Calumet Specialty Products

Latest Calumet Specialty Products News and Updates

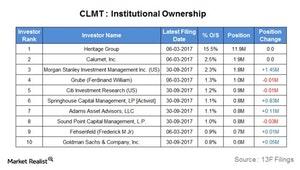

Are Institutional Investors Bullish on Calumet Specialty?

Heritage Group and Calumet are the top two investors in Calumet Specialty Products Partners (CLMT).

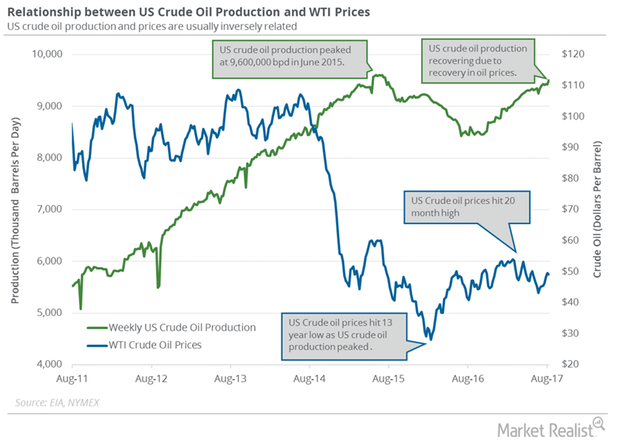

Why Is US Crude Oil Production at a 2-Year High?

The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 79,000 bpd or 0.83% to 9,502,000 bpd on August 4–11, 2017.

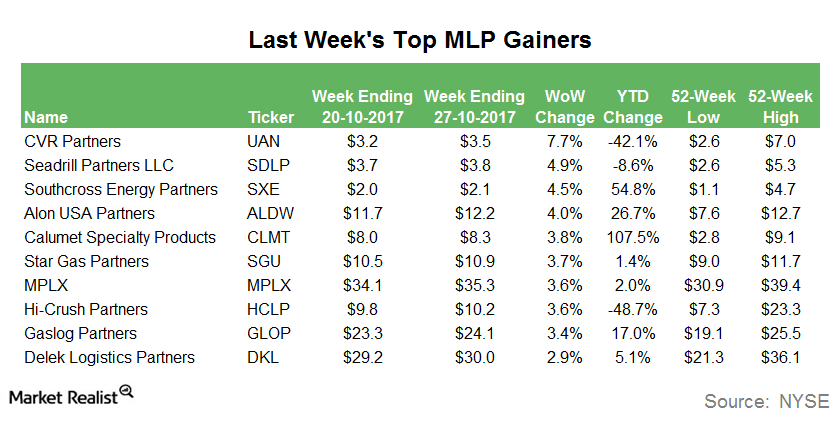

Last Week’s Top MLP Gainers

CVR Partners (UAN), the MLP mainly involved in the production of nitrogen fertilizers, was the top MLP gainer last week. CVR Partners rose 7.7%.

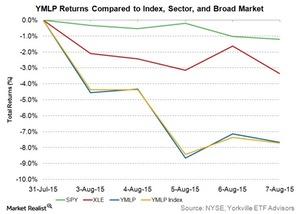

Why Did the YMLP ETF Fall Last Week?

The Yorkville High Income MLP ETF (YMLP) dropped 7.69% in the week ended August 7. The broad-market SPDR S&P 500 ETF (SPY) dropped 1.2%.