Why US Crude Oil Production Is Bearish for Oil Prices

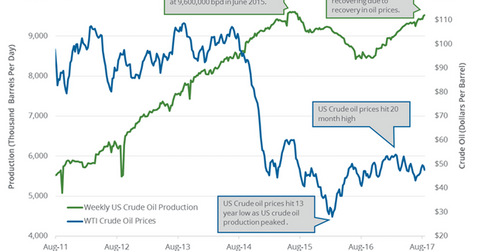

US crude oil production hit 9.6 MMbpd (million barrels per day) in June 2015, the highest level ever.

Nov. 20 2020, Updated 3:48 p.m. ET

US crude oil production

On August 23, 2017, the EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report. The EIA estimates that US crude oil production rose by 26,000 bpd (barrels per day) to 9,528,000 bpd between August 11, 2017, and August 18, 2017. Production rose 0.3% week-over-week and 980,000 bpd, or 11.5%, year-over-year.

Production is at its highest level since July 2015. US crude oil (OIH) (DBO) futures are down 15.2% YTD (year-to-date) due to the rise in US crude oil production.

Energy sector top losers

Lower crude oil (DIG) (SCO) prices have a negative impact on energy producers. The energy sector’s top losers as of August 23, 2017, are as follows:

- PrimeEnergy (PNRG) fell 14.3% to $46.55.

- Chesapeake Granite Wash (CHKR) fell 4.4% to $2.15.

- Adams Resources & Energy (AE) fell 3.6% to $32.80.

- Pacific Ethanol (PEIX) fell 3.4% to $4.25.

- Calumet Specialty (CLMT) fell 2.2% to $6.55.

US crude oil production’s peak and low

US crude oil production hit 9.6 MMbpd (million barrels per day) in June 2015, the highest level ever. In contrast, production hit 8.4 MMbpd in July 2016, the lowest level since May 2014.

US crude oil production estimates

US production averaged 8.9 MMbpd in 2016. The EIA estimates that US crude oil production could average 9.4 MMbpd in 2017. Production is expected to rise by 6% from 2017 levels to 9.9 MMbpd in 2018. Production could hit a record in 2018.

Why US crude oil production could hit a record in 2018

The following factors are driving US crude oil production:

- President Trump’s energy plans

- technological advancement

- improving efficiency

- a rise in US crude oil rigs by ~140% from lows in May 2016

High US crude production could pressure oil (XES) (IEZ) prices. US crude production would be the biggest bearish catalyst for oil prices in 2017 and 2018.

In the next part of this series, we’ll look at US gasoline inventories.