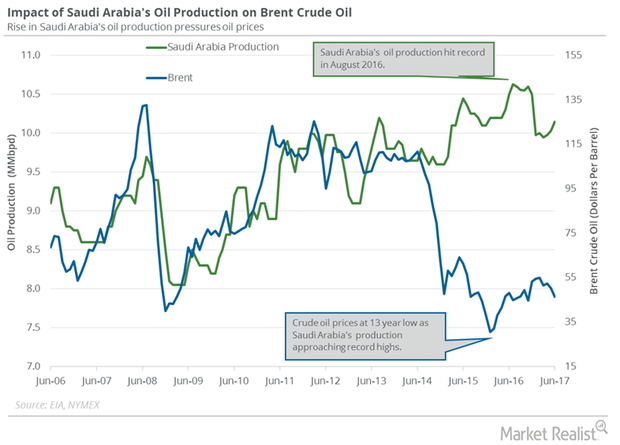

Will Saudi Arabia’s Crude Oil Export Plans Rescue Oil Prices?

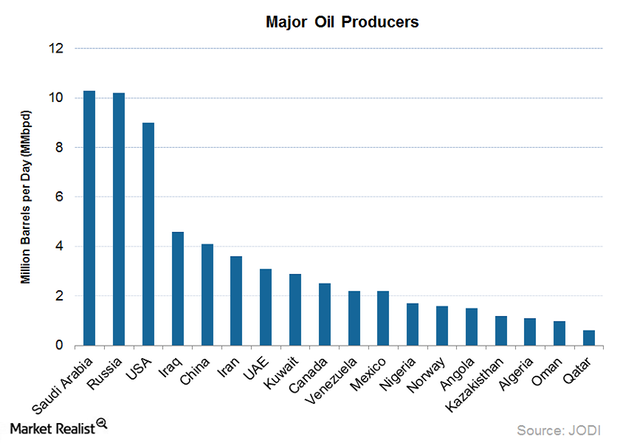

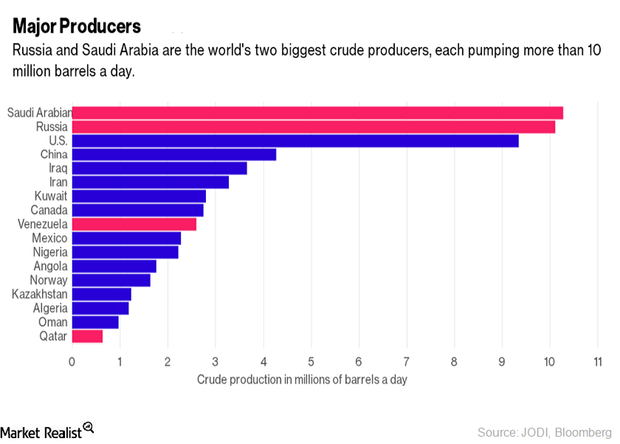

Saudi Arabia is the largest crude oil producer and exporter among the OPEC (Organization of the Petroleum Exporting Countries) member countries.

Hedge Funds’ Net Bullish Positions on US Crude Oil

Hedge funds reduced their net bullish positions in US crude oil futures and options by 1,136 contracts to 133,606 contracts on June 20–27, 2017.

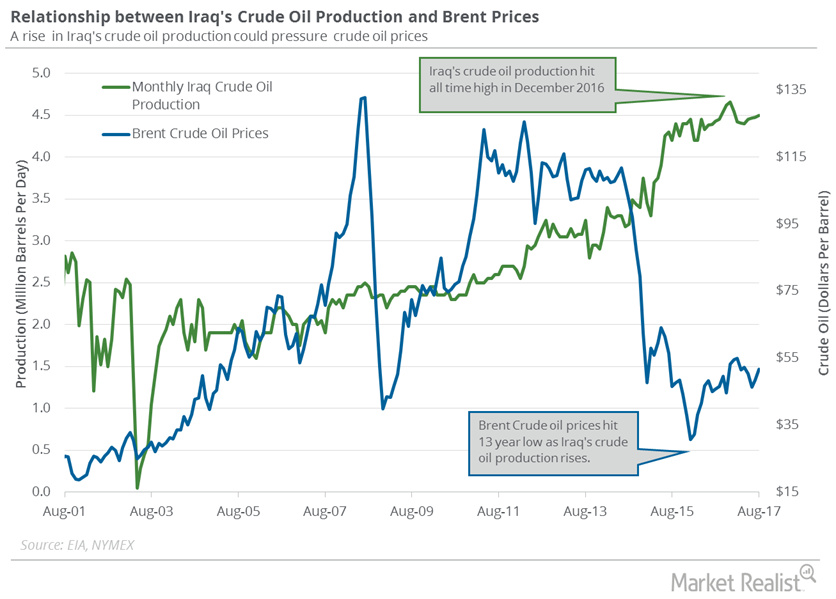

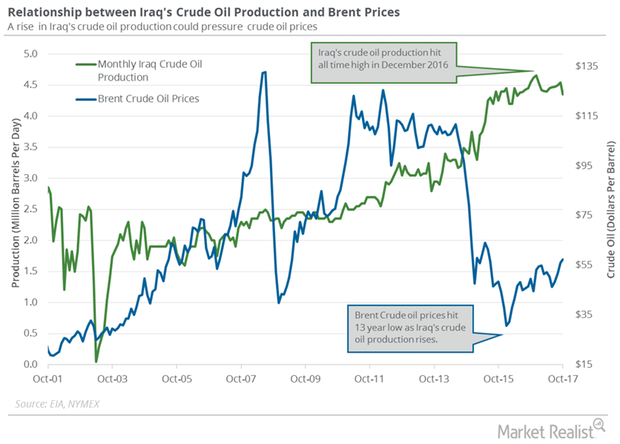

Iraq’s Production and Exports Impact Crude Oil Futures

The EIA estimated that Iraq’s crude oil production fell by 185,000 bpd (barrels per day) to 4,355,000 bpd in October 2017—compared to the previous month.

US Crude Oil Production Is near August 2015 High

The EIA (U.S. Energy Information Administration) reported that US crude oil production rose by 13,000 bpd (barrels per day) to 9,265,000 bpd on April 14–21.

Are US Distillate Inventories Bearish for Oil Prices?

US distillate inventories rose by 1,667,000 barrels or 1.3% to 129.4 MMbbls (million barrels) on November 24–December 1, 2017.

Hedge Funds’ Net Long Bullish Positions Hit a 10-Month Low

The Commodity Futures Trading Commission reported that hedge funds decreased their net long positions in US crude oil futures and options on June 13–20.

Will the Crude Oil Supply and Demand Gap Narrow by Early 2017?

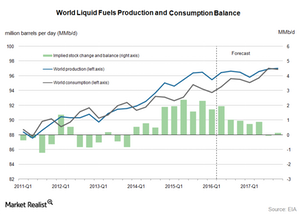

The IEA forecast that the global crude oil supply and demand gap would decline to 200,000 bpd in 2H16—compared to 1.5 MMbpd in 1H16.

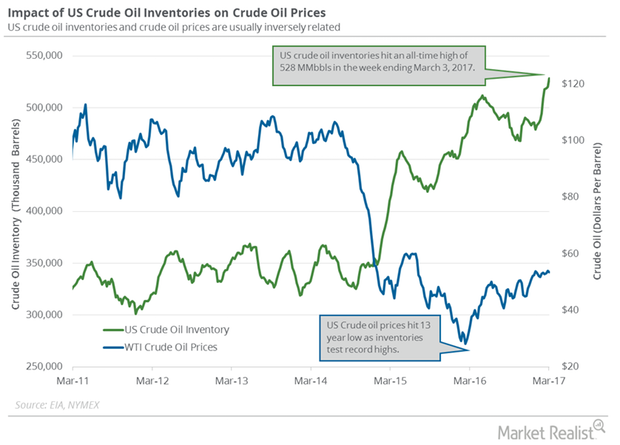

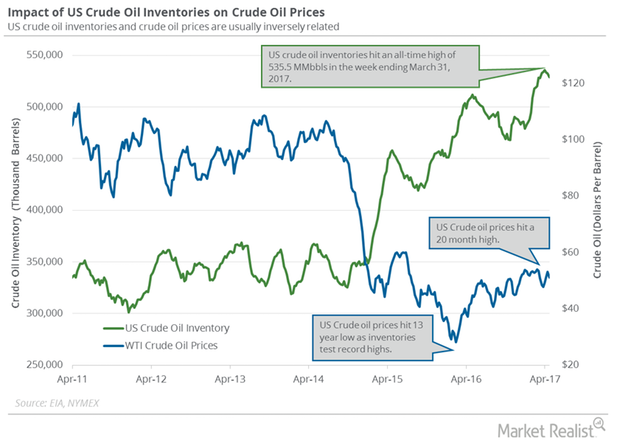

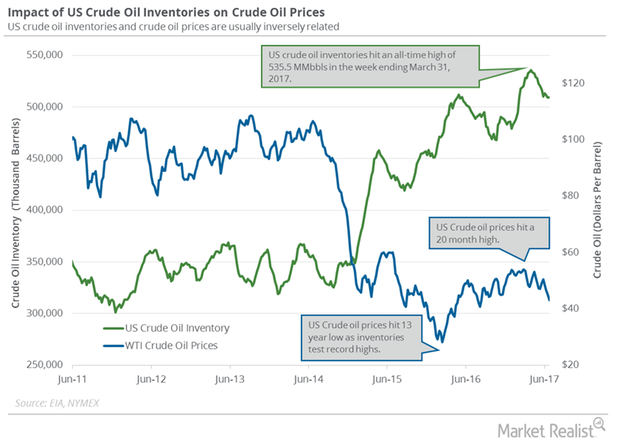

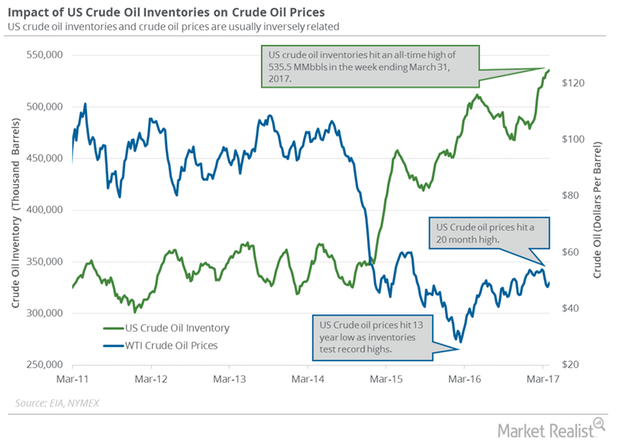

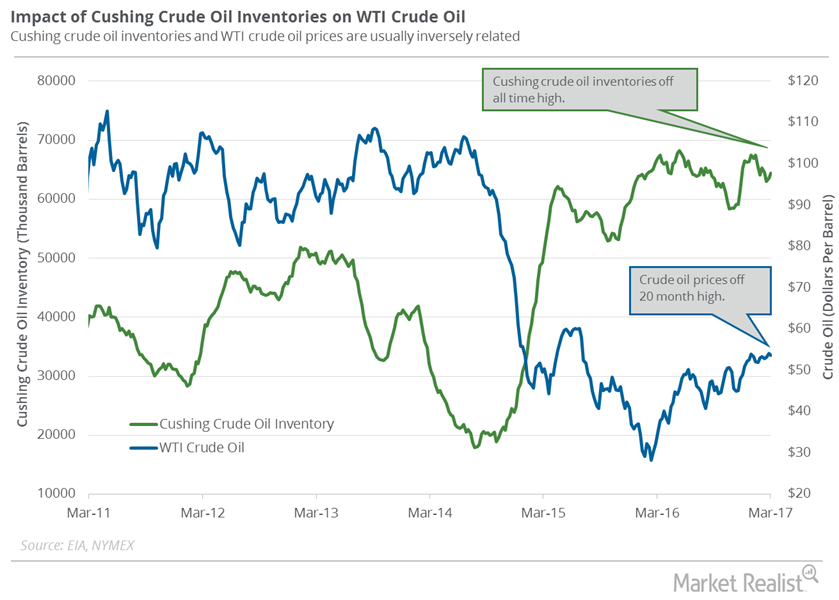

Cushing Crude Oil Inventories: More Pain for Oil Prices?

Market surveys estimate that Cushing crude oil inventories rose from March 3–10. A rise in crude oil inventories could pressure US crude oil prices.